Content

What is the Green Polypropylene Market Size and Share?

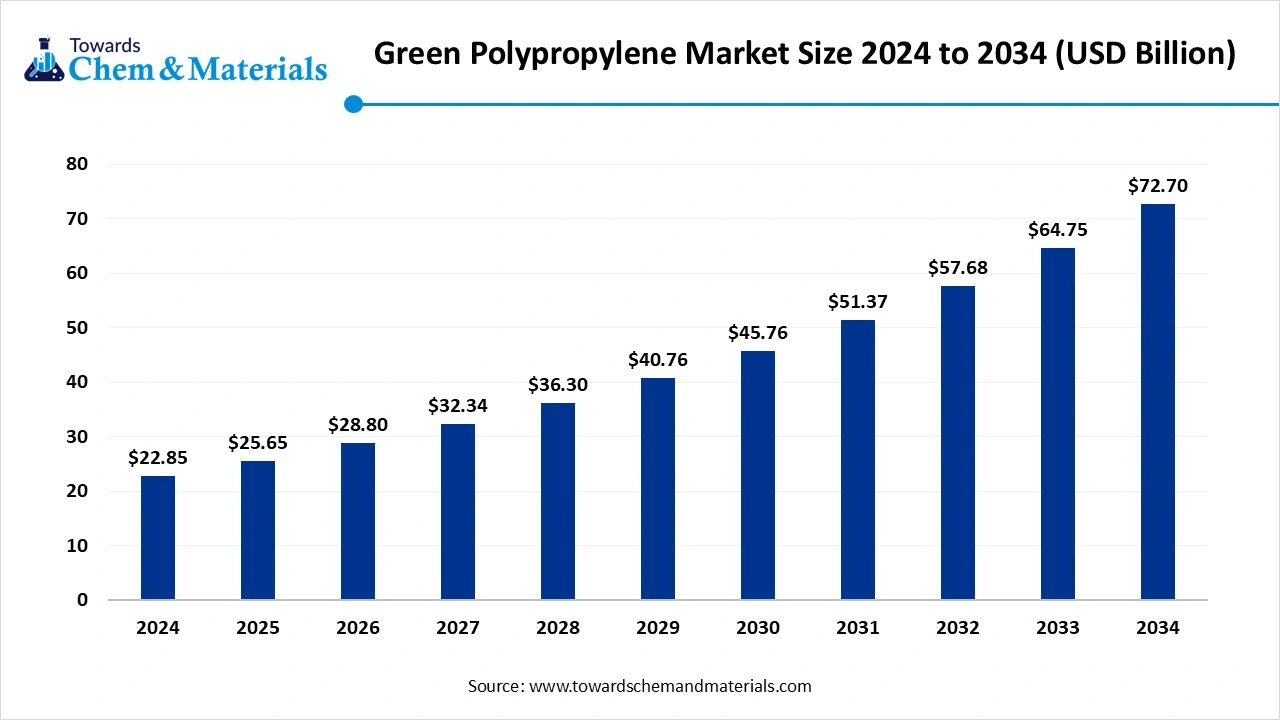

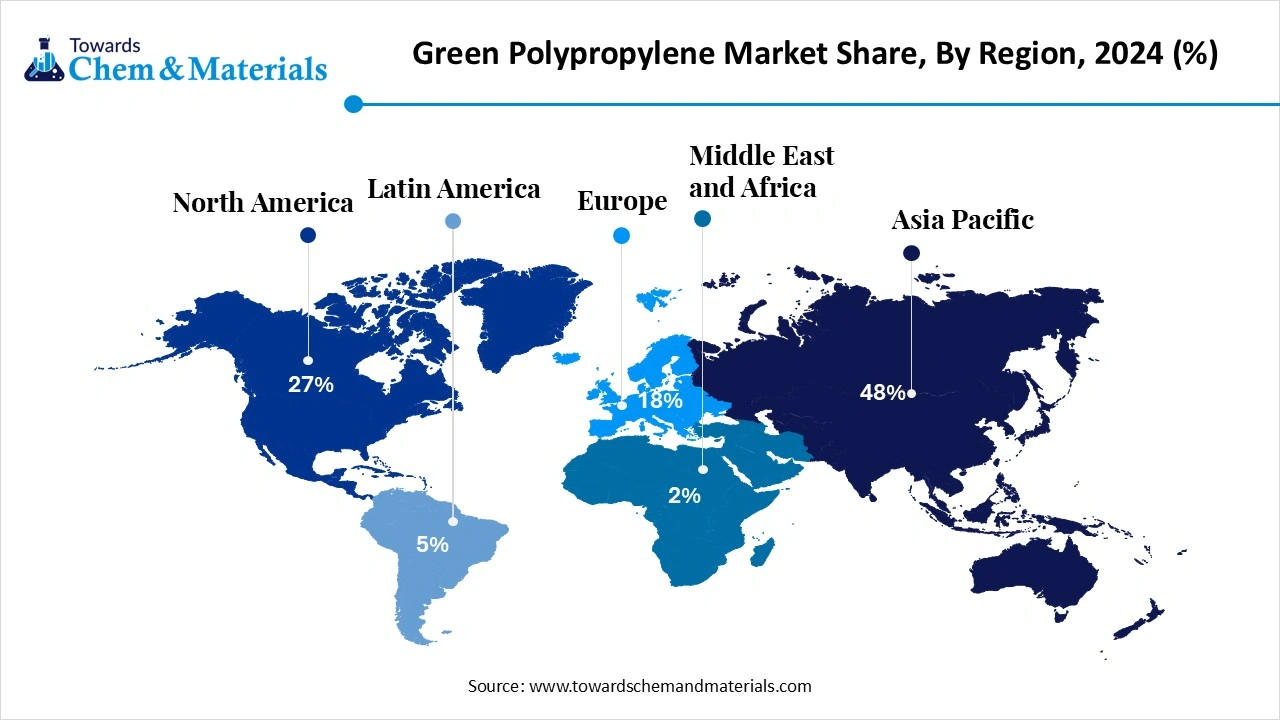

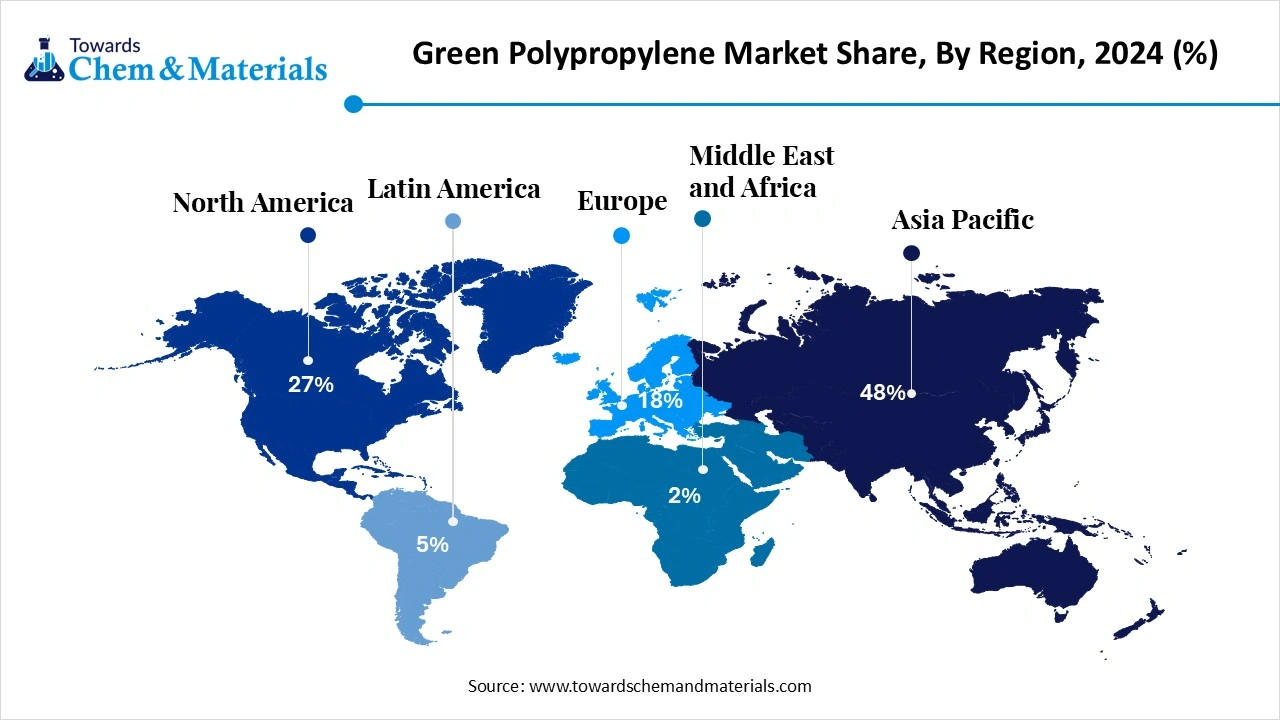

The global green polypropylene market size was valued at USD 22.85 billion in 2024 and is expected to hit around USD 72.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.27% over the forecast period from 2025 to 2034. Asia Pacific dominated the green polypropylene market with a market share of 48% in 2024. the global shift towards eco-friendly plastic manufacturing is actively shaping the industry dynamics nowadays.

Key Takeaways

- By region, Asia Pacific dominated the green polypropylene market with 48% industry share in 2024.

- By region, Europe is expected to grow with a significant CAGR in the future.

- By region, North America is also a notably growing region in the market.

- By feedstock type, the mechanical recycled PP segment dominated the market with 40% industry share in 2024.

- By feedstock type, the chemically recycled/depolymerized PP segment is expected to grow at the fastest rate in the market during the forecast period.

- By product grade type, the homopolymer green PP segment dominated the market with 55% industry share in 2024.

- By product grade type, the copolymer green segment is expected to grow at the fastest rate in the market during the forecast period.

- By application type, the packaging segment dominated the market with 50% industry share in 2024.

- By application type, the automotive segment is expected to grow at the fastest rate in the market during the forecast period.

What is Green Polypropylene?

Green polypropylene (green PP) refers to polypropylene produced with substantially lower cradle-to-gate greenhouse-gas emissions or fossil carbon intensity than conventional PP. This includes PP made from renewable feedstocks (bio-PP), mass-balance / ISCC-certified PP using renewable feedstock co-processing, chemically or mechanically recycled polypropylene (rPP), and low-carbon PP manufactured using renewable energy, carbon capture, or e-/power-to-chemistry routes.

The market covers feedstock suppliers, polymer producers, recyclers, and depolymerization technology providers, compounders, and brand owners pursuing decarbonized supply chains for packaging, automotive, consumer goods, textiles and technical applications. Key dynamics are feedstock availability (bio & recycled), certification & traceability, price parity vs virgin PP, performance parity in application, and corporate/regulatory demand for lower-carbon polymers.

Green Polypropylene Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the need for plastic that contains regular plastic performance but is made my eco-friendly material is positively impacting revenue potential and industry scalability in recent years. Furthermore, having factors like lightweight, durability, and recyclability, the green polypropylene has risen to prominence within the manufacturing sector nowadays.

- Sustainability Trends: The surge in raw materials like bio-based and closed-loop recycling has been recognized as a driver of sustainable development in recent years. Also, several manufacturers are actively seen in minimizing dependence on oil while shifting to eco-friendly raw materials in the developed region, as per the recent observation.

- Global Expansion: The global manufacturing initiatives are actively running on the global government’s strong policy support in recent years. Moreover, regions like China, India, and Japan are seen under heavy investment in biobased refineries in the current period. Also, the manufacturers of the North America region have heavily established partnerships with chemical companies and agricultural firms.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 28.80 Billion |

| Expected Size by 2034 | USD 72.70 Billion |

| Growth Rate from 2025 to 2034 | CAGR 12.27% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Feedstock / Source, By Product Grade, By Application, By Region |

| Key Companies Profiled | INEOS , TotalEnergies / TotalEnergies Corbion , Neste , Borealis-Borouge / Borouge , Berry Global , Indorama Ventures , Repsol , Agilyx / Brightmark, Veolia , Unilever / Nestlé , Genomatica / Gevo |

Key Technological Shifts in the Green Polypropylene Market:

The global manufacturers are heavily shifting towards modern technology methods like CO2 to polymer conversion and biocatalytic polymerization in the current period. Moreover, the significant investment in the bio-refinery updating is set to enable high-return ventures for manufacturers during the forecast period. Furthermore, the 3D printing and digital simulation tools have been spotlighted in industry investment reports in the past few years.

Trade Analysis of the Green Polypropylene Market: Import & Export Statistics

- India has exported a sophisticated amount of polypropylene in 2024, with is estimated cost is $153.2 million.(Source: plexconcil.org)

- China exported a huge amount of polypropylene polymers in 2024, reaching $2.77 billion as per the published report.(Source: oec.world)

Value Chain Analysis of the Green Polypropylene Market:

- Distribution to Industrial Users : The producers distribute green polypropylene to a wide range of industrial users, especially in the packaging, automotive, consumer goods, and electrical and electronics sectors.

- Chemical Synthesis and Processing : Chemical synthesis and processing of green polypropylene (PP) focuses on replacing fossil-based feedstocks with renewable or recycled materials. Key methods include using bio-based monomers from sources like biomass and chemically recycling plastic waste.

- Regulatory Compliance and Safety Monitoring : Regulatory compliance and safety monitoring for the green propylene market involve a complex set of regulations and voluntary standards that vary by region and production method.

Green Polypropylene Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA) | Toxic Substances Control Act (TSCA) | Environmental Impact of Production | The EPA regulates the environmental impact of renewable polypropylene production, covering aspects like emissions and waste management. |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC) No 1907/2006 | Microplastics | This agency manages chemical safety through the REACH framework. |

| China | Ministry of Ecology and Environment (MEE) | Opinions on Further Strengthening Plastic Pollution Control (2020) | Eliminating Single-Use Plastics | This agency oversees environmental regulations for the production of green polypropylene. |

| India | Bureau of Indian Standards (BIS) | Polypropylene (PP) Materials for Molding and Extrusion (Quality Control) Order, 2025 | Quality Standardization | This department sets quality standards for materials, including polypropylene. A Quality Control Order (QCO) for PP makes BIS certification mandatory. |

Segmental Insights

Feedstock Type Insights

How did the Mechanical Recycled PP (rPP) Segment Dominate the Green Polypropylene Market in 2024?

The mechanical recycled PP (rPP) segment dominated the market with 40% share in 2024 due to its affordability and easy procedures. Furthermore, by minimizing the efforts of complex chemical methods, the mechanically recycled PP has gained major industry attention in recent years. Also, the demand from sectors like containers, packaging, and automotive parts has increased in recent years, while many recycling plants have seen in equipped mechanical recycling facilities in recent years.

The chemically recycled/depolymerized PP segment is expected to grow at a notable rate during the forecast period, owing to its offerings, such as better qualities and purity. Also, by breaking plastic into small components and providing a fresher look to the recycled plastic, like new, the chemical procedure is likely to dominate the green polypropylene industry. Also, the emergence of chemical recycling facilities and greater investment in developed regions is likely to create lucrative opportunities for the chemically recycled and depolymerized PP manufacturers.

Product Grade Insights

Why does the Homopolymer Green PP Segment Dominate the Green polypropylene market?

The homopolymer green PP segment dominated the market with 55% share in 2024 because it offers high stiffness, clarity and easy processability--ideal for packaging, films, and fibers. It is also simpler and cheaper to manufacture compared to copolymer grades. Many existing recycling and production systems are designed around homopolymers, making their adoption faster. Industries like consumer goods and textiles rely heavily on this type for consistent quality and strength.

The copolymer green segment is expected to grow at a notable rate during the forecast period, because it offers better flexibility, toughness, and impact resistance. These properties make it ideal for automotive construction and electrical applications that need durable materials. As industries shift to sustainable yet high-performance polymers, copolymer grades meet both strength and environmental goals. New technologies in bio-based and chemically recycled PF production will make copolymer grades easier to produce. Manufacturers are also focusing on copolymers for lightweight, long-lasting, and greener product designs.

Application Insights

How Did The Packaging Segment Dominate The Green Polypropylene Market In 2024?

The packaging segment dominated the market with 50% share in 2024 because of the huge demand for sustainable packaging materials. Green PP is widely used in bottles, containers, and films for food, beverages, and personal care products. Growing awareness about single-use plastic reduction encouraged companies to switch to recyclable and bio-based PP. It also provides good moisture resistance and durability, making it perfect for packaging. As brands and consumers focus on eco-friendly packaging solutions, this segment continues to hold the largest market share.

The automotive segment is expected to grow at a notable rate during the forecast period, due to car manufacturers increasingly using lightweight and sustainable materials. Green PP helps reduce vehicle weight, improving fuel efficiency and reducing carbon emissions. Automakers are under pressure to meet strict emission norms, leading them to replace traditional plastics with green alternatives. Chemically recycled and copolymer PP offer both toughness and sustainability, ideal for car interiors, bumpers, and trims. With EVs' growth and rising green manufacturing standards, automotive applications will expand rapidly.

Regional Insights

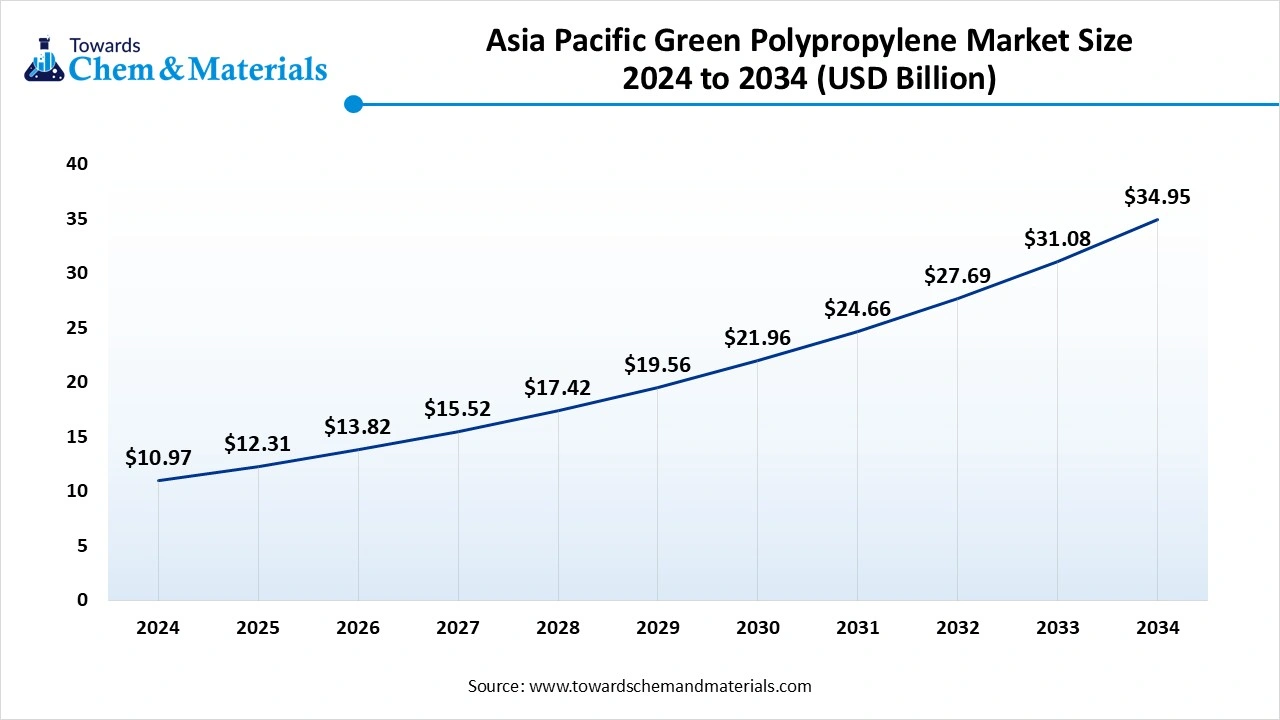

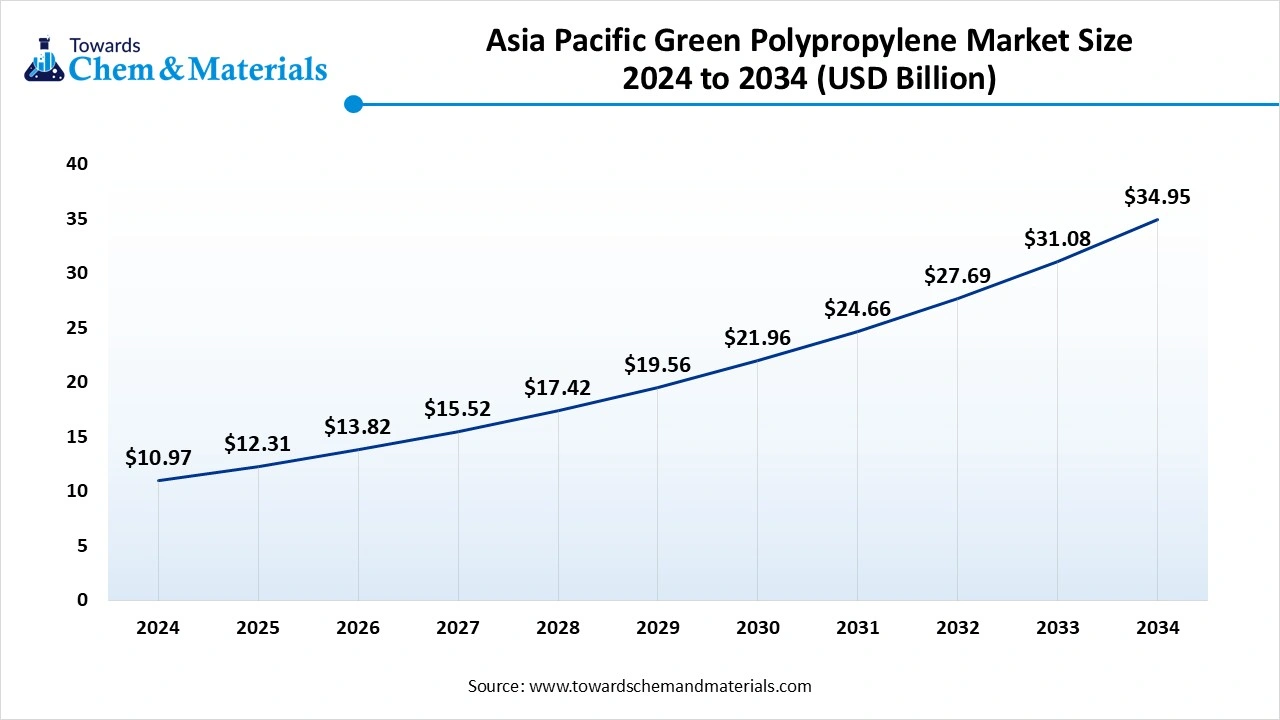

The Asia Pacific green polypropylene market size is estimated at USD 12.31 billion in 2025 and is projected to reach USD 34.95 billion by 2034, growing at a CAGR of 12.29% from 2025 to 2034. Asia Pacific dominated the market with a share of 50% in 2024. Asia Pacific dominated the market with 48% share owing to its large plastic manufacturing industries and strong recycling infrastructure, specifically in China, Japan, and India. Growing packaging, automotive, and consumer goods sectors increase the need for sustainable materials. Governments in the region also promote recycling and eco-friendly production. The availability of low-cost labor and raw materials supports the large-scale production of green PP.

How is China Reshaping the Green Polypropylene Industry?

China maintained its dominance in the green polypropylene market due to its massive plastic production capacity and strong government focus on sustainability. The country has launched strict regulations on plastic waste management and encourages the use of recycled and biobased polymers. Major Chinese companies are investing in chemical recycling technologies and large-scale green PP production plants. The nation's booming packaging, automotive, and electronics industries also drive demand.

Europe Green Polypropylene Market Analysis

Europe is expected to capture a major share of the market during the forecast period, due to its strict environmental regulations and early adoption of green manufacturing policies. The European Union's targets for recycled content and carbon neutrality push manufacturers toward sustainable materials like green PP. Major packaging and automotive companies in Europe are already switching to recycled and bio-based PP. The region also invests heavily in chemical recycling infrastructure.

Germany’s Engineering Excellence Fuels Demand for High-Quality Green Polypropylene

Germany is expected to emerge as a prominent country for the market in the coming years, owing to its advanced recycling systems and leadership in green technologies. German companies are pioneers in chemical recycling, bio-based polymers, and sustainable packaging. The nation's automotive sector, home to major brands like Volkswagen and BMW, drives demand for high-quality green PP.

North America Green Polypropylene Market Trends

North America is a notably growing region, due to increasing sustainability commitments by packaging and automotive industries. The regional countries such as United States and Canada are investing in advanced recycling technologies and bio-based material research. Consumer awareness about plastic pollution is also driving companies to adopt greener alternatives. Supportive policies and collaborations between major manufacturers and recyclers are expanding production capacities.

United States Leads the Shift to Green Polypropylene with Innovation and Investment

The United States is expected to gain a major industry share because of its innovation and large consumer market. Many American packaging and automotive companies are transitioning to green PP to meet sustainability goals. The U.S. government and private sector are funding chemical recycling startups and green material R&D Major brands like Coca-Cola and Ford are adopting recycled PP in their products.

Recent Developments

- In February 2025, Polyplastic unveiled its sustainable plastic product line. The newly launched product has been made from recycled PP resin and is called Plastron, as per the report published by the company recently.(Source: oec.world)

- In September 2024, Braskem launched its first bio-circular polypropylene line. Also, the material used in the production of this eco-friendly polypropylene includes used cooking oil as per the company claim.(Source : www.braskem.com)

Top Vendors in the Green Polypropylene Market & Their Offerings:

- Braskem: It is a Brazilian petrochemical company and a global leader in producing bio-based polyethylene from sugarcane

- LyondellBasell: It is a multinational chemical company that produces plastics and petrochemicals.

- SABIC: SABIC diversified Saudi chemical company and one of the world's largest petrochemical manufacturers.

- Borealis: It is an Austrian-based chemical company that is a leading provider of advanced and sustainable polyolefin solutions.

Other Key Players

- INEOS

- TotalEnergies / TotalEnergies Corbion

- Neste

- Borealis-Borouge / Borouge

- Berry Global

- Indorama Ventures

- Repsol

- Agilyx / Brightmark

- Veolia

- Unilever / Nestlé

- Genomatica / Gevo

Segments Covered in the Report:

By Feedstock / Source

- Mechanical Recycled PP (rPP)

- Chemically Recycled / Depolymerized PP

- Bio-based / Renewable Feedstock

- Mass-balance / ISCC-certified co-processed PP

By Product Grade

- Homopolymer Green PP

- Copolymer Green PP

- Filled, Reinforced & Specialty Green PP

By Application

- Flexible & Rigid Packaging

- Automotive

- Consumer Goods & Appliances

- Textiles & Nonwovens

- Industrial & Construction

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait