Content

What is the Current Renewable Natural Gas Market Size and Share?

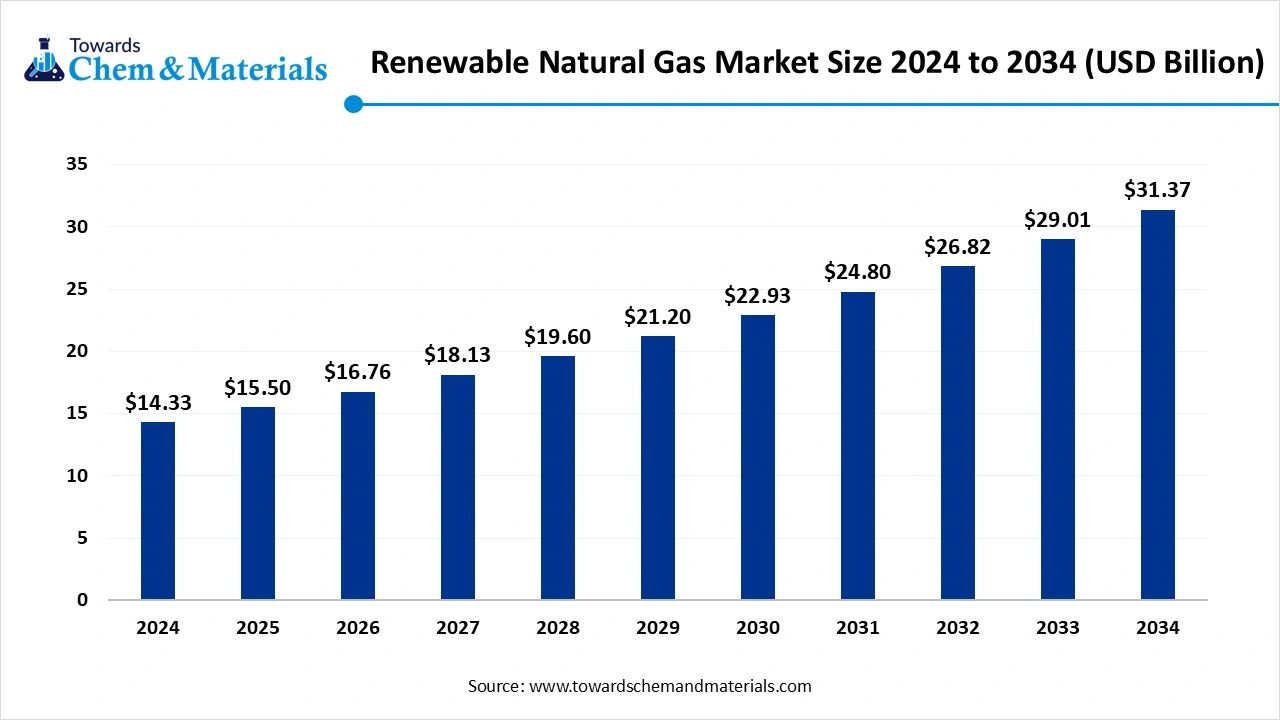

The global renewable natural gas market size was USD 15.50 billion in 2025 and is predicted to increase from USD 16.76 billion in 2026 and is expected to be worth around USD 33.93 billion by 2035, growing at a CAGR of 8.15% from 2026 to 2035. Increasing environmental concerns around the world is the key factor driving market growth. Also, innovations in biogas production coupled with the rising application of alternative fuels in the transportation industry can fuel market growth further.

Key Takeaways

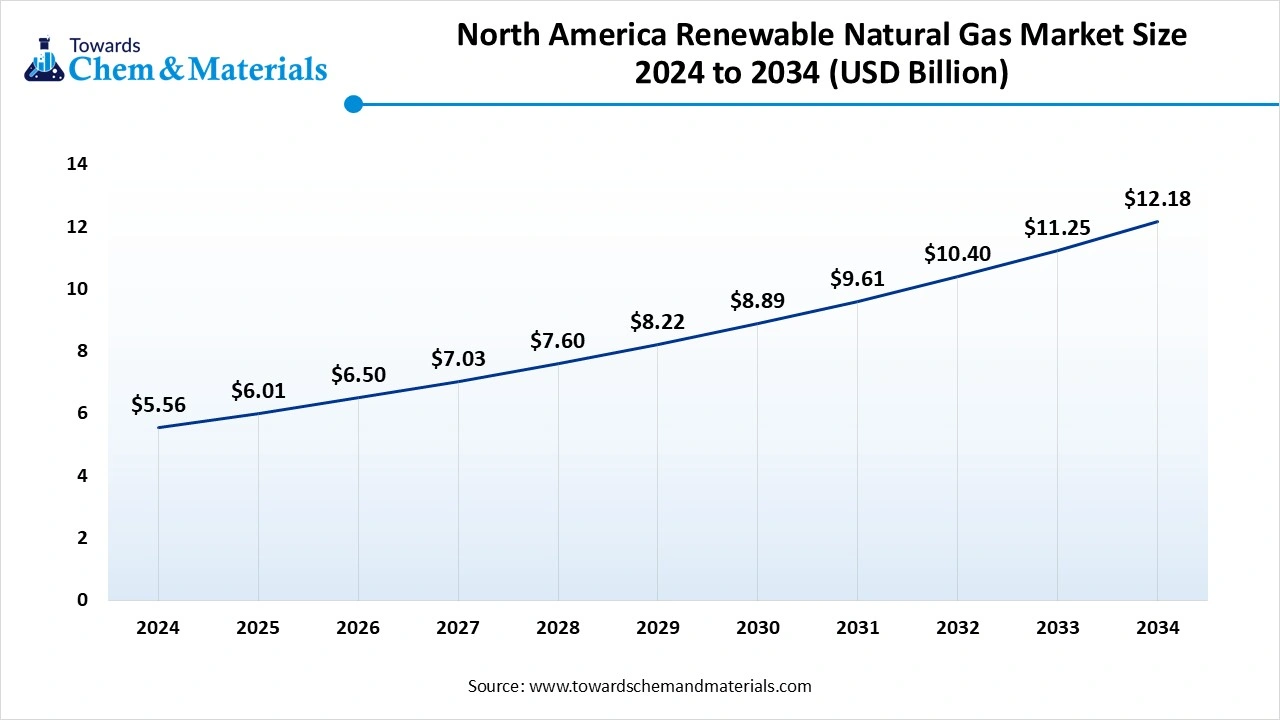

- By region, North America dominated the global renewable natural gas market with the largest share in 2025. The dominance of the region can be attributed to the robust pipeline network and distribution network across the region enabling smooth transportation of renewable gas.

- By region, Asia Pacific is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the growing demand to address greenhouse gas emissions.

- By feedstock, the landfill segment dominated the market in 2025. The dominance of the segment can be attributed to the strong availability of waste-based feedstock to convert it into renewable natural gas.

- By feedstock, the wastewater treatment segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be linked to the substantial economic and environmental benefits of RNG.

- By application, the vehicle fuel segment held the largest renewable natural gas market in 2025. The dominance of the segment can be credited to the substantial economic and environmental benefits of renewable natural gas in vehicles.

The Surge in the Application of Alternative Fuel is Expanding Market Growth

The market covers the production, distribution, and sale of gas obtained from renewable sources. Mainly it's a biogas that has been processed to fulfil the standards of conventional natural gas, which makes it usable and interchangeable in existing natural gas infrastructure like vehicles. RNG can be produced from different waste materials such as landfill gas, agricultural waste, and wastewater treatment plant byproducts.

RNG production can reduce greenhouse gas emissions with trapping methane which can easily get released into the environment from decomposing organic matter. Governments are offering fiscal incentives, tax reliefs, and subsidies to improve total RNG production.

What are the Key Trends Influencing the Renewable Natural Gas Market?

- Innovations in technology utilized to capture methane, and upgrade biogas and waste-to-energy technology are enhancing the production of RNG. The technologies are enabling more economical manufacturing and competition as fossil fuel-based traditional natural gas.

- Consumers across the globe are increasingly becoming aware of the bad consequences of fossil fuels and climate change. This demand further increases the clean energy sources like RNG. Low-carbon fuel policies, renewable energy mandates, and carbon tax programs are propelling the production and consumption of RNG.

- Ongoing collaboration among the agricultural cooperatives and farmers is also the latest trend fuelling the market growth. Such collaboration helps renewable gas projects address the crucial challenges of securing an eco-friendly feedstock supply. This also boosts synergies between various industries. Such models can boost renewable gas production volumes across the globe.

How is the Government Supporting the Renewable Natural Gas Market?

The Indian government is supporting the market through various initiatives and policies such as the Gobardhan initiative, SATAT scheme, and blending mandates. These efforts aim to minimize import reliance on crude oil, support cleaner energy sources, and create a circular and more sustainable economy. SATAT emphasizes strengthening Compressed Biogas (CBG) production to make CBG available for use in automobile fuels.

The US government is promoting the market through different financial mechanisms and policies, like incentives, tax credits, and mandates. The Renewable Fuel Standard (RFS) program mandates the utilization of renewable fuels like RNG in the transportation sector, creating market opportunities in the country further. Moreover, several states including Oregon, Washington, and California have implemented Low Carbon Fuel Standards (LCFS) that incentivize RNG production.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 16.76 Billion |

| Expected Market Size in 2035 | USD 33.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.15% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026 - 2035 |

| Dominant Region | North America |

| Segment Covered | By Feed Stock, By Application, By Region |

| Key Companies Profiled | Clean Energy Fuels Corp. (United States), Montauk Renewables, Inc. (United States), VERBIO Vereinigte BioEnergie AG (Germany) , Eni S.p.A. (Italy), TotalEnergies SE (France) , BP plc (United Kingdom) , Engie SA (France) , Orsted A/S (Denmark) , Technip Energies N.V. (France) , VARO Energy (Switzerland) , Gazprom PJSC (Russia) , FortisBC Energy Inc. (Canada) , Dominion Energy, Inc. (United States) |

Market Dynamics

Market Drivers

The renewable natural gas market is driven by increasing policy focus on decarbonization, methane emission reduction, and circular economy development across energy and waste management sectors. Governments are promoting RNG production through renewable fuel standards, low-carbon fuel incentives, landfill gas recovery mandates, and grid injection frameworks to displace fossil-based natural gas. Rising availability of organic feedstocks such as agricultural residues, livestock manure, food waste, and municipal solid waste is supporting steady expansion of anaerobic digestion and gas upgrading projects. Demand is further reinforced by utilities, fleet operators, and industrial users seeking low-carbon fuel alternatives that can be integrated into existing natural gas infrastructure without major system modifications.

Market Restraints

The renewable natural gas market faces restraints related to high capital investment requirements for anaerobic digesters, biogas upgrading systems, and pipeline interconnection infrastructure. Feedstock supply variability, influenced by seasonal agricultural cycles and competing waste utilization pathways, can affect plant utilization rates and economic returns. Regulatory complexity across waste handling, environmental permitting, gas quality standards, and grid access can delay project development and increase compliance costs. In regions with limited pipeline density or interconnection capacity, RNG projects may face logistical constraints that reduce commercial viability. Price volatility in conventional natural gas markets can also impact the relative competitiveness of RNG without long-term policy support mechanisms.

Market Opportunities

Significant opportunities exist in expanding RNG use across transportation, power generation, and industrial heating applications where electrification remains challenging. Growth in renewable fuel credit markets and carbon offset programs is improving project economics and attracting private investment. Technological advancements in gas upgrading, monitoring, and automation are increasing methane recovery efficiency and reducing operating costs. Integration of RNG production with carbon capture and utilization systems presents pathways for negative-emission fuels. In addition, decentralized RNG projects are creating opportunities for rural economic development by linking waste management, agriculture, and local energy supply.

Market Challenges

The renewable natural gas market faces challenges in ensuring long-term feedstock security while maintaining environmental sustainability and avoiding land-use conflicts. Scaling projects beyond regional deployment requires coordinated infrastructure planning, skilled workforce availability, and stable policy frameworks. Community acceptance issues related to odor, traffic, and facility siting can delay or restrict project approvals if stakeholder engagement is insufficient. Variability in RNG quality standards and certification systems across regions complicates cross-border trading and market integration. Maintaining consistent operational performance across diverse feedstocks and facility sizes also requires advanced monitoring, technical expertise, and continuous optimization.

Value Chain Analysis

- Feedstock Sourcing and Collection: This involves gathering various organic waste materials, which are the primary sources of biogas.

- Key Players: Waste Management Inc., Republic Services Inc., Vanguard Renewables, and Archaea Energy Inc.

- Biogas Production : In this, organic matter undergoes decomposition, primarily through anaerobic digestion, to produce raw biogas, a mix of methane and impurities.

- Key Players: Ameresco Inc., Montauk Renewables Inc., Bioenergy DevCo, EnviTec Biogas AG.

- Upgrading and Purification: This involves processing raw biogas to remove impurities, a step called conditioning or upgrading, to achieve pipeline quality.

- Key Players: Xebec Adsorption Inc., Air Liquide Advanced Technologies U.S. LLC, DMT Environmental Technology, and Waga Energy.

- Logistics and Distribution:This involves upgrading the RNG that is transported from production sites to end-users.

- Key Players: FortisBC Energy Inc., Enbridge Inc., SoCalGas, Kinder Morgan Renewable Natural Gas, and GRDF.

- Storage and Commercialization:In this RNG is stored and then used across various applications, replacing conventional natural gas.

- Key Players: Clean Energy Fuels Corp., BP plc, Shell plc, TotalEnergies SE, Vanguard Renewables.

Segmental Insight

Feedstock Insight

Which Feedstock Segment Dominated the Renewable Natural Gas Market in 2025?

The landfill segment dominated the market in 2025. The dominance of the segment can be attributed to the strong availability of waste-based feedstock to convert it into renewable natural gas. Landfills receive large amounts of municipal solid waste, via anaerobic digestion, generates biogas, primarily methane. In addition, advancements in gas collection and treatment methods are improving the quality and efficiency of landfill gas utilization, which makes it a more attractive choice.

- In June 2025, EQT stepped into negotiations with the plan of taking Waga private. The firm is looking at its investment as crucial to boost Waga's position in the renewable natural gas market.(Source: wastedive)

The wastewater treatment segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be linked to the substantial economic and environmental benefits of RNG.RNG production can substantially minimize methane emissions, a harmful gas responsible for global warming. In addition, wastewater treatment plants can create revenue by selling the RNG they produce, presenting new income streams.

Application Insight

Why Did Vehicle Fuel Segment Dominated the Renewable Natural Gas Market in 2025?

The vehicle fuel segment held the largest market share in 2025. The dominance of the segment can be credited to the substantial economic and environmental benefits of renewable natural gas in vehicles. RNG vehicles generate fewer harmful emissions such as nitrogen oxides, carbon monoxide, and particulate matter, contributing to cleaner air, particularly in urban areas. Moreover, this adoption is generally high in heavy-duty applications, like trucks and buses where RNG has demonstrated its ability to substantially curtail emissions.

The power generation segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a growing emphasis on energy security, environmental sustainability, and economic development. RNG obtained from biogas can be utilized in existing natural gas power plants, providing a cleaner energy source as compared to fossil fuels, while contributing to job creation and waste management.

Regional Insight

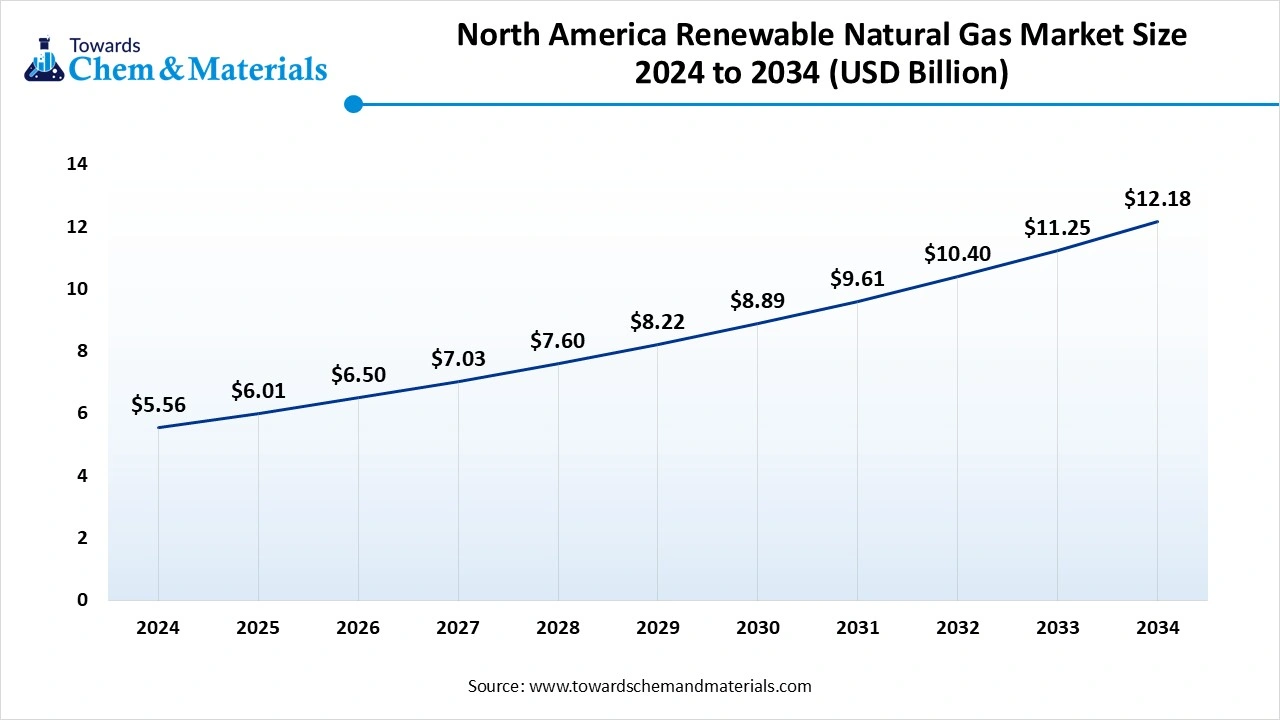

The North America renewable natural gas market size was valued at USD 6.01 billion in 2025 and is expected to be worth around USD 13.17 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 8.16% over the forecast period from 2026 to 2035.

The dominance of the region can be attributed to the robust pipeline network and distribution network across the region enabling smooth transportation of renewable gas. In addition, Canada and the United States have experienced a substantial surge in RNG development, propelled by their strong natural gas infrastructure, rising commitment to decarbonization, and conducive policy frameworks.

Renewable Natural Gas Market in U.S.

In North America, the U.S. led the market owing to the growing awareness of climate change along with sophisticated government policies. Federal and state policies such as California's Low Carbon Fuel Standard and Renewable Fuel Standard play a significant role in fuelling this adoption. Also, RNG production from sources such as livestock operations, landfills, and wastewater treatment plants provides an eco-friendly alternative for waste management.

- In January 2025, Pilgrim's Pride launched the SC renewable natural gas project. This project is anticipated to reduce greenhouse gas emissions and enhance overall water and air quality. The project was unveiled at Pilgrim's poultry processing setting in South Carolina.(Source: wattagnet)

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing demand to address greenhouse gas emissions and air quality concerns in developing countries. Furthermore, emerging economies such as China, Japan, and South Korea are increasingly exploring RNG as a means to shift away from fossil fuels and improve air quality standards.

Renewable Natural Gas Market in China

In the Asia Pacific, China dominated the market in 2025, by holding the largest market share, due to the growing need for clean energy and supportive government policies. Additionally, China has big renewable energy targets, hence RNG can play a significant role in minimizing dependence on fossil fuels and diversifying the energy mix. Hence natural gas consumption in China is increasing, generating lucrative opportunities for renewable and conventional sources.

How will Europe be considered a Notable Region in the Renewable Natural Gas Market?

Europe is a notably growing region in the near future, primarily due to its ambitious decarbonization goals, strong policy support, and the urgent need to enhance energy security by reducing dependence on fossil fuel imports. RNG production utilizes agricultural residues, manure, and food waste as feedstock, resulting in clean energy while addressing waste management issues and preventing significant methane emissions from landfills and manure storage. The European Union has established a comprehensive and legally binding regulatory framework, including the European Green Deal and related initiatives.

Germany Renewable Natural Gas Market Trends

Germany plays a key role in this growth, as its focus shifts from using energy crops to utilizing waste and residue streams due to land-use concerns and new regulations. The country is also developing domestic bio-methane production to meet its ambitious climate neutrality goals. Regulatory frameworks such as the Renewable Energy Sources Act and the new Building Energy Act provide incentives and create a market for renewable gases.

Emergence of Latin America in the Renewable Natural Gas Market

Latin America is an emerging region in the global market. This growth is driven by its vast biomass resources, a strong push for energy security and diversification, and supportive government policies aimed at decarbonization and methane emission reduction. Many countries have set ambitious climate targets and have signed the Global Methane Pledge. By utilizing RNG from waste streams, these countries can significantly reduce potent methane emissions. Governments are implementing policies, tax incentives, and blending mandates to make these initiatives economically viable.

Brazil Renewable Natural Gas Market Trends

Brazil is positioned to become a major player in the region by leveraging its abundant agricultural resources and large livestock operations. The government recognizes natural gas as a crucial transition fuel that can support industrial growth and provide reliable backup capacity for its large but intermittent renewable electricity sources. The New Gas Law aims to open the market to competition, attracting private investment in infrastructure.

How will the Middle East and Africa surge in the Renewable Natural Gas Market?

The Middle East and Africa region is also surging as a significant player in the global market. This growth is driven by a combination of environmental, economic, and energy security factors. Many oil-producing countries in the MEA are actively pursuing economic diversification to reduce their heavy reliance on hydrocarbon exports, thus creating a more resilient and diverse economy. Countries such as Morocco, Egypt, and Oman benefit from favorable wind corridors, making renewable energy generation highly efficient and cost-competitive.

The UAE Renewable Natural Gas Market Trends

The UAE stands out in the region, being a key exporter of future green gases while relying on natural gas as a critical bridge fuel for its power generation and industrial needs. The country is investing heavily in world-class infrastructure, such as the Ruwais LNG project, designed to be powered by clean energy sources and committed to serving international customers through long-term agreements.

Recent Developments

- In January 2026, Officials in Hillsborough County, Florida, have selected Waga Energy, a French company with U.S. operations based in Philadelphia, to build, own, operate and maintain a renewable natural gas (RNG) production unit at the Southeast County Landfill in Lithia, Florida.(Source: www.wastetodaymagazine.com)

- In October 2025, Researchers in Canada discovered a previously unknown bacteria capable of converting food waste into renewable natural gas, which opens new opportunities for carbon-neutral fuel production. The find was made by a team of researchers at the University of British Columbia (UBC), who discovered a methane-producing bacterium at one of the country’s biggest organic waste sites, the Surrey Biofuel Facility.

(Source: interestingengineering.com)

Top Companies List

- Clean Energy Fuels Corp. (United States)

- Montauk Renewables, Inc. (United States)

- VERBIO Vereinigte BioEnergie AG (Germany)

- Eni S.p.A. (Italy)

- TotalEnergies SE (France)

- BP plc (United Kingdom)

- Engie SA (France)

- Orsted A/S (Denmark)

- Technip Energies N.V. (France)

- VARO Energy (Switzerland)

- Gazprom PJSC (Russia)

- FortisBC Energy Inc. (Canada)

- Dominion Energy, Inc. (United States)

Segments Covered

By Feed Stock

- Landfill

- Wastewater Treatment

- Agricultural Waste

- Others

By Application

- Vehicles Fuel

- Power Generation

- Pipeline Injection

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait