Content

Glycol Market Size and Growth 2025 to 2034

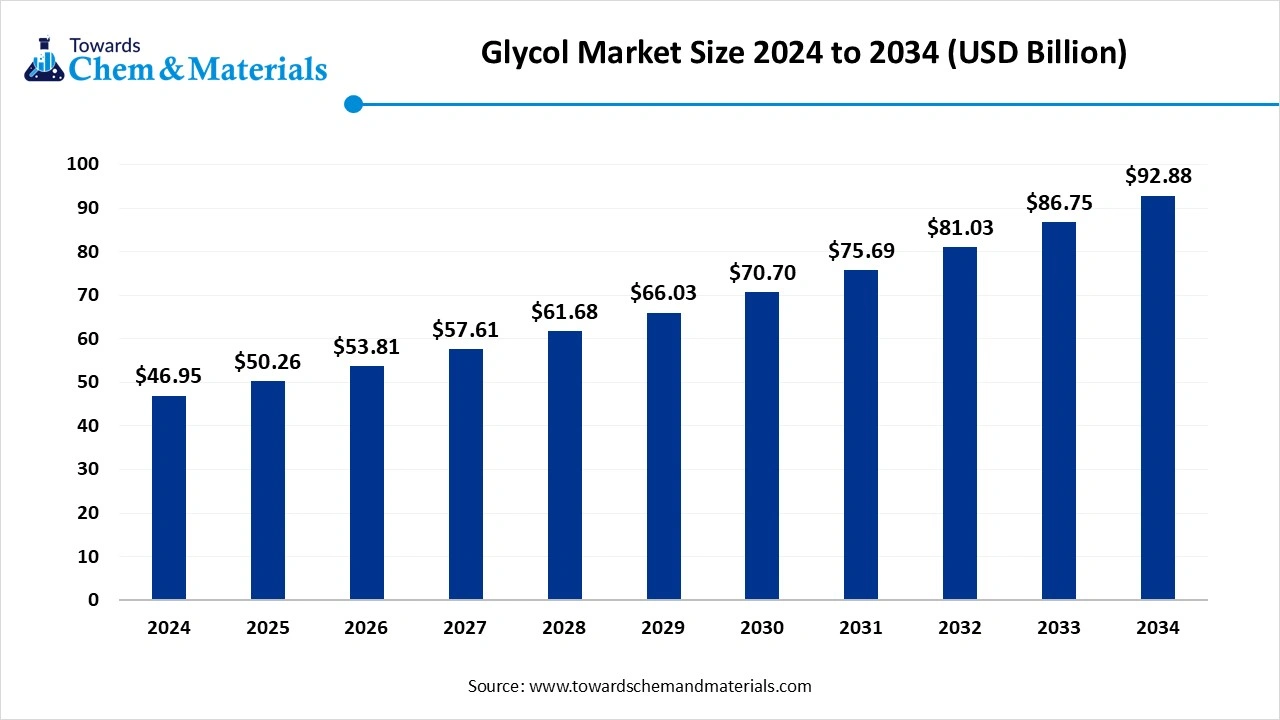

The global glycol market size was reached at USD 46.95 billion in 2024 and is expected to be worth around USD 92.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.06% over the forecast period 2025 to 2034. The growth of the market is driven by the widespread demand from various industries due to expanding use fuels the growth of the market.

Key Takeaways

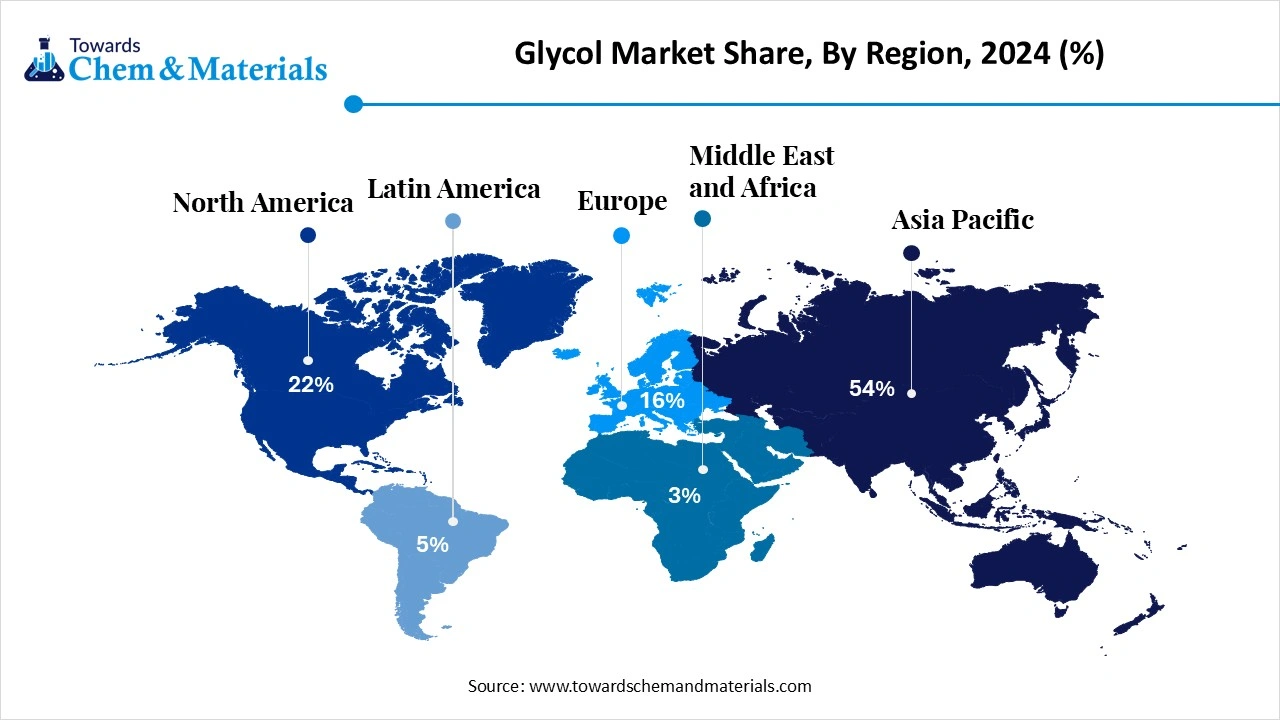

- The Asia Pacific glycol market size was estimated at USD 25.35 billion in 2024 and is expected to reach USD 50.20 billion by 2034, growing at a CAGR of 7.07% from 2025 to 2034.

- By region, Latin America is expected to have significant growth in the market in the forecast period. The growing industries, especially packaging, fuel the growth.

- By product type, the monoethylene glycol (MEG) segment dominated the market in 2024. The monoethylene glycol (MEG) segment held a 44% share in the market in 2024. The versatile product profile fuels the demand for the market.

- By product type, the propylene glycol (food and pharma grade) segment is expected to grow significantly in the market during the forecast period. the growing applications in pharma and food industry due to its properties drives the growth.

- By source, the petroleum-based segment dominated the market in 2024. The petroleum-based segment held an 85% share in the market in 2024. The growing demand from industries fuels the growth of the market.

- By source, the bio-based glycol (renewable feedstocks) segment is expected to grow in the forecast period. The shift towards sustainability and environmentally friendly materials drives the growth.

- By application, the polyester fibers and PET resin segment dominated the market in 2024. The polyester fibers and PET resin segment held a 47% share in the market in 2024. The durability and versatility drive the demand for the market.

- By application, the heat transfer fluids and food humectants segment is expected to grow in the forecast period. The stability offered by the products fuels the growth.

- By end use, the packaging (PET bottles) segment dominated the market in 2024. The packaging (PET bottles) segment held a 38% share in the market in 2024. The wide and exclusive use of glycol for production drives the demand.

- By end use, the pharmaceutical and personal care segment is expected to grow in the forecast period. the growing demand due it its benefits and properties offered drives the growth.

- By distribution channel, the direct sale segment dominated the market in 2024. The direct sale segment held a 52% share in the market in 2024. The availability of a wide range of products fuels the growth.

- By distribution channel, the online chemical portals segment is expected to grow in the forecast period. The easy accessibility drives the growth.

Market Overview

Rising Demand for Durable Materials: Glycol Market to Expand

The Market refers to the global industry involved in the production, distribution, and consumption of various types of glycols, primarily ethylene glycol (EG) and propylene glycol (PG), used across a wide range of applications. Glycols are versatile organic compounds widely used as antifreeze agents, humectants, solvents, and intermediates in industries such as automotive, construction, pharmaceuticals, food & beverages, and personal care. The demand is driven by factors such as industrialization, rising demand for PET plastics, and increased usage in HVAC and de-icing applications.

What Are the Key Growth Drivers Responsible for The Growth of The Glycol Market?

The glycol market's growth is mainly fueled by rising demand from industries such as textiles, automotive, construction, and packaging. Additionally, increased use of glycols in cosmetics, pharmaceuticals, and food and beverage sectors contributes to this expansion. The expanding building sector and the development of bio-based and recycled glycols also serve as important growth factors. Key drivers include sustainability, innovation in manufacturing processes, and the exploration of new applications.

Market Trends

- The automotive industry growth and increased vehicle production boost the demand for glycol-based coolants, antifreeze, and battery thermal management systems.

- The growing focus on bio-based glycol and sustainable production methods and use of recyclable and biodegradable alternatives due to rising environmental concerns drives the growth.

- The technological advancements and development of smart glycol solutions further fuel the growth of the market.

- The rising construction activities and demand for insulation materials also contribute to the growth of the market.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 50.26 Billion |

| Expected Size by 2034 | USD 92.88 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.06% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Source, By Application, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | SABIC, BASF SE, Dow Inc., LyondellBasell Industries, Huntsman Corporation , Shell plc , Reliance Industries Limited, India Glycols Limited , LOTTE Chemical Corporation, INEOS Oxide , Global Bio-Chem Technology Group, MEGlobal (Equate Group) , Shandong Hualu-Hengsheng Chemical Co., Ningbo Fortune Petrochemical, ADM (Archer Daniels Midland), Braskem S.A. , Manali Petrochemicals Limited , Tokyo Chemical Industry Co., Royal Dutch Shell, ExxonMobil Chemical |

Market Opportunity

What Are the Key Growth Opportunities Responsible for The Growth of The Glycol Market?

The market is seeing substantial growth, fueled by rising demand in multiple sectors, creating numerous opportunities. This expansion is driven by the extensive use of glycols as coolants, antifreeze agents, and in manufacturing plastics, resins, and polyester fibers. Major contributors to this growth include increasing automotive production, higher construction activity, and the expanding packaging and textile industries. These factors collectively generate new growth opportunities, further fueling the market expansion.

Market Challenge

What are the key challenges that hinder the growth of the glycol market?

The glycol market encounters various challenges, such as volatile raw material costs, strict environmental regulations, and rising competition from bio-based options. Producing glycol, especially ethylene glycol, largely depends on fossil fuel-derived feedstocks like natural gas and crude oil. These feedstocks' prices can fluctuate significantly because of global economic and geopolitical influences, affecting production expenses and profit margins for manufacturers. Moreover, the market remains volatile due to geopolitical tensions, trade restrictions, and difficulties in waste management and recycling.

Regional Insights

How Did Asia Pacific Dominate the Glycol Market In 2024?

The Asia Pacific glycol market size was estimated at USD 25.35 billion in 2024 and is anticipated to reach USD 50.20 billion by 2034, growing at a CAGR of 7.07% from 2025 to 2034.

The Asia Pacific glycol market size was estimated at USD 25.35 billion in 2024 and is anticipated to reach USD 50.20 billion by 2034, growing at a CAGR of 7.07% from 2025 to 2034. Asia Pacific dominated the market in 2024. The growth of the market in the region is driven by the expanding industrial sector and increased chemical production in the region, which fuels the growth of the market. The growing pharmaceutical and personal care sector also contributes to the growth of the market. The expanding automotive sector in the region also contributes to the growth due to increasing demand for coolant and antifreeze from the industry, further propelling the growth of the market in the region.

The Strong Demand from The Textile and Automotive Industry Fuels the Growth.

The growth of the market is driven by the growing demand from textile and automotive industry due to expansion of the industry which fuels the growth. ethylene glycol is a primary ingredient in polyester fiber production, and in automotive industry glycol is used as base for coolant and antifreeze which increase the demand for the product increasing the growth of the market in the country.

- China shipped out 285 Glycol coolant shipments. These exports were done by 52 China exporters to 64 buyers.(Source: www.volza.com)

The Growing Packaging Industry in Latin America Is a Major Factor

Latin America is expected to have a significant growth in the glycol market in the forecast period. The growth of the market is driven by the growing and increasing demand from the personal care and construction sectors due to the expanding industry in the region. Caprylyl glycol is a popular ingredient in personal care products, which contributes to the growth of the market. The growing packaging industry and use of PET in packaging, fueled by the growth of industries like food and beverages and the growth in e-commerce, also drive the demand for the market in the region, contributing to the expansion of the market.

Brazil's Expanding Chemical Sector Contributes to The Growth of The Market.

The growth of the market is driven by the growing automotive sector in the country, which fuels the growth. The growth is also propelled by the growing chemical industry in the country due to increasing demand for coolant and antifreeze from various industries, which increases production in the country, which contributes to the growth of the market. Additionally, the growing environmentally friendly materials contributes to the growth and expansion of the market in the country.

- The world shipped out 1,072 Glycol Organic shipments from October 2023 to September 2024 (TTM). These exports are done by 176 world exporters to 134 buyers, with the growth rate of 47% over the previous 12 months.(Source: www.volza.com)

- Globally, Taiwan, the United States, and South Korea are the top three exporters of Glycol Organic. Taiwan is the global leader in Glycol Organic exports with 736 shipments, followed closely by the United States with 656 shipments, and South Korea in third place with 224 shipments.(Source: www.volza.com)

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated the Glycol Market in 2024?

The monoethylene glycol (MEG) segment dominated the glycol market in 2024. Monoethylene glycol is a versatile organic compound that increases the demand from various industries. The growing use and demand to produce PET bottles, polyester resins, and other products, and in coolants, fuels the growth of the demand and growth of the market. They are commonly used in deicing fluids compounds, health transfer fluids, solvents, and other applications like adhesives, sealants, and as a chemical intermediate due to their low volatility, solubility, and appearance also boosts the growth of the market.

The propylene glycol (food & pharma grade) segment expects significant growth in the market during the forecast period. The growth of the market is driven by the growing application in both the pharmaceutical and food and beverage industry due to its versatile applications, like drug development, in baked goods and confections, due to its properties like humectant, stabilizer, solvent, and even as excipient, which fuels the growth of the market. The growth is propelled due to the growing demand for its benefits, which contributes to the growth of the market.

Source Insights

How Did the Petroleum-Based Segment Dominate the Glycol Market In 2024?

The petroleum-based segment dominated the market in 2024. The growing and wide applications like antifreeze, cosmetics, food, pharmaceutical, and industrial processes, as they serve as lubricants, coolants, and components in various industries, which fuel the demand and growth of the market. The ongoing research and developments for enhancing the thickness, softness, and formulation of the products, especially the cosmetics, further boost the growth of the market. Propylene glycol and polyethylene glycol (PEG) are common examples of petroleum-based glycols, which are used by the industries that drive the growth of the market.

The bio-based glycol (renewable feedstocks) segment expects significant growth in the glycol market during the forecast period. The growing applications like textiles, packaging, antifreeze, coolants, cosmetics, pharmaceuticals, industrial solvents, and many more increase the demand. The growth of the market is driven by the growing demand for biobased products, especially due to growing environmental concerns and demand for sustainable products, with a rising shift towards reduced dependence on fossil fuel and lower greenhouse gas emissions, and demand for renewable products boosts the growth and expansion of the market.

Application Insights

Which Application Segment Dominated the Glycol Market In 2024?

The polyester fibers & PET resin segment dominated the market in 2024. The growing applications like beverage bottles, food containers, and other packaging like cosmetics and films a responsible for the growth of the market. The key properties like lightweight nature, moisture resistance property, recyclability, chemical resistance strength, and durability further increase the demand and growth of the market. The demand from industries like automotive, medical, construction, and composites, especially the packaging and textile industry, boosts the growth and expansion of the market.

The heat transfer fluids & food humectants segment expects significant growth in the glycol market during the forecast period. The most used types of especially used glycols are ethylene glycol and propylene glycol. The growth of the market is driven by the growing demand from the industries and food-related applications, which fuels the growth of the market. The low toxicity profile also increases the demand from the industry as a humectant, stabilizer, and as a solvent for industrial applications, which boosts the growth of the market.

End Use Insights

How Did the Packaging (PET Bottles) Segment Dominate the Glycol Market In 2024?

The packaging (PET bottles) segment dominated the market in 2024. The growth is driven by the growing demand from the industry, as glycol is a key component in the production of PET bottles, especially for beverage bottles, which fuels the growth of the market. The ongoing research and development for the development of improved and efficient products further fuels the growth of the market. The key applications, due to its strength, durability, and transparency, make it a preferred and suitable choice for water bottles, food, and beverage containers, which boosts the growth of the market.

The pharmaceuticals and personal care segment expects significant growth in the market during the forecast period.

The glycol is widely used in pharmaceutical and personal care product development due to its properties and benefits offered, which increases the demand for the market. It is widely used as a solvent, solubilizer, stabilizer, and vehicle for injection, in oral and topical medications. These versatile benefits make it a preferred choice by the industry, which increases the demand for the market. In personal care, properties like humectants, penetration enhancers, solvents, and emulsifiers, and in haircare and makeup products, drive the demand for the market, supporting expansion.

Distribution Channel Insights

Which Distribution Channel Segment Dominated the Glycol Market In 2024?

The direct sales segment dominated the market in 2024. Direct sales are a significant distribution channel in the glycol market, allowing manufacturers to supply large volumes directly to industrial end users such as automotive, textile, and pharmaceutical companies. This approach ensures strong customer relationships, customized product offerings, and consistent quality, while also providing better pricing transparency and supply chain control. The increasing demand for high-purity glycols and tailored formulations supports the preference for direct sales, driving market growth and fostering long-term partnerships with key industrial clients.

The online chemical portals segment expects significant growth in the market during the forecast period. Online chemical portals are an emerging distribution channel in the glycol market, offering a convenient and efficient platform for buyers to source glycols in various quantities. These digital platforms enable easy comparison of products, transparent pricing, and quick ordering, catering especially to small and medium-sized enterprises seeking flexible purchasing options. The growing trend toward digitalization and e-commerce in the chemical industry drives the adoption of online portals, supporting market growth by expanding accessibility, improving supply chain efficiency, and enhancing customer reach.

Recent Developments

- In March 2025, Glenmark Therapeutics Inc. announced the launch of polyethylene glycol 3350, a powder solution, due to growing demand from the suppliers.(Source: www.business-standard.com)

- In April 2025, NoviqTech and Global Resource Recovery collaborated to announce the launch of blockchain-backed sustainability certificates for recycled glycol. This is due to growing environmental concerns.(Source: www.tradingview.com)

Top Companies List

- SABIC

- BASF SE

- Dow Inc.

- LyondellBasell Industries

- Huntsman Corporation

- Shell plc

- Reliance Industries Limited

- India Glycols Limited

- LOTTE Chemical Corporation

- INEOS Oxide

- Global Bio-Chem Technology Group

- MEGlobal (Equate Group)

- Shandong Hualu-Hengsheng Chemical Co.

- Ningbo Fortune Petrochemical

- ADM (Archer Daniels Midland)

- Braskem S.A.

- Manali Petrochemicals Limited

- Tokyo Chemical Industry Co.

- Royal Dutch Shell

- ExxonMobil Chemical

Segments Covered

By Product Type

- Ethylene Glycol (EG)

- Monoethylene Glycol (MEG)

- Diethylene Glycol (DEG)

- Triethylene Glycol (TEG)

- Propylene Glycol (PG)

- Industrial Grade

- Pharmaceutical Grade

- Food Grade

- Other Glycols

- Butylene Glycol

- Hexylene Glycol

- Polyethylene Glycol (PEG)

By Source

- Petroleum-Based Glycol

- Bio-Based Glycol (Renewable Feedstocks)

By Application

- Antifreeze & Coolants

- Polyester Fibers & Resins

- PET Bottles

- Humectants & Solvents

- De-icing Fluids

- Heat Transfer Fluids

- Plasticizers

- Pharmaceuticals & Cosmetics

- Food & Beverage Additives

By End-Use Industry

- Automotive & Transportation

- HVAC & Refrigeration

- Construction & Infrastructure

- Textile & Apparel

- Packaging (PET Bottles)

- Pharmaceuticals & Healthcare

- Food & Beverage

- Cosmetics & Personal Care

- Industrial Manufacturing

By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait