Content

What is the Current Nanochemicals Market Size and Share?

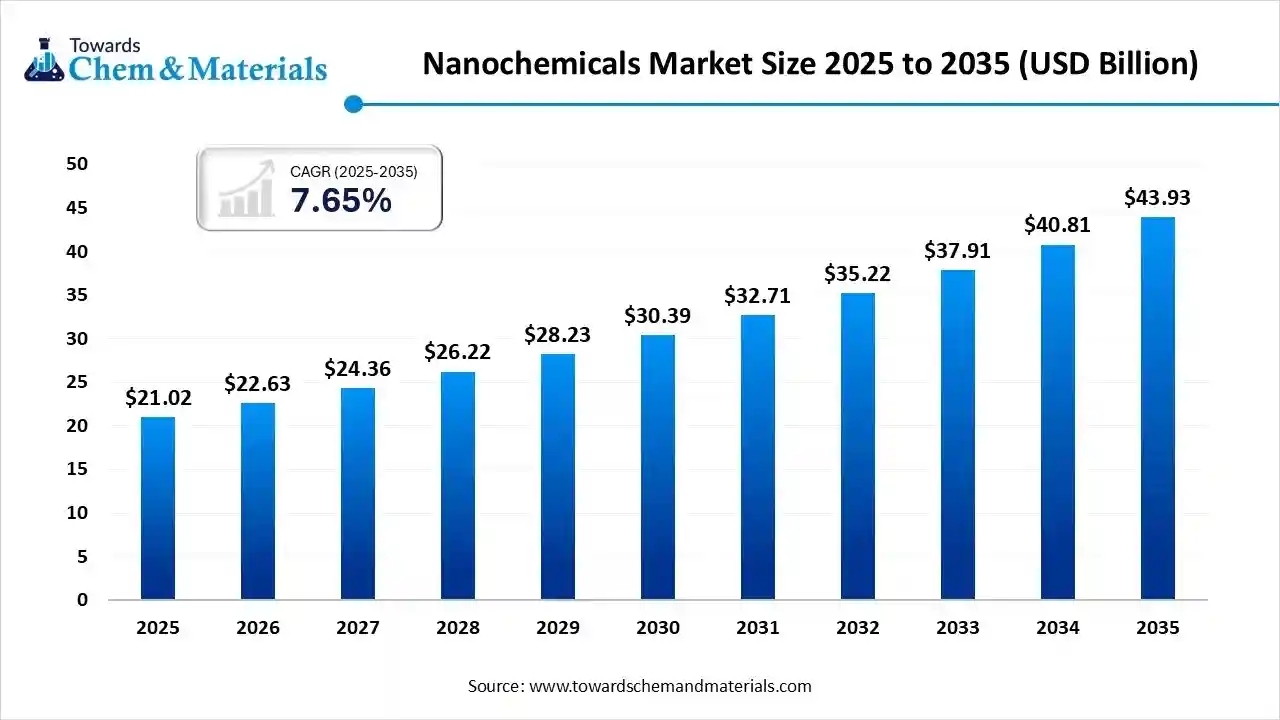

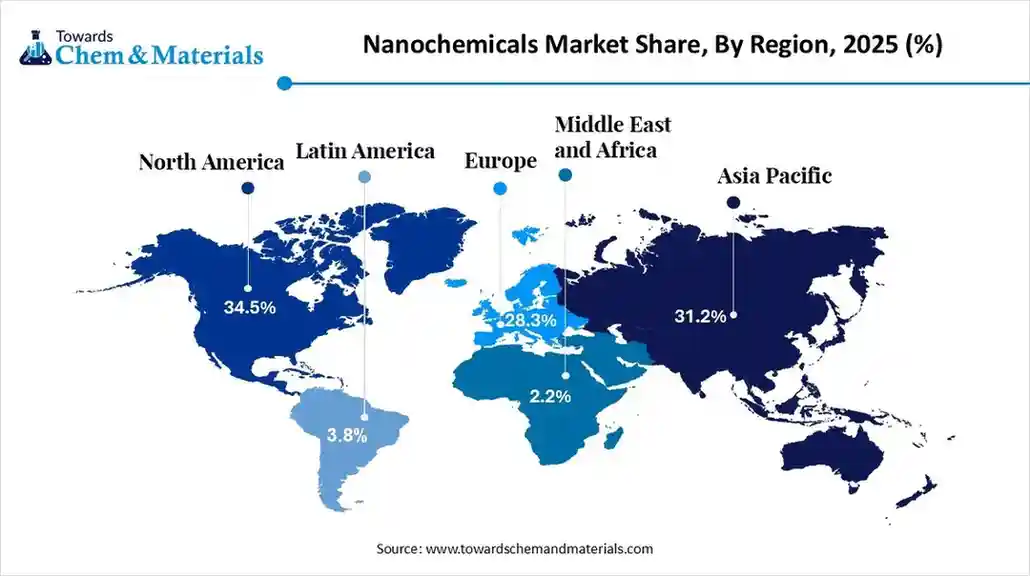

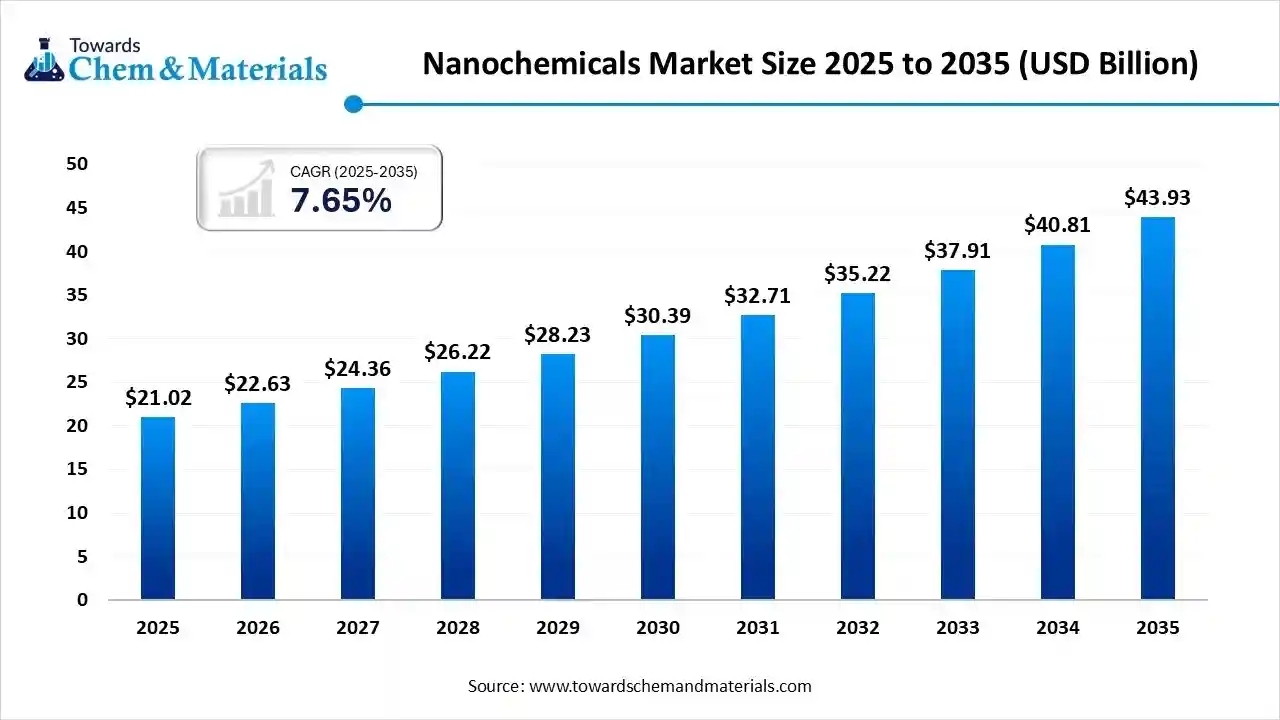

The global nanochemicals market size is calculated at USD 21.02 billion in 2025 and is predicted to increase from USD 22.63 billion in 2026 and is projected to reach around USD 43.93 billion by 2035, The market is expanding at a CAGR of 7.65% between 2026 and 2035. North America dominated the globalnanochemicals market with the largest revenue share of 34.5% in 2025.The global shift towards miniaturization of electronics has accelerated the industry's potential in recent years.

Key Takeaways

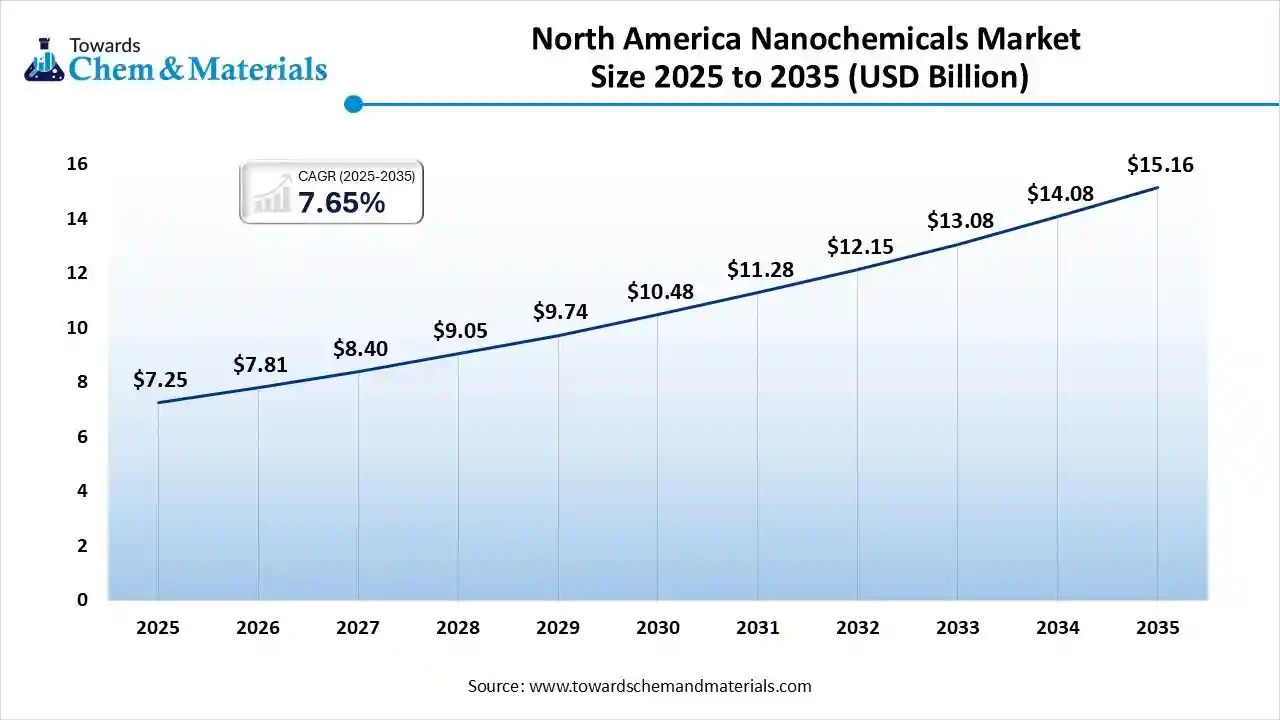

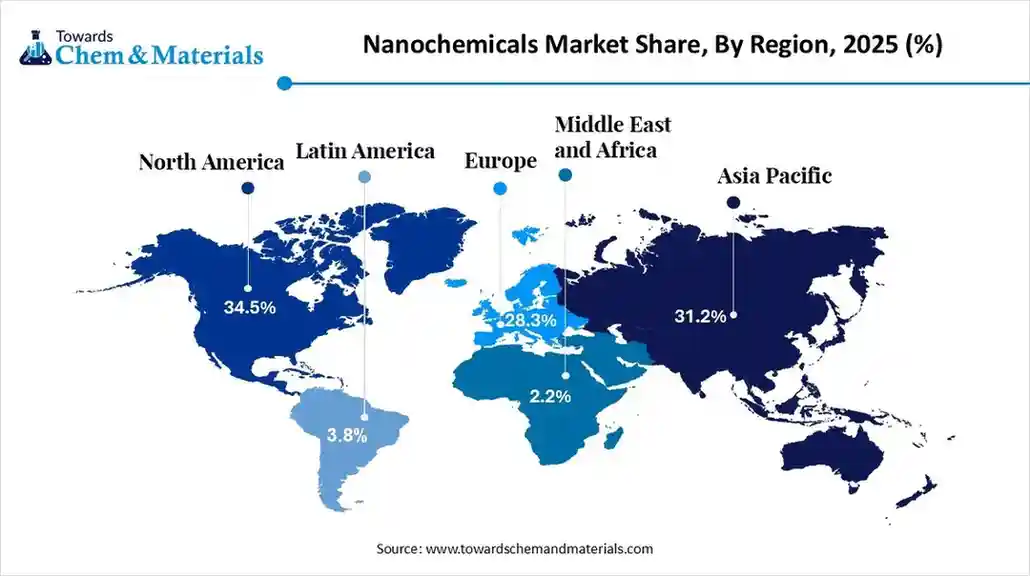

- By region, North America dominated the globalnanochemicals market with the largest revenue share of 34.5% in 2025.

- By nanomaterial type, the metal & metal oxide nanochemicals segment led the market with the largest revenue share of 46% in 2025.

- By functionality type, the catalytic nanochemicals segment led the market with the largest revenue share of 34% in 2025.

- By end-use type, the chemical & material manufacturing segment accounted for the largest revenue share of 31% in 2025.

Engineering at The Smallest Scale: The Rise of Nanochemicals

Nanochemicals refer to the specific engineered chemicals which made at the very small scale. These production methods allow nanochemicals to change according to material behaviour. Also, the demand for nanochemicals is increasing from sectors like electronics, batteries, coatings, and plastics in recent years. Also, by increasing product efficiency and precision and making everyday products work better, the nanochemicals have gained industry attention in recent years.

Nanochemicals Market Trends:

- The increasing demand for the nano surface boosters has opened profitable avenues for manufacturers in recent years. Also, these surface boosters are basically chemical layers that can add to the surface for scratch resistance, UV blocking, and antibacterial action.

- Several manufacturers are using nanochemicals as an energy enhancer, which is actively driving the strategic transformation and sectoral scalability in the current period. Furthermore, by helping to move electrons faster while storing more energy and minimizing heat loss, the non-chemicals have gained major industry presence in sectors such as solar cells, batteries, and hydrogen systems.

- The integration of nanochemicals in the agriculture sector is likely to unlock new business opportunities for producers in the coming years. Several farmers have seen in using nanochemicals to deliver sufficient nutrients and pesticides to the crop yield. Also, the nanochemicals are actively targeting pests while improving soil health and better crop yield, as per the recent observation.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 22.63 Billion |

| Revenue Forecast in 2035 | USD 43.93 Billion |

| Growth Rate | CAGR 7.65% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Nanomaterial Type, By Functionality, By End-Use Industry, By Region |

| Key companies profiled | Dow Inc., Arkema SA, BASF SE, DuPont , Solvay S.A. , Cabot Corporation , Clariant AG , Wacker Chemie AG , NanoXplore Inc. , Nanophase Technologies Corporation , Altairnano , American Elements , Showa Denko K.K. , LG Chem Ltd. , Sumitomo Chemical Co., Ltd. , Merck KGaA |

When Material Think: The Emergence of Nano-Intelligent Systems

The market is moving from simple nano-sized materials to "nano-intelligent systems." These are nano chemicals that respond to light, heat, pressure, or electrical signals. For example, coatings that repair themselves when scratched, nano drugs that activate only at disease sites, or nano catalysts that turn on only when energy demand rises.

Trade Analysis of the Nanochemicals Market:

Import, Export, Consumption, and Production Statistics

- The United States has seen under a heavy export of organic chemicals in 2024, and the export value is approximately US$51.88 billion as per the published report.

- China exported a significant number of chemical products in 2024. The trade value of these products is approximately $194 billion, according to the reports.

Value Chain Analysis of the Nanochemicals Market:

- Distribution to Industrial Users: The nanochemicals market is driven by major chemical manufacturers and specialized nanomaterial suppliers who distribute their products to diverse industrial users through a mix of direct sales and specialized distributors. Key players often handle both production and distribution, leveraging global networks to serve various sectors.

- Key Players: Evonik Industries AG and BASF SE

- Chemical Synthesis and Processing: Nanochemicals are primarily produced using "bottom-up" approaches, building materials from atoms and molecules, as well as "top-down" methods, which break down bulk material.

- Key Players: Sol-gel Process and Hydrothermal/Solvothermal Synthesis

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring for nanochemicals are managed by a combination of national, regional, and international agencies, primarily through existing chemical control frameworks that have been updated with nano-specific requirements.

- Key Agencies: Organisation for Economic Co-operation and Development (OECD), and International Organization for Standardization (ISO)

Nanochemicals Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | TSCA Section 8(a) | Assessing potential risks before production begins |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EU) 2018/1881 | Ensuring safety and transparency by requiring specific nanoform registration under REACH |

| China | National Medical Products Administration (NMPA) | GB/T 30544.1 (2021) | Accelerating regulation for biomedical and medical device application |

Segmental Insights

Nanomaterial Type Insights

How did the Metal & Metal Oxide Nanochemicals Segment Dominate the Nanochemicals Market in 2025?

The metal & metal oxide nanochemicals segment dominated the market with 46% share in 2025 due to it being considered the widely used nanomaterial type to produce at a large scale. Moreover, by offering strong catalytic activity, UV protection, antimicrobial properties, and higher thermal stability, the segment has gained major industry share in recent years.

The carbon-based segment is expected to grow with a significant CAGR owing to its flexibility and higher strength. Moreover, the enlarged expansion of electric vehicles, next-generation electronics, and energy devices is expected to contribute heavily to the carbon-based nanochemicals industry in the coming years.

The polymeric nanochemicals segment is also notably growing, owing to the increasing demand for flexible, lightweight, and safe materials in sectors such as drug delivery, packaging, and agriculture nowadays. Moreover, by improving barrier performance and stability without adding excess weight, the polymeric nanomaterials have created their own space in the industry.

Functionality Type Insights

Why does the Catalytic Nanochemicals Segment Dominate the Nanochemicals Market?

The catalytic nanochemicals segment dominated the market with 34% share in 2025 because industries rely heavily on nanocatalysts to speed up chemical reactions in refining, polymer production, energy systems, and environmental treatment. Their ultra-small size increases reaction speed and efficiency, helping companies reduce energy use and improve product quality.

The conductive & electronic segment is expected to grow at a rapid CAGR owing to the increasing demand for advanced materials in high industries. Furthermore, by offering excellent and high-frequency compatibility and ultra-thin design flexibility, the nano material has gained a major industry share in recent years. The magnetic nanochemicals segment is also notably growing because they are increasingly used in medical imaging, targeted drug delivery, data storage, sensors, and environmental cleanup. Their ability to respond to magnetic fields makes them useful for controlled treatment delivery and advanced diagnostic tools.

End Use Insights

How did the Chemicals & Materials Manufacturing Segment Dominate the Nanochemicals Market in 2025?

The chemicals & materials manufacturing segment dominated the market with a 31% share in 2025. As non-chemicals have seen usage as the greater enhancer in applications like plastics, adhesives, and composites catalysts. Also, several manufacturers are utilizing non-chemicals to enhance heat resistance, conductivity, and strength nowadays.

The automotive & transportation segment is expected to grow at a significant CAGR akin to the surge in demand for lightweight and stronger materials in new vehicle designs in the current period. Moreover, non-chemicals have been observed to improve battery performance, safety features, and fuel efficiency.

The healthcare and pharmaceuticals segment is also notably growing, because nano-chemicals are used in targeted drug delivery, cancer therapy, imaging, diagnostics, and regenerative medicine. Nano-particles help medicines reach the right part of the body more effectively, improving treatment results.

Regional Insights

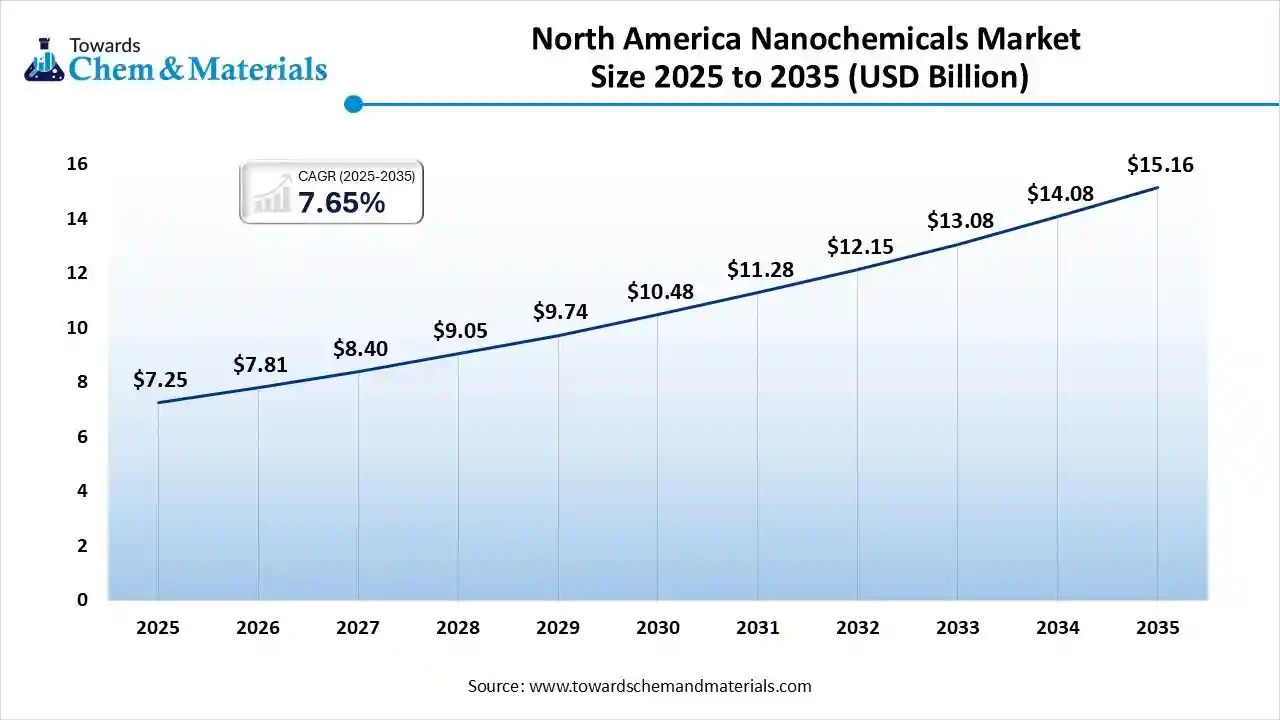

The North America nanochemicals market size was valued at USD 7.25 billion in 2025 and is expected to reach USD 15.16 billion by 2035, growing at a CAGR of 7.65% from 2026 to 2035. North America dominated the globalnanochemicals market with the largest revenue share of 34.5% in 2025. North America is expected to capture a major share of the nanochemicals market with a rapid CAGR, owing to early access to advanced technology and higher precision manufacturing. Moreover, the regional countries like the United States and Canada have increased focus on semiconductor production while investing in innovative technology, where nano chemicals are likely to gain major market share in the coming years.

Asia Pacific Nanochemicals Market Trends

Asia Pacific region is anticipated to witness substantial growth during the projected period, owing to the presence of major chemical, automotive, and electronics manufacturing ecosystems. Also, the regional countries such as Japan, China, and India have been seen using nanochemicals in coatings, batteries, industrial materials, and consumer electronics in the current period. Also, the stronger government push towards advancing material manufacturing is supporting the industry growth in the current period.

China Dominates Advanced Chemical Manufacturing

China maintained its dominance in the market due to the country being considered as one of the largest exporters and manufacturers of chemicals, batteries, and industrial materials nowadays. Moreover, China has recently seen under a heavy investment in nanotechnology via multiple state R&D programs in recent years.

United States Nanochemicals Momentum Grows Across High Tech Sectors

The United States is expected to emerge as a prominent country for the market in the coming years, owing to the increased shift towards high-performance materials and next-generation technologies in recent years. Also, the country has been seen using nanochemicals in their one of its prominent sector called defence equipment, in the past few years.

Europe Nanochemicals Market Evaluation

Europe is a notably growing region because the region focuses strongly on sustainable materials, green ènergy, advanced automotive technologies, and high-quality manufacturing. Nano-chemicals are used in lightweight vehicle parts, medical tools, coatings, and renewable energy systems.

Germany Accelerated Ahead as a Leader in Nanomaterial Innovation

Germany is expected to gain a major industry because it leads in automotive engineering, chemicals, and industrial manufacturing. German companies use nanomaterials to create stronger composites, efficient EV batteries, advanced coatings, and high-precision electronics.

Nanochemicals Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the market because the region is investing in new manufacturing, renewable energy, water treatment, and petrochemical projects - all areas that use nano-chemicals. Countries are adopting nanomaterials to improve filtration, coatings, catalysts, and construction materials.

Saudi Arabia’s Big Leap in Nanochemicals

Saudi Arabia is expected to emerge as a prominent country in the market in the coming years, owing to the country’s advanced and high-tech petrochemical industry in the current period. furthermore, Saudi Arabia is heavily expanding its manufacturing capabilities while putting an enlarged investment in research and development programs in the current period.

Nanochemicals Market Study in South America

The nanochemicals market in South America is expanding steadily, driven by growing demand across agriculture, healthcare, energy, and manufacturing. Countries like Brazil, Argentina, and Chile are increasing investments in nanotechnology research to enhance crop yields, improve drug delivery systems, and develop advanced materials. Industrial sectors are adopting nanochemicals for better performance, sustainability, and cost efficiency. Government initiatives supporting innovation and public–private partnerships further accelerate regional growth.

In Brazil, the market is gaining momentum as the country strengthens its research capabilities and industrial applications in nanotechnology. Brazilian agriculture increasingly uses nanochemicals to improve fertilizers, pest control, and crop productivity. The healthcare sector is adopting nanomaterials for advanced diagnostics and drug delivery, while industries such as energy, electronics, and coatings use them to enhance performance and durability.

Recent Developments

- In August 2025, the NSF established the nanocrystal research centre. The motive behind this establishment is to chemical innovation with the integration of AI-based technology as per the published report.(Source: www.nsf.gov)

Top Vendors in the Nanochemicals Market & Their Offerings:

- BASF SE: As the largest chemical producer in the world, BASF utilizes innovation and science to create a diverse portfolio of advanced chemical products, including those used in nanomaterials, sustainable catalysts, and performance polymers.

- Evonik Industries AG: A global specialty chemicals company that focuses on innovation and application-oriented research to create high-performance products across various sectors, including advanced materials and sustainable solutions.

- Dow Inc.: A global materials science company that delivers a broad range of technology-based products and solutions in areas like packaging, infrastructure, and consumer care through its integrated, market-driven portfolio of specialty chemicals, advanced materials, and plastics.

- Arkema SA: A global specialty materials company built on unique expertise in adhesives and high-performance polymers, committed to creating innovative and sustainable solutions for lightweight materials and renewable energy applications.

Top Companies in the Nanochemicals Market

- Arkema SA

- Dow Inc.

- Evonik Industries AG

- BASF SE

- DuPont

- Solvay S.A.

- Cabot Corporation

- Clariant AG

- Wacker Chemie AG

- NanoXplore Inc.

- Nanophase Technologies Corporation

- Altairnano

- American Elements

- Showa Denko K.K.

- LG Chem Ltd.

- Sumitomo Chemical Co., Ltd.

- Merck KGaA

Segments Covered

By Nanomaterial Type

- Metal & Metal Oxide Nanochemicals

- Silver nanoparticles

- Gold nanoparticles

- Titanium dioxide (nano-TiO₂)

- Zinc oxide (nano-ZnO)

- Iron oxide nanoparticles

- Carbon-Based Nanochemicals

- Carbon nanotubes (single-wall & multi-wall)

- Graphene & graphene derivatives

- Fullerenes

- Carbon black (nano-grade)

- Polymeric Nanochemicals

- Nanopolymers & nanocomposites

- Dendrimers

- Polymer nanoparticles

- Ceramic & Inorganic Nanochemicals

- Nanoclay

- Silica nanoparticles

- Alumina nanoparticles

- Other advanced ceramic nanomaterials

- Quantum Dots & Specialty Nanostructures

- Semiconductor quantum dots

- Nano-phosphors

- Other functional nanostructures

By Functionality

- Catalytic Nanochemicals

- Conductive & Electronic Nanochemicals

- Optical & Photonic Nanochemicals

- Magnetic Nanochemicals

- Antimicrobial & Self-Cleaning Nanochemicals

By End-Use Industry

- Chemical & Materials Manufacturing

- Electronics & Electrical

- Automotive & Transportation

- Aerospace & Defense

- Healthcare & Pharmaceuticals

- Energy & Utilities

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa