Content

What is the Phenolic Resins Market Volume and Share?

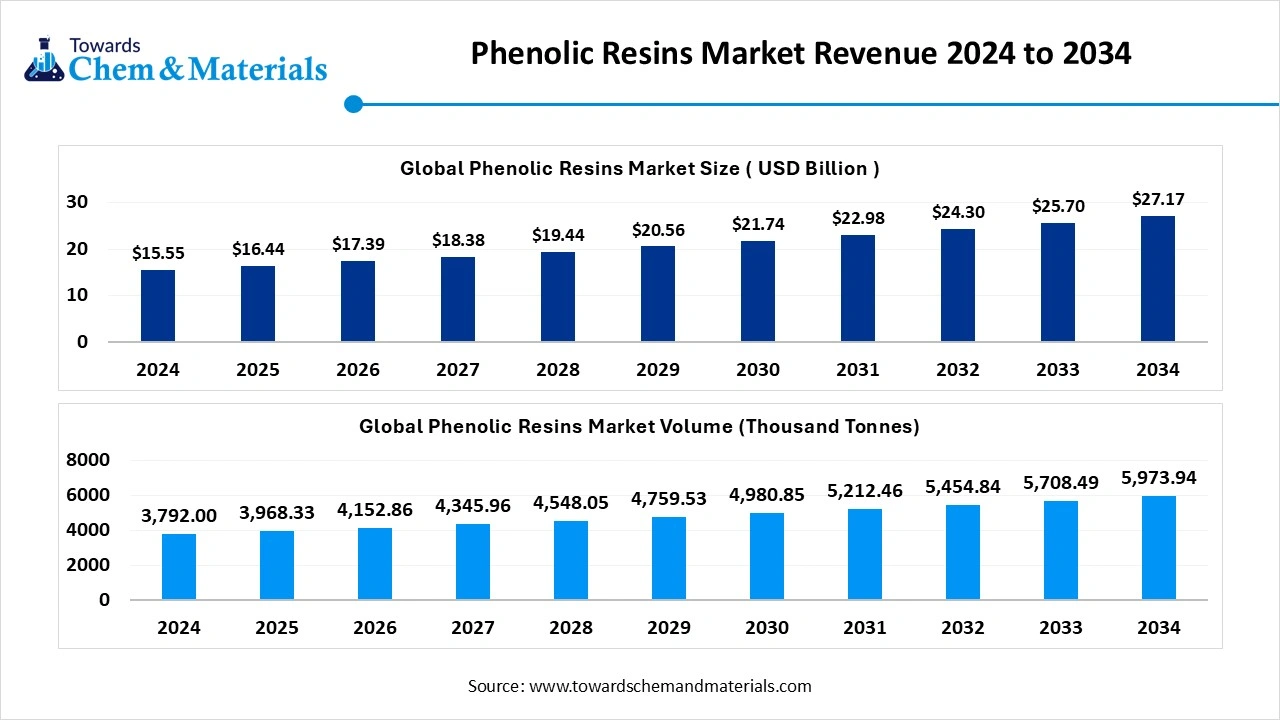

The global phenolic resins market is experiencing rapid growth, with volumes expected to increase from 3,968.33 Thousand Tones in 2025 to 5,973.94 Thousand Tones by 2034, representing a robust CAGR of 4.65% over the forecast period.

The global phenolic resins market size is accounted for USD 16.44 billion in 2025 and is expected to be worth around USD USD 27.17 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.74% over the forecast period 2025 to 2034. Asia Pacific phenolic resins market dominated with the largest revenue share of 31% in 2024. The growing construction activities and the rise in the adoption of electronic devices drive the market growth.

Key Takeaways

- By region, asia pacific held approximately a 31% share in the phenolic resins market in 2024.

- By region, europe is growing at the fastest cagr in the market during the forecast period.

- By product type, the novolac resins segment held approximately a 47.7% share in the market in 2024.

- By product type, the resol resins segment is expected to grow at the fastest cagr of approximately 6.1% in the market during the forecast period.

- By application, the wood adhesives & panel bonding segment held approximately a 30% share in the market in 2024.

- By application, the molding or compression applications segment is expected to grow at the fastest cagr of approximately 6.8% in the market during the forecast period.

- By end-use industry, the building & construction segment held approximately a 32% share in the phenolic resins market in 2024.

- By end-use industry, the automotive & transportation segment is expected to grow at the fastest cagr in the market during the forecast period.

What are Phenolic Resins?

Phenolic resins market growth is driven by growing commercial & residential construction activities, strong focus on vehicle safety features, high manufacturing of electronic devices, rise in 3D printing technology, and increasing demand for durable materials.

Phenolic resins are synthetic thermosetting polymers derived from formaldehyde and phenol. It consists of high electrical insulation, mechanical strength, and chemical resistance. Phenolic resins are widely used in binders, molding compounds, coatings, adhesives, laminates, impregnation materials, and insulation.

Phenolic Resins Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expected to see accelerated growth in industries such as electronics, automotive, and construction. Growth is being driven by end-user shifts toward fire-safe materials and lightweight components across industries, particularly in the Asia-Pacific and Europe.

- Sustainability Trends: Sustainability is transforming the phenolic resins industry, with advanced manufacturing, development of bio-based resins, adoption of recyclable resins, and creation of low-VOC formulations. For instance, UPM Biochemicals offers lignin solutions for manufacturing bio-based phenolic resins.

- Global Expansion: Leading players are expanding worldwide to align with sustainability, rapid industrialization, and manufacturing activities in the Asia Pacific, Europe, and North America. For instance, ASK Chemicals is expanding geographically in regions like South Africa, Brazil, & India for strengthening its industrial resins & molding presence.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 17.39 Billion |

| Expected Size by 2034 | USD 27.17 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.74% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | Aica Kogyo Co., Ltd., Georgia-Pacific Chemicals, Allnex GmbH, Prefere Resins Holding GmbH, Sumitomo Bakelite Co., Ltd., Kraton Corporation, Mitsui Chemicals, Inc., Bostik (Arkema), Ashland Inc., Shandong Laiwu Runda New Material Co., Ltd. |

Key Technological Shifts in the Phenolic Resins Market:

The phenolic resins market is undergoing key technological shifts driven by the demand for improving thermal, chemical, and mechanical properties. One of the significant transformations is the integration of nanotechnology, which expands applications and boosts performance. Nanotechnology integration offers superior flame retardancy, improves mechanical performance, enhances electrical conductivity, and increases thermal stability. Nanotechnology-based phenolic resins are widely used in applications like additive manufacturing, vehicles, electrical & electronic components.

- For instance, Sumitomo Bakelite Co., Ltd develops nanotech-integrated resins to be used in industries like electronics & automotive.

Trade Analysis of Phenolic Resins Market: Import & Export Statistics

- The United States exported $226M of phenolic resins in 2023.(Source: oec.world )

- Japan exported $222M of phenolic resins in 2023. (Source: oec.world )

- China imported $286M of phenolic resins in 2023. (Source: oec.world )

- The United States exported $262M of phenolic resins in 2024. (Source: oec.world )

- The United States imported $124M of phenolic resins in 2024. (Source: oec.world )

Phenolic Resins Market Value Chain Analysis

- Feedstock Procurement : Feedstock procurement is sourcing raw materials like formaldehyde, phenol, and renewable materials like biomass, lignin, & CNSL.

- Key Players: Evonik Industries AG, Mitsui Chemicals, BASF SE, and Kraton Corporation

- Chemical Synthesis & Processing : The chemical synthesis & processing involve steps like addition reaction, condensation, and curing.

- Key Players: SI Group, BASF SE, Georgia-Pacific Chemicals, Hexion Inc., Sumitomo Bakelite Co., Ltd.

- Quality Testing and Certifications : The quality testing involves testing of properties like solid content, curing temperature, mechanical strength, water absorption, viscosity, & gel time, and certifications like ISO 9001, ISCC Plus, & ISO 14001.

What are the Types of Phenolic Resins?

| Types | Production Method | Curing Process | Characteristics | Applications |

| Novolac | Acid-Catalyzed Reaction between Phenol & Formaldehyde | Process requires a hardener like hexamine to develop cross-links |

|

|

| Resol | Base-Catalyzed Reaction between Phenol & Formaldehyde | Cure with heat and its self-curing |

|

|

Segmental Insights

Product Type Insights

Why Novolac Resins Segment Dominates the Phenolic Resins Market?

The novolac resins segment dominated the market with approximately 47.7% share in 2024. The growing usage of electrical laminates and automotive friction materials increases demand for novolac resins. The growing construction activities and the growing automotive industry increase the adoption of novolac resins. They offer excellent mechanical strength, heat resistance, and high dimensional stability. The increased manufacturing of electronic & electrical components increases demand for novolac resins, driving the overall market growth.

The resol resins segment is growing at the fastest CAGR of approximately 6.1% in the market during the forecast period. The growing manufacturing of internal protective coatings and a strong focus on the development of energy-efficient buildings increase demand for resol resins. The growing vehicle production and the rise in infrastructure development increase the adoption of resol resins. They offer high impact resistance and consist of self-curing properties. The resol resins' cost-effectiveness and energy efficiency support the overall market growth.

Application Insights

How did Wood Adhesives & Panel Bonding Segment hold the Largest Share in the Phenolic Resins Market?

The wood adhesives & panel bonding segment held the largest revenue share of approximately 30% in the phenolic resins market in 2024. The growing commercial & residential projects increase demand for OSB, plywood, & particleboard that require wood adhesives. The adoption of green buildings and the development of infrastructure projects increase demand for wood adhesives. The high production of engineered wood products and the rise in sustainable insulation require wood adhesives & panel bonding, driving the overall market growth.

The molding or compression applications segment is growing at the fastest CAGR of approximately 6.8% in the market during the forecast period. The growing development of lightweight vehicle parts and the rise in adoption of electric vehicles increase demand for molding or compression compounds. The manufacturing of consumer electronic products and the development of electrical components require molding or compression compounds. The high investment in infrastructure development and the high need for construction materials require molding or compression, supporting the overall market growth.

End-Use Industry Insights

Which End-Use Industry Dominated the Phenolic Resins Market?

The building & construction segment dominated the market with approximately 32% share in 2024. The growing development of infrastructure projects and increasing construction activities increases demand for phenolic resins. The stricter building codes and growing demand for sustainable building solutions increase the adoption of phenolic resins. The growing commercial & residential construction projects and high investment in infrastructure development require phenolic resins, driving the overall growth of the market.

The automotive & transportation segment is the fastest-growing in the market during the forecast period. The strong focus on lowering vehicle weight and high adoption of electric vehicles increases demand for phenolic resins. The development of lightweight vehicle materials and a focus on enhancing vehicle fuel efficiency require phenolic resins. The manufacturing of under-the-hood components and electrical parts requires phenolic resins, supporting the overall market growth.

Regional Insights

Asia Pacific Phenolic Resins Market Trends

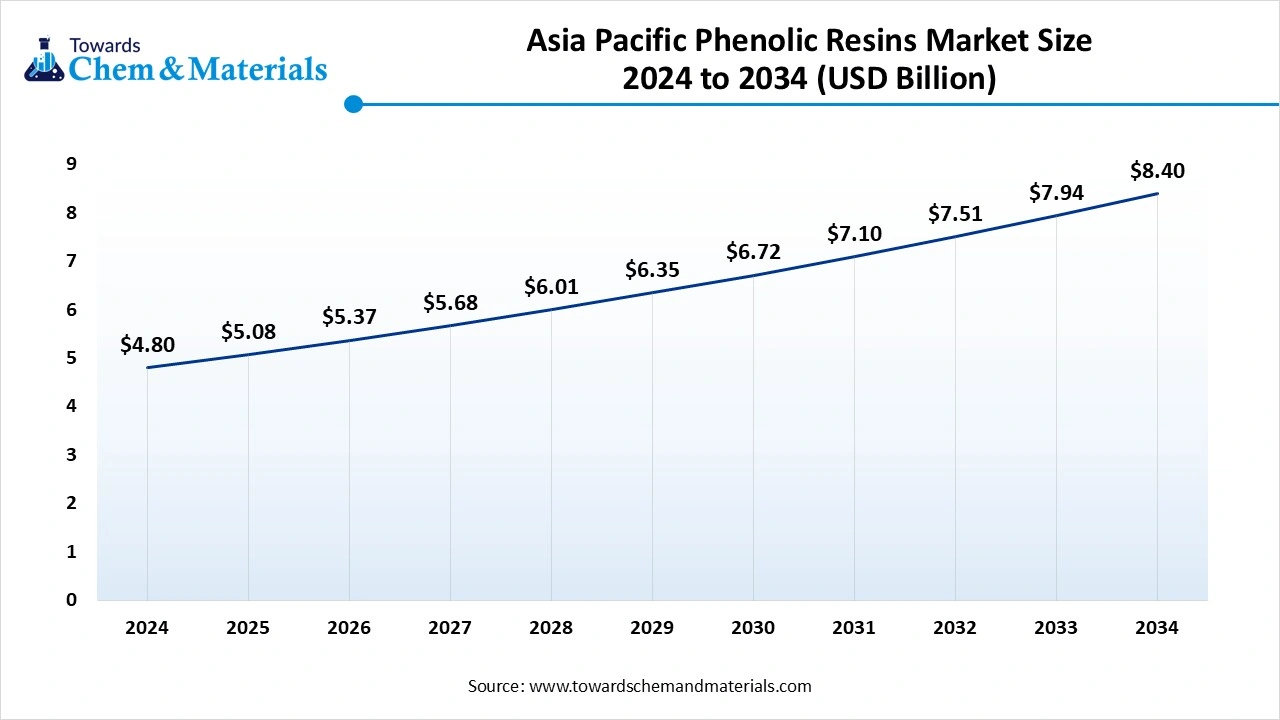

The Asia Pacific Phenolic Resins market size is valued at USD 5.08 billion in 2025 and is expected to surpass around USD 8.40 billion by 2034 expanding at a CAGR of 5.76%

Asia Pacific dominated the market with approximately 31% share in 2024. The growing development of infrastructure projects and increasing industrial expansion increases demand for phenolic resins. The rapid growth in the production of vehicles and vehicle parts requires phenolic resins. The growing development of residential buildings and commercial infrastructure increases demand for phenolic resins. The increasing adoption of consumer electronics products and consumer goods requires phenolic resins, driving the overall growth of the market.

China Phenolic Resins Market Trends

China is a major contributor to the market. The growing manufacturing activities and rapid industrialization increase demand for phenolic resins. The increasing development of large-scale construction projects and the rise in manufacturing of heat-resistant automotive components require phenolic resins. The growing manufacturing of electronic products and strong government support for industrial modernization require phenolic resins, supporting the overall growth of the market.

- China exported $233M of phenolic resins in 2023.(Source: oec.world )

- China exported $240M of phenolic resins in 2024.(Source: oec.world )

Phenolic Resins Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 22% |

| Europe | 19% |

| Asia Pacific | 48% |

| Latin America | 8% |

| Middle East and Africa | 3% |

Europe Phenolic Resins Market Trends

Europe is experiencing the fastest growth in the market during the forecast period. The growing development of lightweight & high-performance automotive components and stricter emission regulations on vehicles requires phenolic resins. The growing expansion of construction activities and focus on the development of sustainable buildings increases demand for phenolic resins. The growing sectors like aerospace and electronics increase demand for phenolic resins, driving the overall market growth.

Germany Phenolic Resins Market Trends

Germany is growing in the market. The well-established automotive industry and the development of energy-efficient building solutions require phenolic resins. The growth in the development of infrastructure projects and the growing semiconductor manufacturing increases demand for phenol resins. The growing demand for phenol resins in industrial applications, such as binders and flue gas desulfurization units, drives the overall market growth.

North America Phenolic Resins Market Trends

North America expects the significant growth in the market during the forecast period. Key growth areas include insulation for energy-efficient buildings, molding compounds for automotive and aerospace, and low-emission materials in response to environmental regulations. Increasing preference for bio-based and formaldehyde-free phenolic resins is also shaping market trends. As industries seek durable, lightweight, and thermally stable materials, phenolic resins are becoming essential in modern manufacturing. The ongoing shift toward sustainable and high-performance alternatives is expected to create new opportunities for innovation and investment in the region. Overall, North America remains a vital and evolving market for phenolic resins, supported by technological advancements and the growing focus on energy efficiency and regulatory compliance.

United States Phenolic Resins Market Trends

In the United States, the phenolic resins market is growing steadily, driven by demand in automotive, construction, and electronics sectors. Key trends include a shift toward low-emission and bio-based formulations to meet strict environmental regulations. Applications in insulation, wood adhesives, and advanced molding compounds are expanding, especially in energy-efficient buildings and electric vehicles. Technological innovations such as hybrid and nanofilled phenolic resins are gaining traction.

Recent Developments

- In December 2024, Michelin Resicare launched its sugar-based phenolic resin, thermosetting araminolic. The resin is made up of maize or wheat fructose & beet sucrose.(Source: www.jeccomposites.com)

- In June 2025, Sumitomo Bakelite Co., Ltd announced the commercialization of the World’s first biomass-derived solid novolac-type lignin-modified phenolic resins. The company focuses on lowering greenhouse gas emissions and is widely used in the automotive industry.(Source: www.sumibe.co.jp)

Top Companies List

- Hexion Inc.: The global specialty chemical supplier and manufacturing company includes products like coatings, resins, adhesives, and composites.

- DIC Corporation: The Japan-originated company manufactures key products like organic pigments, polymers, specialty materials, printing inks, synthetic resins, and coatings.

- BASF SE: The German-based chemical company manufactures products including adhesives, paints, fungicides, solvents, pigments, food additives, and others.

- Kolon Industries, Inc.: The South Korea-based company develops diverse resol and novolac resins to support applications like adhesives, refractories, and castings.

- SI Group, Inc.: The global chemical manufacturing company develops phenolic resins to support applications like rubber reinforcement, composites, adhesives, and coatings.

Other Companies List

- Aica Kogyo Co., Ltd.

- Georgia-Pacific Chemicals

- Allnex GmbH

- Prefere Resins Holding GmbH

- Sumitomo Bakelite Co., Ltd.

- Kraton Corporation

- Mitsui Chemicals, Inc.

- Bostik (Arkema)

- Ashland Inc.

- Shandong Laiwu Runda New Material Co., Ltd.

Segments Covered

By Product Type

- Novolac Resins

- Resol Resins

- Modified / Specialty Phenolics

By Application

- Wood Adhesives & Panel Bonding

- Molding / Compression / Phenolic Molding Compounds

- Insulation & Foams

- Laminates & Decorative Surfaces

- Paper Impregnation

- Coatings & Surface Treatments

- Other (Friction Materials, Abrasives, Composites)

By End-Use Industry

- Building & Construction

- Automotive & Transportation

- Electrical & Electronics

- Furniture & Interiors

- Industrial Goods & Composites

- Other (Aerospace, Defense, etc.)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait