Content

Acetic Acid Market Size and Growth 2025 to 2034

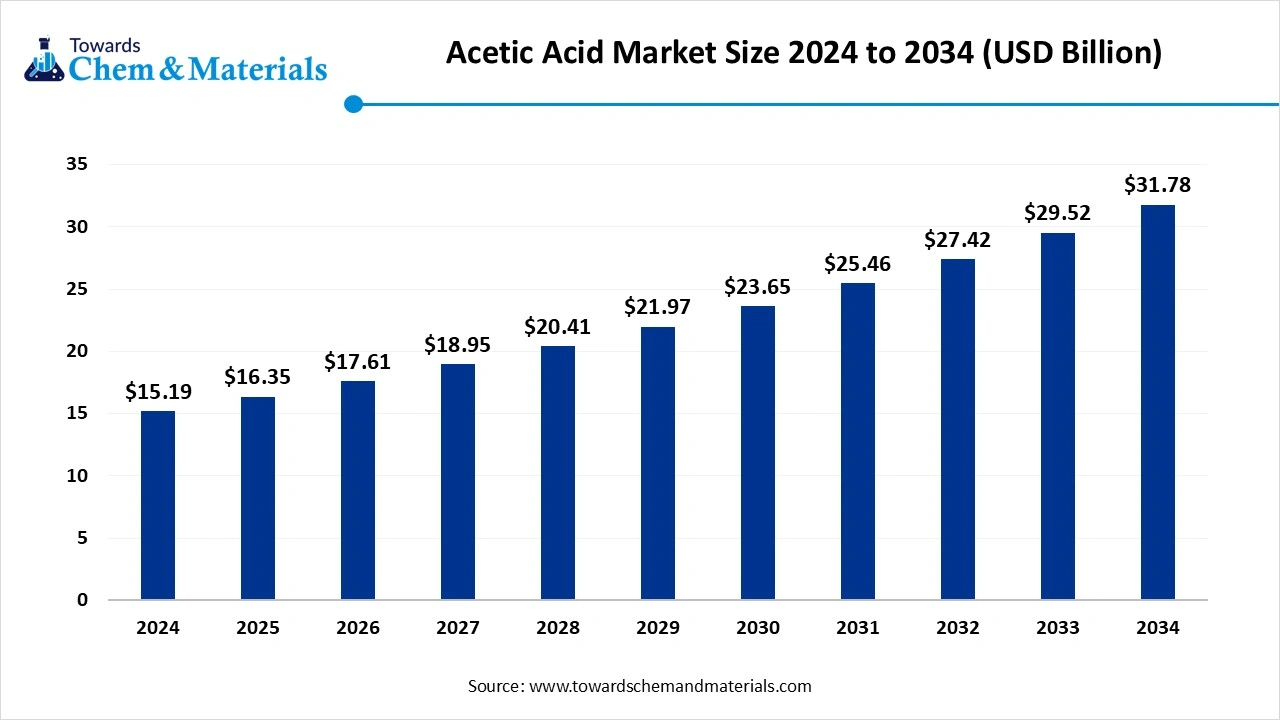

The global acetic acid market was valued at approximately USD 15.19 billion in 2024 and is projected to grow at a CAGR of 7.66% from 2025 to 2034, reaching a value of USD 31.78 billion by 2034. The growing demand across key industries like textiles, food & beverage, and pharmaceuticals drives the growth of the market.

Key Takeaways

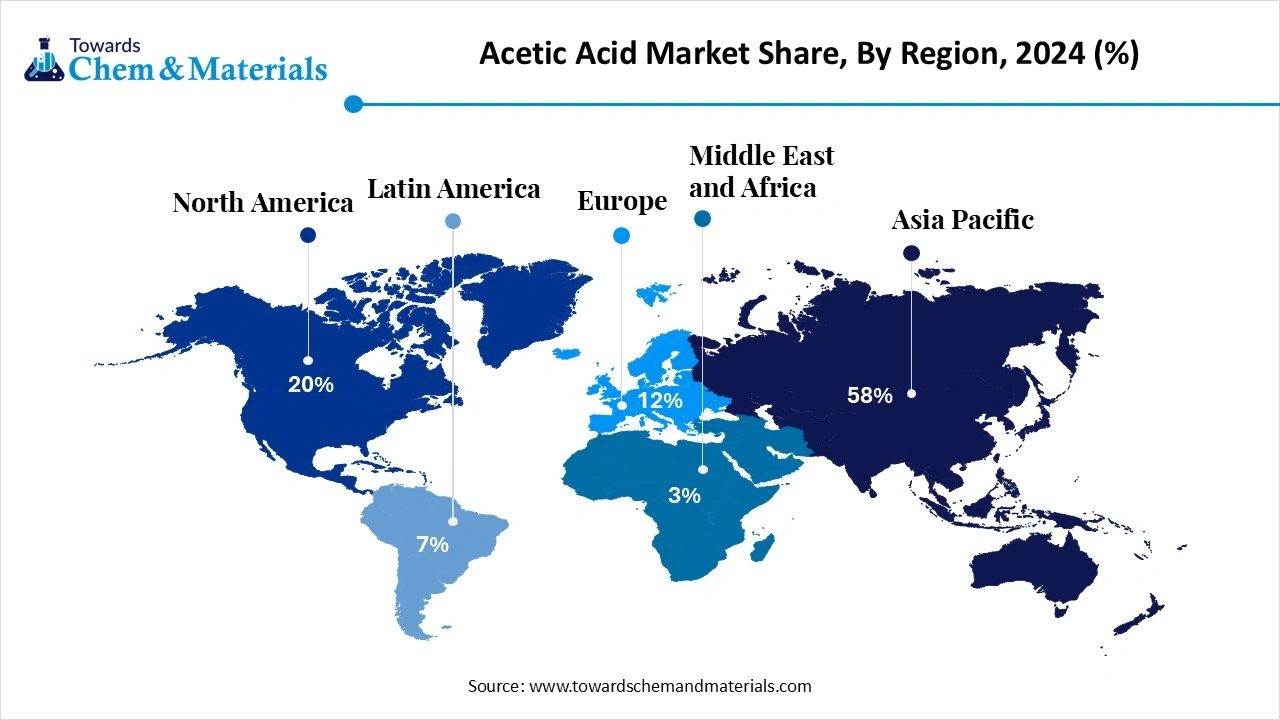

- The acetic acid market in Asia Pacific dominated the global industry with a revenue share of 58% in 2024.

- By region, Middle East & Africa is growing at the fastest CAGR in the market during the forecast period due to the rapid growth in infrastructure development.

- By derivative, the vinyl acetate monomer segment held a 32% share in the market in 2024 due to the growing demand in the packaging industry.

- By derivative, the purified terephthalic acid segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing production of PET.

- By end-use industry, the plastics & polymers segment held a 36% share in the market in 2024 due to the growing demand in the automotive and packaging industries.

- By end-use industry, the food & beverages segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for preservatives.

- By production method, the methanol carbonylation segment held an 85% share in the market in 2024 due to the growing demand for high-yield acetic acid.

- By production method, the biological fermentation segment is expected to grow at the fastest CAGR in the market during the forecast period due to the focus on improving scalability.

- By purity, the glacial acetic acid segment held a 90% share in the market in 2024 due to the growing demand in coatings & adhesives.

- By purity, the diluted acetic acid segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for natural cleaning agents.

- By distribution channel, the direct segment held a 70% share in the acetic acid market in 2024, due to the focus on minimizing transportation costs.

- By distribution channel, the online/e-commerce segment is expected to grow at the fastest CAGR in the market during the forecast period due to the ease of purchasing.

From Households to Industries: The Versatility of Acetic Acid

Acetic acid is an organic compound with the second simplest carboxylic acid. The chemical formula of acetic acid is CH3COOH, and the molecular weight is 60.052 g/mol. It has a sour taste, a pungent smell, and called as the ethanoic acid. Acetic acid is a colorless liquid and has strong corrosive properties. Its boiling point is 391K and its melting point is 289K. Acetic acid is a major component is vinegar and is used as an antiseptic. Acetic acid can react with carbonates, metals, and bases to form salts. It is widely used to manufacture different perfumes and rubber. The increasing demand for flavoring agents and food preservatives in the food & beverage industry increases demand for acetic acid.

The vinyl acetate monomer produce by the acetic acid. The increasing demand for processed and packaged food fuels the adoption of acetic acid. The growing production of various pharmaceuticals fuels demand for acetic acid. Factors like the growing production of vinyl acetate monomer, the development of bio-based acetic acid, and rapid industrial growth contribute to the acetic acid market growth.

- South Korea exported $82.8M of acetic acid in 2024.(Source: oec.world)

- South Korea exported $6.2M of acetic acid in May 2025.(Source: oec.world)

- Germany exported $60.3M of acetic acid in 2023.(Source: oec.world)

Who are the leading Exporters of Acetic Acid in 2023?

| Country | Export - 2023 |

| United States | 572M |

| China | 424M |

| Malaysia | 153M |

Growing Construction Sector Drives Acetic Acid Market Growth

The growing construction activities in various regions increase demand for acetic acid for different applications. The growth in commercial, residential, and infrastructure development fuels demand for acetic acid. The increasing demand for adhesives to bond materials like composites, wood, and plastics fuels demand for acetic acid. The growing demand for paints and coatings in the construction sector for aesthetics & protection requires acetic acid.

The construction activities like insulation, flooring, and roofing increase demand for polymers & resins, which require acetic acid. The increasing production of materials like concrete additives, sealants, and caulks increases demand for acetic acid. The focus on building sustainable construction increases demand for bio-based acetic acid. The growing development of infrastructure projects like public places, roads, and bridges increases demand for acetic acid for applications like coatings and paints. The growing construction sector is a key driver for the market growth.

Market Trends

- Growing Focus on Bio-Based Acetic Acid: The increasing shift towards bio-based acetic acid increases demand for sustainable production of acetic acid. Companies focus on the development of bio-based acetic acid to lower the carbon footprint.

- Rising Demand for PTA and VAM: The increasing demand for PTA and VAM in various sectors like construction, packaging, and textiles helps the market growth. The increasing production of PET fibers, paints, adhesives, PET bottles, and coatings fuels demand for PTA and VAM.

- Rise in Electric Vehicles: The growing adoption of electric vehicles requires adhesives and coatings to enhance aesthetic appeal is fueling demand for acetic acid.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 16.35 Billion |

| Market Size by 2034 | USD 31.78 Billion |

| Growth rate from 2024 to 2025 | CAGR 7.66% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Derivative / Application, By End-Use Industry, By Production Method, By Purity, By Distribution Channel, By Region |

| Key Companies Profiled | Celanese Corporation (USA), Eastman Chemical Company (USA), LyondellBasell Industries (Netherlands), SABIC (Saudi Arabia), BP Plc (UK), Daicel Corporation (Japan), Jiangsu Sopo Group (China), Wacker Chemie AG (Germany), INEOS Group (UK), China Petroleum & Chemical Corporation (Sinopec), Shanghai Huayi Group (China), HELM AG (Germany), Mitsubishi Chemical Corporation (Japan), Sipchem (Saudi Arabia), Indian Oil Corporation Ltd (India), Gujarat Narmada Valley Fertilizers & Chemicals (India), PetroChina (China), Yankuang Cathay Coal Chemicals Co., Ltd. (China), Lotte Chemical Corporation (South Korea), GNFC (India) |

Market Opportunity

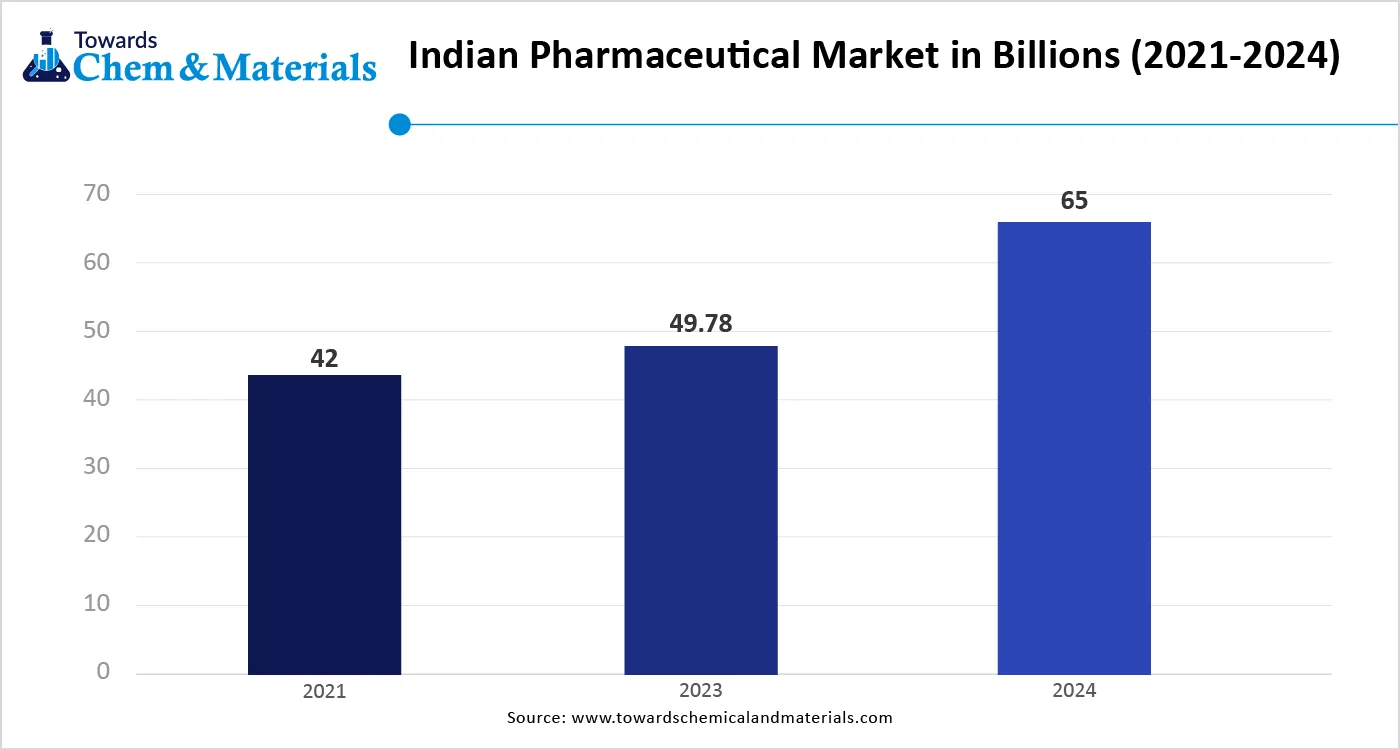

The Growing Expansion of the Pharmaceutical Sector

The growing expansion of the pharmaceutical industry and rising demand for various pharmaceutical products increase the demand for acetic acid. The increasing preparations of a wide range of pharmaceuticals, like ophthalmic solutions, topical preparations, and injections, use acetic acid as a pH adjuster and solvent. The production of active pharmaceutical ingredients like vitamins, aspirin, and hormones increases demand for acetic acid as a catalyst or reagent. The growing demand for wound care products and antiseptics increases the adoption of diluted acetic acid due to its antimicrobial properties. The production of ear drops requires acetic acid. It is widely used as an excipient, and it controls the quality of pharmaceuticals. Acetic acid is used in disinfecting and cleaning pharmaceutical manufacturing equipment and surfaces. The growing expansion of the pharmaceutical sector creates an opportunity for the growth of the acetic acid market.

Market Challenge

Raw Material Price Fluctuations Restrict Acetic Acid Market Growth

Despite several benefits of acetic acid in various industries, the fluctuations in the raw materials costs limit the expansion of the market. Factors like upstream materials cost and supply & demand are responsible for fluctuating raw materials prices. Methanol is a key material used in the production of acetic acid during the methanol carbonylation process, but volatility in the prices of methanol directly affects the market. The fluctuations in the prices of raw materials like coal and natural gas increase the overall cost. The various logistical problems, like port congestion, transportation costs, and others, are responsible for the fluctuation of raw materials prices. The raw materials price fluctuations hamper the growth of the market.

Regional Insights

How Asia Pacific Dominated the Acetic Acid Market?

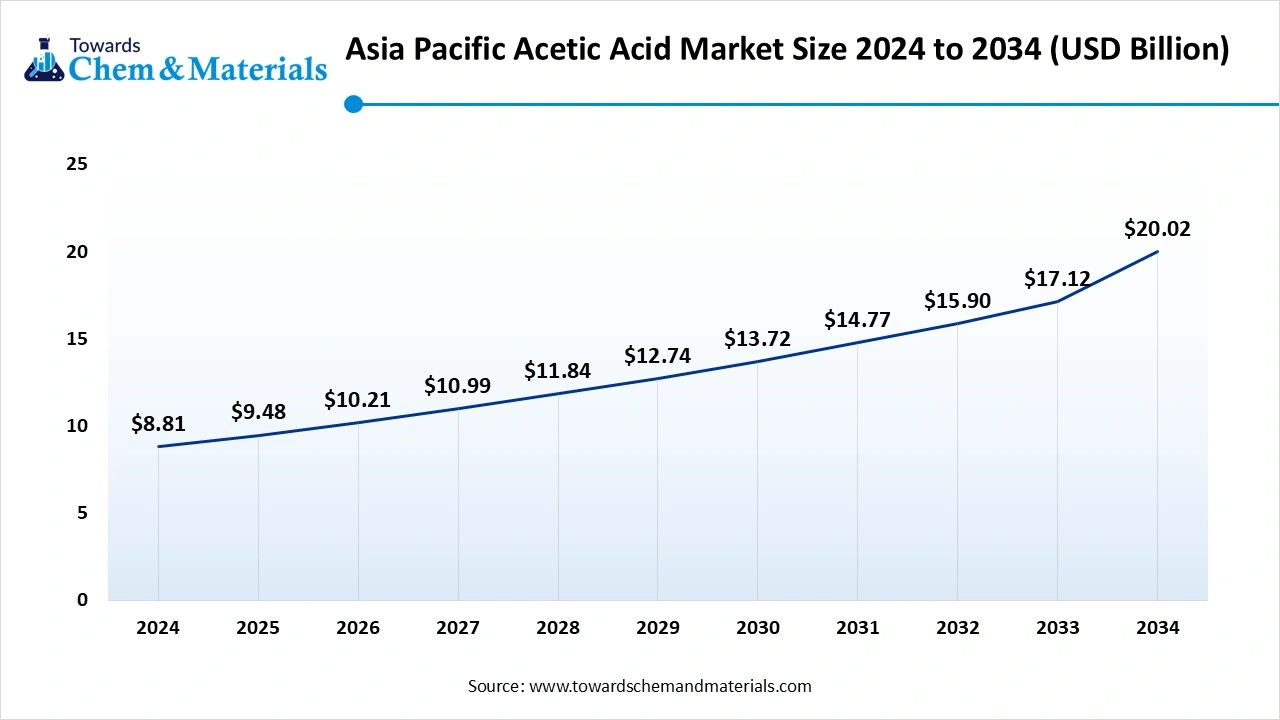

The Asia Pacific acetic acid market size accounted for USD 9.48 billion in 2025 and is forecasted to hit around USD 20.02 billion by 2034, representing a CAGR of 8.55% from 2025 to 2034.

Asia Pacific dominated the market in 2024. The rapid industrialization in countries like South Korea, China, and India increases demand for acetic acid. The increasing production capacity of acetic acid and the rising demand for purified terephthalic acid and vinyl acetate monomer help the market growth. The growing production of polymer and plastic increases demand for acetic acid. The growing expansion of end-user industries like pharmaceuticals, household cleaning products, textiles, and food & beverages fuels demand for acetic acid. The rising demand across the automotive and construction sectors drives the market growth.

India’s Acetic Acid Market Trends

India is growing in the acetic acid market. The expansion of the textile industry increases demand for acetic acid for processes like fabric finishing and dyeing. The rapid industrialization and growing production of chemicals help the market growth. The increasing production of active pharmaceutical ingredients and drugs is fueling demand for acetic acid. The growing demand for various foods & beverages increases the adoption of acetic acid. The strong investment in infrastructure development and growing construction activities drive the market growth.

- India exported $11.8M of acetic acid in 2023.(Source: oec.world)

- India exported $471K of Vinegar in 2023.(Source: oec.world)

- Jubilant Ingrevia Limited is the leading supplier of acetic acid in India.

(Source: www.volza.com)

Why Middle East & Africa Growing in the Acetic Acid Market?

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The growing focus on infrastructure development and the growing demand for various chemicals help the market growth. The growing textile industry increases demand for acetic acid for fabric finishing and dying processes. The increasing manufacturing activities in various industries are fueling demand for acetic acid. The growing healthcare infrastructure and the rising pharmaceutical sector increase the demand for acetic acid. The growing construction industry fuels demand for acetic acid for materials like adhesives, resins, and coatings. The rising expansion of the agriculture sector supports the market growth.

Acetic Acid Market Trends in the United Arab Emirates

The United Arab Emirates is significantly growing in the acetic acid market. The growing expansion of the industrial base and manufacturing activities leads to higher demand for acetic acid. The rapid growth in the pharmaceutical industry fuels demand for acetic acid for the production of drugs, helping the market growth. The growing textile industry increases demand for acetic acid for fabric finishing and the dying process. The increasing development of infrastructure projects like transportation networks and new buildings supports the overall growth of the market.

- The United Arab Emirates exported $1.36M of acetic acid in 2023.(Source: oec.world)

- The United Arab Emirates exported $4.93M of vinegar in 2023.(Source: oec.world )

- Hunter Foods is the leading supplier of acetic acid in the United Arab Emirates. (Source: www.volza.com)

Segmental Insights

Derivative / Application Insights

Why did Vinyl Acetate Monomer Segment Dominate the Acetic Acid Market?

The vinyl acetate monomer (VAM) segment dominated the acetic acid market in 2024. The growing demand for coatings, films, paints, textiles, and adhesives increases the adoption of vinyl acetate monomer. The increasing expansion of the packaging industry fuels demand for VAM for copolymers & packaging films production, helping the market growth. The growing demand for a sustainable solution like paints & adhesives in various industries fuels demand for VAM. The increasing demand for coatings and paints in the automotive & construction sectors increases the adoption of VAM. The growing demand across end-user industries like adhesives, packaging, and textiles drives the market growth.

The purified terephthalic acid (PTA) segment is the fastest-growing in the market during the forecast period. The increasing production of thermoplastic polymer and polyethylene terephthalate is fueling demand for PTA. The growing consumption of PET containers and bottles fuels demand for PTA, helping the market growth. The rising demand for composite materials and coatings increases the adoption of PTA. The growing demand for home furnishing, food containers, and clothing supports the market growth.

End-Use Industry Insights

Which End-User Industry Held the Largest Share of the Acetic Acid Market?

The plastics & polymers segment held the largest revenue share of the acetic acid market in 2024. The growing consumption of plastic packaging materials, bottles, and food containers increases the demand for acetic acid. The increasing demand for polymers across various sectors like coatings, textiles, films, paints, and adhesives fuels demand for acetic acid, helping the market growth. The growing adoption of plastic & polymers in the food & beverage industry fuels demand for acetic acid. The rising demand for plastic & polymers in sectors like construction, automotive, packaging, and textile drives the market growth.

The food & beverage segment is experiencing the fastest growth in the market during the forecast period. The growing demand for preservatives in various food products like dressings, pickles, and sauces increases demand for acetic acid. The growing consumer preference for a tangy and sour taste fuels demand for acetic acid, helping the market growth. Acetic acid provides quality, flavor, and texture to food products. The increasing demand for natural and sustainable food ingredients increases the adoption of acetic acid. The growing vinegar applications in various food products like salad, marinades, pickling, and dressing fuel demand for acetic acid. The rising consumption of packaged food and ready-to-eat foods supports the market growth.

Production Method Insights

How Methanol Carbonylation Segment Dominated the Acetic Acid Market?

The methanol carbonylation segment dominated the acetic acid market in 2024. The high availability of raw materials like carbon monoxide and methanol helps in the large-scale production of acetic acid. The growing demand for high-yield acetic acid in various sectors increases the adoption of the methanol carbonylation process. It produces fewer unwanted byproducts and is ideal for industrial, large-scale production. The increasing demand for acetate esters, vinyl acetate monomer, and purified terephthalic acid is fueling the adoption of the methanol carbonylation process. The high selectivity and lower pressure operation drive the market growth.

The biological fermentation segment is the fastest growing in the market during the forecast period. The strong focus on lowering carbon emissions increases the adoption of the biological fermentation process. The growing consumer demand for eco-friendly products helps the market growth. The focus on improving scalability and cost-effectiveness increases the adoption of biological fermentation. The growing adoption of greener production methods for acetic acid increases demand for the biological fermentation process. The increasing demand for biological fermentation of acetic acid across industries like textiles, food & beverage, and pharmaceuticals supports the market growth.

Purity Insights

How Glacial Acetic Acid Segment Held the Largest Share of the Acetic Acid Market?

The glacial acetic acid segment held the largest revenue share of the acetic acid market in 2024. The growing demand for glacial acetic acid in the production of acetic anhydride, VAM, and PTA helps the market growth. Glacial acetic acid is 99.5% pure and is widely used for large-scale industrial production. It is cost-effective and provides control over chemical reactions. The growth in manufacturing processes and industrialization increases demand for glacial acetic acid. The growing demand across industries like textiles, coatings & adhesives, plastic, and food & beverage drives the market growth.

The diluted acetic acid segment is experiencing the fastest growth in the market during the forecast period. The increasing consumer demand for natural cleaning agents in household surfaces fuels demand for acetic acid. The growing production of various food products like flavoring agents, pickles, and salad dressing increases demand for diluted acetic acid, helping the market growth. Diluted acetic acid is used to remove mineral buildup and limescale from various equipment. It regulates pH and is relatively safe for use. The growing demand for sustainable ingredients supports the market growth.

Distribution Channel Insights

Which Distribution Channel Segment Dominated the Acetic Acid Market?

The direct (bulk) segment dominated the acetic acid market in 2024. The manufacturers' focus on supplying a large volume of acetic acid through bulk channels increases the adoption of direct supply. The growing focus on reducing transportation and handling costs increases demand for direct supply, helping the market growth. It is a cost-effective way to supply high-volume chemicals. The growing demand for acetic acid in various sectors increases the adoption of direct supply, driving the overall market growth.

The online/e-commerce segment is the fastest growing in the market during the forecast period. The easy access to a wide range of buyers and suppliers increases the adoption of online platforms. The ease of purchases and browsing through an online portal helps the market growth. The increasing digital transformation of chemical companies and 24/7 accessibility increases the adoption of e-commerce platforms. The shift towards online shopping and focus on personalized shopping experiences support the market growth.

Recent Developments

- In March 2023, KBR obtained the acetic acid production technology, Acetica. The technology produces vinyl acetate monomer chemical and supports the net-zero transition.(Source: www.indianchemicalnews.com)

- In December 2024, Lenzing collaborated with the Italian Licensee to produce biobased acetic acid. The partnership aims to use biobased acetic acid in fabric dyeing processes in the textile industry. This reduces the carbon footprint by over 85% and enhances sustainability.(Source: www.chemanalyst.com)

- In May 2023, Sekab expanded production of bio-based acetic acid. The expansion lowers 50% carbon footprint and meets supply requirements in Europe.(Source: www.sekab.com)

Top Companies List

- Celanese Corporation (USA)

- Eastman Chemical Company (USA)

- LyondellBasell Industries (Netherlands)

- SABIC (Saudi Arabia)

- BP Plc (UK)

- Daicel Corporation (Japan)

- Jiangsu Sopo Group (China)

- Wacker Chemie AG (Germany)

- INEOS Group (UK)

- China Petroleum & Chemical Corporation (Sinopec)

- Shanghai Huayi Group (China)

- HELM AG (Germany)

- Mitsubishi Chemical Corporation (Japan)

- Sipchem (Saudi Arabia)

- Indian Oil Corporation Ltd (India)

- Gujarat Narmada Valley Fertilizers & Chemicals (India)

- PetroChina (China)

- Yankuang Cathay Coal Chemicals Co., Ltd. (China)

- Lotte Chemical Corporation (South Korea)

- GNFC (India)

Segments Covered

By Derivative / Application

- Vinyl Acetate Monomer (VAM)

- Paints & Coatings

- Adhesives

- Films & Packaging

- Purified Terephthalic Acid (PTA)

- Polyester Fibers

- PET Resins (bottles, films)

- Acetic Anhydride

- Pharmaceuticals

- Cellulose Acetate (cigarette filters)

- Flavors & Fragrances

- Ethyl Acetate

- Solvents (inks, coatings)

- Pharmaceuticals

- Butyl Acetate

- Paints & Coatings

- Cleaning agents

- Food-Grade Acetic Acid (Vinegar)

- Others

- Textile auxiliaries

- Rubber processing

By End-Use Industry

- Plastics & Polymers

- PET

- Polyvinyl acetate

- Textile

- Paints & Coatings

- Food & Beverages

- Pharmaceuticals

- Chemicals

- Personal Care & Cosmetics

By Production Method

- Methanol Carbonylation (Cativa Process)

- Biological Fermentation

- Anaerobic (bacterial)

- Aerobic (yeast)

- Oxidation of Acetaldehyde

- Liquid-phase oxidation of n-butane

By Purity

- Glacial Acetic Acid (≥99%)

- Diluted Acetic Acid (Food Grade – typically 4–8%)

By Distribution Channel

- Direct (Bulk Chemical Supply

- Distributors / Traders

- Online / E-commerce Platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait