Content

What is the Bio-Based Polypropylene Market Size and Volume?

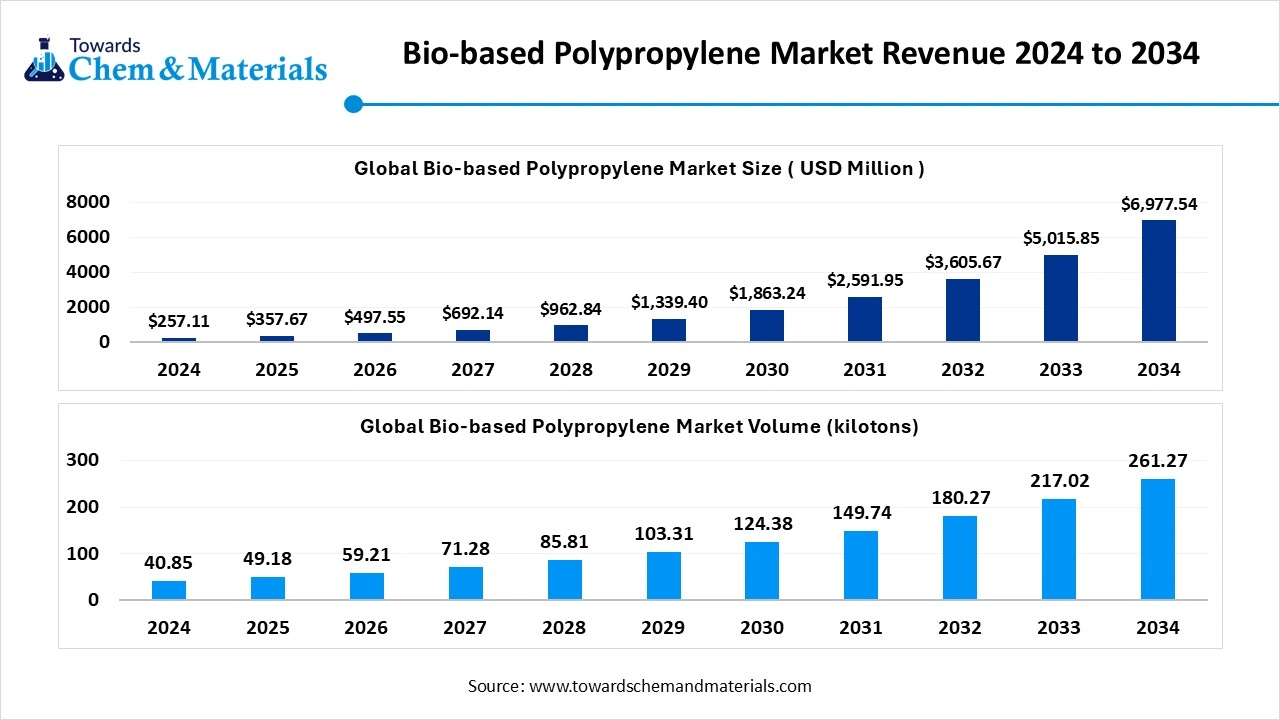

The global bio-based polypropylene market stands at 49.18 kilo tons in 2025 and is forecast to reach 261.27 kilo tons by 2034, advancing at a 20.39% CAGR.

The global bio-based polypropylene market size accounted for USD 257.11 million in 2024 and is predicted to increase from USD 357.67 million in 2025 to approximately USD 6,977.54 million by 2034, expanding at a CAGR of 39.11% from 2025 to 2034. The growth of the market is driven by growing demand from various sectors, especially automotive, packaging and medical devices, which drives the growth of the market.

Key Takeaways

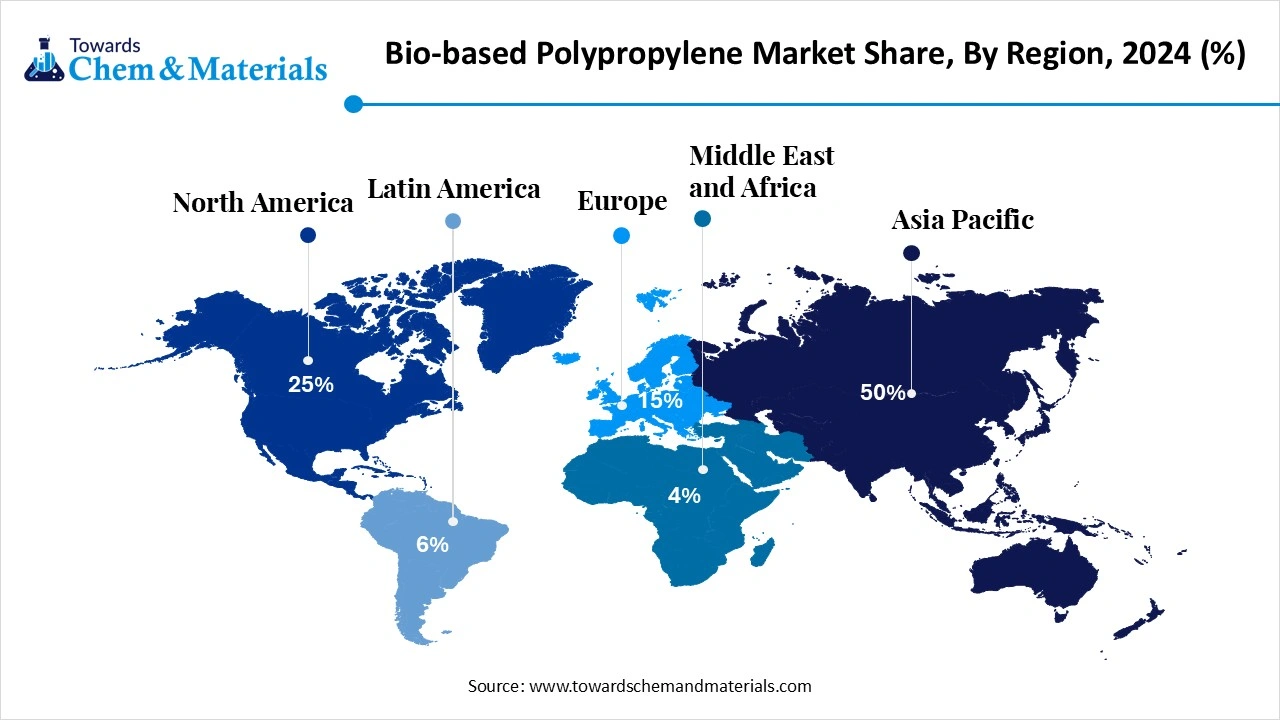

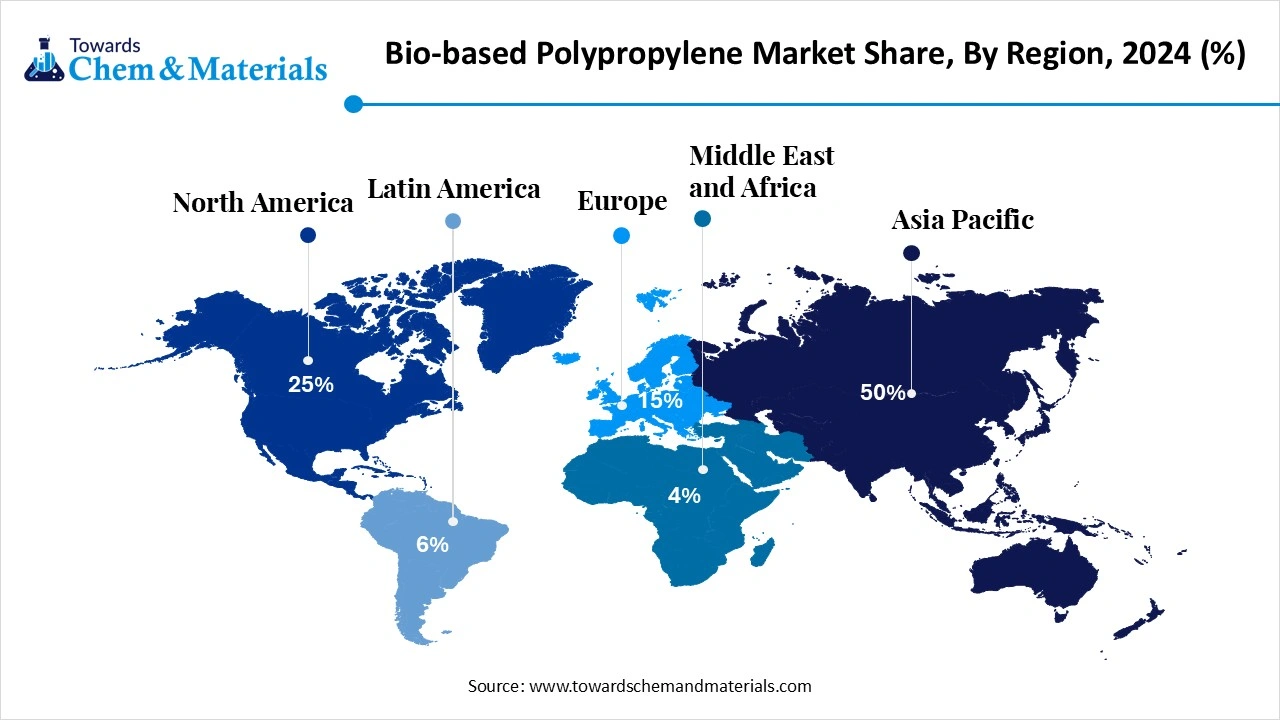

- By region, Asia Pacific dominated the market with a share of 50% in 2024.

- By region, Europe is expected to have significant growth in the market in the forecast period.

- By feedstock source, the first-generation sugars/bioethanol segment dominated the market with a share of 45% in 2024.

- By feedstock source, the waste & residue oils segment is expected to grow significantly in the market during the forecast period.

- By production/ technology route, the mass-balance / certified bio-circular PP segment dominated the market with a share of 50% in 2024.

- By production/ technology route, the biotechnological routes (fermentation → bio-propylene) segment is expected to grow in the forecast period.

- By product grade, the PP homopolymer segment dominated the market with a share of 60% in 2024.

- By product grade, the cohesive bond / double-sided segment is expected to grow in the forecast period.

- By end-use industry, food & beverage packaging segment dominated the market with a share of 52% in 2024.

- By end-use industry, the automotive & mobility segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Bio-Based Polypropylene Market?

Bio-based polypropylene (bio-PP) is polypropylene produced wholly or partially from renewable carbon feedstocks (e.g., plant sugars, bioethanol, waste oils, or renewable hydrogen + co₂ pathways) or via mass-balance certified supply chains that replace fossil feedstock with renewable inputs. Bio-PP products range from iscc/rsb-certified mass-balanced grades to fully bio-derived drop-in polymers made using bioconversion or advanced catalytic routes.

The importance of the market stems from its function as a sustainable substitute for conventional plastics, offering environmental advantages such as decreased greenhouse gas emissions and a smaller carbon footprint. Additionally, it promotes industry growth by fulfilling rising consumer demand for eco-friendly products across sectors like packaging, automotive, textiles, and medical devices. It can reduce greenhouse gas emissions by up to 65% compared to petroleum-based plastics because it originates from renewable feedstocks that capture CO2 during their growth.

Bio-Based Polypropylene Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the bio-based polypropylene market is projected to grow rapidly as industries shift toward sustainable and low-carbon materials. Rising demand from the packaging, automotive, and consumer goods sectors is driving adoption due to bio-PP’s comparable mechanical strength and processability to conventional polypropylene.

- Sustainability Trends: Sustainability is the key growth catalyst, with companies investing in renewable feedstocks such as bioethanol and waste biomass to produce polypropylene with significantly lower carbon footprints. Circular economy models and life-cycle assessments are gaining importance to validate carbon savings.

- Global Expansion & Partnerships: Major chemical and bioplastic producers are forming strategic collaborations to scale up production and ensure feedstock security. Investments in large-scale biorefineries and biopolymer plants are accelerating, particularly in Europe, Japan, and Brazil.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 497.55 Million |

| Expected Size by 2034 | USD 6,977.54 Million |

| Growth Rate from 2025 to 2034 | CAGR 39.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Feedstock Source, By Production/Technology Route, By Product Grade, By End-Use Industry, By Region |

| Key Companies Profiled | Borealis , Neste , Natureplast , Fkur (And Partners) , LG Chem (Partnering With Gevo / Others) , Gevo , Genomatica , Citroniq , Beaulieu International Group , neos (Circular Initiatives) , Mitsubishi Chemical Group |

Key Technological Shifts In The Bio-Based Polypropylene Market:

Key technological shifts in the market include advancements in feedstock conversion through improved fermentation and catalysis, the development of advanced polymerisation techniques, and the integration of AI and precision manufacturing for greater control and efficiency.

Additionally, the sector is seeing innovation in carbon capture and utilisation (CCU) to create bio-propylene from CO2, and a greater focus on circular economy principles, such as improving recycling methods and using bio-based PP as a "drop-in" replacement that is compatible with existing recycling infrastructure.

Trade Analysis Of Bio-Based Polypropylene Market: Import & Export Statistics

- Between July 2023 and June 2024 (TTM), India exported a total of 6 shipments of Biodegradable Plastic, carried out by 3 Indian exporters to 3 buyers.

- In June 2024 alone, India recorded 2 export shipments of Biodegradable Plastic.

- On a global scale, the leading exporters of Biodegradable Plastic are China, Vietnam, and Italy. China dominates with 650 shipments, followed by Vietnam with 112 shipments, while Italy ranks third with 59 shipments.(Source: www.volza.com)

- For Polypropylene Compound, the top three global exporters are Thailand, India, and South Korea. Thailand leads the segment with 7,640 shipments, trailed by India with 3,257 shipments, and South Korea with 1,851 shipments.(Source: www.volza.com)

Bio-Based Polypropylene Market Value Chain Analysis

- Chemical Synthesis and Processing : Biobased polypropylene is produced from renewable feedstocks such as sugarcane, corn, or biomass through fermentation, dehydration, and polymerisation processes to yield propylene monomers and biopolymer resins.

- Key players: Braskem S.A., TotalEnergies Corbion, LyondellBasell Industries, SABIC, Mitsui Chemicals, Inc.

- Quality Testing and Certification : Biobased polypropylene is tested for molecular weight, tensile strength, and thermal stability, complying with standards such as ISO 16620 for bio-based content and ASTM D6866 for carbon origin verification.

- Key players: SGS, Intertek, TÜV SÜD, UL Solutions.

- Distribution to Industrial Users : Biobased polypropylene is distributed to packaging, automotive, textiles, and consumer goods industries seeking sustainable and recyclable material alternatives.

- Key players: Braskem S.A., Borealis AG, TotalEnergies, Mitsui Chemicals, Inc.

Bio-Based Polypropylene Regulatory Landscape: Global Regulations

| Region / Country | Regulatory Body | Key Regulations / Frameworks | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA), U.S. Department of Agriculture (USDA), Food and Drug Administration (FDA) | - USDA BioPreferred Program (7 CFR Part 3201) - EPA Toxic Substances Control Act (TSCA) - FDA 21 CFR (for food contact materials) |

- Biobased content certification - Chemical safety and pre-manufacture notice - Food-contact safety compliance |

Bio-PP producers can obtain a USDA Certified Biobased Product label. EPA TSCA applies to new polymer substances. The FDA regulates PP used in packaging and consumer goods. |

| European Union | European Chemicals Agency (ECHA), European Commission (DG ENV), CEN (European Committee for Standardisation) | - REACH Regulation (EC 1907/2006) - EU Single-Use Plastics Directive (EU 2019/904) - EN 16785-1 – Biobased content verification - EU Circular Economy Action Plan (2020) |

- Chemical registration and labelling - Biobased and compostable certification - Recyclability and sustainability claims |

EU requires REACH registration for bio-PP chemicals and EN 16785-1 for bio-content measurement. The upcoming Packaging and Packaging Waste Regulation (PPWR) mandates circular design for bio-plastics. |

| China | Ministry of Ecology and Environment (MEE), National Development and Reform Commission (NDRC) | - MEE Order No. 12 – New Chemical Substance Registration - GB/T 41010-2021 – Biobased plastics labelling - Circular Economy Promotion Law (amended 2021) |

- New chemical registration - Biobased labelling and certification - Industrial-scale recycling |

China promotes bio-based polymer development under its National Green Materials Plan (2020-2025). Biobased plastics labelling standard (GB/T 41010-2021) specifies carbon origin testing. |

| India | Ministry of Environment, Forest and Climate Change (MoEFCC), Bureau of Indian Standards (BIS), Department of Chemicals and Petrochemicals | - Plastic Waste Management (PWM) Rules, 2016 (amended 2022) - Draft Bio-Plastics Standard (IS 17899-2022) - Extended Producer Responsibility (EPR) Guidelines, 2022 |

- EPR compliance and labelling - Biodegradability and compostability tests - Sustainable plastic alternatives |

India is finalising national standards for bioplastics, aligned with ISO 17088. Bio-PP producers must meet EPR targets for recovery and recycling. |

| Middle East (UAE, Saudi Arabia) | Environment Agency – Abu Dhabi (EAD), Saudi Standards, Metrology and Quality Organisation (SASO) | - SASO 2879:2021 – Biodegradable plastic materials - UAE Federal Law No. 12 (2018) – Waste Management - GCC Sustainable Plastics Strategy (Vision 2030) |

- Biodegradability verification - Waste reduction - Product labelling and compliance |

GCC countries promote bio-based and oxo-biodegradable alternatives under Vision 2030. SASO certification is mandatory for bioplastic importers. |

Segmental Insights

Feedstock Source Insight

Which Feedstock Source Segment Dominated The Bio-Based Polypropylene Market In 2024?

The first-generation sugars/bioethanol segment dominated the bio-based polypropylene market with a share of 45% in 2024. Bioethanol from first-generation sugars (corn, sugarcane) is a commercially mature feedstock route for producing bio-propylene via dehydration and catalytic conversion. The wide availability of ethanol at scale makes it attractive for near-term bio-PP projects and supports mass-balance schemes. Its established logistics and commodity markets reduce feedstock risk, enabling large integrated producers to produce certified bio-PP grades that match conventional PP performance while lowering lifecycle greenhouse-gas intensity.

The waste and residue oils segment expects significant growth in the market during the forecast period. Waste and residue oil (used cooking oil, tallow, waste fats) offer a low-carbon, circular feedstock route for bio-propylene via hydroprocessing and co-processing in existing refinery streams. Their high conversion efficiency and favourable carbon accounting make them appealing for brand owners targeting aggressive scope-3 reductions. Scaling collection and ensuring feedstock sustainability and traceability remain the primary operational challenges, but growing waste-oil aggregation networks are rapidly improving feedstock visibility.

Production / Technology Route Insight

How Did Mass Balance/ Certified Bio-Circular PP Segment Dominate The Bio-Based Polypropylene Market In 2024?

The mass-balance / certified bio-circular PP segment dominated the bio-based polypropylene market with a share of 50% in 2024. Mass-balance certified bio-PP enables renewable feedstock to be introduced into existing production lines while allocating renewable content to final polymer batches through certification systems (e.g., ISCC). This pragmatic route accelerates market availability of bio-PP without requiring full plant reconfiguration, helping converters and brand owners meet sustainability targets. It supports immediate commercialisation at scale, although it relies on robust bookkeeping, auditability, and credible certification to maintain market trust.

The biotechnological routes (fermentation → bio-propylene) segment expects significant growth in the market during the forecast period. Biotechnological routes convert sugars or other biomass via fermentation and catalytic upgrading to produce bio-propylene, enabling the possibility of fully bio-derived 100% propylene streams. These processes promise high traceability and low carbon intensity but are still scaling commercially. Biotech pathways may deliver higher premium products and fully traceable chains, attractive to speciality converters and brands that require demonstrable, end-to-end bio content and sustainability credentials.

Product Grade insight

Which Product Grade Segment Dominated The Bio-Based Polypropylene Market In 2024?

The PP homopolymer segment dominated the bio-based polypropylene market with a share of 60% in 2024. Recycled or biobased PP homopolymer is targeted for rigid packaging, containers, and injection-moulded components where stiffness and high melt strength are required. Bio-homopolymer grades aim to match virgin PP mechanical properties while delivering lower lifecycle emissions. They are attractive to packaging converters and OEMs looking to replace fossil PP in rigid formats without compromising processability or end-use performance.

The PP copolymer segment expects significant growth in the market during the forecast period. Biobased PP copolymers (random or block) deliver improved impact resistance, clarity, and flexibility over homopolymers, making them suitable for films, medical components, and automotive interior parts. Bio-copolymers enable converters to offer performance parity across a broader set of applications from flexible films to structural parts, thereby expanding the addressable market for bio-PP in both packaging and mobility sectors.

End-Use Industry insight

How Did The Food And Beverage Packaging Segment Dominate The Bio-Based Polypropylene Market In 2024?

The food & beverage packaging segment dominated the market with a share of 52% in 2024. Food and beverage packaging is a high-value end market for bio-PP due to strict food-contact requirements and brand sustainability goals. Certified bio-PP homopolymers and copolymers must meet regulatory and safety standards while delivering recyclability. Many beverage and packaged-food brands prefer mass-balance or fully traceable bio-PP to communicate lower environmental impact while maintaining supply reliability and functional performance.

The automotive & mobility segment expects significant growth in market during the forecast period. Automotive and mobility sectors require bio-PP with validated long-term durability, thermal stability, and regulatory compliance.

Adoption is driven by OEM sustainability targets and lightweighting initiatives in electric vehicles. Partnerships between material suppliers and automakers to qualify bio-PP grades for specific components, backed by life-cycle analysis (LCA), are critical for expanding penetration into high-volume vehicle programs.

Regional Analysis

Asia Pacific Dominated The Bio-Based Polypropylene Market in 2024?

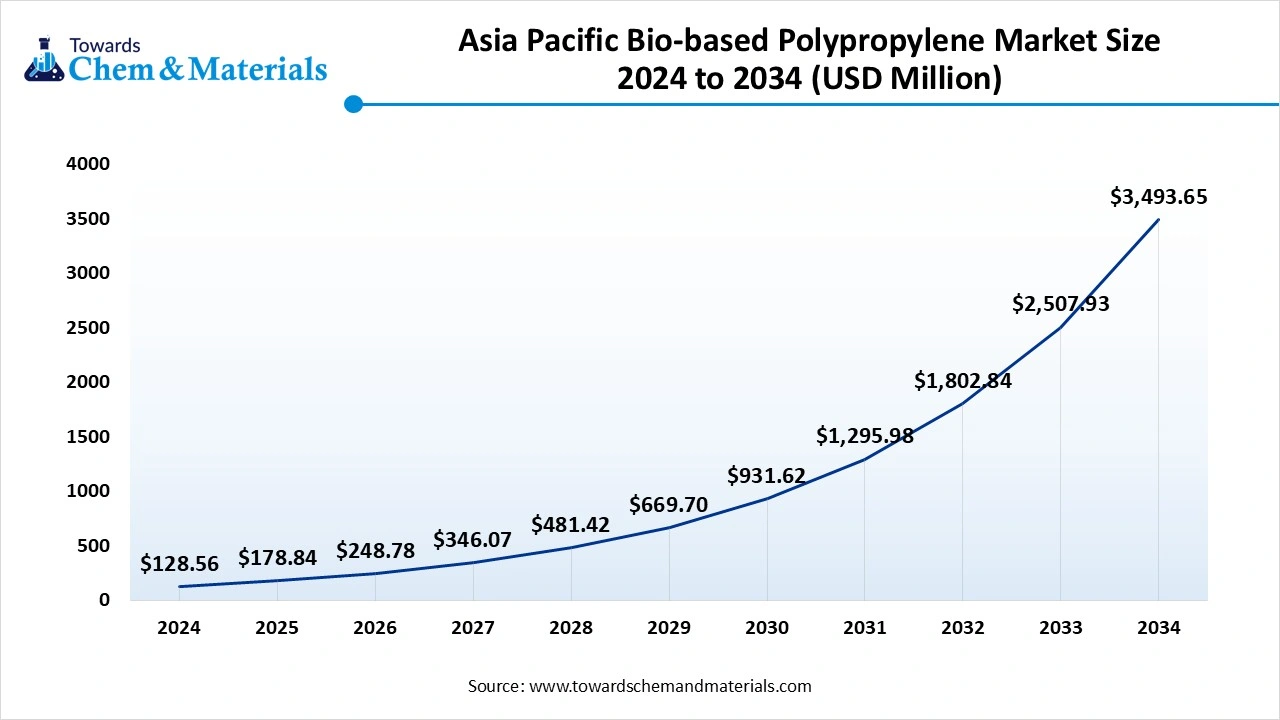

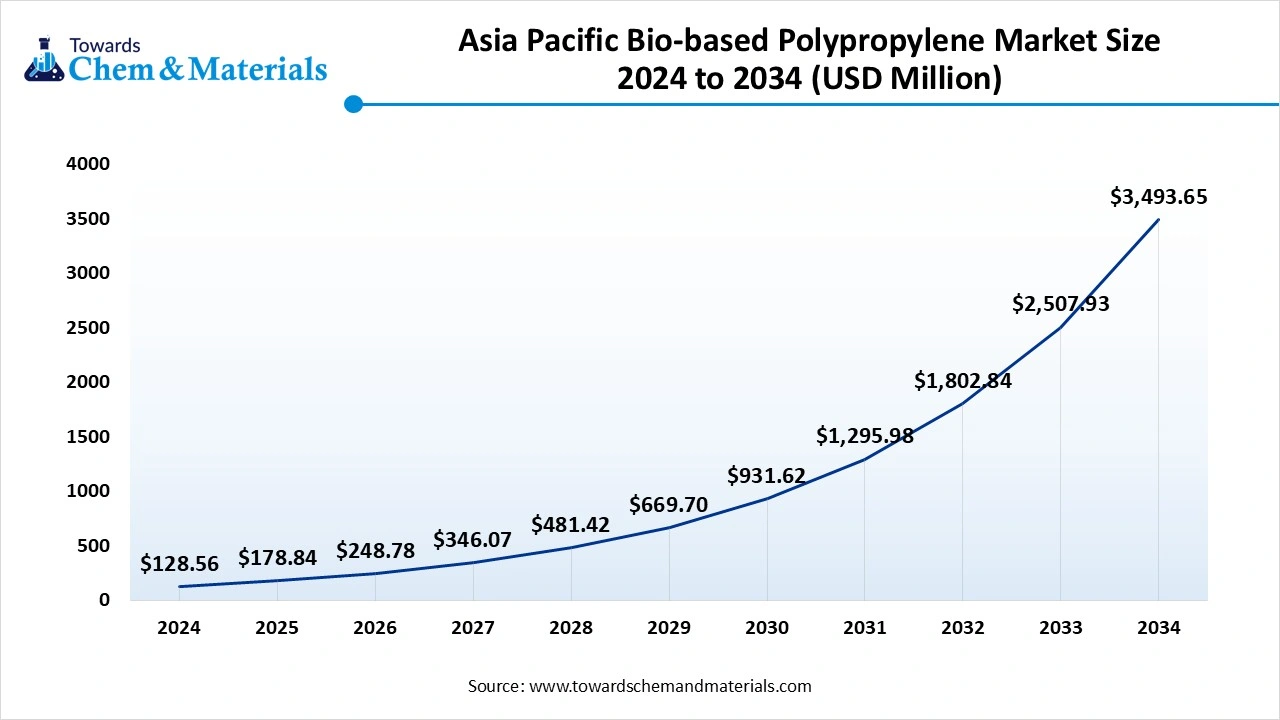

The Asia Pacific bio-based polypropylene market size is estimated at USD 357.67 million in 2025 and is projected to reach USD 3,493.65 million by 2034, growing at a CAGR of 39.11% from 2025 to 2034.Asia Pacific dominated the market with a share of 50% in 2024. Asia Pacific is a rapidly expanding market for biobased polypropylene driven by strong packaging demand, rising automotive production, and government sustainability targets.

Regional feedstock availability, especially bioethanol and waste oils, plus growing refinery and petrochemical integration, supports early-stage bio-PP projects. Manufacturers in China, South Korea, and Southeast Asia are piloting mass-balance and co-processing routes, while platform providers and converters scale product portfolios to serve large-volume consumer and industrial markets seeking lower-carbon polyolefins.

India Has Seen Growth In The Market Due To the Presence Of Government Support.

India’s bio-PP market is emerging as feedstock supplies such as sugarcane ethanol and diverse waste oils become more commercially accessible. Government programs promoting biofuels and circular economy practices encourage investments in bio-refining and co-processing capacity. Local compounders and packaging converters are beginning to evaluate mass-balance certification and trial bio-PP grades for pulp-and-film applications. Cost, supply-chain traceability, and performance parity with fossil PP remain key adoption considerations for Indian brand owners and manufacturers.

Europe Bio-Based Polypropylene Market Analysis

Europe is expected to have significant growth in the market in the forecast period. Europe leads in policy-driven demand for lower-carbon polymers, with stringent recycled content targets and corporate net-zero commitments fueling bio-PP interest. European refiners and chemical majors are developing mass-balance and bio-propylene routes, often linking renewable feedstock procurement with ISCC certification. Demand is strongest in packaging and automotive lightweighting, where OEMs and brand owners use certified bio-polymers to report scope-3 emission reductions and satisfy ecolabel or procurement requirements across the EU market.

UK Market Growth Is Driven By The Growing Industries In The Country.

The UK market for biobased polypropylene is characterised by progressive sustainability procurement among retailers and automotive suppliers, alongside growing R&D in fermentation and bio-propylene routes. Post-BREXIT industrial strategies emphasising green industrial growth and bioeconomy pilots are encouraging investments in certified mass-balance streams and speciality compounders. UK converters and packaging firms increasingly seek traceable supply chains, driving interest in ISCC and fully traceable bio-PP for differentiated product lines and public sector tenders.

North America Bio-Based Polypropylene Market Trends

North America is a strategic market for bio-PP development due to large polymer demand, mature logistics, and feedstock (bioethanol, waste oils) availability. US refiners and chemical companies are investing in co-processing and HEFA/bioprocess pathways to produce renewable propylene feedstock. Brand commitments to recycled and bio-content in packaging, combined with fleet electrification and automotive lightweighting initiatives, are creating commercial pull for certified bio-PP grades across consumer and industrial segments.

The U.S. Has Seen Significant Growth Driven By The Major Consumer Demand

In the U.S., bio-PP adoption is driven by major consumer brands, packaging OEMs, and automakers seeking lower-carbon material options. Availability of corn-derived ethanol and expanding used cooking oil and waste oil collection infrastructure support both first-generation and waste-feedstock pathways. Pilot projects focus on mass-balance certification to enable rapid market entry; meanwhile, investments in fermentation-to-propylene routes aim for fully bio-derived products. Regulatory incentives and corporate sustainability procurement accelerate demand among U.S. buyers.

Recent Developments

- In August 2025, ABB and Citroniq are collaborating to launch the world's first commercial-scale plant for 100% bio-based polypropylene in Nebraska. This facility will utilise corn-based ethanol to produce certified biogenic polypropylene, with ABB providing the necessary automation and electrification technologies.(Source: themachinemaker.com)

- In August 2025, Sumitomo Chemical launched a pilot facility for its new, one-step process to produce propylene directly from ethanol. The company aims to commercialise and license the technology by the early 2030s to create bio-based polypropylene and reduce reliance on fossil fuels.(Source: bioenergytimes.com)

- In August 2025, Vioneo selected Lummus Technology for its new industrial-scale complex in Antwerp to produce fossil-free polypropylene. The facility aims to use green methanol, renewable electricity, and renewable hydrogen to create sustainable, CO2-negative polypropylene.(Source: fuelcellsworks.com)

Top Players In The Bio-Based Polypropylene Market & Their Offerings:

- Braskem: A pioneer in bio-based polymers, Braskem produces I’m green™ Bio-based Polypropylene derived from renewable feedstocks such as sugarcane ethanol, offering a reduced carbon footprint for packaging, automotive, and consumer goods applications

- LyondellBasell: Develops bio-based and circular polypropylene under its CirculenRenew line, offering drop-in sustainable alternatives for injection moulding, films, and fibres.

- Mitsui Chemicals: Invests in renewable feedstock integration for polypropylene production, focusing on sustainable materials that align with Japan’s carbon neutrality initiatives

- SABIC: Through its TRUCIRCLE initiative, SABIC manufactures certified renewable polypropylene made from second-generation bio-based feedstocks, enabling sustainable material solutions for the automotive and packaging industries.

- TotalEnergies Corbion: Focuses on biopolymer innovation, producing bio-based and biodegradable plastics; exploring integration of renewable feedstocks into polypropylene production for lower emissions and circular solutions.

Other Top Players Are

- Borealis

- Neste

- Natureplast

- Fkur (And Partners)

- LG Chem (Partnering With Gevo / Others)

- Gevo

- Genomatica

- Citroniq

- Beaulieu International Group

- Ineos (Circular Initiatives)

- Mitsubishi Chemical Group

Segments Covered:

By Feedstock Source

- first-generation sugars/bioethanol (sugarcane, corn)

- waste & residue oils (UCO, animal fats)

- renewable hydrogen + co₂ / e-carbon routes

- biomass-to-intermediates (cellulosic sugars)

By Production/Technology Route

- mass-balance / certified bio-circular pp (renewable feedstock co-processing)

- bio-propylene via catalytic/thermochemical routes (bio-naphtha → pdh → pp)

- biotechnological routes (fermentation → bio-propylene)

- advanced electrochemical / co₂-to-propylene routes (emerging)

By Product Grade

- pp homopolymer (pp-h)

- pp copolymer (ppc/pp-random)

- filled/reinforced / speciality pp

By End-Use Industry

- food & beverage packaging

- automotive & mobility

- consumer durables & homecare

- textiles & nonwovens

- industrial & construction

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait