Content

What is the Current Chemical Industry Market Size and Share?

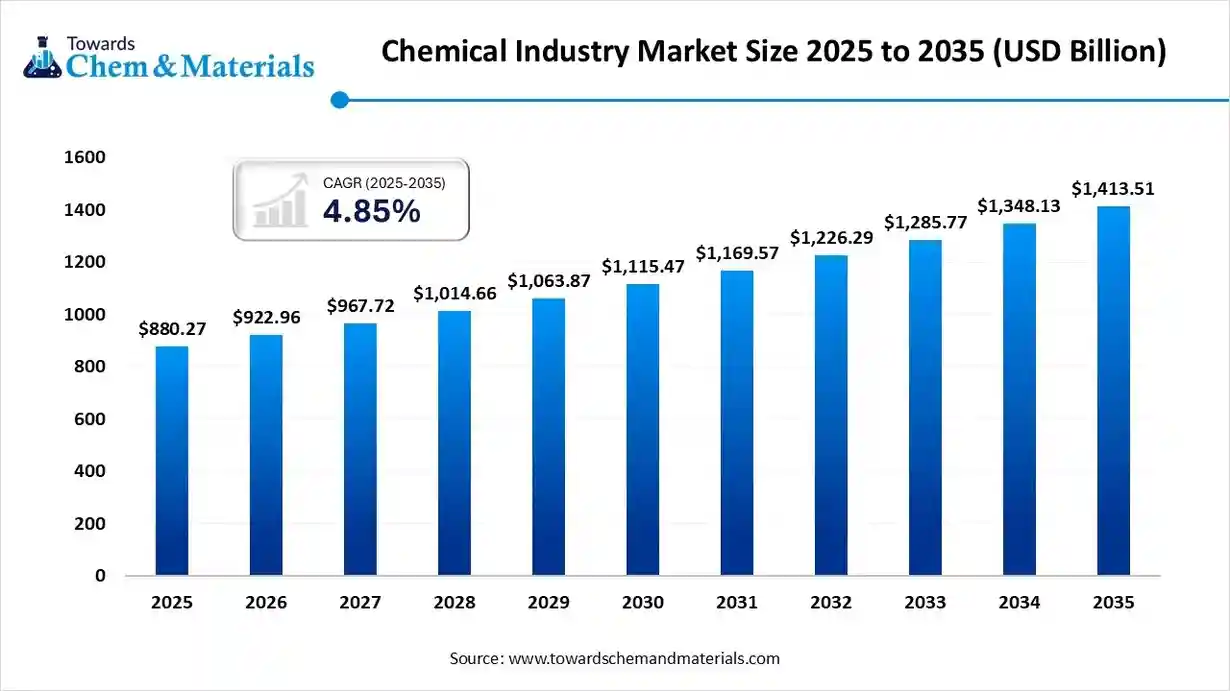

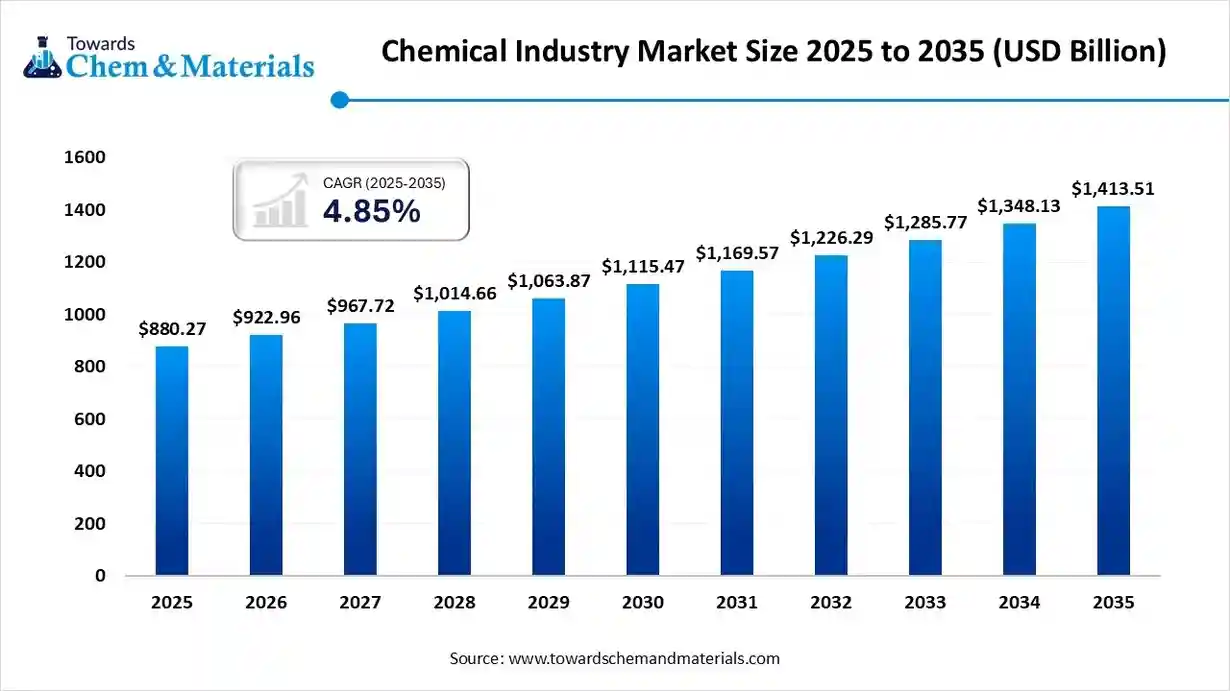

The global chemical industry market size is calculated at USD 880.27 billion in 2025 and is predicted to increase from USD 922.96 billion in 2026 and is projected to reach around USD 1,413.51 billion by 2035, The market is expanding at a CAGR of 4.85% between 2026 and 2035. The growing agriculture sector and increasing use of personal care product drives market growth.

Key Takeaways

- Asia Pacific dominated the global chemical industry market with the largest revenue share in 2025.

- Europe is growing at the fastest CAGR in the market during the forecast period.

- By product, the petrochemical & polymers or plastics segment led the market in 2025.

- By product, the specialty chemical segment is growing at the fastest CAGR in the market during the forecast period.

- By application, the packaging & plastics segment led the market in 2025.

- By application, the pharmaceuticals & healthcare segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By chemical property, the resins & polymers segment led the market in 2025.

- By chemical property, the additives, fillers, & plasticizers segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By manufacturing, the integrated petrochemical producers or commodity segment led the market in 2025.

- By manufacturing, the specialty chemical manufacturers & contract manufacturers segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By feedstock, the naphtha or crude-oil-derived segment led the market in 2025.

- By feedstock, the bio-based feedstocks segment is expected to grow at the fastest CAGR in the market during the forecast period.

Unleashing the Power Behind Chemical Industry Growth

Chemical Industry market growth is driven by the increasing use of agrochemicals, growing construction activities, a shift towards sustainable chemical solutions, rising industrialization, and increased consumption of flavored beverages.

The growing end-user sectors like agrochemicals, personal care, pharmaceuticals, healthcare, automotive, and construction increase demand for Chemicals Industry. The increasing consumption of processed foods and the growing food processing industry require Chemicals Industry to enhance fragrances and flavors. The rapid growth in electric vehicles, packaging, and nutraceuticals requires specialty chemicals.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 922.96 Billion |

| Revenue Forecast in 2035 | USD 1,413.51 Billion |

| Growth Rate | CAGR 4.85% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segments covered | By Product / Chemical Type, By Application / End-Use, By Chemical Property / Function, By Manufacturing / Business Model, By Feedstock / Technology, By Region |

| Key companies profiled | INEOS , PetroChina , LyondellBasell , LG Chem , ExxonMobil Chemical , Mitsubishi Chemical , Hengli Petrochemical , Covestro , DuPont de Nemours , Evonik Industries, Arkema, Reliance Industries Ltd. , Huntsman Corporation , Clariant, Ashland , Brenntag , Univar Solutions |

What are Chemical Industry?

Chemical Industry are chemicals used across diverse industrial processes. These chemicals are inorganic or organic. The various types of Chemicals Industry are inorganic chemicals like salts, acids, sulfuric acids, & bases, organic chemicals like hydrocarbons & alcohols, specialty chemicals like catalysts & adhesives, and bulk chemicals like polymers, petrochemicals, & solvents. The commonly used Chemicals Industry are phosphoric acids, sodium carbonate, ammonium nitrate, sulfuric acid, and others.

Chemicals Industry like fertilizers, plastic, pesticides, coatings, polymers, adhesives, paints, sealants, chlorine, and others are widely used in industries like agriculture, consumer goods, manufacturing, automotive, electrical, construction, electronics, pharmaceuticals, and many more.

Chemical Industry Market Trends:

- Growing Specialty Chemicals Demand:- The growing industrialization and expansion of industries like electronics, automotive, manufacturing, and construction increase demand for specialty chemicals. The growing development of infrastructure projects increases demand for specialty chemicals like sealants, adhesives, and other chemicals to enhance durability and performance.

- Green Chemistry Adoption:- The stricter environmental regulations and increasing environmental concerns increase the adoption of green chemistry to lower environmental impact. The shift towards sustainable products and a strong focus on minimizing waste increases the production of green or eco-friendly chemicals.

- Growing Automotive Industry:- The shift towards electric vehicles and increasing use of hybrid vehicles increases demand for Chemicals Industry for the development of electrolytes, batteries, and other components. The manufacturing of lightweight vehicle parts and the focus on enhancing fuel efficiency require chemicals like advanced plastics & polymers.

- Rapid Urbanization:- The growing population and expansion of urban areas increase the development of infrastructure, residential, construction, and commercial buildings that require chemicals. Urbanization increases industrial activities, like the development of manufacturing facilities, which increases demand for specialty and basic chemicals.

Key Technological Shifts in the Chemical Industry Market:

The Chemical Industry market is undergoing a key technological transformation driven by the demand for performance efficiency, boosting innovation, and sustainability. Technological advancements in Chemical Industry, such as big data analytics, digital twins, blockchain, cloud computing, and IoT, enhance efficiency and develop smarter manufacturing processes. One of the major transformations is the adoption of AI and machine learning (ML) optimizes manufacturing processes.

Artificial Intelligence & ML speed up the research and development process and develop new compounds faster. AI can easily identify new catalysts with enhanced properties like lower cost, higher selectivity, and better stability. AI automates new compound synthesis & high-throughput testing process and adjusts process settings like pressure & temperature in real-time. ML detects defects easily and maintains the consistency of products. Overall, AI & ML revolutionize the Chemical Industry sector by enhancing the efficiency of the supply chain and accelerating the process of research & development.

- For instance, BASF uses machine learning for the prediction of polymer properties.

- For instance, Dow Chemical collaborated with Microsoft to use AI for accelerating research & development of new polyurethane products.

Trade Analysis of the Chemical Industry Market: Import & Export Statistics

- Germany exported $225B of chemical products in 2023.(Source: oec.world)

- The United States exported $15.8B of ethylene polymers in 2023.(Source: oec.world)

- China imported $19.4B of ethylene polymer in 2023.(Source: oec.world )

- China exported $356M of additives for making cement, concrete, or mortar in 2023.(Source: oec.world)

- The United Arab Emirates imported $104M of additives for making cement, concrete, or mortar in 2023. (Source: oec.world)

- Canada exported $140M of chlorine in 2023.(Source: oec.world)

- Russia exported $15.3B of fertilizers in 2023.(Source: oec.world)

Chemical Industry Market Value Chain Analysis

- Feedstock Procurement : Feedstock procurement is the sourcing and acquisition of feedstocks like fossil-based, including coal, crude oil, & natural gas, mineral-based, bio-based, captured carbon, and recycled plastic to produce Chemical Industry.

- Key Players: Dow, SABIC, BASF, Reliance Industries Limited, Sinopec

- Quality Testing and Certifications : The quality testing is an evaluation of properties like contaminant detection, regulatory compliance, composition analysis, & performance to verify performance, safety, & composition, and certifications include NSF International, ISO 9001, & BIS.

- Key Players: Eurofins India, TUV SUD, UL Solutions, SGS SA, Bureau Veritas

- Regulatory Compliance and Safety Monitoring :Regulatory compliance is the process of ensuring labelling, documentation, classification, financial protection, chemical lifecycle, & packaging to adhere to regulations & laws of the chemical industry, whereas safety monitoring is the process of tracking safety through risk assessment, environmental protection, workplace safety, and regulatory updates.

- Key Players: Intertek Assuris, WSP, UL Solutions, Velocity EHS, 3E

Chemical Solution Behind Industry's Success

| Industry | Most Used Chemicals | Used For |

| Pharmaceutical |

|

|

| Food & Beverage |

|

|

| Agriculture |

|

|

| Textile |

|

|

| Automotive |

|

|

| Water Treatment |

|

|

Segmental Insights

Product Insights

Why the Petrochemicals & Polymers Segment Dominates the Chemical Industry Market?

The petrochemicals & polymers or plastics segment dominated the Chemical Industry market in 2025. The growing production of synthetic rubber, detergents, plastics, pharmaceuticals, and synthetic fibers increases demand for petrochemicals. The growing expansion of the packaging industry and the development of lightweight vehicle parts increase demand for polymers. The increasing manufacturing of adhesives, PVC pipes, casings, connectors, insulation, and circuit boards requires petrochemicals & polymers, driving the overall market growth.

The specialty chemicals segment is the fastest-growing in the market during the forecast period. The growing development of infrastructure projects and increasing use of agrochemicals like pesticides & herbicides requires specialty chemicals. The rising sectors like automotive, pharmaceuticals, electronics, consumer goods, and construction increase the adoption of specialty chemicals. The availability of specialty chemicals like adhesives, additives, pigments, and surfactants supports the overall market growth.

The agrochemicals segment is experiencing significant growth in the market. The growing demand for food and the presence of limited arable land increase demand for agrochemicals. The strong focus on protecting crops from weeds, pests, and diseases requires agrochemicals. The rise in precision agriculture and demand for high-value crops requires agrochemicals, supporting the overall market growth.

Application Insights

Which Application Held the Largest Share in the Chemical Industry Sector?

The packaging & plastics segment held the largest revenue share in the Chemical Industry sector in 2025. The rapid growth in e-commerce and the increasing need for specialized packaging increase demand for chemicals. The strong focus on protecting packaging products from oxygen, physical damage, and moisture increases demand for chemicals like UV stabilizers & barrier resins. The growing consumption of packaged food requires high-performance chemicals, driving the overall market growth.

The pharmaceuticals & healthcare segment is experiencing the fastest growth in the market during the forecast period. The growing production of generic drugs and the development of personalised medicines require Chemical Industry. The strong focus on vaccine development and the production of specialty drugs requires chemicals. The growing expansion of the pharmaceutical industry and development of drug delivery systems requires specialty chemicals, supporting the overall growth of the market.

The construction & building materials segment is growing significantly in the market. The growing development of industrial, residential, and commercial buildings increases demand for Chemical Industry. The increasing investment in infrastructure projects like smart cities, roads, and airports requires high-performance chemicals. The growing use of products like waterproofing agents, protective coatings, sealants, concrete admixtures, and adhesives supports the overall market growth.

Chemical Property Insights

How Resins & Polymers Segment Dominated the Chemical Industry Market?

The resins & polymers segment dominated the Chemical Industry market in 2025. The growing development of lightweight packaging solutions and the focus on lowering the weight of vehicles require resin & polymers. The increasing use of insulation, sealants, pipes, protective coatings, and adhesives in construction projects requires resins. The focus on thermal management and essential insulation in electronic products requires polymer, driving the overall market growth.

The additives, fillers, & plasticizers segment is the fastest-growing in the market during the forecast period. The growing use of medical devices and the increasing need for wire insulation require plasticizers. The strong focus on enhancing shelf life and durability of goods, food & beverage packaging requires additives. The growing construction activities require fillers, supporting overall market growth.

The solvents & intermediates segment is experiencing significant growth in the market. The formulation of drugs and the rise in biopharmaceuticals require solvents. The growing expansion of the automotive sector and the rapid growth in construction projects require solvents & intermediates. The increased manufacturing of batteries and semiconductors requires high-purity solvents, fueling the overall market growth.

Manufacturing Insights

How did Integrated Petrochemical Producers or the Commodity Segment hold the Largest Share in the Chemical Industry Sector?

The integrated petrochemical producers or commodity segment held the largest revenue share in the Chemical Industry sector in 2025. The strong focus on controlling overall supply chains and lowering third-party dependence increases the adoption of integrated petrochemical producers. The high operational efficiency and low cost of production in commodity chemical production drive the overall market growth.

The specialty chemical manufacturers & contract manufacturers segment is experiencing the fastest growth in the market during the forecast period. The growing demand for specialty chemicals across industries like agriculture, automotive, healthcare, consumer goods, construction, electronics, and pharmaceuticals increases demand for specialty chemical manufacturers. The strong focus on the avoidance of capital expenditure and flexibility to scale up production requires contract manufacturers, supporting the overall market growth.

Feedstock Insights

Which Feedstock Segment Dominated the Chemical Industry Market?

The naphtha or crude-oil derived segment dominated the Chemical Industry market in 2025. The growing production of synthetic materials, plastics, and resins increases the adoption of naphtha. The growing demand for petrochemicals in industries like construction, consumer goods, and packaging requires naphtha. The increasing use of synthetic fibers, solvents, detergents, adhesives, and agrochemicals requires naphtha, driving the overall market growth.

The bio-based feedstocks segment is the fastest-growing in the market during the forecast period. The growing awareness about environmental concerns and increasing use of eco-friendly products requires bio-based feedstocks. The strong focus on lowering greenhouse gas emissions and carbon footprint requires bio-based feedstocks. The growing use of bio-based feedstocks in industries like cosmetics, automotive, agriculture, and packaging drives the market growth.

The natural gas or ethane feedstock segment is experiencing significant growth in the market. The growing use of products like synthetic fiber and plastics increases demand for natural gas. The increasing demand for ethane feedstock in industries like automotive and packaging helps market growth. The cost-effectiveness and expansion of the petrochemical sector require ethane feedstock, supporting the overall market growth.

Regional Insights

Asia Pacific Chemical Industry Market Trends

Asia Pacific dominated the Chemical Industry market in 2024. The well-established chemical manufacturing base in countries like China and growing industrial activities increase the production of Chemical Industry.The increasing government investment in research & development and a strong focus on high-performance specialty chemicals in countries like South Korea & Japan help market growth. The booming sectors like electronics, textiles, automotive, and construction increase demand for chemicals, driving the overall market growth.

Catalyzing Change: How China Drives the Chemical Industry Landscape

China is a key contributor to the market. The growing manufacturing in sectors like construction, automotive, and electronics increases demand for specialty and basic chemicals. The rapid expansion of petrochemical capacity and shift towards producing specialty & fine chemicals help market growth. The well-established industrial base and government support for domestic chemical production through policies like Made in China support the overall market growth.

- China exported $226B of chemical products in 2023.(Source: oec.world)

Europe Chemical Industry Market Trends

Europe is experiencing the fastest growth in the market during the forecast period. The strong presence of integrated chemical parks and the production of high-quality chemicals help market growth. The strong focus on electrochemical synthesis, green chemistry principles, and CO2 utilization increases the production of chemicals. The growing manufacturing of automotive batteries requires Chemical Industry. The growing end-user industries like automotive, construction, pharmaceuticals, and electronics increase demand for Chemical Industry, driving the overall market growth.

Tech Revolution: Germany's Precision in the Industrial Chemicals

Germany is a major contributor to the market. The strong focus on biotech processes, battery materials, and solar panels increases demand for Chemical Industry. The strong emphasis on chemical recycling and the development of sustainable chemical solutions helps market growth. The growing demand for chemical products in industries like aerospace, personal care, automotive, and pharmaceuticals supports the overall market growth.

North America Chemical Industry Market Trends

North America is growing at a notable rate in the market. The growing use of specialty chemicals like adhesives, polymers, and coatings in industries like consumer goods, automotive, and construction helps market growth. The expansion of electric vehicles and the increasing need for crop protection products increase demand for Chemical Industry. The growing domestic manufacturing capacity of chemicals drives the market growth.

From Labs to Industry: U.S. Redefining Chemical Industry Progress

The United States is growing notably in the Chemical Industry market. The availability of natural gas and low production costs increase the production of Chemical Industry. The growing manufacturing of hygiene products, drugs, and medical devices increases demand for chemicals. The growing expansion of the electronic sector and rapid growth in the automotive industry increase demand for Chemical Industry, supporting the overall market growth.

The United States exported $239B of chemical products in 2023.(Source: oec.world)

Middle East & Africa Chemical Industry Market Trends

The Middle East & Africa are growing significantly in the market. The development of infrastructure projects and the expansion of industries increase demand for Chemical Industry. The abundance of agricultural resources, oil & gas increases production of bio-based chemicals & petrochemicals. The growing demand for costings, pesticides, polymers, adhesives, and fertilizers across diverse industries like manufacturing, construction, and agriculture supports the overall market growth.

Beyond Oil: Saudi Arabia’s Role in Chemical Industry

Saudi Arabia is growing substantially in the market. The abundance of feedstocks like oil & gas reserves increases the production of Chemical Industry. The growing infrastructure development, residential and commercial construction, increases demand for Chemical Industry. The increasing manufacturing in sectors like agriculture, automotive, and healthcare requires chemicals, supporting the overall market growth.

- Saudi Arabia exported $10.5B of ethylene polymers in 2023.(Source: oec.world)

South America Chemical Industry Market Trends

South America is growing in the market. The growing development of construction projects increases demand for Chemical Industry like sealants, coatings, and adhesives. The increasing expansion of the agriculture sector requires agrochemicals like pesticides and fertilizers. The rise in semiconductor manufacturing and increasing investment in infrastructure projects requires Chemical Industry, driving the overall market growth.

From Rainforest to Reactors: Rise of Chemical Industry in Brazil

Brazil is growing at a significant rate in the market. The abundance of natural sources like gas, biodiversity, oil, and minerals increases the production of chemicals. The increased utilization of fertilizers and agrochemicals helps market expansion. The use of Chemical Industry in pharmaceuticals, cosmetics, and packaged goods supports the overall market growth.

Recent Developments

- In October 2025, Bhageria Industries launched plasticizers and ethoxylates chemical solutions. The solutions are widely used in applications like personal care, industrial formulations, textiles, and agrochemicals. The chemical solution aligns with sustainability and innovation commitment.(Source: chemindigest.com )

- In March 2025, Nouryon launched low-carbon hydrogen peroxide, Eka HP Puroxide. The hydrogen peroxide supports diverse industries like water treatment, pulp & paper, and mining. The product lowers carbon emissions up to 90% and is an eco-premium solution. (Source: chemindigest.com)

- In March 2025, BASF and Sika launched an epoxy hardener, Baxxodur EC 151, for the construction industry. The solution has an excellent color stability, optimum flow property, and low viscosity. The product is used in flooring applications and parking decks. (Source: www.indianchemicalnews.com)

Top Companies List

- Sinopec (Sinopec Group): A Chinese company produces and supplies various chemical products like fine chemicals, synthetic fibers, commodity chemicals, petrochemicals, and specialty resins.

- BASF SE: A German multinational company manufactures chemicals like pigments, agricultural solutions, electronic chemicals, & catalysts to support diverse industries like automotive, electronics, consumer goods, agriculture, construction, and pharmaceuticals.

- Dow Inc.: The company manufactures various products like performance materials, silicones, plastics, & coatings to serve diverse sectors like infrastructure, consumer care, packaging, and mobility.

- SABIC: The Saudi Arabia-based company manufactures specialty plastics, petrochemicals, and agri-nutrients to support major industries healthcare, construction, automotive, and packaging.

- Formosa Plastics Group: The leading petrochemical company produces petrochemical products like ethylene-vinyl acetate, vinyl chloride monomer, and high-density polyethylene to support numerous industries.

Other Companies List

- INEOS

- PetroChina

- LyondellBasell

- LG Chem

- ExxonMobil Chemical

- Mitsubishi Chemical

- Hengli Petrochemical

- Covestro

- DuPont de Nemours

- Evonik Industries

- Arkema

- Reliance Industries Ltd.

- Huntsman Corporation

- Clariant

- Ashland

- Brenntag

- Univar Solutions

Segments Covered

By Product / Chemical Type

- Petrochemicals & Polymers / Plastics (ethylene, propylene, monomers → PE, PP, PVC, PET, etc.)

- Basic / Commodity Chemicals (inorganics, acids, caustics, chlorine, soda ash)

- Specialty Chemicals (additives, surfactants, adhesives, pigments, coatings, electronic chemicals)

- Fine & Intermediates (active pharma intermediates, performance intermediates)

- Agrochemicals (fertilizers, crop protection active ingredients)

- Industrial Gases (oxygen, nitrogen, hydrogen)

- Others (bio-based chemicals, solvent families, silicones, oleochemicals)

By Application / End-Use

- Packaging & Plastics

- Construction & Building Materials

- Automotive & Transportation

- Agrochemicals & Fertilisers

- Pharmaceuticals & Healthcare

- Consumer Goods (FMCG, personal care, detergents)

- Electronics & Semiconductors

- Energy & Utilities

By Chemical Property / Function

- Solvents & Intermediates

- Resins & Polymers

- Additives, Fillers, Plasticizers (specialty)

- Catalysts & Process Chemicals

- Coatings, Adhesives, Sealants, Elastomers (CASE)

By Manufacturing / Business Model

- Integrated Petrochemical Producers / Commodity

- Specialty Chemical Manufacturers & Contract Manufacturers

By Feedstock / Technology

- Naphtha / Crude-oil derived

- Natural gas/ethane feedstock

- Bio-based feedstocks (biopolymers, oleochemicals)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa