Content

Low-Density Polyethylene (LDPE) Market Size and Forecast 2025 to 2034

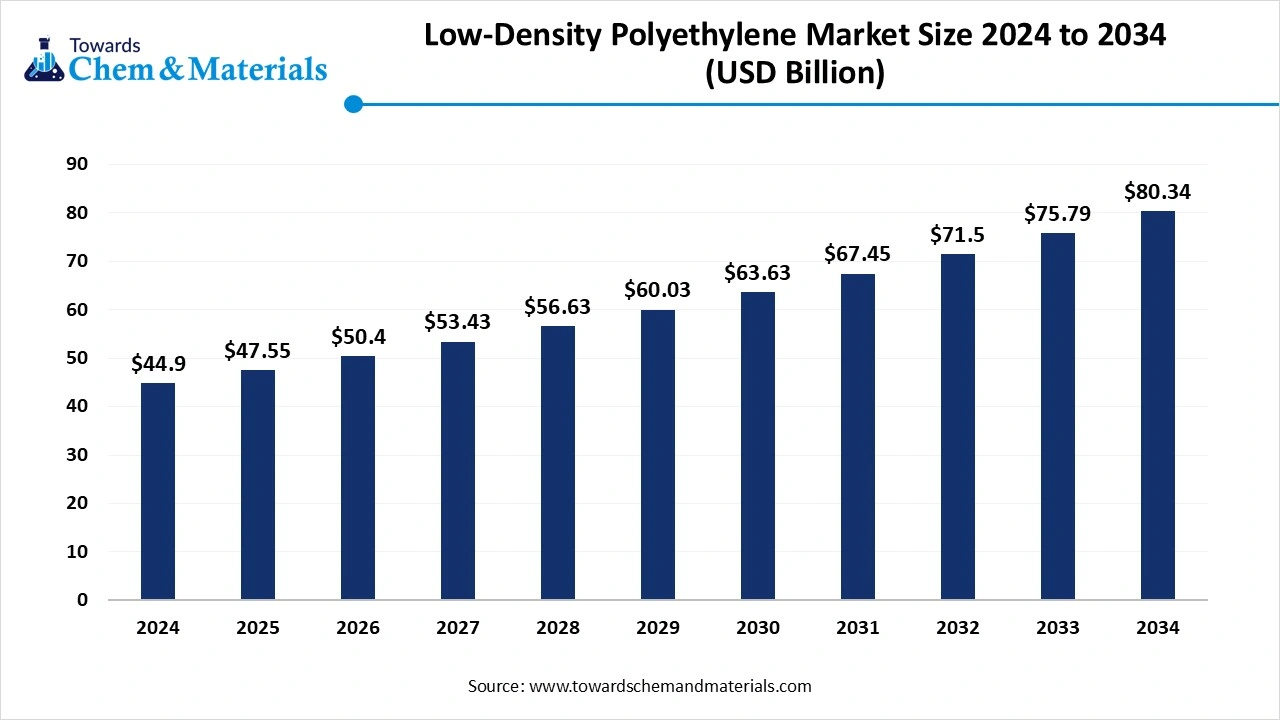

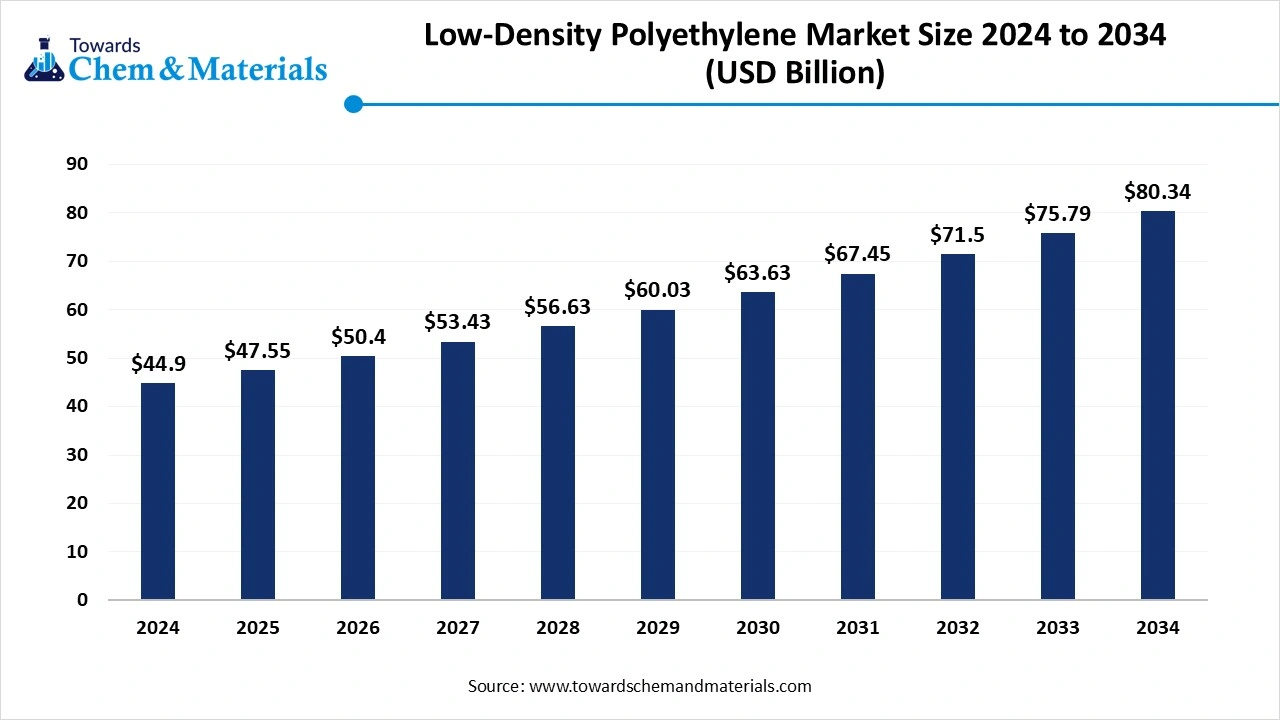

The global low-density polyethylene (LDPE) market size was valued at USD 44.86 billion in 2024 and is expected to hit around USD 80.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 6% over the forecast period 2025 to 2034. The growing demand for plastic containers and the rising demand for recyclable and eco-friendly plastics drive the growth of the market.

Low-Density Polyethylene (LDPE) Market Key Takeaways

- By region, Asia Pacific dominated the market in 2024. the growth is driven by rapid industrialization, urbanization, and an increasing middle-class population.

- By region, North America is anticipated to have significant growth in the low-density polyethylene (LDPE) market in the forecasted period. the growth is driven by technologically advanced products, with strong demand across industries such as packaging, construction, and automotive.

- By manufacturing process, the autoclave method segment dominated the market in 2024. The increasing demand for premium-grade LDPE drives the growth.

- By manufacturing process, the tubular method segment is anticipated to grow significantly in the market during the forecasted period. The tubular process is more cost-effective and energy-efficient, making it suitable for large-scale production of LDPE.

- By application, the film and sheets segment dominated the low-density polyethylene (LDPE) market in 2024. Rising demand for sustainable and eco-friendly alternatives drives the growth of the market.

- By application, the extrusion coating segment is anticipated to grow in the forecasted period. The growth is driven by properties like excellent flexibility, moisture resistance, and lightweight properties.

Rising Demand for Durable and Flexible Materials: Low-Density Polyethylene (LDPE) Market to Expand

Low-density polyethylene is a type of thermoplastic polymer that is made from the monomer ethylene, with having the properties like flexibility, low density, and high ductility, which results from its highly branched molecular structure. This structure gives the LDPE its characteristics, like lightweight, chemical resistance, waterproofing, and easy processing into thin films and sheets. They are commonly used in plastic bags, packaging films, containers, insulation for wires and cables, and various other consumable goods.

The drivers for the growth of the low-density polyethylene (LDPE) market are the rising demand for flexible and lightweight packaging across various industries, including food and beverage, pharmaceuticals, and consumer goods. LDPE’s excellent moisture barrier properties, durability, and ease of processing make it ideal for applications such as films, bags, and wraps.

Additionally, the rapid growth of e-commerce has increased the need for protective and adaptable packaging materials. Furthermore, the rapid urbanization and infrastructure development, especially in emerging economies, are driving the use of LDPE in construction films, insulation, and agricultural applications, further fueling market expansion.

Low-Density Polyethylene (LDPE) Market Trends

- The growing demand for sustainable and recycled LDPE due to the shift towards biobased LDPE and environmental regulation has helped the market to grow.

- The surge in demand for lightweight, flexible, and moisture-resistant packaging for e-commerce, food, and pharmaceuticals drives the market's growth.

- Innovation and technological advancement in processing and manufacturing methods, like autoclave and tubular methods, improve and strengthen the process efficiency.

- Use of AI and IoT for process optimization and digitalization in supply chain management, especially in logistics, inventory, and quality control, helps the market to grow.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 47.55 Billion |

| Expected Size by 2034 | USD 80.34 Billion |

| Growth Rate from 2025 to 2034 | CAGR is 6% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Manufacturing Process, By Application, By Region |

| Key Companies Profiled | Braskem, Chevron Phillips Chemical Company, INEOS, Mitsui Chemicals Inc., Formosa Plastics Corporation, Reliance Industries Limited, SABIC, Sasol, LyondellBasell Industries Holdings B.V, China Petrochemical Corporation, Shell, Petkim Petrokimya Holding A.Ş, Qatar Petrochemical Company (QAPCO) Q.P.J.S.C., Exxon Mobil Corporation, BASF SE |

Market Opportunity

The Growing Demand for Sustainable and Recyclable Packaging Solutions

One significant opportunity in the low-density polyethylene (LDPE) market is the increasing demand for sustainable and recyclable packaging materials, particularly in emerging economies. As environmental regulations tighten and consumer awareness around plastic pollution grows, companies are actively seeking eco-friendly alternatives to conventional plastics, which drives the growth of the market.

This shift creates a favorable market environment for LDPE manufacturers that can innovate with recycled or bio-based LDPE solutions. By investing in advanced recycling technologies and sustainable production methods, manufacturers can not only meet regulatory requirements but also tap into a growing segment of environmentally conscious consumers, thus gaining a competitive edge and unlocking new revenue streams.

Market Challenge

The Growing Regulatory Pressure and Ban on Single-Use Plastic

A major challenge in the low-density polyethylene (LDPE) market is the growing regulatory pressure and backlash against single-use plastics. Governments worldwide are implementing bans and restrictions on plastic bags and packaging, which are key applications for LDPE.

This has forced manufacturers to adopt recycled content, which is costly and technologically demanding which ultimately hindering the growth and is a challenge. The inconsistent recycling infrastructure is also a big limitation and challenge to overcome.

Low-Density Polyethylene (LDPE) Market Regional Insights

Asia Pacific dominated the low-density polyethylene (LDPE) market in 2024. Asia-Pacific region stands as the largest market for Low-Density Polyethylene (LDPE), and the growth is driven by rapid industrialization, urbanization, and an increasing middle-class population. Countries like China and India are at the forefront, with increasing demand in sectors such as packaging, agriculture, and construction.

The region’s robust manufacturing base and expanding infrastructure projects further boost LDPE consumption. Additionally, governmental initiatives promoting sustainable packaging and environmental regulations are influencing market dynamics, encouraging the adoption of recyclable and bio-based LDPE variants. These emerging factors and key applications support the growth of the market in the region.

India is Experiencing Rapid Growth Due to the Emerging and Expanding Industrial Sector in the Country. India’s LDPE market is experiencing significant growth, the growth is driven by the country’s expanding economy and industrial sectors. The packaging industry is a major consumer of LDPE, utilizing it for applications like films, bags, and containers. Agricultural uses, such as greenhouse films and irrigation components, also contribute to the increasing demand.

The government’s focus on infrastructure development and initiatives like “Make in India” stimulates the domestic production and consumption of LDPE. Furthermore, increasing environmental awareness is leading to a gradual shift towards sustainable and recyclable LDPE products, aligning with global trends and enhancing India’s role in the regional market, which helps in the growth of the low-density polyethylene (LDPE) market.

- 5,162 shipments of Low-Density Polyethylene exported by India from October 2023 to September 2024 (TTM).

- The top three exporters of Low-Density Polyethylene are the United States, India, and Saudi Arabia.

North America is anticipated to grow rapidly in the low-density polyethylene (LDPE) market in the forecasted period. The LDPE market in North America is mature and technologically advanced, with strong demand across industries such as packaging, construction, and automotive. The region benefits from a well-established petrochemical infrastructure, and a focus on innovation in polymer processing and recycling technologies drives the growth of the market.

Growth is supported by rising consumption of flexible packaging materials and increased awareness of sustainable practices. North American manufacturers are also investing in upgrading production facilities to meet evolving environmental regulations and consumer preferences. Additionally, the region is witnessing steady integration of recycled LDPE in various applications, which aligns with its broader circular economy and waste reduction goals, supporting the growth of the market in the region.

The United States Market is Largely Driven by The Large Food and Beverage Sector in the Country, Which Increases the Demand. In the United States, LDPE demand is largely driven by the packaging sector, especially food and beverage packaging, due to LDPE’s excellent barrier properties and flexibility. The country is also seeing increased use of LDPE in e-commerce packaging, agriculture films, and healthcare products.

Additionally, U.S. companies are focusing on sustainable product innovation, such as biodegradable and recycled-content LDPE, to align with government and corporate environmental initiatives. Furthermore, the presence of major LDPE producers and advanced R&D capabilities enhances the country’s role as a leader in material innovation. Regulatory support and growing consumer preference for eco-friendly materials continue to shape market dynamics, resulting in the growth of the low-density polyethylene (LDPE) market in the country.

Market Segmental Insights

Manufacturing Process Insights

The autoclave method segment dominated the low-density polyethylene (LDPE) market in 2024. The autoclave process is one of the two primary methods used to manufacture Low-Density Polyethylene (LDPE). In this process, polymerization of ethylene occurs at very high pressures and elevated temperatures around 200–300°C in a stirred high-pressure reactor, or autoclave.

The high-pressure conditions promote the formation of long-chain branching, giving LDPE its distinctive properties like softness, flexibility, high clarity, and good impact resistance. LDPE produced through the autoclave process is especially suitable for high-quality films, coatings, and pharmaceutical or food-grade packaging, where optical clarity and mechanical flexibility are crucial.

While this process is more energy-intensive and costly than the tubular method, it allows for better control over molecular structure, resulting in premium-grade LDPE, which increases the demand for the segment and helps in the expansion of the market.

The tubular method segment expects significant growth in the low-density polyethylene (LDPE) market during the forecast period. The tubular process is the other primary method used to produce Low-Density Polyethylene (LDPE) and differs significantly from the autoclave process.

In this method, ethylene polymerization occurs in a vertical tubular reactor at moderate pressures and high temperatures, about 200–300°C. The polymerization is initiated by a free radical catalyst, and the process occurs in a continuous flow system, where the polymer is formed and then extruded out of the reactor. The tubular process is more cost-effective and energy-efficient compared to the autoclave method, making it suitable for large-scale production of LDPE.

However, the polymer produced by this process tends to have less branching than that from the autoclave process, resulting in lower flexibility and clarity. As a result, LDPE made via the tubular process is typically used for industrial applications, such as piping, packaging films, and agricultural films, where high strength and durability are prioritized over optical properties, which drives the demand for the market in the industrial sector.

Application Insights

The film and sheets segment dominated the low-density polyethylene (LDPE) market in 2024. Film and sheet are the largest application segments in the market, accounting for a significant share due to LDPE’s excellent flexibility, moisture resistance, and lightweight properties.

LDPE films are widely used in packaging, including grocery bags, shrink wraps, bread bags, and food packaging films, where transparency, softness, and sealing ability are essential. In agriculture, LDPE films are used for greenhouse covers, mulch films, and silage bags, providing UV protection and preserving soil moisture.

Construction-grade sheets made from LDPE are employed as vapor barriers and protective wraps due to their chemical resistance and durability. The segment benefits from the rising demand for sustainable and recyclable packaging solutions, with manufacturers increasingly integrating recycled content into film and sheet production to meet environmental regulations and consumer expectations.

The extrusion coating segment expects significant growth in the low-density polyethylene (LDPE) market during the forecast period. Extrusion coating is a key application of Low-Density Polyethylene (LDPE), where a thin layer of LDPE is melted and applied to substrates such as paper, aluminum foil, or other plastic films to enhance their properties. This process significantly improves the moisture resistance, grease barrier, and sealability of the coated material, making it ideal for liquid packaging cartons (like milk and juice boxes), food wrappers, and paper cups.

LDPE’s good adhesion, flexibility, and clarity make it a preferred material for this process. The extrusion coating segment is experiencing steady growth, especially in the food and beverage industry, driven by the rising need for hygienic and durable packaging. Additionally, advancements in multilayer coating technologies are expanding the use of LDPE in complex packaging structures that combine multiple barrier and mechanical properties, which drives the growth of the market.

Low-Density Polyethylene (LDPE) Market Recent Developments

Duo UK

- Launch: In March 2025, packaging manufacturer Duo UK partnered with social enterprise EMERGE Recycling to launch a pilot program for collecting and recycling low-density polyethylene (LDPE) in Manchester.

- The scheme will involve collecting LDPE films from 30 businesses across Greater Manchester until March 18, 2025, after which the material will be recycled into new packaging by Duo UK. This initiative aims to promote sustainable recycling practices and reduce waste in the region.

Univation Technologies

- Launch: In June 2024, Univation Technologies introduced its UNIGILITY Technology platform, a new licensed solution enabling polyethylene (PE) producers to manufacture both ethylene-vinyl acetate (EVA) copolymer resins and low-density polyethylene (LDPE). This launch expands Univation’s technology portfolio and supports greater flexibility and efficiency in PE production.

Low-Density Polyethylene (LDPE) Market Top Companies List

- Braskem

- Chevron Phillips Chemical Company

- INEOS

- Mitsui Chemicals, Inc.

- Formosa Plastics Corporation

- Reliance Industries Limited

- SABIC

- Sasol

- LyondellBasell Industries Holdings B.V

- China Petrochemical Corporation

- Shell

- Petkim Petrokimya Holding A.Ş

- Qatar Petrochemical Company (QAPCO) Q.P.J.S.C.

- Exxon Mobil Corporation

- BASF SE

Segments Covered in the Report

By Manufacturing Process

- Autoclave Method

- Tubular Method

By Application

- Film and Sheets

- Extrusion Coating

- Injection Molding

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait