Content

What is the Current Magnesium Oxide Market Size and Share?

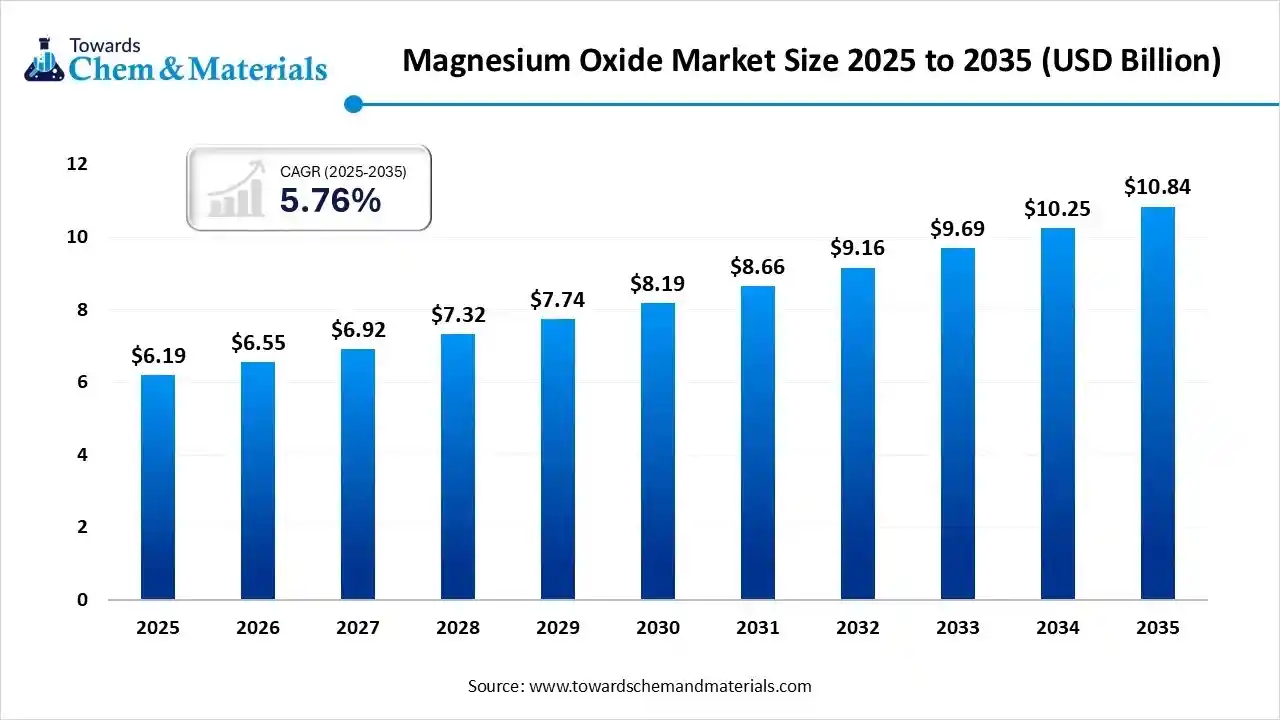

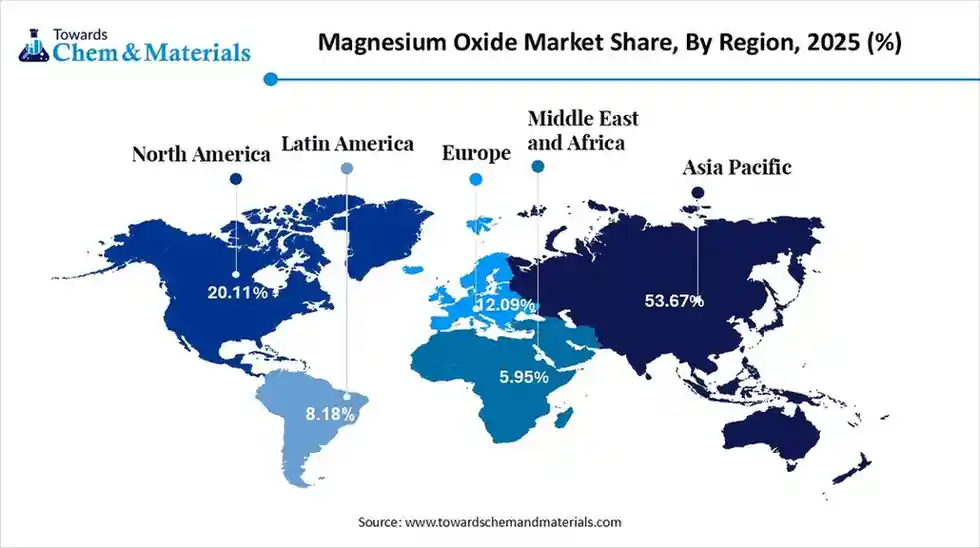

The global magnesium oxide market size was estimated at USD 6.19 billion in 2025 and is predicted to increase from USD 6.55 billion in 2026 and is projected to reach around USD 10.84 billion by 2035, The market is expanding at a CAGR of 5.76% between 2026 and 2035. Asia Pacific dominated the magnesium oxide market with a market share of 53.67% the global market in 2025. The expanding steel & cement industries requiring refractories are the key factor driving market growth. Also, a surge in construction for fire-resistant materials, coupled with the ongoing urbanisation in developing economies, can fuel market growth further.

Key Takeaways

- By region, Asia Pacific led the magnesium oxide market with the largest revenue share of over 53.67% in 2025. The dominance of the region can be attributed to the extensive industrialization, particularly in China and India.

- By region, North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the increasing adoption of MgO nanoparticles in automotive, electronics, and aerospace.

- By product, the dead burned magnesia segment led the market with the largest revenue share of 49.15% in 2025. The dominance of the segment can be attributed to its excellent thermal stability, resistance to chemical attack, and density.

- By product, the fused/electrofused MgO segment is expected to grow at the fastest CAGR 8.15% over the forecast period. The growth of the segment can be credited to the increasing demand for durable, high-performance, and fire-resistant plastics.

- By application, the agriculture segment dominated the global magnesium oxide industry with the largest revenue share of 32.21% in 2024 The dominance of the segment can be linked to the ongoing trends for better bioplastic and material performanc.

- By application, the industrial segment is expected to grow at the fastest CAGR 6.8% during the projected period. The growth of the segment can be driven by a surge in vehicle manufacturing and demand for durable and lightweight components.

What is Magnesium Oxide?

The market refers to the industry that deals with global trade and demand for magnesium oxide, a versatile mineral used as a crucial raw material in sectors such as refractories, construction, environmental, and agriculture. The market is mainly driven by sustainability trends, infrastructure growth, and high-temperature industrial needs, with major players often in the Asia Pacific region.

Magnesium Oxide Market Trends

- The increasing demand for magnesium oxide in functional foods and nutritional supplements is the latest trend in the market. Magnesium oxide is favoured for its health benefits and high bioavailability, like supporting bone health, aiding digestion, and maintaining muscle function.

- The ongoing advancements in high-purity variants are another major trend in the market, fuelled by their increasing application in specialized sectors like electronics, pharmaceuticals, and food industries.

- The ongoing development of specialty and high-purity magnesia grades is driving positive market growth soon. The emergence of electrofused magnesia, fused magnesia, and ultra-high purity caustic calcined magnesia is creating tailored applications in industrial applications.

- Market players are rapidly adopting sustainable production methods, such as sourcing from brines and seawater, to minimize the carbon footprint associated with conventional calcination and mining processes, leading to market growth soon.

- MgO is increasingly gaining traction as a greener substitute to traditional materials such as cement and gypsum due to its better durability, fire resistance, and moisture resistance, which aligns with global green building initiatives.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 6.55 Billion |

| Revenue Forecast in 2035 | USD 10.84 Billion |

| Growth Rate | CAGR 5.76% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Product, By Application, By Region |

| Key companies profiled | Israel Chemicals Ltd. (ICL), Premier Magnesia, Grecian Magnesite, NEDMAG B.V., Magnezit Group, Haicheng Guangling Refractory Manufacturing Co. LTD, YINGKOU MAGNESITE CHEMICAL IND GROUP CO., LTD, Bhavani Chemicals, Ube Material Industries Ltd |

How Cutting Edge Technologies are revolutionizing the Magnesium Oxide Market?

Advanced technologies are transforming the market via innovative material engineering, novel synthesis techniques, and the integration of digital technologies such as the Internet of Things (IoT) and artificial intelligence (AI). Furthermore, these advancements can optimise conventional manufacturing methods, unveiling diverse applications across a wide range of fields.

Trade Analysis of Magnesium Oxide Market Import & Export Statistics:

Exports

- In 2024, the United States exported $45.2M of Magnesium, being the 875th most exported product (out of 1,227) in the United States.

- In 2024, the main destinations of the United States' Magnesium exports were: Canada ($10.2M), the United Kingdom ($7.21M), Mexico ($6.61M), France ($3.06M), and Thailand ($2.16M).

Imports

- In 2024, the United States imported $353M of Magnesium, being the 611th most imported product in the United States.

- In 2024, the main origins of the United States' Magnesium imports were: Israel ($90.5M), Turkey ($43.8M), South Korea ($40.4M), Canada ($38.5M), and Mexico ($33.3M).

- China's magnesium imports surged in March 2025, reaching 22 shipments. This volume reflects robust growth metrics: a 57.1% year-on-year increase compared to March 2024 levels, and a substantial 340% sequential increase from February 2025 import figures.

Magnesium Oxide Market Value Chain Analysis

- Feedstock Procurement : It refers to the strategic process of sourcing the raw materials, such as dolomite, magnesite, and industrial sources such as brines and seawater, required for the manufacturing of different grades of magnesium oxide.

- Major Players: RHI Magnesita, Grecian Magnesite S.A.

- Chemical Synthesis and Processing: This stage involves the manufacturing of speciality and high-purity grades of magnesium oxide using controlled chemical methods, as opposed to the conventional calcination and mining of natural magnesite.

- Major Players: Israel Chemicals Ltd, Konoshima Chemical Co., Ltd.

- Packaging and Labelling : It includes the necessary practices and material types used to contain, safeguard, and identify the product during storage, logistics, and sale.

- Major Players: Nedmag B.V., Hebei Meishen Technology Co., Ltd.

- Regulatory Compliance and Safety Monitoring : It refers to the critical framework of standards, laws, and practices that govern the manufacturing, use, handling, and disposal of MgO to protect the environment and human health.

- Major Players: Grecian Magnesite S.A., Nedmag B.V

Magnesium Oxide Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| Key Regulations | The U.S. Food and Drug Administration (FDA) classify food-grade magnesium oxide as "Generally Recognized as Safe" (GRAS) when used within specified limits and adhering to purity standards like the U.S. Pharmacopeia (USP). |

| India | Trade is governed by the Bureau of Indian Standards (BIS), which ensures quality control, and the Directorate General of Foreign Trade (DGFT), which handles import/export licensing. |

| China | The government has historically implemented policies to consolidate the industry, eliminate small, inefficient producers, and promote larger enterprises with specific annual output capacities. |

Segmental Insights

Product Insights

How Much Share Did the Dead Burned Magnesia Segment Held in 2025?

The dead burned magnesia dominated the global magnesium oxide market with the largest revenue share of 49.15% in 2024. The dominance of the segment can be attributed to its excellent thermal stability, resistance to chemical attack, and density, which makes it crucial for refractory applications like cement manufacturing and steelmaking. In addition, extensive government investments in housing and transportation need cost-effective and durable plastic compounds.

The fused/electrofused MgO segment is expected to grow at the fastest CAGR 8.15% over the forecast period. The growth of the segment can be credited to the increasing demand for durable, high-performance, and fire-resistant plastics for better electric grids and modern infrastructure. Advancements in plastic compounding technology enhance cost-effectiveness and efficiency, enabling smooth integration of additives such as MgO.

Application Insights

Which Application Type Segment Dominated the Magnesium Oxide Market in 2025?

The agriculture segment dominated the global magnesium oxide industry with the largest revenue share of 32.16% in 2024. The dominance of the segment can be linked to the ongoing trends for better bioplastic and material performance, along with the increasing food demand requiring films. Farmers across the globe are rapidly adopting modern farming techniques like mulching and greenhouse cultivation to reduce overall water consumption and optimize environmental factors.

The industrial segment is expected to grow at the fastest CAGR 6.8% during the projected period. The growth of the segment can be driven by a surge in vehicle manufacturing and demand for durable and lightweight components. Furthermore, the automotive industry in developed countries is rapidly using specialized resins to replace heavier metal parts, impacting positive market growth.

Regional Insight

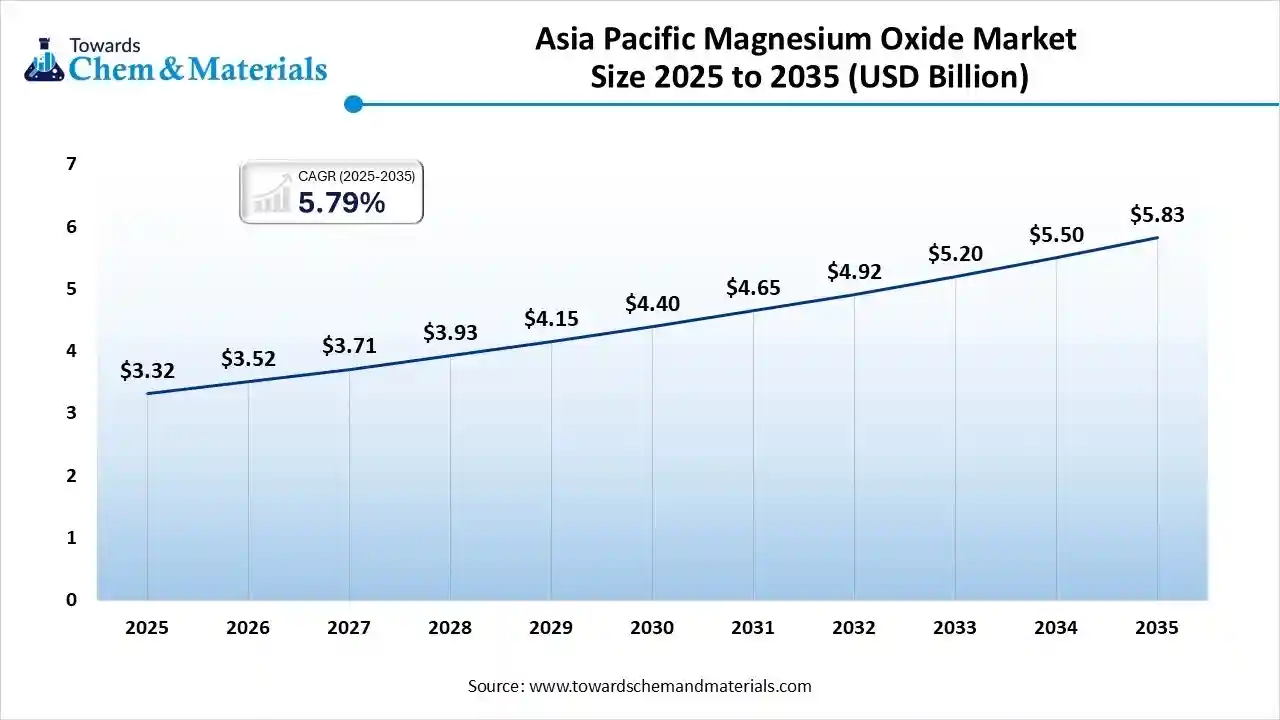

The Asia Pacific magnesium oxide market size was estimated at USD 3.32 billion in 2025 and is projected to reach USD 5.83 billion by 2035, growing at a CAGR of 5.79% from 2026 to 2035. Asia Pacific dominated the market with the largest share in 2025. The dominance of the region can be attributed to the extensive industrialization, particularly in China and India, along with the surge in infrastructure projects. In addition, China's vast cement and steel sectors are huge consumers of MgO for refractories, contributing to market expansion soon.

China Magnesium Oxide Market Trends

In the Asia Pacific, China dominated the market owing to huge product demand from the construction, steel, and agriculture sectors, supported by government policies and cost benefits, which make it a global supply hub for the country. Also, the increasing awareness of magnesium's role in animal and plant nutrition has led to a surge in the use of magnesium oxide as an animal feed supplement.

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the increasing adoption of MgO nanoparticles in automotive, electronics, aerospace, and healthcare sectors due to green tech trends. Moreover, stringent regulations are pushing industries to adopt more green solutions, which will impact positive regional growth soon.

U.S. Magnesium Oxide Market Trends

In North America, the U.S. led the market due to strong production bases and growing demand for convincing in personal and food care. Also, governments in the country are moving towards sustainable solutions and encouraging recycled and bio-based resins, creating lucrative opportunities in the market further.

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by strong demand from the cement, steel, and glass industries, coupled with the region's emphasis on energy-efficient and sustainable production. The growth in online shopping fuels the demand for durable and lightweight packaging materials.

Germany Magnesium Oxide Market Trends

The growth of the market in Germany can be fuelled by a surge in disposable income and an ongoing shift towards bio-based/sustainable resins. The county's emphasis on advanced packaging solutions mimics APAC's trends and leads to further innovation.

South America held a significant market share in 2025. The growth of the region can be propelled by its status as a global production hub, along with the wide availability of abundant raw materials. Government mandates are supporting plastic recycling, and advancements of bio-based resins are also shaping the positive market dynamics.

Brazil Magnesium Oxide Market Trends

The growth of the market in Brazil can be boosted by increasing product demand from major end-use sectors such as construction, packaging, and automotive, coupled with the increasing focus on government sustainability initiatives.

The Middle East & Africa held a major market share in 2025. The growth of the region is due to a surge in demand for specialised and high-purity MgO for advanced electronics and ceramics. Major countries in the region are shifting away from oil, fuelling the growth of construction and non-oil industrial activities, which is impacting positive market growth.

Saudi Arabia Magnesium Oxide Market Trends

The growth of the market in the country can be fuelled by its robust petrochemical base to fulfil regional demand in extensive sectors such as consumer goods, medical, and infrastructure. Advancements in biodegradable polymers, smart packaging, and state-of-the-art plastic compounds will support market expansion soon.

Recent Developments

- In April 2025, US MgO announced plans to build a new production facility for its advanced construction material products in Brunswick County, North Carolina. This facility is likely to create at least 35 new jobs and $5 million in total investments.(Source: www.brunswickcountync.gov)

Magnesium Oxide Market Companies

- Israel Chemicals Ltd. (ICL): ICL (Israel Chemicals Ltd.) is a major global player in the Magnesium Oxide (MgO) market, leveraging Dead Sea minerals for specialty, high-purity products used in animal feed, flame retardants, agriculture, and refractories, focusing on sustainable mining, advanced tech, and global supply.

- Premier Magnesia: Premier Magnesia is a key US supplier of magnesia products (MgO, Mg(OH)₂), leveraging its unique Nevada mine for domestic supply in the growing global MgO market driven by construction, environment, and agriculture.

Other Companies in the Market

- Premier Magnesia

- Israel Chemicals Ltd. (ICL)

- Grecian Magnesite

- NEDMAG B.V.

- Magnezit Group

- Haicheng Guangling Refractory Manufacturing Co. LTD

- YINGKOU MAGNESITE CHEMICAL IND GROUP CO., LTD

- Bhavani Chemicals

- Ube Material Industries Ltd

Segments Covered

By Product

- Dead Burned Magnesia (DBM)

- Caustic Calcined Magnesia (CCM)

- Fused/Electrofused MgO

By Application

- Agriculture

- Industrial

- Building & Construction

- Pharmaceuticals

- Environmental (FGD, Wastewater, Flue Gas)

- Other Applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa