Content

Sulfur Fertilizer Market Size | Companies Analysis 2034

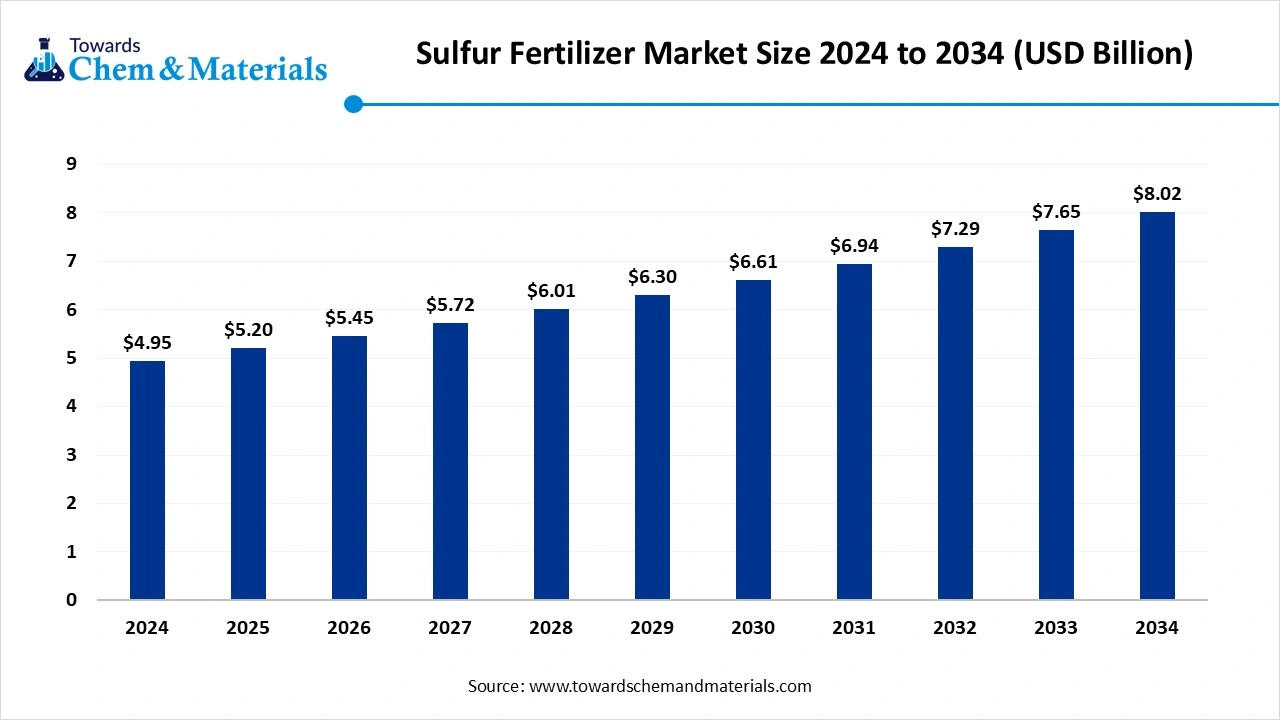

The global sulfur fertilizer market size was approximately USD 4.95 billion in 2024 and is projected to reach around USD 8.02 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 4.95% between 2025 and 2034The growing production of high-yield crops and the adoption of sustainable agriculture practices drive the market growth.

Key Takeaways

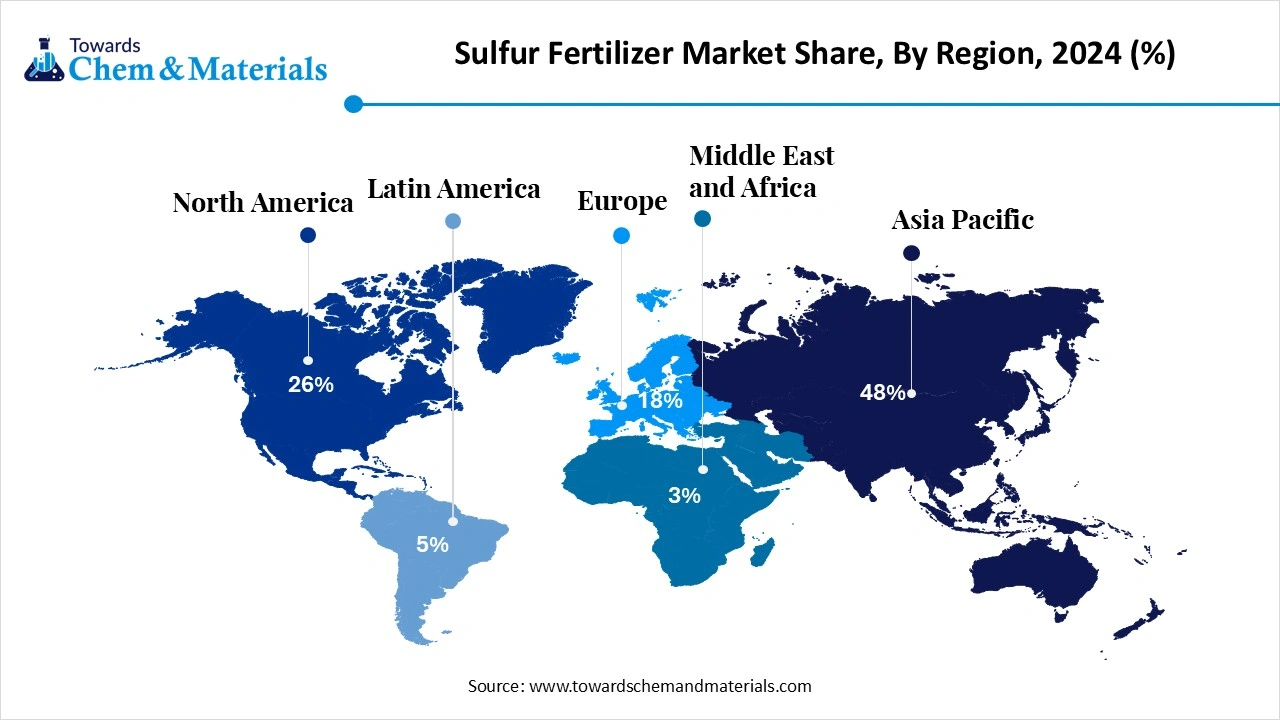

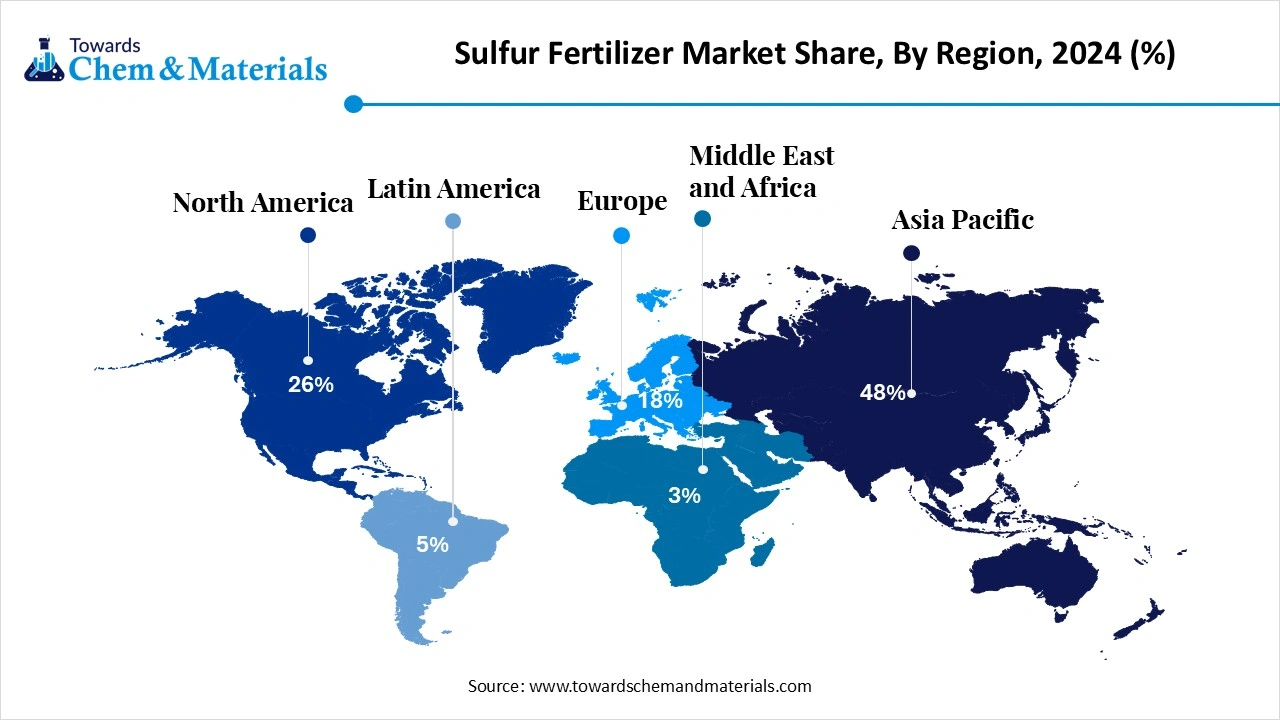

- By region, Asia Pacific held a 48% share in the market in 2024.

- By region, Latin America is growing at the fastest CAGR in the market during the forecast period.

- By product type, the ammonium sulfate segment held a 40% share in the market in 2024.

- By product type, the elemental sulfur segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By formulation, the granular segment held a 60% share in the market in 2024.

- By formulation, the liquid segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the cereals & grains segment held a 35% share in the sulfur fertilizer market in 2024.

- By application, the oilseeds segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application method, the soil application segment held a 68% share in the market in 2024.

- By application method, the foliar application segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By distribution channel, the distributors/agrodealers/co-ops segment held a 60% share in the market in 2024.

- By distribution channel, the direct sales segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Sulfur Fertilizer?

The sulfur fertilizer market growth is driven by growing soil depletion, the development of specialty crops, the adoption of sustainable agriculture, stricter nutrient regulations, and the deficiency of sulfur in soils.

Sulfur fertilizer is a process of providing sulfur to plants for the production of chlorophyll, proteins, and vitamins. Sulfur helps in the synthesis of amino acids, oil, and the activation of enzymes in plants. Sulfur fertilizer enhances nitrogen efficiency and manages the pH of the soil. They are widely used in legumes, cereals, oilseeds, brassicas, and corn.

Sulfur Fertilizer Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expected to see accelerated growth due to the growing manufacturing of high-yield crops and increasing soil deficiency. Growth is being reinforced by the adoption of precision farming and growing organic farming in the Asia Pacific, North America, and Europe.

- Sustainability Trends: Sustainability is reshaping the sulfur fertilizer industry, with growth in organic farming, development of bio-based fertilizer, and recycling waste sulfur. For instance, Montana Sulphur & Chemical Co. develops high-purity sulfur products for sustainable agriculture applications.

- Global Expansion: Leading global players and private firms are expanding globally to align with advanced farming practices, environmental regulations, and sustainability initiatives, particularly into Europe, North America, and the Asia Pacific. For instance, ICL Group Ltd collaborated with Deepak Fertilizers to manufacture advanced sulfur-containing solutions in India.

Key Technological Shifts in the Sulfur Fertilizer Market:

The sulfur fertilizer market is undergoing key technological shifts driven by the demand for enhancing application methods and lowering environmental impact. One of the most significant transformations is the integration of IoT optimizes nutrient delivery and enables precision agriculture. IoT helps with real-time soil diagnostics and site-specific nutrient management. IoT lowers the waste of fertilizers and supports precise & controlled application. IoT supports better nutrient absorption and manufactures specialized formulations.

- For instance, Fasal, an Indian-based startup company, uses IoT to monitor weather and soil conditions.

Trade Analysis of the Sulfur Fertilizer Market: Import & Export Statistics

- Saudi Arabia exported 125 shipments of sulfur fertilizer. (Source: www.volza.com)

- The United Arab Emirates exported 103 shipments of sulfur fertilizer.(Source: www.volza.com)

- China exported $2.8B of ammonium sulfate, in packs >10kg in 2023.(Source: oec.world)

- Belgium exported $173M of potassium sulfate, in packs >10kg in 2023.

(Source: oec.world) - Spain exported $300M of gypsum in 2023.(Source: oec.world)

Sulfur Fertilizer Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement involves the sourcing of sulfuric acid, elemental sulfur, and sulfur dioxide.

- Key Players: Yara International, CF Industries Holdings Inc., Nutrien, The Mosaic Company

- Chemical Synthesis and Processing : The chemical synthesis and processing involve steps like melting, mixing, the reverse microemulsion technique, inverse vulcanization, physical mixing, extrusion, and pelletizing.

- Key Players: Haifa Chemicals, Nufarm, The Mosaic Company, Nutrien, Yara International

- Quality Testing and Certifications : The quality testing involves testing of properties like mass fraction of impurities, pH, particle size distribution, sulfur speciation, granule strength, & mass fraction of nutrients and certifications like ISO 9001, GLP, ASTM Compliance, & ISO 45001.

What are the Types of Sulfur Fertilizer?

| Types | Description | Examples |

| Sulfate Fertilizers | These fertilizers offer essential nutrients to plants and dissolve easily in water. |

|

| Elemental Sulfur Fertilizers | It is a yellow crystalline solid and a concentrated form of sulfur. |

|

| Liquid Sulfur Fertilizers | The liquid form of sulfate compounds or elemental sulfur. |

|

| Combination Fertilizer | The blend of elemental sulfur and sulfate. |

|

Segmental Insights

Product Type Insights

Why Ammonium Sulfate Segment Dominates the Sulfur Fertilizer Market?

The ammonium sulfate segment dominated the market with a 40% share in 2024. The increasing need for sulfur & nitrogen for plant growth increases the adoption of ammonium sulfate. The large-scale farming application and focus on easy storage increase demand for ammonium sulfate. The cost-effectiveness and ease of application of ammonium sulfate drive the overall growth of the market.

The elemental sulfur segment is the fastest-growing in the market during the forecast period. The stricter regulations on sulfur emissions and intensive agricultural practices increase the adoption of elemental sulfur. The rise in the manufacturing of pulses & oilseeds requires elemental sulfur. The strong focus on improving the quality of crops and increasing awareness about sulfur benefits increases the adoption of elemental sulfur, supporting the overall market growth.

Formulation Insights

How Granular Segment Held the Largest Share in the Sulfur Fertilizer Market?

The granular segment held the largest revenue share of 60% in market in 2024. The ease of handling and slow-release mechanism increase the adoption of the granular form. The focus on reducing frequent reapplication and growing loss of nutrients increases demand for the granular form. The easy blending with other NPK and rise in production of staple crops like rice, wheat, & maize requires a granular form, driving the overall market growth.

The liquid segment is experiencing the fastest growth in the market during the forecast period. The strong focus on faster absorption of fertilizer and compatibility with modern irrigation systems increases demand for the liquid form. The availability of methods like soil drench & foliar spray, and the adoption of precision agriculture, increases demand for the liquid form. The easy integration of liquid form with specialty blends supports the overall growth of the market.

Application Insights

Which Application Segment Dominated the Sulfur Fertilizer Market?

The cereals & grains segment dominated the market with a 35% share in 2024. The growing production of cereals like rice, wheat, and corn increases the adoption of sulfur fertilizers. The strong focus on the nutritional enhancement of grains and the need for increasing grain yields require sulfur fertilizers. The dietary shifts and high consumption of cereals & grains drive the overall market growth.

The oilseeds segment is the fastest-growing in the market during the forecast period. The strong focus on the consumption of protein-rich diets increases demand for oilseeds. The growing consumption of sunflower, soybean, and canola increases demand for sulfur fertilizers. The growing demand for vegetable oils and the focus on boosting oil content in oilseeds increase the demand for sulfur fertilizers, supporting the overall market growth.

Application Method Insights

Why the Soil Application Segment Held the Largest Share in the Sulfur Fertilizer Market?

The soil application segment held the largest revenue share of 68% in the market in 2024. The focus on minimizing sulfur deficiencies and the need for even distribution of sulfur across farming increases the demand for soil application. The compatibility of soil application with different fertilizer types like liquid, granules, prills, and powders helps market growth. The growing manufacturing of oilseed & staple crops, and focus on long-term nutrient availability, increases demand for soil application, driving the overall market growth.

The foliar application segment is experiencing the fastest growth in the market during the forecast period. The strong focus on rapid absorption of nutrients and coping with environmental stresses increases the adoption of foliar application. The need for improving the quality of crops and the rise in precision agriculture increase demand for foliar application. The growing cultivation of crops like specialty crops, fruits, and vegetables requires foliar application, supporting the overall market growth.

Distribution Channel Insights

Which Distribution Channel Segment Dominated the Sulfur Fertilizer Market?

The distributors/agrodealers/co-ops segment dominated the market with a 60% share in 2024. The presence of decentralized storage networks and highly seasonal demand for fertilizers requires distributors. The presence of large volumes of fertilizers and well-established infrastructure for handling supply chain issues requires co-ops. The growing demand for small quantities of fertilizers and extension of credit in co-ops & dealers drives the market growth.

The direct sales segment is the fastest-growing in the market during the forecast period. The growing demand for a large volume of fertilizers and focus on long-term supply reliability increase the adoption of direct sales. The greater transparency and control on pricing in direct sales help the market growth. The growing demand for customized products and the availability of technical support in direct sales fuel the overall growth of the market.

Regional Insights

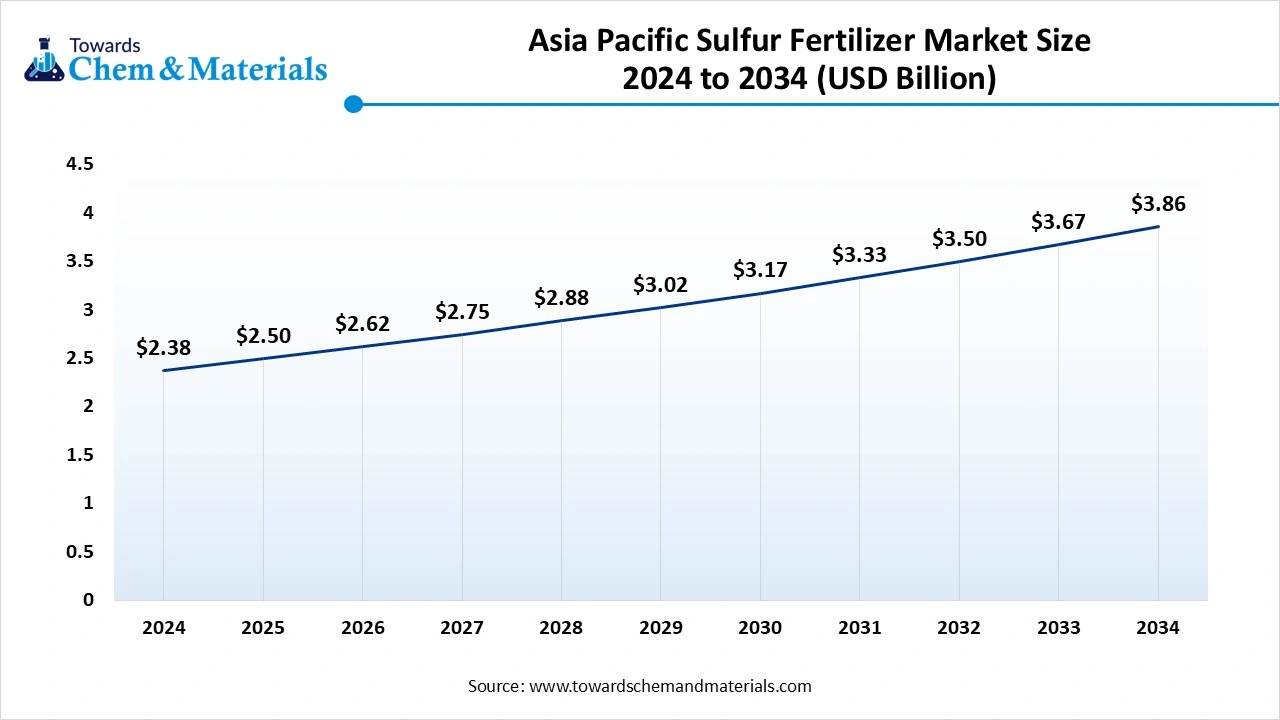

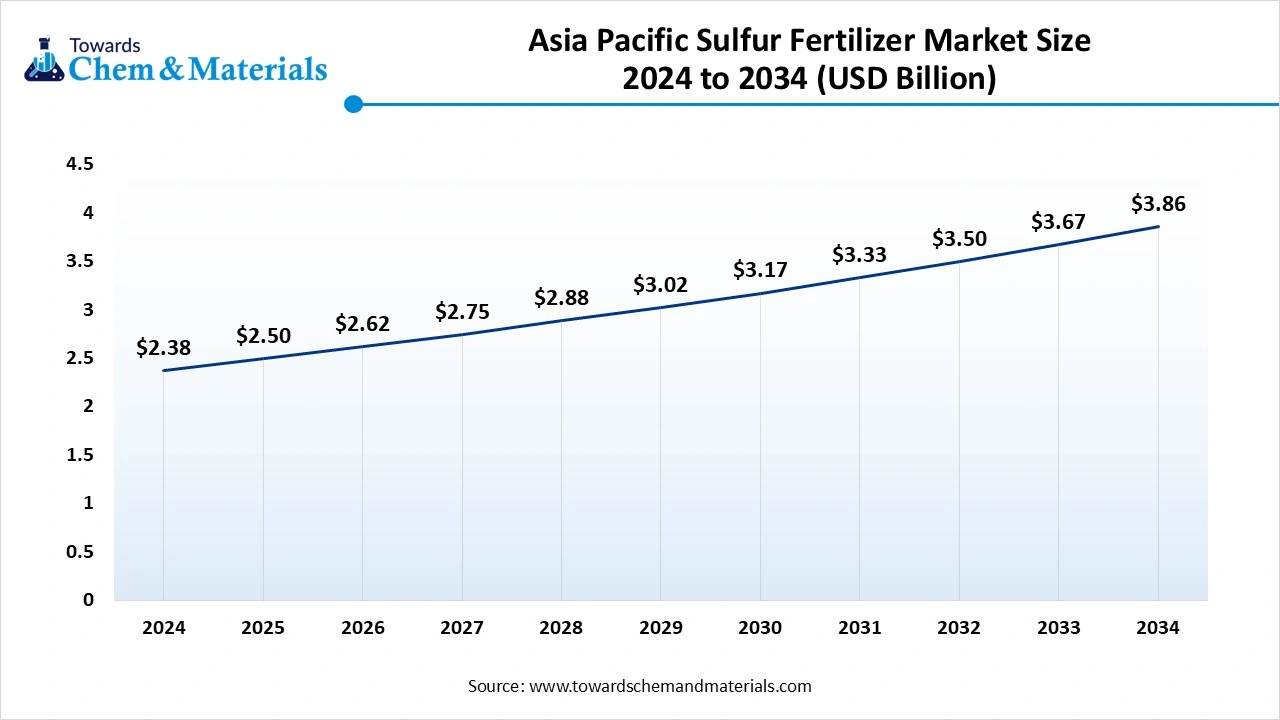

The Asia Pacific sulfur fertilizer market size was estimated at USD 2.50 billion in 2025 and is projected to reach USD 3.86 billion by 2034, growing at a CAGR of 4.97% from 2025 to 2034. Asia Pacific dominated the sulfur fertilizer market with a 48% share in 2024.

The strong presence of a vast agricultural base and high production of staple crops like maize, rice, & wheat increases demand for sulfur fertilizer. The government initiatives for boosting crop production and improving the health of the soil increase the adoption of sulfur fertilizers. The increasing awareness about sulfur benefits in agriculture and intensive agricultural practices increases demand for sulfur fertilizer, driving the overall growth of the market.

India Sulfur Fertilizer Market Trends

India is a key contributor to the market. The large agricultural infrastructure and growing sulfur depletion issues in soil increase demand for sulfur fertilizer. The strong government support for fertilizer use and increased cultivation of pulses & oilseeds increases the adoption of sulfur fertilizers. The intensive agricultural practices and presence of key manufacturers like Deepak Fertilizers & Coromandel International drive the overall market growth.

- India exported $5.71M of gypsum in 2023.(Source: www.volza.com )

- India exported 1123 shipments of ammonium sulphate.(Source: www.volza.com)

Latin America Sulfur Fertilizer Market Trends

Latin America is experiencing the fastest growth in the market during the forecast period. The growing depletion of sulfur in soils and the expansion of crop cultivation increase demand for sulfur fertilizers. The growing production of soybeans, oilseeds, and corn increases demand for sulfur fertilizers. The strong emphasis on food security and increasing awareness about sulfur in agricultural productivity requires sulfur fertilizers. The growing demand for high-quality crops like pulses & oilseeds and the adoption of modern farming require sulfur fertilizers, supporting the overall market growth.

Brazil Sulfur Fertilizer Market Trends

Brazil is growing in the sulfur fertilizer market. The major production of sugarcane and soy increases demand for sulfur fertilizer. The growing deficiencies in soil and focus on improving crop quality require sulfur fertilizer. The increasing adoption of precision farming and strong government support for sustainable agriculture increase demand for sulfur fertilizers, driving the overall growth of the market.

Europe Sulfur Fertilizer Market Trends

Europe is growing at a notable rate in the market in 2024. The higher production of crop yields and increasing soil deficiency issues increase the adoption of sulfur fertilizers. The growing production of cereals & oilseeds requires sulfur fertilizers. The adoption of modern farming techniques and strong government support for sustainable agriculture practices increases demand for sulfur fertilizers, supporting the overall market growth.

Germany Sulfur Fertilizer Market Trends

Germany is experiencing growth in the market. The presence of a large farming base and growing cultivation of crops like potatoes, wheat, and rapeseed increases demand for sulfur fertilizers. The stricter environmental regulations and presence of controlled-release & liquid sulfur fertilizers drive the overall growth of the market.

- Germany exported $244M of potassium sulphate, in packs >10kg in 2023.(Source: oec.world)

Recent Developments

- In July 2025, ICL launched sulfur-based fertilizer, Sulfurball, with a unique granule format. The fertilizer is available in spherical format and is manufactured using additives & elemental sulfur. Fertilizer enhances the uptake of sulfur in soil and reduces operational costs.(Source: news.agropages.com )

- In January 2024, the Cabinet approved the launch of sulfur-coated fertilizer under the brand name Urea Gold. The fertilizer is available in 40Kg bags, and the price is Rs 266.50. The fertilizer improves crop yields, enhances soil health, and optimizes the release of nutrients.(Source: www.aninews.in)

- In February 2025, Grupa Azoty started production of multi-component fertilizer, POLIFOSKA, with 23% sulfur content in sulfate form. The fertilizer enhances crop yield quality and promotes plant growth. The fertilizer is highly efficient and readily soluble.(Source: www.indianchemicalnews.com)

Top Companies List

- Nutrien: The Canada-based company produces fertilizer and offers diverse products like crop protection, digital tools for growers, seeds, and merchandise.

- Yara International: Norwegian Company produces sulfur products, including YaraVita, Yara Krista SOP, YaraRega, and Yaravera Amidas.

- ICL Group (Israel Chemicals): The key producer of compound & specialty fertilizers to enhance crop yields and nutrition.

- The Mosaic Company: The leading producer of crop nutrients, and its product portfolio includes industrial products, concentrated potash & phosphate fertilizers, & animal feed ingredients.

- SQM (Sociedad Química y Minera): The Chilean-based company and its sulfur fertilizer product portfolio includes potassium sulfate, magnesium sulfate, and blended products.

Other Companies List

- Rallis India

- Koch Fertilizer

- OCI N.V.

- EuroChem Group

- Coromandel International

- Sinochem Group / Sinofert

- Haifa Group

- Sulphur Mills Ltd.

- Shell

- ExxonMobil

Segments Covered

By Product Type

- Ammonium Sulfate (AS)

- Elemental Sulfur (granular/powdered/micronized)

- Gypsum (calcium sulfate)

- Potassium Sulfate (K₂SO₄)

- Complex NPK-S / Compound Sulfate Blends

- Liquid Sulfur Fertilizers (sulfate solutions, polysulfides)

By Formulation

- Granular

- Powder

- Liquid

- Coated

By Application / Crop Type

- Cereals & Grains (wheat, maize, rice)

- Oilseeds (canola/rapeseed, soybean, sunflower)

- Fruits & Vegetables

- Pasture & Forage

- Industrial / Specialty Crops (cotton, sugarcane)

By Application Method

- Soil Application (broadcast, banding)

- Foliar Application

- Fertigation / Irrigation-applied

By Distribution Channel

- Distributors / Agrodealers / Co-ops

- Direct Sales (contract/bulk to farms & agribusiness)

- Retail / E-commerce (bagged retail packs)

- Fertilizer Blenders & Custom Compounders

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait