Content

What is the Current Green Fertilizer Market Size and Share?

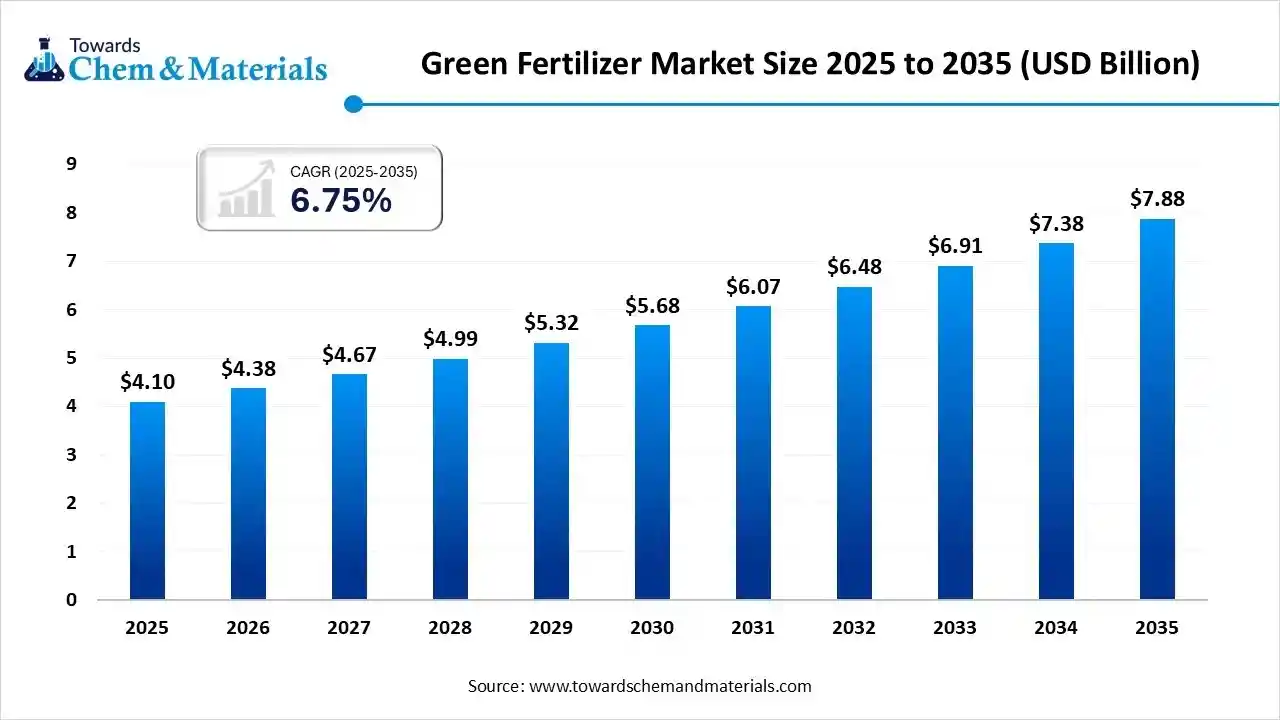

The global green fertilizer market size is calculated at USD 4.1 billion in 2025 and is predicted to increase from USD 4.38 billion in 2026 and is projected to reach around USD 7.88 billion by 2035, The market is expanding at a CAGR of 6.75% between 2026 and 2035. The growth of the market is driven by the increased demand for sustainable agriculture, government support and regulations favouring eco-friendly farming, and growing consumer awareness of organic products.

Key Takeaways

- By region, Asia Pacific dominated the market with a share of 42% in 2025.

- By product type, the enhanced-efficiency fertilizers segment led the market with the largest revenue share of 38% in 2025.

- By nutrient type, the nitrogen-based fertilizers segment led the market with the largest revenue share of 55% in 2025.

- By application, the cereals & grains segment accounted for the largest revenue share of 40% in 2025.

- By farming practice, the conventional (low-carbon transition) segment dominated with the largest revenue share of 47% in 2025.

Market Overview

The global green fertilizer market includes the production, distribution, and application of environmentally sustainable fertilizers designed to reduce carbon emissions, nutrient losses, and ecological damage while maintaining or enhancing agricultural productivity. These fertilizers include low-carbon nitrogen products, enhanced-efficiency fertilizers, bio-enhanced formulations, and renewable-energy-based fertilizers such as green ammonia.

What is the significance of the Green Fertilizer Market?

The significance of the green fertilizer market lies in its ability to address critical environmental and agricultural challenges by providing sustainable alternatives to traditional chemical fertilizers. Its growth is driven by the push for eco-friendly farming, which improves soil health, reduces pollution, and meets consumer demand for safer produce. Green fertilizers also support decarbonization efforts and promote a more resilient and secure food system by moving towards sustainable production methods.

The market is driven by global climate commitments, stricter environmental regulations on conventional fertilizers, rising adoption of climate-smart agriculture, and decarbonization initiatives across the fertilizer value chain. Technological innovation in controlled nutrient release, inhibitor technologies, renewable ammonia production, and precision nutrient management is accelerating the global transition toward greener fertilizer inputs.

Green Fertilizer Market Growth Trends:

- Growing demand for sustainability: Farmers and consumers are increasingly prioritising environmentally friendly and organic solutions, driving demand for green fertilisers derived from natural sources like compost and manure.

- Government support: Many governments are encouraging the adoption of green fertilisers through subsidies and policies. For example, India's PM PRANAM scheme rewards states for reducing chemical fertiliser use.

- Focus on soil health: There is a growing recognition that green fertilisers can improve long-term soil health, an important aspect of sustainable food production.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 4.38 Billion |

| Revenue Forecast in 2035 | USD 7.88 Billion |

| Growth Rate | CAGR 6.75% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segments covered | By Product Type, By Nutrient Type, By Application, By Farming Practice, By Regions |

| Key companies profiled | ICL Group Ltd., OCI Global, CF Industries Holdings, Inc., Nutrien Ltd., Yara International ASA, BASF SE , EuroChem Group , Mosaic Company, SABIC , OCP Group , Koch Fertiliser , Tata Chemicals Ltd. , Coromandel International Ltd. , Indorama Corporation , Helm AG , Haldor Topsoe (green ammonia technology) , Fertiglobe PLC |

Key Technological Shifts In The Green Fertilizer Market:

The green fertilizer market is undergoing significant technological shifts driven by a need for sustainability, efficiency, and reduced environmental impact. Key changes include decarbonised production methods (especially green ammonia), the rise of enhanced efficiency fertilizers (slow-release and nano-fertilizers), and the integration of digital and precision agriculture for optimised application.

Trade Analysis Of Green Fertilizer Market

- According to India Export data, India shipped 1,369 units of Organic Fertiliser through 157 exporters to 316 buyers. The primary destinations for these exports are Vietnam, the United States, and Malaysia.

- Globally, the leading exporters of Organic Fertiliser are Japan, Vietnam, and Turkey, with Japan at the top with 7,436 shipments, followed by Vietnam with 4,379 shipments, and Turkey with 2,459 shipments.

- Additionally, Global Export data shows the world exported 27,175 shipments of Organic Fertiliser via 2,261 exporters to 2,755 buyers. The major Organic Fertilizer exports from the world goes to Vietnam, Cambodia, and the United States.

- The top exporters globally are Japan, Vietnam, and Turkey, with Japan leading with 7,436 shipments, Vietnam with 4,459 shipments, and Turkey with 2,461 shipments.

Green Fertilizer Market Value Chain Analysis

- Chemical Synthesis and Processing: Green fertilizers are produced using low-carbon and renewable processes such as green ammonia synthesis via electrolysis-based hydrogen, bio-based nitrogen fixation, composting, and organic waste fermentation.

- Key players: Yara International, CF Industries, Nutrien Ltd., OCI Global, Sumitomo Chemical.

- Quality Testing and Certification:The Green fertilizers undergo testing for nutrient composition, purity, microbial activity (for biofertilizers), heavy metal limits, and environmental compliance under standards such as ISO 14001, EU Fertilizing Products Regulation (FPR 2019/1009), and organic certification frameworks.

- Key players: SGS, Bureau Veritas, Intertek, TÜV SÜD.

- Distribution to Industrial Users: Green fertilizers are supplied to agriculture, horticulture, and controlled-environment farming through agrochemical distributors, cooperative networks, and direct supply agreements with large farming enterprises.

- Key players: Yara International, Nutrien Ltd., CF Industries, Sumitomo Chemical.

Green Fertilizer Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. EPA (Environmental Protection Agency) + USDA | - FIFRA (for bio-based agricultural inputs) - USDA BioPreferred Program - Clean Air Act (for green ammonia) |

- Product safety & registration - Bio-based certification - Emission reduction compliance |

Increasing incentives for low-carbon ammonia production; tax credits under the IRA support green fertilizer manufacturing. |

| European Union | ECHA + EFSA + European Commission | - EU Fertilising Products Regulation (FPR 2019/1009) - REACH - EU Green Deal directives |

- Safety, quality & traceability - Carbon footprint reduction - Restrictions on harmful additives |

EU FPR includes specific rules for organic & bio-based fertilizers; strong push toward decarbonised fertilizer production. |

| China | Ministry of Agriculture & Rural Affairs (MARA) + MEE | - Green Agricultural Input Standards - GB National Standards - Circular Agriculture Policy |

- Low-carbon and organic fertilizer promotion - Environmental safety controls |

China is aggressively promoting bio-fertilizers to reduce synthetic fertilizer dependency; domestic certification is required. |

| India | FCO (Fertilizer Control Order) + MoEFCC | - FCO Standards for Organic & Bio-fertilizers - Nutrient-Based Subsidy (NBS) Policy - Green Hydrogen/Ammonia Policy (for green urea) |

- Quality control & licensing - Labelling standards - Support for green ammonia |

India recently added stricter norms for biofertilizers; subsidies are expanding to encourage green urea and ammonia. |

| Japan | MAFF (Ministry of Agriculture, Forestry and Fisheries) | - Fertilizer Control Act - Green Ammonia Roadmap (METI) |

- Registration & quality standards - Promotion of carbon-neutral fertilizers |

Japan is investing heavily in green ammonia imports and domestic pilot plants to support a sustainable fertilizer supply. |

Segmental Insights

Product Type Insights

How Did The Product Type Segment Dominate The Green Fertilizer Market In 2025?

The enhanced-efficiency fertilizers segment dominated the market with a share of 38% in 2025. Enhanced efficiency fertilizers are gaining strong market traction as they minimise nutrient losses and improve uptake efficiency, supporting both economic and environmental goals in modern agriculture. Growing regulatory pressure and sustainability commitments from food producers further accelerate adoption across high-intensity cropping systems.

The green nitrogen fertilizers segment expects significant growth in the green fertilizer market during the forecast period. Green nitrogen fertilizers are emerging as a key sustainability-focused product category driven by decarbonization initiatives across the fertilizer value chain. The segment benefits from increasing investments in green hydrogen, government-backed low-carbon agriculture programs, and corporate climate commitments aimed at minimising fertilizer-related carbon footprints.

The bio-enhanced chemical fertilisers segment has seen notable growth in the market. Bio-enhanced chemical fertilizers combine traditional nutrient compounds with biological inoculants or microbial additives to boost nutrient-use efficiency while improving soil health. Strong demand for biologically fortified formulations is supported by advancements in microbial technologies, crop-specific blends, and soil microbiome research that enable improved nutrient availability and plant resilience.

Nutrient Type Insights

Which Nitrogen-Based Fertilizers Segment Dominates The Green Fertilizer Market In 2025?

The nitrogen-based fertilizers segment dominated the market with a share of 55% in 2025. Nitrogen-based green fertilizers remain the largest nutrient segment due to their critical role in supporting high-yield crop production. Market growth is driven by innovations such as nitrification inhibitors, slow-release technologies, and renewable-source nitrogen that collectively reduce volatilisation and leaching losses. Rising demand for low-carbon nitrogen solutions further strengthens this segment, particularly in regions with nitrogen management regulations.

The multi-nutrient & customised blends segment expects significant growth in the green fertilizer market during the forecast period. Multi-nutrient and customised blends are expanding rapidly as farmers increasingly prefer nutrient programs tailored to soil profiles, crop types, and climatic conditions. The shift toward precision agriculture and soil-testing-driven fertilization strategies is accelerating demand for highly customised, crop-specific green fertilizer solutions.

The phosphorus-based segment has seen notable growth in the market. Phosphorus-based green fertilizers are gaining significance due to growing concerns over resource depletion, runoff, and waterway eutrophication. Increasing global focus on circular nutrient models and phosphorus recovery technologies further drives growth in this segment.

Application Insights

How Did Cereals And Grains Segment Dominate The Green Fertilizer Market In 2025?

The cereals & grains segment dominated the market with a share of 40% in 2025. Cereals and grains represent a major application segment for green fertilizers owing to the large-scale cultivation and high nutrient demand of crops such as wheat, corn, and rice. Growing global food demand and tighter nutrient management regulations further reinforce the application across intensive grain production systems.

The fruits & vegetables segment expects significant growth in the green fertilizer market during the forecast period. The fruits and vegetables segment is witnessing strong adoption as speciality crop producers prioritise soil health, nutrient precision, and residue-free production. High-value horticulture operations and protected cultivation environments particularly benefit from controlled-release and biofortified nutrient solutions.

The oilseeds & pulses segment has seen notable growth in the market. Oilseeds and pulses rely on green fertilizers to improve nutrient-use efficiency and support biological nitrogen fixation, particularly in leguminous crops. Adoption is rising as growers integrate sustainable nutrient programs to reduce synthetic input dependency and enhance soil organic matter. Increasing demand for plant-based proteins and export-oriented cultivation is strengthening fertilizer adoption in this segment.

Farming Practice Insights

Which Farming Practice Segment Dominate The Green Fertilizer Market In 2025?

The conventional (low-carbon transition) segment dominated the market with a share of 47% in 2025. In conventional farming systems, green fertilizers are used to improve nutrient efficiency, reduce losses, and align with the changing environmental conditions, with a rising focus on sustainability. Adoption is rising as farmers face increasing pressure to balance productivity with long-term soil and resource sustainability.

The sustainable & climate-smart farming segment expects significant growth in the green fertilizer market during the forecast period. Sustainable and climate-smart farming practices represent a rapidly expanding segment where green fertilizers play a central role in reducing emissions, improving water-use efficiency, and enhancing soil resilience. Policy incentives and carbon-footprint reduction initiatives further accelerate uptake within climate-smart agriculture programs.

The organic & regenerative agriculture segment has seen notable growth in the market. Organic and regenerative agriculture relies heavily on bio-based, natural, and environmentally compatible fertilizer solutions to build soil fertility and enhance ecosystem health. Growing consumer demand for chemical-free produce and the global expansion of organic farming certifications are strengthening this segment.

Regional Insights

How Did Asia Pacific Dominate The Green Fertilizer Market In 2025?

Asia Pacific dominated the market with a share of 42% in 2025. The Asia Pacific market is rapidly growing as governments, farmers, and agri-industries respond to soil degradation, water scarcity, and regulatory pressure to reduce chemical runoff. Demand is particularly strong where intensive cropping systems and high fertilizer application rates have prompted the need for more efficient and sustainable nutrient solutions.

India: Green Fertilizer Market Growth Trends

India represents one of the most important Asia Pacific markets due to its large agricultural sector, policy focus on sustainable farming, and growing interest in organic and climate-smart agriculture. Domestic manufacturers and startups are scaling localised green fertilizer solutions to meet smallholder needs while improving nutrient efficiency across staple and horticultural crops.

Europe Has Seen Growth Driven By Strong Regulation

Europe is expected to have fastest growth in the market in the forecast period. Europe’s green fertilizer market is shaped by rigorous environmental regulations, ambitious agricultural sustainability targets, and wide adoption of integrated nutrient management practices. The Farmers, cooperatives, and agri-suppliers are increasingly integrating green fertilizer products into crop nutrient programs to meet regulatory requirements and customer demand for climate-friendly agricultural inputs.

Germany: Green Fertilizer Market Growth Trends

Germany stands out in Europe for early adoption of sustainable fertilizer solutions, supported by strong agricultural research institutions and progressive farm advisory networks. German farmers and agri-businesses are experimenting with slow-release formulations, microbial inoculants, and precision application systems. Policy support for nutrient stewardship, coupled with active supply-chain pressure, accelerates market penetration of green fertilizers in both arable and specialised horticultural sectors.

North America's Growth In The Market Is Driven By Growing Adoption

The North American green fertilizer market is expanding due to strong regulatory emphasis on sustainable agriculture, rising adoption of precision farming, and increasing demand for lower-environmental-impact nutrient solutions. Investments in ag-tech, soil health programs, and public–private sustainability initiatives are accelerating commercialisation and farmer acceptance of green fertilizer alternatives across row crops and speciality agriculture.

United States: Green Fertilizer Market Growth Trends

The United States is a leading market for green fertilizers within North America, driven by large-scale commercial farming, significant R&D in agronomy, and strong sustainability commitments from major food companies and retailers. Collaboration between fertilizer producers, agritech firms, and extension services is helping scale bio-based and enhanced-efficiency fertilizer solutions across diverse cropping systems.

South America's Shift Towards Sustainability Drives Growth

South America’s green fertilizer market is gaining momentum as producers seek to combine high productivity with environmental stewardship amid expanding export-oriented agriculture. Trade-driven quality requirements and sustainability commitments from international buyers further stimulate the regional shift toward greener nutrient inputs.

Brazil: Green Fertilizer Market Growth Trends

Brazil is a regional leader for green fertilizers in South America, propelled by its massive agricultural industry, emphasis on sustainable intensification, and growing local industry for bio-based inputs. Research institutions and private-sector innovation hubs are developing region-specific products to address tropical soils and high-weather variability, supporting broad-based commercialisation.

The Middle East And Africa have seen Growth Due To Growing Adoption

The Middle East & Africa market for green fertilizers is emerging in response to water scarcity, soil salinity challenges, and the need for sustainable intensification. Adoption is led by high-value horticulture, greenhouse production, and government-driven agricultural modernisation programs. Green fertilizer solutions that enhance nutrient-use efficiency, reduce leaching, and perform under arid conditions are of particular interest to regional growers and policymakers focused on food security and resource conservation.

South Africa: Green Fertilizer Market Growth Trends

South Africa is a key market in the Middle East & Africa region where commercial farmers and emerging agri-enterprises are exploring biofertilizers, slow-release formulations, and soil health interventions to boost productivity on marginal soils. South African suppliers and research institutes collaborate to tailor green fertilizer products for local soil types and cropping systems.

Recent Developments

- In September 2025, Refex Renewables launched Biodhanic, a new line of organic manure. This initiative aims to produce fermented organic manure (FOM), liquid fermented organic manure (LFOM), and other bio-products using nutrient-rich digestate, a byproduct of their existing Compressed Bio-Gas operations, thereby contributing to sustainable agricultural practices.(Source: scanx.trade)

- In October 2025, the agriculture department and local sugar mills launched a project to convert sugarcane trash into organic fertilizer to improve soil health and curb stubble burning. This initiative aims to reduce the need for chemical fertilizers and help tiny organisms in the soil thrive.(Source: www.chinimandi.com)

- In September 2025, Campco is set to begin in-house organic fertiliser production by acquiring 18 acres of land in Hiriyur, Chitradurga. This initiative aims to reduce costs and improve the availability of their current 'Campco Aayush' organic manure brand, which is presently outsourced.(Source: www.indiancooperative.com)

Top Players in the Green Fertilizer Market

- Yara International ASA: Yara is a leading global producer advancing green ammonia-based fertilizers made using renewable energy. The company focuses on reducing carbon emissions from nitrogen fertilizer production and supports low-carbon agriculture through innovative, sustainable nutrient solutions.

- Nutrien Ltd.: Nutrien is expanding its portfolio of environmentally responsible fertilizers, including enhanced-efficiency and reduced-emission nitrogen products. The company emphasises regenerative agriculture, soil-health technologies, and sustainable crop nutrition systems across global markets.

- CF Industries Holdings, Inc.: CF Industries is investing heavily in green ammonia and clean hydrogen to produce next-generation green nitrogen fertilizers. With major decarbonization projects underway, the company aims to supply low-carbon fertilizers for climate-smart farming and industrial uses.

- OCI Global: OCI is developing green ammonia and eco-friendly nitrogen products using renewable power and carbon-capture technologies. Its sustainability-centred fertilizer solutions serve agricultural, transportation, and industrial sectors looking to cut emissions.

- ICL Group Ltd.: ICL offers a range of speciality and sustainable fertilizers, including controlled-release and organic-based nutrient products. The company prioritises soil health, resource efficiency, and green chemistry to support sustainable farming across global markets.

Top Companies in the Green Fertilizer Market

- ICL Group Ltd.

- OCI Global

- CF Industries Holdings, Inc.

- Nutrien Ltd.

- Yara International ASA

- BASF SE

- EuroChem Group

- Mosaic Company

- SABIC

- OCP Group

- Koch Fertiliser

- Tata Chemicals Ltd.

- Coromandel International Ltd.

- Indorama Corporation

- Helm AG

- Haldor Topsoe (green ammonia technology)

- Fertiglobe PLC

Segments Covered

By Product Type

- Green Nitrogen Fertilizers

- Green ammonia

- Green urea

- Low-carbon ammonium nitrate

- Enhanced-Efficiency Fertilizers (EEFs)

- Controlled-release fertilizers

- Slow-release fertilizers

- Urease inhibitor–based fertilizers

- Nitrification inhibitor–based fertilizers

- Bio-Enhanced Chemical Fertilizers

- Microbial-coated fertilizers

- Fertilizers blended with biostimulants

- Bio-augmented nutrient formulations

- Recycled & Circular Nutrient Fertilizers

- Recovered phosphate fertilizers

- Waste-derived nutrient products

- Circular economy-based fertilizers

By Nutrient Type

- Nitrogen-Based

- Phosphorus-Based

- Potassium-Based

- Multi-Nutrient & Customized Blends

By Application

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Commercial & Plantation Crops

- Turf, Ornamentals & Landscaping

- Greenhouse & Protected Cultivation

By Farming Practice

- Conventional Agriculture (Low-Carbon Transition)

- Sustainable & Climate-Smart Farming

- Organic & Regenerative Agriculture

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa