Content

CIP (Clean In Place) Chemicals Market Size, Share | Industry Report, 2034

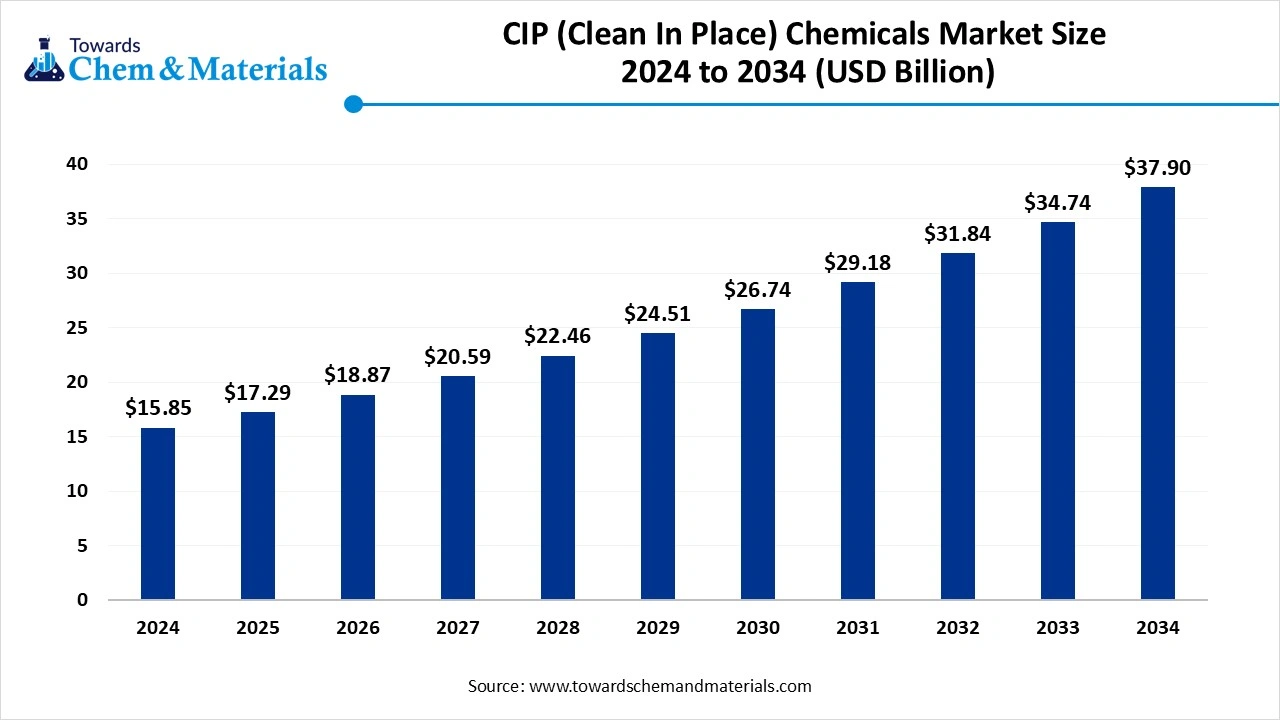

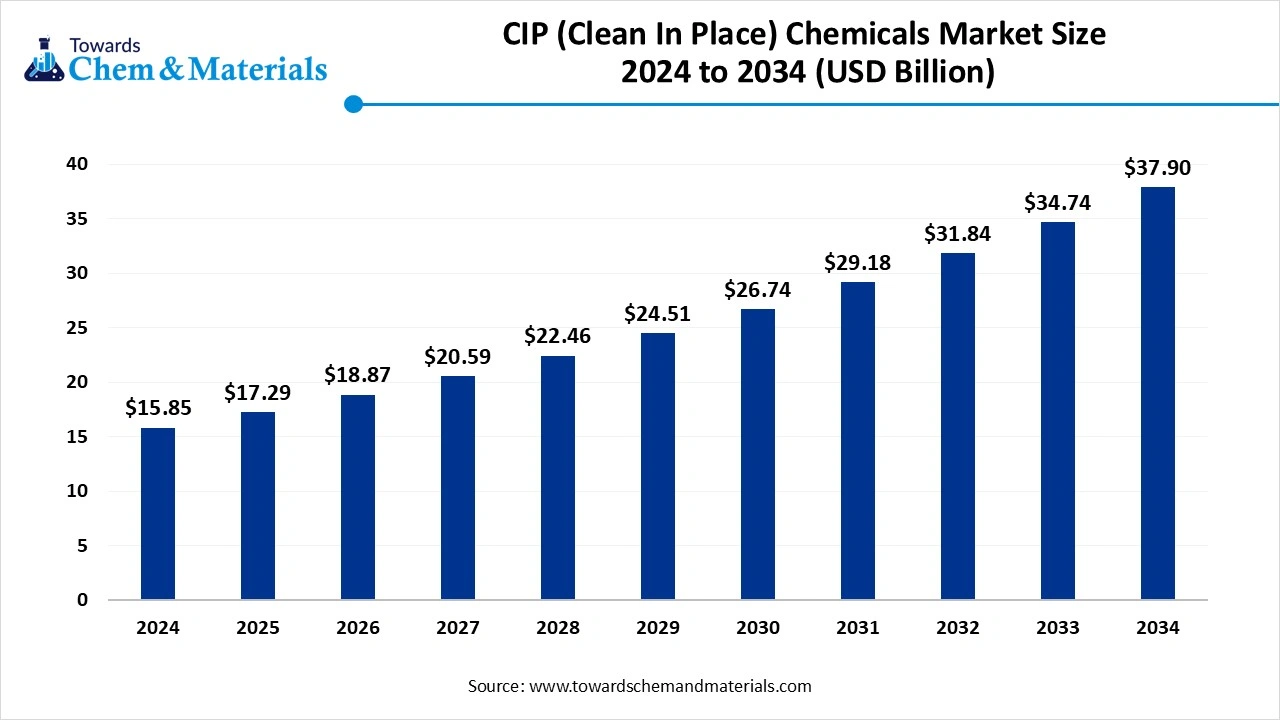

According to market projections, the CIP (clean in place) chemicals market industry is expected to grow from USD 15.85 billion in 2024 to USD 37.90 billion by 2034, reflecting a CAGR of 9.11%. The enlarged expansion of the food and beverages industry and global safety standards have accelerated the industry's potential in recent years.

Key Takeaways

- By region, Europe dominated the market in 2024, owing to the increased hygiene and cleaning regulations for sectors such as the food, dairy, and pharmaceutical industries.

- By region, Asia Pacific is expected to grow at a notable rate in the future, akin to the fast-paced industrialization.

- By chemical type, the alkaline cleaners segment led the market in 2024, due to its high effectiveness while removing the organic fats, oils, and proteins.

- By chemical type, the peracetic acid segment is expected to grow at the fastest rate in the market during the forecast period, akin to its strength in disinfectant properties and environmentally friendly properties.

- By form, the liquid segment emerged as the top-performing segment in 2024, due to having unique characteristics such as easy mixability, long-term storage, and easy pumping through automated cleaning systems.

- By form type, the gel segment is expected to lead the market in the coming years, as increasing need for the cleaning of vertical and the hard to clean surfaces in recent years.

- By cleaning type, the two-phase cleaning segment led the CIP (clean in place) chemicals market in 2024, as Two-phase cleaning, which involves a detergent wash followed by a disinfectant rinse, is widely used because it's simple, effective, and affordable.

- By cleaning type, the multiphase cleaning segment is likely to experience notable growth during the expected period, akin to multi-phase cleaning systems, which include pre-rinse, alkaline wash, acid wash, and disinfection steps

- By application industry, the food and beverage-dairy segment captured the biggest portion of the market in 2024, because these industries require strict hygiene to ensure safe consumption.

- By application industry, the pharmaceutical and biotechnology segment is anticipated to expand at the highest rate in the coming years, akin to their high need for sterile and contamination-free production environments.

- By equipment type, the tank segment led the market in 2024 because they are large, hard to dismantle, and often used for storing or mixing sensitive materials like milk, beer, or liquid medicines.

- By equipment type, the fillers and valves segment is expected to grow at the fastest rate in the market during the forecast period. As filters and valves are complex parts of production lines that are now receiving more attention for thorough cleaning.

- By end-use scale, in 2024, the large-scale industrial plants segment emerged as the top consumer of the market, as they process high volumes and require frequent cleaning to maintain hygiene and avoid downtime.

- By end user scale, the small-scale batch facilities segment is likely to witness the most rapid growth in the market in the years ahead, as mall-scale batch facilities are growing in number, especially in craft brewing, specialty foods, and personalized medicine.

- By distribution channel, the direct supply contracts segment led the CIP (clean in place) chemicals market in 2024, due to big manufacturing facilities prefer to work directly with chemical suppliers for steady supply, bulk pricing, and tailored product support

- By distribution channel, the online industrial marketplace segment is expected to grow at the fastest rate in the market during the forecast period, as it makes it easier for small and medium businesses to compare prices, access product details, and place orders quickly.

Market Overview

Cleaning Without Dismantling: CIP Chemicals Reshape Industry Standards

CIP (Clean-In-Place) chemicals market refers to the global industry focused on the production, distribution, and application of chemical formulations used for automated cleaning of interior surfaces of equipment (tanks, pipes, fillers, etc.) in industries without disassembly. Major users include food & beverage, pharmaceutical, and dairy industries, where hygiene and sterilization are critical. Moreover, the sudden shift towards stricter hygiene regulations has contributed to the industry's growth in the past few years.

Which Factor Is Driving the CIP (Clean in Place) Chemicals Market?

The enlarged expansion of the food and beverage industry is spearheading the industry's growth in the current period. Moreover, manufacturers have been increasingly looking for faster and safer cleaning solutions in recent years. Also, the global regulations for safety and cleaning have increased in the past few years, which is providing a significant consumer base to CIP solutions, as per the recent industry observation.

Market Trends

- The sudden shift toward eco-friendly and sustainable CIP solutions is leading the industry growth in the current period. Several major manufacturers are actively looking for eco-friendly cleaning solutions owing to the global sustainable shift.

- The increased need for ready-to-use CIP chemicals has driven the market potential in recent years. Moreover, these products are seen as saving the manufacturers' time while reducing human errors.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 17.29 Billion |

| Market Size by 2034 | USD 37.90 Billion |

| Growth rate from 2024 to 2025 | CAGR 9.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Chemical Type, By Form, By Cleaning Type, By Application Industry, By Equipment Type, By End-use Scale, By Distribution Channel, By Region |

| Key Companies Profiled | Ecolab Inc., Diversey Holdings Ltd., Kersia Group , BASF SE , SUEZ (Veolia Group), Stepan Company , Solvay SA , Merck KGaA, Christeyns , Neogen Corporation, Zep Inc., Pilot Chemical Company , Quaron (a Barentz company) , Clariant AG , Evonik Industries AG , Spartan Chemical Company, Inc., AFCO (A Zep Company) , Hydrite Chemical Co. , Klenzan Ltd (Christeyns Group) , Dubo Chem Pvt. Ltd. |

Market Opportunity

Small Business Automation Drives New Revenue Streams for Chemical Makers

The upgradation of the automated cleaning services from smaller and mid-size businesses is expected to create significant opportunities for the CIP (clean in place) chemicals market. The manufacturers can provide affordable and easy-to-use chemicals for these businesses. Furthermore, chemical manufacturers can establish partnerships with the automated cleaning services providers, which can provide them long-term profit margins with consumers' trust, as per their expectations.

Market Challenge

Cost Pressures Limit CIP Adoption in Developing Markets

The high cost of the high-performance CIP solutions is anticipated to hinder the industry's growth in the upcoming years. This cost can create growth barriers for small and mid-sized businesses, where the company’s budget is limited. Moreover, these price barriers can limit industry growth in developing regions or small operations, as per industry experience.

Regional Insights

Europe accounted for the significant revenue in the current sector, akin to the increased hygiene and cleaning regulations for sectors such as the food, dairy, and pharmaceutical industries. Moreover, the regional countries such as the United Kingdom, Germany, and others have seen a heavy implementation of product safety in their spaces over the past few years, which is leading to the demand for the CIP chemical, as per the recent survey.

Why is Germany Leading the Global CIP Chemicals Market?

Germany maintained its dominance in the CIP (clean in place) chemicals market, owing to the developed industrial infrastructure and presence of major food, beverage, and pharmaceutical manufacturers. Also, the German manufacturers are observed to increasingly focus on precision products with quality and hygiene, which is actively providing a sophisticated consumer base to the CIP chemical manufacturers in recent years.

Asia Pacific is expected to capture a major share of the market during the forecast period, owing to the fast-paced industrialization. These industries are actively seeking the quality of products, which includes hygiene and precision. Thus, the regional countries such as China, India, and South Korea are increasingly developing a huge consumer base in recent years due to the presence of major companies in their region in recent years.

How Are China’s Food and Pharma Sectors Driving CIP Chemical Demand?

China is expected to rise as a dominant country in the region in the coming years, owing to having the world's massive food processing, pharmaceutical, and dairy sectors, which have seen heavy usage of the CIP chemical to maintain regulatory and quality standards in the past few years. Furthermore, several manufacturers are observed under the heavy adoption of automated cleaning systems, which is likely to drive chemical growth in the coming years.

Segmental Insights

Chemical Type Insights

How the Alkaline Cleaners Segment Dominated the CIP (Clean in Place) Chemicals Market in 2024?

The alkaline cleaners segment held the largest share of the market in 2024, due to its highly effectiveness while removing the organic fats, oil, and proteins. Moreover, the expansion of the food and beverage industry is actively providing immense attention to CIP chemicals, as the several regions are also implementing strict safety standards for the food and beverage industry in the current period.

The paracetic acid segment is expected to grow at a notable rate during the predicted timeframe due to its strength in disinfectant properties and environmentally friendly properties. These chemicals are seen as very effective against bacteria, fungi, and viruses at low concentrations with faster working capacities, which is likely to gain immense industry attention in the coming years, as per the recent industry attention.

Form Type Insights

Why Do Liquid Segments Dominated the CIP (Clean in Place) Chemicals Market by Form Type?

The liquid segment held the largest share of the CIP (clean in place) chemicals market in 2024, owing to having unique characteristics such as easy mixability, long-term storage, and easy pumping through automated cleaning systems. Furthermore, the domination and use of the CIP setups, which are designed to handle general liquid, has driven the liquid form growth in recent years, as per industry observation.

The gel segment is expected to grow at a notable rate, increasing the need for the cleaning of the vertical and the hard to clean surfaces in recent years. Moreover, having cost effectiveness with the lower water and chemical usage, the gel segment is expected to gain substantial industry in the coming years, as per expectations.

Cleaning Type Insights

Why Did the Two-Phase Cleaning Segment Dominate the CIP (Clean in Place) Chemicals Market in 2024?

The two-phase cleaning segment dominated the market with the largest share in 2024. Two-phase cleaning, which involves a detergent wash followed by a disinfectant rinse, is widely used because it's simple, effective, and affordable. Most food and beverage industries follow this method as it ensures good hygiene without too much complexity or cost. It helps remove visible dirt first, then kills microorganisms, meeting health and safety standards.

The multi-phase segment is expected to grow at a notable rate due to multi-phase cleaning systems, which include pre-rinse, alkaline wash, acid wash, and disinfection steps, and will grow due to stricter hygiene demands in high-risk environments like pharmaceuticals and biotech. These systems ensure deeper cleaning by removing different types of contaminants at each stage. They also help extend equipment life and reduce microbial risks.

By Application Type Insights

How does the Food, Beverage & Dairy Segment Maintain Dominance in the Application Type?

The food, beverage & dairy segment held the largest share of the market in 2024. These industries require strict hygiene to ensure safe consumption. CIP systems help clean milk tanks, bottling lines, pasteurizers, and fermenters without dismantling the equipment, saving time and reducing contamination risks. Alkaline and acid cleaners are commonly used to remove organic buildup and sanitize surfaces. With the growing demand for processed food and beverages, especially in developed markets, companies are investing in effective cleaning systems.

The pharmaceutical and biotechnology segment is expected to grow at the fastest rate during the forecast period, owing to their high need for sterile and contamination-free production environments. These sectors produce sensitive drugs, vaccines, and biologics that require extremely clean equipment. CIP chemicals help meet strict regulatory requirements from agencies like the FDA and EMA.

By Equipment Type Insights

Why is the Tanks Segment Dominating the CIP (Clean in Place) Chemicals Market in 2024?

The tanks segment led the market in 2024. Tanks are the most clean equipment using CIP chemicals because they are large, hard to dismantle, and often used for storing or mixing sensitive materials like milk, beer, or liquid medicines. CIP systems allow automated cleaning of tank interiors without manual scrubbing, saving labor and ensuring thorough sanitation. Tanks can trap residue on walls and bottoms, so reliable chemical cleaning is essential to avoid contamination.

The fillers and valves segment is expected to grow at the fastest rate in the market during the forecast period. Fillers and valves are complex parts of production lines that are now receiving more attention for thorough cleaning. They have small spaces and moving parts where contaminants can hide. As equipment design becomes more advanced, targeted CIP solutions for fillers and valves are in high demand.

By End Use Scale Insights

How the Large-Scale Industrial Plant Segment Dominated the CIP (Clean in Place) Chemicals Market in 2024?

The large-scale industrial plant segment held the largest share of the market in 2024. As they process high volumes and require frequent cleaning to maintain hygiene and avoid downtime. These plants use automated CIP systems to save labor, ensure consistent cleaning, and meet quality standards. In sectors like dairy, brewing, and pharmaceuticals, regular cleaning of tanks, pipelines, and mixers is essential. These plants can invest in advanced systems that use CIP chemicals efficiently.

The small-scale batch facilities segment is expected to grow at a notable rate during the predicted timeframe. Small-scale batch facilities are growing in number, especially in craft brewing, specialty foods, and personalized medicine. These setups still need high cleaning standards but have limited budgets and space. Manufacturers are now offering compact and cost-effective CIP systems tailored to these facilities.

By Distribution Channel Insights

How the Direct Supply Contracts Segment Dominated the CIP (Clean in Place) Chemicals Market in 2024?

The direct supply contract segment held the largest share of the market in 2024, due to big manufacturing facilities prefer to work directly with chemical suppliers for steady supply, bulk pricing, and tailored product support. These agreements ensure regular delivery of high-grade CIP chemicals and technical help for proper usage. Long-term contracts also help companies control costs and maintain consistency in cleaning processes.

The online industrial marketplaces segment is expected to grow at a notable rate during the predicted timeframe because they make it easier for small and medium businesses to compare prices, access product details, and place orders quickly. These platforms offer flexible buying, lower minimum quantities, and fast delivery, which benefits smaller facilities that can't commit to large contracts.

Recent Developments

- In 2024, Tetra Pak introduced the sustainable CIP solution. This solution is specifically designed for the food and beverage industry, includes plant integration capabilities.(Source: www.dairyfoods.com)

- In June 2025, Suncombe introduced the advanced next-generation CIP system. Furthermore, this newly launched CIP system is portable, as per the report published by the company.(Source: manufacturingchemist.com)

Top Companies list

-chemicals-market-companies.webp)

- Ecolab Inc.

- Diversey Holdings Ltd.

- Kersia Group

- BASF SE

- SUEZ (Veolia Group)

- Stepan Company

- Solvay SA

- Merck KGaA

- Christeyns

- Neogen Corporation

- Zep Inc.

- Pilot Chemical Company

- Quaron (a Barentz company)

- Clariant AG

- Evonik Industries AG

- Spartan Chemical Company, Inc.

- AFCO (A Zep Company)

- Hydrite Chemical Co.

- Klenzan Ltd (Christeyns Group)

- Dubo Chem Pvt. Ltd.

Segment Covered

By Chemical Type

- Alkaline Cleaners

- Caustic Soda-based

- Non-Caustic Alkaline Cleaners

- Acid Cleaners

- Nitric Acid

- Phosphoric Acid

- Sulfamic Acid

- Disinfectants/Sanitizers

- Peracetic Acid (PAA)

- Hydrogen Peroxide

- Sodium Hypochlorite

- Iodophors

- Quaternary Ammonium Compounds (QACs)

- Detergents

- Non-ionic

- Anionic

- Amphoteric

- Enzymatic Cleaners

- Protease-based

- Amylase-based

- Additives

- Surfactants

- Chelating Agents

- Defoamers

By Form

- Liquid

- Powder

- Gel

- Tablets

By Cleaning Type

- Single-phase Cleaning (One-Step CIP)

- Two-phase Cleaning (Alkaline + Acid)

- Multi-phase (Pre-rinse, Alkaline, Intermediate Rinse, Acid, Final Rinse, Disinfection)

By Application Industry

- Food & Beverage

- Dairy

- Brewery

- Processed Foods

- Soft Drinks & Juices

- Confectionery

- Pharmaceuticals & Biotechnology

- Injectable Drugs

- API Plants

- R&D Labs

- Cosmetics & Personal Care

- Agriculture (Nutraceuticals, Animal Health, Plants)

By Equipment Type

- Tanks

- Pipelines

- Heat Exchangers

- Valves and Pumps

- Fillers and Kettles

- Spray Balls/Nozzles

By End-use Scale

- Large-scale Industrial Plants

- Medium-scale Processing Units

- Small-scale Batch Facilities

By Distribution Channel

- Direct Supply Contracts

- Industrial Distributors

- Specialty Chemical Suppliers

- Online Industrial Marketplaces

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

-chemicals-market-companies.webp)