Content

Hollow Fiber Ceramic Membrane Market Size and Forecast 2025 to 2034

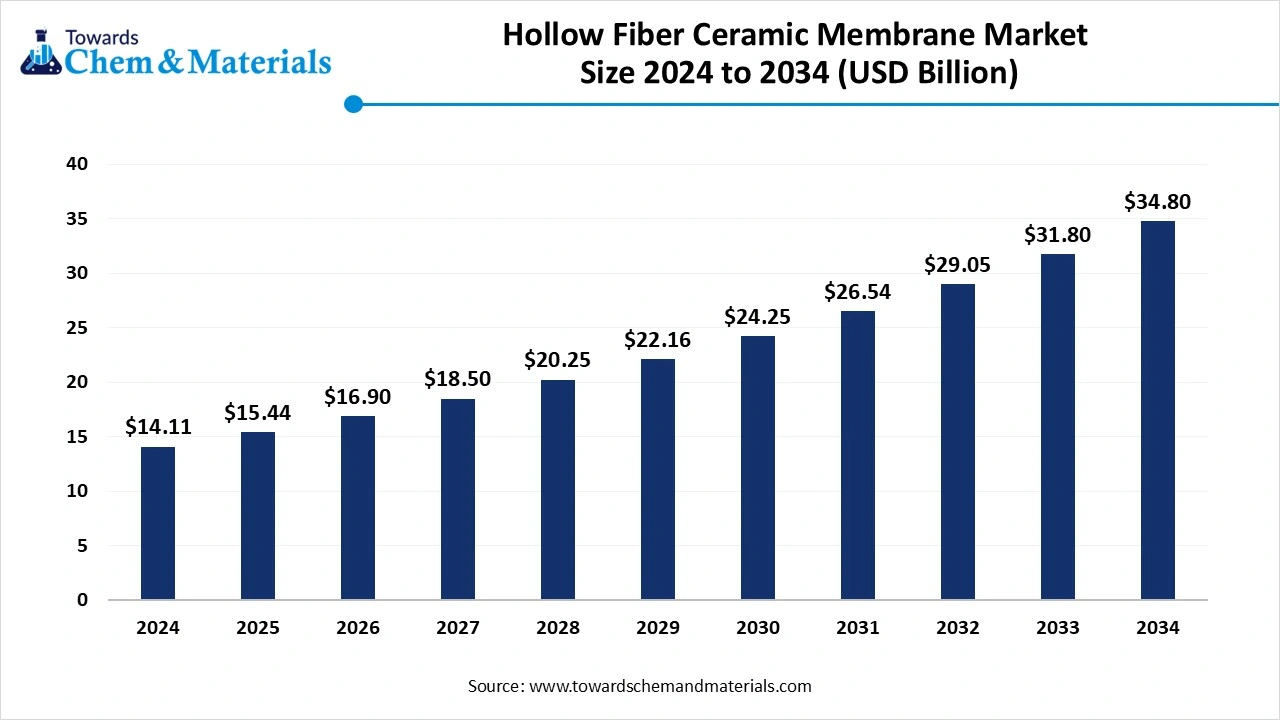

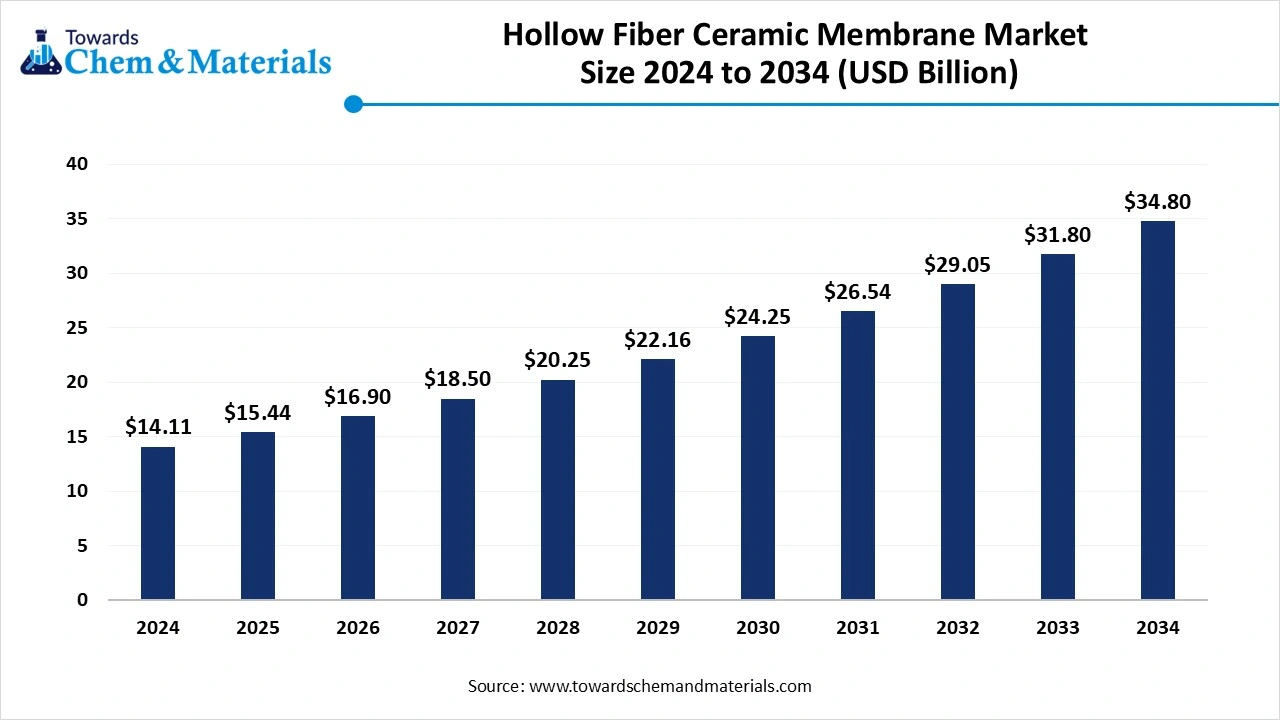

The global hollow fiber ceramic membrane market size accounted for USD 14.11 billion in 2024 and is predicted to increase from USD 15.44 billion in 2025 to approximately USD 34.80 billion by 2034, expanding at a CAGR of 9.45% from 2025 to 2034. The increasing sustainable wastewater management and use of ceramic membranes in various sectors increases the demand for the market.

Hollow Fiber Ceramic Membrane Market Key Takeaways

- By region, Asia Pacific dominated the market in 2024. The growth of the market is driven by the demand for water treatment, rising water pollution levels, and strict environmental regulations in the region.

- By region, North America is anticipated to have significant growth in the market in the forecasted period. Advanced industrial base and growing emphasis on sustainable water management and process efficiency demand in the region drive the growth.

- By filtration type, the microfiltration segment dominated the hollow fiber ceramic membrane market in 2024. Versatility and high efficiency of the segment help in the overall growth of the market.

- By filtration type, the ultrafiltration segment is anticipated to grow significantly in the market during the forecasted period. Ability to separate smaller particles and macromolecules

- By membrane material, the polymer segment dominated the market in 2024. The cost-effectiveness, ease of manufacturing, and broad application base of the polymer have helped the market dominate.

- By membrane material, the ceramic segment is anticipated to grow in the forecasted period. The properties like durability, chemical resistance, and long service life increase the demand and lead to growth.

- By end use, the pharmaceutical and chemicals segment dominated the hollow fiber ceramic membrane market in 2024. The high-purity separation, durability, and resistance to harsh conditions attract the consumers and help in the growth.

- By end use, the water and wastewater treatment segment are anticipated to grow in the forecasted period. The high mechanical strength, thermal stability, and chemical resistance boost the growth of the market.

The Rising Demand for Durable Materials, Self-Healing Material Accelerate the Market Growth

Membrane technology is one of the important aspects in the separation and filtration processes. This technology is widely used by many sectors, including food and beverages, water and wastewater treatment, biotechnology, pharmaceutical and chemicals, paper, oil, and gas pesticides. It is a type of filtration membrane that is characterized by the unique hollow fiber structure and ceramic material composition.

The membrane wall allows separation and removal of contaminants and impurities, which makes it efficient for use in various applications. The ceramic material provides high durability, resistance to harsh chemicals and temperatures, and a long lifespan. These factors make them a reliable choice by many researchers and industries, which increases the demand for the product.

The growing demand for wastewater treatment due to water scarcity and stricter environmental regulations, rising adoption in various sectors due to the consistent performance and long lifespan, offering by the membrane, advancement in membrane technology to enhance the performance and output, increasing adoption and demand for the use of sustainable and long-lasting solutions making the cost effective, regulatory and government policies and initiatives to encourage the use of the product, these factors drives the demand for the market and also expands the hollow fiber ceramic membrane market over time.

Hollow Fiber Ceramic Membrane Market Trends

- Integration of advanced materials and nanotechnology in the process efficiency and advancement in the process and manufacturing processes.

- Growing trends towards combining ceramic membranes with other filtration techniques to form integrated systems.

- Rising emphasis on sustainability goal achievement and the durability and reusability reduces waste and operational costs, which aligns with the environmental objectives.

- Government initiatives for sustainable and new advancements in wastewater treatment to overcome pollution amid rising environmental concerns.

- Launch: In July 2024, the government launched an underground sewage treatment plant in Kerala in a pioneering move to tackle water pollution and address land scarcity. Led by the local self-government department (LSGD), this initiative marks a significant shift in wastewater management strategy. It aims to reduce pollution in water bodies while minimizing public opposition to establishing such facilities by placing them out of sight, below ground.

Hollow Fiber Ceramic Membrane Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 15.44 Billion |

| Expected Size in 2034 | USD 34.80 Billion |

| Growth Rate | CAGR of 9.45% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Filteration Type, By Membrane Material, By End Use, By Region |

| Key Companies Profiled | Atech Innovations GmbH, CerafloCoorsTek, Inc.,I2M,Koch Membrane,Media and Process Technology Inc.,Microdyn-Nadir,Nanostone,QUA,TAMI Industries |

Hollow Fiber Ceramic Membrane Market Opportunity

The Technological Advancement in the Process Optimization

Technological advancements in hollow fiber ceramic membranes have significantly enhanced the performance and application range. Innovations include the development of multi-channel and gradient-pore structures, which improve permeability and reduce fouling.

Nanotechnology integration has enabled surface modifications that enhance selectivity and chemical resistance. Advanced fabrication techniques like 3D printing and sol-gel processing improve membrane uniformity and reduce production costs. Hybrid systems combining ceramic membranes with other separation technologies like UV and activated carbon are also gaining attention for complex water treatment by consumers.

These advances are making ceramic membranes more efficient, cost-effective, and attractive for high-demand industries and harsh operating environments, which creates opportunities for the growth of the market and helps in the expansion of the hollow fiber ceramic membrane market.

Hollow Fiber Ceramic Membrane Market Challenge

The High Cost and Investment

The high initial investment and manufacturing cost of hollow fiber ceramic membranes are one of the primary limitations in the hollow fiber ceramic membrane market. Like polymeric membranes, ceramic membranes require specialized raw materials (such as alumina or zirconia) and energy-intensive fabrication processes, including high-temperature.

This results in significantly higher production costs, which results in the high cost of the final products, which affects the adoption by the cost-sensitive consumers. Additionally, setting up ceramic membrane systems involves custom modules, pressure vessels, and supporting infrastructure, further increasing capital expenditure.

Hollow Fiber Ceramic Membrane Market Regional Insights

The Rising Demand for Water Treatment and the Rising Pharmaceutical Sector in the Asia Pacific

Asia Pacific dominated the highest share in the hollow fiber ceramic membrane market in 2024. The growth is driven by the demand for water treatment, rising water pollution levels, and strict environmental regulations have led to a significant increase in the adoption by consumers. The region's strong manufacturing sector and rising adoption across sectors like chemicals, food and beverages, and pharmaceuticals further increases the demand for the ceramic membranes, also due to their durability.

The heavy investments by the regions in advanced filtration techniques to address water scarcity and industrial wastewater challenges increase the demand for the new filtration patterns and which helps in the market expansion and growth of the market.

Global Hollow Fiber Ceramic Membrane Market Revenue, By Regional, 2024-2034 (USD Billion)

| By Regional | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| North America | 2.96 | 3.2 | 3.45 | 3.72 | 4.01 | 4.32 | 4.66 | 5.02 | 5.41 | 5.82 | 6.27 |

| Europe | 3.1 | 3.37 | 3.67 | 3.99 | 4.33 | 4.71 | 5.12 | 5.56 | 6.04 | 6.57 | 7.14 |

| Asia-Pacific | 5.79 | 6.38 | 7.02 | 7.74 | 8.55 | 9.42 | 10.38 | 11.44 | 12.61 | 13.89 | 15.31 |

| Latin America | 1.13 | 1.24 | 1.37 | 1.51 | 1.66 | 1.83 | 2.01 | 2.22 | 2.44 | 2.69 | 2.96 |

| Middle East & Africa | 1.13 | 1.25 | 1.39 | 1.54 | 1.7 | 1.88 | 2.09 | 2.31 | 2.56 | 2.83 | 3.13 |

China is Experiencing Growth in the Market Due to Increasing Government Initiatives

The country holds the largest market in the region for hollow fiber ceramic membrane. The growth is driven by the large-scale municipal water treatment projects, and rapid industrial development in the country. The government initiatives in the country, like the water ten plan and expansion of membrane-based sewage treatment facilities, are gaining the attention of the consumers and creating opportunities for the market to grow exponentially in the country.

North American Region's Advanced Industrial Base Drives the Growth in the Region

North American expects the significant growth in the hollow fiber ceramic membrane market during the forecast period. The growth of the market is driven by the advanced industrial base and growing emphasis on sustainable water management and process efficiency. North American region has the highest demand for ceramic membranes due to high adoption of ceramic membranes in sectors such as biotechnology, pharmaceutical, water treatment, and food and beverages.

The strict regulatory standards from the USEPA and FDA encourage the use of high-performance, durable membrane systems. The rising need and demand for water reuse and zero-liquid discharge technologies in the region shifts the industries towards ceramic membranes for long operational life, high fouling resistance, and chemical durability properties of the product, which drives the growth of the market in the region.

The USA's Overall High Usage of Hollow Fiber Ceramic Membrane Drives Strong Demand

The United States dominated the region as the membrane usage in the country is in high volume, due to applications in pharma manufacturing, industrial wastewater treatment, and drinking water purification. The environmental policies and rising awareness of water conservation also help in the market expansion of the country as a greater number of environmentally conscious consumers increases. The presence of major players such as pharmaceutical and biotech companies and ongoing infrastructure upgrades for water treatment continue to drive the strong demand for the hollow fiber ceramics membrane market.

Hollow Fiber Ceramic Membrane Market Segmental Insights

By Filtration Type

The microfiltration segment dominated the hollow fiber ceramic membrane market in 2024. The microfiltration segment of the market holds a significant share due to its versatility and high efficiency. With pore sizes typically between 0.1 to 1 micron, the membranes are ideal for removing bacteria, suspended solids, and other large particles while preserving essential nutrients in liquids. They are widely used in water and wastewater treatment, ensuring clean, pathogen-free water. In the food and beverage industry, microfiltration is used for beer clarification, juice purification, and dairy processing. The pharmaceutical and biotechnology sectors rely on it for sterile filtration and maintaining product integrity. Its applications in chemical processing, where it helps in particle separation and stream purification.

Ceramic microfiltration membranes are used for their durability, resistance to high temperatures and chemicals, and long lifespan compared to traditional alternatives. Rising demand for clean water and strict quality standards in various industries continue to drive the growth of the hollow fiber ceramic membrane market. The ultrafiltration segment expects significant growth in the hollow fiber ceramic membrane market during the forecast period. The ultrafiltration segment of the market is gaining strong attention due to its ability to separate smaller particles and macromolecules, with pore sizes typically ranging from 0.01 to 0.1 microns.

It is widely used for the removal of viruses, proteins, colloids, and emulsified oils from liquids, which makes it essential in pharmaceuticals, biotechnology, food and beverage processing, and wastewater treatment. In water treatment, ultrafiltration serves as a crucial step for producing high-purity water. In the pharmaceutical and biotechnology industries, it’s used for protein concentration, enzyme recovery, and purification processes. Ultrafiltration membranes made from ceramic materials offer superior chemical and thermal stability, long service life, and high resistance to fouling. With the increasing need for sterile processing, sustainable water reuse, and precision separation technologies, the ultrafiltration segment is expected to witness steady growth in both industrial and municipal applications, which ultimately results in the growth of the market.

By Membrane Material

The polymer segment dominated the hollow fiber ceramic membrane market in 2024. The polymer segment in the membrane market remains dominant due to its cost-effectiveness, ease of manufacturing, and broad application base. Polymeric membranes, typically made from materials like polyethersulfone, polyvinylidene fluoride, polysulfone, and polypropylene, are widely used for microfiltration, ultrafiltration, nanofiltration, and reverse osmosis processes.

They are used in municipal water treatment, food & beverage processing, and biopharmaceutical applications. Polymer membranes offer high permeability, flexibility in design, and compatibility with a wide range of operating conditions. Well-established production infrastructure and growing demand for low-cost water purification solutions continue to drive the growth of the polymer segment and help in the growth of the market. The ceramic segment expects significant growth in the hollow fiber ceramic membrane market during the forecast period. The ceramic segment in the membrane market is steadily growing due to its durability, chemical resistance, and long service life. The product is made from materials like alumina, zirconia, and titania, ceramic membranes, which are ideal for harsh operating environments.

Global Hollow Fiber Ceramic Membrane Market Revenue, By Membrane Material, 2024-2034 (USD Billion)

| By Membrane Material | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Polymer | 4.52 | 4.83 | 5.17 | 5.53 | 5.91 | 6.32 | 6.74 | 7.2 | 7.67 | 8.17 | 8.7 |

| Ceramic | 9.59 | 10.61 | 11.73 | 12.97 | 14.34 | 15.84 | 17.52 | 19.35 | 21.39 | 23.63 | 26.11 |

They offer excellent resistance to high temperatures, aggressive chemicals, and extreme pH levels, making them highly suitable for industrial wastewater treatment, food and beverage clarification, pharmaceutical processing, and chemical separations. With growing environmental regulations and increasing demand for sustainable and demand for new filtration technologies, the ceramic segment is gaining attraction, which helps the hollow fiber ceramic membrane market to grow.

By End Use

The pharmaceutical and chemicals segment dominated the hollow fiber ceramic membrane market in 2024. The pharmaceutical and chemical segment is a key driver in the market, due to the need for high-purity separation, durability, and resistance to harsh conditions. In the pharmaceutical industry, the membranes are used for processes such as sterile filtration, protein separation, enzyme recovery, and cell broth clarification. The hollow fiber ceramic can withstand aggressive cleaning protocols and maintain performance consistency, which is essential for complying with GMP and regulatory standards. With growing emphasis on process efficiency, waste minimization, and product quality, the adoption of hollow fiber ceramic membranes in these sectors helps the market to grow significantly.

The water and wastewater treatment segment expects significant growth in the hollow fiber ceramic membrane market during the forecast period. The wastewater treatment is the most important application of the hollow fiber ceramic membranes. The membrane is highly effective in removing suspended solids, bacteria, viruses, and organic contaminants from water, making it ideal for both industrial and municipal water treatment systems. The high mechanical strength, thermal stability, and chemical resistance allow them to operate under harsh conditions, where polymeric membranes often fail. The rising concerns over water scarcity, environmental regulations, and the need for sustainable water management help to drive significant growth in the market.

Hollow Fiber Ceramic Membrane Market Recent Developments

- Announcement: In December 2024, Toray Industries Inc., installed of a its all-carbon carbon dioxide (CO2) separation membrane pilot facility at the Shiga Plant. Scheduled to begin operations in the fiscal year starting April 1, 2025, the facility will support the mass production of this advanced membrane technology aimed at efficient CO2 capture.

- Innovation: In January 2025, Researchers at the National Institute of Technology Rourkela developed a groundbreaking hybrid wastewater treatment system designed to tackle industrial wastewater contaminated with stubborn dyes. This environmentally friendly approach integrates advanced nanocomposite materials with microbubble technology, effectively removing persistent dyes like Bismarck Brown R, which are typically resistant to traditional treatment methods.

- Announcement: In April 2024, Asahi Kasei began sales of a new membrane system designed for producing Water for Injection (WFI), a sterile water essential for preparing injectable medications. Developed as an alternative to traditional distillation methods, the system utilizes Microza hollow-fiber membrane technology for water treatment and liquid filtration. This innovative approach reduces the need for steam generation, resulting in lower CO2 emissions and cost savings in WFI production.

Hollow Fiber Ceramic Membrane Market Top Companies List

- Atech Innovations GmbH

- Ceraflo

- CoorsTek, Inc.

- I2M

- Koch Membrane

- Media and Process Technology Inc.

- Microdyn-Nadir

- Nanostone

- QUA

- TAMI Industries

Segments Covered in the report

By Filtration Type

- Microfiltration

- Ultrafiltration

- Reverse osmosis

By Membrane Material

- Polymer

- Ceramic

By End Use

- Water & wastewater treatment

- Food & beverages

- Biotechnology

- Pharmaceuticals & chemicals

- Others (paper, oil & gas, pesticide, etc.)

By Regional

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait