Content

What is the Current Thermal Spray Coatings Market Size and Volume?

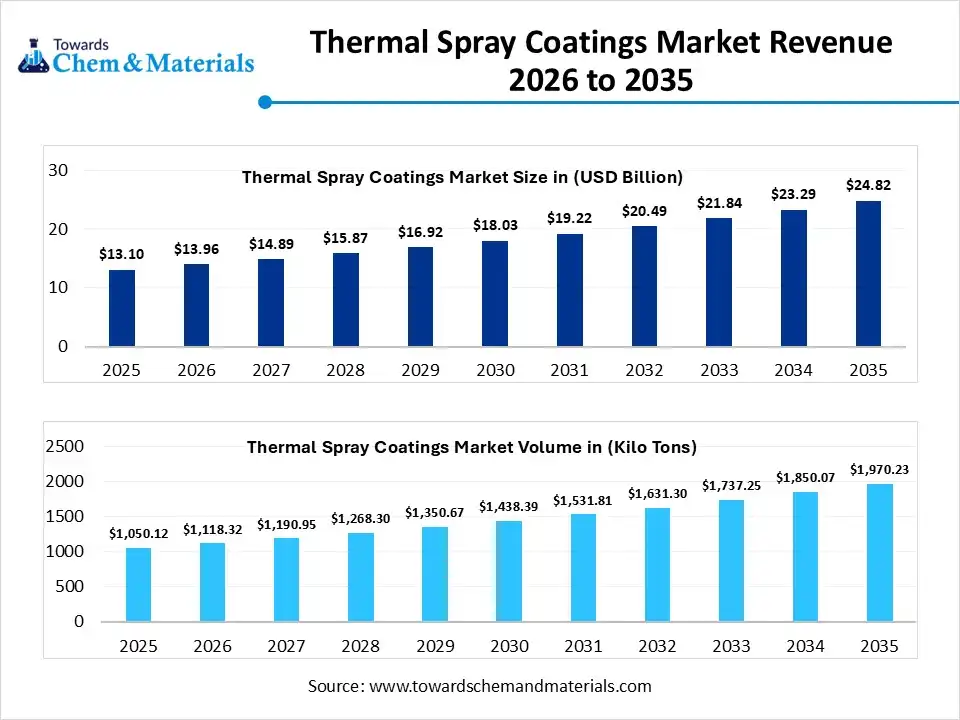

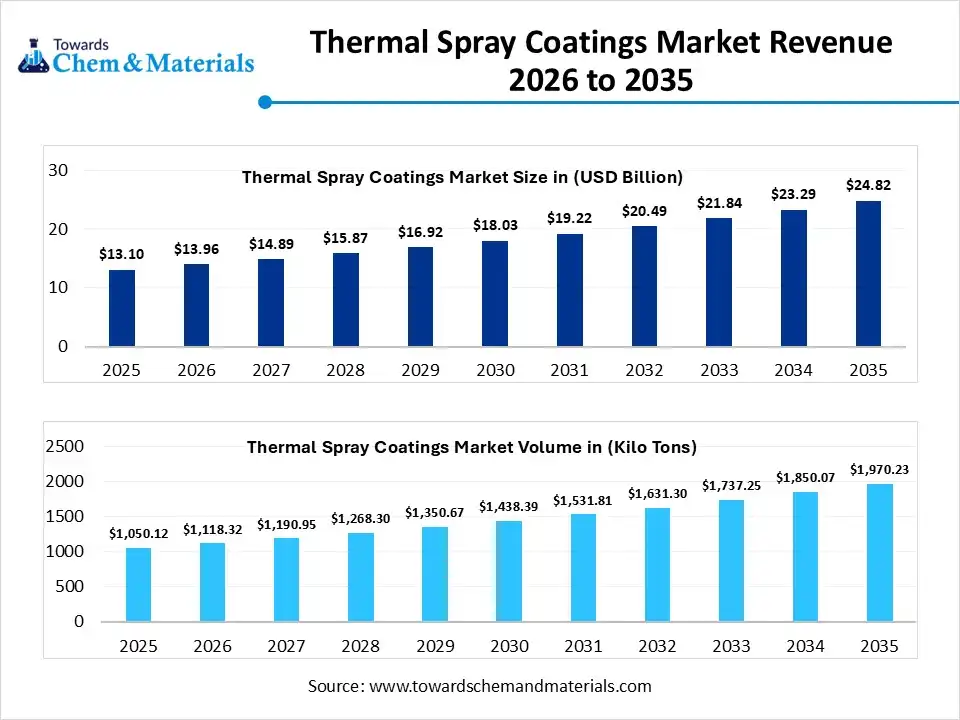

The global thermal spray coatings market size was estimated at USD 13.10 billion in 2025 and is expected to increase from USD 13.96 billion in 2026 to USD 24.82 billion by 2035, growing at a CAGR of 6.6% from 2026 to 2035. In terms of volume, the market is projected to grow from 1,050.12 kilo tons in 2025 to 1,970.23 kilo tons by 2035. growing at a CAGR of 6.49% from 2026 to 2035. Asia Pacific dominated the thermal spray coatings market with the largest volume share of 42% in 2025.The greater shift towards restoration and refurbishment while minimizing extra expense in the heavy manufacturing industry has fueled the industry's growth in recent years.

Market Highlights

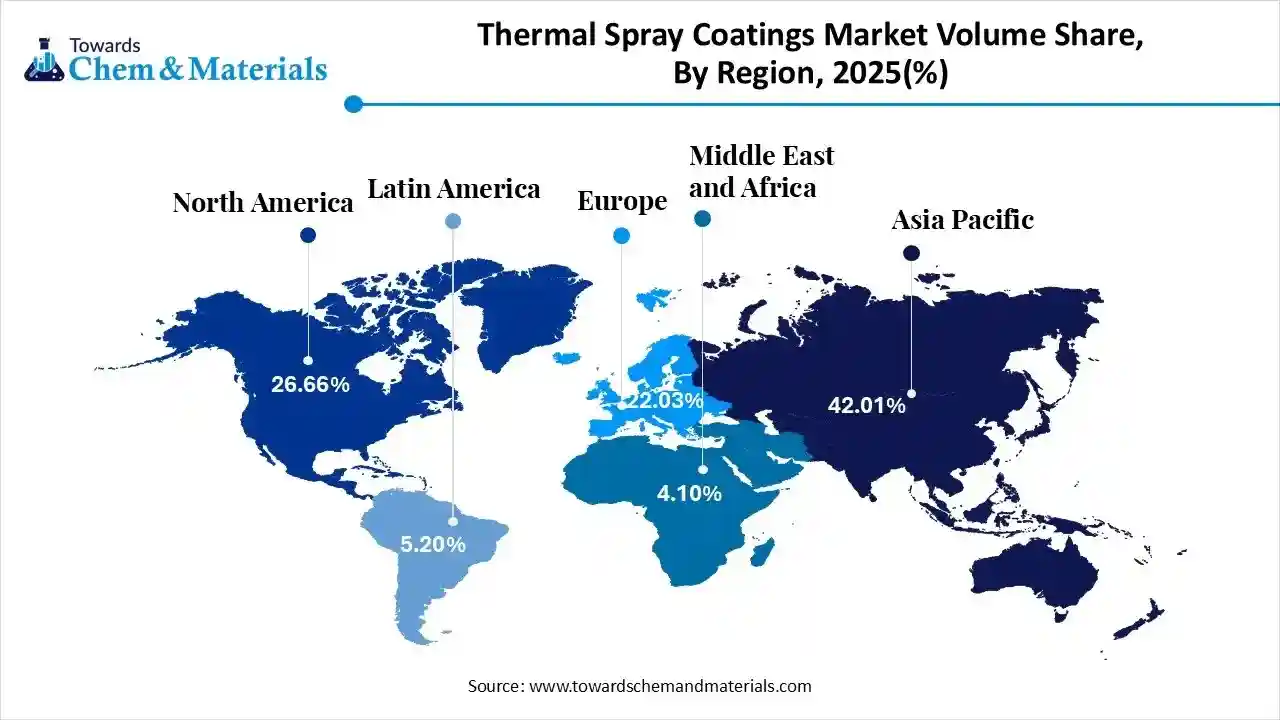

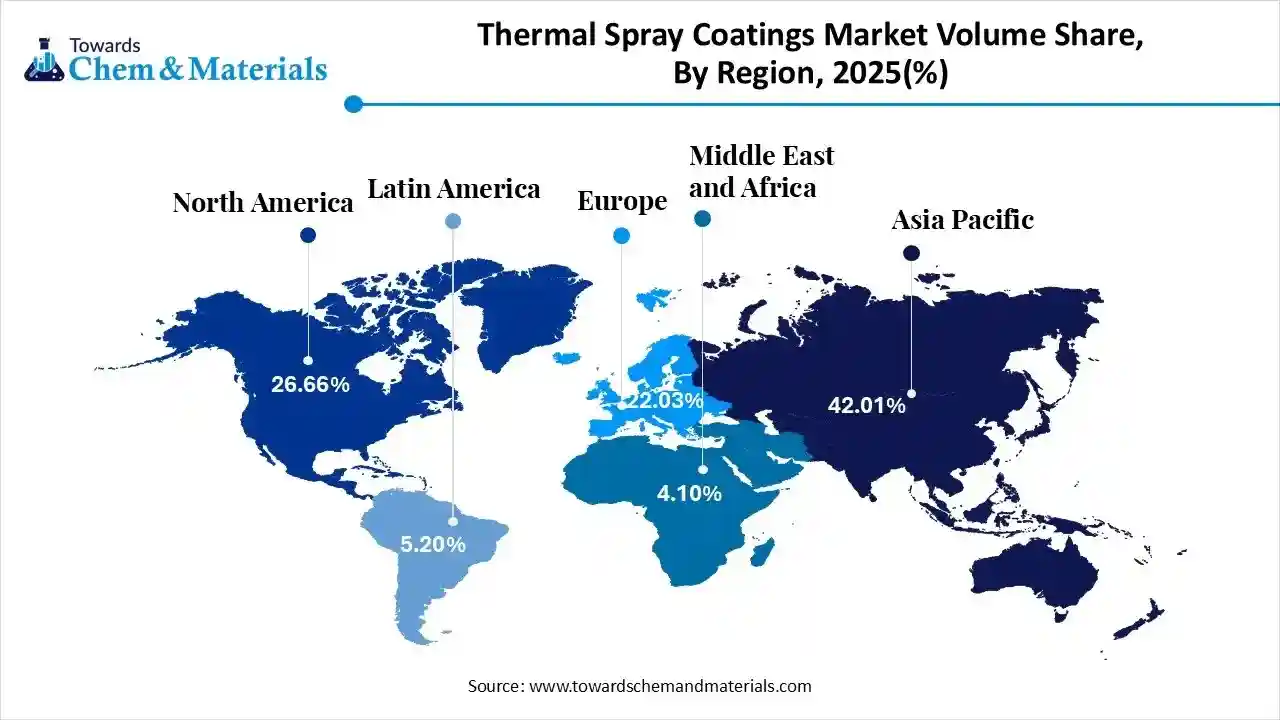

- The Asia Pacific dominated the thermal spray coatings market with the largest volume share of 42.01% in 2025.

- The thermal spray coatings market in North America is expected to grow at a substantial CAGR of 5.02% from 2026 to 2035.

- The Europe thermal spray coatings market segment accounted for the major volume share of 22.03% in 2025.

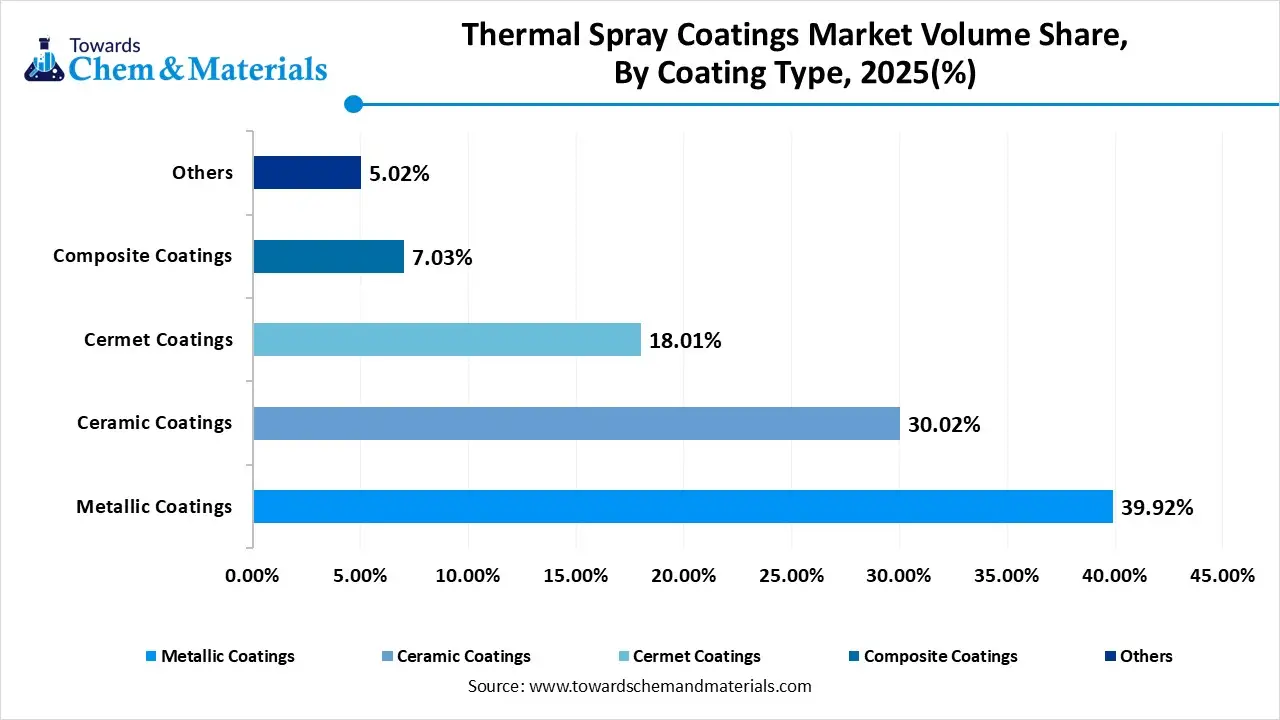

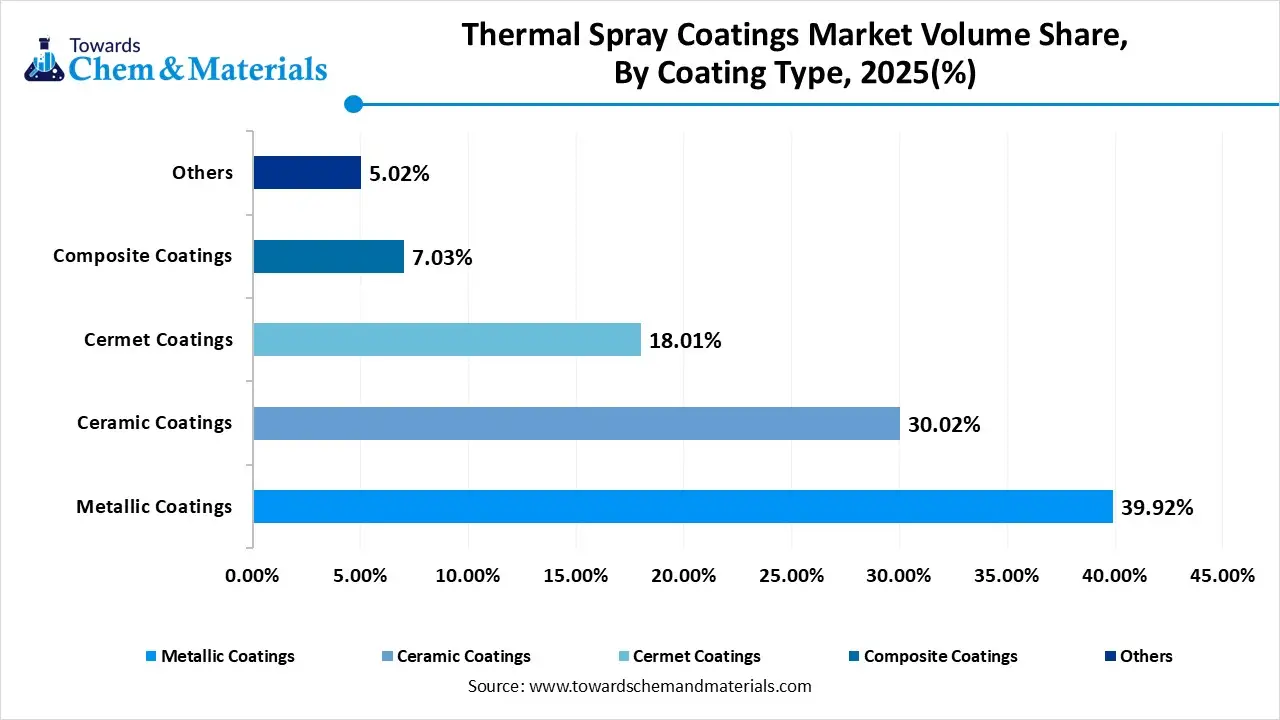

- By coating type, the metallic coatings segment dominated the market and accounted for the largest volume share of 39.92% in 2025.

- By coating type, the ceramic coatings segment is expected to grow at the fastest CAGR of 8.05% from 2026 to 2035 in terms of volume.

- By material type, the nickel and nickel alloys segment led the market with the largest revenue volume share of 28% in 2025.

- By process type, the plasma spray segment dominated the market and accounted for the largest volume share of 35% in 2025.

- By end-use, the aerospace and defence segment led the market with the largest revenue volume share of 30% in 2025.

Thermal Spray Coatings: The Protecting Shield for Modern Industry

The process where the heated materials or melted materials are sprayed from the surface to the top to protect it or improve it is called thermal spray coating. Also, by protecting parts from the heat, wear, damage, and corrosion, the thermal spray coatings have attracted increased capital investment from the major industries in recent years. Moreover, the thermal spray coating is seen as extending the life of expensive equipment in specific sectors, such as the aerospace and automotive sectors, nowadays.

Thermal Spray Coatings Market Trends:

- The greater demand for the refurbishment and repair from heavy manufacturing industries has elevated the earning potential for producers in the past few years. Also, the industries have seen coating-damaged components instead of throwing them away, which supports the minimisation of expense in the industry.

- The shift towards the customised coatings from specific industries is likely to lead to robust revenue growth across the sector during the forecast period. Moreover, major manufacturers are demanding specific coating types for exact conditions such as the friction, extreme heat, and chemicals in the current period.

- The emergence of the extension of equipment life is expected to support stronger cash flow for the thermal spray coatings manufacturing enterprises in the coming years. Also, the sectors like mining, aviation, and power plants are likely to support this trend during the projected time by the adoption of these specialised coatings.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 13.96 Billion / 1118.32 Kilo Tons |

| Revenue Forecast in 2035 | USD 24.82 Billion / 1,970.23 Kilo Tons |

| Growth Rate | CAGR 6.6% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Coating Type , By Material Type, By Process Type, By End-User Industry, By Region |

| Key companies profiled | Oerlikon Metco, Praxair Surface Technologies, Sulzer Metco, H.C. Starck, Kennametal Thermal Spray Materials, Amdry, Zircoa, Metsource, Aubert & Duval, Plasma Biotal Ltd, Ionbond, Bodycote, Sulzer Ltd., Environmental Coating Systems, Thermal Spray Technology Group . |

Digital Precision Powering Next Generation Thermal Spray

The technology shift in the thermal spray coatings market is focused on better control and precision nowadays. Moreover, the modern systems use advanced sensors and digital controls to manage temperature, spray speed, and coating thickness. This improves coating quality and reduces material waste. Automation also reduces dependence on operator skills. These improvements help industries achieve consistent results and meet strict quality standards.

Trade Analysis of the Thermal Spray Coatings Market:

Import, Export, Consumption, and Production Statistics

- China exported 3,508 shipments of coatings paints exports from Juns 2024 to May 2025.

- The United States has exported a heavy amount of spray coatings, and the country records 398 shipments.

Value Chain Analysis of the Thermal Spray Coatings Market:

- Distribution to Industrial Users: The distribution of thermal spray coatings is heavily concentrated in high-performance sectors requiring advanced surface protection.

- Key Players: Oerlikon Metco and Linde PLC / Praxair Surface Technologies

- Chemical Synthesis and Processing: The chemical synthesis and processing are defined by a shift toward advanced material synthesis and precision processing to meet the needs of the aerospace, medical, and energy sectors.

- Key Players: Höganäs AB (Sweden) and H.C. Starck (Germany)

- Regulatory Compliance and Safety Monitoring: The thermal spray coatings industry faces a rigorous regulatory environment focused on limiting exposure to hazardous byproducts and ensuring high performance in safety-critical sectors.

- Safety Standards- OSHA 29 CFR 1910.1026 (Hexavalent Chromium) and EPA NESHAP (National Emission Standards for Hazardous Air Pollutants)

Thermal Spray Coatings Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | OSHA Permissible Exposure Limits (PELs) (29 CFR Part 1910, Subpart Z) | Ensuring high worker safety through effective ventilation and personal protective equipment (PPE) |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC 1907/2006) | Strict control over hazardous substances (e.g., chromium VI) |

| China | Ministry of Emergency Management (MEM) | Law of the People's Republic of China on the Prevention and Control of Occupational Diseases | Enforcing strict worker health and safety regulations |

Segmental Insights

Coating Type Insights

How did the Metallic Coatings Segment Dominate the Thermal Spray Coatings Market in 2025?

The metallic coatings segment volume was valued at 419.21 kilo tons in 2025 and is projected to reach 798.73 kilo tons by 2035, expanding at a CAGR of 7.43% during the forecast period from 2025 to 2035. The metallic coatings segment dominated the market with approximately 39.92% share in 2025, due to factors such as cost-effectiveness, easy application, and versatile industry suitability. Moreover, industry has seen heavy demand for metallic coatings for specific sectors such as power generation, oil and gas, and heavy machinery in recent years.

The ceramic coatings segment volume was valued at 315.25 kilo tons in 2025 and is projected to reach 632.84 kilo tons by 2035, expanding at a CAGR of 8.05% during the forecast period from 2025 to 2035, owing to the increasing need for better insulation and heat resistance. Moreover, by performing extremely well in very high temperatures where the metallic coating can fail, the ceramic coating is likely to gain major industry attention in the coming years.

Thermal Spray Coatings Market Volume and Share, By Coating Type, 2025-2035

| By Coating Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Metallic Coatings | 39.92% | 419.21 | 798.73 | 7.43% | 40.54% |

| Ceramic Coatings | 30.02% | 315.25 | 632.84 | 8.05% | 32.12% |

| Cermet Coatings | 18.01% | 189.13 | 300.07 | 5.26% | 15.23% |

| Composite Coatings | 7.03% | 73.82 | 146.59 | 7.92% | 7.44% |

| Others | 5.02% | 52.72 | 92.01 | 6.38% | 4.67% |

Material Type Insights

How did the Nickel & Nickel Alloys Segment Dominate the Thermal Spray Coatings Market in 2025

The nickel & nickel alloys segment dominated the market with approximately 28% share in 2025, due to specialized advantages like exceptional corrosion resistance and versatility. Moreover, these materials maintain structural integrity under severe operating conditions, making them suitable for critical industrial applications.

The titanium and titanium alloys segment is expected to grow due to the superior strength-to-weight ratio and corrosion resistance. These materials support lightweight engineering without compromising durability. Growing demand from aerospace, automotive, and advanced manufacturing sectors accelerates adoption.

Process Insights

How did the Plasma Spray Segment Dominate the Thermal Spray Coatings Market in 2025

The plasma spray segment dominated the market with approximately 35% share in 2025, due to its ability to process a wide range of coating materials at extremely high temperatures. Also, it enables dense, high-quality coatings suitable for demanding applications. The process offers flexibility, repeatability, and strong industrial acceptance.

The cold spray segment is expected to grow with a rapid CAGR, owing to its solid-state deposition process, which preserves material properties. Moreover, reduced thermal stress improves coating quality and component integrity. Its suitability for repair and restoration aligns with sustainability goals. These factors support increasing industrial adoption.

End Use Insights

How did the Aerospace And Defence Segment Dominate the Thermal Spray Coatings Market in 2025

The aerospace and defence segment dominated the market with approximately 30% share in 2025, due to stringent performance requirements and high operational stress. Moreover, the thermal spray coatings enhance durability and reliability. Continuous investment in maintenance and safety drives stable demand. This sector values long-term performance over cost considerations.

The automotive segment is expected to grow akin to emerging electric vehicle expansion and efficiency requirements. Moreover, the thermal spray coatings support friction reduction, durability, and lightweight design. Scalable production and regulatory compliance further accelerate adoption across global automotive manufacturing.

Regional Insights

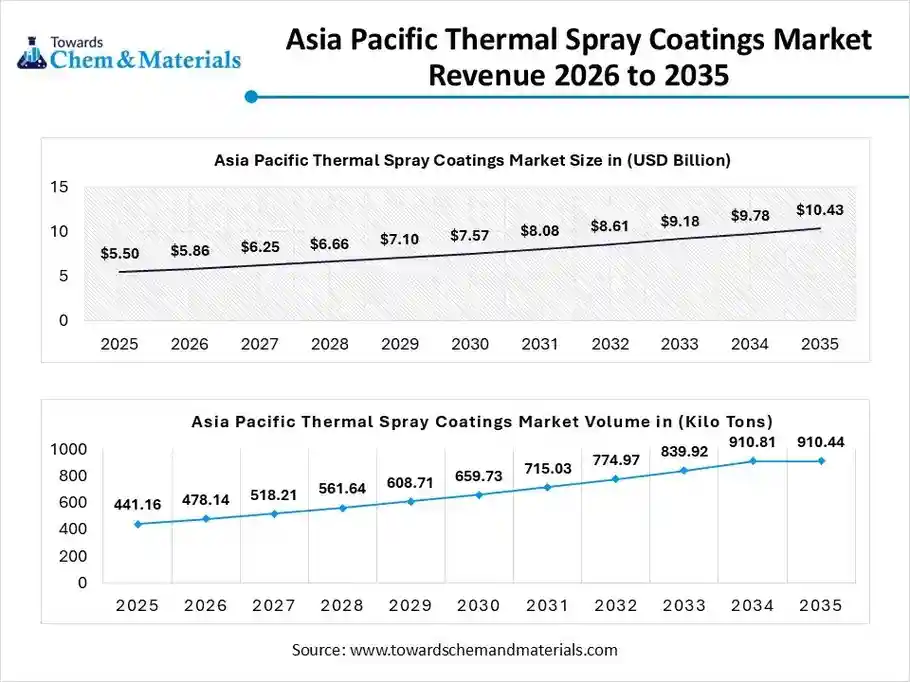

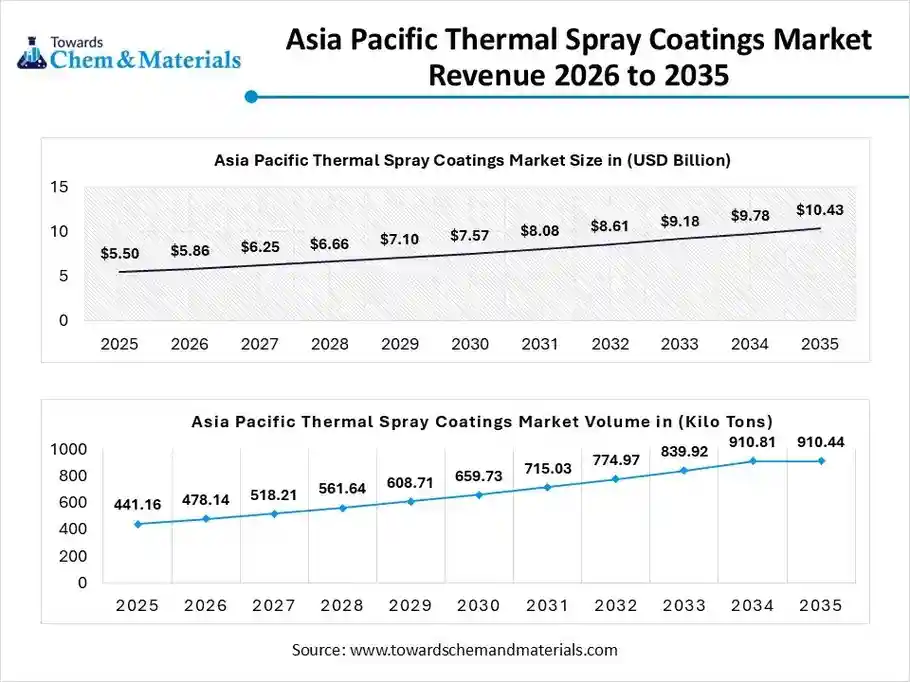

The Asia Pacific thermal spray coatings market size was valued at USD 5.50 billion in 2025 and is expected to be worth around USD 10.40 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.58% over the forecast period from 2026 to 2035. The Asia Pacific thermal spray coatings volume was estimated at 441.16 kilo tons in 2025 and is projected to reach 910.44 kilo tons by 2035, growing at a CAGR of 8.38% from 2026 to 2035.

Asia Pacific dominated the thermal spray coatings market with approximately 42% share in 2025, due to the presence of heavy manufacturing infrastructure. Moreover, the regional countries such as India, China, and Japan have been seen in establishing and advancing the traditional factories where the repairing and extension of the machine life is a critical element that supports the growth of the thermal spray coatings manufacturing in the region.

China Leads with Massive Industrial Infrastructure

China maintained its dominance in the market, owing to the country’s massive industry infrastructure, which includes steel, power plants, and automotive manufacturing. Also, the domestic coating service providers are seen in advancing capabilities and providing premium services to the major industries in the country nowadays.

North America Thermal Spray Coatings Market Evaluation

The North America thermal spray coatings volume was estimated at 279.96 kilo tons in 2025 and is projected to reach 435.22 kilo tons by 2035, growing at a CAGR of 5.02% from 2026 to 2035. North America is expected to capture a major share of the thermal spray coatings market with a rapid CAGR, owing to the region's focus on technology rather than volume. Companies here want high-quality coatings with long life and exact performance. The major manufacturers in the region, such as the electric vehicles, energy, and aerospace has observed under heavy usage of the advanced thermal spray coatings to extend the equipment life in the current period.

High Tech Coatings Fuel American Growth

The United States is expected to emerge as a prominent country for the thermal spray coatings market in the coming years due to it uses thermal spray coatings for advanced applications. Aerospace, defense, medical, and electric vehicles create strong demand. The companies in the United States focus on precision, safety, and performance. Thermal spray helps reduce maintenance costs and improve efficiency. The country also invests in research and new coating methods.

Europe Thermal Spray Coatings Market Examination

The Europe thermal spray coatings volume was estimated at 231.34 kilo tons in 2025 and is projected to reach 436.01 kilo tons by 2035, growing at a CAGR of 7.30% from 2026 to 2035. Europe is notably growing in the industry, owing to strict environmental and efficiency rules. Companies want coatings that improve machine life and reduce waste. In the region nowadays. Also, the thermal spray helps meet these goals. Europe also focuses on sustainable manufacturing and energy efficiency, which is expected to create lucrative opportunities for thermal spray coating manufacturers.

Germany Drives the Precision Thermal Innovation

Germany is expected to gain a major industry share, as the country has strong automotive, engineering, and industrial equipment industries. German companies use thermal spray coatings to improve performance and reduce downtime. Precision and quality are very important in Germany, and thermal spray fits these needs well.

Thermal Spray Coatings Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 26.66% | 279.96 | 435.22 | 5.02% | 22.09% |

| Europe | 22.03% | 231.34 | 436.01 | 7.30% | 22.13% |

| Asia Pacific | 42.01% | 441.16 | 910.44 | 8.38% | 46.21% |

| South America | 5.20% | 54.61 | 105.21 | 7.56% | 5.34% |

| Middle East & Africa | 4.10% | 43.05 | 83.34 | 7.61% | 4.23% |

Recent Developments

- In August 2024, the PPG unveiled its latest spray-on insulation coating called PPG PITT-THERM 909. This coating is specifically designed for the oil and gas industry, which is ceramic based, as per the published report by the company.(Source: www.coatingsworld.com)

Top Vendors in the Thermal Spray Coatings Market & Their Offerings:

- Oerlikon Metco: A global leader in surface engineering that provides a comprehensive portfolio of high-performance thermal spray equipment, materials (such as the Amdry and Metco brands), and specialized coating services through an extensive global network.

- Praxair Surface Technologies: A subsidiary of Linde plc and a premier global specialist in advanced surface-enhancing processes, renowned for its diverse range of high-velocity oxy-fuel (HVOF) and plasma spray solutions tailored for turbine and industrial components.

- Sulzer Metco: Formerly a division of Sulzer AG, this entity was acquired by Oerlikon in 2014 to form a world-class technology leader in surface solutions; its legacy systems continue to be integrated under the Oerlikon Metco brand.

- H.C. Starck: An international specialist in refractory metals and advanced ceramics, well-known in the thermal spray market for its high-quality AMPERIT brand powders, including spherical molybdenum and ceramic formulations designed for maximum flowability.

- Kennametal Thermal Spray Materials

- Amdry

- Zircoa

- Metsource

- Aubert & Duval

- Plasma Biotal Ltd

- Ionbond

- Bodycote

- Sulzer Ltd.

- Environmental Coating Systems

- Thermal Spray Technology Group .

Segments Covered in the Report

By Coating Type

- Metallic Coatings

- Ceramic Coatings

- Cermet Coatings

- Composite Coatings

- Others

By Material Type

- Nickel & Nickel Alloys

- Titanium & Titanium Alloys

- Carbides & Tungsten

- Aluminum & Aluminum Oxides

- Other Alloys & Composites

By Process Type

- Plasma Spray

- HVOF (High Velocity Oxygen Fuel)

- Flame Spray

- Cold Spray

- Arc Spray

By End-User Industry

- Aerospace & Defense

- Automotive

- Power Generation & Energy

- Oil & Gas

- Industrial Machinery

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa