Content

What is the Current Microspheres Market Size and Volume?

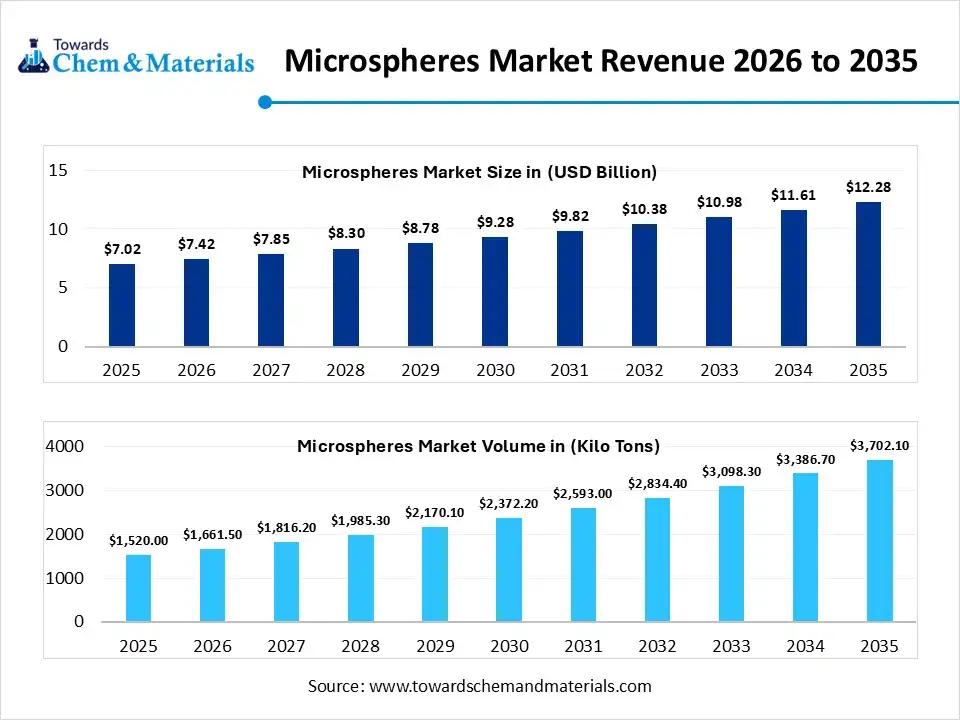

The global microspheres market size was estimated at USD 7.02 billion in 2025 and is expected to increase from USD 7.42 billion in 2026 to USD 12.28 billion by 2035, growing at a CAGR of 5.75% from 2026 to 2035. In terms of volume, the market is projected to grow from 1520 kilo tons in 2025 to 3702.1 kilo tons by 2035. growing at a CAGR of 9.31% from 2026 to 2035. North America dominated the microspheres market with the largest volume share of 42% in 2025. The market is driven by a sustainability focus, innovation in healthcare, the adoption of automation and rising industrial demand.

Market Highlights

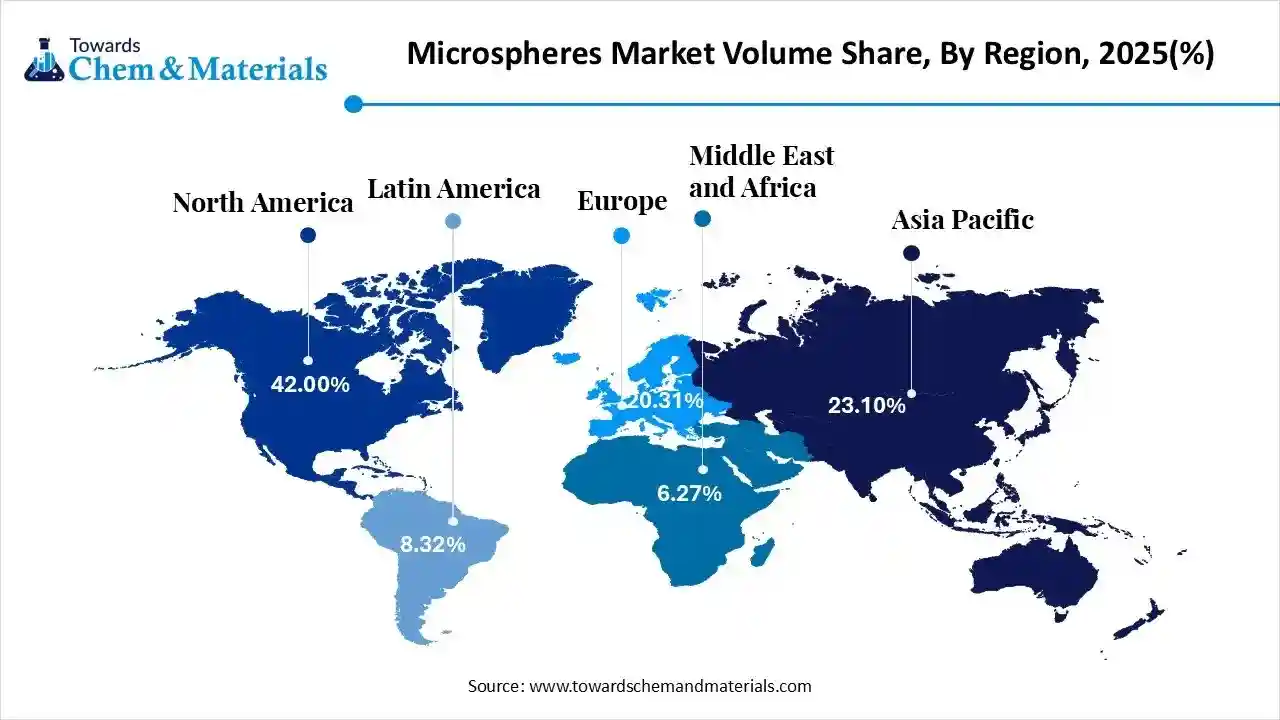

- The North America dominated the microspheres market with the largest volume share of 60% in 2025.

- The microspheres market in Asia Pacific is expected to grow at a substantial CAGR of 11.69% from 2026 to 2035.

- The Europe microspheres market segment accounted for the major volume share of 20.31% in 2025.

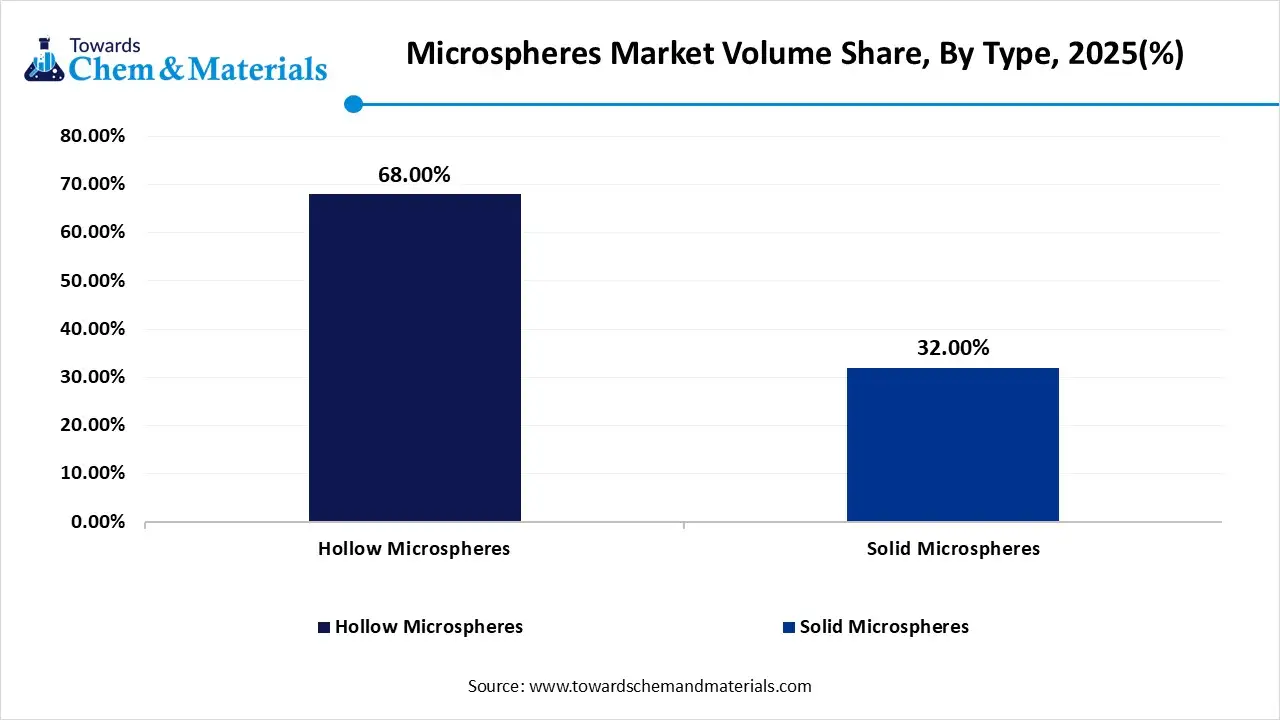

- By type, the hollow microspheres segment dominated the market and accounted for the largest volume share of 68.00% in 2025.

- By type, the solid microspheres segment is expected to grow at the fastest CAGR of 11.50% from 2026 to 2035 in terms of volume.

- By material, the glass segment led the market with the largest revenue volume share of 41% in 2025.

- By application, the construction composites segment dominated the market and accounted for the largest volume share of 29% in 2025.

Market Overview

The microspheres market is driven by innovation in material science, sustainability requirements, and industrial applications, especially in the medical and biotechnology sectors. The growth is driven by government mandates for weight reduction to reduce carbon footprint and improve fuel efficiency. Additionally, the AI integration supports novel materials formation and accelerates R&D.

The industry shift towards improvement of functional efficiency and energy conservation, fostering the demand for microspheres in construction, automotive, healthcare, aerospace, biotechnology, personal care and cosmetics that strengthening the market and driving expansion.

Microspheres Market Trends

- Emerging Shift to Sustainability: The rising focus on bio-based and biodegradable microspheres aligns with stringent regulatory pressure and industrial application especially for cosmetics, shaping the trend.

- Healthcare Expansion: The microspheres act as a crucial material for targeted drug delivery, tissue engineering and diagnostics, driving innovation in personalized medicine, which is accelerating expansion.

- Innovation in Hydrogen Storage: The research focuses on specialized hollow glass microspheres with safety, scalability and energy density for hydrogen storage and electrode materials for energy applications.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 7.42 Billion / 1661.5 Kilo Tons |

| Revenue Forecast in 2035 | USD 12.28 Billion / 3702.1 Kilo Tons |

| Growth Rate | CAGR 5.75% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | North America |

| Segment Covered | By Type, By Material, By Application, By Region |

| Key companies profiled | 3M Company, Potters Industries LLC, Nouryon (Expancel), Matsumoto Yushi-Seiyaku Co., Ltd, Trelleborg AB, Chase Corporation, Luminex Corporation, AkzoNobel N.V., Cospheric LLC, Sigmund Lindner GmbH, Bangs Laboratories, Merck KGaA, Thermo Fisher Scientific, Sekisui Chemical, Mo-Sci Corporation |

Key Technological Shifts and AI in the Microspheres Market

The microspheres market is shifting towards autonomous, self-optimizing systems by integration in microfluidic to ensure uniform particle size, and Generative Adversarial Networks propose novel chemical structures for specialty microspheres. The advancement in wearing sensors for medical and healthcare fuels the market with operational efficiency and optimization. The emerging smart microspheres, including closed-loop systems and hybrid systems pushing the market towards the adoption of technology.

Trade Analysis of the Microspheres Market: Import and Export Statistics

- China exported 5,752 shipments of microsphere.

- The United States exported 4,192 shipments of microsphere.

- Russia exported 1,855 shipments of microsphere.

- From June 2024 to May 2025, the world exported 7,816 shipments of microsphere.

Microspheres Market: Value Chain Analysis

- Feedstock Procurement:The initial stage involves the sourcing of bulk materials like ceramics, glass, fly ash, and polymers by maintaining cost-competitiveness and product quality from suppliers.

- Key Players: 3M Company, Potters Industries LLC, Chase Corporation and Nouryon.

- Manufacturing/Production: In this stage, raw materials are processed using solvent evaporation, spray drying and polymerization to form microspheres with key characteristics to meet strict quality and performance requirements.

- Key Players: Matsumoto Yushi-Seiyaku Co., Ltd., 3M, Trelleborg AB, Luminex Corporation and Momentive Performance Materials Inc.

- Distribution to End-Users: The microspheres are packaged and distributed to end-user industries with efficient delivery and logistics, with major applications like medical, construction composites, cosmetics, automotive, paints & coatings.

- Key Players: Nouryon, Cospheric LLC, 3M, Sigmund Lindner GmbH

Regulatory Framework: Microspheres Market

| Region | Regulations | Regulatory Focus |

| North America | Food and Drug Administration (FDA), Environmental Protection Agency (EPA) | The regulations for medical-grade microspheres require testing, validation with good manufacturing practices for efficiency and also focus on sustainable materials |

| Europe (EU) | European Chemical Agency (ECHA), EMA | The regulation added for various medical devices containing microspheres with safety and performance. |

| Asia Pacific | National Medical Products Administration (NMPA), PMDA | The standards focus on quality control, efficiency and a strong push for domestic manufacturing. |

Segmental Insights

Type Insights

Why the Hollow Microspheres Segment Dominates the Microspheres Market?

The hollow microspheres segment volume was valued at 1,033.6 kilo tons in 2025 and is projected to reach 2,406.3 kilo tons by 2035, expanding at a CAGR of 9.84% during the forecast period from 2025 to 2035. The hollow microspheres segment dominated the market with approximately 68% share in 2025, by enabling industries to reduce weight and improve thermal efficiency. Their hollow structure lowers material density while maintaining mechanical durability, driving innovation in transportation and the energy sector by creating ultra-light composites that extend EV range and boost aircraft fuel economy. Additionally, the encapsulated air offers superior thermal and acoustic insulation, making it vital in extreme environments. The industry is transitioning from specialized fillers to essential structural components, which define modern material performance.

The solid microspheres segment volume was valued at 486.4 kilo tons in 2025 and is projected to reach 1,295.7 kilo tons by 2035, expanding at a CAGR of 11.50% during the forecast period from 2025 to 2035.The solid microspheres segment is the fastest-growing in the market during the forecast period, which is crucial in precision medicine, biotechnology, and specialized electronics. The solid microspheres are valued for stability and functionalisation because they enable precisely engineered targeted drug delivery and diagnostics. Their highly predictable and uniform surface makes them vital for immunoassays and flow cytometry. Additionally, the rising adoption of semiconductor packaging and cosmetics for active ingredients is boosting the market, while the high purity and density support next-generation healthcare and micro-electronics.

Microspheres Market Volume and Share, By Type, 2025-2035

| By Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Hollow Microspheres | 68.00% | 1,033.6 | 2,406.3 | 9.84% | 65.00% |

| Solid Microspheres | 32.00% | 486.4 | 1,295.7 | 11.50% | 35.00% |

Material Insights

How did the Glass Segment hold the Largest Share in the Microspheres Market?

The glass segment held the largest revenue share of approximately 41% in the market in 2025. By combining mechanical strength with chemical neutrality. Their ability to withstand high pressures in processes like injection molding and deep-sea exploration without crumbling. Their structural integrity and low density make them ideal for lightweight automotive and aerospace applications, by replacing heavier fillers to improve fuel efficiency. The glass microspheres are resistant to heat and environmental impact factors that offer excellent thermal insulation and UV stability, making them prominent in specialty coatings and construction.

The polymer segment is experiencing the fastest growth in the market during the forecast period. Due to their molecular customisation and biocompatibility. They serve as biodegradable carriers in biomedical applications, enabling controlled drug release for chronic conditions and gene therapies by protecting sensitive pharmaceuticals. The shift to sustainable chemistry fuels growth in bio-based and compostable polymer spheres for cosmetics and packaging. By combining high performance with environmental safety, polymers drive innovation in specialized applications with chemical flexibility and biological safety.

Application Insights

Which Application Dominated the Microspheres Market?

The construction composites segment dominated the market with approximately 29% share in 2025, serving as lightweight, thermally efficient solutions for infrastructural development. Microspheres improve flow, reduce density by acting as microscopic lubricants, and create lightweight concrete and precast panels that are easier to transport and resistant to shrinkage and cracking. By Integrating them into building materials and composite matrix provides thermal barriers that lower energy consumption with improved insulation. As the global transition to sustainable construction grows, microspheres are essential for high-performance, eco-friendly composites. With a lower environmental impact.

The oil & gas segment is anticipated to grow fastest in the market during the forecast period. The growth is driven by energy industries pushing towards deepwater and ultra-deepwater exploration. The microsphere is essential in syntactic foams by supplying buoyancy for pipelines and risers under extreme hydrostatic pressure. They enable precise density control for lightweight cementing slurries, preventing collapses during drilling and reducing the costs of heavy machinery. The surging demand for pressure-resistant microspheres is due to rising offshore explorations and oil recovery practices sustained its leadership as a key tool for technological innovation.

Regional Insights

How did North America Dominate the Microspheres Market?

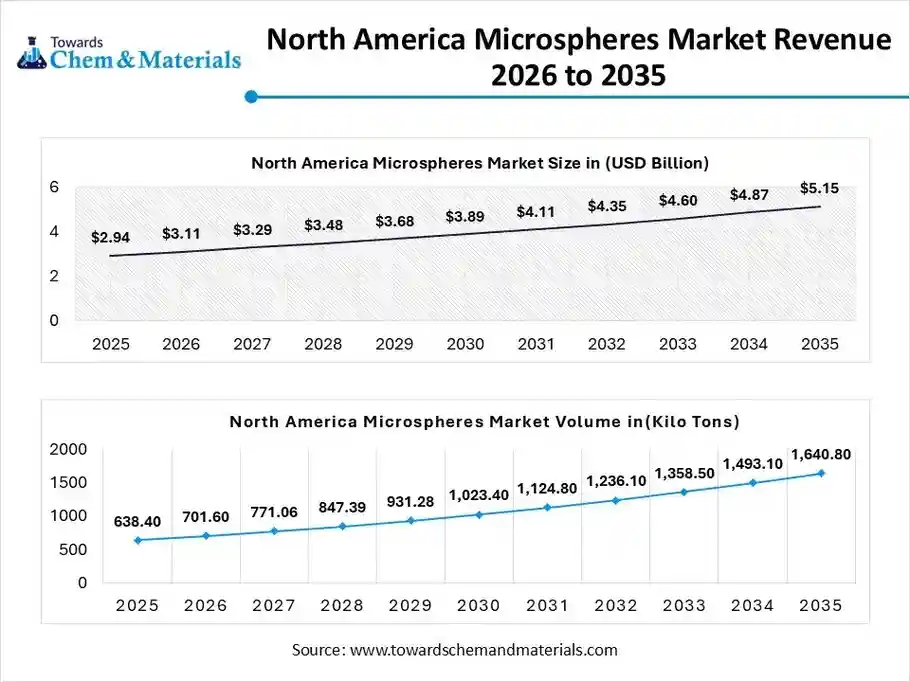

The North America microspheres market size was valued at USD 2.94 billion in 2025 and is expected to be worth around USD 5.15 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.76% over the forecast period from 2026 to 2035.

The North America microspheres volume was estimated at 638.4 kilo tons in 2025 and is projected to reach 1640.8 kilo tons by 2035, growing at a CAGR of 9.90% from 2026 to 2035. North America dominated the market with approximately 42% share in 2025. The industry is shifting from simple fillers to high-performance smart components for functional specialization. The market is driven by aerospace lightweighting, AI-driven manufacturing and sustainability initiatives. The manufacturers are integrating hollow spheres into advanced composites for improvement in fuel efficiency and thermal shielding, while the adoption of technology-based precision production supports cancer treatment and diagnostics. The market also promotes eco-friendly, high-margin applications that emphasize material consistency and multifunctionality.

U.S. Microspheres Market Growth Trends

The U.S. show dominance in the market due to its escalating domestic demand in key industries and its investment in innovation projects by enhancing performance to meet stringent regulations, to lower environmental impact and quality standards. The regional player driving the growth in manufacturing and local supply with the adoption of AI-driven navigation in medical and aerospace &defence that fueling the growth.

The Asia Pacific microspheres volume was estimated at 351.1 kilo tons in 2025 and is projected to reach 949.6 kilo tons by 2035, growing at a CAGR of 11.69% from 2026 to 2035. Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to its global leadership in lightweighting and electronics, with the implementation of hollow microspheres reducing vehicle weight and supporting battery management in electric vehicles. The construction projects use microsphere-infused composites for insulation and efficiency in smart city infrastructure due to the rising urban population, fueling the expansion. The region is also advancing in life sciences, producing high-precision polymer beads for diagnostics and therapeutic delivery. As industrialization accelerates shift toward sustainable, bio-based microspheres to meet the massive demand in the personal care and consumer goods sectors.

China Microspheres Market Growth Trends

China dominates the market due to its immense manufacturing base and supply chain infrastructure. The rising demand for electric vehicles creates the need for microspheres utilized in lightweight automotive components, while the rapid urbanization driving the demand for construction materials, which is strengthening its position.

Europe Microspheres Market Growth Trends

The Europe microspheres volume was estimated at 308.7 kilo tons in 2025 and is projected to reach 818.9 kilo tons by 2035, growing at a CAGR of 11.45% from 2026 to 2035.Europe show significant growth in the market, driven by its stringent environmental regulations to boost biodegradable, eco-friendly microspheres solutions. The rising adoption in diversified applications such as construction, medical & healthcare, personal care and especially in automotive due to demand for lightweight composites is pushing the regional growth.

Germany Microspheres Market Growth Trends

Germany led the European market due to demand for energy-efficient infrastructure and innovation for eco-friendly alternatives. Germany leads in medical technology and automotive lightweighting. Additionally, the rising consumer preference and strong government regulation are driving the growth.

Microspheres Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 42.00% | 638.4 | 1,492.7 | 9.90% | 40.32% |

| Europe | 20.31% | 308.7 | 818.9 | 11.45% | 22.12% |

| Asia Pacific | 23.10% | 351.1 | 949.6 | 11.69% | 25.65% |

| Latin America | 8.32% | 126.5 | 242.1 | 7.48% | 6.54% |

| Middle East & Africa | 6.27% | 95.3 | 198.8 | 8.51% | 5.37% |

Recent Developments

- In November 2024, Sintx Technologies and NED Medical signed the joint development agreement that focuses on advancement in ceramic-based microspheres, especially for radiotherapeutic applications in oncology.(Source: www.nasdaq.com)

- In March 2025, Nouryon launched extra-small grade expandable Expancel® XS200 microspheres, offering a reduction in weight in interior decorative paints without compromising performance and surface finish with emphasis on sustainable growth.(Source: www.nouryon.com)

Top Microspheres Market Players and Their Offerings

- 3M Company: The global leader for technology that supplies high-performance glass and polymer microspheres with a strong focus on research and development.

- Potters Industries LLC: The global innovator in specializing in high-volume glass microspheres and glass feedstocks for industrial filler applications and road marking applications.

- Nouryon (Expancel): The global speciality chemicals leader known for expandable microspheres for raw material supply and global distribution networks in lightweight coatings and thermoplastics.

- Matsumoto Yushi-Seiyaku Co., Ltd: The Japanese pioneer known for expandable microspheres used for manufacturing in footwear and automotive applications.

- Trelleborg AB

- Chase Corporation

- Luminex Corporation

- AkzoNobel N.V.

- Cospheric LLC

- Sigmund Lindner GmbH

- Bangs Laboratories

- Merck KGaA

- Thermo Fisher Scientific

- Sekisui Chemical

- Mo-Sci Corporation

Segment Covered in the Report

By Type

Hollow Microspheres

Solid Microspheres

By Material

Glass

Polymer

Ceramic

Fly Ash/Cenospheres

Metallic & Other

By Application

Construction Composites

Healthcare & Biotechnology

Paints & Coatings

Oil & Gas

Automotive

Others (Cosmetics, Aerospace, etc.)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa