Content

Europe Green Hydrogen Market Size & Growth Analysis Report, 2034

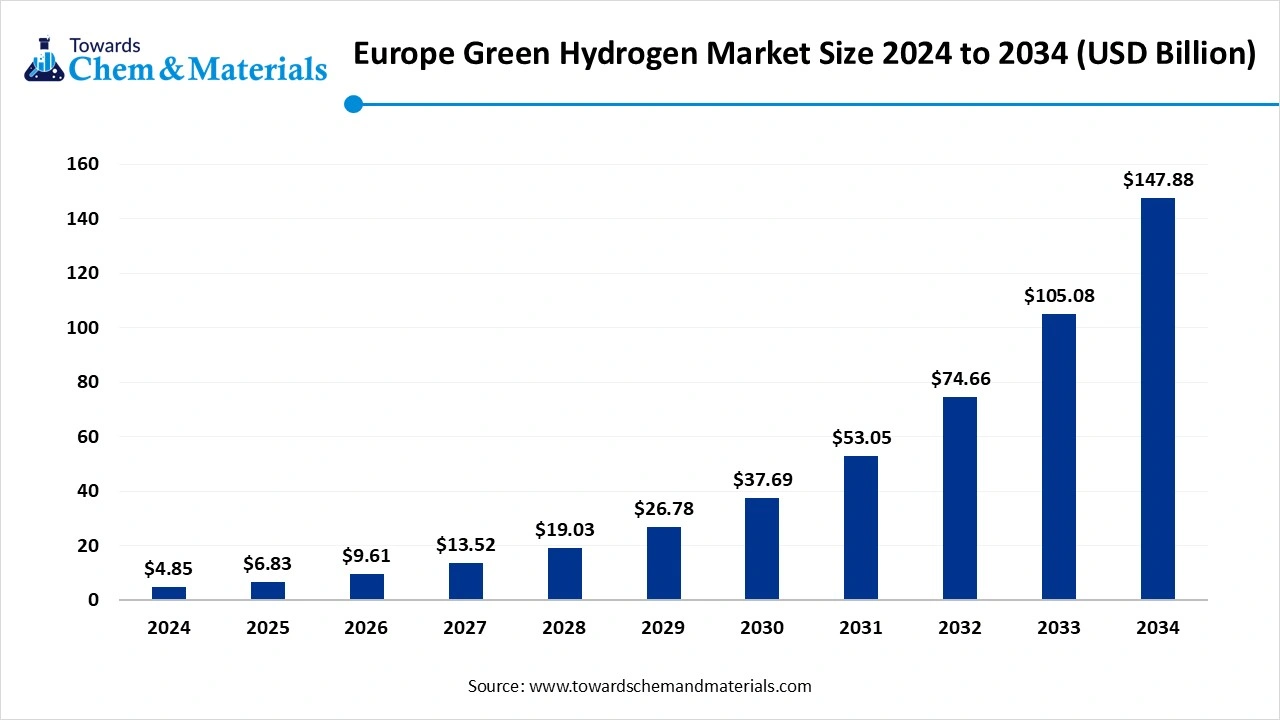

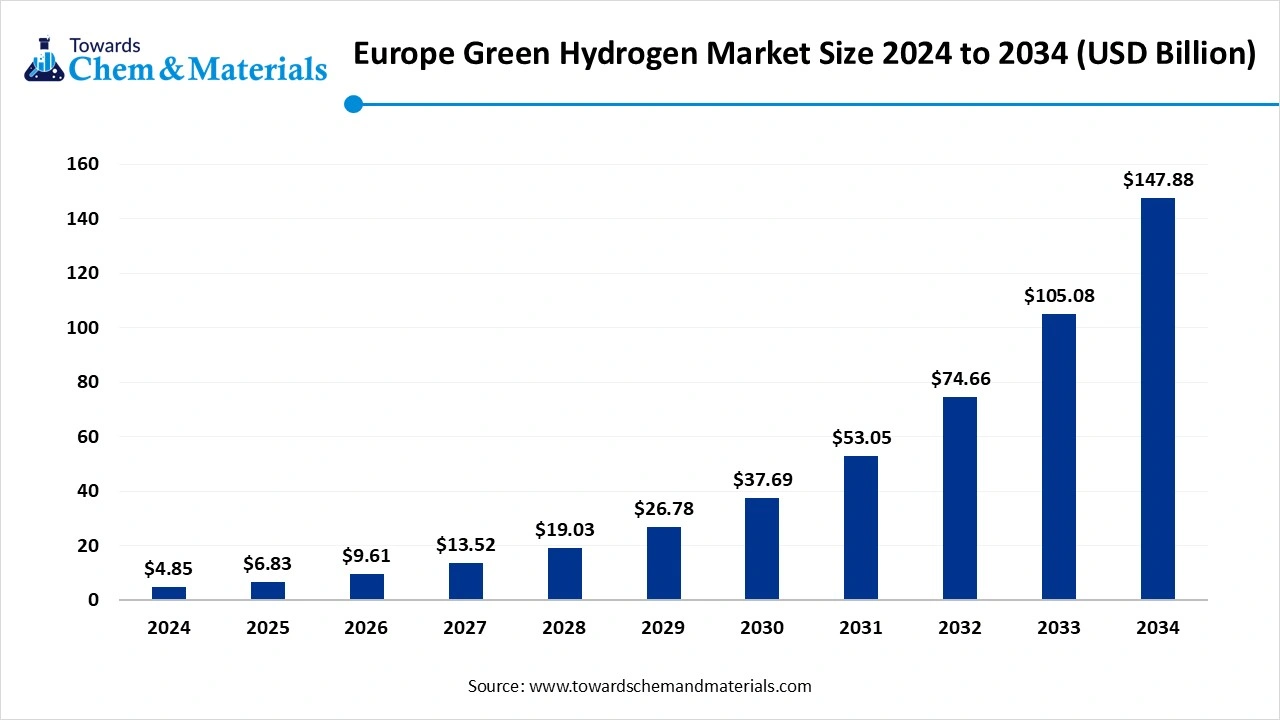

The Europe green hydrogen market size was approximately USD 4.85 billion in 2024 and is projected to reach around USD 147.88 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 40.74% between 2025 and 2034.The growth of the market is driven by the growing demand and push towards a net-zero economy, demand from key sectors, and increasing renewable energy and green hydrogen production, which drives the growth of the market.

Key Takeaways

- By technology, the alkaline electrolyzer segment dominated the market with a share of 45% in 2024.

- By technology, the PEM electrolyzer segment is expected to grow significantly in the market during the forecast period.

- By application, the mobility segment dominated the market with a share of 67% in 2024.

- By application, the industrial feedstock segment is expected to grow in the forecast period.

- By generation mode, the captive generation segment dominated the market with a share of 55% in 2024.

- By generation mode, the merchant generation segment is expected to grow in the forecast period.

- By end-use industry, the transportation segment dominated the market with a share of 60% in 2024.

- By end-use industry, the industrial manufacturing segment is expected to grow in the forecast period.

- By storage and distribution, the pipeline distribution segment dominated the market with a share of 50% in 2024.

- By storage and distribution, the liquid hydrogen storage segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Europe Green Hydrogen Market?

The significance of Europe green hydrogen market is the shift towards achieving climate neutrality by 2050, which also helps in reducing reliance on fossil fuels also helps in enhancing energy security which also supporting the growth of the market.

The green hydrogen also plays a significant role in industries like steel and cement production, which also help meet the carbon reduction goals, fueling growth. Other key significances are renewable energy growth, energy system flexibility, and industrial applications driving the growth of the market.

Europe Green Hydrogen Market Outlook

- Industry Growth Overview: Between 2025 and 2034, the European green hydrogen market is expected to experience strong double-digit growth, driven by aggressive decarbonization goals and large-scale renewable energy integration. The European Union’s “Fit for 55” package and Hydrogen Strategy are key policy drivers, targeting over 40 GW of electrolyzer capacity by 2030.

- Sustainability Trends: Green hydrogen production in Europe is at the forefront of the energy transition, enabling deep emissions cuts in hard-to-abate sectors. Integration with solar and wind power is enhancing renewable utilization, while R&D is focused on improving electrolyzer efficiency and lowering production costs.

- Regional Expansion & Investment: European energy majors and technology companies are expanding partnerships to develop cross-border hydrogen corridors and infrastructure. The North Sea region is emerging as a strategic hub for offshore wind-powered hydrogen production.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 6.83 Billion |

| Expected Size by 2034 | USD 147.88 Billion |

| Growth Rate from 2025 to 2034 | CAGR 40.74% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Technology, By Application, By Generation Mode, By End-User Industry, By Storage and Distribution |

| Key Companies Profiled | Nel ASA , Plug Power Inc. , ITM Power plc , Cummins Inc. , Thyssenkrupp Nucera AG , Enapter AG , McPhy Energy S.A. , Nel Hydrogen Electrolyser AS , Haldor Topsoe A/S , Snam S.p.A. , Iberdrola S.A. , Shell plc , TotalEnergies SE , BP plc , VNG AG |

Key Technological Shifts In The Europe Green Hydrogen Market:

Key technological shifts in the European green hydrogen market include advances in electrolyzer technologies such as PEM and SOE, which enhance efficiency and scalability. Ongoing research, development, and the innovation of new materials and designs also play a crucial role in optimizing performance and driving growth.

Another significant opportunity is the integration with renewable energy sources, where excess energy from solar and wind power is used directly to operate electrolyzers, further supporting market expansion.

Trade Analysis Of the Europe Green Hydrogen Market: Import & Export Statistics

- The EU aims to import 10 million tonnes of green hydrogen by 2030, in addition to producing 10 million tonnes domestically, to reduce its reliance on fossil fuels.

- The EU is actively forming partnerships with countries like India, Namibia, and Egypt to facilitate green hydrogen imports and accelerate decarbonization efforts.

- In 2023, the most significant hydrogen flow was from Belgium to the Netherlands, which accounted for 65% of all hydrogen traded within Europe.

- Belgium was Europe's top hydrogen exporter in 2023, while the Netherlands remained the continent's main importer.

Europe Green Hydrogen Market Value Chain Analysis

- Chemical Synthesis and Processing : The synthesis, or production, of green hydrogen is done through a process called electrolysis.

- Key players: Nel ASA, Plug Power Inc., ITM Power plc, Cummins Inc., and Thyssenkrupp Nucera AG

- Distribution to Industrial Users: The green hydrogen is distributed to the steel, mobility, energy, transportation, and mining industries.

- Key players: Haldor Topsoe A/S, Snam S.p.A., Iberdrola S.A., Shell plc, TotalEnergies SE, BP plc, and VNG AG

Europe Green Hydrogen Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| European Union | European Commission (EC), European Parliament, ECHA (for chemical handling), CEN/CENELEC (for standards) | - EU Hydrogen Strategy (2020) → sets roadmap for scaling green hydrogen production & infrastructure - Renewable Energy Directive II & III (RED II – Directive (EU) 2018/2001; RED III – 2023 update) → defines “Renewable Fuels of Non-Biological Origin (RFNBOs)” and renewable hydrogen criteria - Delegated Acts on Additionality, Temporal & Geographical Correlation (2023) → define renewable electricity sourcing for hydrogen - CertifHy Scheme (EU-wide certification for renewable hydrogen) - CEN EN 17124 → guarantees origin and quality of hydrogen fuel |

- Renewable electricity sourcing criteria - Hydrogen purity & certification - Carbon intensity tracking (LCA-based) - Infrastructure & market integration |

RED III mandates a 42.5% renewable energy share by 2030; green hydrogen must meet strict “additionality” and low-carbon rules. CertifHy provides Guarantees of Origin (GoO) across EU member states. |

| Germany | BMWK (Federal Ministry for Economic Affairs and Climate Action), DENA (German Energy Agency) | - National Hydrogen Strategy (2020) - EEG (Renewable Energy Sources Act) for green electricity - DIN EN 17124 / ISO 14687 (fuel quality standards) |

- Domestic production incentives - Hydrogen refueling standards - Industry decarbonization |

Germany leads the EU in electrolyzer deployment and certification pilots. Strong link between EEG and hydrogen incentives. |

| France | ADEME (French Environment & Energy Management Agency), Ministry for Ecological Transition | - French Hydrogen Plan (2018, updated 2022) - Hydrogen Decree (2021) defining renewable/low-carbon hydrogen thresholds |

- Certification - Transport & industrial decarbonization - Hydrogen refueling infrastructure |

France distinguishes renewable vs low-carbon hydrogen based on carbon intensity (kg CO₂/kg H₂). |

| Netherlands | Ministry of Economic Affairs and Climate Policy, TNO, NEN | - National Hydrogen Strategy (2020) - CertifHy alignment and EU RED III compliance - NEN-EN ISO 14687 (hydrogen fuel quality) |

- Hydrogen trade hubs (Rotterdam) - Fuel purity & distribution - Renewable energy integration |

The Netherlands is developing hydrogen import/export hubs and storage networks in line with EU Fit-for-55 goals. |

| Spain | Ministry for Ecological Transition (MITECO), IDAE | - Hydrogen Roadmap (2020) - National Energy and Climate Plan (NECP) - RED III transposition |

- Renewable hydrogen in transport & industry - Certification compliance - Regional electrolyzer projects |

Spain aims for 4 GW green hydrogen capacity by 2030, leveraging strong solar resources and EU funding. |

Market Opportunity

The Supportive Government Policies

The key opportunity that drives the growth of the market is the supportive government policies and investments like the EU Green Deal and Hydrogen Strategy, which fuel the development of the hydrogen economy, aligning with the rising environmental concerns in the region, further fueling the growth of the market.

Other key opportunities are infrastructure development, like the southern two corridor, which is crucial for creating the large-scale hydrogen transport infrastructure, which creates further opportunity for the growth and expansion of the market in the region.

Market Challenge

High Cost Of Production

The main challenge that hinders the growth of the market is the high production costs and the cost of infrastructure. Building out the necessary infrastructure for storage, pipelines, and refuelling stations requires massive investments, making it a significant barrier to market expansion. Other key challenges are the infrastructure and technical challenges, and policy and market challenges hindering the growth of the market.

Segmental Insights

Technology Insights

Which Application Segment Dominated The Europe Green Hydrogen Market In 2024?

The alkaline electrolyzer segment dominated the Europe green hydrogen market with a share of 45% in 2024. Alkaline electrolyzers are the most established technology in market, known for reliability, durability, and cost-effectiveness.

They are widely deployed in large-scale industrial hydrogen generation, particularly in the steel and chemical sectors. European manufacturers are advancing efficiency through automation and digital monitoring systems, making alkaline systems a preferred choice for long-term hydrogen production infrastructure.

The PEM electrolyzer segment expects significant growth in the market during the forecast period. Proton Exchange Membrane (PEM) electrolyzers are gaining momentum due to their high efficiency, compact design, and rapid response to variable renewable energy sources. Europe’s energy transition initiatives increasingly favor PEM technology for integration with wind and solar projects. With ongoing cost reductions and government incentives, PEM systems are key enablers of decentralized, flexible hydrogen generation for industrial and mobility applications.

Application Insights

How did the Mobility Segment dominate the Europe green Hydrogen Market in 2024?

The mobility segment dominated the market with a share of 67% in 2024. Green hydrogen is revolutionizing Europe’s mobility sector by enabling zero-emission transport solutions. Hydrogen fuel cell vehicles, including buses, trucks, and trains, are being rapidly deployed across countries like Germany, France, and the Netherlands. Supported by EU decarbonization policies, hydrogen refueling infrastructure expansion, and public-private collaborations are accelerating the shift toward clean mobility in heavy-duty and long-distance transportation is accelerating.

The industrial feedstock segment expects significant growth in the Europe green hydrogen market during the forecast period. Industries across Europe are increasingly using green hydrogen as a sustainable feedstock to replace natural gas and grey hydrogen. It supports decarbonization in chemical manufacturing, steelmaking, and refining. Major industrial clusters are integrating green hydrogen to lower carbon footprints and meet stringent EU emission reduction targets. Industrial adoption remains central to Europe’s net-zero industrial transformation strategy.

Generation Mode Insights

Which Generation Mode Segment Dominated The Europe Green Hydrogen Market In 2024?

The captive generation segment dominated the market with a share of 55% in 2024. Captive hydrogen generation involves on-site production using renewable-powered electrolyzers. This model ensures a consistent supply, reduces transportation costs, and enhances energy independence for industrial users.

European chemical and steel plants are increasingly adopting captive setups to secure green hydrogen for internal use, driven by carbon neutrality goals and renewable energy integration initiatives under national hydrogen strategies. The merchant generation segment expects significant growth in the Europe green hydrogen market during the forecast period.

Merchant generation involves centralized hydrogen production for distribution to multiple users through pipelines or transport networks. Europe’s growing hydrogen hubs and port-based facilities are expanding merchant production capacity. Backed by EU funding and partnerships, merchant generation projects support large-scale hydrogen trading, enabling regional supply networks and cross-border energy cooperation across the European market.

End-User Industry Insights

How did the Transportation Segment dominate the Europe green Hydrogen Market in 2024?

The transportation segment dominated the market with a share of 60% in 2024. The transportation sector is a major end user of green hydrogen in Europe, particularly for heavy-duty vehicles, marine transport, and aviation. Hydrogen-based fuels offer high energy density and rapid refueling advantages. Ongoing investments in hydrogen corridors and refueling stations across Europe are accelerating the deployment of sustainable mobility solutions aligned with EU climate goals.

The industrial manufacturing segment expects significant growth in the Europe green hydrogen market during the forecast period. Industrial manufacturing represents the largest consumer segment for green hydrogen, particularly in metallurgy, ammonia production, and refining. European manufacturers are transitioning to hydrogen-based processes to cut CO₂ emissions and comply with strict environmental standards. Hydrogen integration enhances operational sustainability while fostering innovation in clean industrial technologies across the continent’s manufacturing hubs.

Storage and Distribution Insights

Which Storage And Distribution Segment Dominated The Europe Green Hydrogen Market In 2024?

The pipeline distribution segment dominated the market with a share of 50% in 2024. Pipeline distribution offers a cost-effective and continuous mode of green hydrogen delivery across industrial and mobility sectors. Europe is actively repurposing existing natural gas pipelines and building new hydrogen-ready networks. Strategic initiatives such as the European Hydrogen Backbone aim to create interconnected infrastructure supporting cross-border hydrogen transport and trade.

The liquid hydrogen storage segment expects significant growth in the Europe green hydrogen market during the forecast period. Liquid hydrogen storage technology is advancing rapidly to support large-scale energy transport and mobility applications. Europe’s aerospace, transport, and industrial sectors are adopting cryogenic storage systems for efficient, high-density hydrogen containment. Ongoing R&D and demonstration projects are focused on improving insulation materials and reducing liquefaction energy costs to enable viable long-term storage solutions.

Country Analysis

Germany Has Seen Significant Growth In The Market, Driven By Growing Policies And Infrastructure Development

Germany stands at the forefront of Europe’s green hydrogen development, driven by its National Hydrogen Strategy and strong industrial base. The country is rapidly expanding electrolyzer capacity using both alkaline and PEM technologies to support industrial decarbonization, mobility, and power storage. Strategic projects such as H2Global and partnerships with neighboring EU nations are enhancing hydrogen imports, infrastructure, and integration into heavy industries like steel and chemicals.

The UK Has Seen Growth In The Market, Driven By Government Investments

The UK is emerging as a major player in market through initiatives under its Hydrogen Strategy and Net Zero 2050 roadmap. The government is investing heavily in offshore wind-powered electrolyzer projects and regional hydrogen hubs, particularly in Scotland and Northern England. Focus areas include mobility decarbonization, industrial hydrogen clusters, and large-scale storage infrastructure, positioning the UK as a leader in clean energy innovation and green fuel exports.

Country-level Investments & Funding Trends for the Green Hydrogen Industry:

- Germany's updated National Hydrogen Strategy (2023) aims for at least 10 GW of electrolysis capacity and 1,800 km of hydrogen pipelines by 2030.

- €4.6 billion in grants have been allocated to 23 green hydrogen projects with Important Project of Common European Interest (IPCEI) status.

- Germany is supporting green hydrogen projects in other countries with up to €350 million by 2024, focusing on partnerships for technology transfer and import.

- France's updated National Hydrogen Strategy (March 2025) emphasizes domestic production and targets 4.5 GW of electrolysis capacity by 2030, increasing to 8 GW by 2035.

- The government formally approved a €149 million grant for Lhyfe's 100 MW Green Horizon project in Le Havre.

- The European Commission granted €3.5 million for planning the cross-border RHYn and RHYn Interco hydrogen pipelines connecting France and Germany.

Recent Developments

- In September 2025, Moeve is preparing for the construction launch of Europe's largest green hydrogen project in Spain, known as the "Andalusian Green Hydrogen Valley". This initiative involves building two green hydrogen production facilities in Palos de la Frontera and San Roque with a total electrolysis capacity of 2 GW, capable of producing up to 300,000 tonnes of green hydrogen annually.(Source: hydrogeneurope.eu )

- In May 2025, India and the European Union initiated two joint research projects, valued at approximately $47 million (€41 million), to find innovative solutions for marine pollution and green hydrogen production. These initiatives, focusing on waste-to-green hydrogen and marine plastic litter, are part of the India-EU Trade and Technology Council framework and are co-funded under the EU’s Horizon Europe program.(Source: ddnews.gov.in)

Top Players In The Europe Green Hydrogen Market & Their Offerings:

- Linde plc: Linde plc is the world's largest industrial gas supplier by revenue and market share. The multinational chemical company is heavily involved in the hydrogen market and provides technology and services across the entire hydrogen value chain, from production to fueling stations.

- Air Liquide S.A.: Air Liquide S.A. is a French multinational corporation and a world leader in industrial gases, technologies, and services. Like its competitor Linde, Air Liquide has made a significant commitment to hydrogen, particularly low-carbon and renewable (green) hydrogen, as a key part of the energy transition.

- Air Products and Chemicals, Inc.: Air Products and Chemicals, Inc. is a leading American industrial gas and chemical company that is heavily focused on the energy transition through the large-scale production and supply of clean hydrogen.

- Engie SA: Engie SA is a French multinational energy company heavily focused on the energy transition, with green hydrogen as a key strategic pillar. The company operates across the entire hydrogen value chain, from production and storage to transport and end-user applications.

- Siemens Energy AG: Siemens Energy AG, a German energy technology company, is a key player in the green hydrogen sector, specializing in the manufacturing of Proton Exchange Membrane (PEM) electrolyzers. Through partnerships and internal innovation, the company is actively developing and deploying large-scale green hydrogen projects globally.

Other Top Players Are

- Nel ASA

- Plug Power Inc.

- ITM Power plc

- Cummins Inc.

- Thyssenkrupp Nucera AG

- Enapter AG

- McPhy Energy S.A.

- Nel Hydrogen Electrolyser AS

- Haldor Topsoe A/S

- Snam S.p.A.

- Iberdrola S.A.

- Shell plc

- TotalEnergies SE

- BP plc

- VNG AG

Segments Covered

By Technology

- Alkaline Electrolyzer

- Proton Exchange Membrane (PEM) Electrolyzer

- Solid Oxide Electrolyzer (SOE)

- Anion Exchange Membrane (AEM) Electrolyzer

- High-Temperature Steam Electrolysis (HTSE)

By Application

- Mobility

- Road Transport

- Rail Transport

- Maritime

- Aviation

- Power Generation

- Grid Balancing

- Dispatchable Power Plants

- Industrial Feedstock

- Ammonia Production

- Methanol Production

- Steel Manufacturing

- Petrochemical Refining

- Residential and Commercial Energy

- On-site Power Generation

- Backup Power Systems

By Generation Mode

- Captive Generation

- Dedicated Electrolysis Plants

- Co-located with Renewable Energy Sources

- Merchant Generation

- Pipeline Distribution

- Tube Trailers

- Liquid Tanker Trucks

By End-User Industry

- Transportation

- Power and Utilities

- Industrial Manufacturing

By Storage and Distribution

- Compressed Hydrogen Storage

- High-Pressure Cylinders

- Liquid Hydrogen Storage

- Cryogenic Tanks

- Underground Storage

- Salt Caverns

- Distribution Infrastructure

- Refueling Stations