Content

Lithium Chemicals Market Size and Growth 2025 to 2034

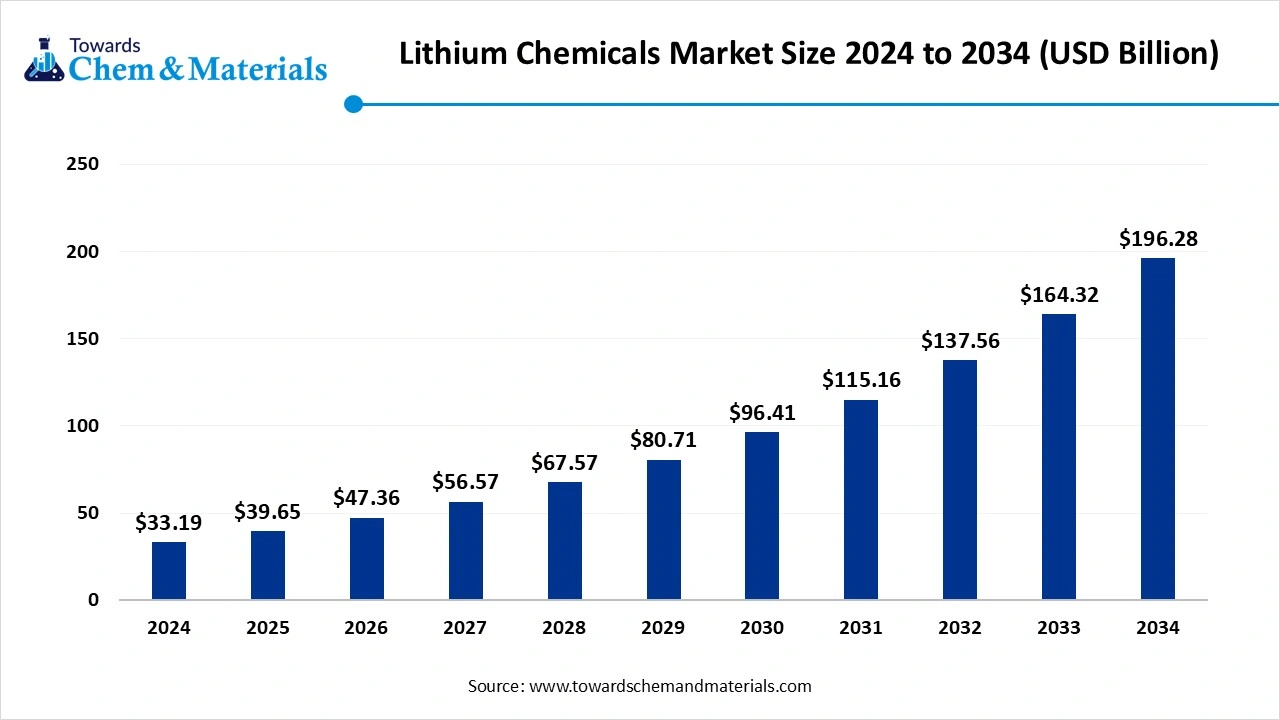

The global lithium chemicals market size was reached at USD 33.19 billion in 2024 and is expected to be worth around USD 196.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 50% over the forecast period 2025 to 2034. The growing demand for lithium-ion batteries in electric vehicles is the key factor driving market growth. Also, the rapid surge in battery manufacturing globally, coupled with the innovations in battery technology, can fuel market growth further.

Key Takeaways

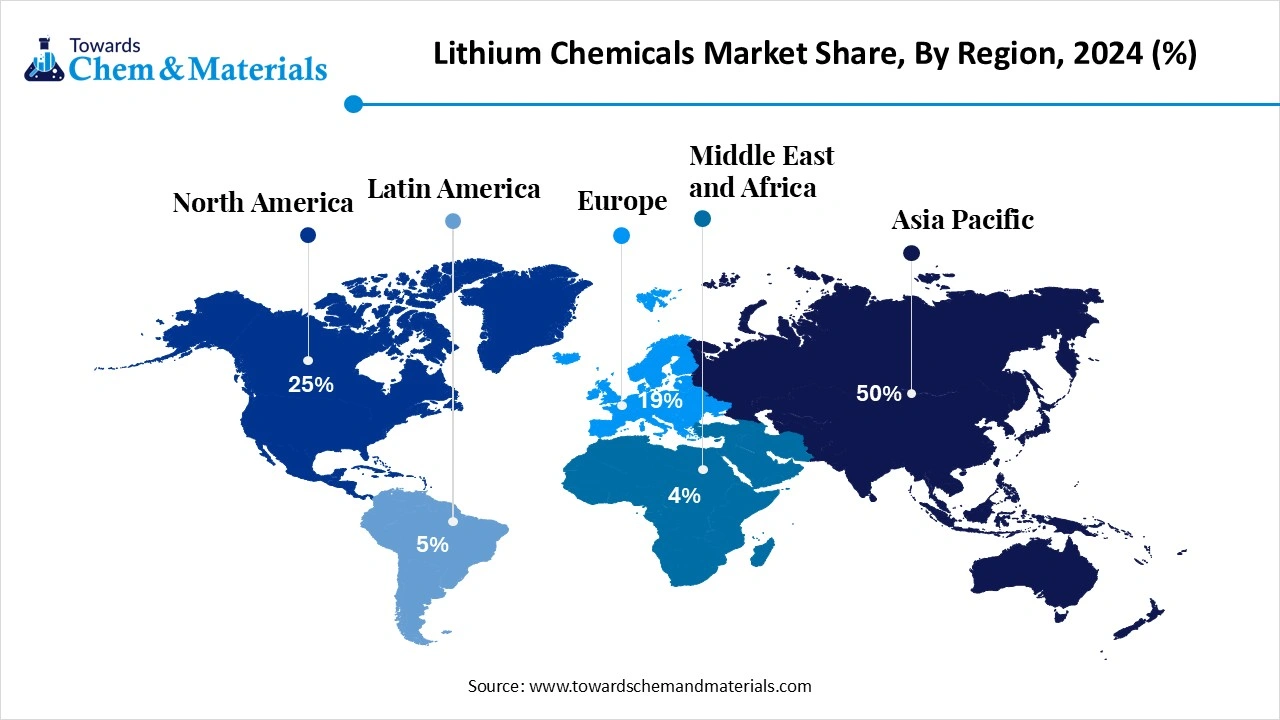

- By region, Asia Pacific dominated the market with approximately 50% share in 2024. The dominance of the region can be attributed to the robust EV production in major countries such as China, India, and Japan.

- By region, North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the favorable government initiatives promoting battery production.

- By product type, the lithium carbonate segment dominated the market with approximately 45% share in 2024. The dominance of the segment can be attributed to the rapidly expanding consumer electronics and electric vehicle (EV) market.

- By product type, the lithium hydroxide segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for portable electronics and electric vehicles (EVs).

- By application, the batteries segment held approximately 65% market share in 2024. The dominance of the segment can be linked to the growing need for renewable energy storage and the rapid adoption of portable electronics.

- By application, the polymers & aluminum production segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing demand for cutting-edge energy storage solutions.

- By source, the brine segment dominated the market by holding approximately 55% share in 2024. The dominance of the segment is owed to the growing emphasis on sustainable energy and decarbonization solutions.

- By source, the recycled lithium segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing industrial and consumer demand for recycled lithium.

- By end-use industry, the automotive & transportation segment holds approximately 60% market share in 2024. The dominance of the segment can be attributed to the increasing government mandates to minimize carbon emissions.

- By end-use industry, the healthcare & pharmaceuticals segment is expected fastest growth in the market during the study period. The growth of the segment can be credited to the growing incidence of mental conditions such as bipolar disorder, which requires lithium-based treatments.

Technological Advancements are Expanding Market Growth

The lithium chemicals market refers to the production, supply, and utilization of lithium-based compounds, including lithium carbonate, lithium hydroxide, lithium chloride, lithium metal, and other derivatives. These chemicals are critical for manufacturing rechargeable batteries (especially lithium-ion), glass & ceramics, lubricants, polymers, pharmaceuticals, and industrial applications.

Market growth is primarily driven by the exponential demand for electric vehicles (EVs), energy storage systems (ESS), and renewable energy integration. Supply dynamics are influenced by lithium mining capacity (brine and hard rock), recycling advancements, and geopolitical factors related to critical minerals. Key trends include the shift toward battery-grade lithium hydroxide for high-nickel cathode chemistries, vertical integration by battery and EV manufacturers, regional diversification of supply chains (U.S., Europe), and technological innovations in lithium extraction and recycling.

What Are the Key Trends Influencing the Lithium Chemicals Market?

The growing adoption of EVs globally is the latest trend in the market. Lithium-ion batteries, which use compounds like lithium hydroxide and lithium carbonate, are extensively integrated in EV powertrains because of their fast-charging abilities and high energy density.

The stringent decarbonization regulations are another major trend shaping positive market growth. Many countries are providing tax rebates, purchase incentives, and stringent regulatory frameworks to boost the inclination towards electric mobility. Also, national renewable integration plans are also propelling the demand for lithium-based storage technologies.

Major automotive market players and battery manufacturers are increasingly forming new strategic collaborations and joint ventures with lithium manufacturers to secure a long-term and stable supply of raw materials. Moreover, new lithium mining projects are emerging in regions such as Africa, which can impact positive market expansion.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 39.65 Billion |

| Expected Size by 2034 | USD 196.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR 19.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Application, By Source, By End-Use Industry, By Region |

| Key Companies Profiled | Infinitylithium, ProChem, Inc. International, Arcadium Lithium, Talison Lithium Pty Ltd, SICHUAN BRIVO LITHIUM MATERIALS CO., LTD., Neometals Ltd, ANDRITZ Sovema S.p.A., Ganfeng Lithium Co., Ltd., Critical Elements Lithium Corporation, Altura Mining, Lithium Americas Corp., The Pallinghurst Group, SQM S.A., Albemarle Corporation, Mody Chemi-Pharma Limited, Pilbara Minerals Limited |

Market Opportunity

Growth of Grid Energy Storage

The random nature of renewable energy sources like wind and solar needs large-scale energy storage systems for grid stability. This system depends largely on lithium-ion batteries, creating a strong demand for lithium chemicals beyond the automotive industry. Furthermore, the ongoing demand for lightweight, high-capacity batteries in electronics such as laptops, smartphones, and wearables remains a major market driver.

Market Challenge

Concerns Regarding Supply Chain Instability

Despite growing demand, the market faces substantial challenges associated with high production costs and supply chain instability, which is the major factor hindering market growth. Moreover, the capital investment necessary to establish lithium mines stays high, limiting the entry of new players, particularly in emerging economies, and hampering market expansion further.

Regional Insight

Asia Pacific Lithium Chemicals Market Trends

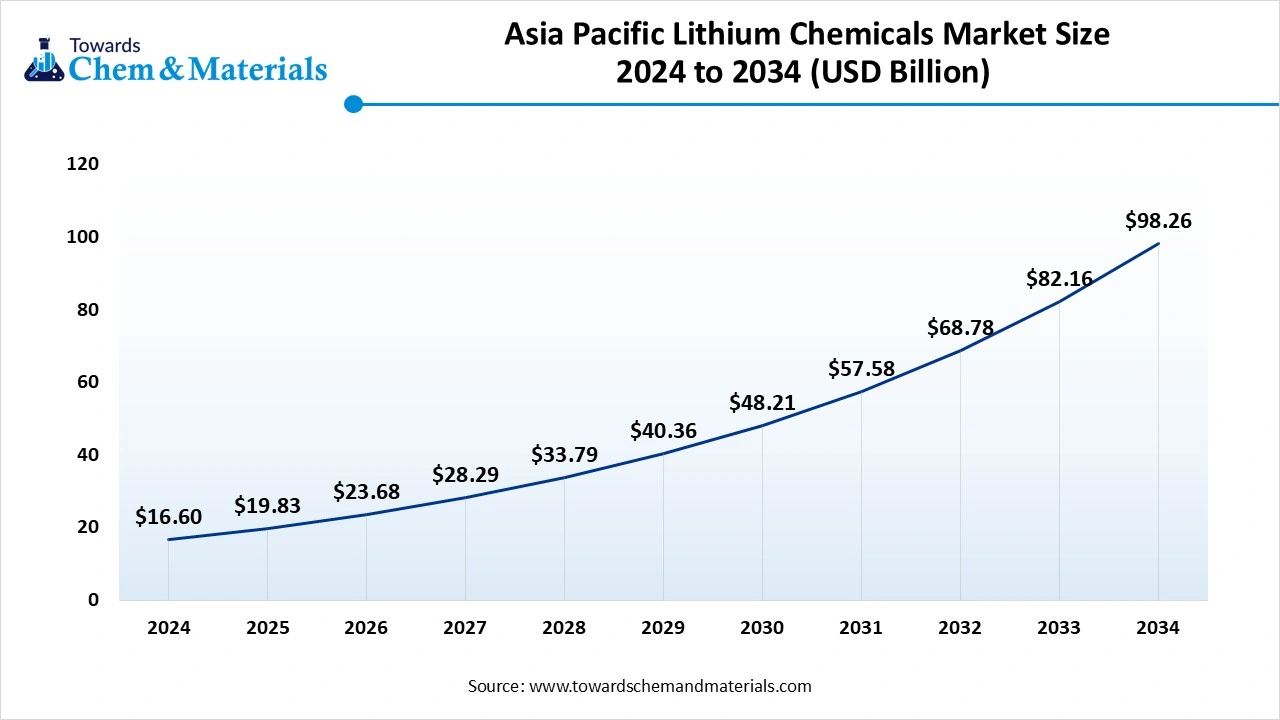

The Asia Pacific lithium chemicals market size was estimated at USD 16.60 billion in 2024 and is anticipated to reach USD 98.26 billion by 2034, growing at a CAGR of 19.45% from 2025 to 2034. Asia Pacific dominated the market with a 50% share in 2024.

The dominance of the region can be attributed to the robust EV production in major countries such as China, India, and Japan, along with the growth of APAC in battery production. In addition, a surge in investment in advanced battery technologies such as highly efficient lithium-based materials and solid-state batteries is boosting demand for high-grade lithium chemicals.

China Lithium Chemicals Market Trends

In the Asia Pacific, China holds the largest market share owing to its rapidly expanding EV sector and ongoing investment in lithium mining and battery gigafactories. Also, China has substantial lithium reserves, and its consumption outnumbers domestic manufacturing, which makes it the world's largest importer of lithium compounds and raw materials.

North America Lithium Chemicals Market Trends

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the favorable government initiatives promoting battery production, along with the growing investment in lithium refining and recycling facilities. Furthermore, in North America, the U.S. dominated the market due to the country's increasing emphasis on reshoring lithium supply chains supported by the government.

Who is the Top Lithium-Ion Batteries Exporting Countries in 2024?

| Country | Exports in Millions |

| mainland China | US$583.1 million |

| United States | $575.1 million |

| Singapore | $282.8 million |

| Germany | $220.6 million |

| Indonesia | $208.7 million |

Segmental Insight

Product Type Insight

Which Product Type Segment Dominated the Lithium Chemicals Market in 2024?

The lithium carbonate segment dominated the market with a 45% share in 2024. The dominance of the segment can be attributed to the rapidly expanding consumer electronics and electric vehicle (EV) market, coupled with the growing adoption of grid-scale energy storage systems. Additionally, lithium carbonate is used in the production of ceramics, glass, and aluminum, improving their overall strength and thermal traits.

The lithium hydroxide segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for portable electronics and electric vehicles (EVs), both of which depend on lithium-ion batteries. Also, apart from batteries, lithium hydroxide has uses in industrial applications like the production of pharmaceutical intermediates, catalysts, ceramics, and corrosion inhibitors.

Application Insight

How Much Share Did the Batteries Segment Held in 2024?

The batteries segment held a 65% market share in 2024. The dominance of the segment can be linked to the growing need for renewable energy storage and the rapid adoption of portable electronics. In addition, enhancements in battery performance, efficiency, and lower manufacturing costs make them more accessible and affordable, widening their use across various industries.

The polymers & aluminum production segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing demand for cutting-edge energy storage solutions, which require large-scale lithium consumption for batteries, coupled with the demand for electric vehicles (EVs). Polymers such as polyvinylidene fluoride (PVdF) are sometimes used as a binder in battery electrodes, which helps to maintain the integrity of the electrode.

Source Insight

Why Brine Segment Dominated the Lithium Chemicals Market in 2024?

The brine segment dominated the market by holding a 55% share in 2024. The dominance of the segment is owing to the growing emphasis on sustainable energy and decarbonization solutions, and their ability to recover lithium from desalination brines. Moreover, brine extraction is generally a more cost-efficient method than hard rock mining, because it can include pumping brine into evaporation ponds.

The recycled lithium segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing industrial and consumer demand for recycled lithium, along with the strict government regulations supporting waste reduction and the circular economy. Also, ongoing advancements in recycling technologies like pyrometallurgical and hydrometallurgical processes are substantially increasing the efficiency of materials.

End-Use Industry Insight

Which End Use Industry Segment Held a Largest Lithium Chemicals Market Share in 2024?

The automotive & transportation segment held a 60% market share in 2024. The dominance of the segment can be attributed to the increasing government mandates to minimize carbon emissions and substantial investment in battery manufacturing technology. Moreover, market players are continuously enhancing battery energy efficiency and density to extend EV range, further boosting the consumption of lithium chemicals.

The healthcare & pharmaceuticals segment expects the fastest growth in the market during the study period. The growth of the segment can be credited to the growing incidence of mental conditions such as bipolar disorder, which requires lithium-based treatments like mood stabilizers. Furthermore, lithium compounds are crucial in different medical applications, such as in producing certain medical implants and surgical tools.

Lithium Chemicals Market Value Chain Analysis

- Feedstock Procurement: This is a crucial stage in the market, where companies use raw lithium-containing materials to transform into high-value chemical products such as lithium hydroxide and lithium carbonate.

- Chemical Synthesis and Processing: It is the methods and techniques used to convert raw lithium sources into high-grade compounds such as lithium hydroxide. These steps for this stage rely on the source of the raw lithium.

- Packaging and Labelling: This is a highly regulated process emphasizing risk mitigation, safety, and adherence to international standards for transporting harmful substances.

Regulatory Compliance and Safety Monitoring: This framework is essential for managing the risk related to lithium's highly reactive and hazardous nature.

Recent Developments

- In June 2025, Chevron announced its plan to step into the U.S. lithium market to produce lithium. Chevron also has acquired mining rights to the formation of Smackover in Texas and Arkansas.(Source: www.electrive.com)

Lithium Chemicals Market Top Companies

- Infinitylithium

- ProChem, Inc. International

- Arcadium Lithium

- Talison Lithium Pty Ltd

- SICHUAN BRIVO LITHIUM MATERIALS CO., LTD.

- Neometals Ltd

- ANDRITZ Sovema S.p.A.

- Ganfeng Lithium Co., Ltd.

- Critical Elements Lithium Corporation

- Altura Mining

- Lithium Americas Corp.

- The Pallinghurst Group

- SQM S.A.

- Albemarle Corporation

- Mody Chemi-Pharma Limited

- Pilbara Minerals Limited

Segments Covered

By Product Type

- Lithium Carbonate

- Lithium Hydroxide

- Lithium Chloride

- Lithium Metal

- Others (Lithium Bromide, Lithium Stearate, Lithium Titanate)

By Application

- Batteries (EVs, consumer electronics, ESS)

- Glass & Ceramics

- Lubricants & Greases

- Polymers & Aluminum Production

- Pharmaceuticals & Medical Applications

- Others (Air Treatment, Nuclear, Metallurgy)

By Source

- Brine (South America, salt flats)

- Hard Rock (spodumene, mainly Australia)

- Recycled Lithium (urban mining, emerging)

By End-Use Industry

- Automotive & Transportation (EV batteries)

- Consumer Electronics

- Energy Storage (grid-scale & residential)

- Industrial (glass, ceramics, lubricants)

- Healthcare & Pharmaceuticals

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait