Content

What is the Current Green Gas Market Size and Share?

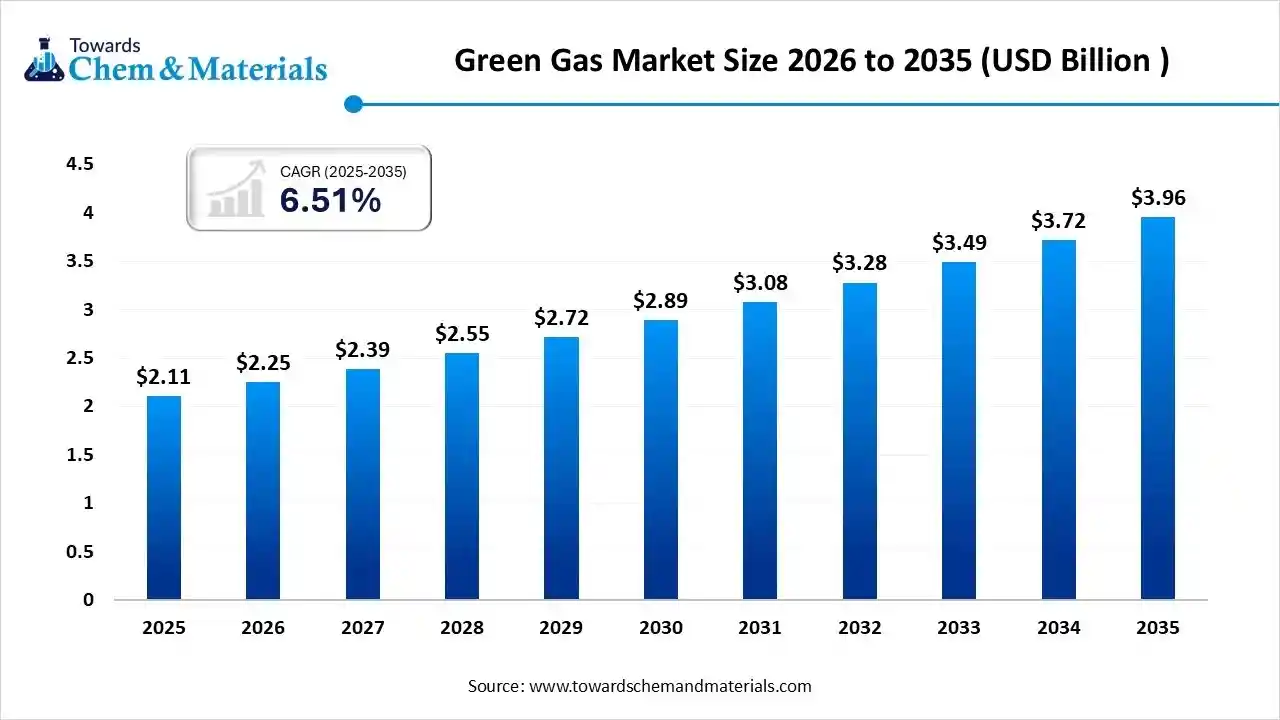

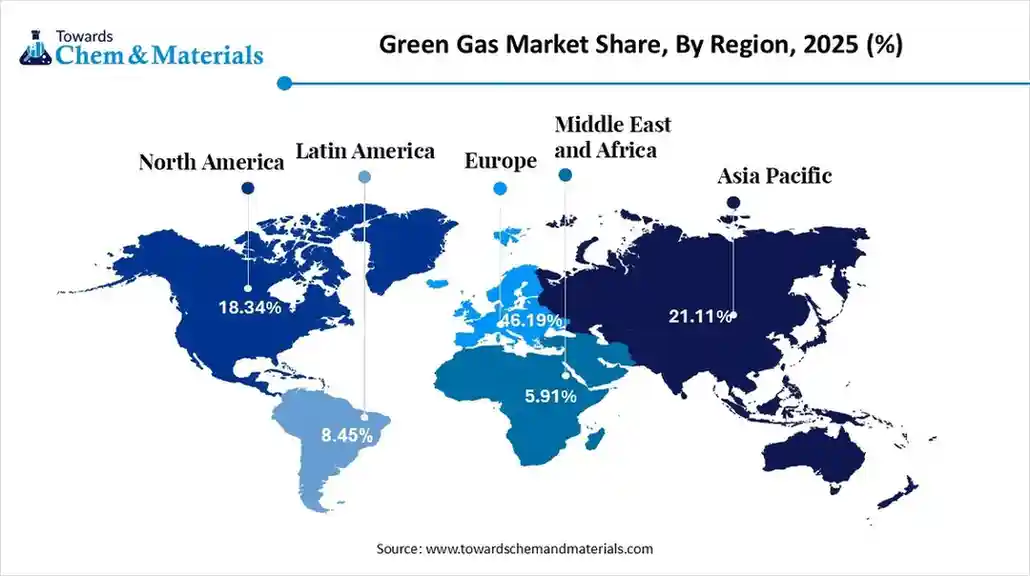

The global green gas market size was estimated at USD 2.11 billion in 2025 and is predicted to increase from USD 2.25 billion in 2026 and is projected to reach around USD 3.96 billion by 2035, The market is expanding at a CAGR of 6.51% between 2026 and 2035. Europe dominated the green gas market with a market share of 46.19% the global market in 2025.The growth of the market is driven by urgent decarbonization goals, government mandates, rising environmental concerns over fossil fuels, and the need for energy storage/grid stability.

Key Takeaways

- By region, Europe led the green gas market with the largest revenue share of over 46.19% in 2025. The growing demand due to sustainability droves the growth of the market.

- By region, Asia Pacific is expected to have fastest growth in the market in the forecast period between 2026 and 2035. Growth is driven by heavy industry fuel switching.

- By gas type, the biomethane / renewable natural gas (RNG) segment led the market with the largest revenue share of 52.12% in 2025. Increasing demand for low-carbon fuels drives the growth of the market.

- By gas type, the green hydrogen segment is projected to grow at a CAGR between 2026 and 2035. Its versatility across power storage in the market drives growth.

- By source/feedstock, the organic waste segment accounted for the largest revenue share of 44.32% in 2025. increased reducing landfill emissions demand fuels the growth.

- By source/feedstock, the electrolysis segment is projected to grow at a CAGR between 2026 and 2035. the high-purity, zero-carbon hydrogen for industrial and mobility applications drives the growth.

- By application, the power generation segment dominated with the largest revenue share of 41.10% in 2025, growing investments by the government supports the growth.

- By application, the transportation segment is projected to grow at a CAGR between 2026 and 2035. companies increasingly prefer green gas solutions to meet emission standards.

- By technology, the anaerobic digestion segment dominated the market and accounted for the largest revenue share of 47.05% in 2025. Benefits from cost-effectiveness fuels the growth.

- By technology, the electrolysis segment is projected to grow at a CAGR between 2026 and 2035. Government-backed hydrogen hubs drive the growth of the market.

- By end user, the utilities & power producers segment accounted for the largest market revenue share of 38.07% in 2025. improving renewable energy reliability increases the growth.

- By end user, the transportation & mobility sector segment is projected to grow at a CAGR between 2026 and 2035. expansion of hydrogen refueling networks drives the growth of the market.

Market Overview

The green gas market refers to the production, distribution, and utilization of renewable, low-carbon gaseous fuels such as biomethane, green hydrogen, renewable natural gas (RNG), syngas, and power-to-gas (P2G) derivatives. These gases are generated from sustainable feedstocks biomass, organic waste, agricultural residues, electrolysis powered by renewable energy, or carbon capture, and serve as cleaner substitutes for conventional fossil-based natural gas.

What Is The Significance Of The Green Gas Market?

The green gas market is significant for decarbonizing energy-intensive sectors like heating, transport, and power by replacing fossil fuels with sustainable alternatives (biomethane, green hydrogen) from waste or renewable electricity. It boosts energy security by diversifying supply, supports the circular economy through waste utilization, and drives technological innovation, all crucial for achieving global climate goals and transitioning to cleaner energy systems.

Green gases support decarbonization in power generation, industrial manufacturing, mobility (transport), and residential heating. Global energy transition policies, net-zero targets, grid decarbonization, and corporate sustainability commitments are driving rapid adoption.

Green Gas Market Growth Trends:

- Biomethane Focus: Derived from organic waste, biomethane is a key player, especially in heavy transport and utilities, leveraging existing gas infrastructure.

- Green Hydrogen Rise: Produced via renewable energy electrolysis, green hydrogen is crucial for decarbonizing power, heating, and industry, with major investments flowing in.

- Policy & Incentives: Government schemes (like the UK's Green Gas Levy, the EU's hydrogen package) are accelerating development and creating competitive markets.

- Sectoral Adoption: Automotive (trucks), power generation, and industrial heat are seeing increased adoption to meet emission targets.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 2.25 Billion |

| Revenue Forecast in 2035 | USD 3.96 Billion |

| Growth Rate | CAGR 6.51% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Segment Covered | By Gas Type, By Source / Feedstock, By Application, By Technology, By End User, By Region |

| Key companies profiled | Air Liquide, Engie SA, Linde plc, Ørsted A/S, Enagas S.A., Air Liquide , Engie , Siemens Energy , Ørsted , Shell New Energies , Enel Green Power , Iberdrola , TotalEnergies , BP (bp pulse / green gas unit) , Xebec Adsorption , Fortum , Plug Power , Bloom Energy , Cummins Hydrogenics , Linde Plc , Snam S.p.A. , Veolia Environment , ADIC (Anaerobic Digestion Industry Collective) , Archaea Energy (RNG specialist) , Nature Energy (biomethane producer) |

Key Technological Shifts In The Green Gas Market:

The green gas market is undergoing a significant transformation driven by advancements in production, distribution, and digitalization to decarbonize traditional energy systems. Key shifts include the rise of Power-to-Gas (P2G) systems for hydrogen production, the evolution of anaerobic digestion (AD) through bio-electrochemical integration, and the widespread adoption of digital twin and AI-driven monitoring to manage renewable gas infrastructure.

Trade Analysis Of the Green Gas Market: Import & Export Statistics

- According to global export data, the world exported 5 shipments of Green Gas from November 2023 to October 2024 (TTM). These exports handled by 2 exporters to 2 buyers, showing a 0% growth compared to the previous twelve months.

- Most Green Gas exports from the world are sent to Kazakhstan. The Netherlands is the leading global exporter of Green Gas, accounting for 72 shipments.

- The top global importers of Green Gas are the United States, Uzbekistan, and the United Arab Emirates. The U.S. leads with 628 shipments, followed by Uzbekistan with 491 shipments, and the UAE with 24 shipments.

- According to India export data, India exported 7,311 shipments of CNG, handled by 322 Indian exporters to 888 buyers. Most CNG exports from India go to Bangladesh, Peru, and Myanmar.

- Worldwide, the top exporters of CNG are India, the United States, and China. India is the largest with 7,010 shipments, followed by the U.S. with 3,680 shipments, and China with 884 shipments.

Green Gas Market Value Chain Analysis

- Chemical Synthesis and Processing: Green gas is produced through processes such as anaerobic digestion, biomass gasification, power-to-gas conversion, biogas upgrading, purification, compression, and pipeline injection. These methods ensure low-carbon renewable gas suitable for industrial and utility applications.

- Key players: Air Liquide, ENGIE, Ørsted, EnviTec Biogas

- Quality Testing and Certification :Green gas requires certifications for renewable origin, gas purity, grid compliance, emission reduction, and sustainability validation. Key certifications include Renewable Gas Guarantees of Origin (RGGO), ISO clean energy standards, EU Renewable Energy Directive (RED II) compliance, and carbon footprint verification.

- Key players: ISO (International Organization for Standardization), European Biogas Association, Green Gas Certification Scheme (GGCS), UL Solution

- Distribution to Industrial Users: Green gas is distributed to power generation facilities, commercial heating systems, residential utilities, transportation fuel networks (bio-CNG/Bio-LNG), and industrial manufacturing operations transitioning to low-carbon energy.

- Key players: Gasum, National Grid, TotalEnergies

Green Gas Regulatory Landscape: Global Regulations

| Region | Market Characteristics | Key Growth Drivers | Major End-Use Industries | Notable Notes |

| North America | Rapid adoption of renewable natural gas (RNG), strong policy incentives, and expanding biogas upgrading facilities | Carbon-neutral fuel mandates; state-level clean energy programs; rising demand for low-carbon transportation fuels | Transportation, utilities, industrial heating, and commercial buildings | California’s LCFS continues to drive the fastest RNG market growth in the region |

| Europe | Most mature green gas market globally, extensive biomethane injection infrastructure, strong regulatory backing | EU Green Deal, Fit-for-55, biomethane targets to replace fossil gas; decarbonization mandates | Residential heating, industrial processes, power generation, transport | Europe aims for 35 bcm of biomethane by 2030, making it the largest global consumption hub |

| Asia Pacific | Growing interest but uneven adoption; early-stage biogas upgrading and hydrogen blending projects | Waste-to-energy programs; government clean-fuel subsidies; industrial decarbonization | Power generation, industrial boilers, transport (CNG/RNG), and agricultural waste | Japan and South Korea push hydrogen-blended gas; China is scaling agricultural biogas. |

| South America | Emerging market with strong agricultural and waste feedstock potential; limited grid injection | Waste management initiatives, bioenergy investments, and rural electrification | Agriculture, industrial heating, and power generation | Brazil show the strongest project pipelines for biomethane |

| Middle East & Africa | Early-stage development; pilot green hydrogen and biogas projects rising; resource-rich | National hydrogen strategies; circular economy programs; energy diversification | Power generation, desalination, industry, transport | UAE, Saudi Arabia, and South Africa are developing major green hydrogen hubs |

Segmental Insights

Gas Type Insights

How Did The Biomethane/Renewable Natural Gas (RNG) Segment Dominate The Green Gas Market In 2025?

The biomethane/renewable natural gas (RNG) segment dominated the market with a share of approximately 52.12% in 2025. Biomethane/RNG dominates the market due to its compatibility with existing natural gas infrastructure and its strong adoption across power generation, mobility, and industrial heating. Increasing demand for low-carbon fuels, expansion of anaerobic digestion facilities, and government incentives for renewable natural gas blending significantly support segment growth.

The green hydrogen segment is projected to grow at a CAGR between 2026 and 2035 in the market. Green hydrogen is rapidly emerging as a key future energy carrier driven by net-zero policies, declining electrolyzer costs, and large-scale investments in hydrogen mobility and green steel production. Its versatility across power storage, industrial feedstock, and heavy-duty transportation ensures strong long-term market potential despite current cost challenges.

Source/Feedstock Insights

Which Source/Feedstock Segment Dominates The Green Gas Market In 2025?

The organic waste segment dominated the market with a share of approximately 44.32% in 2025. Organic waste is the largest feedstock source, supported by increasing waste-to-energy projects, circular economy models, and mandatory waste diversion regulations. Municipal solid waste, agricultural residues, and food waste are extensively utilized to produce biomethane, reducing landfill emissions and enabling decentralized renewable energy solutions.

The electrolysis segment is projected to grow at a CAGR between 2026 and 2035 in the green gas market. Electrolysis-based green gas, especially green hydrogen, is expanding rapidly due to rising investments in renewable-powered electrolyzers and national hydrogen roadmaps. As solar and wind energy costs decline, electrolysis becomes more economically viable, making it a central pathway for producing high-purity, zero-carbon hydrogen for industrial and mobility applications.

Application Insights

How Did Power Generation Segment Dominate The Green Gas Market In 2025?

The power generation segment dominated the market with a share of approximately 41.10% in 2025. Green gas is increasingly used in decentralized power systems, gas turbines, combined heat and power (CHP) plants, and backup power applications. Utilities are adopting biomethane and hydrogen blending to reduce carbon intensity while maintaining system stability, driving continued investment in green gas integration into existing energy networks.

The transportation segment is projected to grow at a CAGR between 2026 and 2035 in the green gas market. Green gas adoption in transportation is rising due to the growth of renewable natural gas vehicles, hydrogen fuel-cell vehicles, and low-carbon mobility targets. Fleet operators, public transit agencies, and logistics companies increasingly prefer green gas solutions to meet emission standards, enabling a transition to cleaner transportation alternatives.

Technology Insights

Which Technology Segment Dominates The Green Gas Market In 2025?

The anaerobic digestion segment dominated the market with a share of approximately 47.05% in 2025. Anaerobic digestion remains a core technology for producing biomethane, leveraging agricultural waste, municipal waste, and industrial residues. The technology benefits from cost-effectiveness, established infrastructure, and strong policy support for biogas upgrading, making it the foundation of the renewable natural gas sector globally.

The electrolysis segment is projected to grow at a CAGR between 2026 and 2035 in the green gas market. Electrolysis technologies such as PEM, alkaline, and solid oxide electrolyzers enable the production of green hydrogen using renewable electricity. Rapid cost reductions, government-backed hydrogen hubs, and industrial decarbonization initiatives are driving major expansion, making electrolysis the fastest-growing technology segment in the market.

End User Insights

How Did Utilities And Power Producers Segment Dominate The Green Gas Market In 2025?

The utilities and power producers segment dominated the market with a share of approximately 38.07% in 2025. Utilities are increasingly integrating green gas into their energy mix to meet decarbonization targets and reduce dependency on fossil-based natural gas. Utilities leverage green hydrogen for grid balancing, RNG for pipeline injection, and hybrid systems for improving renewable energy reliability, driving strong market uptake.

The transportation and mobility sector segment is projected to grow at a CAGR between 2026 and 2035 in the green gas market. The transportation sector is a major consumer of green gas due to the expansion of hydrogen refueling networks, RNG-powered vehicle fleets, and low-emission logistics solutions. Growing mandates for clean mobility, especially in heavy-duty and long-haul transportation, underpin the accelerating demand for green gas in this segment.

Regional Insights

The Europe green gas market size was valued at USD 0.97 billion in 2025 and is expected to reach USD 1.83 billion by 2035, growing at a CAGR of 6.55% from 2026 to 2035. Europe dominated the market with a share of approximately 46.19% in 2025. Europe is aggressively developing green gas via biomethane, hydrogen, and synthetic methane to decarbonize heat, industry, and transport. Strong policy drivers include RED II/III, national renewable gas targets, and sizable funding for electrolyzers and AD upgrading. Grid injection of biomethane, hydrogen-ready networks, and sector-coupling projects support a rapidly maturing green gas ecosystem tailored to energy security and emissions reduction goals.

Germany: Green Gas Market Growth Trends

Germany is a leading European market, investing heavily in biomethane upgrading, hydrogen infrastructure, and power-to-gas pilot plants as part of its Energiewende. Agricultural biogas upgrading for grid injection, industrial hydrogen use cases, and municipal waste-to-energy projects feature prominently. Policy incentives and industrial decarbonization strategies accelerate the deployment of green gas across transport and industrial heat applications.

Asia Pacific: Growth Is Driven By Heavy Industry Fuel Switching

Asia Pacific is expected to have fastest growth in the market in the forecast period between 2026 and 2035. Asia-Pacific green gas activity is growing but uneven: some countries emphasize biomethane from waste and agricultural residues, while others prioritize green hydrogen for industrial decarbonization. Demand drivers include urban air quality concerns, heavy industry fuel switching, and export ambitions for green hydrogen. Infrastructure and feedstock constraints shape project sizing and timelines across the region.

China: Green Gas Market Growth Trends

China pursues green gas development through large-scale biomethane projects, pilot RNG network injection, and ambitious hydrogen roadmaps tied to renewable expansion. Municipal solid waste and agricultural residues underpin biomethane projects; electrolyzer deployment is scaling for industrial hydrogen. Strategic national planning and state-backed investments support rapid commercialization where regional policy and feedstock availability align.

North America: Growing Demand Due To Leading Projects Drives Growth

North America’s green gas market, comprising biomethane, renewable natural gas (RNG), and hydrogen blending initiatives, is expanding as states and provinces set low-carbon gas targets, renewable fuel standards, and food-waste/anaerobic digestion incentives. Growth is led by landfill and anaerobic digestion projects feeding pipeline networks and transport fuel markets, plus pilot hydrogen blending and power-to-gas projects. Policy support and corporate net-zero commitments underpin project pipelines.

United States: Green Gas Market Growth Trends

The U.S. market for green gas is increasingly active with RNG projects for RNG vehicle fuel, pipeline injection, and utility blending, supported by low-carbon fuel standards in California and federal tax incentives. Renewable hydrogen pilots and electrolyzer projects complement biomethane development. Investment is concentrated where gas grids, dairy/agricultural feedstock, and landfill resources enable economically viable green gas production and credits monetization.

South America: Growing Interest In Hydrogen Export Drives The Growth

South America’s green gas market is emerging with strong biomethane potential from agriculture, landfills, and wastewater, and growing interest in hydrogen exports. Countries explore RNG for transport and grid injection while assessing hydrogen for industrial uses and export-led green commodity strategies. Project development often hinges on financing, feedstock aggregation, and enabling gas-market reforms.

Brazil: Green Gas Market Growth Trends

Brazil has significant RNG prospects due to abundant agricultural residues, large livestock operations, and landfill resources. Biomethane projects for transport fuel and grid injection are gaining traction, backed by sustainability priorities in agri-business. Early hydrogen initiatives are exploring green hydrogen for the domestic industry and potential export pathways, supported by renewable power expansion.

MEA Green Gas Market Trends

MEA’s green gas market centers on hydrogen potential, leveraging low-cost renewables for large-scale electrolyzer projects, alongside selective biomethane from waste. Gulf countries position hydrogen for export and industrial decarbonization, while African nations evaluate biomass-to-gas opportunities for local energy access and decarbonization. Investment flows favor export-oriented and strategic industrial use cases.

United Arab Emirates: Green Gas Market Growth Trends

The UAE is a regional leader in green hydrogen and green gas planning, investing in large electrolyzer projects, and exploring integrated hydrogen/derivatives value chains. Strategic vision targets green hydrogen for industrial decarbonization and export markets, complemented by pilot biomethane and waste-to-energy projects aimed at circularity and domestic energy transition goals.

Recent Developments

- In July 2025, Delgaz Grid, part of E.ON Group in Romania, initiated three pilot projects to integrate biomethane and hydrogen into the country's natural gas infrastructure, marking Romania's first national effort to test green gas solutions in existing distribution networks.(Source: www.bioenergy-news.com)

- In September 2025, Kawasaki Heavy Industries announced the world's first commercial launch of a large gas engine system capable of hydrogen 30% co-firing on September 30, 2025. Based on the high-efficiency Kawasaki Green Gas Engine, this "hydrogen-ready" model completed its verification phase in September 2025.(Source: fuelcellsworks.com )

- In October 2025, Desco Infratech Limited, KPI Green Hydrogen and Ammonia, and Naveriya Gas Pvt. Ltd. formed a partnership in October 2025 to launch large-scale hydrogen-natural gas blending projects in India's City Gas Distribution sector.(Source: solarquarter.com)

- In February 2025, Steel Authority of India Limited (SAIL) is conducting major industrial trials and pilot projects to incorporate green fuels, such as bamboo biochar and green hydrogen, into its steelmaking processes. These efforts are part of a strategy to move towards "green steel" and decrease carbon emissions across its five integrated steel plants.(Source: tubepipeindia.com )

Top players in the Green Gas Market & Their Offerings:

- Air Liquide: Air Liquide is a major global supplier of green gases, including biomethane, renewable hydrogen, and synthetic methane. The company invests heavily in large-scale electrolyzers, biogas upgrading units, and hydrogen mobility infrastructure, supporting industrial decarbonization and clean energy transitions.

- Engie SA: Engie is a leading producer and distributor of renewable gases such as biomethane and green hydrogen. The company focuses on anaerobic digestion projects, power-to-gas facilities, and large-scale hydrogen production to support clean mobility, heating, and industrial processes across Europe and global markets.

- Linde plc: Linde provides green hydrogen, renewable LNG (bio-LNG), and synthetic gases through advanced gas production, liquefaction, and storage technologies. The company supports various sectors, including heavy transport, chemicals, and power generation, with sustainable gas solutions.

- Ørsted A/S: Ørsted is expanding aggressively into the renewable gas sector, producing green hydrogen and e-fuels using offshore wind power. The company focuses on large power-to-X projects aimed at decarbonizing aviation, shipping, and industrial manufacturing.

- Enagas S.A.: Enagas is a major player in biomethane and renewable hydrogen infrastructure development. The company operates biogas upgrading plants, hydrogen transport networks, and pilot power-to-gas projects crucial for promoting green gas adoption in Europe’s energy.

Top Companies in the Green Gas Market

- Air Liquide

- Engie SA

- Linde plc

- Ørsted A/S

- Enagas S.A.

- Air Liquide

- Engie

- Siemens Energy

- Ørsted

- Shell New Energies

- Enel Green Power

- Iberdrola

- TotalEnergies

- BP (bp pulse / green gas unit)

- Xebec Adsorption

- Fortum

- Plug Power

- Bloom Energy

- Cummins Hydrogenics

- Linde Plc

- Snam S.p.A.

- Veolia Environment

- ADIC (Anaerobic Digestion Industry Collective)

- Archaea Energy (RNG specialist)

- Nature Energy (biomethane producer)

Segments Covered

By Gas Type

- Biomethane / Renewable Natural Gas (RNG)

- Green Hydrogen

- Syngas

- Power-to-Gas (P2G) Hydrogen & Methane

- Bio-LPG / Renewable Propane

- Others (Landfill Gas, Bio-SNG)

By Source / Feedstock

- Organic Waste

- Agricultural Residues

- Energy Crops

- Industrial Waste

- Sewage Sludge

- Electrolysis

- Landfills

By Application

- Power Generation

- Industrial Fuel

- Transportation

- Residential & Commercial Heating

- Grid Injection

- Chemical & Refinery Feedstock

By Technology

- Anaerobic Digestion

- Gasification

- Electrolysis (Green Hydrogen)

- Methanation

- Carbon Capture + Power-to-Gas

- Others (Pyrolysis, Plasma Gasification)

By End User

- Utilities & Power Producers

- Industrial Manufacturers

- Transportation & Mobility Sector

- Commercial Establishments

- Residential Consuming Sector

- Municipal Bodies & Waste Management

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa