Content

Linear Low-Density Polyethylene (LLDPE) Market Size and Growth 2025 to 2034

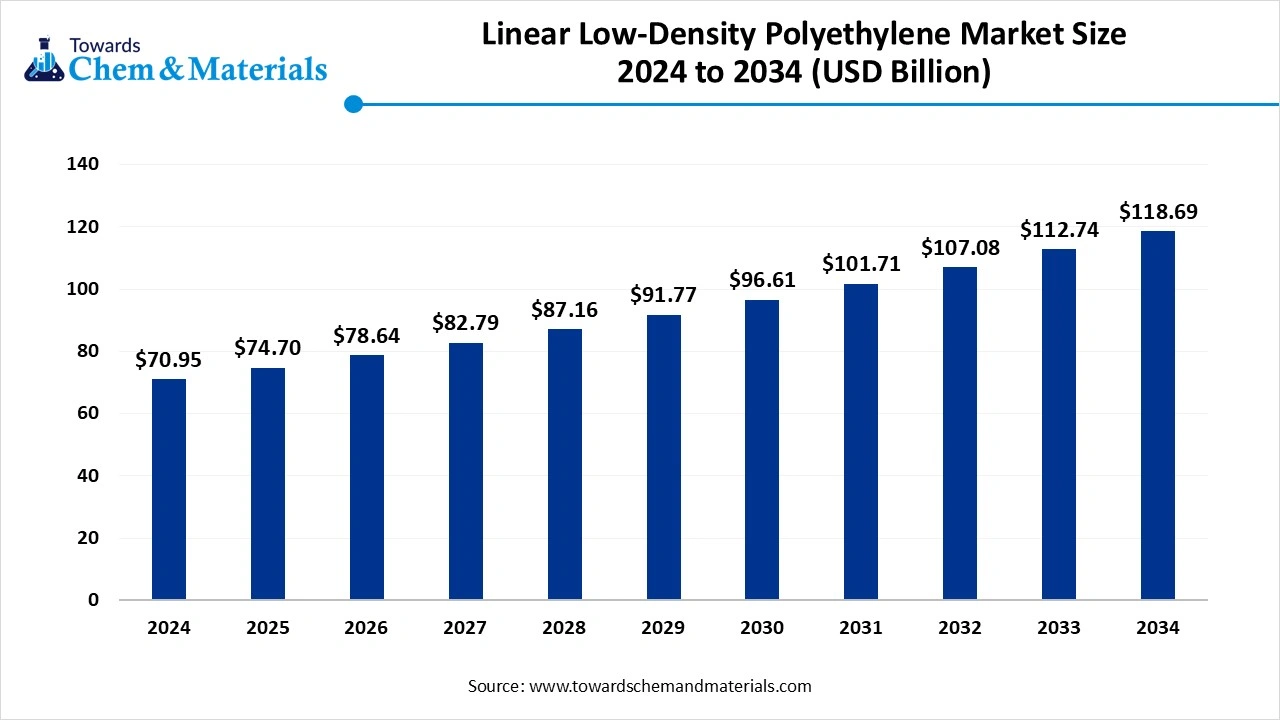

The global linear low-density polyethylene (LLDPE) market size was reached at USD 70.95 Billion in 2024 and is expected to be worth around USD 118.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.28% over the forecast period 2025 to 2034. The shift towards sustainable materials, growing demand for flexible packaging, and expansion of e-commerce drive the growth of the market.

Key Takeaways

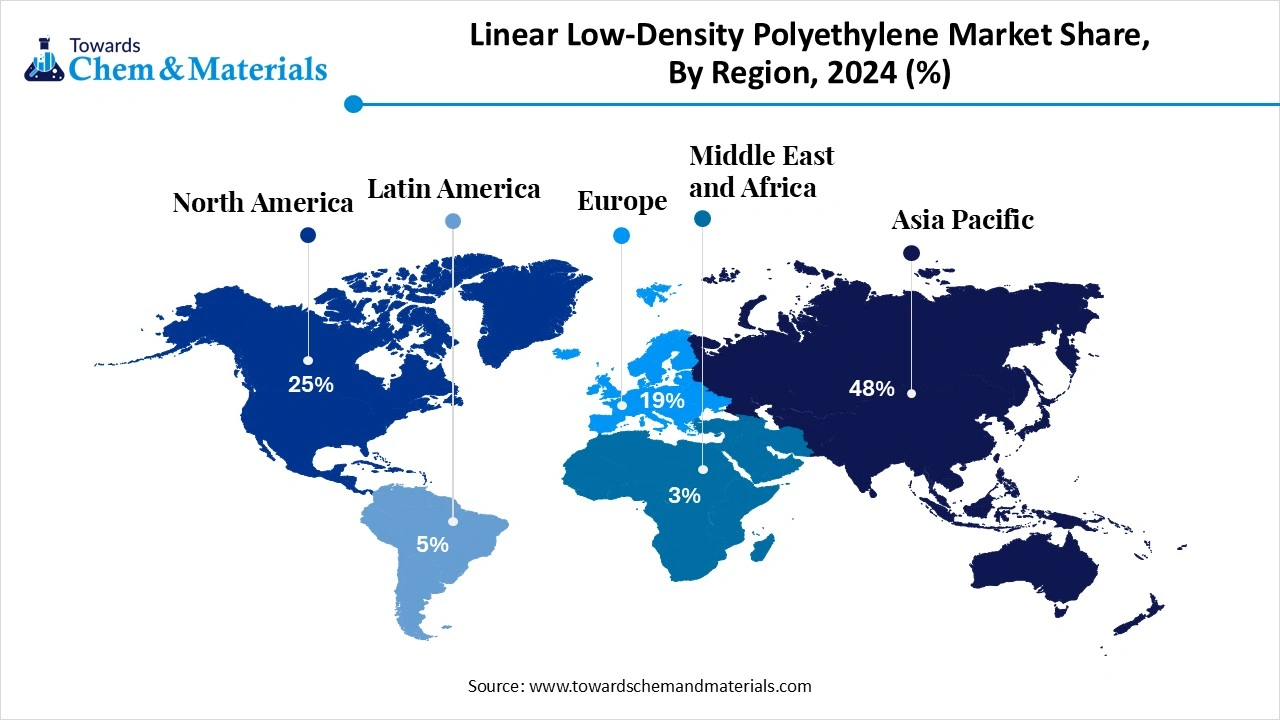

- By region, Asia Pacific held a 48% share in the linear low-density polyethylene (LLDPE) market in 2024 due to the rapid industrialization.

By region, North America is growing at a significant CAGR in the market during the forecast period due to the strong focus on sustainable packaging. - By type, the C4-LLDPE segment held a 55% share in the market in 2024 due to the growing demand for reliable and secure packaging in various industries.

By type, the metallocene LLDPE segment is expected to grow at the fastest CAGR in the market during the forecast period due to the excellent sealing properties. - By application, the films segment held a 70% share in the market in 2024 due to the growing demand for agriculture films.

By application, the pipes & tubes segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growth in the development of sewage systems. - By end-use industry, the packaging segment held a 65% share in the market in 2024 due to the rapid growth in the e-commerce sector.

By end-use industry, the automotive segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for lightweight vehicle components. - By manufacturing process, the gas phase process segment held a 60% share in the market in 2024 due to its cost-effectiveness.

By manufacturing process, the solution phase process segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for high molecular weight LLDPE.

LLDPE: The Silent Power Behind Modern Plastic and the Future of Polymer

Linear low-density polyethylene (LLDPE) is a linear polymer manufactured through low-pressure polymerisation techniques. It is a copolymer of alpha-olefins like octene, butene, & hexene and ethylene. LLDPE exhibits properties like high puncture resistance, good tensile strength, and flexibility. It consists of a linear structure with evenly distributed, short branches. It has a density range of 0.915 to 0.940 g/cm3 and good resistance to organic solvents like acids, bases, and many more. The production of various consumer goods like household products, toys, and containers increases demand for LLDPE. The applications like gas distribution, plumbing, and irrigation require LLDPE pipes and tubes. The increasing demand for medical applications like disposable medical devices, medical packaging, and tubing fuels demand for LLDPE. Factors like growing demand for packaging, increasing production of agricultural films, rising demand for wire & cable insulation, and increasing automotive sector contribute to the market growth.

- India exported 3137 shipments of the LLDPE polymer.(Source: www.volza.com)

- Saudi Arabia exported 2501 shipments of the LLDPE polymer.(Source: www.volza.com )

- Saudi Arabia exported 14487 shipments of polyethylene LLDPE.(Source: www.volza.com )

- Reliance Industries Limited is the leading supplier of polyethylene LLDPE in India.(Source: www.volza.com)

Who are the Top Exporters of LLDPE?

| Country | Shipments |

| India | 163,605 |

| United States | 135,379 |

| Saudi Arabia | 68,737 |

Growing Agriculture Sector Powers LLDPE Market

The growing agriculture sector in various regions increases demand for LLDPE for various applications. The growing production of various agricultural films requires LLDPE for diverse farming practices. The need for a controlled environment for crop development increases demand for LLDPE greenhouse films. The requirement of regulating soil temperature, suppressing weeds, and retaining soil temperature increases demand for LLDPE mulch films. The increasing production of films and pipes for agricultural irrigation systems increases the adoption of LLDPE. The focus on increasing agricultural productivity and crop yields fuels demand for LLDPE films. The strong focus on sustainable agricultural practices leads to higher demand for LLDPE. The growing agriculture sector and increasing demand for agriculture films fuel the adoption of LLDPE. The growing agriculture sector is a key driver for the market.

Market Trends

- Growing Construction Activities: The rapid urbanization and growing construction activities in various regions increase demand for LLDPE due to its durability. The increasing demand for insulation, films, vapor barriers, and geomembranes fuels demand for LLDPE.

- The Rise in E-Commerce: The rapid expansion of the e-commerce sector increases demand for various packaging applications. The rise in e-commerce fuels demand for various packaging applications like containers, bags, films, and many more.

- Technological Advancements: The ongoing technological advancements, like the development of ultra-low density LLDPE, creating new infrastructure, the incorporation of nanomaterials, and improvement in recycling technologies, help the market growth.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 74.70 Billion |

| Expected Size by 2034 | USD 118.69 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.28% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Application, By End-Use Industry, By Manufacturing Process, By Region |

| Key Companies Profiled | ExxonMobil Corporation, Dow Inc., SABIC (Saudi Basic Industries Corporation), LyondellBasell Industries N.V., NOVA Chemicals Corporation, Chevron Phillips Chemical Company LLC, Formosa Plastics Corporation, INEOS Group AG, Borealis AG, Mitsubishi Chemical Corporation, Indian Oil Corporation Ltd., Sinopec Group, LG Chem, Sasol Ltd., Reliance Industries Limited, Equate Petrochemical Company, PTT Global Chemical Public Company Limited, Repsol S.A., TotalEnergies SE, Braskem S.A. |

Market Opportunity

Expansion of the Automotive Industry Surges Demand for LLDPE

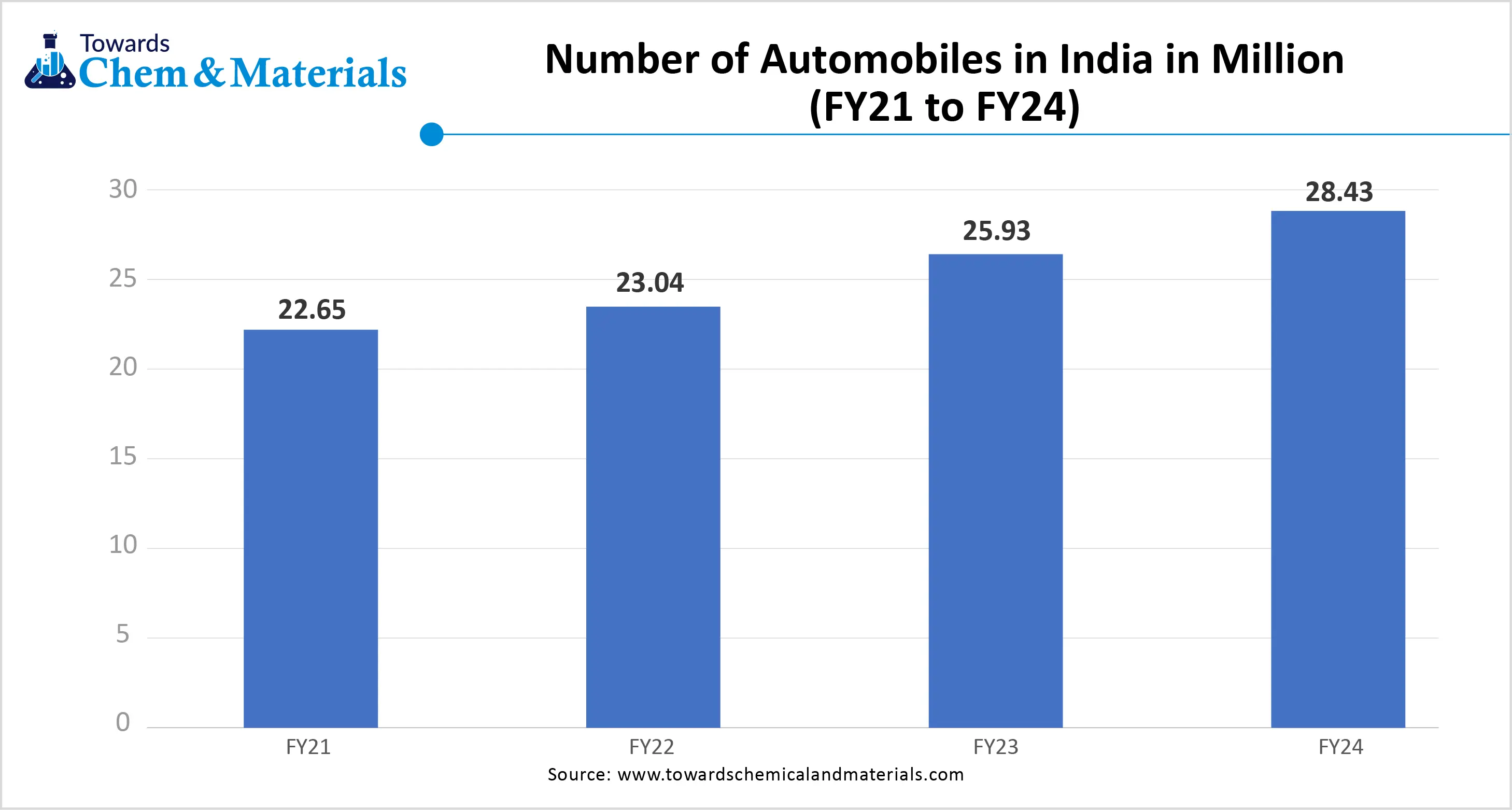

The growing production of vehicles and the expansion of the automotive industry increase demand for LLDPE for various automotive applications. The focus on lowering vehicle weight and improving fuel efficiency increases demand for LLDPE for the production of lightweight automotive parts. The production of various automotive parts like protective films, bumpers, and interior components increases demand for LLDPE. The manufacturing of fuel tanks requires LLDPE due to its durability.

The strong focus on intricate design and shapes of vehicles increases the adoption of LLDPE. The increasing production of automotive parts like dashboards, bumpers, liners, interior panels, body panels, fuel tanks, wiring, and cable insulation increases demand for LLDPE. The growing advancements in the production of vehicles lead to a higher demand for LLDPE. The rise in electric vehicles requires LLDPE for the production of lightweight vehicle parts. The growing expansion of the automotive industry creates an opportunity for the growth of the market.

Market Challenge

High Production Cost Limits Expansion of LLDPE Market

Despite several benefits of the LLDPE in various industries, the high production cost restricts the market growth. Factors like supply chain disruptions, raw material costs, and energy-intensive processes are responsible for the high production cost. The fluctuations in raw materials prices like ethylene, comonomers directly affect the market. The energy-intensive processes and the need for a high amount of electricity increase the production cost. The lower production capacity of LLDPE fuels the production cost. The supply chain disruptions, like geopolitical instability, plant maintenance shutdowns, and force majeure declarations, lead to higher production costs. Factors like trade policies, tariffs, and import/export restrictions increase the production cost. The high production cost hampers the growth of the market.

Regional Insights

How Asia Pacific Dominated the Linear Low-Density Polyethylene (LLDPE) Market?

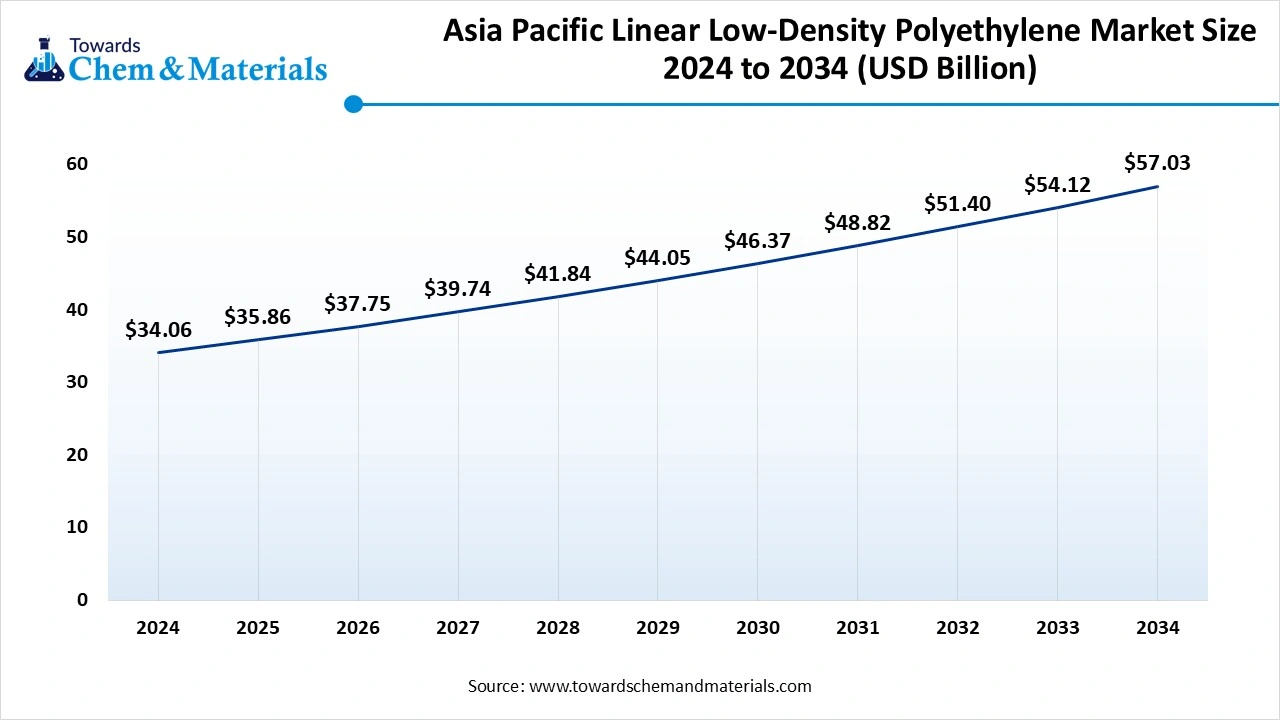

The Asia Pacific linear low-density polyethylene (LLDPE) market size grew from USD 34.06 billion in 2024 to USD 35.86 billion in 2025 at a compound annual growth rate of 5.29%. The market is expected to grow to USD 57.03 billion by 2034.

Asia Pacific dominated the market in 2024, the region is observed to sustain the position during the forecast period. The rapid urbanization and growing industrialization in the region increase demand for LLDPE. The strong presence of well-established manufacturing hubs for LLDPE production in countries like South Korea, China, and India helps the market growth. The increasing demand for consumer goods and strong government support for infrastructure development increase the adoption of LLDPE. The growing expansion of e-commerce fuels demand for LLDPE packaging. The increasing demand across sectors like construction, automotive, packaging, and agriculture drives the overall growth of the market.

China Linear Low-Density Polyethylene (LLDPE) Market Trends

China is a major contributor to the market. The increasing expansion of the retail and e-commerce sector increases demand for LLDPE packaging. The growing infrastructure development, like construction and transportation networks, fuels demand for LLDPE, helping the market growth. The rapid industrialization and growing manufacturing across sectors like automobiles, construction, electronics, & textile supports the overall growth of the market.

Who are the Leading Suppliers of LLDPE in China?

| Company Name | Shipments | Share |

| Guangzhou Lushan New Materials Co, Ltd | 31 Shipments | 47% |

| Dow Chemical International Pvt Ltd | 11 Shipments | 17% |

| Dongguan Huayu Packing Co Ltd | 8 Shipments | 12% |

Why is North America Growing in the Linear Low-Density Polyethylene (LLDPE) Market?

North America is significantly growing in the market. The growing demand for packaged foods and the increasing expansion of retail stores fuel demand for LLDPE. The growing agriculture sector increases demand for LLDPE for irrigation systems, greenhouse films, and mulch films. The focus on sustainable packaging and the growing automotive industry helps market growth. The rapid expansion of sectors like electrical & electronics, packaging, and construction increases demand for LLDPE. The advancements in LLDPE manufacturing and well-established manufacturing for LLDPE production drive the overall growth of the market.

United States Linear Low-Density Polyethylene (LLDPE) Market Trends

The United States is a key contributor to the market. The strong presence of the petrochemical industry increases the production of LLDPE. The availability of feedstocks like ethane and natural gas for the production of LLDPE helps market growth. The presence of advanced technologies like metallocene-based catalysts increases the production of LLDPE. The strong demand across various sectors like agriculture, automotive, packaging, and construction supports the overall growth of the market.

- The United States exported 1,028 shipments of the LLDPE polymer.(Source: www.volza.com )

The United States exported 20,312 shipments of polyethylene LLDPE.(Source: www.volza.com)

Segmental Insights

Type Insights

Why did C4-LLDPE Segment Dominate the Linear Low-Density Polyethylene (LLDPE) Market?

The C4-LLDPE segment dominated the linear low-density polyethylene (LLDPE) market in 2024. The growing demand for secure packaging in industries like medical, food & beverage, and consumer goods increases the adoption of C4-LLDPE. The growth in infrastructure development fuels demand for C4-LLDPE in applications like cable insulation and pipes. C4 LLDPE consists of superior puncture resistance, tensile strength, and flexibility. The shift towards sustainability increases demand for C4 LLDPE. The increasing demand for various bags, stretch films, and shrink films drives the overall growth of the market.

The metallocene LLDPE segment is the fastest growing in the market during the forecast period. The increasing demand for stretch films, flexible packaging, and food packaging increases demand for metallocene LLDPE. The growing preference for high-performance packaging helps market growth. Metallocene LLDPE has better gloss & clarity and consists of excellent sealing properties. The increasing production of agricultural films and stretch wrap fuels the adoption of metallocene LLDPE. The growing demand across sectors like electrical & electronics, building & construction, and automotive supports the overall market growth.

Application Insights

How Films Segment Held the Largest Share of the Linear Low-Density Polyethylene (LLDPE) Market?

The films segment held the largest revenue share in the linear low-density polyethylene (LLDPE) market in 2024. The growth in applications like industrial films, stretch wraps, food packaging, and agricultural films increases demand for LLDPE films. The increasing expansion of e-commerce and rising demand for lightweight & flexible packaging fuels demand for LLDPE films, helping the market growth. The rising demand for food packaging increases the adoption of LLDPE films for their excellent resistance & elongation properties. The growing demand for agricultural films like irrigation systems, greenhouse films, and mulch films drives the market growth.

The pipes & tubes segment is experiencing the fastest growth in the market during the forecast period. The growing development of sewage systems and water supply increases demand for pipes & tubes. The increasing adoption of renewable energy fuels demand for pipes & tubes for applications like fluid transport & cooling systems. The growing demand for transportation of natural gas increases the demand for LLDPE pipes. The rising demand across various applications like sanitation systems, irrigation systems, and water management supports the overall growth of the market.

End-Use Industry Insights

Which End-User Industry Segment Dominated the Linear Low-Density Polyethylene (LLDPE) Market?

The packaging segment dominated the linear low-density polyethylene (LLDPE) market. The growing demand for various packaging, like bags, containers, films, and wraps, increases the demand for LLDPE. The increasing demand for protective and reliable packaging solutions helps market growth. The shift towards sustainable packaging increases the adoption of LLDPE. The increasing demand for frozen foods & beverages and packaged foods fuels demand for LLDPE. The expansion of e-commerce and the growing online shopping increase the adoption of LLDPE for packaging, driving the overall growth of the market.

The automotive segment is the fastest growing in the market during the forecast period. The increasing demand for lightweight automotive components like fuel tanks, bumpers, and interior panels increases demand for LLDPE. The automotive applications, like under-the-hood, fuel lines, and battery components, help the market growth. The growing manufacturing of automobiles and the growth in production of vehicles fuel demand for LLDPE. The growing expansion of the automotive sector and innovations in vehicle production support the overall growth of the market.

Manufacturing Process Insights

How Gas Phase Process Segment Held the Largest Share of the Linear Low-Density Polyethylene (LLDPE) Market?

The gas phase process segment held the largest revenue share in the linear low-density polyethylene (LLDPE) market in 2024. The growing production of versatile LLDPE grades increases the adoption of gas phase reactors. The growing production of LLDPE with certain properties like clarity, flexibility, and strength increases demand for gas phase reactors. The increasing production of pouches, films, and bags fuels demand for the gas phase process. The growing demand across applications like coatings, rotomolding, and injection molding drives the overall growth of the market.

The solution phase process segment is experiencing the fastest growth in the market during the forecast period. The growing demand for higher molecular weight LLDPE in applications like coatings & films increases the adoption of the solution phase process. The rising demand for flexible packaging in industries like consumer goods, food & beverage increases demand for the solution phase process. The increasing demand for sustainable products fuels the adoption of LLDPE manufactured through the solution phase process. The growing demand for lightweight automotive components, irrigation films, greenhouse films, and construction pipes & films supports the overall growth of the market.

Recent Developments

- In March 2025, Borealis launched high-performance recycled LLDPE, Borcycle M CWT120CL, for packaging applications. It is applicable for non-food packaging and is made up of 15% LLDPE booster and 85% PCR. It can be used in stretch hood, industrial, stretch film, agricultural films, and protective packaging. (Source: www.plasticstoday.com )

- In September 2024, Indian Oil Corporation chose the UNIPOL PE process to produce LLDPE and HDPE in India. The production capacity of the facility is 650000 tons per year.(Source:www.prnewswire.com)

- In December 2023, HPCL started developing LLDPE, HDP, and PP resins at the Pachpadra plant. The resins are used for manufacturing flexible packaging and materials, and films.(Source: packagingsouthasia.com)

Top Companies List

- ExxonMobil Corporation

- Dow Inc.

- SABIC (Saudi Basic Industries Corporation)

- LyondellBasell Industries N.V.

- NOVA Chemicals Corporation

- Chevron Phillips Chemical Company LLC

- Formosa Plastics Corporation

- INEOS Group AG

- Borealis AG

- Mitsubishi Chemical Corporation

- Indian Oil Corporation Ltd.

- Sinopec Group

- LG Chem

- Sasol Ltd.

- Reliance Industries Limited

- Equate Petrochemical Company

- PTT Global Chemical Public Company Limited

- Repsol S.A.

- TotalEnergies SE

- Braskem S.A.

Segments Covered

By Type

- C4-LLDPE

- C6-LLDPE

- C8-LLDPE

- Metallocene LLDPE (mLLDPE)

- Other LLDPE Types

By Application

- Films

- Injection Moulding

- Rotomolding

- Extrusion Coating

- Pipes & Tubes

- Other Applications

By End-Use Industry

- Packaging

- Agriculture

- Construction

- Automotive

- Electrical & Electronics

- Household & Consumer Goods

- Other End-Use Industries

By Manufacturing Process

- Gas Phase Process

- Solution Phase Process

- Slurry Loop Process

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait