Content

What is the Current Polyphenylene Sulfide Market Size and Share?

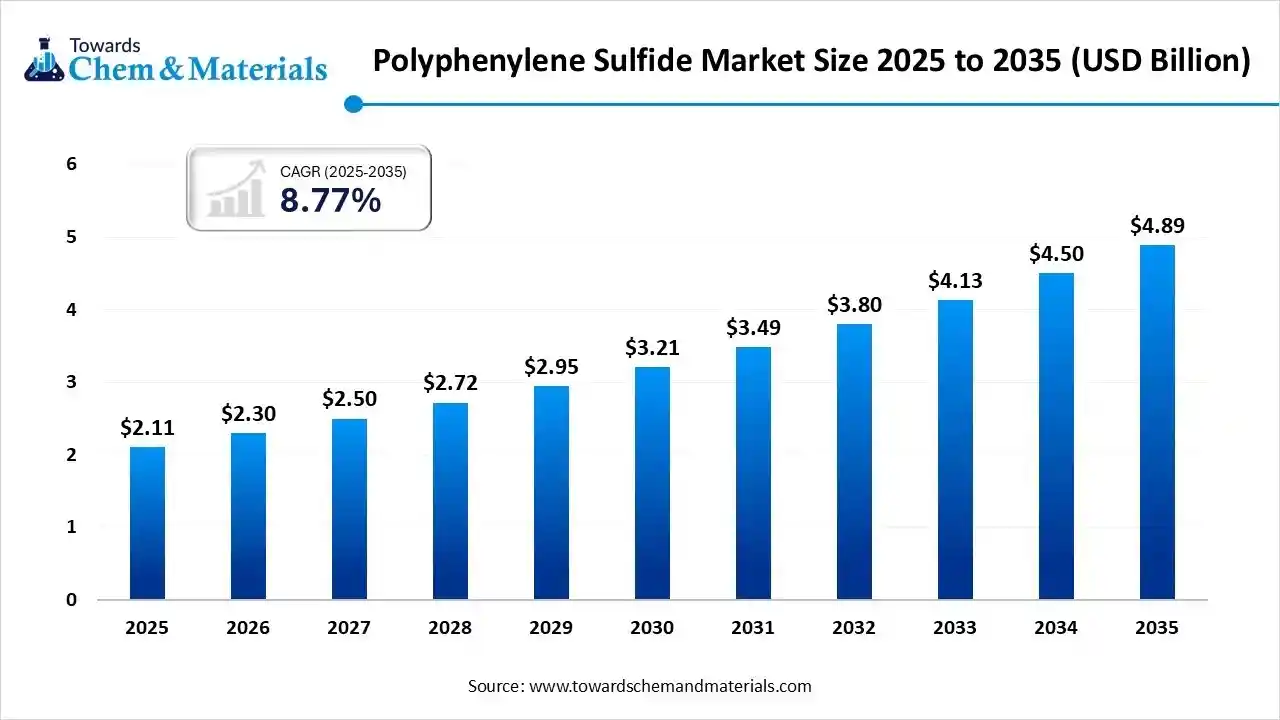

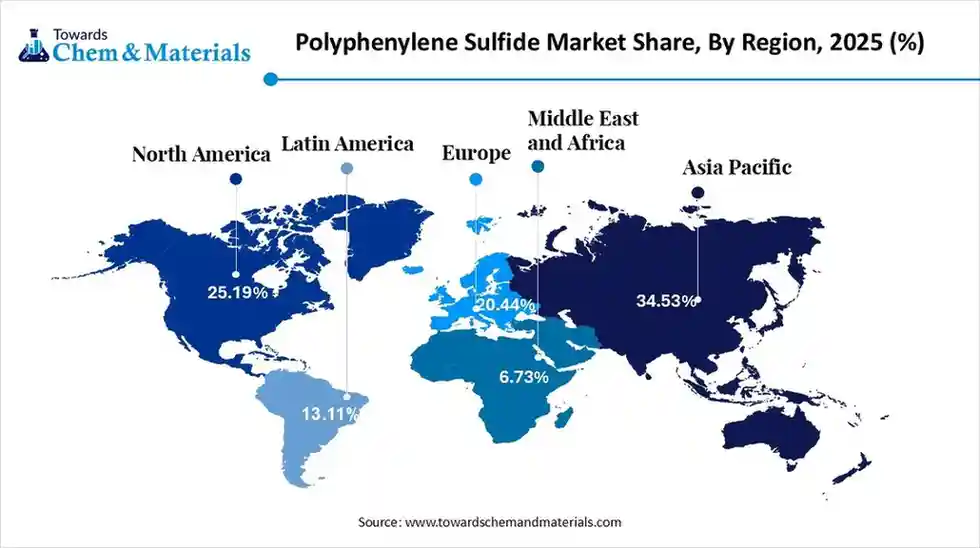

The global polyphenylene sulfide market size was estimated at USD 2.11 billion in 2025 and is predicted to increase from USD 2.30 billion in 2026 and is projected to reach around USD 4.89 billion by 2035, The market is expanding at a CAGR of 8.77% between 2026 and 2035. Asia Pacific dominated the polyphenylene sulfide market with a market share of 34.53% the global market in 2025.The growth of the market is driven by industrialisation, urbanisation, and the need for lightweight, durable, high-performance components.

Key Takeaways

- By region, Asia Pacific dominated the polyphenylene sulfide market with a share of 34.53% in 2025. The growing automotive production in the region fuels the growth of the market. the polyphenylene sulfide industry in China is expected to grow at a substantial CAGR of 9.69% from 2026 to 2035.

- By region, North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035. The strong demand for lightweight materials from various sectors fuels the growth.

- By product, the linear PPS segment dominated the market with a share of 62.11% in 2025. The high-performance filtration membrane demand drives the growth.

- By product, the branched PPS segment is projected to grow at a CAGR of 9.87% between 2026 and 2035. The growing application due to its properties drives the growth of the market.

- By application, the automotive segment dominated the market with a share of 35.11% in 2025. Demand for high-performance and lightweight materials drives the growth.

- By application, the electrical and electronics segment is projected to grow at a CAGR of 9.44% between 2026 and 2035. The rapid growth of consumer electronics increases the demand for the market.

Market Overview

What is the significance of the Polyphenylene Sulfide Market?

The Polyphenylene Sulfide (PPS) market is significant because PPS is a high-performance thermoplastic crucial for demanding applications in automotive, electrical/electronics, aerospace, and industrial sectors, driven by its exceptional thermal stability, chemical resistance, and mechanical strength, supporting trends like EV lightweighting and advanced filtration, with strong growth.

Polyphenylene Sulfide Market Growth Trends:

- Automotive Lightweighting: PPS replaces heavier metals in parts like transmission systems, switches, and coolant components to improve fuel efficiency and cut emissions, crucial for both conventional and electric vehicles (EVs).

- Electronics Miniaturisation: Its high heat resistance, durability, and flame retardancy make it ideal for smaller electronic components that operate at higher temperatures.

- High-Performance Properties: Excellent mechanical strength, creep resistance, and chemical resistance, combined with continuous use above 200°C (392°F), drive adoption in harsh environments.

- Regional Dominance: Asia-Pacific, particularly China and India, leads the market due to robust automotive and electronics industries.

- Product Forms: Moulded/compounded products are the dominant segment, valued for their reliability and resistance to stress relaxation

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 2.30 Billion |

| Revenue Forecast in 2035 | USD 4.89 Billion |

| Growth Rate | CAGR 8.77% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Product, By Application, By Regions |

| Key companies profiled | Kureha Corporation, DIC Corporation, Celanese Corporation, Toray Industries, Inc., Lion Idemitsu Composites Co., Ltd, Tosoh Corporation, SK chemicals, Chengdu Letian Plastics Co., Ltd., TEIJIN LIMITED, SABIC, Zhejiang NHU Co., Ltd., LG Chem, RTP Company, Ensinger, Polyplastics Co., Ltd., Solvay S.A |

Key Technological Shifts In The Polyphenylene Sulfide Market:

The global polyphenylene sulfide market is undergoing significant technological transformations, primarily driven by the transition toward electric vehicles (EVs), the expansion of 5G infrastructure, and increasing sustainability mandates. Key shifts include the dominance of linear PPS grades, the integration of advanced composites for aerospace and automotive lightweighting, and the adoption of Industry 4.0 and Artificial Intelligence in manufacturing processes.

Trade Analysis Of Polyphenylene Sulfide Market: Import & Export Statistics

According to Global Export data, between June 2024 and May 2025 (TTM), the world shipped out 434 shipments of Polyphenylene Sulfide, involving 40 exporters and 44 buyers. This represents a 187% increase compared to the previous twelve months. Most exports from the world go to the United States, Vietnam, and Belgium. Globally, the leading exporters are the United States, South Korea, and Japan.

The U.S. accounts for 301 shipments, South Korea for 233, and Japan for 143. Referring to India Export data, India sent out 24 shipments of Polyphenylene Sulfide, exported by 7 Indian exporters to 9 buyers. Most of the export from India are destined to Singapore, South Korea, and China. Internationally, Japan, Malaysia, and China are the top exporters, with Japan leading at 3,774 shipments, followed by Malaysia with 2,503, and China with 1,161.

Polyphenylene Sulfide Market Value Chain Analysis

- Chemical Synthesis and Processing : Polyphenylene sulfide is produced through processes such as polymerisation of sodium sulfide and p-dichlorobenzene, melt extrusion, compounding with fillers (glass fibre, minerals), pelletizing, and high-temperature moulding for automotive, electrical, and industrial applications.

- Key players: Toray Industries Inc., DIC Corporation, Solvay S.A., Celanese Corporation

- Quality Testing and Certification: PPS materials require certifications related to thermal stability, chemical resistance, flame retardancy, and industrial polymer safety. Key certifications include UL 94 flame-retardant rating, ISO polymer quality standards, RoHS compliance, and ASTM polymer testing standards.

- Key players: UL Solutions, ISO (International Organisation for Standardisation), ASTM International, TÜV SÜD

- Distribution to Industrial Users: PPS resins and compounds are distributed to automotive manufacturers, electronics producers, industrial machinery suppliers, chemical processing equipment makers, and aerospace component manufacturers.

- Key players: Ensinger, RTP Company, SABIC.

Polyphenylene Sulfide Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. Environmental Protection Agency (EPA) | TSCA (Toxic Substances Control Act), Clean Air Act (CAA), OSHA Chemical Safety Standards | Polymer safety, workplace exposure control, and emission compliance | PPS used in automotive and electronics must comply with VOC limits and TSCA inventory rules. |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation, RoHS Directive, CLP Regulation | Registration & safety profiling, hazardous substance restriction, labelling | PPS compounds for electrical applications must meet strict RoHS limits on heavy metals and flame retardants. |

| China | Ministry of Ecology and Environment (MEE), SAMR | MEE Order No. 12 (New Chemical Substance Registration), GB Standards | Environmental risk assessment, chemical registration, and product quality standards | Local testing and Chinese-only documentation are required for PPS importers. |

| Japan | METI, MHLW | CSCL (Chemical Substances Control Law), Industrial Safety and Health Law | Pre-market evaluation, workplace chemical management | PPS is widely used in electronics; CSCL requires risk assessments for high-volume polymers. |

| India | MoEFCC, BIS | Chemical (Management and Safety) Rules (proposed), BIS Quality Standards | Chemical inventory, environmental clearance, hazard communication | India is moving toward REACH-like rules that will impact engineering plastics, including PPS. |

Segmental Insights

Product Insights

Which Product Segment Dominated The Polyphenylene Sulfide Market In 2025?

The linear PPS segment dominated the market with a share of 62.11% in 2025. Linear PPS dominates applications that require high mechanical stability, superior toughness, and better impact resistance. The growing use of linear PPS in EV battery systems, electrical housings, and high-performance filtration membranes continues to boost demand, supported by its excellent chemical resistance and dimensional stability under extreme operating conditions.

The branched PPS segment is projected to grow at a CAGR between 2026 and 2035 in the polyphenylene sulfide market. Branched PPS is valued for its enhanced melt flow properties, allowing easier processing in injection molding and extrusion applications. The material’s strong thermal stability and inherent flame retardancy further drive its adoption in connectors, switches, and other electrical components, particularly as miniaturization trends accelerate across industries.

Application Insights

How Did the Automotive Segment Dominated The Polyphenylene Sulfide Market In 2025?

The automotive segment dominated the market with a share of 35.11% in 2025. In the automotive sector, PPS is widely used for under-the-hood components, fuel system parts, electrical connectors, and EV powertrain systems due to its exceptional heat resistance and chemical inertness. Its reliability under high temperatures and corrosive environments ensures long-term performance, making PPS a preferred engineering plastic for next-generation automotive designs.

The electrical and electronics segment is projected to grow at a CAGR between 2026 and 2035 in the polyphenylene sulfide market. The electrical and electronics segment represents one of the fastest-growing application areas for PPS, driven by rising miniaturization, higher heat loads, and expanding semiconductor production. The rapid growth of consumer electronics, 5G infrastructure, EV electronics, and industrial automation systems continues to strengthen PPS demand across high-performance electronic assemblies.

Regional Insights

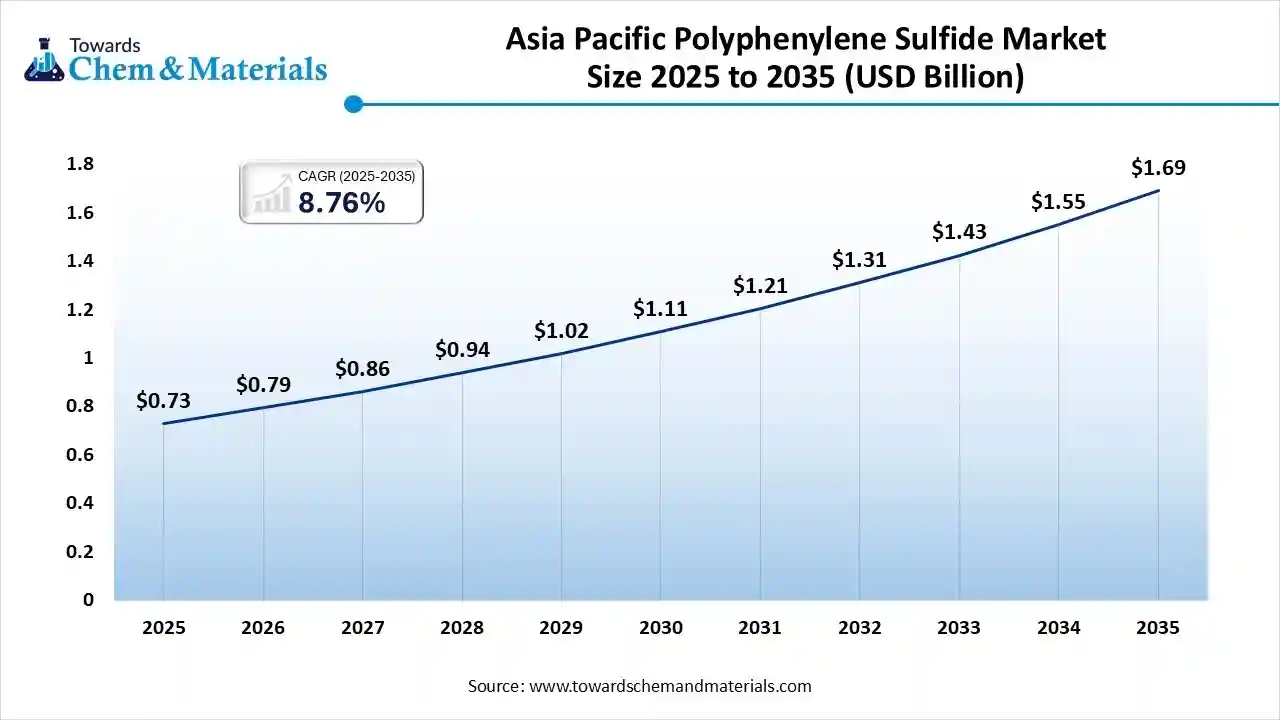

The Asia Pacific polyphenylene sulfide market size was valued at USD 0.73 billion in 2025 and is expected to reach USD 1.69 billion by 2035, growing at a CAGR of 8.76% from 2026 to 2035. Asia Pacific dominates the market with a share of 34.53% in 2025. Asia Pacific remains the largest region for PPS, driven by booming automotive production, expanding electronics and semiconductor manufacturing, and increasing demand for heat-resistant engineering plastics. China, Japan, South Korea, and India are major contributors as industries rapidly shift toward lightweight, durable, high-thermal-performance materials. Expanding EV ecosystems and large-scale electronics manufacturing hubs continue to accelerate PPS adoption across the region.

China: Polyphenylene Sulfide Market Growth Trends

China dominates the PPS market in Asia Pacific due to its large-scale automotive, electronics, and industrial machinery industries. Rapid EV manufacturing growth fuels PPS demand for connectors, motor components, and battery system parts. Additionally, the presence of major PPS producers and expanding domestic compounding capabilities strengthens China’s position as both a leading consumer and exporter of PPS materials.

North America's Growth Is Driven By Strong Demand For Materials.

North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035. North America shows strong demand for polyphenylene sulfide, driven by expanding automotive lightweighting initiatives and high-performance material adoption in electronics and aerospace. Growth is also supported by stringent environmental regulations that encourage the replacement of metal parts with high-performance engineering plastics like PPS.

United States: Polyphenylene Sulfide Market Growth Trends

The United States dominates PPS consumption in North America due to its robust automotive, aerospace, and industrial machinery sectors. Strong investment in electric vehicles (EVs) and electronics manufacturing continues to boost PPS demand for connectors, sensors, and heat-resistant components. Additionally, the presence of major PPS processors and material innovators enhances product availability, driving broader adoption across high-temperature and chemical-resistant applications.

Europe's Strong Emphasis On Sustainability Drives The Growth Of The Market

Europe demonstrates steady PPS demand, supported by a strong emphasis on sustainability, lightweight materials, and high-temperature polymers used in automotive engineering and electrical components. The region’s stringent emission and fuel efficiency norms accelerate the adoption of PPS for reducing vehicle weight while improving durability. Growing industrial automation and advanced electronics manufacturing further strengthen the demand outlook across Germany, France, Italy, and other EU markets.

Germany: Polyphenylene Sulfide Market Growth Trends

Germany leads Europe’s PPS consumption due to its dominant automotive manufacturing base and strong engineering plastics ecosystem. The country’s rapid adoption of PPS for high-precision components, electrical systems, and EV battery housings drives sustained growth. Germany’s strong R&D culture and focus on advanced materials development also support innovation in PPS compounding and customized formulations tailored for high-performance applications.

South America's Growing Market, Especially The Automotive Industry, Drives The Growth

South America shows emerging demand for PPS, driven by growth in the automotive aftermarket, increasing industrial automation, and the gradual adoption of high-performance engineering plastics. As manufacturing capabilities expand and multinational companies invest in regional production, the use of PPS in electrical systems, industrial equipment, and chemical processing applications is gradually increasing. Infrastructure development and rising EV interest further support long-term market potential.

Brazil: Polyphenylene Sulfide Market Growth Trends

Brazil leads PPS consumption in South America due to its sizeable automotive industry and growing electronics manufacturing sector. Increasing investments in EV infrastructure and industrial modernisation are supporting greater adoption of engineering plastics like PPS. The country’s chemical and processing industries are also incorporating PPS for its chemical resistance, durability, and high-temperature performance, contributing to steady market growth.

Middle East & Africa Demand From Industries For High-Performance Polymer Drives Growth

MEA’s PPS demand is gradually increasing as industrial sectors expand and advanced materials gain traction in oil & gas, chemical processing, and automotive applications. The region’s focus on industrial diversification and localised manufacturing is driving the adoption of high-performance polymers. PPS usage is also rising in electrical components and industrial equipment requiring high heat and chemical resistance.

United Arab Emirates: Polyphenylene Sulfide Market Growth Trends

The UAE is a key contributor to PPS demand in the region due to its rapidly developing industrial ecosystem and investment in advanced manufacturing. Increasing adoption of high-performance materials in oil & gas equipment, electronics assembly, and automotive components supports PPS consumption. Government-backed industrial development initiatives also attract companies seeking to utilise engineering polymers such as PPS in precision and high-temperature applications.

Recent Developments

- In April 2025, Syensqo launched Ryton® PPS M2000 FP, a new polyphenylene sulfide powder coating grade aimed at boosting efficiency and safety in industrial and energy applications.(Source: interplasinsights.com)

- In November 2025, China's Ministry of Commerce initiated a sunset review of anti-dumping duties on imported polyphenylene sulfide from Japan, the United States, South Korea, and Malaysia.(Source: www.globaltimes.cn)

- In September 2025, Sun Chemical introduced various innovations for plastics coloration at K 2025, including new pigments, advanced effect finishes, and color solutions for fibers and e-mobility. The company also highlighted PPS engineering compounds for applications from automotive e-powertrains to drinking water systems(Source: www.webwire.com)

- In January 2025, Envalior announced in January 2025 that it will build its first in-house polyphenylene sulfide (PPS) compounding facility in Europe to address growing demand from customers in Europe and America(Source: www.textileworld.com)

- In September 2025, Polyplastics Group has developed specialized polyphenylene sulfide (PPS) grades for components in electric vehicle (EV) lithium-ion batteries (LIB), including module covers and busbars.(Source: www.ptonline.com)

Top Players in the Polyphenylene Sulfide Market & Their Offerings:

- Toray Industries, Inc.: Toray is a leading global producer of PPS resin and compounds under its TORELINA® brand. The company provides high-performance PPS materials used in automotive electrical components, electronics, industrial machinery, and chemical processing due to their superior heat resistance and dimensional stability.

- Celanese Corporation: Celanese offers a broad portfolio of PPS materials through its FORTRON® line, delivering high thermal performance, chemical resistance, and mechanical strength. Its PPS compounds are widely adopted in automotive, E&E components, and industrial applications requiring long-term durability.

- DIC Corporation: DIC is a major supplier of PPS resins and compounds known for their excellent thermal stability and processability. The company’s PPS materials are used in electronics, automotive under-the-hood parts, and precision industrial components, supported by strong global manufacturing capabilities.

- Kureha Corporation: Kureha is one of the earliest innovators in PPS resin and remains a key player with its KURAREY® PPS product line. Its materials are known for high purity, strong heat resistance, and superior chemical stability, making them suitable for filtration, automotive, and electrical components.

Top Companies in the Polyphenylene Sulfide Market

- Lion Idemitsu Composites Co., Ltd

- Tosoh Corporation

- SK chemicals

- Chengdu Letian Plastics Co., Ltd.

- TEIJIN LIMITED

- SABIC

- Zhejiang NHU Co., Ltd.

- LG Chem

- RTP Company

- Ensinger

- Polyplastics Co., Ltd.

- Solvay S.A

Segments Covered

By Product

- Linear PPS

- Cured PPS

- Branched PPS

By Application

- Automotive

- Electrical & Electronics

- Industrial

- Coatings

- Others

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa