Content

What is the Current Green Hydrogen Market Size and Share?

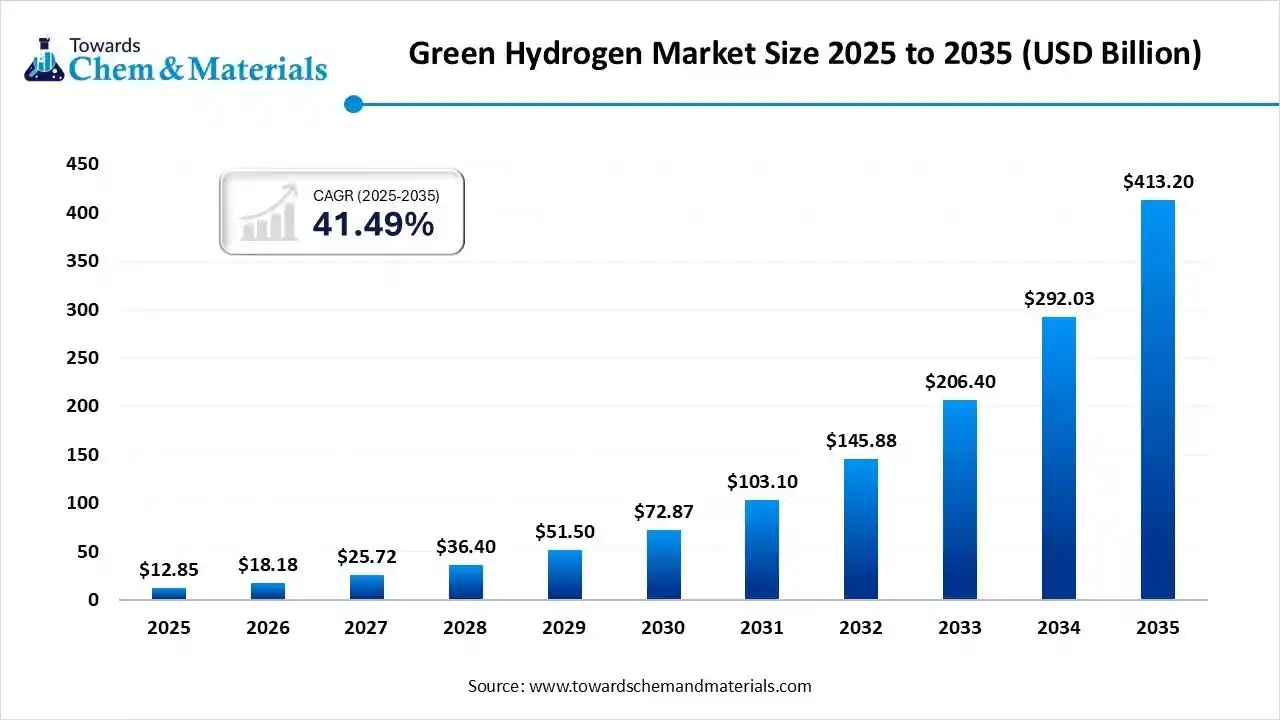

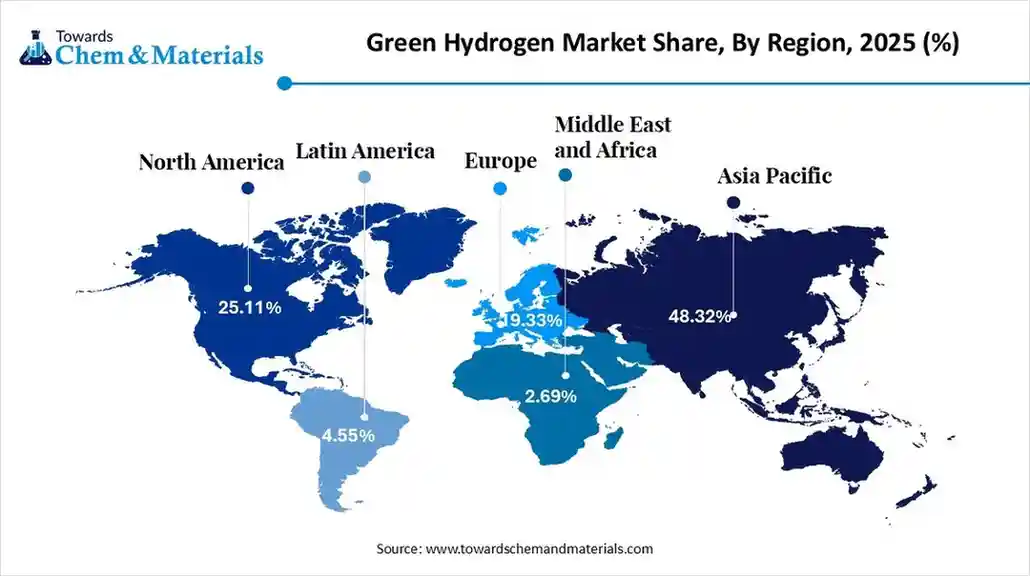

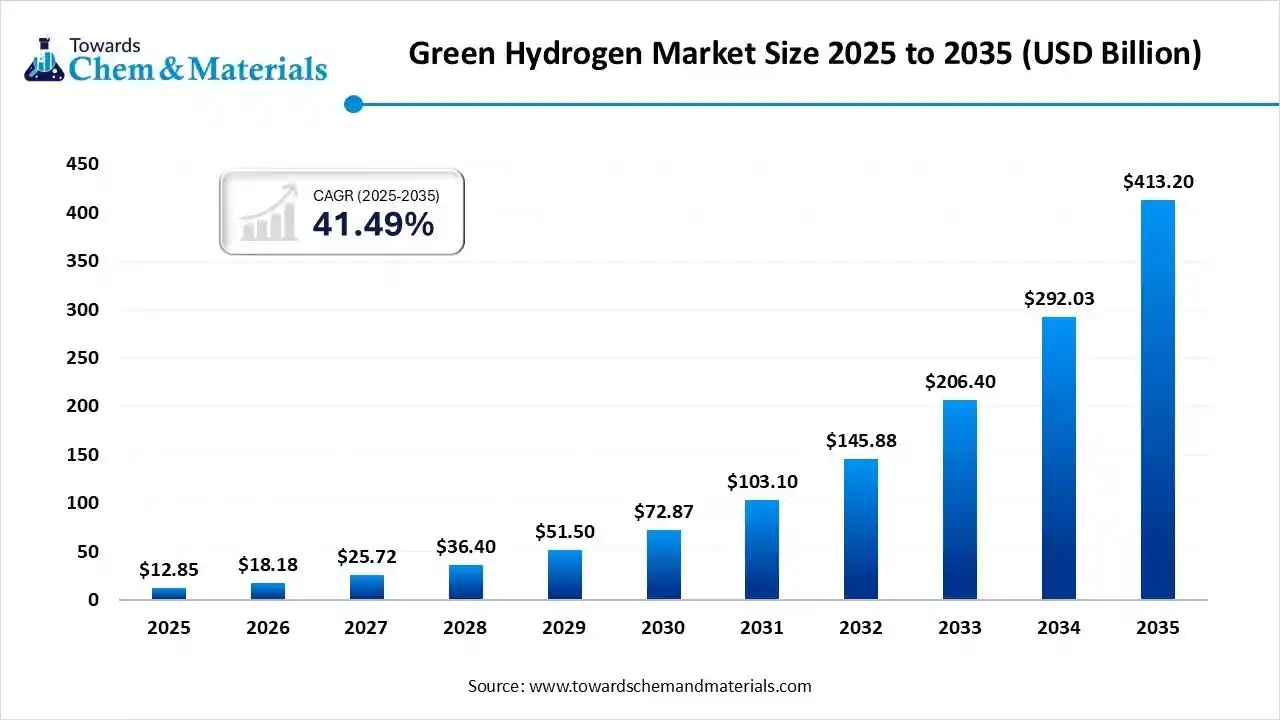

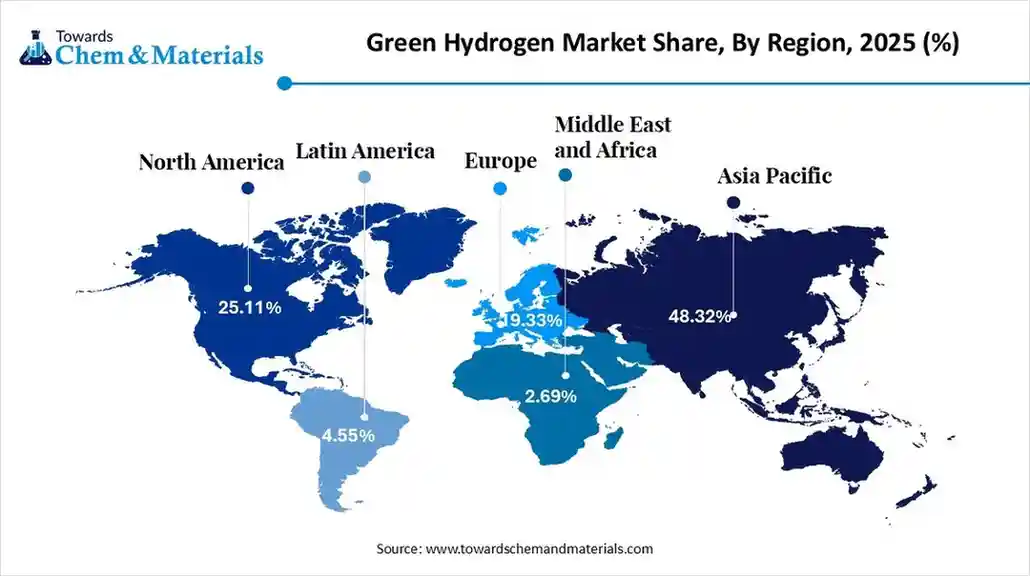

The global green hydrogen market size is calculated at USD 12.85 billion in 2025 and is predicted to increase from USD 18.18 billion in 2026 and is projected to reach around USD 413.20 billion by 2035, The market is expanding at a CAGR of 41.49% between 2026 and 2035. Europe dominated the green hydrogen market with a market share of 41.51% the global market in 2025.The global shift towards clean fuels has accelerated industry potential in recent years.

Key Takeaways

- Europe dominated the global green hydrogen market with the largest revenue share of 41.51% in 2025.

- By technology type, the alkaline electrolyzer segment accounted for the largest revenue share of 66.46% in 2025.

- By application type, the transport segment dominated with the largest revenue share of 44.39% in 2025.

- By distribution channel, the pipeline segment dominated with the largest revenue share of 61.66% in 2025.

- By sealants product, the silicone segment led the market and accounted for 35.19% of the global revenue share in 2025.

- By sealants application, the construction segment accounted for the largest revenue share of 46.7% in 2025.

Water to Power: Green Hydrogen Becomes the New Industrial Choice

The clean fuel, which is made by water splitting into hydrogen and oxygen using electricity, is called green hydrogen. Moreover, the global shift towards zero emissions is making green hydrogen is emerging fuel option in recent years. Furthermore, green hydrogen is likely to replace coal, oil, and natural gas in the upcoming years, which has seen a high demand in the factories, automotive, and power plants.

Green Hydrogen Market Trends:

- The emergence of the local green hydrogen hubs in developing regions has contributed to the favourable industry economics for the market in recent years. Also, several manufacturers are actively establishing compact electrolyzer units near where hydrogen will be used instead of developing large factories in the current era.

- The increased usage of green hydrogen for industrial heating has driven investor confidence in the industry’s future. Moreover, the companies have seen in using of hydrogen in steel, cement, chemical, and food production heating. Also, some brands are testing hybrid furnaces and hydrogen burners, which are likely to create lucrative opportunities in the sector during the projected period.

- The blending of green hydrogen in existing natural gas pipelines is heavily supporting capital growth and economic activity in the sector. Furthermore, the companies are avoiding the expense of the new pipeline installation by mixing a small amount of green hydrogen with regular gas to minimize emissions in recent years.

Market Report

| Report Attribute | Details |

| Market Size Value in 2026 | USD 18.18 Billion |

| Revenue Forecast in 2035 | USD 413.20 Billion |

| Growth Rate | CAGR 41.49% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Europe |

| Fastest Growing Region | North America |

| Segments covered | By Technology, By Application, By Distribution Channel, Source, and End User By Region |

| Key companies profiled | Air Products Inc, Bloom Energy, Cummins Inc., Engie, Linde plc., Nel ASA, Siemens Energy, Toshiba Energy Systems & Solutions Corporation, Uniper SE |

Modern Electrolysis Era: From Heavy Machines to Smart Systems

Technology has played a major role in industry expansion in recent years, where the traditional and heavy electrolyzers are being replaced with modular, smart, and plug-and-play systems. Moreover, the integration of the advanced sensors, improved membranes, and Artificial Intelligence controls is likely to contribute to the market economies in the coming years, as per the future industry expectations.

Trade Analysis of the Green Hydrogen Market:

Import, Export, Consumption, and Production Statistics

China has observed under the heavy green hydrogen projects, and the capacity of the production of the country is 125000 mt/year as er the project establishment, as per the report. The United States government has announced support for the 52 hydrogen projects across the country, and it includes the 24 states of the United States, as per the published report.

Value Chain Analysis of the Green Hydrogen Market:

- Distribution to Industrial Users : The green hydrogen market for industrial users is currently expanding rapidly, driven by the need to decarbonize "hard-to-abate" sectors that heavily rely on traditional, fossil-fuel-based hydrogen. Key industrial consumers are the chemical, refining, and steel industries, with distribution often managed by major industrial gas and energy companies.

- Key Players: Linde plc, Air Liquide, and Siemens Energy

- Chemical Synthesis and Processing : In chemical synthesis and processing, green hydrogen primarily acts as a sustainable feedstock to create essential, low-carbon industrial chemicals, most notably ammonia and methanol.

- Key Players: Cummins Inc. and Yara, and CF Industries

- Regulatory Compliance and Safety Monitoring :Regulatory compliance and safety monitoring for the market is a multi-layered system involving both government agencies and international standards bodies. This framework ensures safety in production, storage, transport, and use, while also verifying that the hydrogen meets "green" environmental standards.

- Key Agencies: Department of Energy (DOE), Department of Transportation (DOT) & Pipeline and Hazardous Materials Safety Administration (PHMSA), and other global agencies.

Green Hydrogen Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Department of Energy (DOE) | Inflation Reduction Act (IRA) - Section 45V | Reducing production costs to $1 per kg ("Hydrogen Shot" initiative) |

| European Union | European Commission (EC) | Renewable Energy Directive (RED III) | Achieving climate neutrality by 2050 |

| China | National Development and Reform Commission (NDRC) and National Energy Administration (NEA) | Medium and Long-term Plan for the Hydrogen Energy Industry Development (2021-2035) | Accelerating the development of the entire value chain (production, storage, transportation, utilization) |

Segmental Insights

Technology Insights

How did the Alkaline Electrolyzer Segment Dominate the Green Hydrogen Market in 2025?

The alkaline electrolyzer segment dominated the market in 2025 due to its traditional and simple but proven technology. Moreover, factors like cheaper development and easy operation, the alkaline electrolyzer segment has maintained its dominance in the market.

The PEM electrolyzers segment is expected to grow at a significant rate owing to characteristics such as flexibility, speed, and better handling of renewable energy. Moreover, by switching on and off quickly which is important during peak renewable power times, the PEM electrolyzer technology has gained major industry attention in recent years.

The SOEC electrolyzer segment is also notably growing, owing to because it offers the highest efficiency by using waste heat from industries such as steel, chemicals, and cement. This allows SOECs to produce hydrogen using much less electricity, lowering overall costs.

Application Insights

Why does the Transport Segment dominate the Green Hydrogen Market?

The transport segment dominated the market in 2025. As many countries are using green hydrogen to power buses, trucks, and trains as a clean alternative to diesel, Hydrogen vehicles offer long driving range and quick refueling, which makes them suitable for heavy transport where batteries are less practical.

The power generation segment is expected to grow at a significant CAGR because countries need clean fuel that can store renewable energy for long periods and stabilize the grid. Green hydrogen can be burned in turbines or used in fuel cells to produce electricity when solar and wind are not available.

The other segment is also notably growing as new industries begin testing greener hydrogen for decarbonization. Many companies are exploring hydrogen for high-temperature heat where electric systems do not work well. Data centers are also using hydrogen fuel cells to replace diesel generators.

Distribution Channel Insights

How did the Pipeline Segment Dominate the Green Hydrogen Market in 2025?

The pipeline segment dominated the market in 2025 due to because it is the safest, cheapest, and most efficient way to transport large volumes of hydrogen across industrial zones. Existing natural gas pipelines can often be partially upgraded for hydrogen, reducing new infrastructure costs.

The cargo segment is expected to grow at a significant rate because hydrogen will be exported internationally in the form of ammonia, liquid hydrogen, or hydrogen carriers. Countries with abundant renewable energy, like Australia, Saudi Arabia, and Chile, are planning massive exports to Europe and Asia.

Regional Insights

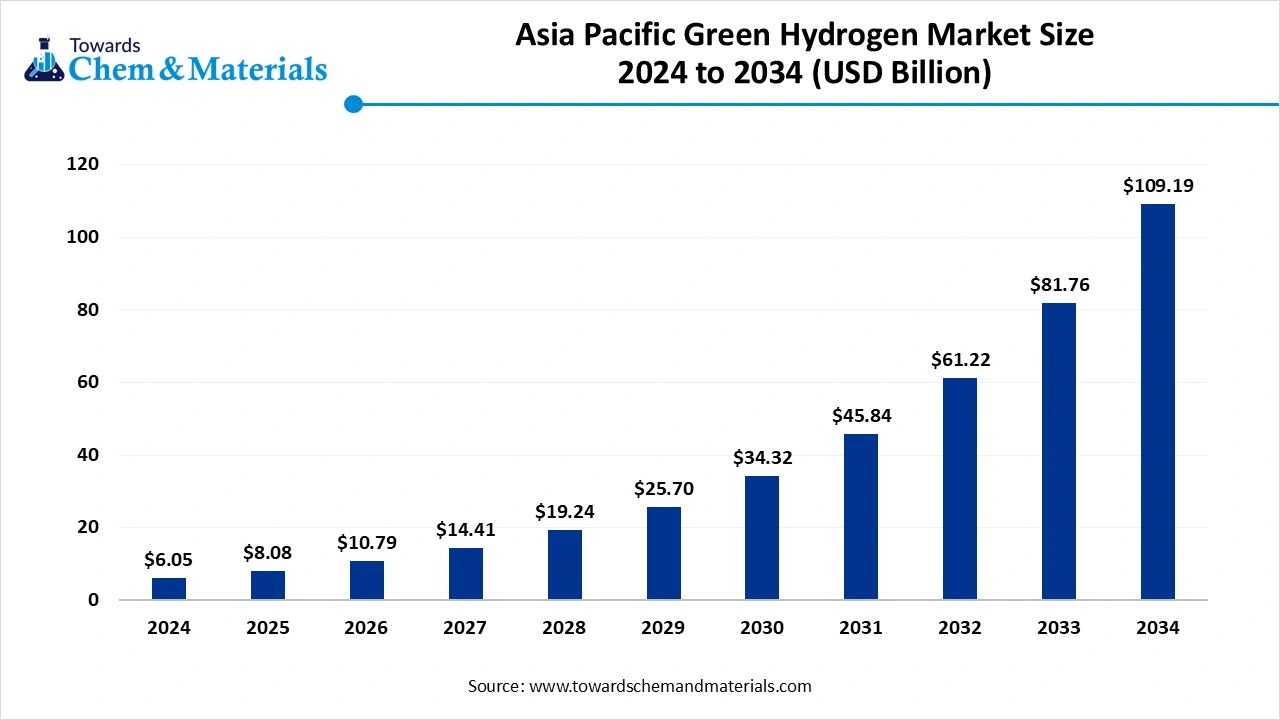

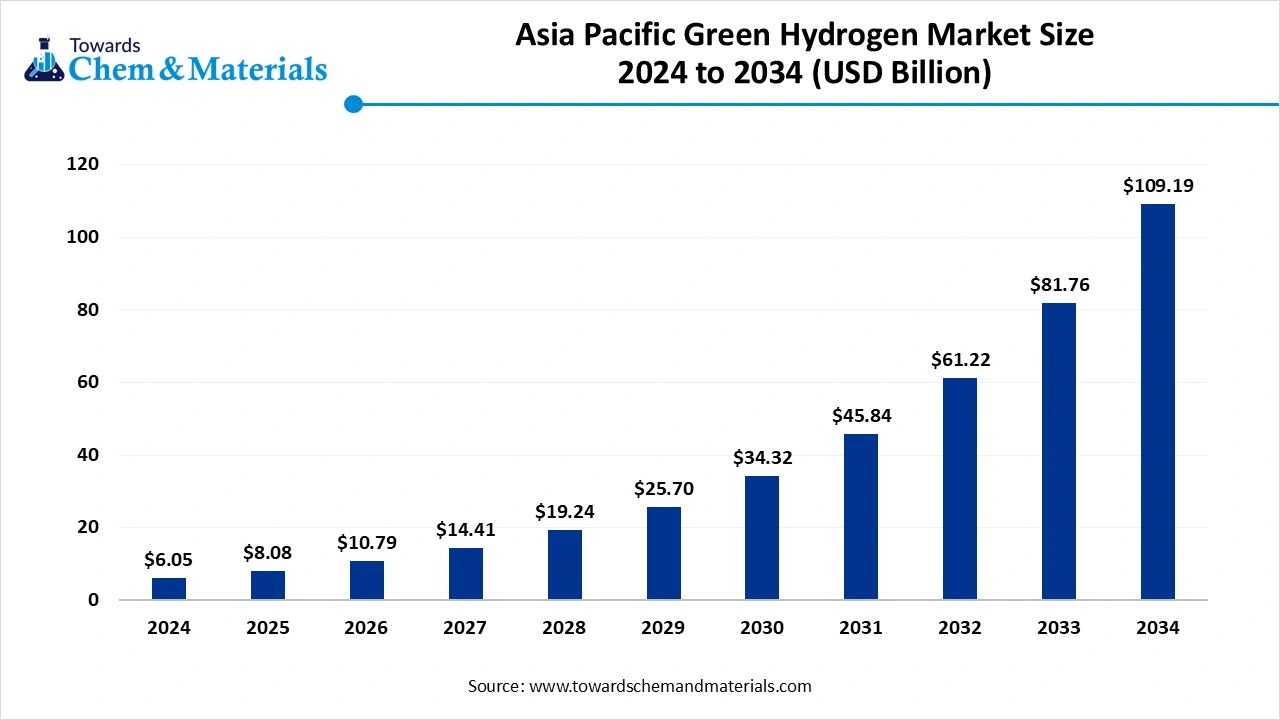

The Asia Pacific green hydrogen market size was valued at USD 6.21 billion in 2025 and is expected to reach USD 199.91 billion by 2035, growing at a CAGR of 41.51% from 2026 to 2035. Asia Pacific is a notably growing region because the region is seen funder the heavy transition of the fuel consumption, where regional manufacturers are minimizing their dependence on imported fossil fuels in the current period. Moreover, the regional countries like China, India, and Japan are moving towards the development of hydrogen vehicles and refueling stations in the current period.

Europe Green Hydrogen Market Trends

Europe dominated the green hydrogen market, owing to the region being known for its stricter climate laws and increased investments in hydrogen technologies. Moreover, the sustainability programs like green deals from the European Union have heavily influenced industry growth in the past few years, as per the recent regional survey

Strong Industrial Base Fuels Germany’s Hydrogen Dominance

Germany maintained its dominance in the market due to the presence of heavy industrial bases and heavy demand for clean energy. Moreover, Germany has seen under a heavy investment in electrolyser manufacturing and research, which is contributing to market growth in recent years. Also, the creating international partnerships, Germany is becoming the hydrogen hub in the coming years.

North America Green Hydrogen Market Examination

North America is expected to capture a major share of the market, owing to having heavy renewable energy sources and financial incentives that support hydrogen growth in the region. Moreover, the government has introduced major tax credits for green hydrogen production, which is expected to make it competitive and cheaper at the same time.

United States Rising as a Global Force in Green Hydrogen Innovation

The United States is expected to emerge as a prominent country for the green hydrogen market in the coming years, owing to early access to modern technology. Furthermore, the presence of the major brands and a major trend towards the development of the hydrogen hub, which connects the producer to the consumer, is projected to create significant opportunities in the coming years.

Is China’s Hydrogen Vehicle Revolution Reshaping the Clean Mobility Industry?

China is expected to gain a major industry share because it is building the world's largest electrolyser factories and hydrogen vehicle fleets. Companies in China are rapidly reducing electrolyser costs through mass production, making green hydrogen more affordable. The country is also developing hydrogen pipelines, fuel-cell trucks, and a large solar-hydrogen project.

Green Hydrogen Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the market because countries want to diversify away from oil and use their strong sunlight and wind resources to produce cheap green hydrogen. The region also has large open land, making it ideal for a massive renewable project.

Why Saudi Arabia Is Becoming the World’s Green Hydrogen Powerhouse?

Saudi Arabia is expected to emerge as a prominent country for the market in the coming years. As Saudi Arabia is the center of this growth, leading projects like NEOM, one of the world's largest green hydrogen developments. The country aims to export hydrogen globally and become a major clean energy supplier.

Expansion Of Green Hydrogen Market In Latin America

The green hydrogen market in Latin America is emerging rapidly as countries seek to decarbonize and leverage abundant renewable resources. Chile and Brazil lead due to strong solar and wind potential, while Colombia, Argentina, and Uruguay are advancing supportive policies and pilot projects. Falling renewable energy costs and global demand for clean fuels are driving investment, with export-oriented strategies targeting Europe and Asia.

Brazil Green Hydrogen Market

Brazil’s green hydrogen market is expanding quickly, driven by abundant renewable energy and growing industrial decarbonization needs. Major hubs such as the Port of Pecém and Port of Açu are attracting large-scale investments in electrolysis and green ammonia production. Companies like Fortescue, Unigel, and Eletrobras are developing multi-gigawatt projects aimed at both domestic use and exports to Europe and North America.

Recent Developments

- In November 2025, Sapio established partnerships with Solvay in Italy. This partnership aims to produce renewable hydrogen, as per the report published by the company recently.(Source: www.indianchemicalnews.com)

Top Vendors in the Green Hydrogen Market & Their Offerings:

Air Liquide

Corporate Information

- Name: Air Liquide S.A.

- Headquarters: Paris, France.

- Founded: 1902.

- Industry: Industrial gases, specialty gases, healthcare, engineering.

- Employees: ~67,800 (as of 2023)

- Operations: Present in over 70 countries.

History and Background

- In 1995, Air Liquide created Air Liquide Healthcare to serve medical gases and home-hospital care.

- In the 2000s, increased hydrogen production capacity establishing hydrogen as a core part of its business.

- In 2013, launched ALIAD, its corporate VC arm for investing in start-ups in energy transition, health, and digital tech.

- Also around 2013, it set up its i Lab innovation campus in Paris (Plateau de Saclay) to foster deep-tech innovation.

Key Developments and Strategic Initiatives

- Strategic Plan: ADVANCE 2025: In March 2022, Air Liquide launched its “ADVANCE” plan, which combines financial performance, decarbonization, technological innovation, and stakeholder engagement.

- As part of this, it aims to begin reducing its absolute CO₂ emissions around 2025.

- It projects to improve return on capital employed (ROCE) above 10% from 2023.

- Operating margin is expected to improve by > 160 basis points by 2025.

Mergers & Acquisitions

- Airgas Acquisition: In 2016, Air Liquide completed the acquisition of Airgas (U.S. industrial gases company), strengthening its presence in North America.

- Home Healthcare Expansion: Acquired home-care operations in Belgium and the Netherlands to strengthen its VitalAire business.

- DIG Airgas (South Korea): In August 2025, Air Liquide agreed to acquire DIG Airgas (South Korean industrial gas player) for ~€2.85 bn, to deepen presence in semiconductors and battery sectors.

- Divestment: In 2017, sold welding gases business (Welding subsidiary) to Lincoln Electric.

Partnerships & Collaborations

TotalEnergies:

- A key JV with TotalEnergies to build over 100 hydrogen refueling stations in Europe for heavy-duty vehicles.

- In 2025, announced two large green-hydrogen projects in the Netherlands: a 200 MW and a 250 MW electrolyzer, jointly funded.

- Their co investment is expected to significantly reduce CO₂ emissions from refineries.

Product Launches / Innovations

- Hydrogen Production & Electrolyzers: As described, big push into green / low-carbon hydrogen via large-scale electrolysers.

- Industrial Gas Technologies: Innovation in air-separation units, modular ASUs, LMAs, etc., especially for clean energy applications.

- CCUS (Carbon Capture): They have been involved in CCUS (carbon capture, utilization, storage) projects.

Key Technology Focus Areas

- Hydrogen (Green, Low Carbon): Very central.

- Electrolysis: Development of large capacity electrolyzers.

- Gas Separation & Purification: Advanced ASUs, modular air separation.

- Carbon Capture & Storage: CCUS for industrial applications.

- Mobility Infrastructure: Hydrogen refueling stations (especially heavy-duty).

R&D Organisation & Investment

- R&D Center: The Claude-Delorme R&D Center (Les Loges en-Josas) is a major hub.

- Innovation Structures: i Lab (innovation lab), ALIAD (venture-capital), start-up accelerator (Accelair).

- Investment: Under ADVANCE, a significant portion of the industrial capex is earmarked for energy transition; billions invested in hydrogen.

SWOT Analysis

Strengths

- Deep technical expertise in industrial gases and gas-separation.

- Strong financial position, long-term contracts, predictable cash flows.

- Global footprint > 70 countries.

- Innovation engine via ALIAD, i Lab, strong R&D.

- Leadership in hydrogen, which aligns with energy transition megatrends.

Weaknesses

- Capital-intensive business requires huge capex for plants, pipelines, electrolyzers.

- Long payback periods for hydrogen and low-carbon infrastructure.

- Exposure to energy cost fluctuations (gas, electricity).

- Complexity of managing a highly diversified global business.

Opportunities

- Huge growth in green / low-carbon hydrogen (industrial, mobility).

- Expansion of hydrogen refueling infrastructure (especially heavy mobility).

- Carbon capture business (CCUS) as industries decarbonize.

- Partnerships with energy majors (like TotalEnergies, ExxonMobil) to build hydrogen value chain.

- Growth in home healthcare and connected medical devices.

Threats

- Regulatory risk: hydrogen economics depend heavily on subsidies and policy support.

- Competition: other industrial gas companies (like Linde), new entrants in hydrogen.

- Technological risk: if other hydrogen production methods (or storage) outpace current ones.

- Geopolitical risk: operations in certain regions may face political uncertainty (e.g., recent Russian assets issue).

- Large capital commitment risk if demand projections do not materialize.

Recent News & Strategic Updates

- Green Hydrogen Projects with TotalEnergies: In 2025, Air Liquide and TotalEnergies are investing over €1 billion to build large-scale electrolysers in the Netherlands 200 MW in Rotterdam and 250 MW in Zeeland.

- ExxonMobil Partnership: Air Liquide is part of ExxonMobil’s Baytown low-carbon hydrogen & ammonia project, supplying oxygen and nitrogen via its pipeline assets.

- Record Investments: In H1 2025, under its ADVANCE plan, Air Liquide made industrial and financial investment decisions of €2.3 bn, underlining its strong capex momentum.

Other Key Players

- Air Products Inc: A world-leading industrial gases company that provides essential gases, related equipment, and expertise, with significant investments in large-scale green hydrogen production projects globally to drive the energy transition.

- Bloom Energy: A company that designs, manufactures, and sells solid oxide fuel cells (SOFCs) and electrolyzers, providing a clean and efficient way to produce electricity and green hydrogen for a variety of power applications.

- Cummins Inc.: A global power solutions provider that, through its Accelera by Cummins business, is a leading supplier of electrolyzers for the production of green hydrogen and is a prominent developer of fuel cell technologies.

- Engie

- Linde plc.

- Nel ASA

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

- Uniper SE

Segments Covered in the Report

By Technology

- Alkaline Electrolyzer

- Polymer Electrolyte Membrane (PEM) Electrolyzer

- SOEC Electrolyzer

By Application

- Power Generation

- Transport

- Others

By Distribution Channel

- Pipeline

- Cargo

By Source

- Solar Energy

- Wind Energy

- Others (hydropower, geothermal, and hybrid of solar & wind)

By End User

- Refining

- Ammonia

- Methanol

- Iron & Steel

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa