Content

What is the Current Waste Management Market Size and Share?

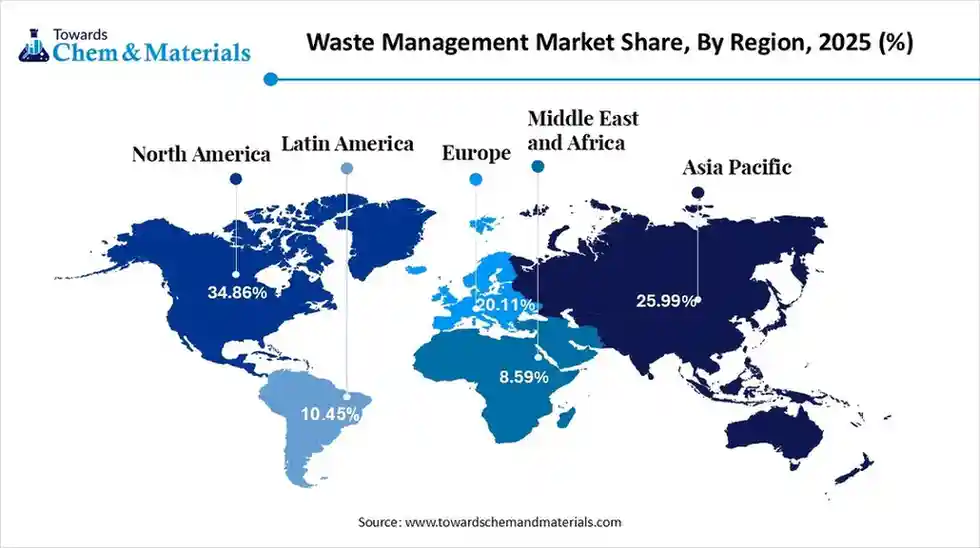

The global waste management market size was estimated at USD 1.51 trillion in 2025 and is predicted to increase from USD 1.60 trillion in 2026 and is projected to reach around USD 2.69 trillion by 2035, The market is expanding at a CAGR of 5.95% between 2026 and 2035. North America dominated the waste management market with a market share of 34.86% the global market in 2025. The shift towards minimization of hazardous waste and more environmentally friendly manufacturing bases has fueled industry potential in recent years.

Key Takeaways

- The North America led the waste management market with the largest revenue share of over 34.86% in 2025. due to the region being equipped with advanced technology and collection systems.

- The Asia Pacific waste management industry is expected to grow at the fastest CAGR of 6.95% from 2026 to 2035, owing to the heavy industrial growth and urbanization.

- By service type, the collection segment leads the global waste management market in 2025 and accounted for a 62.35% share due to its being known as the first and most essential step in the waste management system

- By service type, the disposal segment is expected to grow at the fastest CAGR of 7.88% from 2025 to 2035, due to landfills, advanced waste-to-energy plants, and deep burial sites having emerged as an ideal solution for enlarged urban waste in recent years.

- By waste type, the industrial waste segment dominated the waste management industry with a revenue share of 86.55% in 2025 due to factories simply producing more waste than households or offices nowadays, which need to be managed.

- By waste type, the E-waste segment is expected to grow at a considerable CAGR of 9.11% from 2026 to 2035. As people have been buying more gadgets and replacing them quickly over the past few years.

Total Waste Control: The Market Surges with All-in-One Solutions

The waste management refers to the specific activities that recycle, collect, sort, and safe disposal of the generic or industrial waste efficiently called as the waste management. Furthermore, these sectors have allowed all types of waste, such as hazardous waste, solid waste, and liquid waste, as per the recent survey. Also, by helping in the reduction of pollution, building recycling plants, and managing landfills, the waste management companies have gained significant market presence in the current period.

Waste Management Market Trends:

- The increased focus on the waste light manufacturing by major manufacturing giants has driven substantial financial gains in the industrial sector in the past few years. Moreover, the companies have seen in applying these models, which allow reducing waste in the first place instead of treating waste after it appears nowadays.

- The establishment of the micro sorting hubs in the cities has increasingly enabled the sector to explore untapped potential in the past few years. Moreover, the government's support for these initiatives has allowed the stakeholders to capitalize on growth opportunities in recent years.

- The emergence and development of the digital waste footprint scoring systems are heavily strengthening the foundation for future sector growth in the current period. Furthermore, by helping companies, households, and buildings while showing how effectively they are managing waste via score, the digital systems have positioned the industry for long-term expansion nowadays

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 1.60 Trillion |

| Revenue Forecast in 2035 | USD 2.69 Trillion |

| Growth Rate | CAGR 5.95% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segment Covered | By Service Type, By Waste Type, By Region |

| Key companies profiled | WM Intellectual Property Holdings, L.L.C, Suez, Valicor, Veolia, Waste Connections., Republic Services, Biffa, CLEAN HARBORS, INC., Reworld., DAISEKI CO., Ltd., Stericycle, Inc., Casella Waste Systems, Inc., CECO ENVIRONMENTAL., Cleanaway, GFL Environmental Inc. |

Recycling Reinvented: Smart Bins Make Every Item Count

Technology is expected to play a major role in industry growth with the rise of smart bins that sort waste all by themselves. Instead of people guessing which bin to use, each item carries a tiny invisible mark that tells the bin what it's made of. When the trash is dropped in, the bin scans it and quietly moves it to the correct section inside. Also, this makes recycling easier, cleaner, and much more reliable. Cities like this because it cuts labor costs and avoids messy mistakes during the projected period.

Trade Analysis of the Waste Management Market: Import, Export, Consumption, and Production Statistics

- China has seen under the greater export of polyethylene waste or scrap in 2024 which valued $968k as per the report.

- The United States also exported a significant amount of scrap waste in 2024, and the export value is $48.9 million, as per the latest report.

Value Chain Analysis of the Waste Management Market:

- Distribution to Industrial Users: The industrial waste management market involves the collection, transportation, processing, recycling, treatment, and disposal of waste generated by industrial activities, with distribution to end-users (e.g., recycling facilities, waste-to-energy plants, landfills) being a key part of the process.

- Key Players: Veolia (France) and Republic Services, Inc. (U.S.)

- Chemical Synthesis and Processing: Chemical synthesis and processing within the market primarily involves advanced technologies, particularly for chemical recycling of materials like plastics and the treatment of hazardous chemical waste. This segment bridges the traditional waste management industry with the chemical manufacturing sector.

- Key Players: Veolia Environnement S.A. (France) and Clean Harbors, Inc. (U.S.)

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring in the market are governed by a complex web of local, national, and international laws aimed at protecting human health and the environment. Key agencies set standards, issue permits, and enforce rules for the entire waste lifecycle, from generation to final disposal.

- Key Agencies: Environmental Protection Agencies (National/Federal) and (U.S. Environmental Protection Agency (EPA)

Waste Management Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Resource Conservation and Recovery Act (RCRA) | Protecting human health and the environment from hazardous waste |

| European Union | European Commission (EC) | Waste Framework Directive (WFD) (Directive 2008/98/EC as amended) | Transitioning to a circular economy |

| China | Ministry of Ecology and Environment (MEE) | Law on the Prevention and Control of Environmental Pollution by Solid Waste (Solid Waste Law) (revised 2020) | Strengthening environmental protection and cracking down on illegal activities (dumping, transfer) |

Segmental Insights

Service Type Insights

How did the Collection Segment Dominate the Waste Management Market in 2025?

The collection segment dominated the market in 2025 and accounted for a 62.35% share, owing to its being known as the first and most essential step in the waste management system. Moreover, factors like greater government support via investment in bins, trucks, and pick systems, and population density increase have drawn major attention to the segment in the past few years, as per the observation.

The disposal segment is expected to grow at a rapid CAGR of 7.88% from 2025 to 2035, akin to landfills, advanced waste-to-energy plants, and deep burial sites have emerged as the ideal solution for enlarged urban waste in recent years. Also, the increased investment in incinerators by energy companies is projected to strengthen the bottom line for disposable services firms during the forecast period.

Waste Type Insights,

Why does the Industrial Waste Segment Dominate the Waste Management Market?

The industrial waste segment dominated the waste management industry with a revenue share of 86.55% in 2025, akin to factories simply producing more waste than households or offices, which need attention. Every production step - from cutting metal to mixing chemicals creates leftover material that must be handled properly. Since industries work all day and night, waste builds up quickly, and they need reliable partners to manage it in the coming years.

The e-waste segment is expected to grow at a rapid CAGR CAGR of 9.11% from 2026 to 2035. People have been buying more gadgets and replacing them quickly over the past few years. Moreover, every home now has old phones, chargers, TVs, and laptops stored away, and EV cars add even bigger battery waste. These devices contain expensive metals, so recycling them becomes more valuable than throwing them away.

Regional Insights

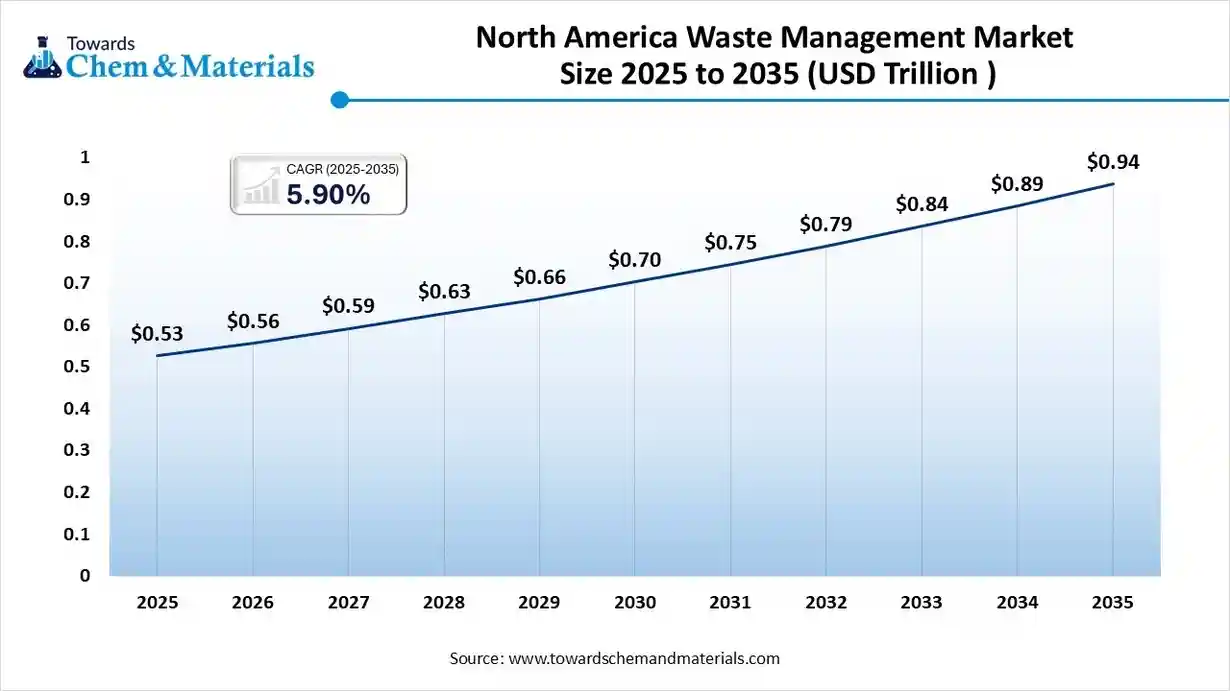

The North America waste management market size was valued at USD 0.53 trillion in 2025 and is expected to reach USD 0.94 trillion by 2035, growing at a CAGR of 5.90% from 2026 to 2035. The North America led the waste management market with the largest revenue share of over 34.86% in 2025, owing to the region being equipped with advanced technology and collection systems. Moreover, the stronger recycling programs and stricter landfills are anticipated to support stronger cash flows for manufacturing enterprises in the region in the coming years. Also, the region has seen an increase in investment in automation and GPS-guided trucks in recent years.

United States Leverages Tech and Treatment Plants to Stay Ahead in Waste Management

The United States maintained its dominance in the market, akin to heavy biomethane recovery and the establishment of hazardous waste treatment plants in the current period. Moreover, the crucial players in the country have focused on the development of digital tracking tools for commercial waste over the past few years, as per the regional survey.

Asia Pacific Waste Management Market Examination

Asia Pacific is expected to capture a major share of the market with a rapid CAGR of 6.95% from 2026 to 2035, akin to heavy industrial growth and urbanization. Several regional governments are supporting their nation to achieve efficient waste management by investing in smart collection zones and recycling parks. The emergence of the waste-to-energy plants is expected to elevate the earning potential for producers.

Smart Sorting Creates Big Potential in China

China is expected to emerge as a prominent country for the waste management market in the coming years, due to the country's observed under heavy focus on the development of automated sorting lines and AI-powered identification stations in the current period. Moreover, China has also been facing difficulties in managing its heavy packaging and industrial scrap, where the waste management brand can major share in the coming years by providing efficient management.

Europe Waste Management Market Evaluation

Europe is a notably growing region owing to its region being known for its eco-friendly initiatives and stricter laws. Moreover, these implementations of the laws have translated into favorable financial prospects for the waste management brands in the region nowadays. Also, the region has been seen in the expansion of high-tech recycling systems in the past few years.

Engineering Excellence Drives Germany’s Next Big Waste Industry

Germany is expected to gain a major industry owing to its deposit return systems and nationwide recycling partners, as per the latest survey. Moreover, Germany's strong and technologically advanced engineering sectors may present new business models for forward-thinking waste management players during the projected period, as per the future industry expectations.

Waste Management Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the industry due to cities are growing fast, and cars no longer rely on old dumping practices. Countries are starting to build modern recycling centers and smarter collection systems. Hot climates demand durable bins, sealed trucks, and high-performance disposal sites, which increases investment.

Modernization Wave Pushes Saudi Arabia into a New Waste Era

Saudi Arabia is expected to emerge as a prominent country for the waste management market in the coming years due to the country is modernizing at a fast pace. With new cities, resorts, factories, and transport networks being built, waste keeps increasing daily. The government wants cleaner surroundings and global-standard recycling, so it is investing heavily in advanced waste systems.

South America Waste Management Market Evaluation

South America is a notably growing region owing to the region is becoming more urban and producing more household and industrial waste. Governments are cleaning cities, upgrading landfills, and building recycling centers to handle the rising waste load.

Brazil Reinvents Waste Management for a Sustainable Tomorrow

Brazil is expected to gain a major industry akin to the country is cleaning up how it handles trash. With huge cities and millions of packages, leftover food, and factory scraps every day, Brazil needs smarter waste systems. Instead of old dumping methods, cities are building recycling sites and cleaner landfills that produce energy in the current period.

Recent Developments

- In September 2025, the Tiruchi Corporation has unveiled its plan to launch waste management projects. Moreover, the company has reclaimed the 40 acres of land in India and organized the projected requirement in Ariyamangalam Dump Yard as per the published report.(Source: www.thehindu.com)

Top Vendors in the Waste Management Market & Their Offerings:

- WM Intellectual Property Holdings, L.L.C: A subsidiary of WM (formerly Waste Management), it manages the intellectual property of North America's leading provider of comprehensive waste management and environmental services.

- Suez: A French-based global leader in smart and sustainable resource management, specializing in water and waste management solutions that help clients preserve and restore environmental elements.

- Valicor: The largest provider of centralized non-hazardous wastewater treatment services in North America, focusing on recovering reusable materials and minimizing waste volume.

- Veolia: A global benchmark for ecological transformation, providing optimized resource management solutions in three main fields: water management, waste recovery, and energy services.

Top Companies in the Waste Management Market

- Waste Connections.

- Republic Services

- Biffa

- CLEAN HARBORS, INC.

- Reworld.

- DAISEKI CO., Ltd.

- Stericycle, Inc.

- Casella Waste Systems, Inc.

- CECO ENVIRONMENTAL.

- Cleanaway

- GFL Environmental Inc.

Segments Covered

By Service Type

- Collection

- Transportation

- Disposal

By Waste Type

- Municipal Waste

- Medical Waste

- Industrial Waste

- E-waste

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa