Content

What is the Europe Steel Rebar Market Size Share?

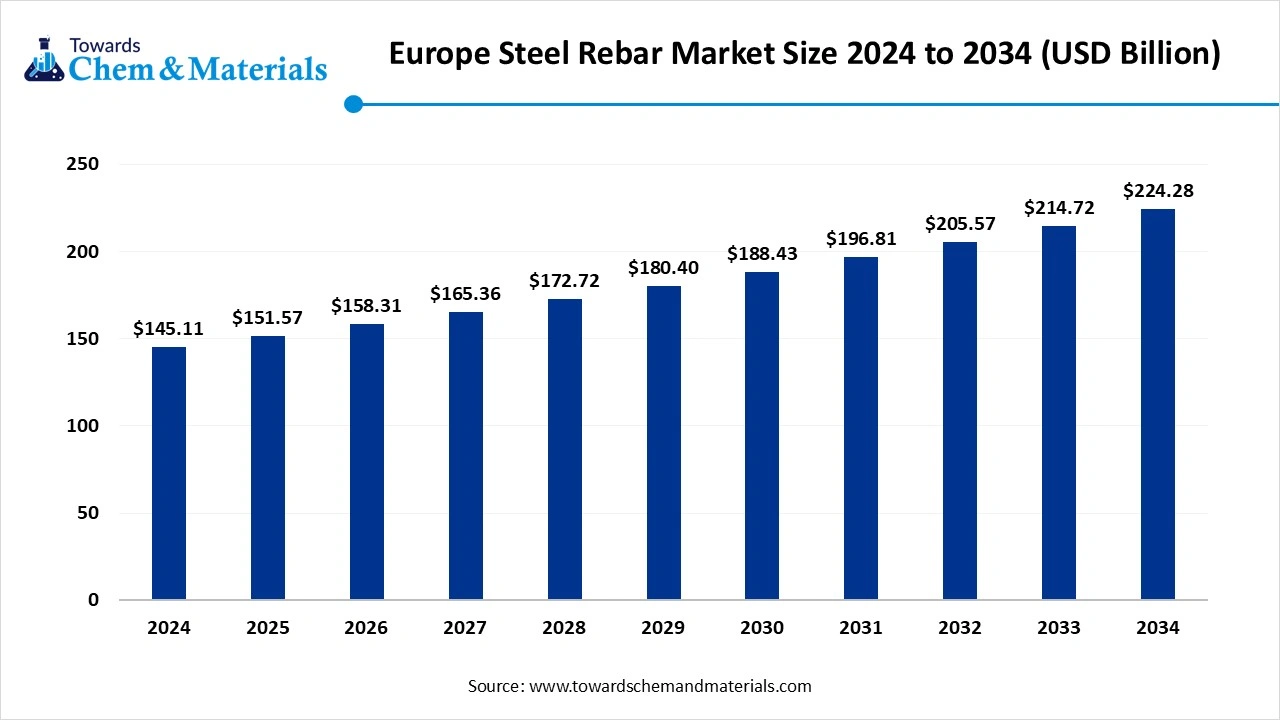

The Europe steel rebar market size was valued at USD 145.11 billion in 2024 and is expected to hit around USD 224.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.45% over the forecast period from 2025 to 2034. the germany dominated the steel rebar market with a market share of 22% in 2024. An extensive investment in infrastructure projects and green energy initiatives is the major factor driving market growth. Also, a push towards sustainable building practices, coupled with the development of high-quality rebars, can fuel market growth further.

Key Takeaways

- By rebar type, the grade B500 carbon rebar segment dominated the market with approximately 58% share in 2024.

- By rebar type, the epoxy-coated / corrosion-resistant rebar segment is expected to grow at the fastest CAGR of approximately 15% over the forecast period.

- By application, the infrastructure & civil engineering segment held an approximate share of 35% in 2024.

- By application, the commercial & institutional construction segment is expected to grow at the fastest CAGR of approximately 18% over the forecast period.

By reinforcement form, the straight bars segment dominated the market by holding an approximate share of 62% in 2024. - By reinforcement form, the prefabricated cut & bent segment is expected to grow at the fastest CAGR of approximately 20% during the projected period.

- By material input, the virgin steel rebar segment held approximately 70% market share in 2024.

- By material input, the low carbon / green steel rebar segment is expected to grow at the fastest CAGR of 16% during the study period.

What is Steel Rebar?

An increasing emphasis on renovating existing structures and buildings is the major factor driving positive market growth. The European Steel Rebar Market covers reinforcing steel bars (rebar) used to reinforce concrete in construction and infrastructure projects. These bars, made typically of carbon steel, may also be epoxy-coated, stainless, or corrosion-resistant.

The scope includes production, supply, distribution, and services (cutting, bending, prefabrication). Rebar demand correlates with infrastructure development, housing, renovation spending, and regulatory requirements on structural durability. The market is influenced by European Union building codes, sustainability trends (recycled steel, low-carbon steel), supply chain disruptions, and steel price volatility.

Europe Steel Rebar Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is expected to witness substantial growth due to stringent EU building safety and durability rules and the rapid development of corrosion-resistant rebars. Also, growing focus on sustainable construction practices and green building projects facilitates the use of specific types of rebar that fulfil sustainability standards.

- Sustainability Trends: Key sustainability trends in the market include stringent environmental regulations such as the EU Emissions Trading System. The drive towards greener manufacturing methods, like the use of renewable energy and hydrogen can impact positive market growth soon.

- Global Expansion: Major players such as ArcelorMittal, Celsa Group, and Tata Steel are actively involved in using various strategies to navigate the mature European market. Companies are also investing in new technologies to meet evolving demands and regulations.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 158.31 Billion |

| Expected Size by 2034 | USD 224.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Rebar Type / Grade, By Application / End Use, By Reinforcement Form, By Material Input / Source, |

| Key Companies Profiled | thyssenkrupp Steel Europe, Tata Steel Europe, Voestalpine Stahl, RIVA Group (Europe), JSW Steel (European operations), Ferriere Nord, Acerinox (stainless, specialty bars), Outokumpu (specialty, stainless), Celsa Group, NLMK Europe, Liberty Steel (UK / Europe operations), Acciaierie d’Italia (formerly ArcelorMittal Italia), Voestalpine Böhler Edelstahl |

Key Technological Shifts in the Europe Steel Rebar Market:

Key technological shifts in the market include the adoption of cutting-edge manufacturing, such as automation and AI, along with the development of specialized and high-performance rebars. The use of AI-driven process optimization and predictive maintenance is increasingly becoming common to enhance efficiency and quality control.

Trade Analysis of the Europe Steel Rebar Market: Import & Export Statistics

- In 2024, in October, Germany exported 333.33 thousand tons of rolled steel, which is 21.2% more than in October 2023. (Source: gmk.center)

- The UK steel sector exports 2.4 million tonnes of steel to the EU, worth nearly £3bn. Currently, 75% of UK steel exports are sent to the EU.(Source: www.uksteel.org )

Value Chain Analysis of the Europe Steel Rebar Market

- Feedstock Procurement : It refers to the strategic sourcing and acquisition of the major raw materials needed for steel production.

- Chemical Synthesis and Processing : It refers to the basic process that is integral to the whole steel manufacturing industry, such as the manufacturing of steel rebar.

- Packaging and Labelling : The packaging and labelling refer to the specific practices and regulatory needs for how steel rebars are bundled and identified for sale and use.

- Regulatory Compliance and Safety Monitoring : It refers to the detailed framework of standards, directives, and procedures that ensures steel rebar products fulfil rigorous performance standards.

Europe Steel Rebar Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations/ Standards |

| United Kingdom | The UK has strong ongoing urban development, and its standards are managed by organizations like the British Association of Reinforcement (BAR). |

| Germany | Germany has a robust construction sector and is promoting the use of high-strength, eco-friendly rebars to improve durability and reduce carbon footprints. |

| France | NF A 35-080-1, NF A 35-016: These national standards govern steel rebar specifications in France. |

Segmental Insights

Rebar Type Insights

Which Rebar Type Segment Dominated the Europe Steel Rebar Market in 2024?

The grade B500 carbon rebar segment dominated the market with approximately 58% share in 2024. The dominance of the segment can be attributed to the ongoing shift towards sustainable and high-strength steel, along with the growing urbanisation in the region. Additionally, there is an increasing trend towards utilising more durable, stronger, and corrosion-resistant rebar, especially B500B, for projects in coastal zones.

The epoxy-coated / corrosion-resistant rebar segment is expected to grow at the fastest CAGR of approximately 15% over the forecast period. The growth of the segment can be credited to the rapid investment in infrastructure projects and stringent government regulations. Ongoing advancements in rebar technology, such as the development of cutting-edge and high-performance steel varieties, are fuelling market expansion shortly.

Application Insights

How Much Share Did the Infrastructure & Civil Engineering Segment Held in 2024?

The infrastructure & civil engineering segment held an approximate share of 35% in 2024. The dominance of the segment can be linked to the rapid government investments in projects such as green transportation and energy, coupled with the new modernization initiatives. Also, government initiatives and population growth are propelling construction activities in both commercial and residential sectors.

The commercial & institutional construction segment is expected to grow at the fastest CAGR of approximately 18% over the forecast period. The growth of the segment can be credited to the growing demand for high-performance and durable materials, along with the growing emphasis on sustainable building practices. In addition, a surge in urban populations creates a significant demand for new commercial spaces and institutional buildings.

Reinforcement Form Insights

Which Reinforcement Form Segment Dominated the Europe Steel Rebar Market in 2024?

The straight bars segment dominated the market by holding an approximate share of 62% in 2024. The dominance of the segment is owed to the ongoing adoption of modern construction methodologies, such as modular construction and prefabrication, which fuel demand for high-precision rebar components, which are processed from straight bars. Moreover, straight bars especially provide a good balance of strength and flexibility.

The prefabricated cut & bent segment is expected to grow at the fastest CAGR of approximately 20% during the projected period. The growth of the segment is due to increasing adoption of advanced construction methodologies and the growing need for better construction efficiency. Cutting-edge fabrication technologies, such as computer-aided design (CAD) systems, ensure high precision and consistency in cutting and bending the rebar.

Material Input Insight

How Much Share Did the Virgin Steel Rebar Segment Held in 2024?

The virgin steel rebar segment held approximately 70% market share in 2024. The dominance of the segment can be attributed to the rapid surge in construction activity across Europe, which necessitates a consistent supply of quality steel rebar. Furthermore, expansion in heavy industries such as the machinery and automotive sectors contributes to the demand for virgin steel rebar in constructing new manufacturing frameworks.

The low-carbon / green steel rebar segment is expected to grow at the fastest CAGR of 16% during the study period. The growth of the segment can be credited to the ongoing innovations in green steel production technologies, coupled with the rising government and consumer demand for sustainable products. The construction and automotive sectors are facing pressure to minimize their carbon footprint and are looking for low-carbon materials.

Country Insights

Germany Europe Steel Rebar Market Trends

Germany dominated the market with approximately 22% share in 2024. The dominance of the country can be attributed to its robust infrastructure development, such as green energy and transportation projects, along with the demand for retrofitting existing infrastructure. Germany's cutting-edge logistical infrastructure makes it a robust hub for manufacturing and supply, promoting market expansion.

Eastern Europe Steel Rebar Market Trends

The Eastern Europe /Rest of Europe segment is expected to grow at the fastest CAGR of approximately 14% during the forecast period. The growth of the segment can be credited to the growing urbanization and housing demand in this region. Government programs aimed at propelling building production and infrastructure development are major contributors to market growth.

United Kingdom Europe Steel Rebar Market Trends

The United Kingdom is expected to grow at a notable CAGR over the forecast period. The growth of the segment can be driven by government infrastructure projects such as HS2 and heavy investment in transportation networks such as roads, bridges, and public utilities. A government push for new housing construction boosts demand for rebar in both residential and commercial projects.

Recent Developments

- In October 2025, the European Composites Industry Association (EuCIA) introduced the European Rebar Council (ERC) to promote and support the composite rebar in Europe.(Source: www.jeccomposites.com )

- In May 2025, Acciaierie di Verona, an Italian steel company, launched a plant for the manufacturing of steel rebar coils. The manufacturing is totally automated and equipped to the cutting-edge industrial standards. (Source: gmk.center)

Top Vendors in Europe Steel Rebar Market & Their Offerings:

- ArcelorMittal: ArcelorMittal is a major player in the European steel rebar market, which is driven by infrastructure and urbanization. The company focuses on technical innovation in its long products business.

- Salzgitter AG: Salzgitter AG is one of Europe's largest steel producers, but it primarily focuses on a diversified portfolio of rolled steel products (strip steel, sheet steel, heavy plates), tubes, and sections (beams).

Other Top Companies

- thyssenkrupp Steel Europe

- Tata Steel Europe

- Voestalpine Stahl

- RIVA Group (Europe)

- JSW Steel (European operations)

- Ferriere Nord

- Acerinox (stainless, specialty bars)

- Outokumpu (specialty, stainless)

- Celsa Group

- NLMK Europe

- Liberty Steel (UK / Europe operations)

- Acciaierie d’Italia (formerly ArcelorMittal Italia)

- Voestalpine Böhler Edelstahl

Segment Covered

By Rebar Type / Grade

- Grade B500 / B500B / B500C (normal carbon steel rebar)

- High Yield / High Strength Rebar (e.g., B600, B550)

- Epoxy-Coated / Corrosion-Resistant Rebar

- Stainless Steel Rebar

- Fiber-reinforced / Composite Rebar (GFRP, CFRP blends, emerging)

By Application / End Use

- Residential Construction

- Commercial & Institutional Construction

- Infrastructure & Civil Engineering (bridges, roads, tunnels)

- Industrial & Utility Structures

By Reinforcement Form

- Straight Bars

- Cut & Bent / Prefabricated Rebar Products

- Rebar Mesh / Fabric

By Material Input / Source

- Virgin Steel (new melt / primary steel)

- Recycled / Scrap-based Steel Rebar

- Low-Carbon / Green Steel (H₂-based, electric arc / DRI emission-reduced steel)