Content

What is the Current Organic Fertilizers Market Size and Share?

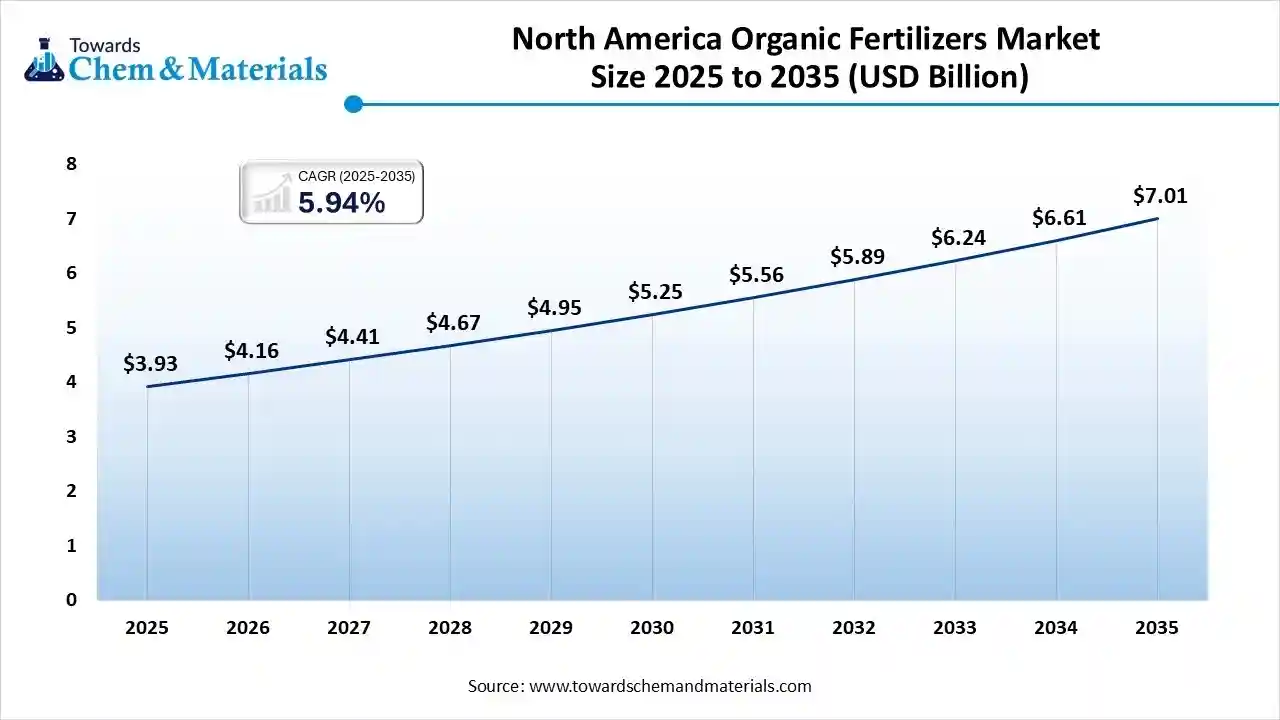

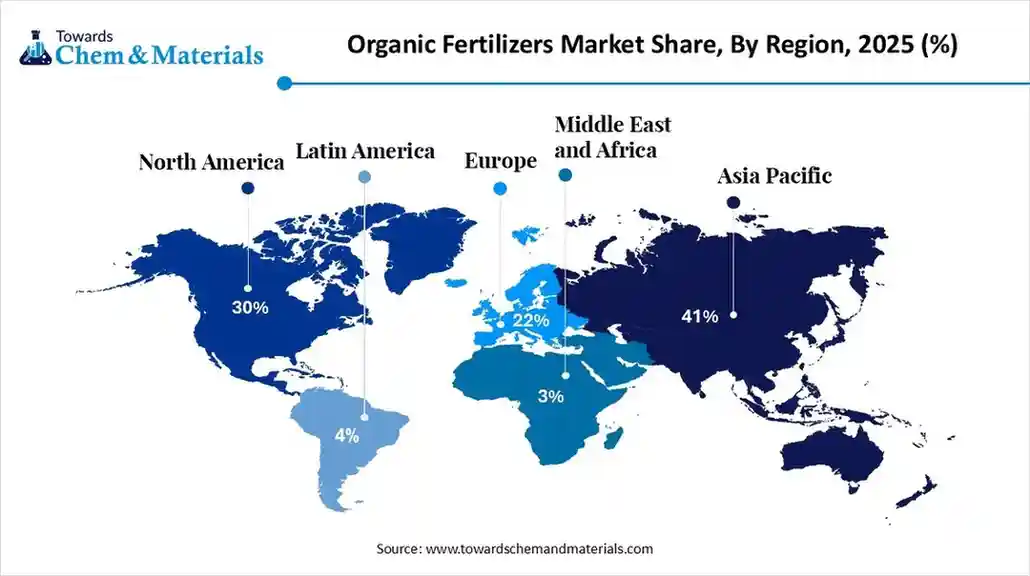

The global organic fertilizers market size is calculated at USD 13.1 billion in 2025 and is predicted to increase from USD 13.88 billion in 2026 and is projected to reach around USD 23.35 billion by 2035, The market is expanding at a CAGR of 5.95% between 2026 and 2035. North America dominated the organic fertilizers market with a market share of 5.94% the global market in 2025.The growing demand for organic food and focus on improving soil health drive the market growth.

Key Takeaways

- By region, North America led the organic fertilizers market with the largest revenue share of over 5.94% in 2025.

- By source, the animal-based organic fertilizers segment led the market with the largest revenue share of 46% in 2025.

- By form, the dry organic fertilizers segment led the market with the largest revenue share of 62% in 2025.

- By application, the cereals & grains segment accounted for the largest revenue share of 39% in 2025.

What are the Growth Factors for the Organic Fertilizers Market?

The organic fertilizers market growth is driven by a shift towards sustainably grown foods, increasing awareness about the impact of chemical fertilizers, stringent regulations on synthetic fertilizers, the development of customized organic fertilizers, focus on enhancing soil health, and the expansion of organic farming practices.

The growing expansion of sustainable and regenerative agriculture practices increases the adoption of organic fertilizers. The shift towards precision agriculture increases demand for organic fertilizers.

What are Organic Fertilizers?

Organic fertilizers are fertilizers made up of natural sources like animal, plant-based, and others to enhance plant growth. The types of organic fertilizers are animal-based, plant-based, and mineral. The animal-based organic fertilizer includes blood meal, fish meal, shellfish, bone meal, animal manure, & fish emulsion, and plant-based organic fertilizers include seaweed extracts, alfalfa meal, compost, soybean meal, & cottonseed meal. The mineral organic fertilizers include rock phosphate and greensand.

Organic fertilizers are widely used in tomatoes, cucumbers, strawberries, citrus fruits, cannabis, grass, lettuce, flowers, and others. Organic fertilizers offer benefits like minimizing the risk of overfertilization, enhancing soil health, and providing long-term fertility.

Organic Fertilizers Market Trends:

- Focus on Sustainable Practices: The rapid expansion of sustainable agricultural practices and increasing awareness about the impact of synthetic fertilizers on the environment increase the adoption of organic fertilizers.

- Strong Emphasis on Soil Health: The strong emphasis of farmers on enhancing soil microbial activity, quality, and structure and development of resilient soil ecosystem increases demand for organic fertilizers.

- Growing Organic Food Demand: The growing health concerns and increasing consumer awareness about the benefits of consumption of organic food increase demand for organic fertilizers. The increasing production of chemical-free crops requires organic fertilizers.

- Rise in Organic Farming: The growing rate of organic farming in regions like the United States, India, and Europe increases demand for organic fertilizers. The strong government support for organic farming and increased consumption of organic food requires organic fertilizers.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 13.88 Billion |

| Revenue Forecast in 2035 | USD 23.35 Billion |

| Growth Rate | CAGR 5.95% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments covered | By Source, By Form, By Region |

| Key companies profiled | Hello Nature (Italpollina), Yara International ASA, The Scotts Miracle-Gro Company, Darling Ingredients Inc. (NatureSafe), T. Stanes & Company Ltd. ,Fertoz Ltd., Lallemand Plant Care, Biolchim S.p.A., ICL Group Ltd., True Organic Products Inc., Queensland Organics, Sigma AgriScience, California Organic Fertilizers Inc., BioStar Organics, National Fertilizers Limited (Organic Portfolio), Perfect Blend LLC |

Key Technological Shifts in the Organic Fertilizers Market:

The organic fertilizers market is undergoing key technological shifts driven by the demand for precision application, performance efficiency, sustainability, and improving soil health. The technological innovations like drones, IoT, data analytics, robotics, catalytic technologies, and GPS develop new processing methods and enhance supply chain traceability. One of the major shifts is the integration of artificial intelligence (AI) helps farmers, enhances sustainability, and increases crop yields.

AI analyzes real-time soil health and recommends application timing, ideal blend, & quantity for diverse crops. AI analyzes crop health, soil conditions, and weather patterns. AI monitors microbial activity and accelerates the development of microbial & bio-based fertilizers. AI accurately detects diseases & pests and minimizes post-harvest losses. AI performs tasks like harvesting, planting, and weeding. AI enhances traceability, predicts harvest time, and optimizes logistics. Overall, AI helps the scalable production of organic fertilizers and reduces environmental impact.

Trade Analysis of Organic Fertilizers Market: Import & Export Statistics

- Japan exported 7,436 shipments of organic fertilizer.

- The Netherlands exported $174M of animal or vegetable fertilizers in 2023.

- France imported $106M of animal or vegetable fertilizers in 2023.

- China exported 77 Shipments of organic granular fertilizer.

- China exported 5,031 shipments of compost.

Organic Fertilizers Market Value Chain Analysis

- Feedstock Procurement: Feedstock procurement is the sourcing of raw materials like animal manures, seaweed, household food waste, biochar, crop residues, dedicated energy crops, garden debris, press mud, and other plant-based materials.

- Key Players:- The Scotts Company LLC, ICL Group Ltd, Darling Ingredients, Italpollina S.p.A., Coromondel International Limited

- Chemical Synthesis and Processing: The chemical synthesis and processing involve steps like the collection of raw materials, preparation, mixing, decomposition or fermentation, curing, and post-processing.

- Key Players:- Biolchim Spa, Cropmate Fertilizers Sdn Bhd, NatureSafe, Amruth Organic Fertilizers, Rizobacter Argentina S.A.

- Quality Testing and Certifications: The quality testing involves evaluating properties like synthetic adulteration, organic mattermoisture content, , macronutrients, particle size & solubility, pH, and certifications like PGS, Ecocert, NPOP, & National Organic Program.

- Key Players:- ECOCERT India, INDOCERT, IFOAM, NPOP, USDA NOP, RCONF

Green Giants: Country-Level Analysis of Organic Fertilizers

| Country | Government Policies | Primary Organic Fertilizer Produces | Company Present |

| India |

|

|

|

| China |

|

|

|

| Germany |

|

Animal Manure |

|

| United States |

|

|

|

Segmental Insights

Source Insights

Why the Animal-Based Organic Fertilizers Segment Dominates the Organic Fertilizers Market?

The animal-based organic fertilizers segment dominated the organic fertilizers market with a 46% share in 2025. The growing demand for macronutrients like phosphorus and nitrogen in agricultural practices increases demand for fertilizers made up of animal-based products like fish emulsion, blood meal, & bone meal. The strong focus on correcting soil deficiencies and promoting the growth of plants requires animal-based organic fertilizers. The availability of raw materials like animal blood, feathers, & bones increases production of animal-based organic fertilizers, driving the overall market growth.

The microbial or biofertilizers segment is the fastest-growing in the market during the forecast period. The strong focus on lowering chemical usage in agriculture and increasing the fertility of soil increases demand for microbial or biofertilizers. The increasing need to produce plant growth-promoting hormones and focus on higher crop yield increases the adoption of microbial or biofertilizers. The cost-effectiveness and sustainability of microbial or biofertilizers support the market growth.

The plant-based organic fertilizers segment is growing significantly in the market. The growing awareness of synthetic fertilizer environmental impact and increasing concern about soil health increases demand for plant-based organic fertilizers. The strong government support for sustainable agriculture and increased cultivation of high-value crops like vegetables & fruits increases the adoption of plant-based organic fertilizer. The improved nutrient absorption, cost-effectiveness, and easy availability of plant-based organic fertilizers support the overall market growth.

Form Insights

How did the Dry Segment hold the Largest Share of the Organic Fertilizers Market?

The dry organic fertilizers segment held the largest revenue share of 62% in the organic fertilizers market in 2025. The longer shelf life, flexible application, and ease of handling of the dry form help market growth. The growing production of cereal & grains like maize, rice, and wheat increases the adoption of the dry form. The cost-effectiveness, ease of storage, and compatibility with equipment like broadcast spreaders drive the overall market growth.

The liquid organic fertilizers segment is experiencing the fastest growth in the market during the forecast period. The strong focus on faster nutrient absorption and growing adoption of precision agriculture increases demand for the liquid form. The shift towards sustainable farming practices and a focus on enhancing soil health increases demand for the liquid form. The growing controlled-environment farming, like vertical & greenhouse farms, requires a liquid form. The longer shelf life, ease of use, and ease of application of the liquid form support the overall market growth.

Application Insights

Which Application Dominated the Organic Fertilizers Market?

The cereals & grains segment dominated the organic fertilizers market with a 39% share in 2025. The growing cultivation of cereals like maize, wheat, and rice helps market growth. The increasing global population and rising demand for staple foods increase the adoption of cereals & grains. The growing health consciousness among consumers and a strong focus on essential calories & nutrients increase the consumption of cereals & grains, driving the overall market growth.

The fruits & vegetables segment is the fastest-growing in the market during the forecast period. The growing demand for food containing more minerals, antioxidants, and vitamins increases demand for fruits & vegetables. The growth in health-conscious consumers and changing dietary habits increases demand for fruits & vegetables. The strong government support to produce fruits & vegetables and consumer focus on higher nutrition support the overall market growth.

The oilseeds & pulses segment is significantly growing in the market. The growing consumer demand for organic food products and the shift towards plant-based protein increase the consumption of oilseeds & pulses. The increased veganism culture and strong focus on food security increase demand for oilseeds & pulses. The consumer focus on a balanced diet and increased health consciousness increases the adoption of oilseeds & pulses, supporting the overall market growth.

Regional Insights

The North America organic fertilizers market size was valued at USD 3.93 billion in 2025 and is expected to reach USD 7.01 billion by 2035, growing at a CAGR of 5.94% from 2026 to 2035. North America expects the fastest growth during the forecast period. The growing health-conscious consumers and the shift towards sustainable agricultural practices increase demand for organic fertilizers. The increasing awareness about synthetic fertilizer farms and strong government support for eco-friendly agriculture practices increases the adoption of organic fertilizers. The growing purchase of organic food and innovations like biostimulants & microbial blends & precision-based organics drive the overall market growth.

Asia Pacific dominated the market with a 41% share in 2025. The well-established agricultural base in countries like Indonesia, China, and India increases demand for organic fertilizers. The strong government support for sustainable agriculture practices and focus on minimizing the environmental impact increases the adoption of organic fertilizers. The increasing awareness about the health benefits of organic food and the increasing use of manure-based fertilizers drive the overall market growth.

Growing Green: India Drives the Organic Fertilizers Movement

India is a key contributor to the market. The well-established agricultural base and increased cultivation of row crops like maize, rice, & wheat increase demand for organic fertilizers. The growing soil degradation issues and adoption of sustainable farming practices increase demand for organic fertilizers. The rising agricultural activities in states like Punjab, Uttar Pradesh, and Maharashtra, and the increasing production of organic fertilizers by farmer on their own farms support the overall market growth.

- India exported 1,369 shipments of organic fertilizer. (Source: www.volza.com)

From Farm to Future: United States Role in Organic Fertilizer Solution

The United States dominates the market. The shift towards sustainable farming practices and stricter regulations on synthetic fertilizers increases the production of organic fertilizers. The increasing consumption of organic food products and increasing awareness about environmental issues increase demand for organic fertilizers. The rise in popularity of home gardening and the increasing adoption of regenerative agriculture practices increase demand for organic fertilizers, supporting the overall market growth.

Europe expects the significant growth in the market. The increased adoption of sustainable farming practices through policies like the Farm to Fork strategy and focus on enhancing soil health increases demand for organic fertilizers. The stricter regulations on synthetic fertilizers and growing cultivation of organic crops increase demand for organic fertilizers. The increasing number of organic farms and increased spending on organic foods in countries like France & Germany increases the adoption of organic fertilizers, driving the overall market growth.

Sowing Sustainability: How Germany is Shaping Organic Fertilizers Growth

Germany is growing substantially in the market. The strong government support for organic farming through policies like the Nitrate Directive and the Organic Farming Regulation increases demand for organic fertilizer. The rise in consumption of organic food and increased awareness about chemical fertilizers negative impact increases the adoption of organic fertilizers. The growing adoption of precision farming and focus on improving soil fertility requires organic fertilizers, supporting the overall market growth.

The Middle East & Africa are growing in the market. The shift towards sustainable agriculture methods and the expansion of organic farming land increases demand for organic fertilizers. The availability of feedstocks like manure, animal waste, and plant debris increases the production of organic fertilizers. The strong focus on minimizing environmental impact and increasing health consciousness among consumers increases the adoption of organic fertilizers. The increasing investment in advanced fertigation systems and controlled-environment agriculture increases demand for organic farming, supporting the overall market growth.

South Africa Organic Fertilizers Trends

South Africa is growing notably in the market. The growing soil issues like degradation & acidification, and increasing farmer awareness about sustainable agriculture benefits, increase demand for organic fertilizers. The strong focus on ensuring food security and strong government support for sustainable farming increases the adoption of organic fertilizers. The rapid growth in global and local organic fertilizers manufacturing players supports the overall market growth.

South America is growing significantly in the market. The increased consumption of organic food products and a strong push for organic farming methods increase demand for organic fertilizers. The growing issues like nutrient depletion and soil degradation require organic fertilizers. The growing cost of chemical fertilizers increases the adoption of organic fertilizers. The large agricultural base in Brazil and the rise in the number of organic farms in Argentina increase demand for organic fertilizers, driving overall market growth.

Brazil Organic Fertilizers Trends

Brazil is growing substantially in the market. The growing sustainable agriculture practices and strong consumer preference for organic food products increase demand for organic fertilizers. The rising expansion of agricultural landscapes and increased production of soybeans increases demand for organic fertilizers.

Recent Developments

- In April 2025, Kyrgyzstan and Korea launch the Kyrgyz-Korean enterprise for the organic fertilizer production, K-Agro. The initiative supports sustainable agriculture practices and the healthy development of plants.(Source: 24.kg/english)

- In May 2025, DEI Organics International Ltd launched a new organic fertilizer, Organic New Earth, for farmers in Uganda. The fertilizer is made up of green waste like wood shavings, plant husks, & wood chips, and raw chicken manure. The fertilizer is environmentally safe and enhances crop yields. (Source: observer.ug)

- In September 2025, the Kumbalangi panchayat launched organic fertilizer, Kumbos. The fertilizer is made up of Thumboormuzhi-model organic waste, and currently, six units are operational in the panchayat. (Source: timesofindia.indiatimes.com)

Top Companies List

- The Scotts Miracle-Gro Company:- The American company distributes garden and lawn care products like grass seeds, weed control, fertilizers, & pest control, and focuses on environmental improvement.

- Yara International ASA:- The Norwegian-based company manufactures fertilizers like compound fertilizers, urea, and calcium ammonium to enhance crop yields and supports sustainability.

- Hello Nature (Italpollina):- The company is the leading producer of sustainable agriculture solutions like beneficial microorganisms, organic fertilizers such as Guanito, and plant-based biostimulants to support sustainable crop production.

Top Companies in the Organic Fertilizers Market

- The Scotts Miracle-Gro Company

- Yara International ASA

- Hello Nature (Italpollina)

- Darling Ingredients Inc. (NatureSafe)

- T. Stanes & Company Ltd.

- Fertoz Ltd.

- Lallemand Plant Care

- Biolchim S.p.A.

- ICL Group Ltd.

- True Organic Products Inc.

- Queensland Organics

- Sigma AgriScience

- California Organic Fertilizers Inc.

- BioStar Organics

- National Fertilizers Limited (Organic Portfolio)

- Perfect Blend LLC

Segments Covered

By Source

- Plant-Based Organic Fertilizers

- Compost & green manure

- Oilseed cakes (neem, castor, groundnut)

- Crop residues & plant-based compost

- Seaweed & algae-based fertilizers

- Animal-Based Organic Fertilizers

- Animal manure & composted manure

- Poultry litter

- Blood meal

- Bone meal

- Fish-based fertilizers

- Other animal by-products (feather meal, meat & bone meal)

- Mineral & Organic-Mineral Fertilizers

- Rock phosphate

- Natural potash & sulfate of potash

- Other organo-mineral blends

- Microbial / Biofertilizers

- Nitrogen-fixing biofertilizers

- Phosphate- and potassium-solubilizing microbes

- Mycorrhizal fungi

- Other microbial consortia

By Form

- Dry Organic Fertilizers

- Granular

- Pelleted

- Powdered

- Liquid Organic Fertilizers

- Liquid concentrates

- Foliar-applied formulations

- Soluble organic nutrient blends

By Application

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Commercial & Plantation Crops

- Sugarcane

- Cotton

- Coffee, tea, cocoa, rubber

- Turf, Ornamentals & Landscaping

- Other Applications

- Fodder crops

- Greenhouse & protected cultivation

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa