Content

What is the Fungicides Market Size and Companies Analysis ?

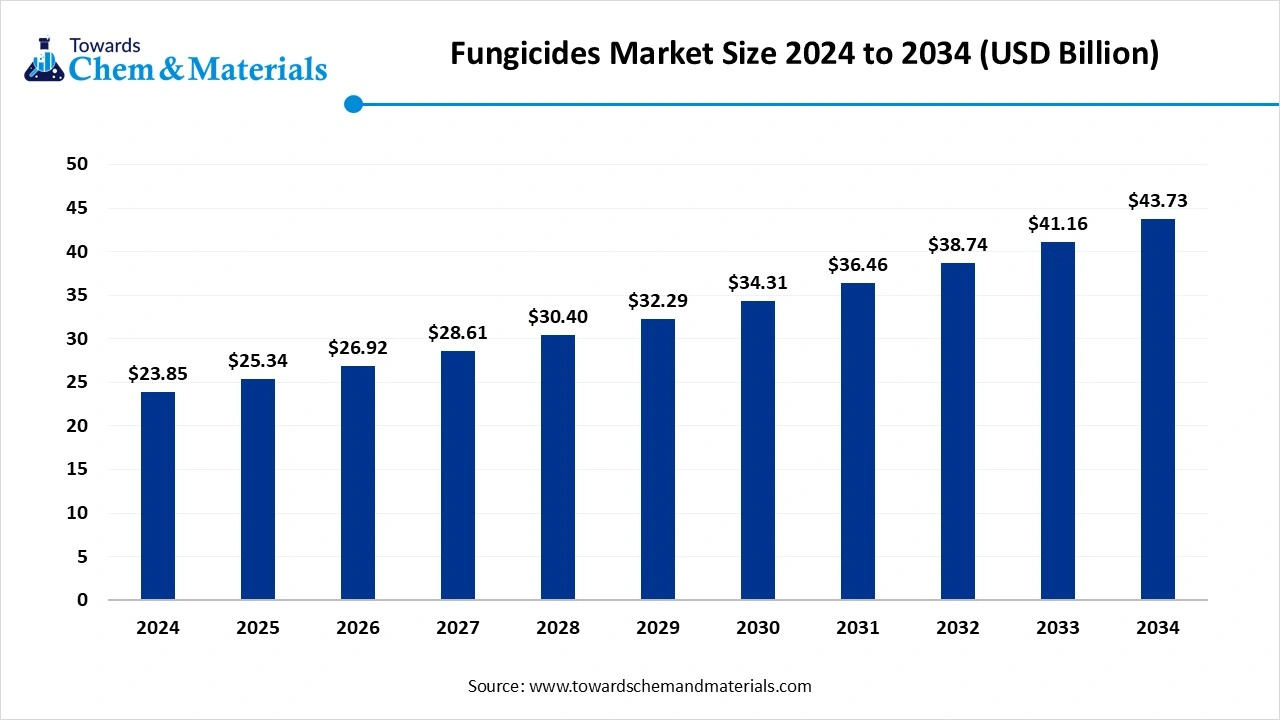

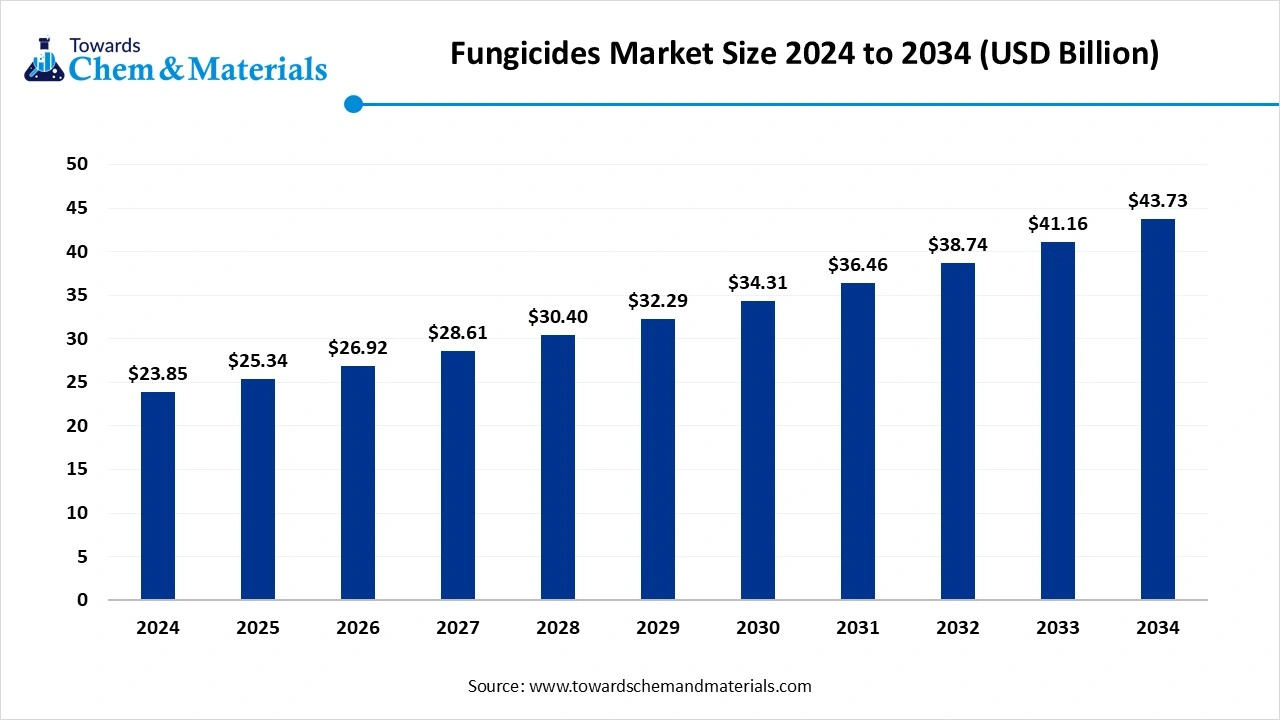

The global fungicides market size was reached at USD 25.34 billion in 2024 and is expected to be worth around USD 43.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.25% over the forecast period 2025 to 2034.The ongoing innovations in fungicide formulations and application technologies are the key factors driving market growth. Also, a surge in consumer demand for healthy fruits and vegetables, coupled with the increase in the number and severity of fungal infections in crops, can fuel market growth further.

Key Takeaways

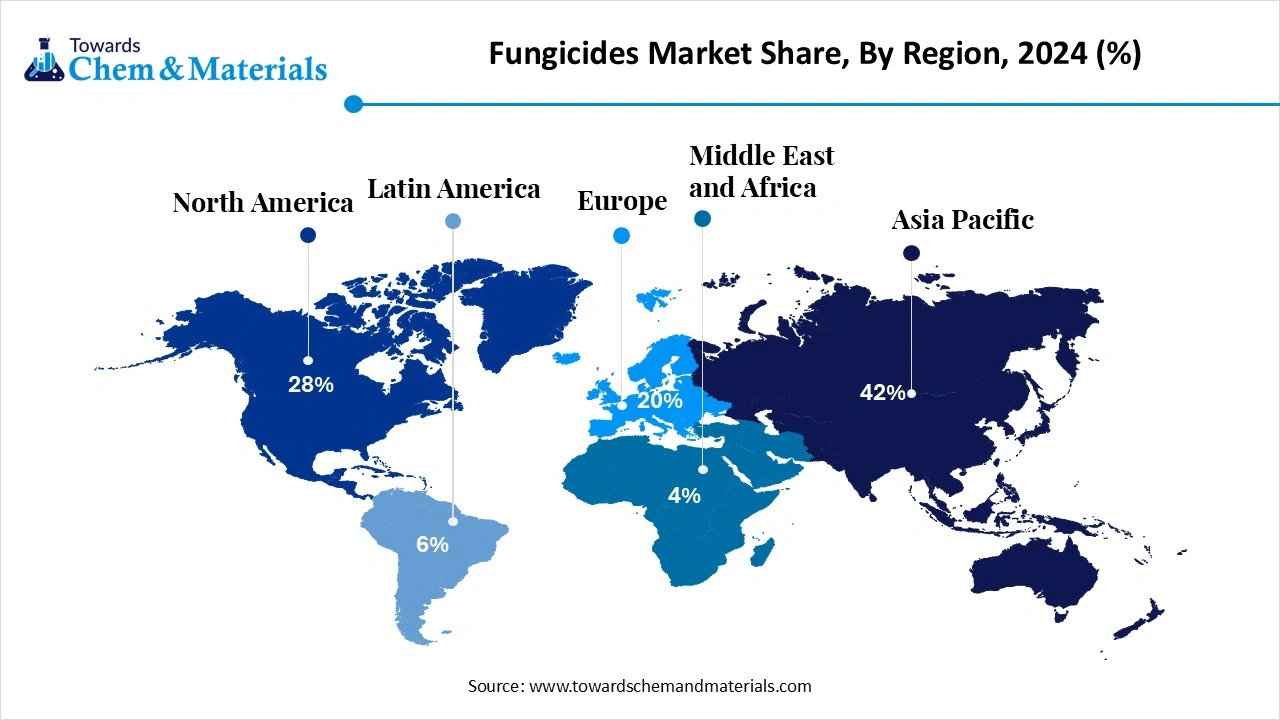

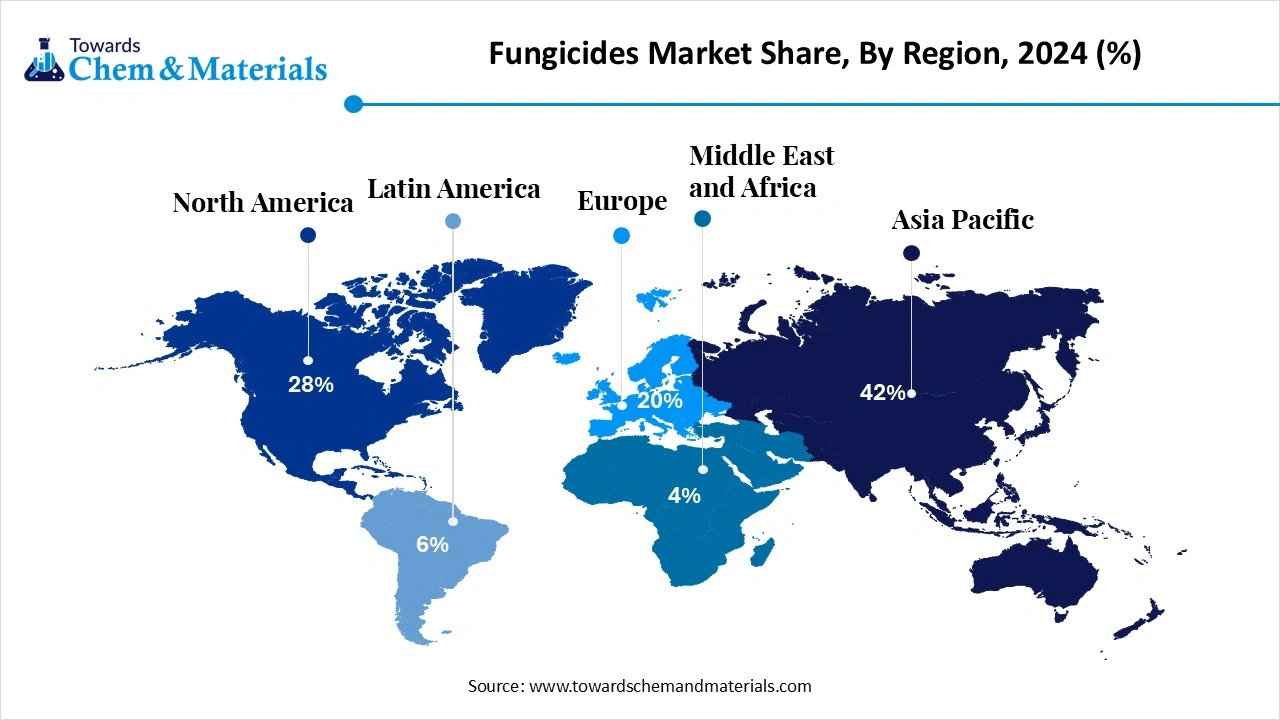

- By region, Asia Pacific dominated the market with a 42% share in 2024.

- By region, Latin America is expected to grow at the fastest CAGR of 22% over the forecast period.

- By region, North America is expected to grow at a notable CAGR over the forecast period.

- By chemical class, the triazoles segment dominated the market with a 32% share in 2024.

- By chemical class, the biological & bio-based fungicides segment is expected to grow at the fastest CAGR of 24% over the forecast period.

- By mode of action, the systemic segment held a 45% market share in 2024.

- By mode of action, the mixed-mode segment is expected to grow at the fastest CAGR of 20% over the forecast period.

- By formulation type, the suspension concentrates (SC) segment dominated the market by holding a 33% share in 2024.

- By formulation type, the water-dispersible granules (WG) segment is expected to grow at the fastest CAGR of 21% during the projected period.

- By end use, the commercial farmers segment held a 70% market share in 2024.

- By end use, the horticultural grower segment is expected to grow at the fastest CAGR of 20% during the forecast period.

- By distribution channel, the agrodealers / distributors segment dominated the market by holding 58% share in 2024.

- By distribution channel, the E-commerce / digital Ag platforms segment is expected to grow at the fastest CAGR of 25% over the forecast period.

What are Fungicides?

Rising disease incidence due to changing climatic conditions, expansion of high-value crops, and growing regulatory support for biocontrol products are driving steady market growth. The Global Fungicides Market encompasses chemical and biological products formulated to prevent or control fungal diseases in crops, turf, ornamentals, and seeds. Fungicides protect yield and crop quality by inhibiting spore germination or fungal growth through contact, translaminar, or systemic action.

The market includes conventional synthetic fungicides (triazoles, strobilurins, carbamates, dithiocarbamates, and others) as well as biological and natural-origin products gaining traction with sustainable agriculture. Integration with precision spraying, seed treatment, and digital crop monitoring solutions is reshaping the sector.

Global Fungicides Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is anticipated to witness substantial growth due to a rise in the cultivation of cash crops such as fruits and vegetables, which are more prone to diseases and command higher prices. Also, the use of agrochemicals for crop protection is growing across various sectors, impacting positive market growth.

- Sustainability Trends: The rise of bio-rational and bio-based fungicides, along with the development of nano-fungicides for better delivery, are the key sustainability trends in the market currently. Some trends are emphasizing resistance management using data analytics.

- Global Expansion: Companies are increasingly emphasising research and development to create more targeted and efficient solutions, boosted by growing global demand for food production and an ongoing shift towards more sustainable options like biopesticides.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 26.92 Billion |

| Expected Size by 2034 | USD 43.73 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type / Chemical Class, By Mode of Action, By Formulation Type, By End Use, By Distribution Channel, By Region |

| Key Companies Profiled | Syngenta AG (ChemChina Group), Corteva Agriscience, FMC Corporation, UPL Limited, Nufarm Limited, Sumitomo Chemical Co., Ltd., Adama Agricultural Solutions Ltd., Isagro S.p.A. (Gowan Group), Marrone Bio Innovations (Biologicals by Bioceres), Certis Biologicals, Nippon Soda Co., Ltd., Rotam CropSciences Ltd., Indofil Industries Ltd. |

Key Technological Shifts in the Global Fungicides Market:

Key technological shifts in the market are propelled by the growing demand for precision applications, sustainable agriculture, and cutting-edge new product chemistry. Advancements focus on creating more effective, targeted, and sustainable solutions to address the surge in pathogen resistance, which is impacting market expansion in the near future.

Trade Analysis of Global Fungicides Market: Import & Export Statistics

- US pesticide exports rose 4.07% from June to July 2025, reaching $369M, generating a positive trade balance of $263M with $106M in imports and $369M of export.(Source: oec.world)

- Chinese fungicide exports are projected to reach 125,640,000 kilograms by 2026, continuing an average annual growth rate of 2.2% since 1997.(Source: www.reportlinker.com)

Value Chain Analysis of the Global Fungicides Market:

- Feedstock Procurement : It refers to the process of sourcing the major raw materials required to manufacture fungicides.

- Chemical Synthesis and Processing : It includes the whole lifecycle of synthetic chemical fungicides, from their discovery and production to formulation and commercialization.

- Packaging and Labelling : This stage involves the entire process of designing, production, and application of the containers and informational labels for fungicide products.

- Regulatory Compliance and Safety Monitoring : It includes the detailed framework of rules, regulations, and surveillance guidance that control the manufacturing, sale, and use of fungicide products.

Global Fungicides Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| European Union | The European Commission revised MRLs for several pesticides in 2024, including benzovindiflupyr, chlorantraniliprole, emamectin, and quinclorac. |

| United States | Following a federal court order, the EPA issued cancellation orders for most chlorpyrifos products in 2024, citing neurodevelopmental risks in children. |

| China | In December 2023, China banned the production and use of four highly toxic pesticides, including carbofuran and methomyl. A sell-and-use grace period was extended until December 2025. |

Segmental Insights:

Chemical Class Insight

Which Chemical Class Type Segment Dominated the Global Fungicides Market in 2024?

The triazoles segment dominated the market with a 32% share in 2024. The dominance of the segment can be attributed to the growing demand for high-yield crops, because of the surge in global population and the sudden increase in fungal diseases across the globe caused by climate change. Additionally, triazoles are known for their broad-spectrum effectiveness against numerous fungal diseases, which makes them a key tool for farmers.

The biological & bio-based fungicides segment is expected to grow at the fastest CAGR of 24% over the forecast period. The growth of the segment can be credited to the growing consumer demand for organic food, along with the innovations in agricultural technology. Biofungicides are used widely on high-grade specialty crops, such as fruits and vegetables, to meet consumer demand for clean-label produce.

Mode of Action Insight

How Much Share Did the Systemic Segment Held in 2024?

The systemic segment held a 45% market share in 2024. The dominance of the segment can be linked to the growing global food demand and surge in crop disease prevalence, which requires effective crop protection and higher crop yields. In addition, advancements in fungicide formulation and delivery techniques are enhancing the effectiveness and efficiency of systemic formulations.

The mixed-mode segment is expected to grow at the fastest CAGR of 20% over the forecast period. The growth of the segment can be driven by the growing demand for high-efficiency and sustainable crop protection methods, coupled with the increase in global food demand. Moreover, major players such as Syngenta and BASF are rapidly investing in research and development to launch new combinations of ingredients.

Formulation Type Insight

Which Formulation Type Segment Dominated the Global Fungicides Market in 2024?

The suspension concentrates (SC) segment dominated the market by holding a 33% share in 2024. The dominance of the segment is owed to the growing global demand for water-based, high-performance formulations, which are safer and more efficient than traditional options. Furthermore, these formulations are compatible with precision agriculture, such as Unmanned Aerial Systems (UAS).

The water-dispersible granules (WG) segment is expected to grow at the fastest CAGR of 21% during the projected period. The growth of the segment is due to its sophisticated safety, handling, and performance benefits for farmers and major players. WG fungicides are much drier, dust-free, and can disperse rapidly in water, which makes them a superior alternative to other powder and liquid formulations.

End Use Insight

How Much Share Did the Commercial Farmers Segment Held in 2024?

The commercial farmers segment held a 70% market share in 2024. The dominance of the segment can be attributed to the rapidly changing agricultural trends and ongoing demand to maximize yields. Advancements in precision agriculture, such as smart spraying systems, allow commercial farmers to apply fungicides more efficiently and strategically, leading to segment growth soon.

The horticultural grower segment is expected to grow at the fastest CAGR of 20% during the forecast period. The growth of the segment can be credited to the rise in fungal disease incidence due to climate change and the growing demand for high-value crops globally. Also, the cultivation of high-value horticultural crops, such as vegetables, specialty fruits, and ornamentals, is expanding across the globe.

Distribution Channel Insight

Which Distribution Channel Segment Dominated the Global Fungicides Market in 2024?

The agrodealers / distributors segment dominated the market by holding a 58% share in 2024. The dominance of the segment can be linked to the surge in consumer health concerns and interest in sustainable and organic farming. Additionally, agrodealers build brand and trust loyalty by providing technical expertise and educational workshops, which ensures farmers depend on them for their product needs.

The E-commerce / digital Ag platforms segment is expected to grow at the fastest CAGR of 25% over the forecast period. The growth of the segment can be driven by the rise of precision agriculture and the surge in penetration of the internet and smartphones. These platforms further offer farmers a wide market access with data-driven insights and enhanced supply chain management.

Regional Analysis

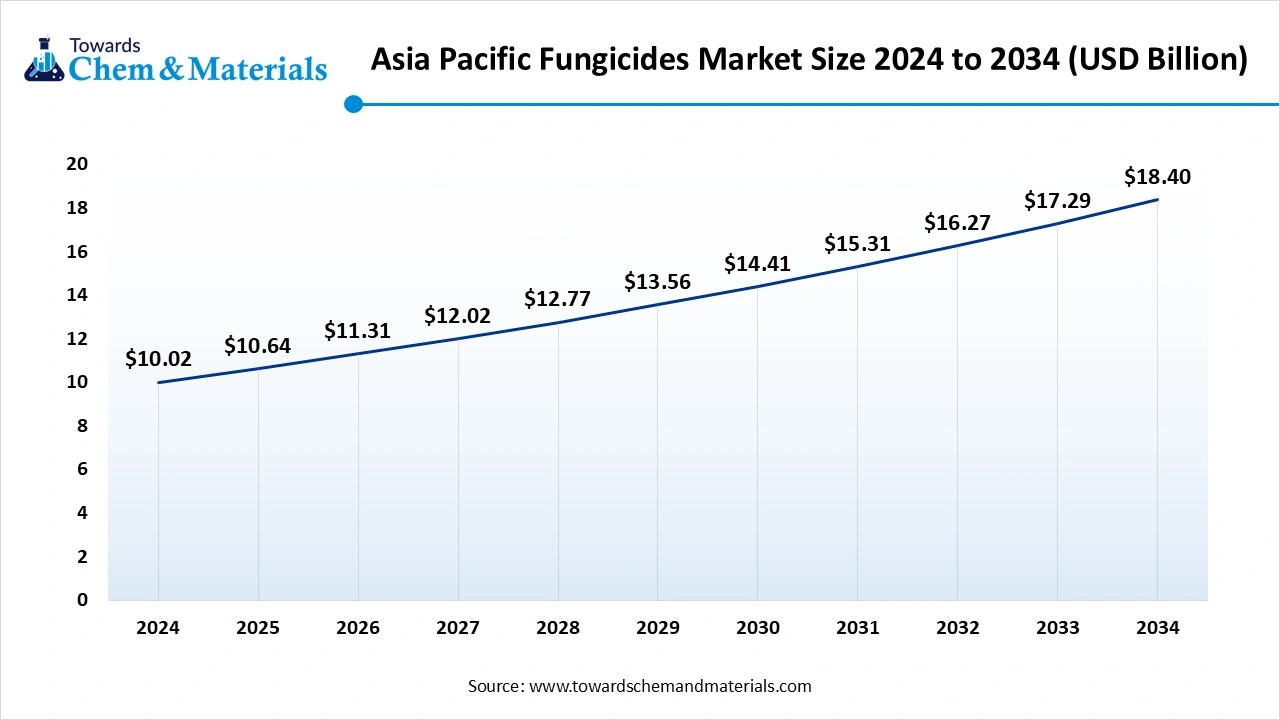

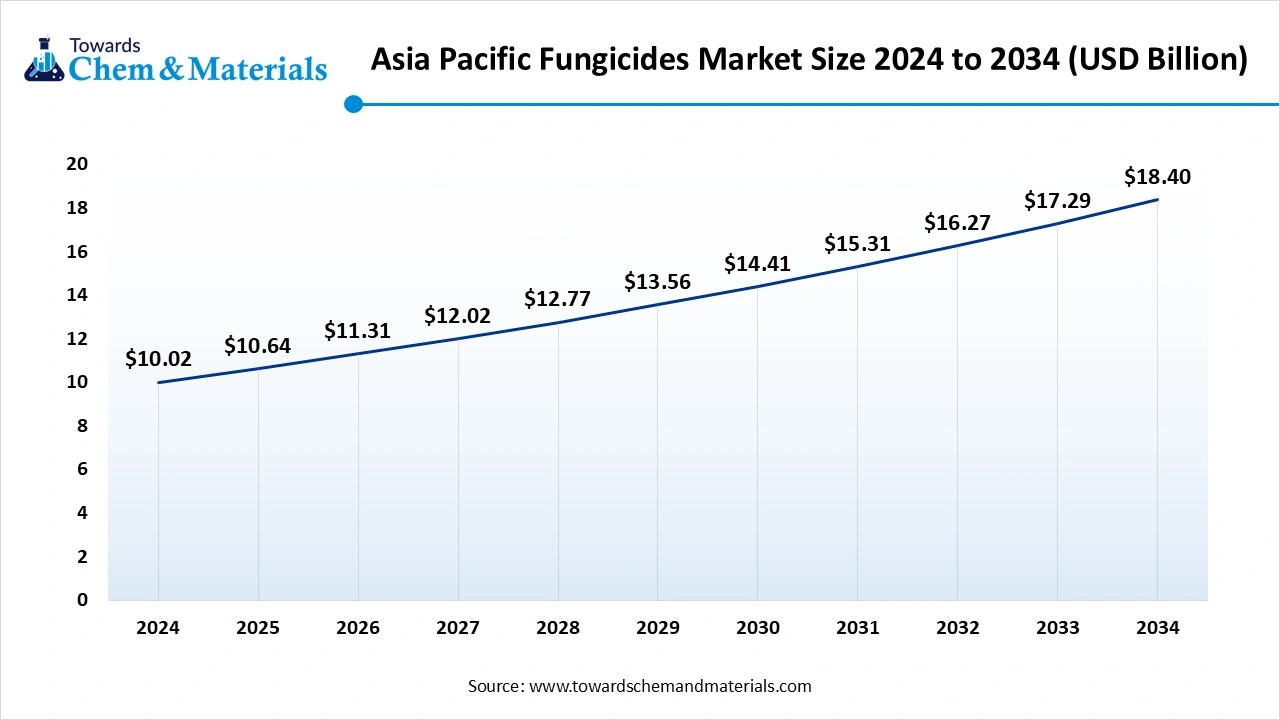

Asia Pacific dominated the market with a 42% share in 2024.

The Asia Pacific fungicides market size is valued at USD 10.64 billion in 2025 and is expected to surpass around USD 18.40 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.27% over the forecast period from 2025 to 2034.

The dominance of the segment can be attributed to the increasing demand for food security for a growing population, along with the government's support for agriculture. In addition, the region's large population needs more food, which in turn fuels the demand for higher crop yields.

China Global Fungicides Market Trends

In the Asia Pacific region, China dominated the market owing to the ongoing innovations in agricultural technology and the rapid shift towards more sustainable practices. China is also a major exporter of agricultural products, which meet the international market's strict quality standards by maximizing residue levels.

Latin America is expected to grow at the fastest CAGR of 22% over the forecast period. The growth of the region can be credited to the increase in adoption of modern farming practices and the favorable climate for fungal diseases. The region is also a world leader in producing and trading high-demand crops such as corn, sugar, coffee, and soybeans. Wide cultivation of pulses and oilseeds, especially soybeans, is a major application area for fungicides.

Brazil Global Fungicides Market Trends

In Latin America, Brazil held the largest market share due to growing demand for agricultural commodities and increasing agricultural production of key crops such as corn and soybeans. Also, strong demand for Brazilian agricultural exports directly boosts the demand for crop protection solutions to keep high yields and quality.

North America is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by technological innovations such as precision agriculture, along with the surge in crop yields to feed a growing population. The region also has a well-established agricultural infrastructure, which has a diverse crop range such as corn, soybeans, and wheat.

U.S. Global Fungicides Market Trends

In North America, the U.S. dominated the market owing to the increasing demand for effective crop protection due to climate change and innovations in fungicide formulations and technology. A greater awareness among farmers regarding the importance of crop protection can fuel market growth further in the country.

Recent Developments

- In May 2025, Synthos Agro, in collaboration with SyVento, introduced a new fungicide with liposomal technology. This cutting-edge product is substantial in terms of formulation technology and safe and selective delivery of the active substance.(Source: www.agribusinessglobal.com)

- In May 2025, Dhanuka launches a cutting-edge fungicide named 'Melody Duo'. The company also celebrated the 25-year journey of its iconic herbicide brand Targa Super. Targa, over the years, has become a symbol of trust and innovation.(Source: www.global-agriculture.com)

- In January 2024, Adama launched five new cereal fungicides in Europe to control one of the most serious diseases affecting farmer yields. All these products give Adama's customers a detailed portfolio of advanced solutions to design and deliver excellent results in the field.(Source : www.indianchemicalnews.com)

Top Vendors in the Global Fungicides Market & Their Offerings:

- BASF SE: BASF SE is a major player in the global fungicides market, contributing significantly to its growth through innovation and a wide portfolio of products, including chemical and biological fungicides for various crops.

- Bayer AG: Bayer AG holds a significant position in the global fungicides market, ranking as the second-largest company in the crop protection sector.

Other Players

- Syngenta AG (ChemChina Group)

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Adama Agricultural Solutions Ltd.

- Isagro S.p.A. (Gowan Group)

- Marrone Bio Innovations (Biologicals by Bioceres)

- Certis Biologicals

- Nippon Soda Co., Ltd.

- Rotam CropSciences Ltd.

- Indofil Industries Ltd.

Segment Covered

By Type / Chemical Class

- Triaz

- oles (DMI fungicides)

- Strobilurins (QoI fungicides)

- Dithiocarbamates (mancozeb, thiram)

- Benzimidazoles (carbendazim, benomyl)

- Chloronitriles (chlorothalonil)

- Carbamates & Phenylamides

- Biological & Bio-based Fungicides (microbial & botanical)

By Mode of Action

- Contact (protectant)

- Systemic (curative & protective)

- Translaminar (localized systemic)

- Mixed-Mode (multi-site & combination products)

By Formulation Type

- Wettable Powders (WP)

- Suspension Concentrates (SC)

- Emulsifiable Concentrates (EC)

- Water-Dispersible Granules (WG)

- Flowables / Liquid Concentrates

By End Use

- Commercial Farmers (row crops, plantations)

- Horticultural Growers (fruits, vegetables, ornamentals)

- Seed Treatment Companies / Agrochemical Formulators

- Public Sector & Research Institutes

By Distribution Channel

- Agrodealers / Distributors

- Direct-to-Farm (contract / cooperatives)

- E-commerce / Digital Ag Platforms

- Retail / Input Stores

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait