December 2025

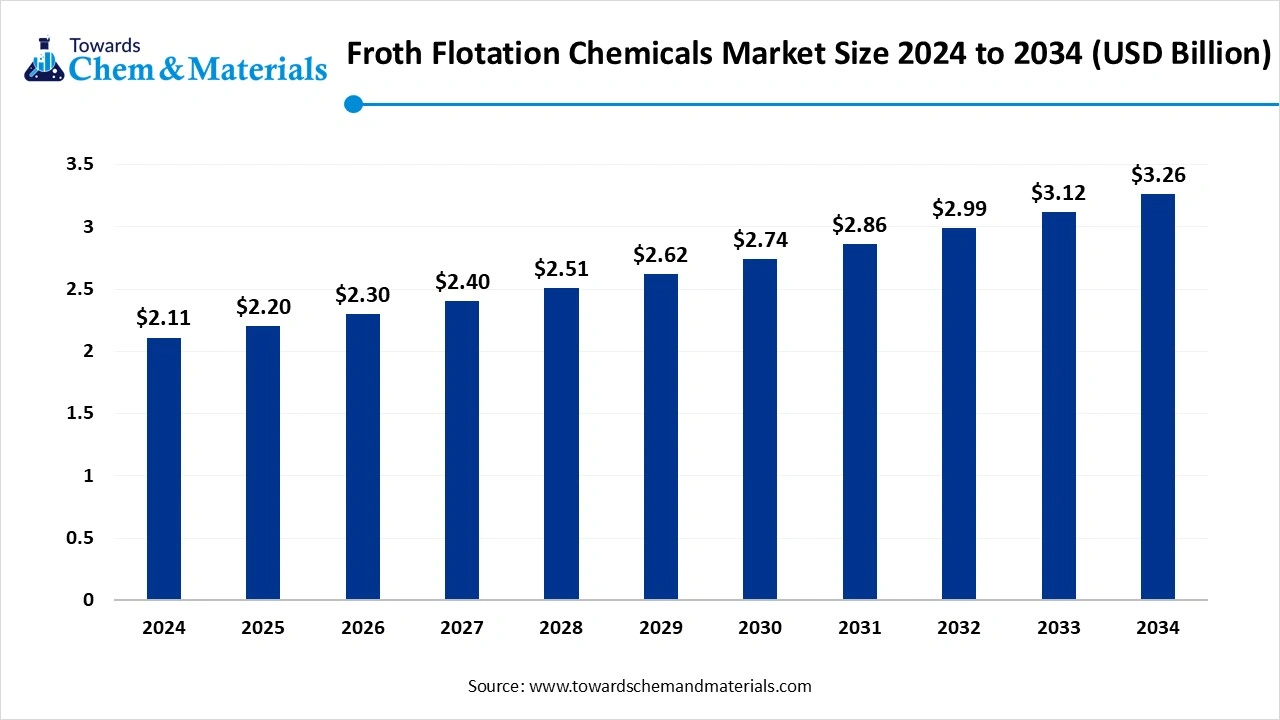

The global froth flotation chemicals market size was reached at USD 2.11 billion in 2024, is grew to USD 2.20 billion in 2025 and is expected to be worth around USD 3.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.45% over the forecast period 2025 to 2034. The surge in mining activities due to growing demand for minerals and metals is the key factor driving market growth. Also, the growth of wastewater treatment plants, coupled with the innovations in flotation technologies, can fuel market growth further.

The market is a global industry that encompasses the manufacturing, sale, and use of specialized chemical agents, like frothers and collectors, which are important for enabling the froth flotation process. The market is fuelled by the growing demand from major end-use industries, especially the mining industry for mineral extraction, and the paper and pulp industry to separate recycled paper.

| Report Attributes | Details |

| Market Size in 2025 | USD 2.20 Billion |

| Expected Size by 2034 | USD 3.26 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

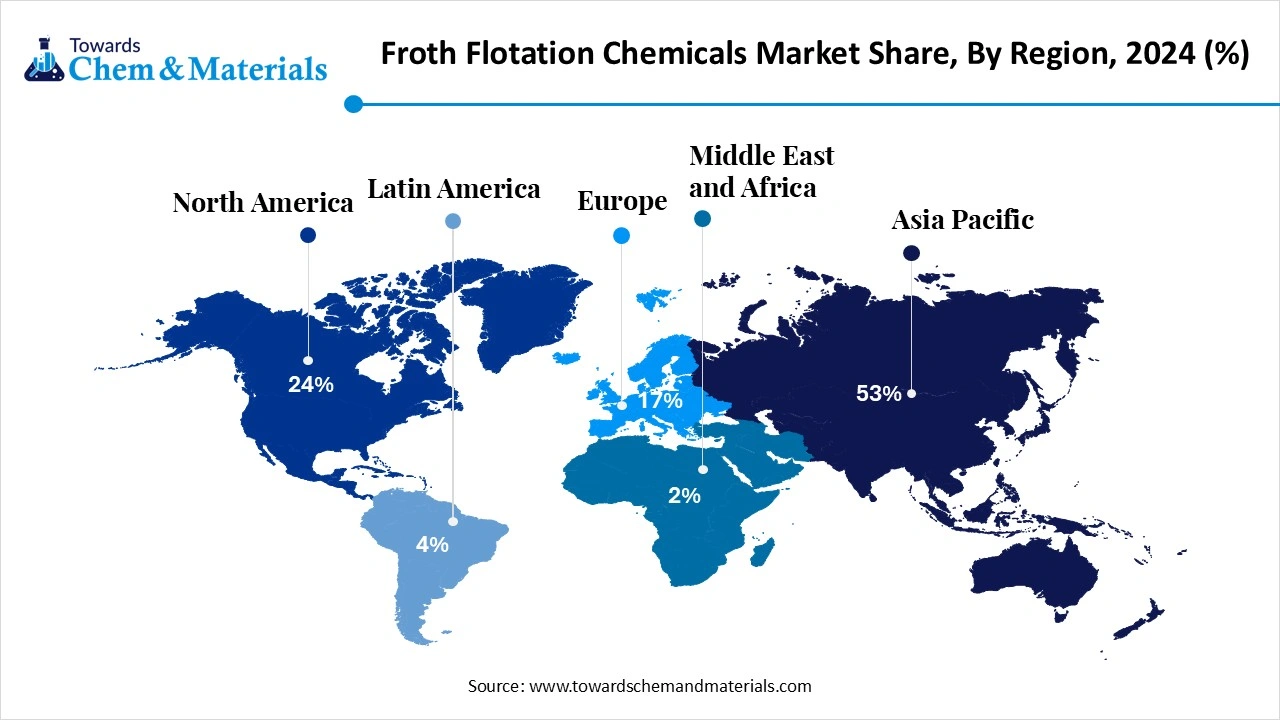

| Dominant Region | Asia Pacific |

| Segment Covered | By Reagent Type, By End-User Industry, By Form, By Ore Type, By Application, By Region |

| Key Companies Profiled | BASF SE, Clariant, Dow, Solvay, Air Products and Chemicals Inc., Arkema, Chevron Phillips Chemical Company LLC, Kemira, Nouryon, SNF Floerger, Elementis, Nasaco, Cytec Solvay Group, Ecolab Inc., AkzoNobel, Huntsman Corporation, Shaanxi Coal and Chemical Industry, Xingyuan Chemical, Yunnan Tin Company Limited, Zhejiang Xinhua Chemical Company Limited |

Stringent environmental regulations and an emphasis on sustainability are presenting lucrative opportunities in the market towards developing and using bio-based, biodegradable, and less toxic chemicals. Furthermore, market players are heavily investing in research to create sustainable alternatives that minimize the environmental impact of mining.

The commercialization of alternative chemicals, such as chelating agents and bioleaching agents, is the major factor hampering market growth. These alternatives provide similar functions with higher sustainability and lower costs. Moreover, the adoption of biosurfactants and sustainable solvents for specific ore extractions is minimizing the need for chemical additives, hindering market expansion further.

Asia Pacific Froth Flotation Chemicals Market Size, Industry Report 2034

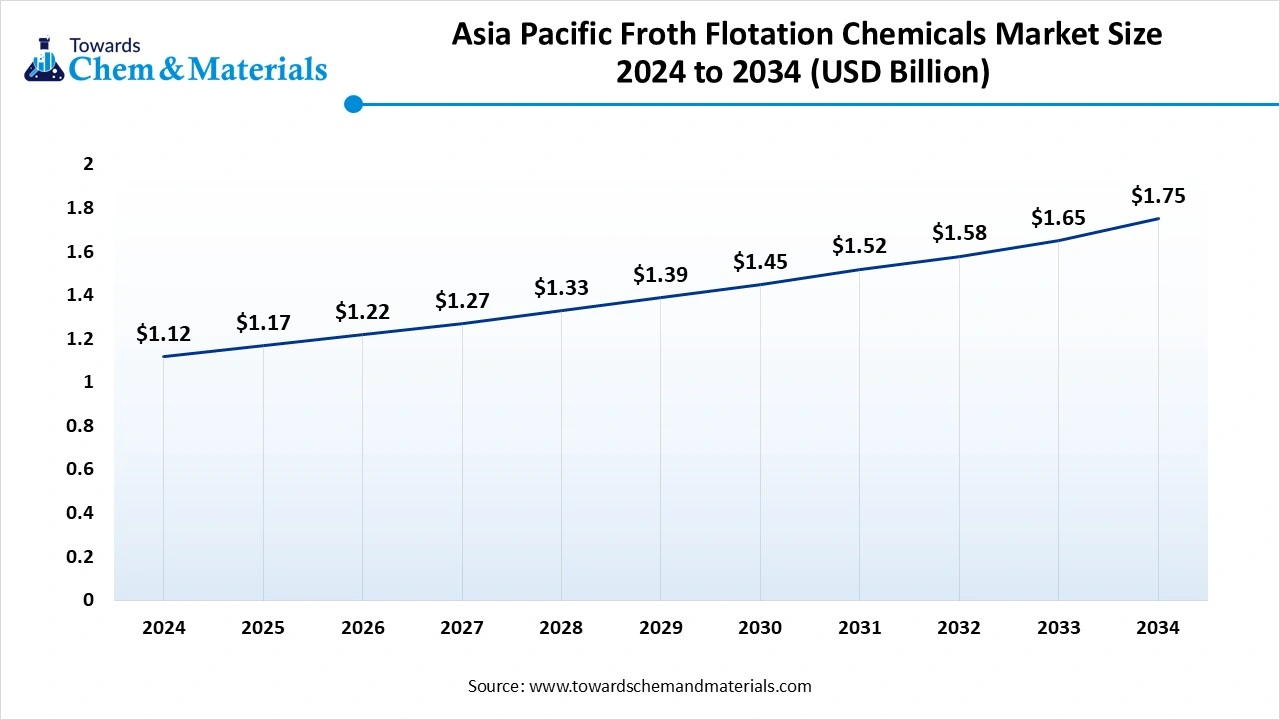

The Asia Pacific froth flotation chemicals market size was valued at USD 1.12 billion in 2024 and is expected to surpass around USD 1.75 billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.56% over the forecast period from 2025 to 2034.

Asia Pacific dominated the market with a 53% share in 2024. The dominance of the region can be attributed to the increasing mining activities in major economies such as China and India, along with the rapid infrastructure and industrialization growth. In addition, ongoing investment in cutting-edge flotation technologies and R&D efforts to improve the selectivity and efficiency in mineral recovery will contribute to market expansion soon.

Europe Froth Flotation Chemicals Market Trends

Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the stringent environmental regulations supporting sustainable reagents, coupled with the growing need for critical minerals such as lithium and copper from the extensive mining industry. Furthermore, Europe has an active and wide mining sector and operations, especially in countries such as Sweden, Finland, and Spain, which necessitate efficient flotation technologies.

Which Reagent Type Segment Dominated the Froth Flotation Chemicals Market in 2024?

The collectors segment held approximately 38% share in 2024. The dominance of the segment can be attributed to the increasing demand for minerals and industrial raw materials and the need to extract valuable minerals from low-quality and complex ores. Also, mining companies are heavily dependent on selective and advanced flotation processes, which rely on effective collectors, to optimize operations and minimize costs.

The frothers segment expects the fastest growth over the forecast period. The growth of the segment can be credited to the rising need for more sustainable and efficient mining practices, along with the innovations in flotation processes. Additionally, Frothers are increasingly being utilized in sewage treatment and industrial waste to remove oil, suspended solids, and grease.

How Much Share Did the Mining Segment Held in 2024?

The mining segment held approximately 41% market share in 2024. The dominance of the segment can be linked to the growing demand for metals and minerals driven by the automotive, construction, and electronics industries, which is leading towards expanded mining operations. Furthermore, there is an increasing focus on using less toxic and biodegradable chemicals to reduce the environmental impact of mining, leading to segment growth soon.

The pulp & paper segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing demand for recycled paper, along with the stringent environmental regulations. Froth flotation chemicals are crucial for the deinking process, which includes removing coatings and inks from recycled paper to create high purity recycled fiber.

Why Liquid Segment Dominated the Froth Flotation Chemicals Market in 2024?

The liquid segment led the froth flotation chemicals market by holding approximately 70% share in 2024. The dominance of the segment is owed to the growing mineral demand from rapid industrialization across the globe, coupled with the technological innovations that lead to higher efficiency. In addition, growing demand for water recycling is increasing the need for thick chemicals to remove pollutants from wastewater.

The powder segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing global demand for minerals and metals from the automotive, construction, and renewable energy sectors. Powder reagents are gaining traction due to their cost-effectiveness and improved performance in treating low-grade and complex ores, leading to further segment expansion.

Which Ore Type Segment Held a Largest Froth Flotation Chemicals Market Share in 2024?

The sulfide ores segment held approximately 46% market share in 2024. The dominance of the segment can be attributed to the surge in mining activities for key metals such as gold and other sulfide-based minerals, along with the rapid urbanisation and industrialization across the globe. Furthermore, the need to process more complex sulfide ores requires more effective flotation techniques and specialized reagents.

The rare earth & phosphate ores segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the rising phosphate mining activities across the globe, coupled with the need for effective processing of low-grade and complex ores. Moreover, cutting-edge flotation chemicals enhance mineral recovery and overall yield, which makes the extraction of key metals more profitable and viable.

How Much Share Did the Mineral Processing Segment Held in 2024?

The mineral processing segment dominated the market with approximately 60% share in 2024. The dominance of the segment can be linked to the growing demand for materials utilized in renewable energy technologies and the development of advanced automation and cell design methods. Market players are finding cost-effective flotation solutions to boost their operations, which propels the demand for chemicals that can improve recovery rates while reducing expenses.

The recycling segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by ongoing environmental regulations supporting sustainability and the growing demand for sustainable chemicals that reduce the ecological impact of industrial processes like recycling operations. Furthermore, flotation is necessary for recovering valuable materials, including additives and fibers, from white water in the papermaking industry.

By Reagent Type

By End-User Industry

By Form

By Ore Type

By Application

By Region

December 2025

December 2025

November 2025

November 2025