Content

What is the Current Liquid Fertilizers Market Size and Share?

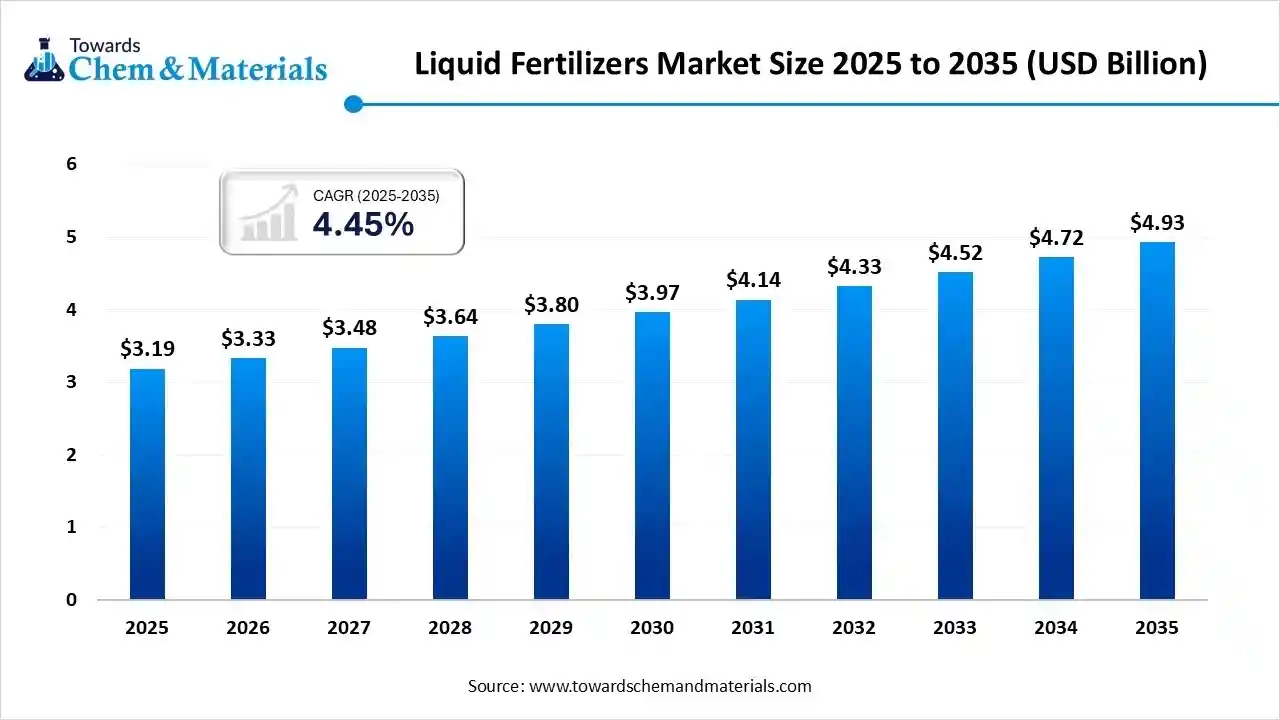

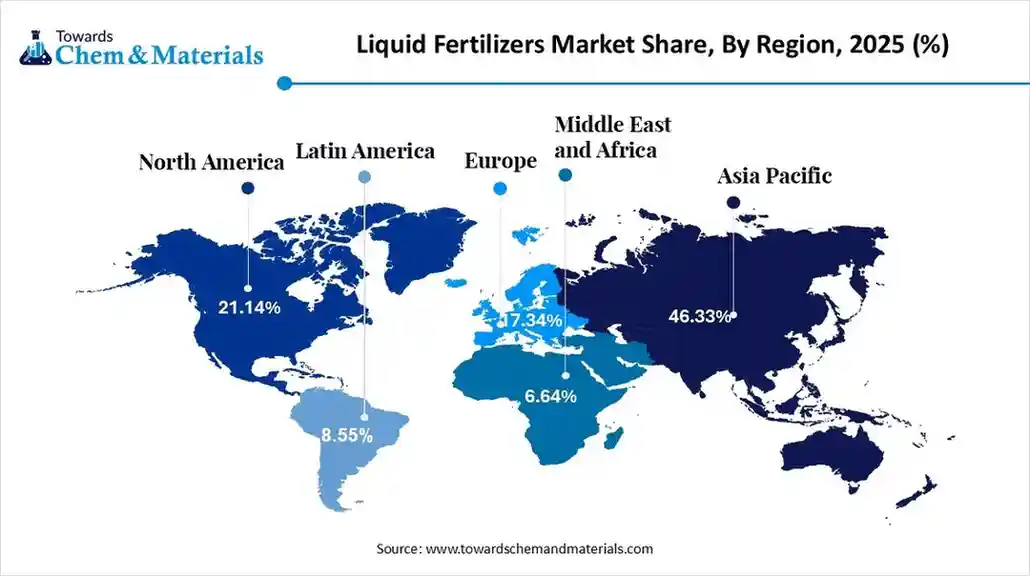

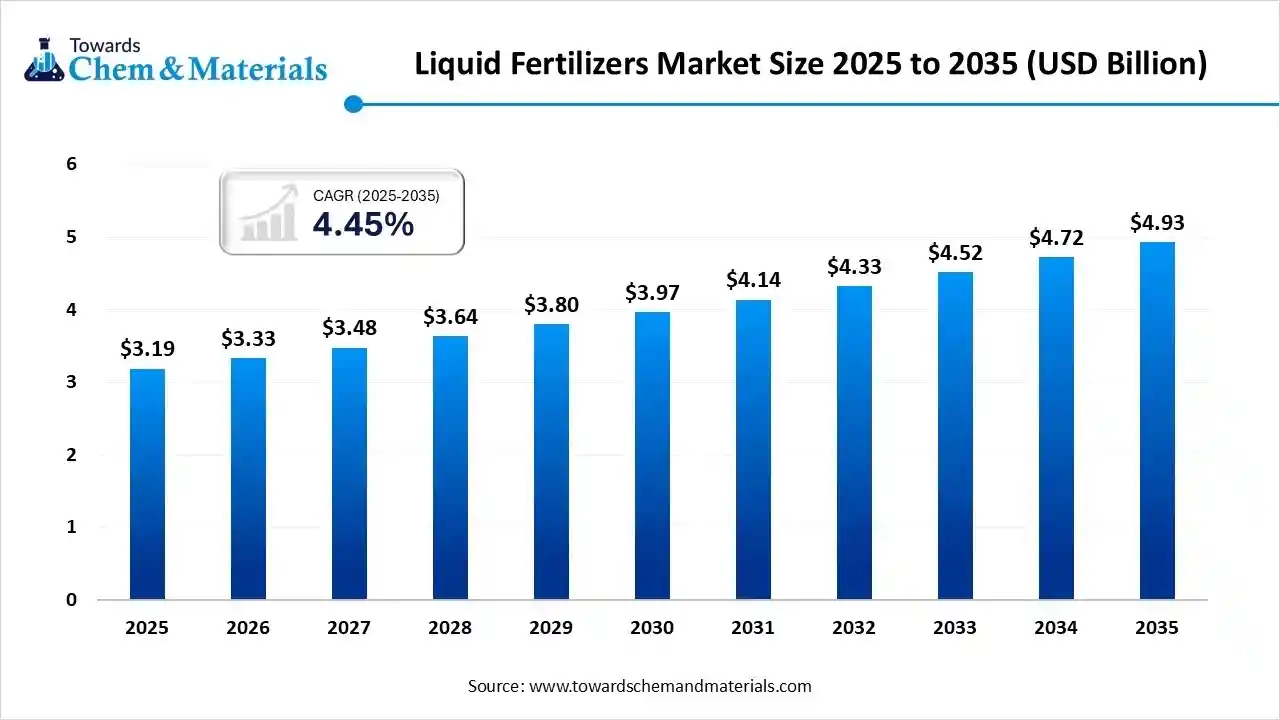

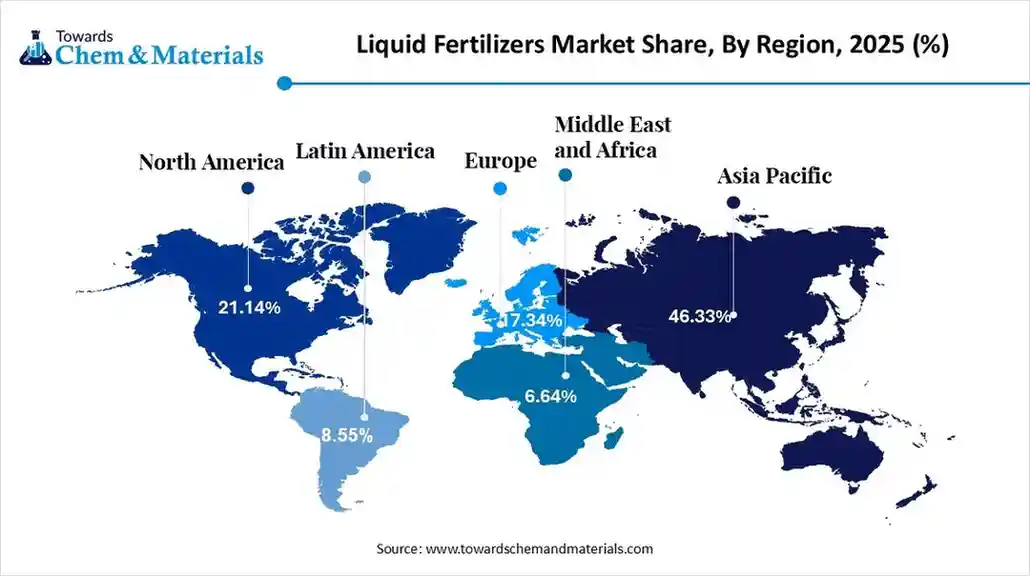

The global liquid fertilizers market size was estimated at USD 3.19 billion in 2025 and is predicted to increase from USD 3.33 billion in 2026 and is projected to reach around USD 4.93 billion by 2035, The market is expanding at a CAGR of 4.45% between 2026 and 2035. Asia Pacific dominated the liquid fertilizers market with a market share of 46.33% the global market in 2025. Also, a surge in consumer preference for nutrient-rich and organic food, coupled with the advancements in liquid fertilizer formulations, can fuel market growth further.

Key Takeaways

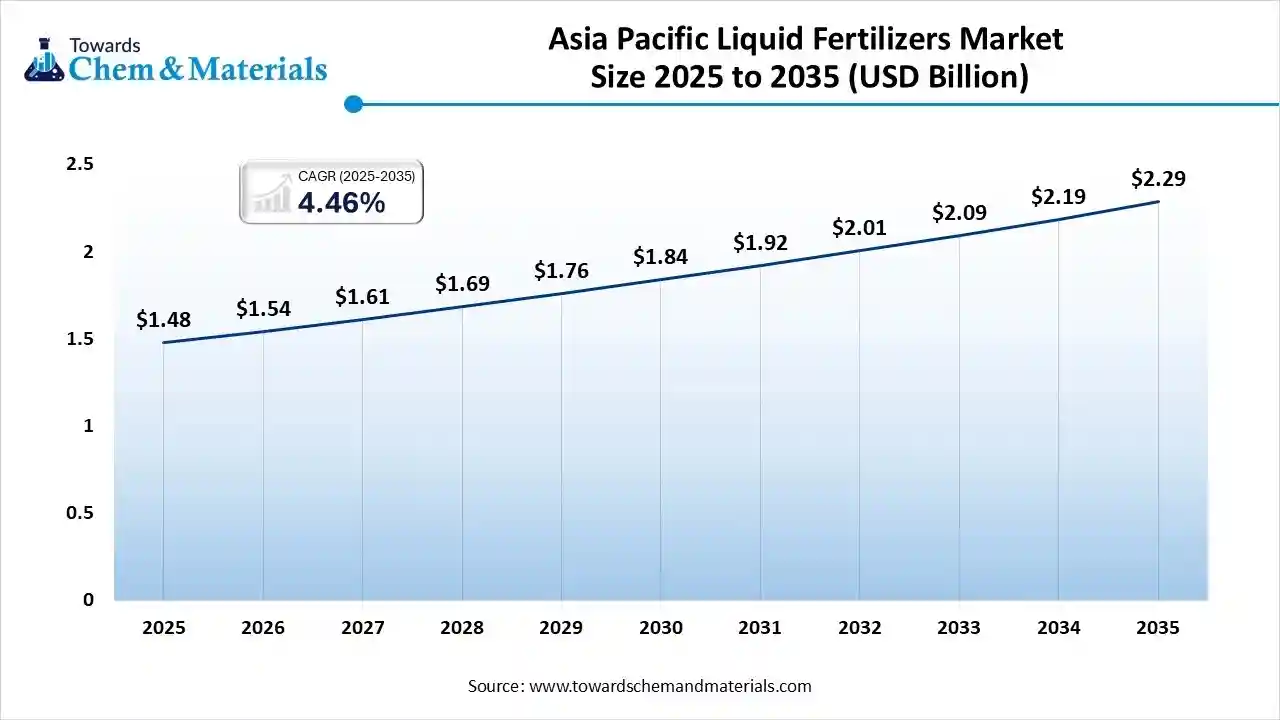

- By region, the Asia Pacific led the liquid fertilizers market with with the largest revenue share of over 46.33% in 2025.

- By product type, the liquid nitrogen fertilizers segment led the market with the largest revenue share of 56.12% in 2025.

- By grade, the straight fertilizers segment led the market with the largest revenue share of 60.53% in 2025.

- By nature, the inorganic liquid fertilizers segment accounted for the largest revenue share of 91.12% in 2025.

- By application method, the fertigation segment dominated with the largest revenue share of 46.11% in 2025.

- By crop type, the field crops segment dominated the market and accounted for the largest revenue share of 61.33% in 2025.

What are Liquid Fertilizers?

A surge in the global population is increasing the need for food, necessitating farmers to find efficient ways to increase crop yields. Liquid fertilizers are nutrient-rich solutions, suspensions, or emulsions containing essential plant nutrients (primary, secondary, and micronutrients) that are dissolved or suspended in water.

Liquid Fertilizers Market Trends

- The ongoing trend towards precision farming is the major factor driving market growth. This trend is expanding and evolving with technological innovations such as autonomous vehicles, sensors, and analysis tools. Precision technologies are being extensively used by farmers across the globe.

- The growing demand for high-quality crops is another major trend in the market. These fertilizers offer plants a readily available and balanced nutrient supply, which leads to enhanced crop quality and overall nutritional content.

- Rapid innovations in product formulations include the development of controlled-release liquid fertilizers and nano-fertilizers created for improved nutrient uptake and less environmental impact.

- There is an increasing demand for bio-based and organic liquid fertilizers, boosted by stringent regulations on chemical use, environmental consciousness, and consumer inclination towards sustainably produced food, impacting positive market expansion.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 3.33 Billion |

| Revenue Forecast in 2035 | USD 4.93 Billion |

| Growth Rate | CAGR 4.45% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Product Type, By Grade, By Nature, By Application Method, By Crop Type, By Region |

| Key companies profiled | EuroChem Group AG, Sociedad Química y Minera de Chile S.A. (SQM), Indian Farmers Fertiliser Cooperative Limited (IFFCO), K+S AG, Grupa Azoty S.A., Tessenderlo Kerley, Inc. (Part of Tessenderlo Group), Coromandel International Limited, Koch Industries (Koch Fertilizer, LLC), Compo Expert GmbH, Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL), AgroLiquid, Kugler Company, Simplot Grower Solutions (J.R. Simplot Company), Sichuan Guangyi Fertilizer Co., Ltd. |

How Cutting Edge Technologies are Revolutionizing the Liquid Fertilizers Market?

The advanced technologies are transforming the market by enabling precision agriculture through drones, AI, and sensors, which allow for reduced waste and targeted application. Furthermore, advancements such as nano-fertilizers and smart fertilizers enhanced nutrient efficiency and delivery, which automation in processing also fuels efficiency and quality control.

Trade Analysis of Liquid Fertilizers Market

- In April 2025 alone, 1 Organic Liquid Fertilizer export shipment was recorded from worldwide locations to the United States. This figure indicates a 1% year-on-year growth compared to April 2024 data yet simultaneously represents a significant -50% sequential decrease from the volume of shipments made in March 2025.

- In 2024, China's exports of fertilizers amounted to US$8.5 billion, according to data from the United Nations COMTRADE database on international trade.

- In April 2025, India made 4 export shipments of Organic Liquid Fertilizer. This volume represents no year-over-year change when compared to April 2024 but marks a -60% sequential decrease from the shipments made in March 2025.

Liquid Fertilizers Market Value Chain Analysis

- Feedstock Procurement : It is the strategic process of sourcing and acquiring the necessary raw materials needed for production. This process is required for managing manufacturing costs, ensuring a stable supply, and maintaining product sustainability and quality.

- Major Players: Yara International ASA, Nutrien Ltd.

- Chemical Synthesis and Processing : It is the industrial processes used to synthetically create the necessary nutrient compound that are then dissolved to form liquid formulations.

- Major Players: CF Industries Holdings, Inc., The Mosaic Company

- Packaging and Labelling: It is a crucial stage that ensures product safety, integrity, and regulatory compliance. This involves using specific container types and applying mandatory and detailed information to protect the supply chain.

- Major Players: Greif, Mauser Packaging Solutions.

- Regulatory Compliance and Safety Monitoring : This stage involves adhering to laws and regulations that govern the production, quality control, distribution, and proper labeling of these products.

- Major Players: Haifa Group, AgroLiquid

Liquid Fertilizers Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| European Union (EU) | The EU operates under a harmonized system for products that are CE-marked, governed primarily by Regulation (EU) 2019/1009, also known as the Fertilising Products Regulation (FPR). |

| United States (US) | Each state has its own fertilizer laws and regulations that largely follow the Association of American Plant Food Control Officials AAPFCO Model State Fertilizer Bill and Regulations. |

| India | India's liquid fertilizers market is regulated under the Fertilizer Control Order (FCO), 1985, issued under the Essential Commodities Act. |

Segmental Insights

Product Type Insights

How Much Share Did the Liquid Nitrogen Fertilizers Segment Held in 2025?

By product type, the liquid nitrogen fertilizers segment led the market with the largest revenue share of 56.12% in 2025. The dominance of the segment can be attributed to the demand to increase crop yields to fulfil the surge in global food demand. Farmers heavily depend on liquid nitrogen fertilizers to enhance vegetative growth across various crops.

The liquid micronutrient fertilizers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the ongoing investment in R&D for improved and sustainable liquid fertilizer formulations. Micronutrients are crucial for various plant processes. The liquid phosphatic fertilizers segment held a major market share in 2024. The growth of the segment can be fuelled by the growing demand to increase food production to feed the global population. These fertilizers can be directly applied to plants through foliar sprays or via irrigation systems.

The growth of the liquid potassic fertilizers segment can be boosted by growing emphasis on improving crop quality and stress tolerance, and the growing trend towards sustainable agriculture. This formulation offers rapid nutrient absorption compared to solid fertilizers.

Grade Insights

Which Grade Type Segment Dominated the Liquid Fertilizers Market in 2025?

The straight fertilizers segment held a 60.53% market share in 2025. The dominance of the segment can be linked to its capability to correct single-nutrient deficiencies with surgical accuracy, with the convenience of on-farm blending. These fertilizers are crucial for use in variable-rate systems.

The complex/compound fertilizers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for improved nutrient efficiency, along with the ongoing demand to increase crop yields to feed an escalating global population.

Nature Insights

Which Nature Type Segment Dominated the Liquid Fertilizers Market in 2025?

The inorganic liquid fertilizers segment dominated the market with a 91.12% share in 2025. The dominance of the segment is owed to the surge in modern farming techniques like fertigation and precision agriculture. These fertilizers are more cost-effective than manufacturing organic alternatives.

The organic liquid fertilizers segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to rapid innovations in technology and government support for organic farming. These fertilizers improve soil texture and fertility.

The growth of liquid bio-fertilizers can be fuelled by growing farmer awareness regarding their benefits and their efficiency in nutrient delivery. These fertilizers can be easily applied through an irrigation system, enabling more efficient use of nutrients and water.

Application Method Insights

Which Application Method Segment Dominated the Liquid Fertilizers Market in 2025?

The fertigation segment dominated the market with a 46.11% share in 2025. The dominance of the segment can be attributed to the increasing adoption of modern and efficient irrigation systems coupled with the rising need for high-yield and cost-effective farming methods.

The foliar application segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing need for more targeted and efficient nutrient delivery methods. The soil application segment held a significant market share in 2025. The growth of the segment can be fuelled by increasing emphasis on soil health and sustainable practices, and rapid use of precision farming technologies. Soil-applied liquid fertilizers combined well with advanced agricultural techniques.

Crop Type Insight

How Much Share Did the Field Crops Segment Held in 2025?

The field crops segment held a 61.33% market share in 2025. The dominance of the segment can be linked to the growing demand to fuel agricultural output to feed a surging population across the globe, along with the rapid innovations in farming technologies.

The horticultural crops segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be driven by escalating adoption of precision agriculture techniques that enable targeted nutrient delivery to the high-value crops.

Regional Insights

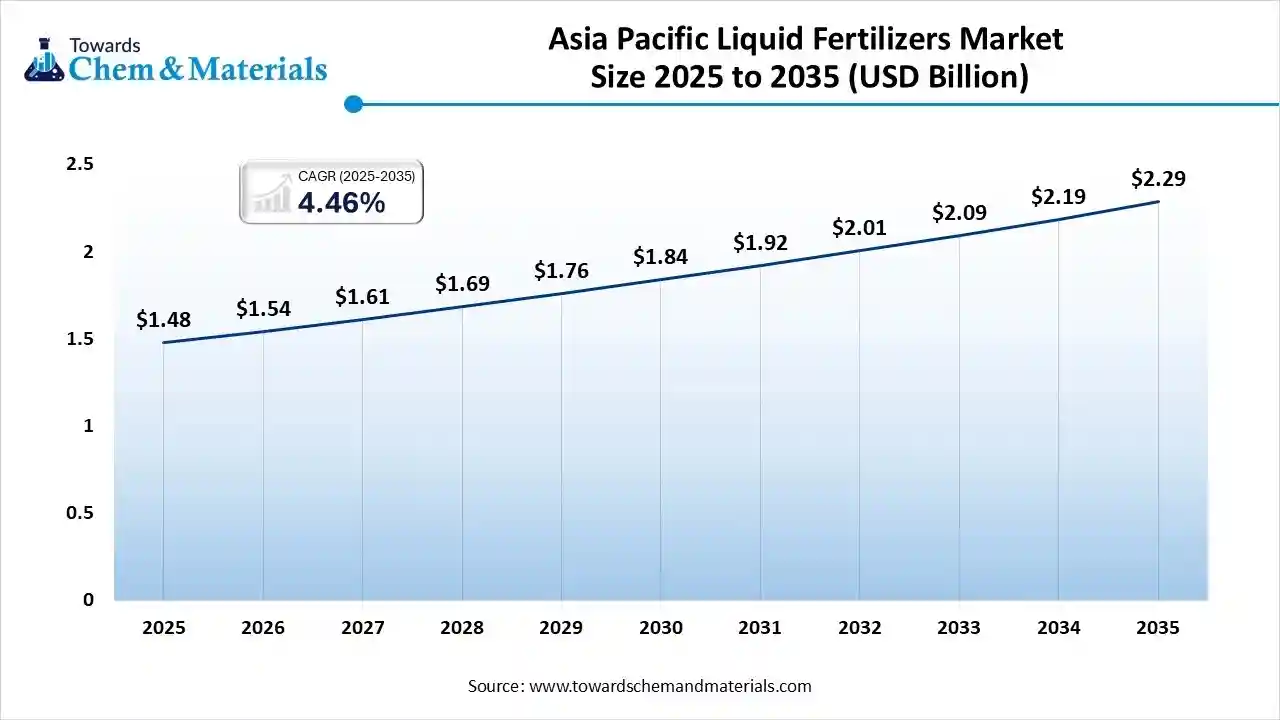

The Asia Pacific liquid fertilizers market size was valued at USD 1.48 billion in 2025 and is expected to reach USD 2.29 billion by 2035, growing at a CAGR of 4.46% from 2026 to 2035. Asia Pacific dominated the market with a 46.33% share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The dominance and growth of the region can be attributed to the ongoing shift toward modern farming practices such as fertigation and agriculture. In addition, governments in the region are increasingly supporting agricultural modernization through various programs and subsidies.

China Liquid Fertilizers Market Trends

In the Asia Pacific, China dominated the market owing to growing investment in bio stimulant-infused liquid fertilizers, which improve soil health and minimize dependence on traditional synthetic inputs. China's large population necessitates high-yielding crops to ensure overall food safety and security.

North America expects the significant growth during the forecast period. The growth of the region can be credited to the increasing interest in organic food and the shift to conventional sustainable farming practices. Government bodies like the U.S. Department of Agriculture (USDA) are promoting the market through various grants and initiatives.

U.S. Liquid Fertilizers Market Trends

In North America, the U.S. led the market due to ongoing R&D activities, which are leading to the creation of more specialized and effective liquid fertilizer products, such as controlled-release and nano-formulations, which reduce environmental impact.

Europe held a significant market share in 2024. The growth of the region can be fuelled by growing demand for higher crop yields to fulfil food security goals and the benefits of liquid fertilizers, such as compatibility with precision farming. The growth of organic farming initiatives is propelling the demand for certified liquid nutrient solutions.

Germany Liquid Fertilizers Market Trends

The growth of the market in Germany can be boosted by increasing domestic food demand, which requires higher agricultural productivity, which liquid fertilizers help to achieve through more effective nutrient delivery. The development of complex nutrient fertilizers allows farmers to address specific nutrient deficiencies in crop quality.

The growth of the market in South America can be propelled by growing demand for sustainable, high-quality food production and a surge in the cultivation of cash crops such as sugarcane and soybeans. Farmers are increasingly seeking better operational efficiency and better crop quality, which makes liquid fertilizers an attractive choice in the region.

Brazil Liquid Fertilizers Market Trends

Brazil held a major market share in 2024. The growth of the country is due to the increasing adoption of precision farming and fertigation, along with the adaptability for specific crops and needs. The development of cutting-edge liquid fertilizers is enhancing efficiency and crop yields.

In the Middle East and Africa (MEA), the liquid fertilizers market is steadily expanding driven by arid climates, water scarcity and growing adoption of precision irrigation and fertigation systems. Liquid formulations dominate the specialty-fertilizer segment (nearly half the revenue share in 2024) because they deliver nutrients efficiently, improve absorption and reduce waste compared to bulk solids. Countries such as Saudi Arabia, Egypt and South Africa lead regional demand, reflecting rising greenhouse farming, large-scale fruit/vegetable production and government-backed agricultural modernization.

Saudi Arabia Liquid Fertilizers Market Trends

In Saudi Arabia, the liquid fertilizer market is growing strongly as the country moves toward more water-efficient, high-tech agriculture. Growth is also supported by government-driven agricultural modernization under Vision 2030, which subsidizes precision irrigation, supports greenhouse and high-value crop cultivation, and favors nutrient solutions optimized for desert soils.

Recent Developments

- In September 2025, Rashtriya Chemicals and Fertilizers introduced a cutting-edge 100 MTPD liquid CO2 plant at the Trombay unit. The plant has a manufacturing capacity of 100 metric tons per day.(Source: scanx.trade)

- In November 2024, National Fertilizers announced the launch of the production of nano liquid urea at its Nangal plant. The nano liquid urea is more effective in terms of nutrient uptake, is sustainable, and releases nitrogen more slowly.(Source: www.business-standard.com)

Liquid Fertilizers Market Companies

- Yara International ASA: Yara International ASA is a key player and innovation leader in the global liquid fertilizers market, known for its extensive range of specialty products and integrated digital solutions. The company focuses heavily on precision agriculture, sustainability, and developing tailored nutrient solutions for various crops.

- Nutrien Ltd.: Nutrien Ltd.: is a major global player and one of the leading companies in the liquid fertilizers market, characterized by its extensive production capacities, global distribution networks, and innovation in crop nutrition solutions.

Top Key players in the Liquid Fertilizers Market

- ICL Group Ltd. (Israel Chemicals)

- Nutrien Ltd.: Nutrien Ltd.

- Yara International ASA

- The Mosaic Company

- CF Industries Holdings, Inc.

- Haifa Group

- EuroChem Group AG

- Sociedad Química y Minera de Chile S.A. (SQM)

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- K+S AG

- Grupa Azoty S.A.

- Tessenderlo Kerley, Inc. (Part of Tessenderlo Group)

- Coromandel International Limited

- Koch Industries (Koch Fertilizer, LLC)

- Compo Expert GmbH

- Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL)

- AgroLiquid

- Kugler Company

- Simplot Grower Solutions (J.R. Simplot Company)

- Sichuan Guangyi Fertilizer Co., Ltd.

Segments Covered in the Report

By Product Type

- Liquid Nitrogen Fertilizers

- Urea Ammonium Nitrate (UAN) Solution

- Calcium Ammonium Nitrate (CAN) Solution

- Ammonium Thiosulfate (ATS)

- Other Liquid Nitrogen Forms

- Liquid Phosphatic Fertilizers

- Ammonium Polyphosphate (APP)

- Liquid Mono-Ammonium Phosphate (MAP)

- Liquid Di-Ammonium Phosphate (DAP)

- Liquid Potassic Fertilizers

- Potassium Thiosulfate (KTS)

- Liquid Potassium Nitrate

- Liquid Potassium Chloride

- Liquid Secondary Macronutrients

- Liquid Sulfur (Thiosulfates)

- Liquid Calcium

- Liquid Magnesium

- Liquid Micronutrient Fertilizers

- Chelated Micronutrients (Fe, Zn, Mn, Cu)

- Non-Chelated Micronutrients

By Grade

- Straight Fertilizers (Single Nutrient Focus)

- Nitrogen-Only (e.g., UAN 32%)

- Phosphate-Only

- Potash-Only

- Complex/Compound Fertilizers

- NPK Formulations (Balanced Macro Nutrients)

- NP/PK/NK Formulations

By Nature

- Synthetic/Inorganic Liquid Fertilizers

- Organic Liquid Fertilizers

- Plant-Based Extracts

- Animal/Fish Emulsions

- Humic and Fulvic Acid Liquids

- Liquid Bio-Fertilizers (Microbial Solutions)

By Application Method

- Fertigation (Application via Irrigation)

- Drip/Micro-Sprinkler Systems

- Center Pivot Systems

- Foliar Application (Direct Spray on Leaves)

- Ground-Based Spraying

- Aerial/Drone Spraying

- Soil Application

- Starter Solutions (In-Furrow)

- Broadcast/Side-Dress/Band Application

By Crop Type

- Field Crops

- Grains and Cereals (Corn, Wheat, Rice)

- Oilseeds & Pulses (Soybeans, Canola)

- Horticultural Crops

- Fruits and Vegetables (High-Value Produce)

- Plantation Crops (Coffee, Tea, Citrus)

- Turf and Ornamentals

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa