Content

Europe Bioplastics Market Size | Companies Revenue

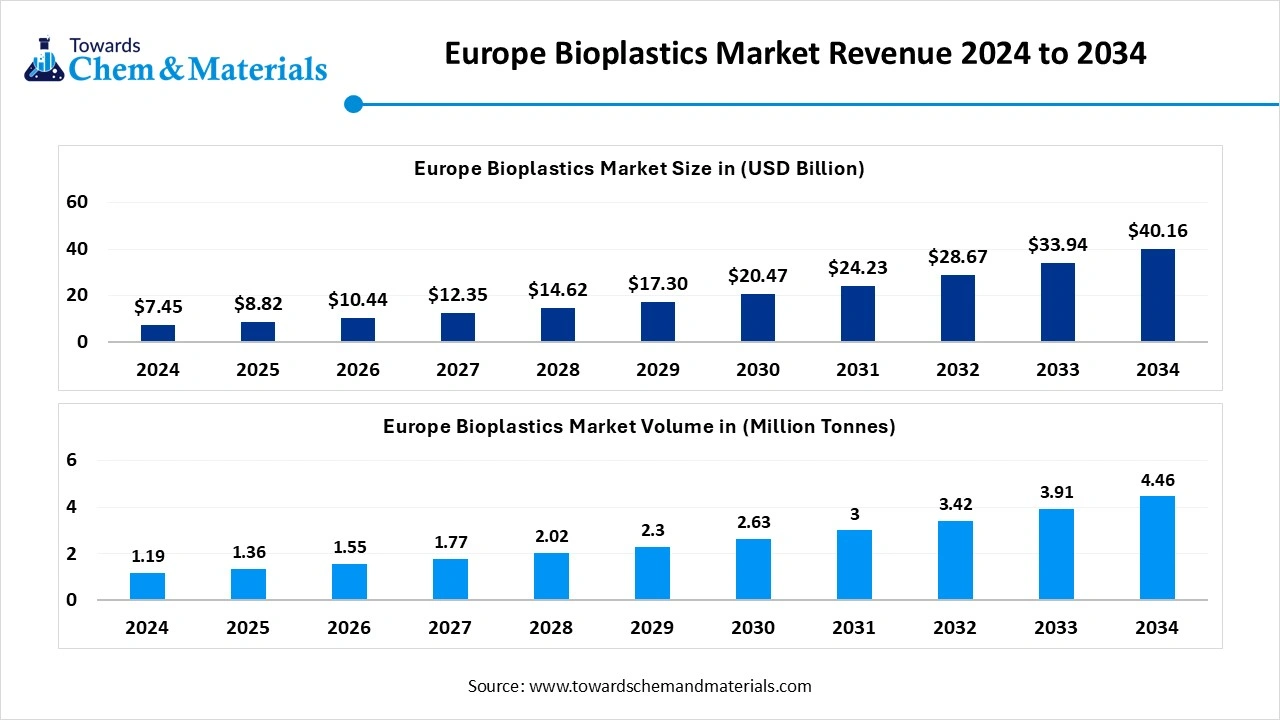

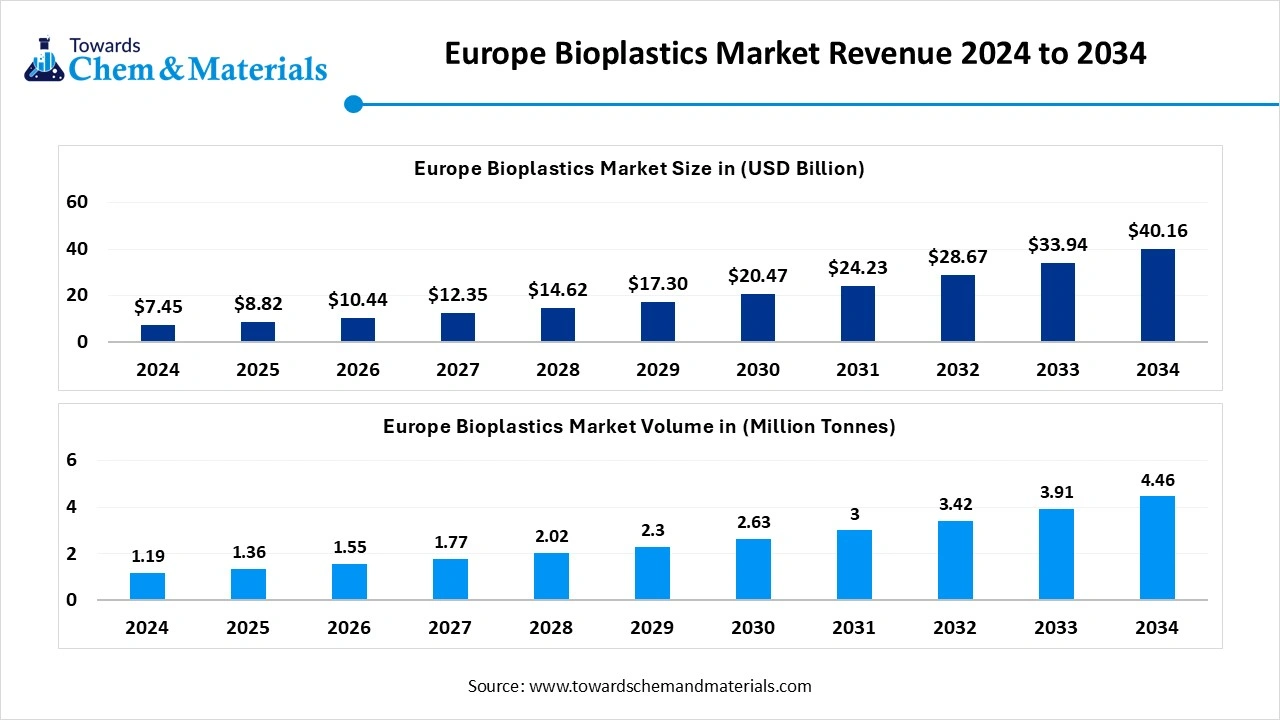

The Europe bioplastics market volume was reached at 7.45 million tons in 2024 and is expected to be worth around 40.16 million tons by 2034, growing at a compound annual growth rate (CAGR) of 18.35% over the forecast period 2025 to 2034. The sudden shift towards sustainability practices has accelerated industry potential in recent years.

Key Takeaways

- By bioplastic type, the biodegradable plastic segment led the Europe bioplastics market in 2024 with 35% of the industry share, due to having unique properties such as easy breakdown while reducing pollution in recent years

- By bioplastic type, the non-biodegradable plastic segment is expected to grow at the fastest rate in the market during the forecast period, owing to the increased need for the plastic, which has durability, strength, and heat resistance in recent years.

- By source type, the plant-based bioplastic segment emerged as the top-performing segment in the market in 2024 with 40% market share, due to its being made from widely availed raw materials like sugarcane, potatoes, and corn.

- By source type, the microbial-based bioplastic segment is expected to lead the market in the coming years, due to its unique properties, such as strength and better thermal resistance

- By processing technology, the extrusion segment led the market in 2024 with 30% industry share, because it is simple, cost-effective, and widely used to make products like films, sheets, pipes, and profiles.

- By processing technology, the injection molding devices segment is expected to capture the biggest portion of the market in the coming years, because it allows for the creation of complex and high-precision products.

- By application type, the packaging application segment emerged as the top-performing segment in the market in 2024 with 55% industry share, because of the global push to replace single-use plastics.

- By application type, the non-packaging application segment is anticipated to capture the biggest portion of the market in the coming years, as applications like automotive, electronics, agriculture, and textiles are expected to drive future growth in the market.

Market Overview

Bioplastics and Big Industry: A Profitable Partnership for the Future

The Europe bioplastics market refers to the production, distribution, and consumption of plastics derived from renewable biological sources such as plants, algae, or microorganisms, instead of conventional petrochemical-based plastics. These materials are designed to be more sustainable by offering solutions that reduce reliance on fossil fuels and minimize environmental impact through biodegradability, compostability, or recyclability. The market includes bioplastics used in a wide range of industries such as packaging, automotive, agriculture, textiles, and medical, among others.

Which Factor is driving the Europe Bioplastics Market?

The heavy implementation of the sustainability standards and single-use plastic ban globally is spearheading the industry’s growth in recent years. Moreover, the European governments are actively seen under the heavy promotion of sustainability standards, where several benefits are being launched for the manufacturers, such as tax reduction and attractive subsidies in the region recently. Also, public awareness of the eco-friendly environment is playing a major role in the current industry expansion, as per the recent regional survey.

Market Trends

- The sudden shift towards biodegradable plastic has been contributing to market growth in recent years, as several manufacturers have been actively demanding compostable and eco-friendly products in the past few years.

- The market is benefiting from the latest technological adaptations in the current period. As methods like improved injection molding and others have been providing better products while maintaining cost-effectiveness in recent years.

Market Scope

| Report Attribute | Details |

| Market Volume in 2025 | 8.82 Million Tons |

| Expected Volume by 2034 | 40.16 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 18.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type of Bioplastics, By Source, By Bioplastic Processing Technology, By Application |

| Key Companies Profiled | BASF SE, Novamont S.p.A. , Total Corbion PLA, NatureWorks LLC , Mitsubishi Chemical Corporation , Braskem , DuPont de Nemours, Inc. , Toray Industries, Inc. , Toyota Tsusho Corporation , Evonik Industries AG , UPM-Kymmene Corporation , Biome Bioplastics , Green Dot Bioplastics , FKuR Kunststoff GmbH , Eastman Chemical Company, Danisco (DuPont) , Synbra Technology , Arkema S.A. , LG Chem Ltd. , Plastic Energy Ltd. |

Market Opportunity

Biobased Plastic Gains Ground as Fossil Alternative Fades

The development of the high-performance bioplastic is expected to create lucrative opportunities for manufacturers during the forecast period. Moreover, the manufacturer can create a strategic collaboration with large-scale industries where they can get long-term profit margins and a sophisticated consumer base in the upcoming period. Furthermore, the heavy replacement of fossil-based plastic can give a greater advantage to the biobased plastic manufacturer in the coming years, as per the recent industry survey.

Market Challenge

Rising Costs Threaten the Future of Bioplastics

The higher production cost of the bioplastic is expected to hamper industry growth in the upcoming years, as these plastics require greater technology and expensive raw materials, which create cost barriers for the new entrepreneurs and mid-sized businesses that have limited and tight budget lines. Moreover, the adoption of modern technology can also be difficult for the manufacturer who follows traditional plastic-making approaches in the upcoming years.

Europe Bioplastics Market Trends

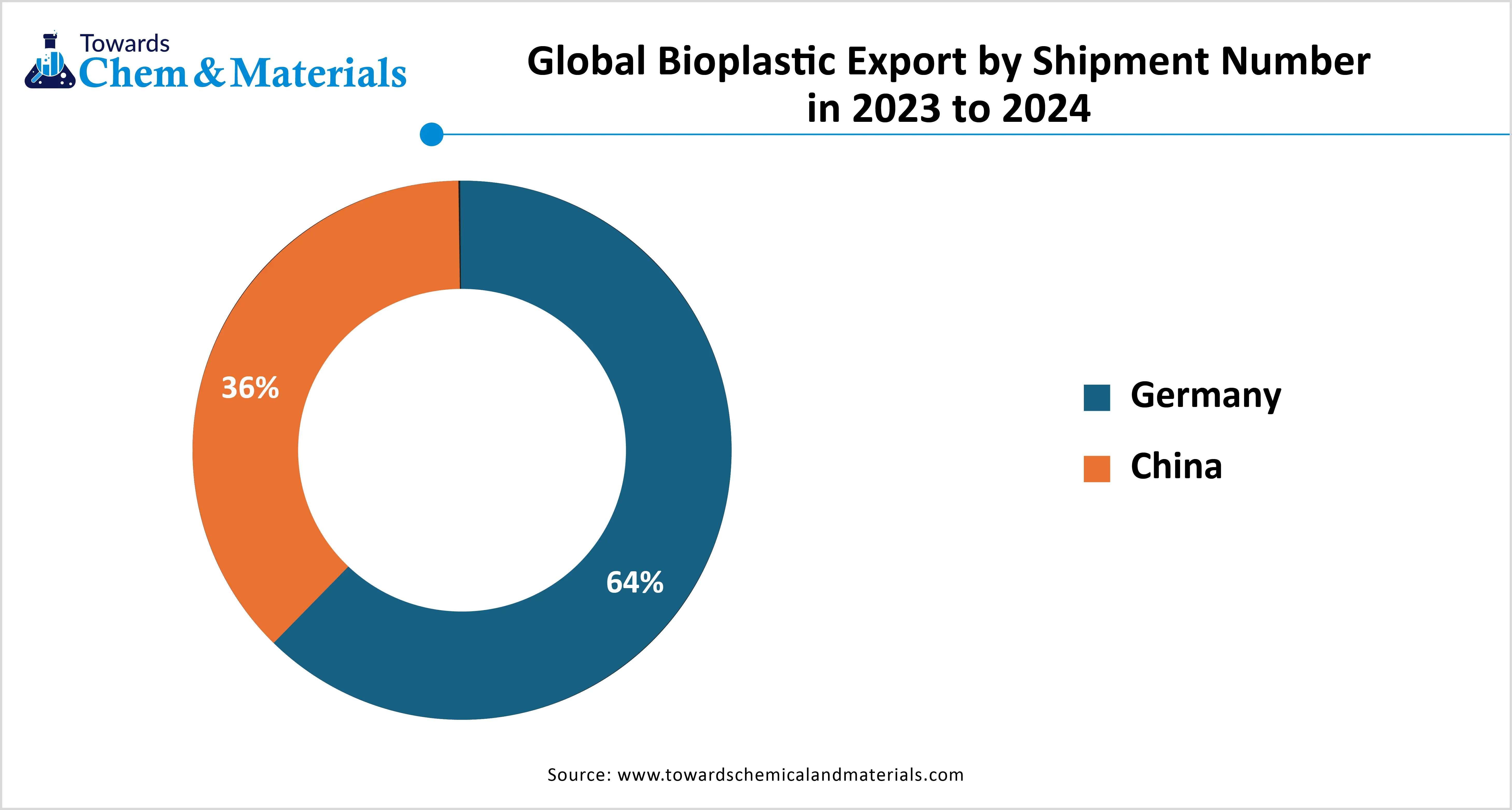

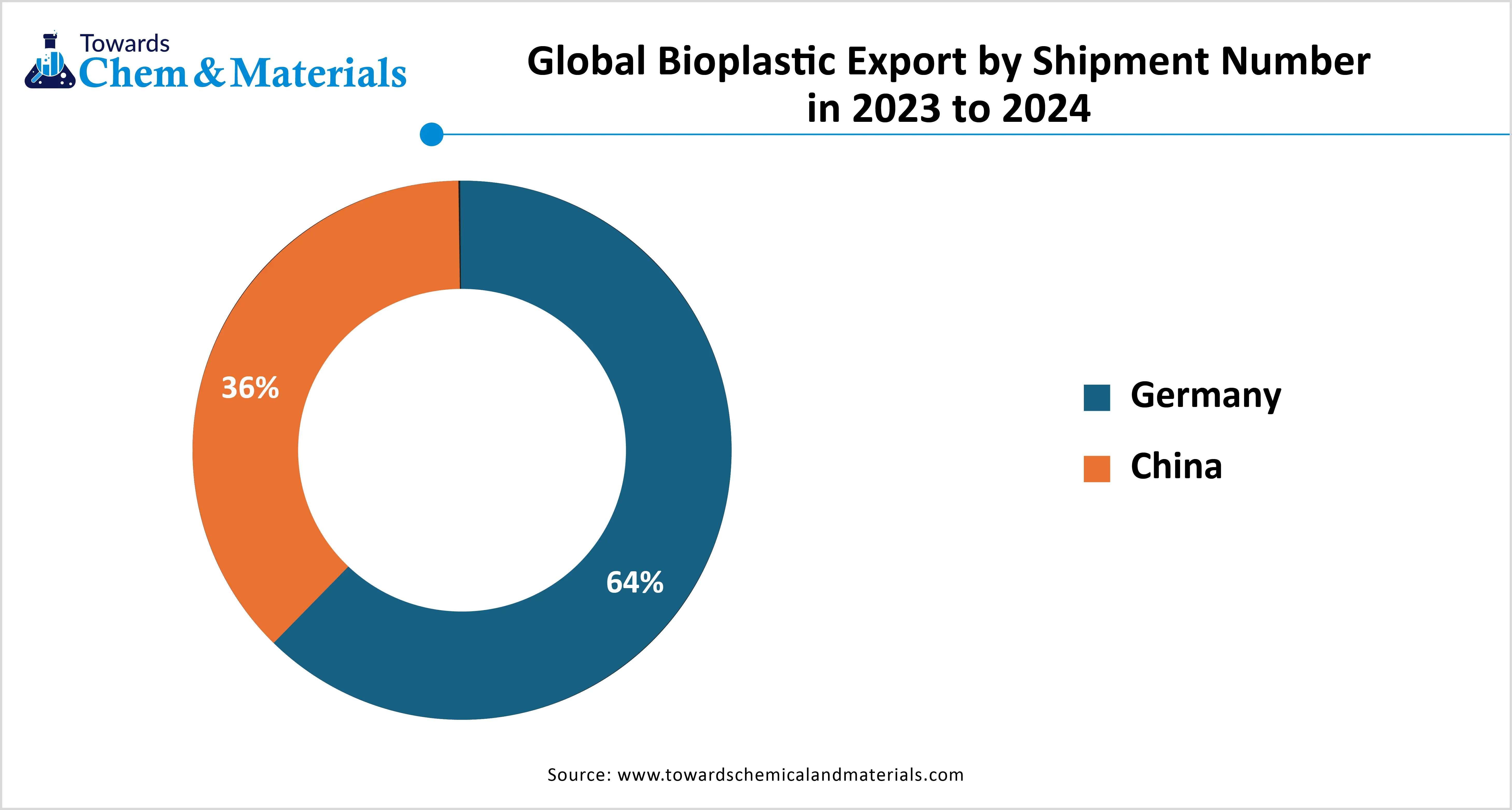

Germany and United Kingdom dominated the Europe bioplastics market in 2024, akin to having stricter sustainability standards and eco-friendly regulation implementation in recent years. As the country Germany has an enlarged and well-established recycling system, while the United Kingdom is actively seen under heavy investment for eco-friendly packaging. Also, both countries are actively involved in the middle of the single-use plastic ban initiatives, where the bioplastic market is expected to gain major industry share in the upcoming years, as per the future industry expectations.

Segmental Insights

Bioplastic Type Insights

How did the Biodegradable Plastic Segment Dominate the Europe bioplastics market in 2024?

The biodegradable plastic segment held the largest share of the market in 2024, due to having unique properties such as easy breakdown while reducing pollution in recent years. These plastics are actively and heavily used in sectors like agriculture, food packaging, and disposable products, which have driven the segment growth in the past few years. Moreover, with the global push for sustainability, major brands are starting to use these plastics in their manufacturing procedures while promoting sustainability in the different plastic forms.

The non-biodegradable plastic segment is expected to grow at a notable rate during the predicted timeframe, owing to the increased need for the plastic, which has durability, strength, and heat resistance in recent years. Having these characteristics, the manufacturers of the automotive, electronics, and construction industries are heavily demanding these non-degradable bioplastics in the current period. Also, this plastic has an eco-footprint as they are derived from plants, and others that have a slow decomposition process.

Source Type Insights

Why does the Plant-Based Bioplastic Segment dominate the Europe bioplastics Market by Source Type?

The plant-based bioplastic segment held the largest share of the market in 2024, due to its being made from widely availed raw materials like sugarcane, potatoes, and corn. The availability of raw materials makes it very ideal and cost-effective solution in the current which is providing a wider consumer base globally. Moreover, the manufacturers in sectors such as agriculture, textiles, and packaging have actively been consuming plant-based bioplastics in large amounts in the past few years.

The microbial-based bioplastic segment is expected to grow at a notable rate due to its unique properties, such as strength and better thermal resistance. Moreover, the sectors such as healthcare, industrial, and electronics are actively providing immense industry attention to the antimicrobial-based bioplastic segment in recent years. Furthermore, the increased need for sustainable but high-performance materials will provide greater industry share to the segment in the upcoming years.

Processing Technology Insights

Why did the Extrusion Segment Dominate the Europe Bioplastics Market in 2024?

The extrusion segment dominated the market with the largest share in 2024, because it is simple, cost-effective, and widely used to make products like films, sheets, pipes, and profiles. It is suitable for processing large volumes of bioplastics and works well with plant-based materials. The packaging industry uses extrusion to create flexible films and wraps, which are in high demand.

The injection molding segments are expected to grow at a notable rate in the coming years, because it allows for the creation of complex and high-precision products. As the demand for bioplastic parts in electronics, automotive, and medical devices grows, injection moulding becomes more Important. This process supports mass production and gives better control over the design and quality of the final product.

Application Type Insights

Why did the Packaging Application Segment Dominate the Europe Bioplastics Market in 2024?

The packaging application segment dominated the market with the largest share in 2024, because of the global push to replace single-use plastics. Bioplastic packaging is widely used in food containers, shopping bags, and wrappers. Consumers and companies prefer eco-friendly packaging due to rising environmental awareness. Also, regulations in Europe favor sustainable packaging, which boosts the market for bioplastic packaging

The non-packaging application segment is expected to grow at a notable rate as applications like automotive, electronics, agriculture, and textiles are expected to drive future growth in the market. These industries are actively replacing traditional plastic with stronger, sustainable options. Bioplastics are now used in car interiors, phone parts, biodegradable farming tools, and even clothing. As technology improves and more durable types of bioplastics are developed, industries outside of packaging will use them more.

Recent Developments

- In October 2024, the Fortum Recycling & Waste introduced biodegradable plastic. The newly launched plastic is produced from carbon dioxide emissions, which is the world's first bioplastic, according to the report published by the company recently.(Source: www.fortum.com)

- In October 2024, Beery unveiled their latest production of the recyclable clarified polypropylene bottle range. The newly launched bottles are specifically designed for the healthcare application, as per the company's claim.(Source: pharmaceuticalmanufacturer.media )

Europe Bioplastics Market Top Companies

- BASF SE

- Novamont S.p.A.

- Total Corbion PLA

- NatureWorks LLC

- Mitsubishi Chemical Corporation

- Braskem

- DuPont de Nemours, Inc.

- Toray Industries, Inc.

- Toyota Tsusho Corporation

- Evonik Industries AG

- UPM-Kymmene Corporation

- Biome Bioplastics

- Green Dot Bioplastics

- FKuR Kunststoff GmbH

- Eastman Chemical Company

- Danisco (DuPont)

- Synbra Technology

- Arkema S.A.

- LG Chem Ltd.

- Plastic Energy Ltd.

Segment Covered

By Type of Bioplastics:

- Biodegradable Plastics:

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Blends

- Polybutylene Succinate (PBS)

- Non-Biodegradable Plastics:

- Bio-based Polyethylene (PE)

- Bio-based Polyethylene Terephthalate (PET)

- Bio-based Polypropylene (PP)

- Bio-based Polyamide (PA)

- Compostable Plastics:

- PLA

- PHA-based Materials

- Bio-based and Biodegradable Blends:

- PLA + PHA

- Bio-based PET + Bio-based PE

By Source:

- Plant-based Bioplastics:

- Corn Starch

- Sugarcane

- Potato Starch

- Wheat

- Other Plant-based Sources

- Algae-based Bioplastics:

- Microbial-based Bioplastics:

By Bioplastic Processing Technology:

- Extrusion

- Injection Molding

- Blow Molding

- Compression Molding

- Thermoforming

- Casting

By Application:

- Packaging Applications:

- Food & Beverage

- Pharmaceuticals

- Household Products

- Non-Packaging Applications:

- Automotive Parts

- Electronics

- Medical Products