Content

What is the Current Tempered Glass Market Size and Volume?

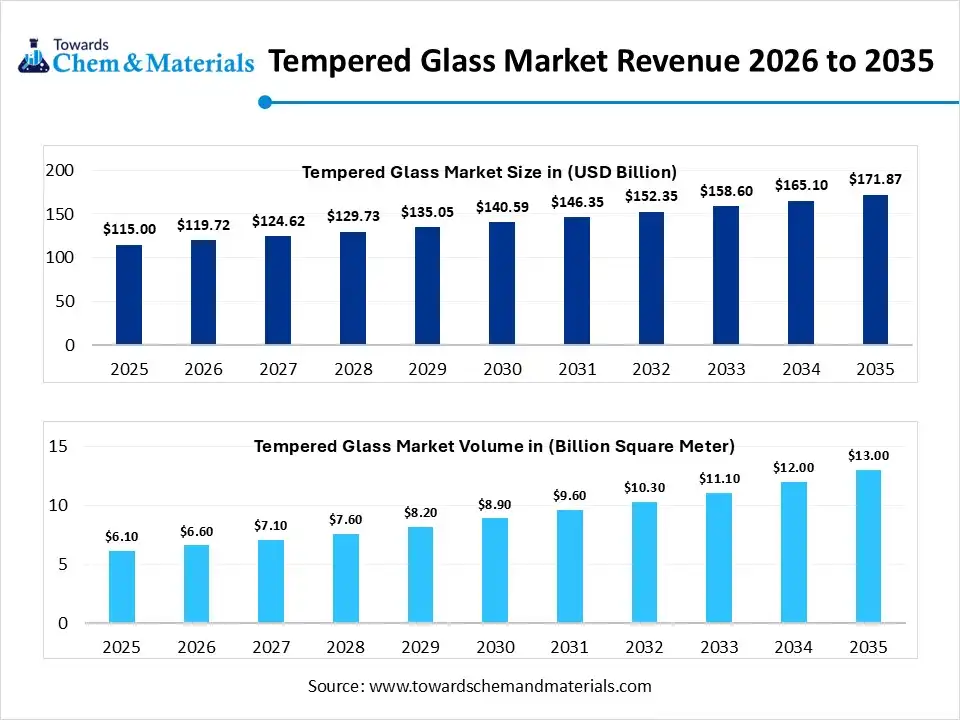

The global tempered glass market size was estimated at USD 115.00 billion in 2025 and is expected to increase from USD 119.72 billion in 2026 to USD 171.87 billion by 2035, growing at a CAGR of 4.10% from 2026 to 2035. In terms of volume, the market is projected to grow from 6.1 billion square meter in 2025 to 13 billion square meter by 2035. growing at a CAGR of 7.83% from 2026 to 2035. Asia Pacific dominated the tempered glass market with the largest volume share of 54% in 2025. Surge in construction of commercial and residential infrastructure is the key factor driving market growth. Also, an increase in infrastructure investment, coupled with the rapid urbanisation in emerging economies, can fuel market growth further.

Market Highlights

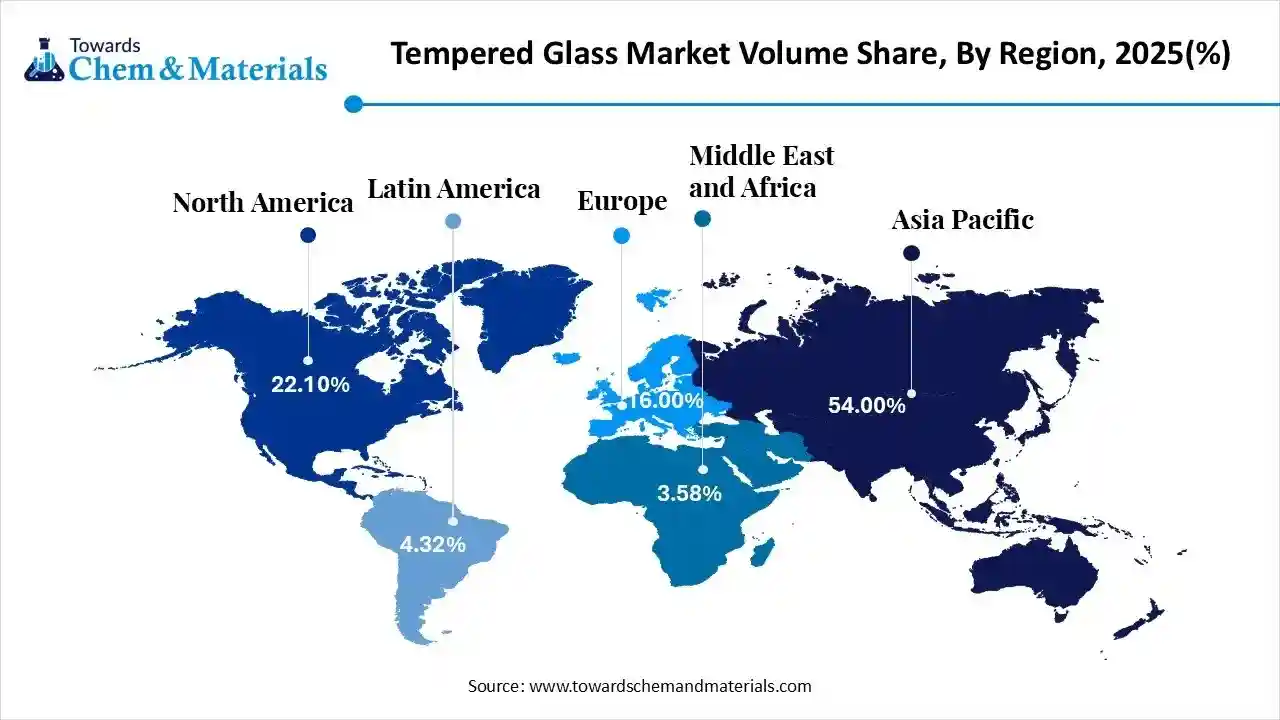

- The Asia Pacific dominated the tempered glass market with the largest volume share of 54% in 2025.

- The tempered glass market in North America is expected to grow at a substantial CAGR of 7.61% from 2026 to 2035.

- The Europe tempered glass market segment accounted for the major volume share of 16.00% in 2025.

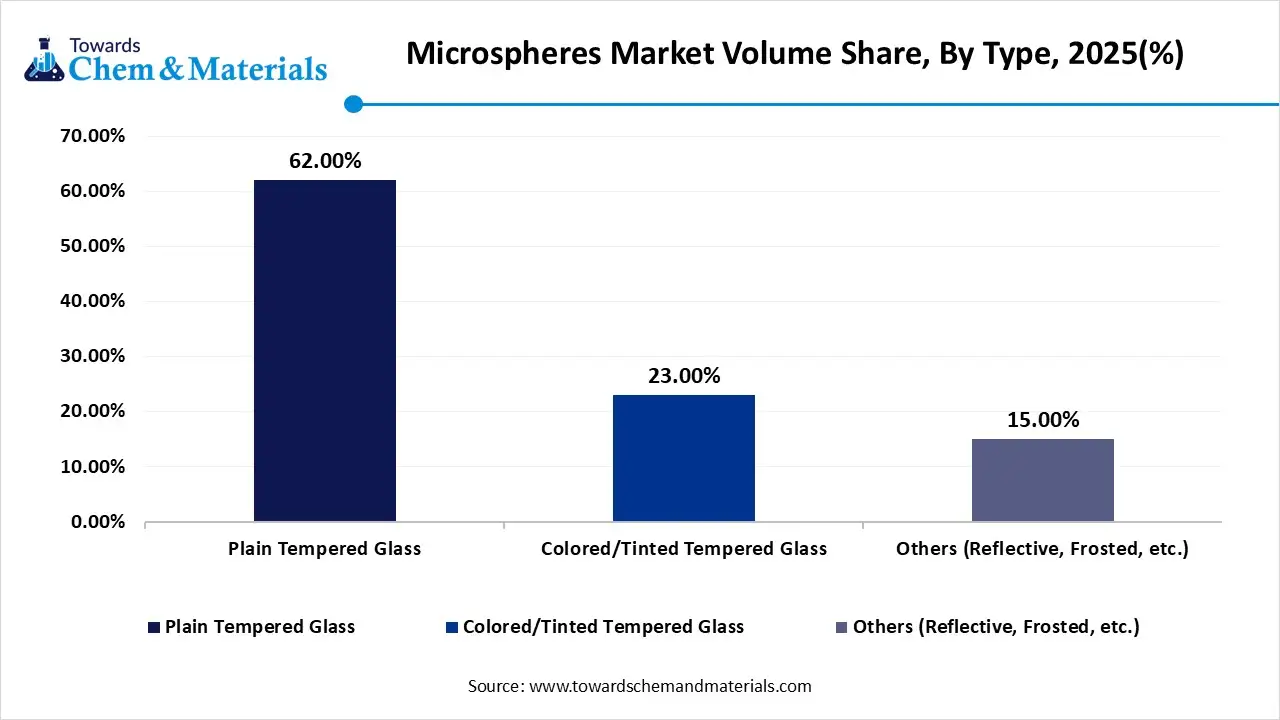

- By type, the plain tempered glass segment dominated the market and accounted for the largest volume share of 62% in 2025.

- By shape, the flat tempered glass segment is expected to grow at the fastest CAGR of 74% from 2026 to 2035 in terms of volume.

- By application, the building & construction segment led the market with the largest revenue volume share of 58% in 2025.

- By thickness, the 5mm to 10mm segment dominated the market and accounted for the largest volume share of 48% in 2025.

Market Overview

The tempered glass market involves the production of safety glass processed by controlled thermal or chemical treatments to increase its strength compared with normal glass. When broken, it crumbles into small granular chunks instead of splintering into jagged shards, making it essential for safety-critical applications in construction, automotive, and consumer electronics.

Tempered Glass Market Trends

- The growing product demand from the electric vehicle industry is the latest trend in the market. As the demand for electric vehicles grows, tempered glass is increasingly being used for strong and lightweight build-ins to enhance overall fuel efficiency and vehicle performance.

- The growing need for safer and durable glass solutions across different sectors is another major factor driving positive market expansion. Also, the growing emphasis on energy efficiency in buildings is propelling the use of tempered glass in facades and windows in the construction sector.

- A surge in environmental concerns is impelling market players to adopt sustainable manufacturing processes, such as recycling and minimizing carbon emissions, appealing to conscious regulators and consumers, leading to market growth soon.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 119.72 Billion / 6.6 Billion Square Meter |

| Revenue Forecast in 2035 | USD 171.87 Billion / 13 Billion Square Meter |

| Growth Rate | CAGR 4.10% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Billion Square Meter) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Shape, By Application, By Thickness By Region |

| Key companies profiled | Saint-Gobain S.A.,AGC Inc, Corning Incorporated, Guardian Industries (Koch Industries), Nippon Sheet Glass Co., Ltd. (NSG Group), Fuyao Glass Industry Group Co., Ltd., SCHOTT AG, Central Glass Co., Ltd., Xinyi Glass Holdings Limited, CSG Holding Co., Ltd., Cardinal Glass Industries, Inc., Vitro, S.A.B. de C.V., Sisecam Group, Taiwan Glass Ind. Corp., |

How Cutting-Edge Technologies Are Revolutionizing the Tempered Glass Market?

Advanced technologies are transforming the market by improving its strength, enhancing manufacturing efficiency, and facilitating smarter functionalities. Furthermore, innovations in tempering now enable the production of very flexible, thin, and durable glass, crucial for wearable devices, smartphones, and foldable screens.

Trade Analysis of the Tempered Glass Market Import & Export Statistics

Between June 2024 and May 2025 (TTM), U.S. tempered glass imports surged by 45% year-over-year, reaching 13,589 shipments, according to data. This growth was driven by 1,660 global exporters catering to 2,428 verified American buyers.

Exports

- In 2024, the United States exported $6.1B of Glass & glassware, being the 39th most exported product in the United States.

- In 2024, the main destinations of the United States' Glass & glassware exports were: Canada ($1.7B), Germany ($737M), Mexico ($1.07B), China ($574M), and Japan ($541M).

Imports

- In 2024, the United States imported $9.06B of Glass & glassware, being the 42nd most imported product in the United States.

- In 2024, the main origins of the United States' Glass & glassware imports were: China ($2.62B), Germany ($632M), Mexico ($1.89B), Canada ($581M), and Chinese Taipei ($317M).

Tempered Glass Market Value Chain Analysis

Feedstock Procurement

- It refers to the acquisition of raw materials, mainly high-quality silica sand, soda-lime-silica glass, and limestone required to manufacture high-grade glass.

- Major Players: Vitro Architectural Glass, Asahi India Glass Ltd

Chemical Synthesis and Processing

- It refers to the manufacturing of chemically strengthened glass, a convenient alternative to conventional thermal tempering. The process improves overall glass durability.

- Major Players: Guardian Industries Corp, Nippon Sheet Glass Co., Ltd

Packaging and Labelling

- It refers to the specialized methods and regulatory requirements used to safeguard, identify, and support tempered glass products during storage and transport.

- Major Players: Saint-Gobain S.A., AGC Inc

Regulatory Compliance and Safety Monitoring

- It involves adherence to strict national and international building codes and standards to ensure the durability, structural integrity, and safety performance of heat-treated glass.

- Major Players: Press Glass SA, Xinyi Glass Holdings Limited.

Tempered Glass Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States | The primary standards are set by the Consumer Product Safety Commission (CPSC) (e.g., 16 CFR 1201) and the American National Standards Institute (ANSI) (e.g., ANSI Z97.1). Focuses on requirements for impact resistance and safe breakage patterns to minimize injury from human contact. |

| European Union | Products must have the CE marking, a manufacturer's declaration that the product complies with all essential EU directives and harmonized European Norm (EN) standards. |

| India | The Bureau of Indian Standards (BIS) is the main body, with certification and the ISI mark often being a mandatory legal requirement for selling or importing specific tempered glass products. |

Segmental Insights

Type Insights

How Much Share Did the Plain Tempered Glass Segment Held in 2025?

The plain tempered glass segment volume was valued at 3.8 billion square meter in 2025 and is projected to reach 7.8 billion square meter by 2035, expanding at a CAGR of 8.38% during the forecast period from 2025 to 2035. The plain tempered glass segment dominated the market with nearly 62% share in 2025. The dominance of the segment can be attributed to the growing popularity of high-strength and durable structural glazing, especially in the construction sector. In addition, plain tempered glass is widely used in commercial and residential buildings for doors, windows, and facades, where durability is necessary.

The colored tempered glass segment volume was valued at 1.4 billion square meter in 2025 and is projected to reach 3.4 billion square meter by 2035, expanding at a CAGR of 10.28% during the forecast period from 2025 to 2035. The colored tempered glass segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing demand for tinted and smart glass in vehicles, along with the rising need for improved aesthetic appeal. These glasses are used to enhance energy efficiency in buildings, offering solar control and minimizing cooling costs.

Tempered Glass Market Volume and Share, By Type, 2025-2035

| By Type | Market Volume Share (%), 2025 | Market Volume (Billion Square Meter)2025 | Market Volume (Billion Square Meter)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Plain Tempered Glass | 62.00% | 3.8 | 7.8 | 8.38% | 60.21% |

| Colored/Tinted Tempered Glass | 23.00% | 1.4 | 3.4 | 10.28% | 26.12% |

| Others (Reflective, Frosted, etc.) | 15.00% | 0.9 | 1.8 | 7.62% | 13.67% |

Shape Insights

Which Shape Type Segment Dominated Tempered Glass Market in 2025?

The flat tempered glass segment held a nearly 74% market share in 2025. The dominance of the segment can be linked to the growing adoption of solar energy components and rapid urbanisation in emerging economies. Flat tempered glass is a necessary component in solar panels because of its high durability, light transmissibility, and resistance to harsh weather conditions.

The bent tempered glass segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing demand for high-strength and advanced architectural facades, along with the growing adoption of curved displays in consumer electronics. This tempered glass offers high tensile strength and thermal shock resistance, which makes it crucial for structural applications.

Application Insights

Which Application Type Segment Dominated Tempered Glass Market in 2025?

The building & construction segment dominated the market with approximately 58% share in 2025. The dominance of the segment is owed to the ongoing transition towards green buildings and sustainability initiatives. Moreover, rising implementation of safety building codes necessitates the use of shatter-resistant and durable glass in doors and windows.

The automotive segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to increasing vehicle production across the globe and growing consumer demands for panoramic roofs and sunroofs. Furthermore, the rapid surge in EV adoption needs durable, lightweight, and specialized glass solutions to enhance vehicle range and performance.

Thickness Insights

Which Thickness Type Segment Dominated Tempered Glass Market in 2025?

The 5mm to 10mm segment held a nearly 48% market share in 2025. The dominance of the segment can be attributed to the rapid urbanisation, especially in emerging regions, coupled with the strict building and safety regulations requiring the use of impact-resistant glass. This thickness range of glass is crucial for producing durable and lightweight automotive parts.

The < 5mm segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the rapid penetration of tablets, smartphones, and wearable devices, along with the growth in durable and thin glass. Market players are increasingly using high-strength, thinner tempered glass to reduce the weight of vehicles.

Regional Insights

How did Asia Pacific Dominate the Tempered Glass Market in 2025?

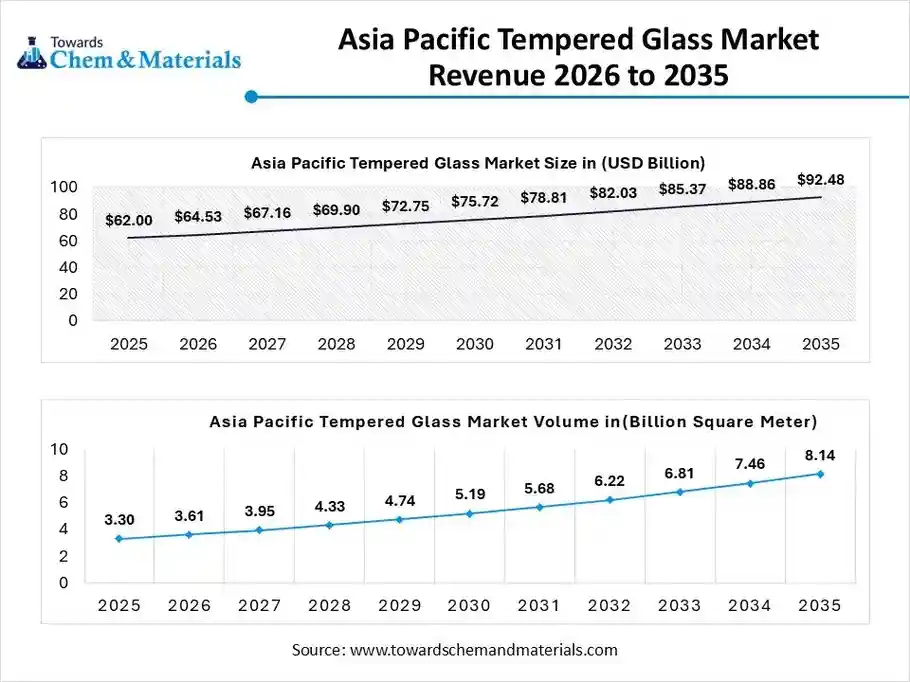

The Asia Pacific tempered glass market size was valued at USD 62.00 billion in 2025 and is expected to be worth around USD 92.48 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.08% over the forecast period from 2026 to 2035.

The Asia Pacific tempered glass volume was estimated at 3.3 billion square meter in 2025 and is projected to reach 8.14 billion square meter by 2035, growing at a CAGR of 9.46%. from 2026 to 2035. Asia Pacific dominated the market with approximately 54% share in 2025. The dominance of the region can be attributed to the increasing need for safety glass in infrastructure projects, along with the ongoing infrastructure development in emerging economies. In addition, the region is a major manufacturing hub for various facilities due to low labor costs for setting up production facilities, attracting major players.

China Tempered Glass Market Trends

In the Asia Pacific, China dominated the market owing to the surge in installations of solar energy projects and the growing adoption of safety glass in commercial and residential building sectors. Also, rapid innovations in tempering technology and the benefits of low-cost production in the country attract investment from many major countries, fuelling market growth.

The North America tempered glass volume was estimated at 1.3 billion square meter in 2025 and is projected to reach 2.6 billion square meter by 2035, growing at a CAGR of 7.61% from 2026 to 2035.North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the surge in product use in the automotive sector, particularly in vehicles, windshields, sunroofs, and side windows. Moreover, rising emphasis on energy efficiency and sustainability drives the demand for specialized, tempered glass.

U.S. Tempered Glass Market Trends

In North America, the U.S. led the market due to growing utilization of tempered glass for protective panels in solar energy installations, coupled with the rapid urbanization in the country. The increasing focus on green building practices promotes the adoption of cutting-edge tempered glass solutions and smart glass technology.

The Europe tempered glass volume was estimated at 1.0 billion square meter in 2025 and is projected to reach 2.0 billion square meter by 2035, growing at a CAGR of 8.30% from 2026 to 2035. Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by increasing demand for safety in automotive, construction, and electronics sectors, along with the robust focus on energy sustainability and efficiency. Furthermore, stringent green building and EU regulations fuel the adoption of tempered glass for its better thermal insulation properties.

Germany Tempered Glass Market Trends

The growth of the market in the country can be linked to the rapid advancements in the production process, including lighter and smarter glass solutions, coupled with the higher penetration of tablets, smartphones, and other devices. The ongoing transition towards solar power has created substantial market opportunities.

Tempered Glass Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Billion Square Meter)2025 | Market Volume (Billion Square Meter)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 22.10% | 1.3 | 2.6 | 7.61% | 20.12% |

| Europe | 16.00% | 1.0 | 2.0 | 8.30% | 15.43% |

| Asia Pacific | 54.00% | 3.3 | 7.4 | 9.46% | 57.30% |

| Latin America | 4.32% | 0.3 | 0.5 | 6.37% | 3.54% |

| Middle East & Africa | 3.58% | 0.2 | 0.5 | 8.83% | 3.61% |

Recent Developments

- In August 2025, India's first tempered glass production facility launched in Noida. They will see investments of over ₹800 crore, scale capacity of 200 million units, and create 4,500 jobs annually, marking an essential boost to the country's Make in India electronics ecosystem.(Source: www.dqindia.com)

Tempered Glass Market Companies

- Saint-Gobain S.A.: Saint-Gobain S.A. is a dominant global player in the tempered (toughened) glass market, recognized for its leadership in sustainable habitat and construction materials. Saint-Gobain operates in 76–80 countries with a massive industrial footprint, including nearly 800 production sites.

- AGC Inc: AGC Inc., a Tokyo-based global leader established in 1907, holds a top share in the worldwide tempered glass market, particularly in the automotive and electronics sectors. AGC provides safety, insulating, and heat-absorbing tempered glass for buildings.

- Corning Incorporated: Corning Incorporated is the dominant, market-leading innovator in damage-resistant cover glass for mobile consumer electronics, primarily through its proprietary Gorilla® Glass brand.

- Guardian Industries (Koch Industries)

- Nippon Sheet Glass Co., Ltd. (NSG Group)

- Fuyao Glass Industry Group Co., Ltd.

- SCHOTT AG

- Central Glass Co., Ltd.

- Xinyi Glass Holdings Limited

- CSG Holding Co., Ltd.

- Cardinal Glass Industries, Inc.

- Vitro, S.A.B. de C.V.

- Sisecam Group

- Taiwan Glass Ind. Corp.

- Kibing Group

Segments Covered in the Report

By Type

- Plain Tempered Glass

- Colored/Tinted Tempered Glass

- Others (Reflective, Frosted, etc.)

By Shape

- Flat Tempered Glass

- Bent/Curved Tempered Glass

By Application

- Building & Construction

- Automotive

- Consumer Electronics

- Furniture & Others

By Thickness

- 5mm to 10mm (~48% share)

- < 5mm (~32% share)

- > 10mm

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa