Content

What is the Current Advanced Carbon Materials Market Size and Share?

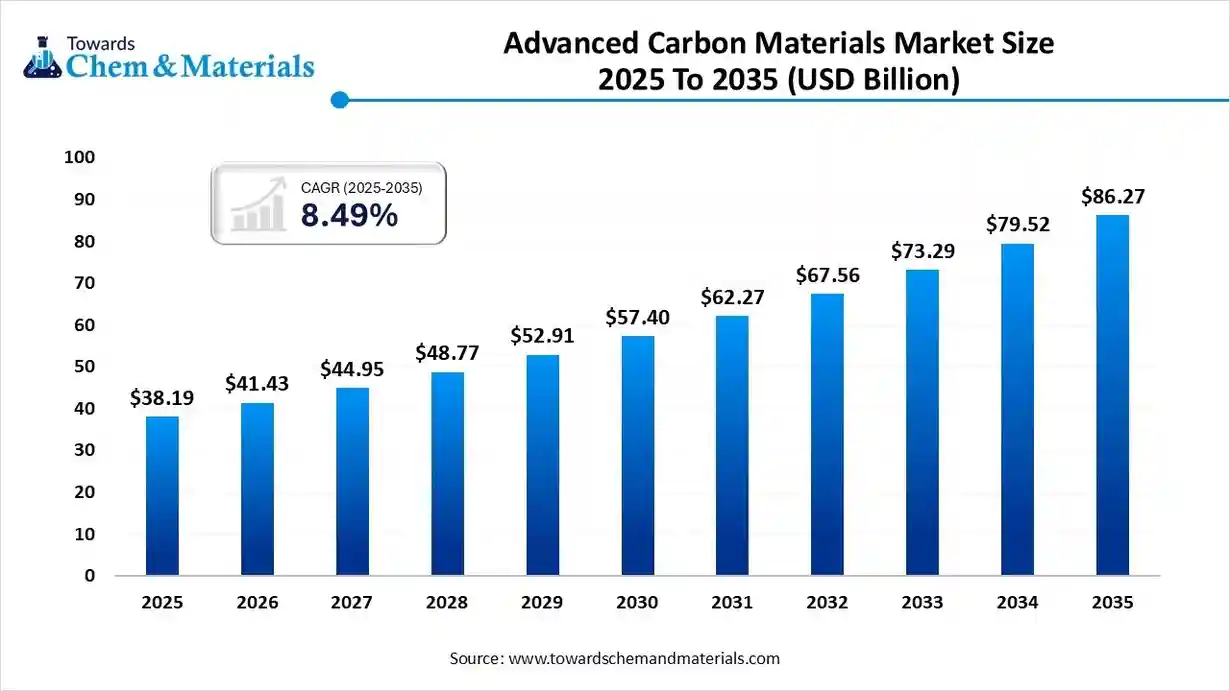

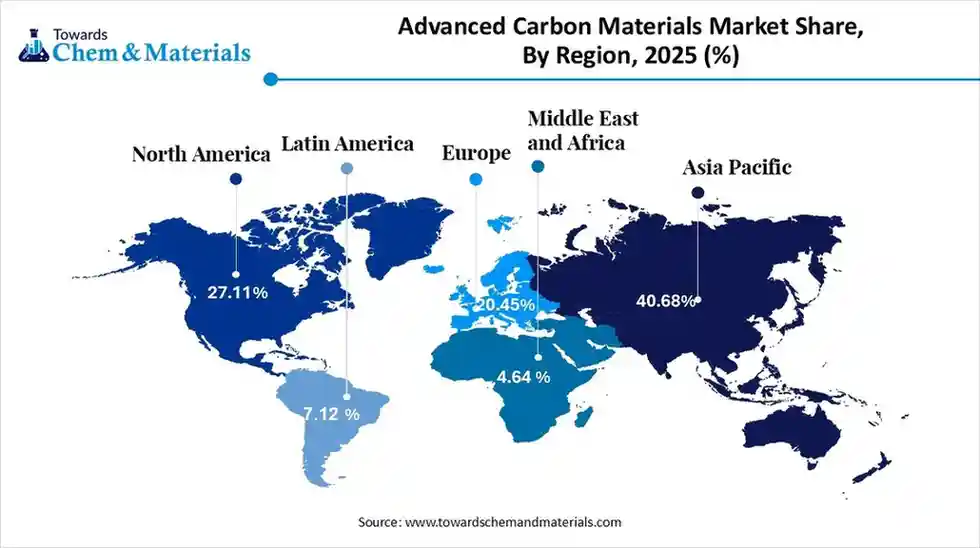

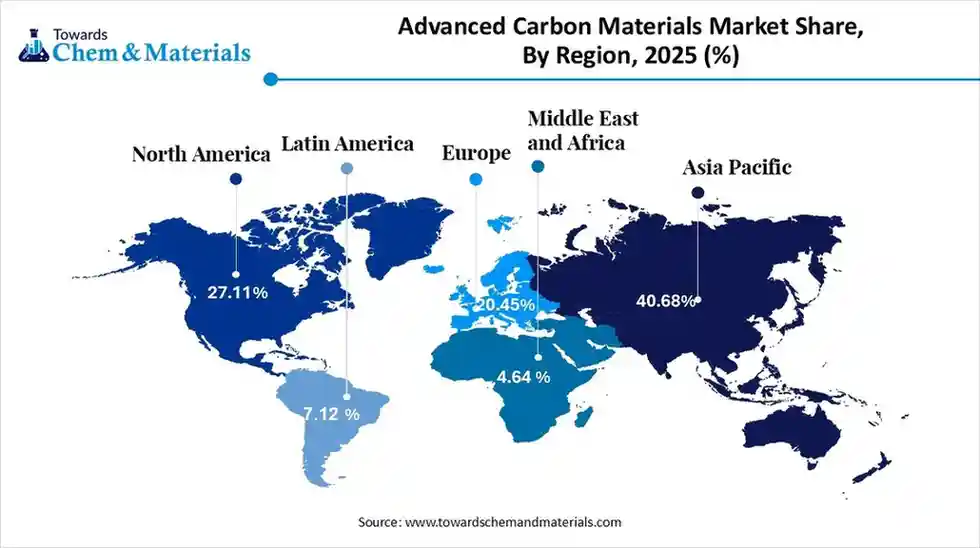

The global advanced carbon materials market size is calculated at USD 38.19 billion in 2025 and is predicted to increase from USD 41.43 billion in 2026 and is projected to reach around USD 86.27 billion by 2035, The market is expanding at a CAGR of 8.49% between 2026 and 2035. Asia Pacific dominated the advanced carbon materials market with a market share of 40.68% the global market in 2025. Increasing demand for high-strength and lightweight materials in various sectors is the key factor driving market growth. Also, advancements in production technologies coupled with the development of advanced carbon materials can fuel market growth further.

Key Takeaways

- By region, Asia Pacific led the advanced carbon materials market with the largest revenue share of over 40.68% in 2025.

- By product, the carbon fibers segment led the market with the largest revenue share of 89.50% in 2025.

- By application, the aerospace & defense industry segment accounted for the largest revenue share of 34.75% in 2025.

What are Advanced Carbon Materials?

The market is the global industry for carbon-based substances designed to have superior thermal, mechanical, and electrical properties compared to traditional materials such as graphite. The market also includes products like graphene, carbon fibers, and carbon foams, which are used in a wide range of applications such as electronics, automotive, and energy storage.

Advanced Carbon Materials Market Trends

The growing demand for lightweight materials is the major trend, driving positive market growth. Stringent emissions and fuel efficiency regulations in the automotive and aerospace sectors are boosting the adoption of materials such as carbon-fiber-reinforced plastic (CFRP).

Advanced carbon materials are being rapidly used in energy storage systems, including supercapacitors, lithium-ion batteries, and fuel cells, due to their superior chemical inertness and conductivity. They are also important in wind energy, used for lightweight wind turbine blades.

There is a growing emphasis on developing sustainable manufacturing processes by producing advanced carbon materials from bio-waste initiatives are also exploring cost-efficient recycling methods for carbon composites, which aligns with circular economy principles.

The aerospace and defense sectors focus on performance over costs, ensuring the adoption of graphene, carbon fibers, and CNTs will be strengthened, especially due to the modernization of global fleets. This demand highlights the steady growth and also propels R&D into higher-performance carbon materials optimised for harsh conditions.

Space exploration programs offer another great opportunity for market expansion. Satellites, space stations, and launch vehicles all demand materials capable of withstanding temperature and radiation extremes. Also, graphene and CNTs are being tested for next-generation sensors and radiation shielding.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 41.43 Billion |

| Revenue Forecast in 2035 | USD 86.27 Billion |

| Growth Rate | CAGR 8.49% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Product, By Application, By Region |

| Key companies profiled | Jiangsu CNano Technology Co, Anaori Carbon Co., Ltd, Grupo Antolin Ingenieria S.A, Graphenano, Graphenea, CVD Equipment Corporation, Haydale Graphene Industries PLC, Showa Denko K.K, Mitsubishi Rayon |

How Cutting Edge Technologies are revolutionizing the Advanced Carbon Materials Market?

- The advanced technologies are transforming the market by enabling the development of novel materials such as carbon nanotubes and graphene by boosting the manufacturing process through Artificial Intelligence and automation. Furthermore, additive manufacturing (AM) techniques are revolutionizing the manufacturing of complex carbon components.

Trade Analysis of Advanced Carbon Materials Market: Import & Export Statistics:

- Between June 2024 and May 2025 (TTM), the United States imported a total of 2,063 shipments of carbon fiber, representing a notable 57% increase in import volume compared to the previous twelve-month period.

- These shipments originated from 319 foreign exporters and were delivered to 941 different buyers within the U.S.

Exports

- In 2024, China exported $529M of Activated Carbon, being the 564th most exported product (out of 1,211) in China.

- In 2024, the main destinations of China's Activated Carbon exports were: South Korea ($62.7M), Japan ($60.4M), India ($34.3M), Belgium ($33.6M), and Italy ($30.9M).

Imports - In 2024, China imported $201M of Activated Carbon, being the 510th most imported product in China.

- In 2024, the main origins of China's Activated Carbon imports were: the United States ($57.1M), Japan ($32.2M), Sri Lanka ($29.1M), the Philippines ($14.6M), and India ($12.3M).

Advanced Carbon Materials Market Value Chain Analysis

- Feedstock Procurement: It is the process of sourcing and securing the raw materials, like petroleum derivatives or sustainable biomass, which are the initial inputs for producing carbon materials.

- Major Players: Toray Industries, Inc., Hexcel Corporation.

- Chemical Synthesis and Processing : It refers to the various techniques used to create and purify diverse carbon-based materials, ranging from conventional activated carbon to cutting-edge carbon nanomaterials such as carbon nanotubes and graphene.

- Major Players: Birla Carbon, Cabot Corporation

- Packaging and Labelling :It includes the specific trends, requirements, and market players involved in the information display and physical containment of carbon-based products.

- Major Players: Graphenea, Inc.

- Regulatory Compliance and Safety Monitoring :It refers to the mandatory adherence to national laws, international standards, and third-party certifications regarding the manufacturing, use, and environmental impact of carbon-based products.

- Major Players: Aker Carbon Capture, Shell Canada

Advanced Carbon Materials Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| European Union (EU) | EU ETS (Emissions Trading System): The world's largest mandatory carbon cap-and-trade scheme, which drives the adoption of lightweight carbon materials to reduce emissions in industries like automotive and aerospace. |

| United States (US) | TSCA (Toxic Substances Control Act): Governed by the Environmental Protection Agency (EPA), TSCA regulates the production, import, and use of commercial chemical substances. |

| China | China has a national emissions trading scheme (ETS), indicating a growing focus on environmental regulations and sustainable development. |

Segmental Insights

Product Insights

How Much Share Did the Carbon Fibers Segment Held in 2025?

The carbon fibers segment dominated the market with the largest share of 89.50% in 2025. The dominance of the segment can be attributed to the growing demand for fiber composites in the future and extensive applications of this material in the manufacturing of various composite applications across construction, automotive, and electronics sectors.

The carbon foams segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to its properties, such as enhanced chemical stability and electrical conductivity. Carbon foams are being used in different industries, such as electronics and construction, to take advantage of their superior properties.

The structural graphite segment held a significant market share in 2025. The growth of the segment can be driven by the growth of production technologies that enhance efficiency and lower overall costs. Structural graphite is a crucial material in fuel cells, lithium-ion batteries, and supercapacitors.

The growth of the graphene segment can be fuelled by rapid innovations in electronics for higher performance, coupled with the push towards more effective energy storage solutions. Graphene's unique properties are boosting its integration into various products, leading to further market expansion.

Application Insights

Which Application Type Segment Dominated the Advanced Carbon Materials Market in 2025?

The aerospace & defense industry segment held the largest market share of 34.75% in 2025. The dominance of the segment can be credited to the ongoing shift away from conventional metals such as aluminium to avoid corrosion issues and a rise in geopolitical tensions, propelling defense spending.

The automotive industry segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be driven by the rapid integration of materials such as carbon nanotubes and graphene into next-generation batteries for electric vehicles. Automakers are using high-strength, lightweight materials for different parts of the vehicles.

The electronics segment held a major market share in 2025. Materials such as carbon nanotubes (CNTs) and graphene have excellent thermal conductivity, electrical conductivity, and mechanical strength, which makes them ideal for high-performance electronics.

The growth of the construction segment can be boosted by rapid innovations in manufacturing techniques and the growing demand for materials with chemical inertness and high-temperature tolerance. This is particularly beneficial for large structures, building repairs, and bridges, which will impact positive market growth soon.

Regional Insights

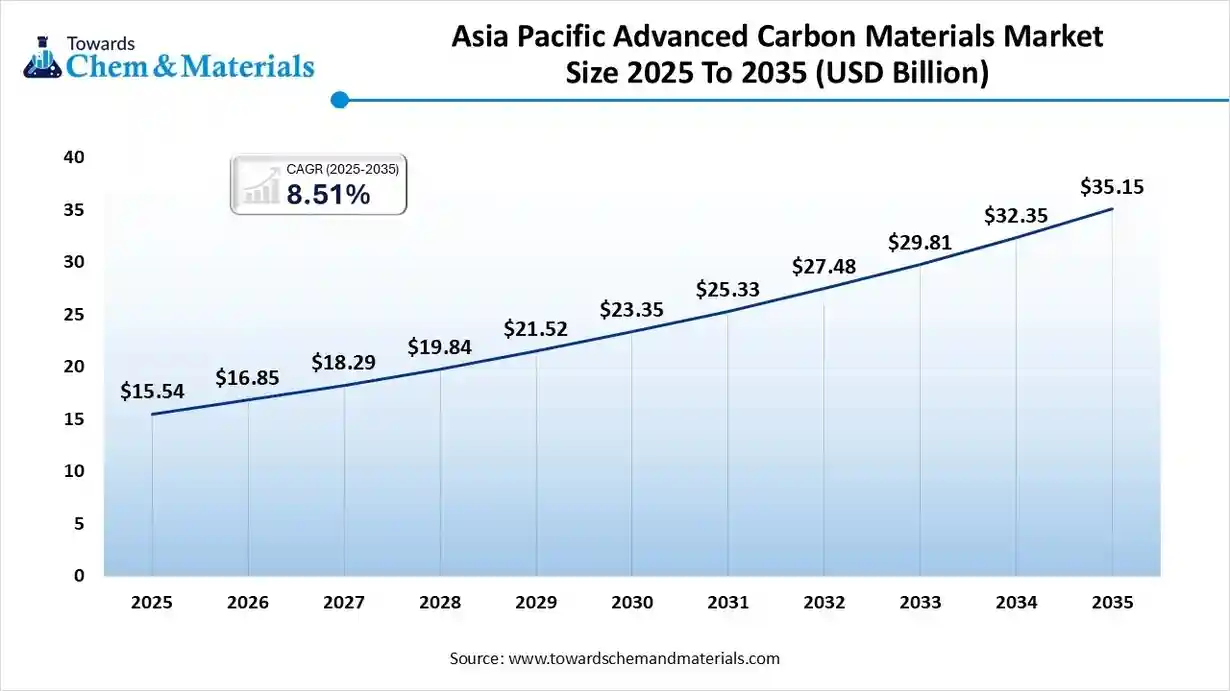

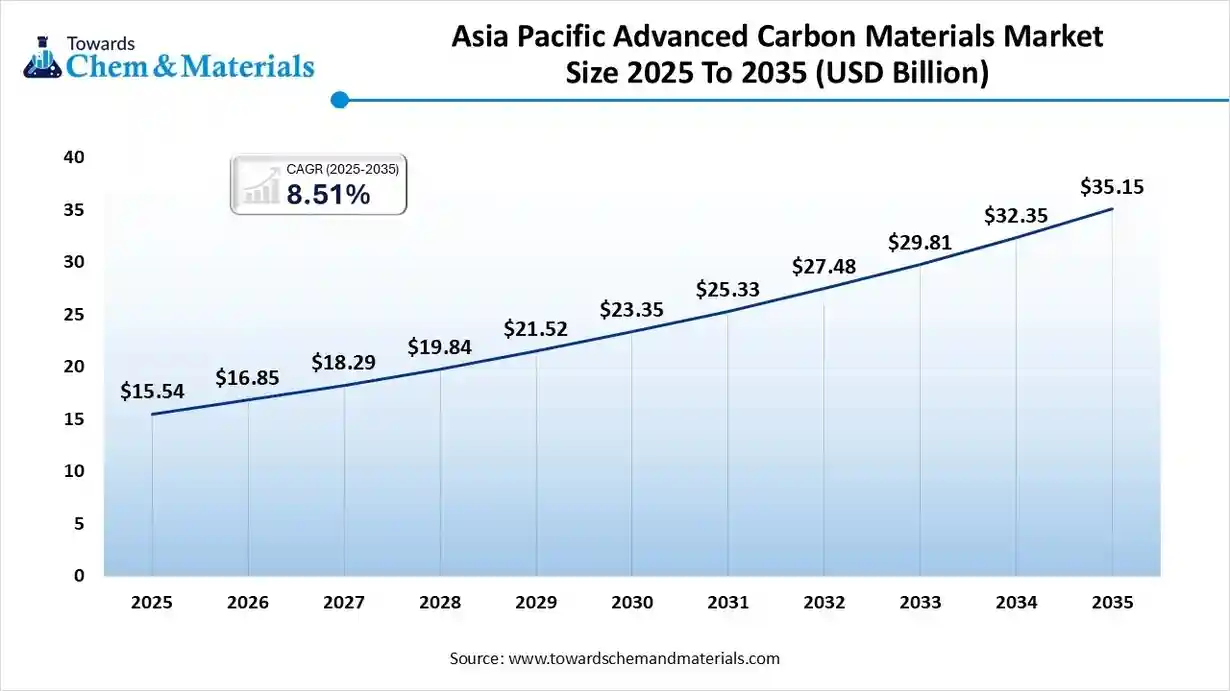

The Asia Pacific advanced carbon materials market size was valued at USD 15.54 billion in 2025 and is expected to reach USD 35.15 billion by 2035, growing at a CAGR of 8.51% from 2026 to 2035. Asia Pacific dominated the market with the largest share of 40.68% in 2025.

The dominance of the region can be attributed to the growing product demand from key sectors such as electronics, automotive, and aerospace, along with the ongoing government support for technology. Moreover, favourable government policies are propelling market expansion in countries such as China, India, and Japan.

China Advanced Carbon Materials Market Trends

In the Asia Pacific, China dominated the market owing to the high demand for lightweight composites in the aerospace and automotive sectors. Also, China's flourishing electronics sector necessitates advanced carbon materials for their unique thermal and electrical properties in components such as semiconductors and batteries.

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rapid innovations in nanomaterials such as carbon nanotubes and graphene, coupled with the growth in renewable energy and construction projects. The aerospace and defense sectors are the largest consumers of advanced carbon materials.

U.S. Advanced Carbon Materials Market Trends

In North America, the U.S. led the market due to the growing need for purification and filtration technologies in environmental applications and ongoing government initiatives such as the CHIPS Act for semiconductors. The growth of wastewater treatment infrastructure with a greater emphasis on safe industrial discharge practices is also fuelling the market.

Europe expects the notable growth in the market over the forecast period. The growth of the region can be driven by government policies supporting renewable and sustainability solutions that optimise the use of advanced carbon materials. Stringent environmental regulations and an emphasis on minimizing carbon footprints are pushing industries to adopt more efficient and sustainable materials.

Germany Advanced Carbon Materials Market Trends

The growth of the market in Germany can be fuelled by the rapid development of more effective manufacturing techniques and automation, which is helping to make these materials more cost-effective and scalable. German automakers, such as Volkswagen, are heavily investing in composite development, driving market growth further.

Latin America held a significant market share in 2024. The growth of the region can be boosted by rapid urbanization, industrialization, and growing demand for lightweight materials in the aerospace and automotive sectors. Supportive government policies in the region are raising funding for advanced materials research, which plays a crucial role in regional expansion.

Brazil Advanced Carbon Materials Market Trends

The growth of the market in Brazil can be propelled by technological innovations, a surge in research and development, and government initiatives promoting advancements. Also, the expanding construction industry uses advanced carbon materials to improve the durability and structural integrity of buildings and infrastructure.

The Middle East and Africa advanced carbon materials market is expanding steadily, driven by industrial diversification, renewable-energy investments, and rising demand in aerospace, automotive, and construction. Countries such as the UAE, Saudi Arabia, and South Africa lead adoption, supported by infrastructure projects and clean-energy initiatives. Despite strong potential, the market faces challenges including high material costs, dependence on imports, and limited local manufacturing capacity. Growing interest in carbon composites, carbon fiber, and nanocarbon materials will continue to shape the region’s market trajectory.

UAE Advanced Carbon Materials Market Trends

The UAE’s advanced carbon materials market is accelerating as the country positions itself as a regional center for high-performance materials, innovation, and manufacturing. Demand is fueled by flagship sectors such as aerospace anchored by companies in Abu Dhabi’s aerospace ecosystem where carbon-fiber composites are essential for light-weighting and improved fuel efficiency.

Recent Developments

- In April 2025, Arkema, AkzoNobel, and Omya partnered to develop a wide range of low-carbon options for more eco-friendly decorative paints with a 30% less carbon footprint for mass market adoption. This project aims to achieve and expand up to 50% carbon reduction of decorative paints.(Source: www.arkema.com)

- In May 2025, Hexcel, Specialty Materials introduced boron fiber-infused high modulus carbon fiber. This material gives significant design flexibility and weight savings, opening a range of applications for commercial aviation and space and defense applications.(Source: www.compositesworld.com)

Top Advanced Carbon Materials Market Companies

Hexcel Corporation

Corporate Information

- Hexcel is an American public company, headquartered in Stamford, Connecticut, USA.

- Industry: advanced composites/materials especially carbon fiber, composite reinforcements, honeycomb, prepregs, resins and engineered composite structures.

- The company serves global markets: commercial aerospace, defense & space, and industrial (wind energy, automotive, other composite intensive applications).

History and Background

- Hexcel traces its roots to 1948 (originally founded as “California Reinforced Plastics”).

- The name “Hexcel” comes from the “hexagonal cell” honeycomb material the company developed and manufactured.

Key Developments and Strategic Initiatives

- 1996: Hexcel significantly expanded by acquiring the composites business of Ciba-Geigy and acquiring the composites operation of Hercules Inc.. This bolstered its carbon fiber capabilities and aerospace qualifications, transforming Hexcel into a world leader in composites. HQ moved to Stamford, Connecticut.

- 1997: Acquisition of a product line from Fiberite (satellite prepreg product line), giving Hexcel proprietary prepreg technology.

Mergers & Acquisitions

- 1996: Acquisition of Ciba Geigy’s composites business + Hercules composites division.

- 1997: Acquisition of Fiberite's satellite prepreg product line and associated proprietary prepreg technology.

Partnerships & Collaborations

- Long standing alliance (since 1998) with Sika AG to develop composite systems for construction targeting strengthening/repair of existing structures with advanced composites.

- Collaboration with Arkema (joint R&D and development of thermoplastic composite solutions for aerospace) an important step toward lighter, more efficient, and manufacturable composite parts.

Product Launches / Innovations

- Carbon fiber reinforcements (various grades, moduli, for different strength/stiffness needs) including high performance aerospace-grade fibers.

- Prepregs (pre-impregnated fiber/resin materials) standard, high-performance, and specialized (e.g. rapid-curing prepreg for high-rate manufacturing). For example, in 2023 Hexcel launched HexPly M51, a rapid-curing prepreg developed for high-rate structural composite part production.

Key Technology Focus Areas

- Materials & solutions for automated and high-rate composite manufacturing anticipating growth in next gen aircraft, Advanced Air Mobility (AAM), eVTOL, etc. In a 2024 strategy update, Hexcel emphasized support for high-rate aerospace composites manufacturing.

- Sustainability- and recycling-focused materials: Via partnership with Carbon Conversions, work on reclaimed carbon fibers for new composite parts addressing increasing interest in lifecycle, waste reduction, and circularity.

R&D Organisation & Investment

- In 2023, Hexcel opened a “Center of Research & Technology Excellence” at its Salt Lake City campus reflecting a commitment to innovation and long-term development.

- Through partnerships (e.g. with Arkema) and internal development, Hexcel explores advanced composites thermoplastic composites, resins, automated manufacturing processes, out-of-autoclave (OOA) prepregs, rapid-curing materials.

SWOT Analysis

Strengths

- Strong legacy & experience: Hexcel has decades-long history in composite materials, giving it deep know-how and track record.

- Vertically integrated capabilities: From fiber to composite structures giving control over quality, supply chain, traceability, and cost.

- Diverse product portfolio: Carbon fiber, prepregs, honeycomb, core materials, specialized composites serving aerospace, defense, industrial, energy, even automotive & recreation.

Weaknesses / Challenges

- Cyclicality and dependence on aerospace/defense markets: Demand fluctuations in aviation, defense spending, global economic cycles can impact business.

- High capital intensity and long lead times: Composite manufacturing (especially aerospace-grade) needs heavy investment and long project cycles raises exposure to demand downturns.

- Competition and technological pressure: As composites and materials technologies evolve, other firms (or newer entrants) may challenge Hexcel’s lead; need to constantly innovate.

Opportunities

- Growth in next-gen aerospace (single-aisle aircraft, eVTOL, Advanced Air Mobility, space) demand for lightweight, high performance composites.

- Increasing interest in sustainable composites / circular materials recycled-carbon composites, bio-derived resins, environmentally responsible materials.

- Expansion into industrial, automotive, renewable energy markets (wind turbines, lightweight transport, EVs) where composites can offer strength-to-weight and efficiency advantages.

Threats / Risks

- Economic downturns which reduce demand for new aircraft, infrastructure, or capital-intensive industrial projects.

- Raw material cost volatility especially precursor materials for carbon fiber or resin components, which may affect margins.

Recent News & Strategic Updates

- 2025 Expanded Americas Aerospace Distribution Network: Hexcel announced expansion of its official Americas aerospace distribution adding partners such as Composites One, GracoRoberts, Heatcon, Krayden, Pacific Coast

- Composites. This aims to improve agility, geographic reach, responsiveness especially for fast-growing aerospace segments (e.g. unmanned vehicles, eVTOL, hypersonics).

- 2025 Long Term Partnership with Kongsberg Defence & Aerospace: Signed a multi year agreement to supply engineered honeycombs and prepregs for Kongsberg’s defense/space programs over five years.

Companies Analysis

- Jiangsu CNano Technology Co.: Jiangsu CNano Technology Co., Ltd. is a leading global manufacturer and innovator specializing in carbon nanotubes (CNT) and graphene-based materials, primarily serving the rapidly expanding lithium battery market.

- Anaori Carbon Co., Ltd: Anaori Carbon Co., Ltd. is a specialized Japanese manufacturer in the advanced carbon materials market, known for developing and producing high-performance carbon and graphite products for various industrial and consumer applications.

- Grupo Antolin Ingenieria S.A: Grupo Antolin Ingeniería S.A. operates in the carbon materials market through its Advanced Carbon Materials (ACM) division, focusing on the research, development, production, and marketing of carbon nanofibers (CNFs) and graphene-related materials (GRMs) for various industrial applications.

- Graphenano

- Graphenea

- CVD Equipment Corporation

- Haydale Graphene Industries PLC

- Showa Denko K.K

- Mitsubishi Rayon

Top Companies in the Advanced Carbon Materials Market

- Jiangsu CNano Technology Co.

- Anaori Carbon Co., Ltd.

- Grupo Antolin Ingenieria S.A.

- Graphenano

- Graphenea

- CVD Equipment Corporation

- Haydale Graphene Industries PLC

- Showa Denko K.K

- Mitsubishi Rayon

Segments Covered in the Report

By Product

- Carbon Fibers

- Structural Graphite

- CNT

- Graphene

- Carbon Foams

By Application

- Aerospace & Defense

- Energy

- Electronics

- Sports

- Automotive

- Construction

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa