Content

What Floating Liquefied Natural Gas (FLNG) Terminals Market Size and Share?

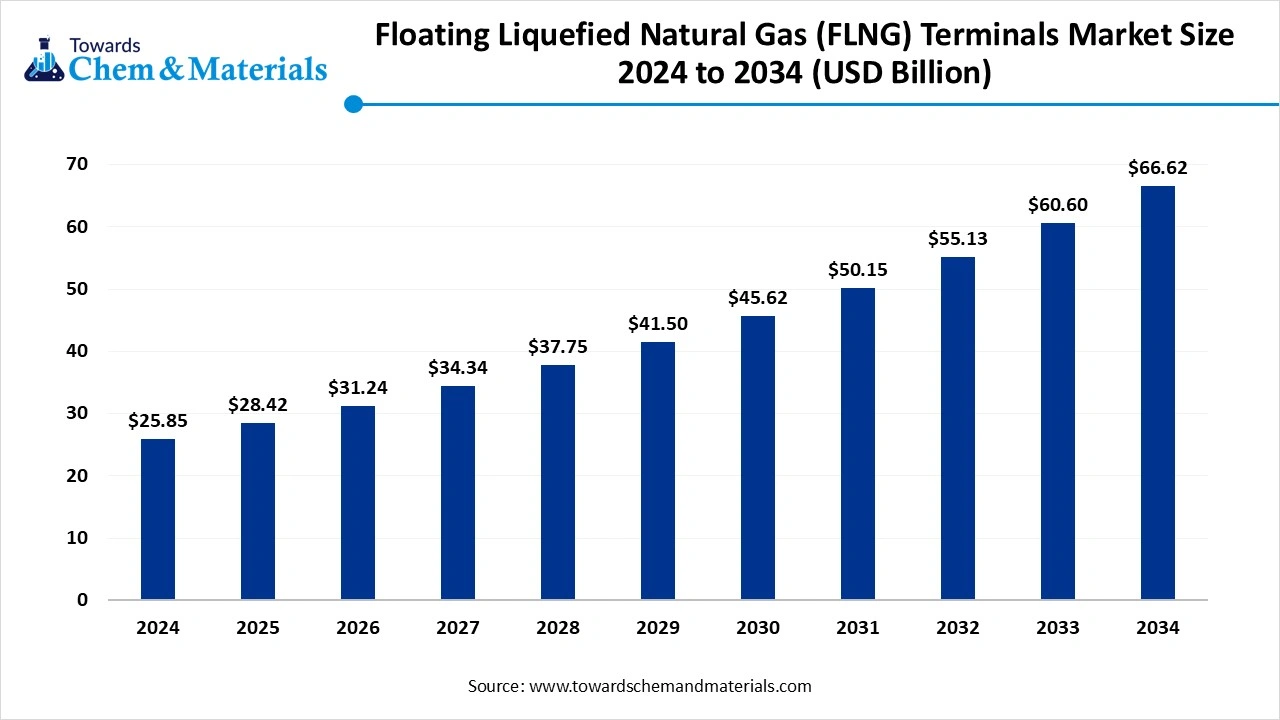

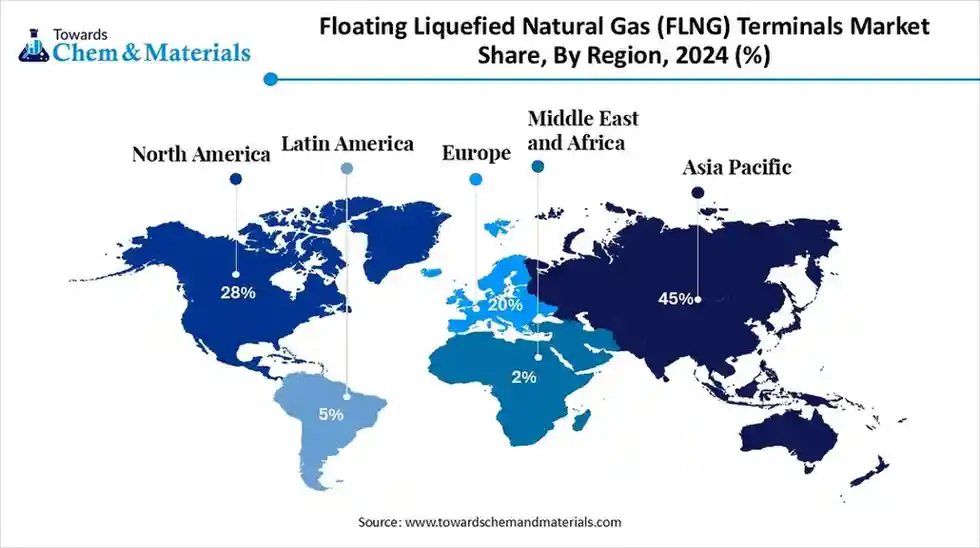

The floating liquefied natural gas (FLNG) terminals market size accounted for USD 25.85 billion in 2024 and is predicted to increase from USD 28.42 billion in 2025 to approximately USD 66.62 billion by 2034, expanding at a CAGR of 9.93% from 2025 to 2034. Asia Pacific dominated the floating liquefied natural gas (FLNG) terminals market with a market share of 45% in 2024.The growth of the market is driven by the growing demand for the product, with technological advancement fueling the growth of the market.

Key Takeaways

- By region, Asia Pacific dominated the market with a share of approximately 45% in 2024.

- By region, the Middle East and Africa are expected to have significant growth in the market in the forecast period.

- By terminal type/ asset, the floating storage and regasification units segment dominated the market with a share of 55% in 2024.

- By terminal type/ asset, the floating LNG production vessels segment is expected to grow significantly in the market during the forecast period.

- By contract type/ business model, the lease/ hire contracts segment dominated the market with a share of approximately 48% in 2024.

- By contract type/ business model, the build-own-operate models segment is expected to grow in the forecast period.

- By application/ end use, the LNG export terminals segment dominated the market with a share of approximately 50% in 2024.

- By application/ end use, the regasification for the marine/ bunkering segment is expected to grow in the forecast period.

- By capacity/ module size, the large-scale (> 1,000,000 tpa) segment dominated the market with a share of approximately 60% in 2024.

- By capacity/ module size, the mid-scale (500k–1 M tpa) segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Floating Liquefied Natural Gas (FLNG) Terminals Market?

The floating liquefied natural gas (FLNG) terminals market involves designing, building, deploying, and operating floating liquefied natural gas facilities. This includes FLNG vessels, FSRUs, FLNG platforms, offshore mooring systems, LNG liquefaction and regasification equipment, and related infrastructure services.

These terminals support offshore LNG production, storage, and transportation without requiring extensive onshore facilities, enabling the development of remote or offshore gas fields. Market expansion is fueled by rising global LNG demand, greater offshore gas exploration, the transition to lower-carbon energy sources, and the need for adaptable LNG import and export options.

Floating Liquefied Natural Gas (FLNG) Terminals Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the floating liquefied natural gas (FLNG) terminals market is projected to experience strong growth as global energy demand shifts toward flexible and cost-efficient LNG infrastructure. The need for rapid deployment, lower capital expenditure, and access to remote offshore reserves is driving investment in FLNG vessels and floating storage and regasification units (FSRUs).

- Sustainability Trends: Sustainability and energy transition goals are influencing FLNG terminal designs, with a growing focus on reducing carbon intensity and methane emissions during liquefaction and regasification. Companies are integrating carbon capture systems, renewable power sources, and hybrid propulsion technologies to enhance operational efficiency.

- Global Expansion & Strategic Investments: Major energy companies and EPC contractors are expanding their FLNG portfolios through partnerships and long-term lease models. Investments in new-build and converted FSRUs are increasing to meet regional demand in Southeast Asia, Sub-Saharan Africa, and the Middle East.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 31.24 Billion |

| Expected Size by 2034 | USD 66.62 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.93% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Terminal Type / Asset, By Contract Type / Business Model, By Application / End-Use, By Capacity / Module Size, Regional Analysis |

| Key Companies Profiled | Samsung Heavy Industries Co., Ltd., TechnipFMC plc , MODEC, Inc. , BW Offshore Ltd. , Shell plc , Petrofac Limited , McDermott International, Inc. , Saipem S.p.A. , KBR, Inc. , Mitsubishi Heavy Industries, Ltd. , Wärtsilä Corporation , Cheniere Energy, Inc. , Golar LNG Ltd. , Hyundai Heavy Industries Holdings Co., Ltd. |

Key Technological Shifts In The Floating Liquefied Natural Gas (FLNG) Terminals Market:

Key technological shifts in the Floating Liquefied Natural Gas (FLNG) terminals market are primarily centred on increasing operational efficiency, flexibility, and sustainability. These shifts are enabling the monetisation of previously "stranded" offshore gas reserves that were uneconomical to develop using traditional onshore infrastructure. The most significant shift is the widespread adoption of modular construction techniques. Equipment and systems are built in controlled fabrication yards and shipped as ready-to-install modules, which are then integrated into the floating facility.

Trade Analysis Of Floating Liquefied Natural Gas (FLNG) Terminals Market: Import & Export Statistics

The United States, already the world's largest LNG exporter, plans to significantly expand its liquefaction capacity by an additional 13.9 Bcf/d between 2025 and 2029. This expansion will nearly double the current operational capacity of 15.4 Bcf/d, solidifying its dominant position in the global LNG market.(Source: www.eia.gov)

Floating Liquefied Natural Gas (FLNG) Terminals Market Value Chain Analysis

- Chemical Synthesis and Processing : FLNG terminals are developed through processes involving offshore gas extraction, liquefaction using cryogenic technologies, storage in insulated tanks, and regasification for distribution. Construction integrates modular fabrication and advanced marine engineering.

- Key players: Shell plc, Petronas, Golar LNG Limited, Exmar NV, Samsung Heavy Industries

- Quality Testing and Certification : FLNG terminals require certifications for safety, environmental compliance, and operational reliability under standards such as ISO 9001, ISO 14001, and MARPOL regulations.

- Key players: DNV, Bureau Veritas, ABS Group, Lloyd’s Register.

- Distribution to Industrial Users : Liquefied natural gas from FLNG terminals is distributed to power generation, industrial, and transportation sectors via LNG carriers and regional gas grids.

- Key players: Shell plc, Petronas, Golar LNG, TotalEnergies SE.

Floating Liquefied Natural Gas (FLNG) Terminals Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Frameworks | Focus Areas | Notable Notes |

| Global / International | International Maritime Organisation (IMO) | - International Gas Carrier (IGC) Code - MARPOL Convention (Annexe VI) - SOLAS (Safety of Life at Sea) Convention - ISGOTT Guidelines (for LNG handling) |

- Vessel and terminal safety - Environmental emission control - LNG cargo containment and transfer - Marine pollution prevention |

The IMO governs the design, construction, and operation of FLNGs and FSRUs. The IGC Code ensures LNG containment safety, while MARPOL Annexe VI limits greenhouse gas and NOx/SOx emissions. |

| United States | Federal Energy Regulatory Commission (FERC) U.S. Coast Guard (USCG) Environmental Protection Agency (EPA) |

- Natural Gas Act (NGA) - Deepwater Port Act (DWPA) - Clean Air Act / Clean Water Act - NEPA (National Environmental Policy Act) |

- LNG terminal siting and approval - Marine safety and spill response - Air/water emissions compliance |

FERC and USCG jointly regulate FLNG and FSRU projects. The DWPA governs offshore port licensing. Developers must conduct full Environmental Impact Assessments (EIAs) under NEPA. |

| European Union | European Maritime Safety Agency (EMSA) European Commission (DG ENER) |

- EU Directive 2014/94/EU (Clean Power for Transport) - EU ETS (Emissions Trading System) - Seveso III Directive (2012/18/EU) |

- LNG bunkering safety - GHG emissions and energy efficiency - Industrial safety and risk management |

EU policies promote LNG as a transition fuel. EMSA guidelines regulate LNG bunkering and port operations. FSRUs are gaining prominence in Europe for energy security diversification. |

| Australia | National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) Department of Climate Change, Energy, the Environment and Water (DCCEEW) |

- Offshore Petroleum and Greenhouse Gas Storage Act (OPGGS Act) - Environmental Protection and Biodiversity Conservation Act (EPBC Act) |

- Offshore licensing and compliance - Safety case requirements - Marine biodiversity and emissions |

Australia enforces stringent safety and environmental standards for FLNG facilities (e.g., Prelude FLNG). Projects undergo comprehensive environmental impact approvals. |

| China | Ministry of Natural Resources (MNR) Ministry of Ecology and Environment (MEE) China Maritime Safety Administration (MSA) |

- Marine Environmental Protection Law (2020 revision) - Port and Coastal Engineering Safety Codes - GB Standards for LNG handling |

- Offshore construction approval - LNG storage and transfer safety - Marine pollution control |

China’s floating LNG terminals are subject to dual regulation by MEE and MSA. LNG handling follows GB/T 21448 standards, harmonised with IMO codes. |

Segmental Insights

Terminal Type/ Asset Insight

Which Terminal Type/ Asset Segment Dominated The Floating Liquefied Natural Gas (FLNG) Terminals Market In 2024?

- The floating storage and regasification units segment dominated the market with a share of approximately 55% in 2024. FSRUs are key components for LNG import operations, enabling efficient storage and regasification of LNG for onshore supply. Their flexibility, lower construction time, and redeployment capability make them ideal for emerging gas-importing regions. Increasing demand for cost-effective energy transition solutions boosts FSRU deployment across the Asia Pacific and developing economies.

- The floating LNG production vessels segment expects fastest growth in the floating liquefied natural gas (FLNG) terminals market during the forecast period. FLNG production vessels integrate liquefaction, storage, and offloading on a single floating platform, minimising the need for onshore infrastructure. They enable monetisation of offshore gas fields previously deemed uneconomical. Growing offshore gas exploration and demand for flexible LNG supply chains drive investment in advanced FLNG units.

- Floating LNG Liquefaction Platforms (Offshore Fixed or Turret-Moored) segment expects the significant growth in the market. These large-scale, turret-moored platforms provide continuous liquefaction of gas extracted from offshore reservoirs. They are engineered for stability and endurance in harsh marine environments. Increased offshore gas discoveries in Africa and Southeast Asia promote the adoption of turret-moored liquefaction platforms as strategic energy infrastructure assets.

Contract Type / Business Model Insight

How Did the Lease/Hire Contracts Segment Dominated The Floating Liquefied Natural Gas (FLNG) Terminals Market In 2024?

- The lease/hire contracts segment dominated the market with a share of approximately 48% in 2024. Under lease or hire arrangements, companies rent floating LNG assets, reducing upfront capital costs while gaining rapid operational flexibility. This model is favoured by emerging importers and smaller utilities. The rise in short-term LNG contracts and modular FSRU projects drives demand for leased floating units.

- The build-own-operate models segment expects fastest growth in the floating liquefied natural gas (FLNG) terminals market during the forecast period. BOO models involve private developers or consortia financing, constructing, and operating FLNG terminals, generating revenue through long-term supply contracts. This model ensures asset longevity and operational control. Increasing investor confidence and regulatory clarity in energy infrastructure promotes BOO adoption for both export and regasification terminals.

- Joint Venture / Public-Private Partnership (PPP) segment expects the notable growth in the market. Joint ventures and PPPs combine public energy agencies and private firms to share risk and expertise in FLNG development. These collaborations enable access to offshore gas resources and modern technology. Government-backed energy diversification projects, especially in India and Africa, strengthen this collaborative business structure.

Application / End-Use Insight

Which Application/ End Use Segment Dominated The Floating Liquefied Natural Gas (FLNG) Terminals Market In 2024?

- The LNG export terminals segment dominated the market with a share of approximately 50% in 2024. Floating LNG export terminals facilitate offshore liquefaction and transhipment directly from production fields, reducing dependence on onshore pipelines. They enhance operational efficiency for remote reserves. Increasing global LNG trade and decarbonization commitments fuel demand for floating export platforms to deliver clean energy to multiple markets.

- The regasification for the marine/bunkering segment expects fastest growth in the floating liquefied natural gas (FLNG) terminals market during the forecast period. Marine regasification and bunkering facilities serve as floating hubs for LNG-fueled vessels. As IMO emission regulations tighten, demand for cleaner marine fuels accelerates the adoption of floating regasification systems. Ports in Asia and Europe increasingly integrate bunkering-oriented FSRUs for maritime decarbonization.

- LNG import terminals expects the significant growth in the market. Floating LNG import terminals offer quick, scalable solutions for countries expanding gas-based power generation. These units meet energy demand in areas lacking onshore terminal infrastructure. Rising energy security initiatives and natural gas integration policies in Asia and Africa propel FLNG import installations.

Capacity / Module Size Insights

How Did Large Scale (> 1,000,000tpa) Segment Dominated The Floating Liquefied Natural Gas (FLNG) Terminals Market In 2024?

- The large-scale (> 1,000,000 tpa) segment dominated the market with a share of approximately 60% in 2024. Large-scale FLNG terminals are designed for high-output liquefaction and regasification capacities, supporting global LNG trade routes. They offer cost efficiencies and supply stability for major importers. The US, Qatar, and Australia lead in developing such large modular units for strategic energy exports.

- The mid-scale (500k–1 m tpa) segment expects fastest growth in the floating liquefied natural gas (FLNG) terminals market during the forecast period. Mid-scale terminals balance cost, scalability, and deployment time, appealing to regional LNG hubs and medium-sized markets. Their modularity enables phased expansion. Increasing LNG demand in Southeast Asia and the Mediterranean fuels investments in mid-scale FLNG assets with hybrid utility capabilities.

- Small-Scale (≤500,000 TPA) segment expects the notable growth in the market. Small-scale floating terminals cater to niche markets and distributed power generation in island nations and remote industrial regions. They enable localised LNG supply for off-grid consumers. Growing interest in decentralised energy systems and micro-LNG projects supports this segment’s steady expansion.

Regional Insights

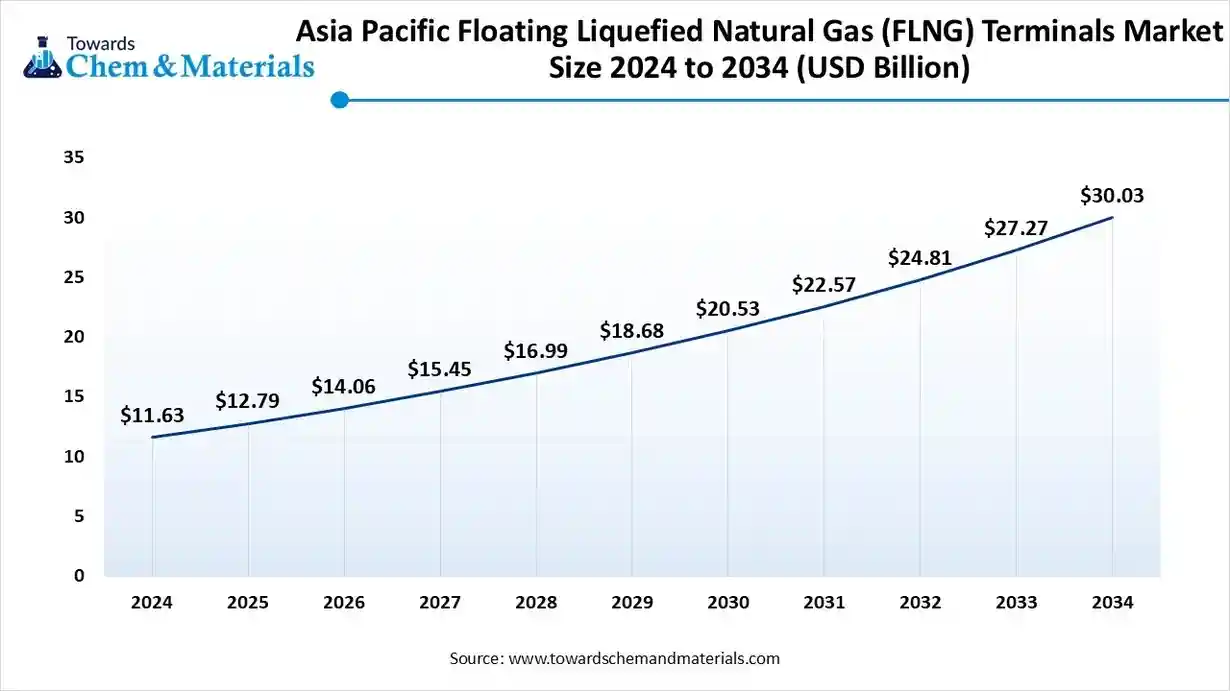

The Asia Pacific floating liquefied natural gas (FLNG) terminals marketmarket size is estimated at USD 12.79 billion in 2025 and is projected to reach USD 30.03 billion by 2034, growing at a CAGR of 9.95% from 2025 to 2034. Asia Pacific dominates the floating liquefied natural gas terminals market in 2025.

Asia Pacific dominates the FLNG market with growing LNG imports in China, India, and Southeast Asia. Rising power demand and energy transition goals drive the deployment of floating import and regasification units. Strategic offshore developments and government-led clean energy policies enhance regional FLNG infrastructure investments.

India Has Seen Growth Driven By Rapid Development.

India’s growing reliance on LNG for industrial and power sectors supports the rapid development of FSRUs and small-scale floating terminals. Coastal regions such as Gujarat and Tamil Nadu witness increased project activity. Supportive policies for LNG infrastructure and private participation stimulate market expansion.

Floating Liquefied Natural Gas (FLNG) Terminals Market: In the Middle East And Africa: Increasing Collaboration

The Middle East and Africa have seen significant growth and are expected to experience growth in the forecast period. The Middle East and Africa leverage FLNG to monetise offshore gas reserves and strengthen energy exports. Countries like Mozambique and Nigeria lead in adopting floating liquefaction platforms. Increasing collaboration with global oil majors accelerates the development of export-oriented FLNG terminals.

The South African Market Is Driven By Government Support And a Growing Sector.

South Africa’s LNG strategy focuses on floating import terminals to reduce coal dependency and enhance energy security. Ports such as Richards Bay and Coega are exploring FSRU-based regasification systems. Government support for cleaner fuels and private sector participation foster steady market growth.

North America Floating Liquefied Natural Gas (FLNG) Terminals Market: Advanced Liquification Technologies

North America, particularly the US, drives global FLNG supply with multiple large-scale offshore projects. The region’s advanced liquefaction technologies and strong export capabilities position it as a major LNG exporter. Favourable regulatory environments and abundant shale gas reserves sustain long-term investments in floating LNG infrastructure.

The U.S. Has Seen Growth In The Market, Driven By The Strategic Partnerships.

The US dominates regional output through large FLNG projects along the Gulf Coast. Technological innovation and low-cost gas production strengthen its competitive edge in global LNG exports. Strategic partnerships and flexible business models underpin continued investments in floating liquefaction capacity.

European Floating Liquefied Natural Gas (FLNG) Terminals Market Expansion

The growth of floating liquefied natural gas (FLNG) terminals in Europe has accelerated, driven by energy-security concerns and the need to diversify away from pipeline imports. Countries like Germany, Italy and Finland are deploying floating-storage and regasification units (FSRUs) and other floating LNG infrastructure to respond quickly to supply shocks and improve flexibility.

Germany Floating Liquefied Natural Gas (FLNG) Terminals Market Trends

In Germany the growth of floating liquefied natural gas (FLNG) terminals more precisely floating storage and regasification units (FSRUs) has been rapid and strategically driven. The government chartered multiple FSRUs to be deployed across key coastal ports such as Wilhelmshaven, Brunsbüttel and Lubmin to reduce dependence on Russian pipeline gas.

Rise of the Floating Liquefied Natural Gas (FLNG) Terminals Market in Latin America due to the export and liquefaction

The growth of floating liquefied natural gas (FLNG) terminals in Latin America reflects increasing interest in flexible LNG infrastructure, especially for export and liquefaction. Key drivers include rising demand for LNG imports in countries with variable hydropower output (notably Brazil), infrastructure flexibility needs, and ambition in some countries (such as Argentina) to eventually export liquefied gas via floating liquefaction units (FLNGs).

Brazil Floating Liquefied Natural Gas (FLNG) Terminals Market Trends

In Brazil, the growth of floating LNG import terminals particularly the deployment of FSRUs (Floating Storage and Regasification Units) has surged in 2023 24. These floating units are helping to fill infrastructure gaps, especially in regions like the north of Brazil, by linking into pipelines or power plants, thereby providing faster gas supply and greater flexibility than large fixed on shore terminals.

Several Floating Liquefied Natural Gas (FLNG) terminals are currently operational worldwide: The key operational projects and their launch dates are:

| Project Name | Location | Launch/Start of Production Date | Operator/Owner |

| PFLNG Satu (formerly PFLNG1) |

Offshore Malaysia (currently at Kebabangan field) | April 2017 (first LNG cargo delivered in March 2017) | Petronas |

| Prelude FLNG | Offshore Western Australia | December 2018 (first LNG cargo offloaded in June 2019) | Shell |

| Hilli Episeyo | Offshore Cameroon | March | Golar LNG / Perenco |

| Tango FLNG (formerly Caribbean FLNG) |

Offshore Argentina (originally for Colombia) | June 2019 (first cargo exported) | Exmar (chartered by Eni for the Congo FLNG project) |

| Coral South FLNG | Offshore Mozambique | November 2022 (first cargo exported) | Eni (operator) |

| Gimi FLNG | Offshore Mauritania/Senegal (Greater Tortue Ahmeyim project) | Expected 2025 (FID taken in Dec 2018) | Golar LNG / BP (charterer) |

Recent Developments

- In September 2025, ABB was awarded a contract by South Korean shipbuilder Hanwha Ocean to provide the complete electrical power and propulsion system for Singapore's inaugural floating storage and regasification unit (FSRU).(Source: new.abb.com)

- In August 2025, Eni launched the Nguya FLNG unit and a floating production and compression unit (FPU) for the second phase of its Congo LNG Project. The Nguya FLNG unit has a liquefaction capacity of 2.4 million tonnes per year and will join the previously deployed Tango FLNG unit, bringing the project's total capacity to 3 mtpa by the end of 2025.(Source: www.ogj.com)

Top Floating Liquefied Natural Gas (FLNG) Terminals Market Companies

Chevron Corporation

Corporate Information : Chevron Corporation (“Chevron”) is a major U.S. multinational energy company, operating in oil & gas exploration, production, refining, marketing, chemicals and newer energy transition technologies.

- Headquarters: The company announced relocation of its global headquarters from San Ramon, California to Houston, Texas.

- CEO & Chairman: Michael Wirth (Mike Wirth) is the Chairman and Chief Executive Officer.

Business segments: Chevron is an integrated energy company upstream (exploration & production), downstream (refining, marketing, chemicals), and midstream (transportation, storage). - Global footprint: Active in more than 100 countries across the value chain.

History and Background

Origins: Chevron’s roots go back to the 19th century in California. It evolved through various predecessor companies including the Standard Oil Company of California (Socal).

Major milestones:

- 2005: Acquisition of Unocal Corporation rebranded as Chevron.

- 2016: Progress on large LNG projects (e.g., in Australia: Gorgon & Wheatstone) was noted.

- 2024: Headquarter move to Houston and continued transformation to streamline and modernize.

Key Developments and Strategic Initiatives

- Digital & AI initiative: Chevron is leveraging artificial intelligence, digital twins, and analytics in subsurface modelling, equipment monitoring and other operations.

- Low carbon and future energies: The company has created a business unit called Chevron New Energies (introduced early 2020s) to address lower carbon solutions.

- Global Tech Hub (India): Chevron is investing US $1 billion to establish the “Engineering & Innovation Excellence Centre” (ENGINE) in Bengaluru, India, targeted at supporting digital/engineering work globally.

Mergers & Acquisitions

- Unocal acquisition (2005) is a big part of Chevron’s upstream expansion.

- Recently, Chevron announced the relocation, leadership changes and reorganization of business segments (Feb 2025) as part of restructuring for efficiency.

- Note: While some sources mention a large acquisition of Hess Corporation (≈ $53 billion) adding assets in Guyana & U.S. (as per Britannica summary).

Partnerships & Collaborations

- Data centre energy supply: Chevron is partnering with GE Vernova and Engine No. 1 to develop onsite power plants (natural gas turbines) to power AI/data centres in the U.S.

- Technology investments: Via Chevron Technology Ventures, the company has invested in over 140 start ups, piloted technologies and integrated some into the supply chain.

Product Launches / Innovations

- Advanced drilling & production: Chevron is scaling “triple frac” technology in its Permian Basin operations fracturing three wells simultaneously to reduce cost and time.

- Deepwater high pressure technology: The company deployed the industry’s first 20,000 psi deep water technology to help unlock resources in the U.S. Gulf of Mexico.

Key Technology Focus Areas

- Digitalization / AI: Use of remote sensors, drones (e.g., the Percepto system for remote facility inspection) and analytics for preventive maintenance, anomaly detection, and efficiency.

- Reservoir & subsurface modelling: Digital twins, high performance computing for geotechnical analysis, carbon storage identification.

- Low carbon solutions: Carbon capture, hydrogen, geothermal, advanced lubricants and materials, and reducing methane intensity (noted 64% reduction since 2016).

R&D Organisation & Investment

- Chevron holds over 4,800 patents, making it one of the leading patent holders in its industry.

- The hub in India (ENGINE) is a key part of its R&D/engineering strategy to harness global talent and build digital/engineering solutions for global operations.

- The company’s technology arm, Chevron Technology Ventures, has invested in more than 140 startups, with about 50% now part of its supply chain.

SWOT Analysis

Strengths:

- Large integrated energy company with a full value chain (upstream, midstream, downstream) and global reach.

- Strong technological capability and innovation focus (digital, AI, production tech).

- Robust capital and operational scale able to invest in large projects and acquisitions.

- Diversifying into lower carbon energy, engineering hubs, digital/AI capabilities.

Weaknesses:

- Heavy legacy exposure to fossil fuels and associated regulatory & environmental risks.

- Complexity in integrating large acquisitions and transforming business processes.

Cost pressures: refining margins, market volatility in oil/gas demand and prices. - Workforce & structural change risks (e.g., planned workforce cuts).

Opportunities:

- Growth in natural gas, LNG and liquefaction/export infrastructure, especially as global energy demand remains strong.

- Expansion of low carbon business: hydrogen, carbon capture, geothermal, new energy solutions.

- Use of digital/AI to drive operational efficiency, asset reliability and cost reduction.

- Emerging markets and talent hubs (e.g., India) to enable cost competitive engineering/digital capabilities.

Threats:

- Transition risk: shift away from fossil fuels may impact long term value and require heavy investment in new technologies.

- Regulatory and social pressure: environmental regulation, climate policies, carbon pricing.

- Commodity price volatility (oil/gas) and market downturns.

- Operational risks: large projects, deepwater drilling, complexity of technologies and integration of acquisitions.

Recent News & Strategic Updates

- October 2025: Chevron expanded its India Engineering & Innovation Excellence Centre (ENGINE) in Bengaluru with a 312,000‑sq‑ft facility, planning ~US $1 billion investment, to bolster its digital and AI capabilities.

- February 2025: Chevron announced a re‑organization of its business structure and leadership: consolidating its Oil, Products & Gas into fewer segments, targeting up to US $3 billion cost savings by 2026, and up to 20% workforce reductions.

Top Players In The Floating Liquefied Natural Gas (FLNG) Terminals Market & Their Offerings:

- Petronas: Operates the PFLNG Satu and PFLNG Dua units, the first two operational FLNG facilities in Asia, providing flexible offshore gas liquefaction and export capabilities.

- Exmar NV: Specialises in floating LNG and regasification units, offering modular FLNG and FSRU (Floating Storage and Regasification Unit) solutions with compact designs suited for remote offshore operations.

- Technip Energies: Provides engineering, procurement, and construction (EPC) services for FLNG projects, including design and integration of liquefaction modules, cryogenic systems, and offshore infrastructure.

- Daewoo Shipbuilding & Marine Engineering Co., Ltd.: Designs and constructs large-scale FLNG vessels and floating production units, including engineering for deepwater liquefaction and storage solutions.

- Keppel Offshore & Marine Ltd.: Specialises in FLNG and FSRU conversions, modular LNG terminals, and shipyard services for liquefaction and regasification projects across Asia and the Middle East.

Other Top Players Are

- Samsung Heavy Industries Co., Ltd.

- TechnipFMC plc

- MODEC, Inc.

- BW Offshore Ltd.

- Shell plc

- Petrofac Limited

- McDermott International, Inc.

- Saipem S.p.A.

- KBR, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Wärtsilä Corporation

- Cheniere Energy, Inc.

- Golar LNG Ltd.

- Hyundai Heavy Industries Holdings Co., Ltd.

Segments Covered:

By Terminal Type / Asset

- Floating LNG Production Vessels (FLNG)

- Floating Storage and Regasification Units (FSRUs)

- Floating LNG Liquefaction Platforms (offshore fixed or turret-moored)

By Contract Type / Business Model

- Build-Own-Operate (BOO)

- Lease / Hire (Time Charter / Charter-Out)

- Joint Venture / Public-Private Partnership (PPP)

By Application / End-Use

- LNG Export Terminals

- LNG Import Terminals

- Regasification for Marine / Bunkering

- Offshore Gas Field Monetisation

By Capacity / Module Size

- Small-scale (≤ 500,000 tpa)

- Mid-scale (500,000 – 1,000,000 tpa)

- Large-scale (> 1,000,000 tpa)

Regional analysis

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

-

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

-

- Eastern Europe

-

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA