Content

What is the Current Smart Fertilizers Market Size and Share?

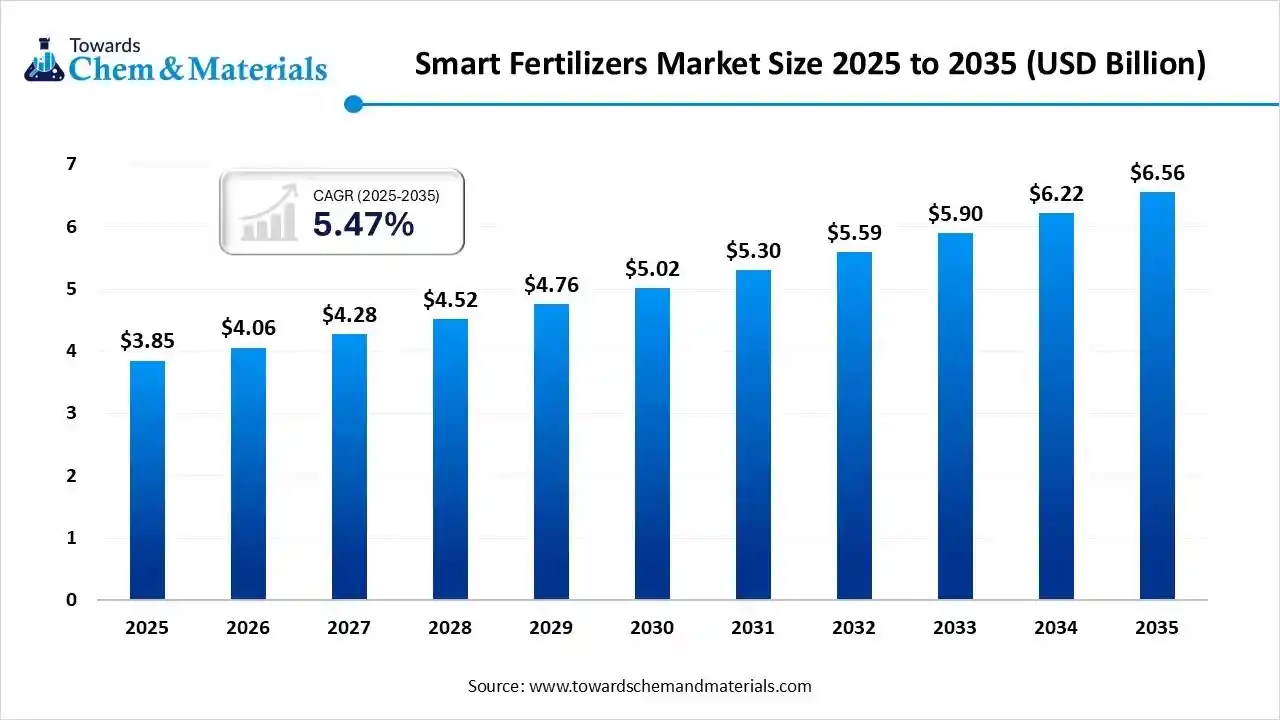

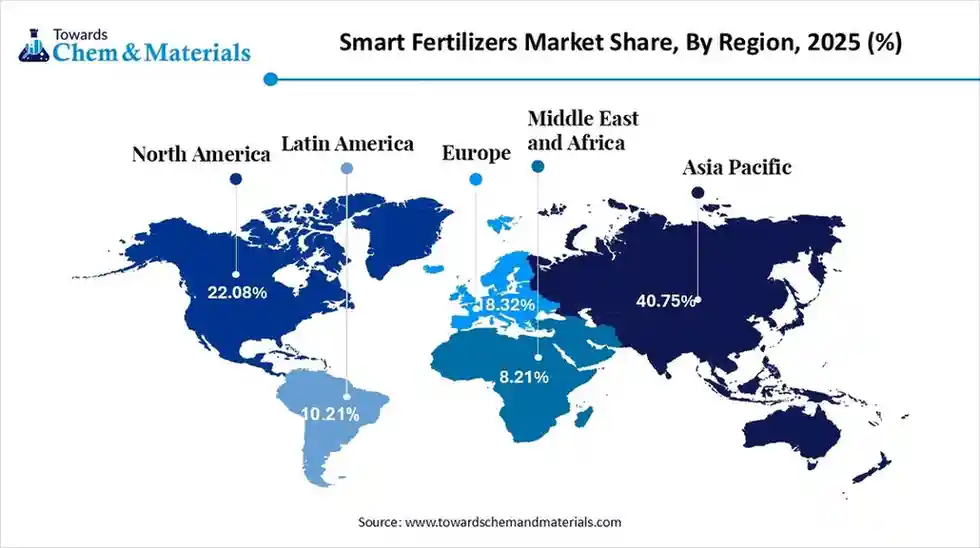

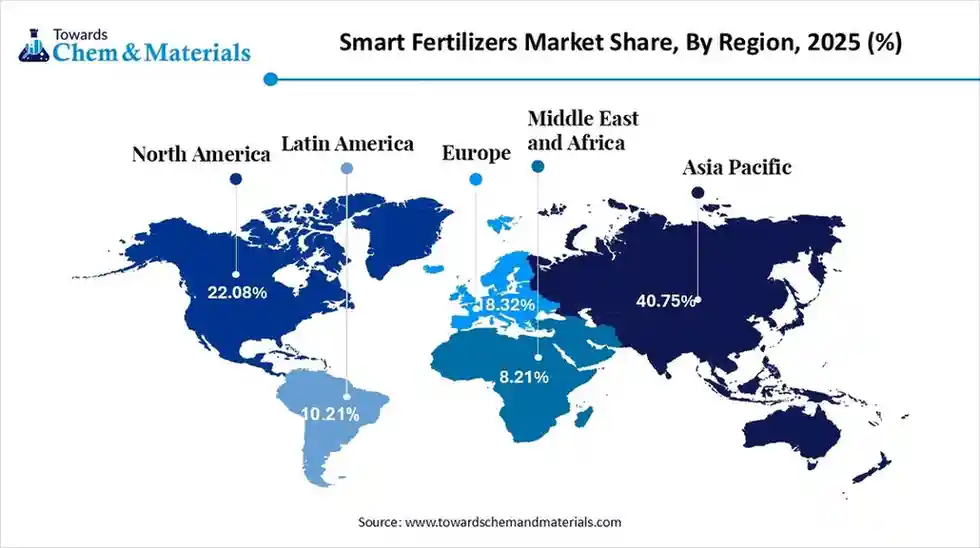

The global smart fertilizers market size was estimated at USD 3.85 billion in 2025 and is predicted to increase from USD 4.06 billion in 2026 and is projected to reach around USD 6.56 billion by 2035, The market is expanding at a CAGR of 5.47% between 2026 and 2035. Asia Pacific dominated the smart fertilizers market with a market share of 40.75% the global market in 2025. The global shift towards modern and technology-based agricultural practices has fueled the industry's potential in recent years.

Key Takeaways

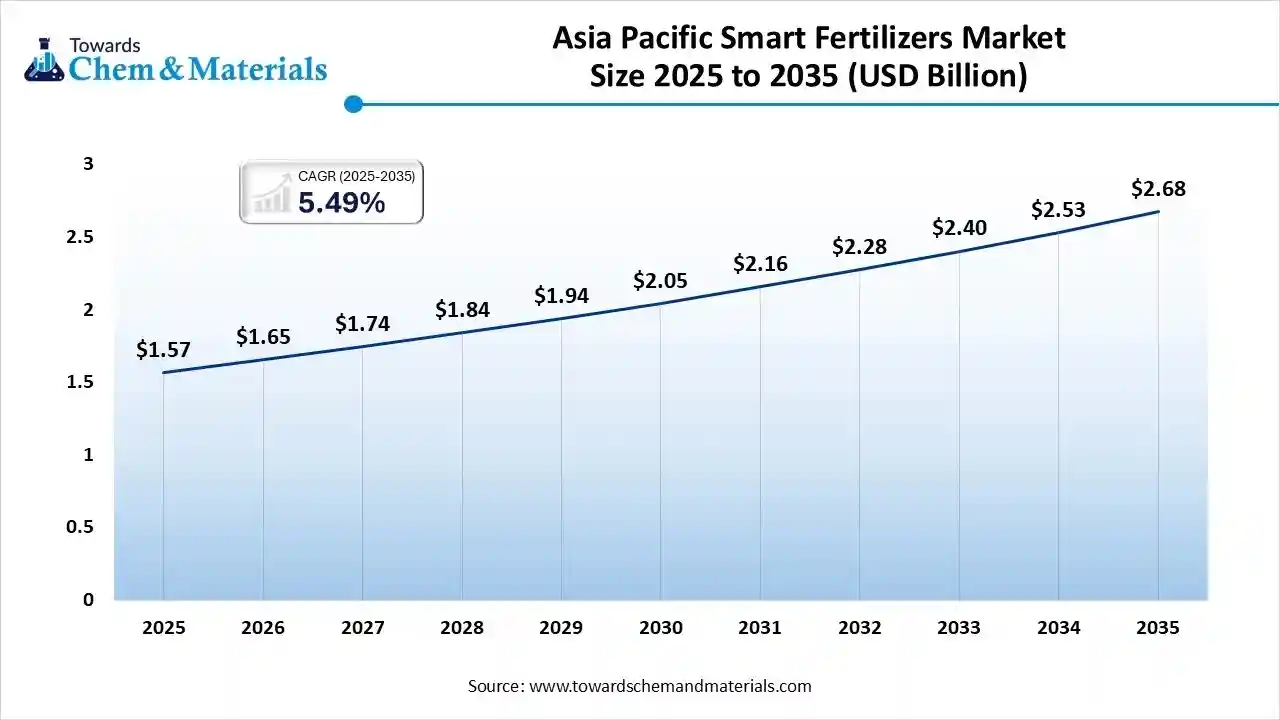

- By region, Asia Pacific led the smart fertilizers market with the largest revenue share of over 40.75% in 2025.

- By product type, the controlled-release fertilizers (CRF) segment led the market with the largest revenue share of 40.90% in 2025.

- By crop type, the grains and cereals segment led the market with the largest revenue share of 46.11% in 2025.

- By application type, the soil application segment accounted for the largest revenue share of 60.57% in 2025.

- By end use, the agriculture segment dominated with the largest revenue share of 81.13% in 2025.

Sensors and Science: The Rise of Responsive Crop Nutrition

Smart fertilizers refer to the research-based and advanced nutrients that are designed to release nutrients only when the crop needs them. Furthermore, these fertilizers have integrated sensors, biological triggers, and coatings that can match the nutrient release with proper temperature, soil moisture, and plant demand as per the recent observations. Moreover, by helping farmers while reducing the loss and protecting soil health, the smart fertilisers are likely to create a lucrative surge in the agriculture field in the coming years.

Smart Fertilizers Market Trends:

- The usage of artificial intelligence to decide nutrient release from the fertilisers is driving the investors' confidence in the industry’s future. Several brands are using advanced intelligence in their manufacturing plants to deliver modern fertilizer batches where AI tools are seen in analyzing soil sensors, weather patterns, and plant growth models in recent years.

- The focus on climate-adaptive release mechanisms has actively improved the financial performance and sector attractiveness in recent years. By protecting crops from nutrient loss during the heatwaves and extreme rainfall, these fertilizers have emerged as the ideal options for extreme temperature field farms in the past few years.

- The emergence of microbial-triggered nutrient release fertilisers is expected to contribute to favourable market economies for the industry during the upcoming years. Where several farmers are using traditional microbial fertilisers like cow dung, biogas, and others. Also, these modern fertilisers can release nutrients only when beneficial microbes become active.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 4.06 Billion |

| Revenue Forecast in 2035 | USD 6.56 Billion |

| Growth Rate | CAGR 5.47% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segments covered | By Product Type, By Crop Type, By Application Method, By End-Use Sector, By Region |

| Key companies profiled | Nutrien Ltd, Yara International ASA, The Mosaic Company, CF Industries Holdings, Inc, EuroChem Group AG , K+S AG , ICL Group Ltd. , Coromandel International Limited , BASF SE , Bayer CropScience AG , COMPO EXPERT GmbH , Adama Ltd. (part of Syngenta Group) , Kingenta Ecological Engineering Co., Ltd. , Koch Industries (Koch Fertilizer, LLC) , Gujarat State Fertilizers & Chemicals Ltd. (GSFC) , Indian Farmers Fertilizer Cooperative Limited (IFFCO) , SQM S.A. , Haifa Group , Sinofert Holdings Limited , Helena Agri-Enterprises, LLC (part of Marubeni Corporation) |

Intelligent Fertilizers: Where Science Meets Plant Signals

Industry is moving from simple controlled-release products to intelligent-release systems. Controlled-release fertilisers rely only on coatings that dissolve slowly. Intelligent-release fertilisers use sensors, biological triggers, nanotechnology, and micro-coatings that respond to real-time plant needs. Also, these fertilisers can adjust release speed based on root signals, soil nutrients, crop stress levels, or weather changes.

Value Chain Analysis of the Smart Fertilizers Market:

- Distribution to Industrial Users: Industrial users of smart fertilizers primarily consist of large-scale farms/plantations (commercial growers), agricultural cooperatives, and government/public sector entities. Distribution to these users is often handled through a combination of direct sales, specialized distributors, and large agri-input platforms.

- Key Players: BASF SE and Nutrien Ltd

- Chemical Synthesis and Processing: The chemical synthesis and processing of smart fertilizers involve innovative techniques like polymer coating, nanoencapsulation, and the use of bioformulations to enable controlled nutrient release and increase efficiency.

- Key Players: Yara International and the ICL Group

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring for smart fertilizers (including enhanced efficiency, slow-release, and bio-based products) are overseen by various national and international agencies to ensure product efficacy, safety for human health, and minimal environmental impact.

- Key Agencies: Environmental Protection Agency (EPA), and U.S. Department of Agriculture (USDA)

Smart Fertilizers Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) | Ensuring product efficacy and safety |

| European Union | European Chemicals Agency (ECHA) | Fertilising Products Regulation (FPR) (EU) 2019/1009 | Reducing the environmental impact of farming through increased nutrient efficiency |

| China | Ministry of Agriculture and Rural Affairs (MARA) | Measures on the Management of Fertilizer Registration | Ensuring product efficacy through mandatory trials |

Segmental Insights

Product Type Insights

How did the Controlled-Release Fertilizers (CRF) Segment Dominate the Smart Fertilizers Market in 2025?

By product type, the controlled-release fertilizers (CRF) segment led the market with the largest revenue share of 40.90% in 2025 due to factors such as being easy to use and not requiring any special equipment or practice. Moreover, by slowly releasing nutrients over a week or a month, the controlled-release fertilizers have gained industry attention while reducing waste, labor cost, and improving crop yield.

The nano-fertilizers segment is expected to grow with a significant CAGR owing to its efficiency. Moreover, by delivering nutrients using small particles that can easily be absorbed, the nano fertilizers have emerged as the crucial and ideal option for modern farmers in the current era, and it is expected to grow rapidly.

The slow-release fertilizers segment is also notably growing, owing to the affordability and simplicity. Also, the slow-release fertilisers have seen an improvement in efficiency without switching to advanced technologies. Moreover, by supplying nutrients steadily, the slow-release fertilisers have created their own space in the smart fertilizers industry in recent years.

Crop Type Insights

Why does the Grains and Cereals Segment Dominate the Smart Fertilizers Market by Crop Type?

The grains and cereals segment dominated the market with 46.11% share in 2025 because they cover the largest farming area worldwide and require high nutrient supply for crops like rice, wheat, and maize. These crops feed billions of people, so farmers focus on maximizing yield and protecting soil health.

The fruits and vegetables segment is expected to grow at a rapid CAGR because consumers are demanding fresher, healthier, and chemical-free produce. These crops are sensitive to nutrient imbalance, and smart fertilizers provide precise feeding that improves taste, color, size, and shelf life.

The pulses and oilseeds segment is also notably growing because they require better nutrient management to improve protein and oil content. Crops like soybeans, peanuts, chickpeas, and sunflowers need balanced micronutrients, which smart fertilizers supply more efficiently.

Application Insights

How did the Soil Application Segment Dominate the Smart Fertilizers Market in 2025?

The soil application segment dominated the market with 60.57% share in 2025, because it is the simplest and most familiar method for farmers. It does not require special equipment or advanced systems, making it easy to use for large and small farms like. Smart fertilizers placed in soil release nutrients slowly and improve soil structure, helping crops grow consistently.

The fertigation segment is expected to grow at a significant CAGR because it combines irrigation and fertilization, allowing farmers to deliver nutrients directly through drip or sprinkler systems. This method provides precise nutrient timing, reduces fertilizer waste, and improves crop quality.

The seed treatment segment is also notably growing, because farmers want to give crops an early advantage before they even reach the soil. Smart fertilizers used as seed coatings supply micronutrients during germination, improving root strength, disease resistance, and early growth.

End User Insights

Why does the Agriculture Segment dominate the Smart Fertilizers Market by End User?

The agriculture segment dominated the market with an 81.13% share in 2025 because it uses the highest amount of fertilisers worldwide. Large crop fields, especially grains, fruits, and vegetables, require consistent nutrient management to maintain yield.

The greenhouses and controlled environment agriculture (CEA) segment is expected to grow at a significant CAGR because it requires precise nutrient control to grow high-quality crops year-round. Smart fertilisers work perfectly in these systems, where water, light, and nutrients are managed digitally.

The horticulture and floriculture segment is also notably growing because flowers, ornamentals, and nursery plants require a precise nutrient balance to maintain colour, shape, and growth quality. Smart fertilisers offer slow, controlled, and targeted nutrient release, making them ideal for nurseries, landscaping businesses, and flower farms.

Regional Insights

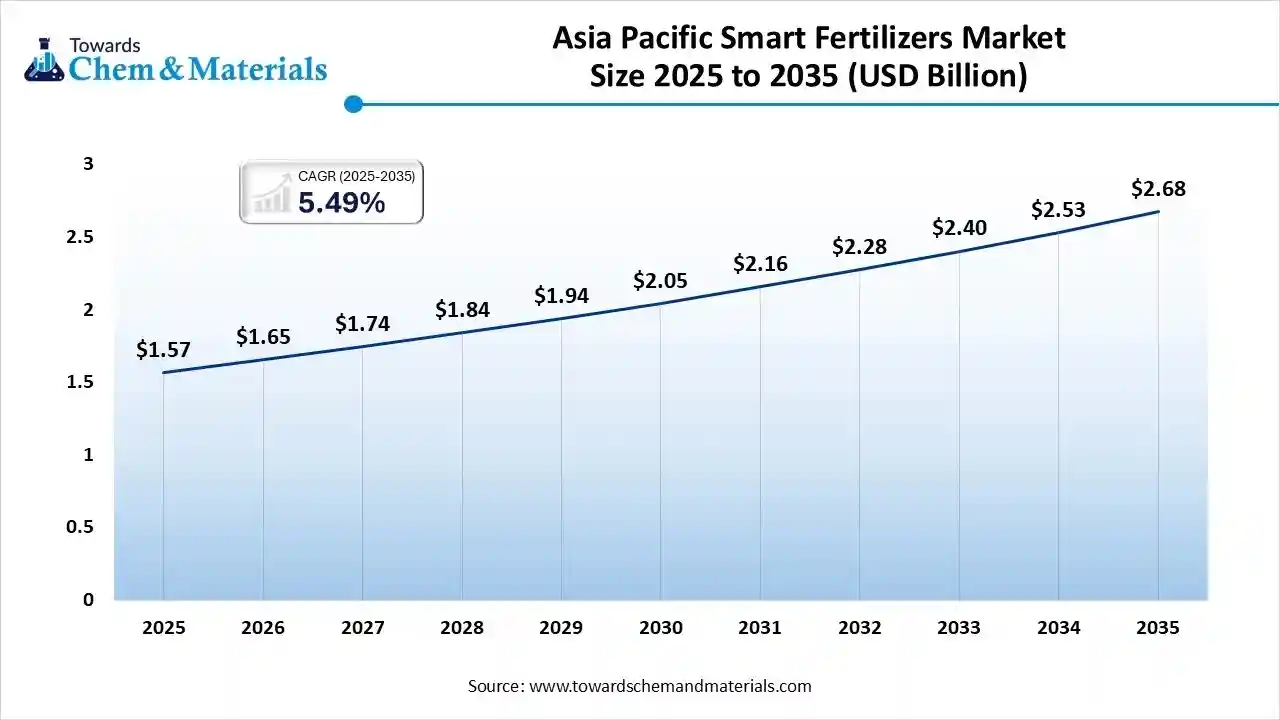

The Asia Pacific smart fertilizers market size was valued at USD 1.57 billion in 2025 and is expected to reach USD 2.68 billion by 2035, growing at a CAGR of 5.49% from 2026 to 2035. Asia Pacific dominated the smart fertilizers market with a 40.75% share, owing to the region having one of the largest agricultural lands and industries. Moreover, the stronger government support and adoption of modern farming practices have contributed heavily to the industry growth in the region in recent years. Also, the farmers in the region have actively reduced chemical overuse by maintaining soil health.

China Remains the Powerhouse of the Smart Fertilizers Market

China maintained its dominance in the market due to the rapid greenhouse expansion and huge governmental support and investment in agricultural technology. Also, the farmers in the country have seen heavy grain and vegetable farming while adopting the advanced farming methods and smart fertilisers in recent years.

Europe Smart Fertilizers Market Examination

Europe is expected to capture a major share of the market with a rapid CAGR, owing to the sudden shift towards eco-friendly and sustainable farming. Moreover, the regional farmers are demanding advanced fertilizers to meet soil and environmental targets while reducing nitrogen emissions in the current period.

Precision Farming Pushes Germany to the Forefront of Smart Fertilizers

Germany is expected to emerge as a prominent country for the market in the coming years, owing to the country's strong research programs in nutrient-efficient solutions. Moreover, several farmers in Germany have seen under the heavy usage of digital tools like drones, soil mapping, and advanced sensors, which is indirectly turning farmers' perception towards the smart fertilisers in the current period.

North America Smart Fertilizers Market Evaluation

North America is a notably growing region because farmers are rapidly adopting precision agriculture, sensor-based farming, and advanced irrigation systems. Smart fertilisers work well with these technologies, helping reduce input costs and improve yields.

United States Leads the Charge in Smart Fertilizer Adoption

The United States is expected to gain a major industry due to its large commercial farms, strong research programs, and early adoption of digital farming tools. Farmers in the United States use smart fertilizers to manage large fields efficiently and reduce fertilizer loss caused by extreme weather.

Smart Fertilizers Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the market because these regions face water shortages and poor soil quality, making smart fertilizers essential for improving productivity. Farmers are adopting controlled-release and fertigation-ready fertilizers to save water and increase crop output.

Smart Fertilizers Powering Saudi Arabia’s Food Future

Saudi Arabia is expected to emerge as a prominent country for the market in the coming years, as the country is leading the region with heavy investments in greenhouse farming. Hydroponics and desert agriculture. Smart fertilisers help the country grow more food locally and reduce dependence on imports.

South America Smart Fertilizers Market Trends

The South America smart fertilizers market is expanding, driven by growing demand for higher yields, soil health restoration and more efficient nutrient use. Key drivers include expansion of field-crop acreage (especially soy, corn, wheat) and increasing recognition of micronutrient deficiencies and soil degradation across major farming zones. Adoption of precision agriculture and modern irrigation/fertigation systems is rising sharply enabling farmers to apply nutrients more precisely and efficiently, which supports uptake of water-soluble, liquid and controlled-release fertilizer formulations.

In Brazil, the market is growing rapidly. Several factors drive this shift: widespread soil micronutrient deficiencies especially zinc and boron shortages in key regions like the Cerrado and MATOPIBA prompt farmers to use chelated and micronutrient-enriched fertilizers. Moreover, there is strong uptake of specialty fertilizers (liquid and controlled-release) compatible with precision-agriculture practices; liquid fertilizers comprised more than half the specialty market in 2024, while controlled-release types are the fastest-growing segment.

Recent Developments

- In March 2024, the startup called Lucent Bio is likely to expand its facilities in countries such as the United States, Brazil, and Europe. Moreover, the company has released its climate-smart fertilizer recently.(Source: www.agriculturedive.com)

Top Vendors in the Smart Fertilizers Market & Their Offerings:

- Nutrien Ltd: The world's largest producer of potash and a leading supplier of nitrogen and phosphate products, offering comprehensive crop input solutions to farmers globally.

- Yara International ASA: Norwegian chemical company with a global presence, specializing in crop nutrition products and precision farming solutions to improve agricultural efficiency and environmental performance.

- The Mosaic Company: A leading producer and marketer of concentrated phosphate and potash crop nutrients, providing essential NPK (Nitrogen, Phosphorus, Potassium) products to farmers around the world.

- CF Industries Holdings, Inc: A global leader in the manufacturing of hydrogen and nitrogen products for fertilizer applications and clean energy initiatives.

Top Companies in the Smart Fertilizers Market

- EuroChem Group AG

- K+S AG

- ICL Group Ltd.

- The Mosaic Company

- CF Industries Holdings, Inc

- Yara International ASA

- Nutrien Ltd

- Coromandel International Limited

- BASF SE

- Bayer CropScience AG

- COMPO EXPERT GmbH

- Adama Ltd. (part of Syngenta Group)

- Kingenta Ecological Engineering Co., Ltd.

- Koch Industries (Koch Fertilizer, LLC)

- Gujarat State Fertilizers & Chemicals Ltd. (GSFC)

- Indian Farmers Fertilizer Cooperative Limited (IFFCO)

- SQM S.A.

- Haifa Group

- Sinofert Holdings Limited

- Helena Agri-Enterprises, LLC (part of Marubeni Corporation)

Segments Covered in the Report

By Product Type

- Controlled-Release Fertilizers (CRF)

- Slow-Release Fertilizers (SRF)

- Stabilized Fertilizers

- Urease Inhibitors

- Nitrification Inhibitors

- Nano-Fertilizers

- Nano-Urea

- Nano-Micronutrients

- Other Nano-Formulations

- Liquid Smart Fertilizers

- Suspensions

- Solutions

- Bio-Fertilizers (as Smart/Precision Inputs)

- Nitrogen-Fixing Bio-Fertilizers

- Phosphate-Solubilizing Bio-Fertilizers

- Potassium-Mobilizing Bio-Fertilizers

- Coated Fertilizers

- Polymer-Coated Fertilizers (PCFs)

- Sulfur-Coated Fertilizers (SCFs)

- Polymer-Sulfur Coated Fertilizers (PCSFs)

- Other Coated Types

- Nitrogen-Based Smart Fertilizers

- Phosphorus-Based Smart Fertilizers

- Potassium-Based Smart Fertilizers

- Micronutrient-Based Smart Fertilizers

- Zinc

- Boron

- Manganese

- Iron

- Others (Copper, Molybdenum, etc.)

By Crop Type

- Grains and Cereals

- Rice

- Wheat

- Maize/Corn

- Others (Barley, Oats, etc.)

- Fruits and Vegetables

- High-Value Fruits

- Root Vegetables

- Leafy Vegetables

- Others

- Pulses and Oilseeds

- Soybeans

- Groundnut

- Canola/Rapeseed

- Others

- Commercial Crops/Cash Crops

- Cotton

- Sugarcane

- Plantation Crops (Tea, Coffee, Rubber)

- Others

- Turf and Ornamentals

By Application Method

- Soil Application (Broadcasting, Banding)

- Foliar Application

- Fertigation (Drip, Sprinkler)

- Seed Treatment

- Other Methods (Side-Dressing, Top-Dressing)

By End-Use Sector

- Agriculture (Open Field Farming)

- Horticulture and Floriculture

- Greenhouses and Controlled Environment Agriculture (CEA)

- Residential/Home Gardening and Landscaping

- Sports Turf and Golf Courses

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa