Content

What is the Middle East Phosphate Fertilizer Market Size?

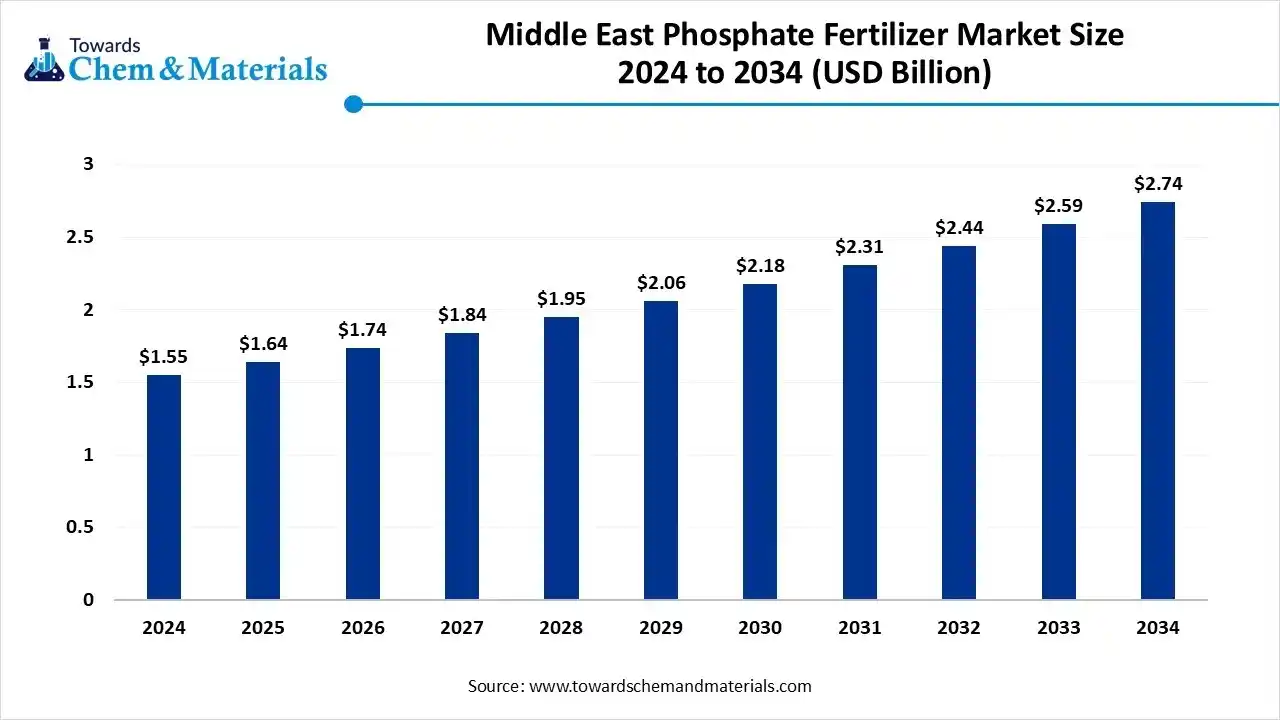

The Middle East phosphate fertilizer market size was reached at USD 1.55 billion in 2024 and is expected to be worth around USD 2.74 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% over the forecast period 2025 to 2034. Growing food demand from increasing populations is the key factor driving market growth. Also, a rise in the need for food security, coupled with the ongoing adoption of modern farming techniques, can fuel market growth further.

Key Takeaways

- By country, Saudi Arabia dominated the market by holding the largest share in 2024.

- By country, the UAE is expected to grow at a significant CAGR over the forecast period.

- By country, Qatar is expected to grow at a notable CAGR over the forecast period.

- By product, the monoammonium phosphate segment dominated the market with the largest share in 2024.

- By product, the triple superphosphate segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the cereals & grains segment held the largest market share in 2024.

- By application, the fruits & vegetables segment is expected to grow at the fastest CAGR during the projected period.

What is Phosphate Fertilizer?

It is the global economic industry for the trade of fertilizers that supply phosphorus, which is a crucial plant nutrient, to enhance crop growth and yield. The market includes the manufacturing and sale of various products such as monoammonium phosphate (MAP), diammonium phosphate (DAP), and superphosphate, which are obtained from mined phosphate rock and are crucial for processes such as energy transfer, root development, and cell division in plants.

Middle East Phosphate Fertilizer Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is expected to witness substantial growth due to the rapid implementation of modern agricultural practices, such as precision agriculture, which creates a demand for efficient and customized fertilizer solutions. Also, advancements in fertilizer production are leading to more efficient products, which are increasingly gaining traction.

- Sustainability Trends: The key sustainability trends in the market are a shift towards more sustainable and eco-friendly formulations, along with the adoption of precision agriculture techniques. Stringent government regulations are pushing market players to develop products that address concerns such as soil degradation and eutrophication.

- Global Expansion: Major companies are emphasizing improving distribution networks to ensure supply chain resilience to adapt to changing market conditions. Companies are rapidly integrating ESG and sustainability factors into their operations to meet regulatory demands.

Key Technological Shifts in the Middle East Phosphate Fertilizer Market:

The key technological shifts in the market are mainly fuelled by the need for sustainability, improved efficiency, and the processing of lower-grade local phosphate reserves. Major market players are heavily investing in integrated mining and processing facilities to transform raw phosphate rock into higher value finished products.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 1.74 Billion |

| Expected Size by 2034 | USD 2.74 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Application, |

| Key Companies Profiled | ordan Phosphate Mines Company (JPMC), Fauji Jordan Fertilizer Company, ICL Group, Groupe Chimique Tunisien (GCT), OCP Group (Morocco) |

Trade Analysis of the Middle East Phosphate Fertilizer Market: Import & Export Statistics

- In 2023, the United Arab Emirates (UAE) exported a precise value of $1.09 billion worth of fertilizers. This made it the 19th largest exporter of fertilizers globally out of 175 countries.

- In 2023, the United Arab Emirates imported $194M of Fertilizers, becoming the 75th largest importer of Fertilizers (out of 221) in the world. (Source: oec.world)https://oec.world/en/profile/bilateral-product/fertilizers/reporter/are

- In 2023, Morocco exported $713M of Phosphatic Fertilizers, making it the largest exporter of Phosphatic Fertilizers in the world.

- In 2023, Morocco imported $67.9k of Phosphatic Fertilizers, becoming the 127th largest importer of Phosphatic Fertilizers in the world.(Source: oec.world )

Value Chain Analysis of the Middle East Phosphate Fertilizer Market

- Feedstock Procurement : It is the strategic process by which market players acquire the primary raw materials required to produce phosphate-based fertilizers.

- Chemical Synthesis and Processing : This process focuses on the industrial methods used to convert raw phosphate rock into usable fertilizers like Diammonium Phosphate (DAP).

- Packaging and Labelling : This stage focuses on the latest trends, advancements, regulations, and market dynamics associated with how these fertilizers are packaged and labelled within the region.

- Regulatory Compliance and Safety Monitoring : This stage includes the necessary framework of laws, standards, and practices that manage and govern the industry's operations in the region.

Middle East Phosphate Fertilizer Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations/ Standards |

| Saudi Arabia | Adheres to GCC-wide standards such as GSO 9:2013 for labeling and general requirements. Production facilities, largely run by the state-backed Ma'aden, must comply with strict environmental protocols and safety standards related to emissions and waste management. |

| UAE | There are specific guidelines for product labeling (must include Arabic) and the use of additives, often referencing Codex Alimentarius or European standards. |

| Israel | Regulations involve the registration of all agricultural products, including fertilizers, with relevant ministries. Regulations involve the registration of all agricultural products, including fertilizers, with relevant ministries. While not mandatory, FDA approval for ingredients can accelerate the process. |

Segmental Insights

Product Insights

Which Product Type Segment Dominated the Middle East Phosphate Fertilizer Market in 2024?

The monoammonium phosphate segment dominated the market with the largest share in 2024. The dominance of the segment can be attributed to the growing demand for food production, fuelled by an increasing population and the need to enhance crop yields. In addition, MAP's high phosphorus content makes it a high-efficiency fertilizer for enhancing plant health and overall crop yields, leading to segment expansion soon.

The triple superphosphate segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing emphasis on food security with improved agricultural productivity, promoted by the adoption of technologies such as drip irrigation and precision agriculture

Application Insights

How Much Share Did the Grains & Cereals Segment Held in 2024?

The grains & cereals segment held the largest market share in 2024. The dominance of the segment can be linked to the surge in government initiatives and emphasis on sustainable agriculture to propel yield production. Moreover, phosphorus is necessary for the development of strong root systems, which is crucial for cereal and grain crops to absorb more water and other nutrients.

The fruits & vegetables segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by increasing consumer demand for high-quality and fresh produce, coupled with the ongoing investments in modern agriculture, such as protected and greenhouse cultivation. Furthermore, fruits and vegetables generally have higher economic returns, which makes them more attractive for investment.

Country Insights

Saudi Arabia Middle East Phosphate Fertilizer Market Trends

Saudi Arabia dominated the market by holding the largest share in 2024. The dominance of the country can be attributed to the growing demand for food production and security, promoted by government initiatives. In addition, the country is a major exporter of phosphate fertilizers, with an increasing reputation as a global supplier, especially for products such as DAP.

The UAE Middle East Phosphate Fertilizer Market Trends

The UAE is expected to grow at a significant CAGR over the forecast period. The growth of the country can be credited to the rapid innovations in desert farming techniques and government initiatives to fuel food security. Additionally, the government in the country is making strategic collaborations to enhance its agricultural productivity to ensure food security for the country.

Qatar Middle East Phosphate Fertilizer Market Trends

Qatar is expected to grow at a notable CAGR over the forecast period. The growth of the country can be driven by the extensive adoption of modern, high-efficiency farming techniques along with the surge in the use of precision agriculture and drip irrigation techniques. Furthermore, government initiatives and subsidies play an important role in supporting fertilizer use across farming communities in the country.

Recent Developments

- In August 2025, V6 Agronomy introduces a low-carbon fertilizer terminal. The project is led by V6 Agronomy in collaboration with the Port of Johnstown, which is a major step towards climate-smart trade, food security, and national supply chain sovereignty.(Source: www.worldfertilizer.com )

- In May 2025, Daewoo Engineering & Construction secured a huge-scale plant project worth over 1 trillion KRW in the Central Asian market. With this deal, Daewoo E&C plans to extend its reach into Central Asia by targeting fertilizer, petrochemical, and fertilizer projects, such as new city developments.(Source: www.koreapost.com)

Top Vendors in Middle East Phosphate Fertilizer Market & Their Offerings:

- Ma'aden Phosphate Company: Ma'aden Phosphate Company (MPC) is a leading, integrated phosphate fertilizer producer in the Middle East, with operations spanning from mining to finished fertilizer production. It is a joint venture between Maaden (70%), SABIC, and the Mosaic Company.

- Wa'ad Al Shamal Phosphate Co. :Ma'aden Wa'ad Al Shamal Phosphate Company (MWSPC) is a major integrated phosphate fertilizer producer in Saudi Arabia, operating a large, world-class complex in the Northern Province. As a key player in the Middle East, it produces a wide range of fertilizers.

Other Players

- ordan Phosphate Mines Company (JPMC)

- Fauji Jordan Fertilizer Company

- ICL Group

- Groupe Chimique Tunisien (GCT)

- OCP Group (Morocco)

Segment Covered

By Product

- Monoammonium Phosphate (MAP)

- Diammonium Phosphate (DAP)

- Single Superphosphate (SSP)

- Triple Superphosphate (TSP)

- Other Product

By Application

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other Application