Content

What is the Polyethylene Terephthalate Catalyst Market Size Share?

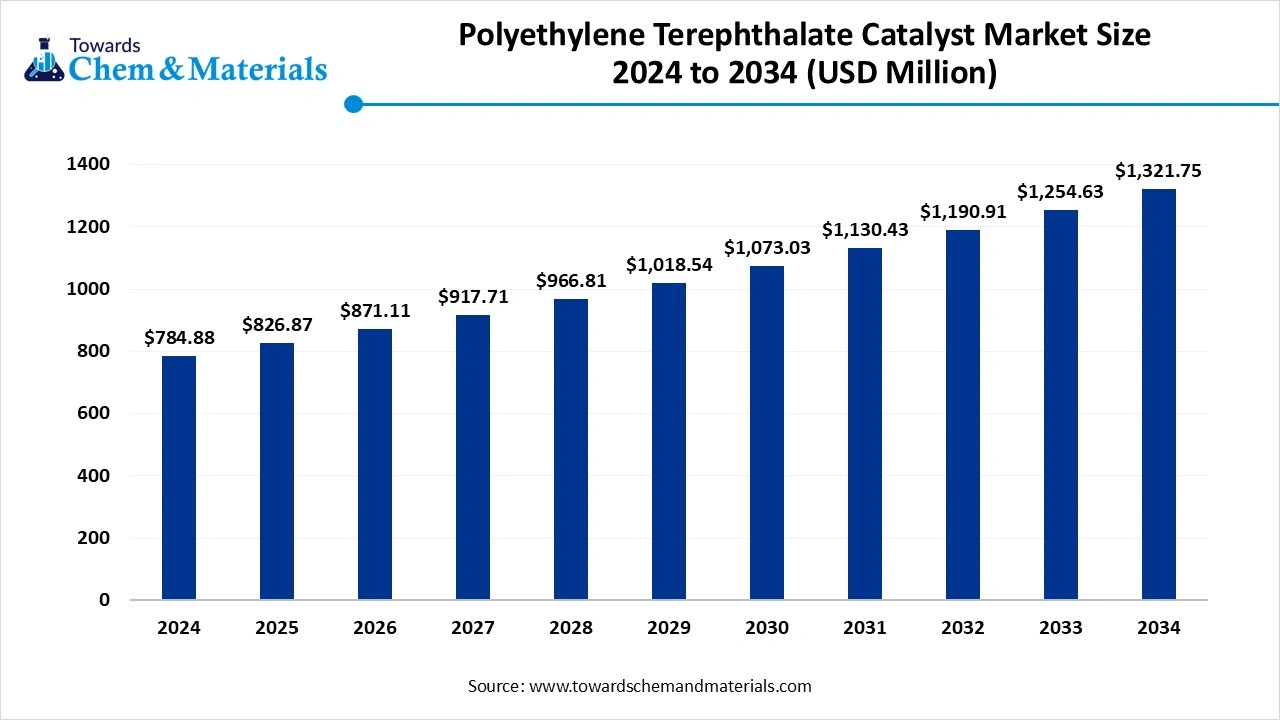

The global polyethylene terephthalate catalyst market size was valued at USD 784.88 million in 2024 and is expected to hit around USD 1,321.75 million by 2034, growing at a compound annual growth rate (CAGR) of 5.35% over the forecast period from 2025 to 2034. Asia Pacific polyethylene terephthalate catalyst market dominated with the largest revenue share of 48% in 2024. The market underpins one of the world’s largest polymer value chains enabling faster, cleaner, and more energy-efficient PET production for packaging, fibers, and engineering applications. Catalysts determine reaction speed, product quality, and process economics in PET synthesis, making them strategic components for producers aiming to boost yields and lower energy consumption.

Key Takeaways

- By region, Asia Pacific dominated the market holding the largest market share of approximately 48% in 2024.

- By region, Europe is expected to grow at a notable rate in market with share of 18% during the forecast period.

- By catalyst type, the antimony-based catalysts segment held the largest share of the market at approximately 55% in 2024.

- By catalyst type, the titanium-based Catalysts segment is expected to grow at the fastest rate during the forecast period.

- By application form, the PET bottles & containers segment held the largest market share of approximately 45% in 2024.

- By application, the PET Fibers/textiles segment is expected to grow at the fastest rate during the forecast period.

- By catalyst form, the heterogeneous catalysts segment held the largest share at approximately 65% in 2024.

- By catalyst form, heterogeneous / supported catalysts segment is expected to grow at the fastest rate during the forecast period.

- By process stage, the polycondensation stage catalysts segment held the largest share at approximately 50% in 2024.

- By process stage, the solid-state segment is expected to grow at the fastest rate during the forecast period.

Market Overview

The polyethylene terephthalate catalyst market covers chemical catalysts used during PET production to accelerate reactions such as esterification, polycondensation, and solid-state polycondensation. Common catalyst systems include antimony, titanium, germanium, and manganese compounds, as well as emerging catalysts like heteropolyacids and enzyme-based systems. These catalysts are critical for controlling polymer properties molecular weight, clarity, color, reaction rates while minimizing side reactions and residuals. The market serves PET resin producers, packaging, fiber, and film manufacturers that demand high performance, lower impurities, and compliance with food-contact and environmental standards.

The market is characterized by a mix of established chemical suppliers and specialty catalyst innovators supplying heterogeneous and homogeneous catalyst systems for esterification and polycondensation. Demand is closely tied to global PET production volumes, feedstock economics (notably PTA and MEG), and downstream end-use growth in packaging and textiles. Product differentiation hinges on activity, selectivity, thermal stability, and tolerance to impurities, with increasing emphasis on catalysts that reduce coloration and acetaldehyde formation.

Customers prioritize catalysts that enable higher throughput, lower energy footprints, and simplified downstream purification to protect product quality. Barriers to entry include significant technical know-how, regulatory compliance, and the need for process validation at scale. Overall, the market favors suppliers who can couple catalytic performance with service process optimization, lifetime monitoring, and regulatory support.

Market Outlook

- Industry growth overview: Industry growth is being influenced by macro consumption patterns in packaged goods, apparel demand cycles, and industrial applications where PET’s mechanical and barrier properties are preferred. Technological modernization of plants driven by capacity expansions and debottlenecking projects creates opportunities for advanced catalysts that improve yields and uptime. Regulatory drivers for recyclability and food-contact safety increase the importance of catalyst residues and by-product control, prompting stricter supplier qualifications. Capital intensity of PET facilities means long equipment lifecycles, translating to recurring catalyst and service revenue over decades. Market expansion is geographic: mature markets focus on higher-value specialty PET grades, while emerging regions scale commodity capacity. Overall, growth is steady but differentiated: high-value catalyst niches outpace commodity segments.

- Sustainability trends: Sustainability is reshaping catalyst R&D, with emphasis on formulations that enable chemical recycling, lower energy use, and reduced side-product formation. Catalysts that tolerate higher proportions of recycled feedstock or enable depolymerization/repolymerization routes are gaining strategic importance. Manufacturers are also optimizing catalyst manufacturing to minimize hazardous by-products, solvent use, and lifecycle environmental impacts. Process intensification achieved through high-activity catalysts helps cut reactor residence times and energy consumption per unit of PET produced. Transparency in supply chains and regulatory compliance for food-contact and recycling streams are motivating greener catalyst choices. Ultimately, sustainable catalyst technology is becoming a competitive differentiator rather than a regulatory afterthought.

- Major investment: Investment flows into the PET catalyst space are concentrated on R&D, process demonstration, and scale-up facilities that can validate new chemistries under industrial conditions. Strategic partnerships between catalyst firms and major PET producers accelerate adoption by coupling innovation with on-site trials and licencing agreements. Private equity and corporate venturing target specialty catalyst companies that promise energy savings or enable recycling economics, seeing them as leverage points across polymer value chains. Capital also funds analytics and service offerings predictive maintenance, lifetime monitoring, and digital twins that extend catalyst revenue streams. Investments in regional production footprint reduce lead times and ensure regulatory alignment for food-contact approvals. Expect continued selective capital deployment into breakthrough chemistries and service-led business models rather than broad speculative funding.

- Startup economy: A small but influential startup cohort is emerging around novel catalytic routes, catalytic materials (e.g., anchored organometallics, optimized heterogeneous catalysts), and process intensification concepts. These ventures often originate from academic spin-offs or cross-disciplinary teams combining catalysis, materials science, and process engineering. Startups typically de-risk technology via pilot demonstrations with incumbent PET producers and seek strategic partnerships for scale-up. Many focus on enabling circularity catalytic depolymerization or compatibility with recycled monomers areas where incumbents seek external innovation. Access to specialized testing and regulatory pathway support remains a bottleneck for early-stage firms. Consequently, the most successful startups combine scientific novelty with pragmatic commercialization plans and industry collaborations.

Key Technological Shifts In The Polyethylene Terephthalate Catalyst Market:

The polyethylene terephthalate (PET) industry is experiencing rapid technological advancement driven by sustainability and efficiency goals. One key innovation is the development of bio-based PET, which uses renewable feedstocks instead of petroleum-derived materials, reducing environmental impact. At the same time, advanced chemical recycling technologies are enabling closed-loop production by converting used PET back into its original monomers for reuse. Manufacturers are also adopting energy-efficient polymerization systems and digital monitoring to improve process control and reduce power consumption.

Trade Analysis of Polyethylene Terephthalate Catalyst Market: Import & Export Statistics

Import Trade

- The data indicates that China leads in polyethylene terephthalate import with a total shipment value of USD 2,370.77 across 28,849 shipments.

- KOREA, REPUBLIC OF recorded USD 212.12 with 11,100 shipments, reflecting its active participation in regional trade. Thailand contributed USD 151.05 from 1,971 shipments.

- Japan showed USD 124.44 from 2,343 shipments, highlighting consistent export and import activities across Asia.(Source: www.eximpedia.app )

- The worldwide exports were 32,333 shipments of Polyethylene Terephthalate from Jun 2024 to May 2025 (TTM). Total exporters were made were around 1645 exporters to 3444 buyers marking a growth rate of 32% comparing previous year. (Source: www.volza.com)

Polyethylene Terephthalate Catalyst Market Value Chain Analysis

- Raw Material Sourcing: The production of PET begins with the sourcing of two primary raw materials purified terephthalic acid (PTA) and monoethylene glycol (MEG). Both are derived from petrochemical feedstocks, primarily paraxylene (for PTA) and ethylene (for MEG). These materials are obtained from crude oil or natural gas refineries.

- Technology Used: PET production is based on polycondensation technology, where PTA reacts with MEG under controlled temperature and pressure to form the polymer chain. The process involves two main stages: esterification and polycondensation. The resulting molten PET is then solidified into granules or pellets for further processing.There are two key processing technologies used downstream:Injection Stretch Blow Molding (ISBM) for producing bottles and containers used in beverages, food packaging, and pharmaceuticals.Extrusion and Fiber Spinning for producing polyester fibers used in textiles, carpets, and industrial applications.

- Recycling Technology: Advancements in recycling technology, especially chemical recycling (depolymerization) and mechanical recycling, are transforming the PET industry. Technologies such as glycolysis, methanolysis, and enzymatic recycling are being adopted to convert waste PET back into monomers, closing the loop in the value chain. Additionally, automation, AI-based quality control, and energy-efficient reactors are improving production consistency and sustainability.

Market Key Trends

- A shift toward catalysts that enable chemical recycling and feedstock flexibility, reflecting circular economy priorities. High-activity, low-residue catalysts that reduce coloration and unwanted by-products are gaining traction in food-contact applications.

- Digital and service integrations predictive performance analytics and lifecycle monitoring are turning catalysts into solutions rather than mere consumables. Manufacturers favor catalysts enabling lower process temperatures and shorter cycles to reduce energy intensity.

- There is an uptick in collaborative R&D and licensing models, accelerating industrial validation of novel chemistries. Lastly, regulatory scrutiny and customer demand for traceability propel suppliers to offer documented, compliant catalytic solutions.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 871.11 Million |

| Expected Size by 2034 | USD 1,321.75 Million |

| Growth Rate from 2025 to 2034 | CAGR 5.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Catalyst Type, By Application, By Catalyst Form / Structure, By Process Stage / Function, By Region |

| Key Companies Profiled | Archroma , Afton Chemical (NewMarket) , Chemours , DOW Inc. , Indorama Ventures (joint ventures / feedstock to catalyst linkage) , TOYO PETROCHEMICAL CO., LTD. , Beijing Yisheng PET Catalyst Co., Ltd. , Radiant Catalysts Pvt Ltd , Evonik Degussa |

Segmental Insights

Catalyst Type Insights

Why Are Antimony-Based Segment Catalysts Dominating The Polyethylene Terephthalate Catalyst Market?

Antimony-based catalysts segment dominate the market holding around approximately 55% of the share in 2024, due to their proven efficiency, cost-effectiveness, and long-standing industrial acceptance. These catalysts offer consistent polymerization rates, ensuring optimal molecular weight and clarity, which are critical for bottle-grade PET applications. The ease of availability of antimony trioxide and its well-established handling protocols further strengthen its dominance across PET production lines globally. Despite growing environmental scrutiny, most manufacturers continue to rely on antimony systems due to process familiarity and low switching costs. The catalytic performance of antimony compounds ensures stable polymer color and viscosity control across large-scale continuous polymerization plants. Hence, this segment maintains its leadership as the industry’s benchmark catalyst technology.

However, the dominance of antimony-based catalysts is gradually being challenged by tightening regulations on heavy metal residues in food-contact materials. Environmental and health concerns are prompting manufacturers to explore low-toxicity alternatives such as titanium and germanium catalysts. Some global producers are working on improved formulations to minimize antimony residues while maintaining reaction efficiency. Despite this, complete replacement remains slow due to the need for process requalification and high conversion costs. In the near term, hybrid catalyst systems combining antimony and titanium are gaining attention as transitional solutions. Thus, while mature and reliable, the antimony-based segment is now under evolutionary pressure from cleaner, sustainable substitutes.

Titanium-based catalysts segment expects the fastest-growing in the market during the forecast period, due to their eco-friendly profile and lower toxicity compared to heavy-metal-based counterparts. They offer faster polymerization rates and excellent color stability, making them ideal for high-clarity packaging and textile-grade PET. Moreover, their suitability for food-contact applications aligns with increasing regulatory and consumer demand for safer packaging materials. Titanium catalysts also enable lower operating temperatures, reducing energy consumption and overall carbon footprint of PET production processes. These advantages make them attractive to producers seeking to modernize facilities and meet sustainability targets. Consequently, demand for titanium-based systems is steadily increasing across new PET plants, especially in Europe and Asia.

The key challenge for titanium catalysts lies in managing the yellowish hue that can develop during processing, particularly in continuous polymerization lines. To overcome this, manufacturers are optimizing co-catalyst systems and refining synthesis techniques for improved color control. Major PET producers are also conducting industrial-scale trials to validate titanium catalysts for high-volume production with recycled feedstock integration. As advancements continue, titanium-based catalysts are expected to gain greater acceptance in high-end applications such as fiber-grade PET and premium packaging. This segment’s growth reflects the industry’s transition toward non-toxic, performance-driven solutions compatible with global sustainability goals. Over the next decade, titanium catalysts could reshape the competitive landscape of the PET catalyst industry.

Application Insights

Why PET Bottles & Containers Is Dominating The Polyethylene Terephthalate Catalyst Market?

PET bottles and containers segment dominated the market with approximately 45% share in 2024, These packaging products require superior transparency, low acetaldehyde content, and high mechanical strength all dependent on effective catalytic systems. Antimony and titanium catalysts are primarily used in this segment to ensure fast reaction kinetics and consistent polymer quality. Beverage and food industries continue to drive demand as they seek lightweight, recyclable, and durable PET packaging materials. The expanding consumption of bottled water and carbonated drinks, particularly in emerging economies, reinforces the demand for catalyst systems optimized for clarity and consistency. Consequently, catalyst suppliers focus heavily on formulations that meet food-grade compliance and regulatory standards worldwide.

In addition, brand owners’ push for sustainability and recycled content integration is redefining catalyst needs in the bottle and container market. Catalysts that tolerate higher recycled PET (rPET) content without compromising clarity or strength are in high demand. Producers are testing hybrid or modified catalytic systems that facilitate melt reprocessing while maintaining polymer integrity. Continuous polymerization systems used in large-scale PET bottle production depend on catalysts with high thermal stability and minimal color formation. With growing emphasis on circular packaging, this segment will continue to lead catalyst consumption, though innovation will shift toward greener and rPET-compatible formulations. Overall, the bottles and containers segment defines the industrial standard for PET catalyst performance and reliability.

The PET fibers and textiles segment is witnessing the fastest growth during the forecast period, the catalyst demand and expanding rapidly with global apparel and home textile consumption. Polyester fibers, derived from PET, dominate the synthetic fiber market, requiring catalysts that deliver uniform polymer chains with high viscosity and stability. Demand is particularly high in Asia-Pacific, where polyester-based fabrics are integral to both domestic and export industries. Catalyst systems designed for fiber-grade PET ensure superior melt strength and controlled crystallization, critical for spinning and filament quality. Titanium and germanium-based catalysts are increasingly preferred for their high activity and minimal discoloration, supporting the production of bright and dyeable fibers. As the textile industry embraces sustainability, the need for catalysts compatible with recycled and bio-based feedstocks is accelerating adoption.

Moreover, advancements in high-tenacity and technical textile applications are pushing catalyst performance requirements further. Fiber producers are collaborating with catalyst suppliers to fine-tune formulations that optimize polymer uniformity and thermal properties. The growth of circular textile initiatives where polyester garments are chemically recycled into monomers creates new opportunities for catalyst technologies that support closed-loop production. With strong growth across Asia, coupled with increasing innovation in Europe, this application segment is set to outpace traditional packaging demand. The combination of regulatory alignment, performance needs, and sustainability makes PET fiber applications a cornerstone for the next wave of catalyst innovation. This segment’s evolution represents the PET industry’s shift from volume-driven to value-driven growth.

Catalyst Form Insights

Why Homogenous Catalyst Segment is Dominating the Polyethylene Terephthalate Catalyst Market?

Homogeneous catalysts segment dominated the market with approximately 65% share in 2024. Their uniform dispersion and molecular-level interaction enable precise reaction control during esterification and polycondensation processes. This results in highly consistent polymer quality and predictable processing behavior crucial for large-scale PET production. Antimony and titanium-based homogeneous catalysts remain industry standards due to their high activity and established integration into continuous polymerization systems. Their compatibility with a variety of feedstocks, including virgin and partially recycled raw materials, further solidifies their dominance. Homogeneous catalysts are particularly favoured for achieving clarity and mechanical strength required in bottle- and film-grade PET.

However, growing environmental and process efficiency demands are leading producers to reassess homogeneous systems. The challenge lies in post-reaction purification, as residues must be carefully controlled to ensure regulatory compliance for food-contact materials. Manufacturers are developing modified homogeneous catalysts that produce fewer by-products and require less downstream filtration. Process optimization and improved dosing systems have also enhanced catalyst utilization efficiency. Despite the emergence of supported alternatives, homogeneous systems remain unmatched in industrial familiarity and scalability. Their dominance will persist in the short-to-medium term, though innovation will focus on greener, lower-toxicity formulations.

Heterogeneous catalysts segment expects the fastest growth in the market during the forecast period and expanding as sustainability and efficiency priorities evolve. These catalysts offer distinct advantages such as easy separation from the reaction mixture, reduced contamination, and reusability making them attractive for eco-conscious manufacturers. Supported catalytic structures improve process safety and enable continuous operation with minimal maintenance. Moreover, they reduce waste and simplify compliance with food-contact and environmental regulations by minimizing metal leaching. The shift toward solid-state and continuous reactors in advanced PET facilities further supports adoption of these catalyst systems. Their versatility makes them ideal candidates for integrating recycled or bio-based monomers into the PET value chain.

Although adoption is still limited compared to homogeneous systems, heterogeneous catalysts are gaining recognition for their operational and environmental benefits. Research efforts focus on optimizing catalytic surface area and active site distribution to enhance polymerization rates. The potential for regeneration and extended catalyst lifetime provides additional cost savings for large-scale plants. Supported catalysts are also compatible with hybrid production processes, bridging chemical and mechanical recycling pathways. With growing interest from major chemical producers and emerging startups, the segment is poised for substantial expansion. Over time, heterogeneous catalysts are expected to transform PET manufacturing by aligning efficiency with circular economy objectives.

Process Stage Insights

Why Polycondensation Stage Catalysts Segment Is Dominating The Polyethylene Terephthalate Catalyst Market?

polycondensation stage catalysts segment dominates the market accounting approximately 50% share in 2024. This stage is crucial for achieving the desired molecular weight, clarity, and thermal stability of PET resin. Polycondensation catalysts commonly antimony or titanium-based enable efficient chain growth by accelerating the reaction between ethylene glycol and dimethyl terephthalate or terephthalic acid. Their performance directly impacts the viscosity, strength, and overall quality of the polymer. Continuous optimization of catalyst concentration and reactivity is essential to maintain consistent polymerization rates across large-scale production lines. As a result, polycondensation-stage catalysts remain the backbone of PET production worldwide.

Solid-state and post-polymerization catalysts segment expects the fastest growth in the market during the forecast period. These catalysts are essential for upgrading polymer properties after initial melt polymerization, particularly for bottle-grade and engineering-grade PET. They enable further molecular weight buildup under controlled conditions, improving mechanical strength and barrier performance. The solid-state polymerization (SSP) process requires catalysts with precise thermal stability and minimal volatilization, characteristics increasingly met by new titanium and supported catalyst systems. The segment benefits from the global trend toward premium-grade PET products that demand superior processing and performance attributes. Hence, solid-state catalysts are becoming vital to producers seeking higher-value output with reduced energy consumption.

Regional Insights

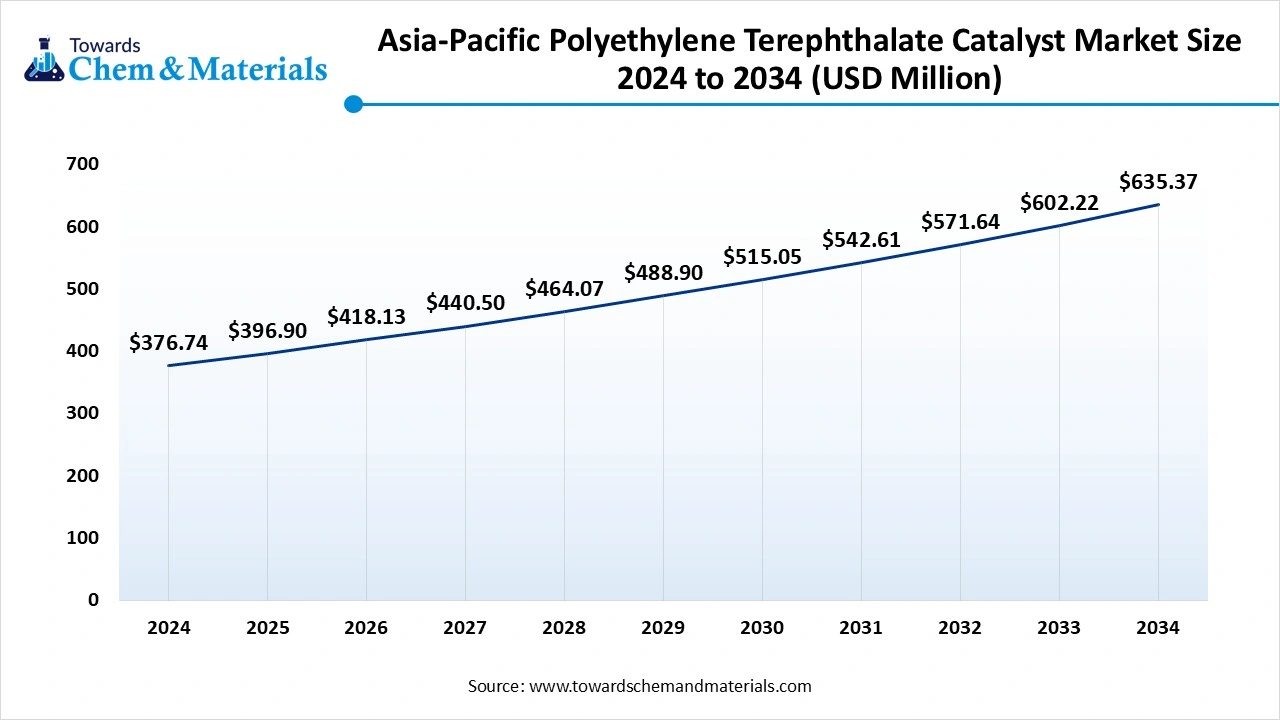

The Asia Pacific polyethylene terephthalate catalyst market size is valued at USD 396.90 million in 2025 and is expected to surpass around USD 635.37 million by 2034 expanding at a CAGR of 5.37% from 2025 to 2034.

Where Volume Meets Innovation Asia Pacific?

Asia Pacific is dominating the polyethylene terephthalate Catalyst Market by holding a share of approximately 48% in 2024, driven by large-scale polyester capacity expansions and robust demand for PET packaging and textiles. High-volume polymer production in the region creates persistent demand for reliable, cost-effective catalyst systems that support continuous operation. Local players and global suppliers compete to provide catalysts tailored for high-throughput plants and diverse feedstock qualities, including growing streams of recycled content. The region’s investment focus on new greenfield plants and retrofits sustains long-term catalyst consumption and service contracts. Meanwhile, environmental policies and recycling targets are nudging suppliers to prioritize catalysts compatible with circular feedstocks. Collectively, these forces make Asia-Pacific the central growth engine for PET catalyst adoption.

Technology adoption is pragmatic producers seek proven catalysts that reduce total cost of ownership while enabling higher product quality. Catalyst providers with strong local technical support and supply chain presence enjoy competitive advantage due to on-site trial needs. As domestic polyester converters move up the value chain toward specialty PET grades, demand for higher-performance catalysts rises. Sustainability initiatives both regulatory and customer-driven are accelerating interest in catalytic solutions that facilitate recycled monomer integration. Price sensitivity remains high, so suppliers must balance innovation with cost-competitive offerings. The combination of scale, evolution in product mix, and sustainability focus will continue to anchor Asia-Pacific’s dominant role.

Polyethylene Terephthalate Catalyst Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 22% |

| Europe | 19% |

| Asia Pacific | 48% |

| Latin America | 8% |

| Middle East and Africa | 3% |

China Polyethylene Terephthalate Catalyst Market Trends

China leads regionally with vast polyester capacity and substantial R&D investments, creating demand for both commodity and specialty catalysts. India is rapidly expanding PET production capacity and favours local technical partnerships and cost-competitive catalyst solutions. Japan focuses on high-value specialty PET grades and places premium on catalyst performance and regulatory compliance. South Korea emphasizes process integration and advanced catalyst adoption through its sophisticated chemical manufacturing base. Southeast Asian countries e.g., Thailand, Vietnam are growing as conversion hubs, preferring scalable, low-cost catalyst systems and strong supplier support.

Why Green Grade Gain are drivers for Sustainability and Growth?

Europe is fastest growing in the polyethylene terephthalate catalyst market by holding a share of approximately 18% during the forecast period, propelled by strong regulatory push for recyclability and circular materials. Producers in the region prioritize catalysts that enable high-recycled-content PET and comply with stringent food-contact and environmental standards. Investment is shifting toward specialty catalysts that improve color control, reduce residues, and facilitate chemical recycling pathways. European buyers value transparency, lifecycle assessments, and documented supply chains, which favor certified catalyst suppliers. Collaboration between catalyst developers, converters, and research institutions accelerates the commercialization of greener chemistries. This regulatory and innovation ecosystem positions Europe as a leader in next-generation catalytic solutions.

Demand in Europe is less about sheer volume and more about enabling circularity and premium performance, driving higher average selling prices for advanced catalysts. Catalysts that reduce energy consumption or unlock depolymerization for chemical recycling are particularly prized by converters and brand owners. Suppliers that can demonstrate compliance with EU regulations and provide robust technical services are preferred. Public and private investments into recycling infrastructure and pilot chemical-recycling plants create demonstration opportunities for novel catalysts. Market entry requires rigorous validation and certifications, which sets high barriers but also provides stickiness once approvals are obtained. Taken together, these dynamics convert sustainability priorities into tangible market growth for advanced catalyst technologies.

Germany Polyethylene Terephthalate Catalyst Market Trends

Germany leads with strong chemical engineering capabilities and industrial adoption of high-performance catalyst systems. The Netherlands and Belgium act as innovation and logistics hubs for PET recycling initiatives and catalyst demonstrations. France emphasizes regulatory compliance and brand-driven demand for recycled-content PET, favoring certified catalyst suppliers. Italy’s strong packaging and textile industries create steady demand for a range of catalyst solutions. Spain is increasing investments in circular economy projects, making it an attractive market for catalysts enabling recycled feedstock integration.

North America: Resilient Modernization, Notable Growth

North America shows notable growth driven by retrofit projects, investments in recycling infrastructure, and demand for higher-value PET grades. The market balances mature capacity with pockets of modernization that require catalysts offering energy efficiency and improved product quality. Interest in chemical recycling and processes that allow mixed feedstock use is rising, prompting demand for specialized catalytic solutions. Strategic collaborations between catalyst suppliers and converters accelerate field validation and scaling of new chemistries. Regulatory and food-contact standards in the region require thorough vendor qualification, benefiting established suppliers with compliance track records. Overall, growth is steady and technology-led, with emphasis on sustainability and operational improvements.

United States Polyethylene Terephthalate Catalyst Market

The U.S. Polyethylene Terephthalate (PET) catalyst market is experiencing steady growth, driven by rising demand for PET in packaging, particularly bottles and containers. Increased focus on sustainability and recycled PET (rPET) is prompting a shift from traditional antimony-based catalysts to environmentally friendly alternatives like titanium and aluminum-based systems. Regulatory pressures and the need for high-performance catalysts that maintain quality in recycled streams are influencing innovation. Future trends include catalyst optimization for recyclability, lower residue formulations, and continued investment in eco-friendly catalyst technologies.

Recent Development

- In October 2025, Clariant has introduced a new titanium-based catalyst designed to transform polyester production with a stronger emphasis polyester production with a stronger emphasis on sustainability and improved performance. (Source : www.chemanalyst.com) Clariant Unveils Sustainable, Titanium-Based Catalyst to Revolutionize Polyester Production

Top Companies Covered in the Report

- Mitsubishi Chemical Corporation: a leading Japanese chemical company specializing in advanced materials, performance products, and life sciences, focusing on sustainable and innovative chemical solutions.

- BASF SE: a global German chemical giant known for its extensive portfolio spanning chemicals, materials, industrial solutions, agricultural products, and sustainability-driven innovations.

- LANXESS A: a specialty chemicals company based in Germany that develops high-performance polymers, additives, and intermediates for industrial and consumer applications.

- Eastman Chemical Company: a U.S.-based global materials and specialty chemicals manufacturer providing sustainable solutions in packaging, textiles, transportation, and construction.

- Envoik Industries: an emerging chemical and materials company focused on eco-friendly manufacturing, innovative formulations, and sustainable industrial solutions.

- WEGO Chemical Group: a U.S.-based international distributor and manufacturer of chemicals, polymers, and specialty products serving diverse industries worldwide.

Other Companies Covered in the Report

- Archroma

- Afton Chemical (NewMarket)

- Chemours

- DOW Inc.

- Indorama Ventures (joint ventures / feedstock to catalyst linkage)

- TOYO PETROCHEMICAL CO., LTD.

- Beijing Yisheng PET Catalyst Co., Ltd.

- Radiant Catalysts Pvt Ltd

- Evonik Degussa

Segments Covered

By Catalyst Type

- Antimony-based Catalysts

- Titanium-based Catalysts

- Germanium-based Catalysts

- Manganese-based Catalysts

- Emerging Catalysts (heteropolyacid, enzyme)

By Application

- PET Bottles & Containers

- PET Fibers / Textiles

- PET Films & Sheets

- Industrial / Engineering PET

By Catalyst Form / Structure

- Homogeneous Catalysts

- Heterogeneous / Supported Catalysts

By Process Stage / Function

- Esterification / Pre-polymerization Catalysts

- Polycondensation Catalysts

- Solid-State Polymerization / Post-polymerization Catalysts

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait