Content

What is the Asia Pacific Steel Rebar Market Size and Share?

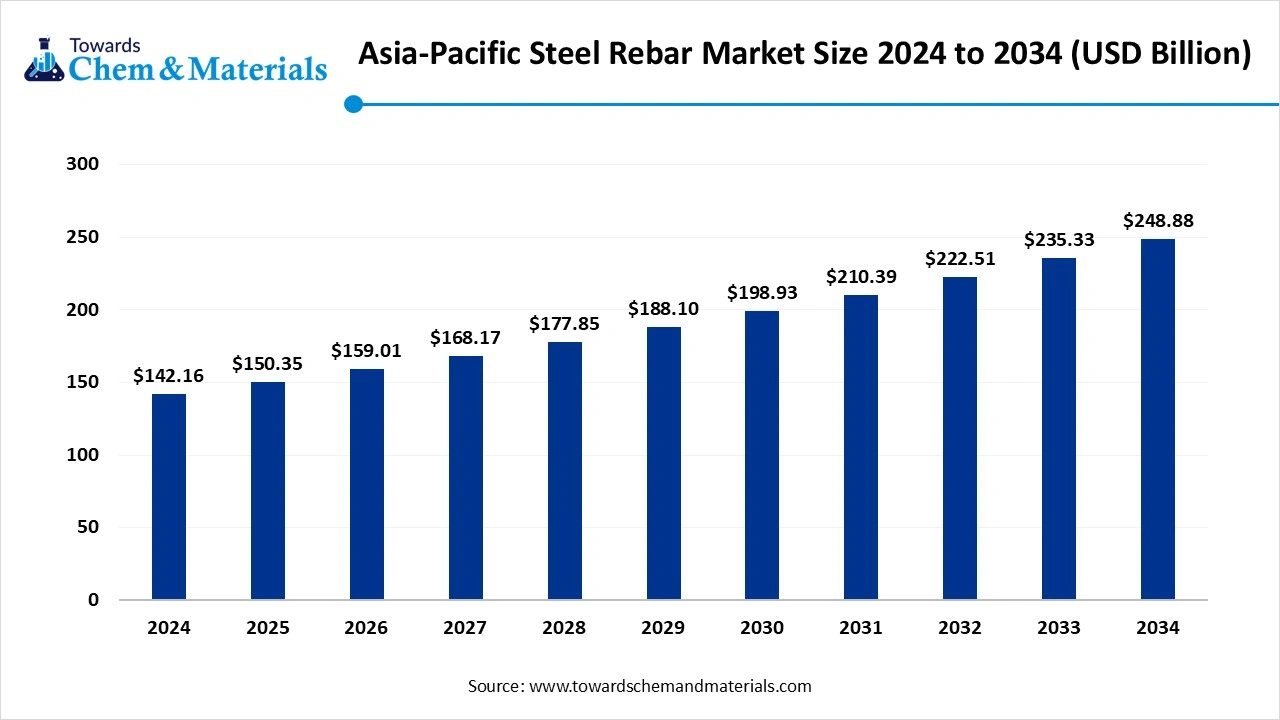

The Asia Pacific steel rebar market size was reached at USD 142.16 billion in 2024 and is expected to be worth around USD 248.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.76% over the forecast period 2025 to 2034. The China dominated the steel rebar market with a market share of 65% in 2024. The extensive infrastructure growth in the region is the major factor driving market growth. Also, rapid government investments coupled with technological advancements in steel rebar manufacturing can fuel market growth further.

Key Takeaways

- By type, the deformed steel rebar segment dominated the market with approximately 70% share in 2024.

- By type, the mild steel rebar segment is expected to grow at the fastest CAGR of approximately 25% over the forecast period.

- By manufacturing process, the basic oxygen steelmaking (BOS) segment held the largest market share of approximately 70% in 2024.

- By manufacturing process, the electric arc furnace (EAF) segment is expected to grow at the fastest CAGR of approximately 30% over the forecast period.

- By coating type, the uncoated (Black) rebar segment dominated the market by holding approximately 80% market share in 2024.

- By coating type, the epoxy-coated rebar segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the infrastructure segment dominated the market with a 67.3% share in 2024.

- By application, the residential buildings segment is expected to grow at the fastest CAGR of 20.2% during the study period.

What is Steel Rebar?

The ongoing expansion of the industrial sectors, such as energy and automotive, is the major factor fuelling market growth. The Asia Pacific steel rebar market comprises production, trade, and supply of steel reinforcing bars (rebars/TMT bars) used principally to reinforce concrete in construction and infrastructure. It includes integrated steelmakers, minimills, and specialty rebar producers that manufacture hot-rolled and deformed reinforcing bars in various grades and sizes, plus downstream processors and distributors that cut, bend, and supply bars to building and civil projects across China, India, Japan, South Korea, Southeast Asia, Australia, and nearby markets.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 159.01 Billion |

| Expected Size by 2034 | USD 248.88 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.76% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Manufacturing Process, By Coating Type, By Application |

| Key Companies Profiled | Ansteel Group, Jiangsu Shagang Group, Jingye Group, Shougang Group, Shandong Iron & Steel Group, Nippon Steel Corporation, JFE Steel Corporation, Kobe Steel (Kobelco), POSCO Holdings (POSCO), Hyundai Steel, Tata Steel Limited, SW Steel Limited, Jindal Steel & Power, Steel Authority of India Limited (SAIL), China Steel Corporation (Taiwan), Hoa Phat Group (Vietnam), Krakatau Steel (Indonesia), BlueScope Steel (Australia). |

Asia Pacific Steel Rebar Market Outlook

- Industry Growth Overview: Between 2025-2034, the market is anticipated to witness substantial growth due to the rapid adoption of new technologies in production like cutting-edge steelmaking techniques, which enhance the quality and efficiency of steel rebar.

- Sustainability Trends: An increasing shift towards more eco-friendly production methods, such as Electric Arc Furnaces (EAF), is the latest sustainability trend in the market. Also, governments in the region are implementing stringent environmental regulations, which have pushed manufacturers to adopt greener technologies for steel manufacturing.

- Global Expansion: Major players such as Tata Steel and JSW Steel are emphasizing strategies such as mergers, acquisitions, and joint ventures. Their global expansion is further promoted by the massive infrastructure projects in developing countries such as China and India.

Key Technological Shifts in the Asia Pacific Steel Rebar Market:

Key technological shifts in the market are playing a crucial role in shaping a positive market landscape. Advancements such as the development of highly durable steel rebar variants are allowing construction companies to build more resilient and safer structures. Moreover, the integration of automation and digital technologies in steel rebar production is improving efficiency and quality control.

Trade Analysis of Asia Pacific Steel Rebar Market: Import & Export Statistics

- In August 2025, China exported $73.2M and imported $15.5M of Steel Bars, resulting in a positive trade balance of $57.7M.

- The fastest growing markets for Steel Bars exports in China between 2023 and 2024 were: Thailand ($101M), Vietnam ($16.6M), and Brazil ($12.9M).(Source: oec.world )

- India was the 2nd largest producer of crude steel with an output of 40.123 MnT in January-March 2025. The country accounted for 8.6% of world crude steel production during the period.

- Japan was the 3rd largest producer of crude steel with an output of 20.393 MnT in January-March 2025. The country accounted for 4.4% of world crude steel production during the period.(Source: jpcindiansteel.nic.in )

Value Chain Analysis of the Asia Pacific Steel Rebar Market:

- Feedstock Procurement : It refers to the process of sourcing and acquiring raw materials such as iron ore, coal, and scrap metal needed for rebar manufacturing.

- Chemical Synthesis and Processing : This stage refers to the industrial methods and chemical aspects needed to produce the steel used for rebar.

- Packaging and Labelling : It is the method used to bundle and mark steel reinforcing rebars for safe handling, transport, and identification.

- Regulatory Compliance and Safety Monitoring : This stage involves adhering to and overseeing laws and standards associated with product quality, environmental impact, and public safety.

Asia Pacific Steel Rebar Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations/Investments |

| China | The government has continued its focus on managing steel overcapacity and reducing crude steel output, with an action plan for 2024-2025 targeting a reduction of 53 million tonnes of CO2 emissions compared to 2023 levels. |

| Japan | There is a growing shift towards EAF deployment, which utilizes scrap steel and reduces greenhouse gas emissions compared to basic oxygen furnaces (BOFs), for which significant investments were announced in May 2024 by key players like Kobelco. |

| India | The latest comprehensive order, the Steel and Steel Products (Quality Control) Order, 2024, was officially notified on August 30, 2024, and mandates that all domestic and imported steel products covered must bear the BIS Standard Mark. |

Segmental Insights

Type Insight

How Much Share Did the Deformed Steel Rebar Segment Held in 2024?

The deformed steel rebar segment dominated the market with approximately 70% share in 2024. The dominance of the segment can be attributed to its improved performance and extensive adoption in the construction sector. Additionally, these rebars are distinguished by surface ridges and patterns, which substantially enhance the bond strength between concrete and steel. These unique characteristics address crucial challenges in reinforcing concrete structures.

The mild steel rebar segment is expected to grow at the fastest CAGR of approximately 25% over the forecast period. The growth of the segment can be credited to the surge in government investment in infrastructure such as mass transit, bridges, and roads, along with its affordability and adaptability. Mild steel rebar is more cost-effective, which is more suited for a variety of construction projects.

Manufacturing Process Insight

Which Manufacturing Process Type Segment Dominated the Asia Pacific Steel Rebar Market in 2024?

The basic oxygen steelmaking (BOS) segment held the largest market share of approximately 70% in 2024. The dominance of the segment can be linked to the rapid investments in R&D and innovative technologies within the BOS process, which are leading to the manufacturing of higher-strength and more durable rebars. In addition, BOS is well-suited for continuous production and high volume, which makes it highly efficient for meeting the huge demand for steel rebar.

The electric arc furnace (EAF) segment is expected to grow at the fastest CAGR of approximately 30% over the forecast period. The growth of the segment can be driven by the growing use of scrap metal as a raw material, coupled with the substantial push towards sustainability and lower carbon emissions. Furthermore, advancements in EAF technology, such as AI and automation, are improving overall operational efficiency and product quality.

Coating Type Insight

Which Coating Type Segment Dominated the Asia Pacific Steel Rebar Market in 2024?

The uncoated (Black) rebar segment dominated the market by holding approximately 80% market share in 2024. The dominance of the segment is owed to its wide availability, cost-effectiveness, and established performance in general construction. Moreover, this rebar is more cost-effective than coated alternatives, which makes it highly attractive for large-scale projects.

The epoxy-coated rebar segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is driven by its enhanced corrosion resistance and infrastructure expansion. Also, epoxy coatings offer substantial protection against corrosion and rust, which is necessary for extending the lifespan of concrete structures in areas with salt exposure and high humidity.

Application Insight

How Much Share Did the Infrastructure Segment Held in 2024?

The infrastructure segment dominated the market with a 67.3% share in 2024. The dominance of the segment can be attributed to the substantial government investment in large-scale infrastructure such as energy and transportation, coupled with the robust economic growth in emerging economies such as China and India. There is an increasing demand for corrosion-resistant rebar to enhance overall building longevity.

The residential buildings segment is expected to grow at the fastest CAGR of 20.2% during the study period. The growth of the segment can be credited to the increasing demand for new housing projects and ongoing government investment in infrastructure, which promotes residential projects. Furthermore, technological advancements like the development of high-strength rebar can impact positive segment growth soon.

Country Insights

China Asia Pacific Steel Rebar Market Trends

In the Asia Pacific, China dominated the market with an approximate share of 65% share in 2024. The dominance of the country can be attributed to the ongoing government investment in infrastructure projects such as the Road Initiative (BRI) and Belt and Road, along with the growth of the real estate sector. In addition, the rapid expansion of government-led infrastructure projects such as railways, highways, and bridges is a factor driving market growth further.

India Asia Pacific Steel Rebar Market Trends

India is expected to grow at the fastest CAGR of approximately 10% over the forecast period. The growth of the country can be credited to the rapid urbanisation and infrastructure development, boosted by government initiatives such as the Smart Cities Mission. Furthermore, an ongoing shift towards using more durable, modern, and high-quality construction materials, such as high-strength steel rebar, will contribute to market expansion in the country soon.

Japan Asia Pacific Steel Rebar Market Trends

Japan is expected to show notable growth during the forecast period. The growth of the country can be driven by its great emphasis on environmental sustainability, which is pushing market players to develop and use low-emission steel production methods. The government in the country is heavily investing in large-scale projects to innovate current infrastructure, such as highways and railways, which influence demand for steel rebar.

Recent Developments

- In February 2025, Bolivia announced it would launch a Chinese-funded steel mill. The $546 million Mutun plant was mainly financed by the Export-Import Bank of China. The plant will be operated by China's Sinosteel Engineering and Technology for the first year of operation.(Source: gmk.center )

- In October 2025, India's Stainless Limited introduced a new range of stainless steel salt tipper trailers for the transportation of salt. The new trailers provide improved durability, minimized maintenance costs, and longer service life as compared to conventional mild steel trailers.(Source: www.steelorbis.com)

Top Vendors in the Asia Pacific Steel Rebar Market & Their Offerings:

- Baowu Group: Baowu Group is the world's largest steel producer and a dominant force in the Asia Pacific steel market, including the rebar sector.

- HBIS Group: HBIS Group is a major global and Asia Pacific steel producer, a key player in the Asia Pacific steel rebar market, known for supplying a wide range of steel products, including high-strength rebar.

Other Players

- Ansteel Group

- Jiangsu Shagang Group

- Jingye Group

- Shougang Group

- Shandong Iron & Steel Group

- Nippon Steel Corporation

- JFE Steel Corporation

- Kobe Steel (Kobelco)

- POSCO Holdings (POSCO)

- Hyundai Steel

- Tata Steel Limited

- JSW Steel Limited

- Jindal Steel & Power

- Steel Authority of India Limited (SAIL)

- China Steel Corporation (Taiwan)

- Hoa Phat Group (Vietnam)

- Krakatau Steel (Indonesia)

- BlueScope Steel (Australia).

Segment Covered

By Type

- Deformed Steel Rebar

- Mild Steel Rebar

- Carbon Steel Rebar

- Stainless Steel Rebar

- Epoxy-Coated / Galvanized Rebar

- GFRP (Glass Fiber Reinforced Polymer) Rebar

By Manufacturing Process

- Basic Oxygen Steelmaking (BOS)

- Electric Arc Furnace (EAF)

By Coating Type

- Uncoated (Black) Rebar

- Epoxy-Coated Rebar

- Galvanized Rebar

- Others (Zinc-Aluminium, etc.)

By Application

- Infrastructure

- Roads & Bridges

- Tunnels & Airports

- Dams & Ports

- Residential Buildings

- Low-Rise Housing

- High-Rise Apartments

- Industrial

- Factories & Warehouses

- Power Plants