Content

What is the Current North American Crop Protection Chemicals Market Size and Volume?

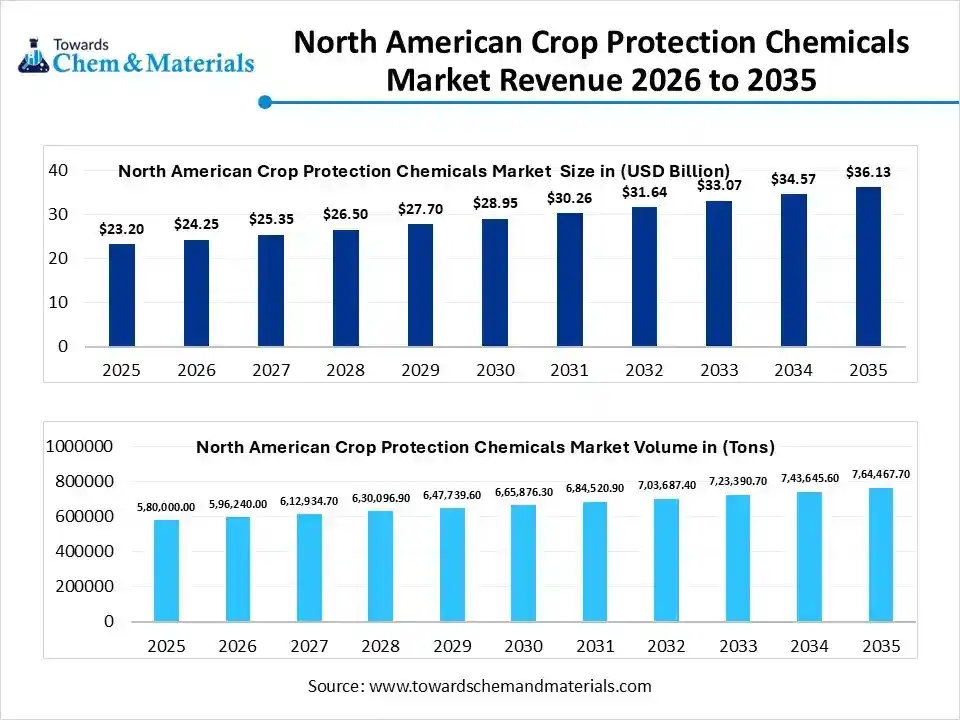

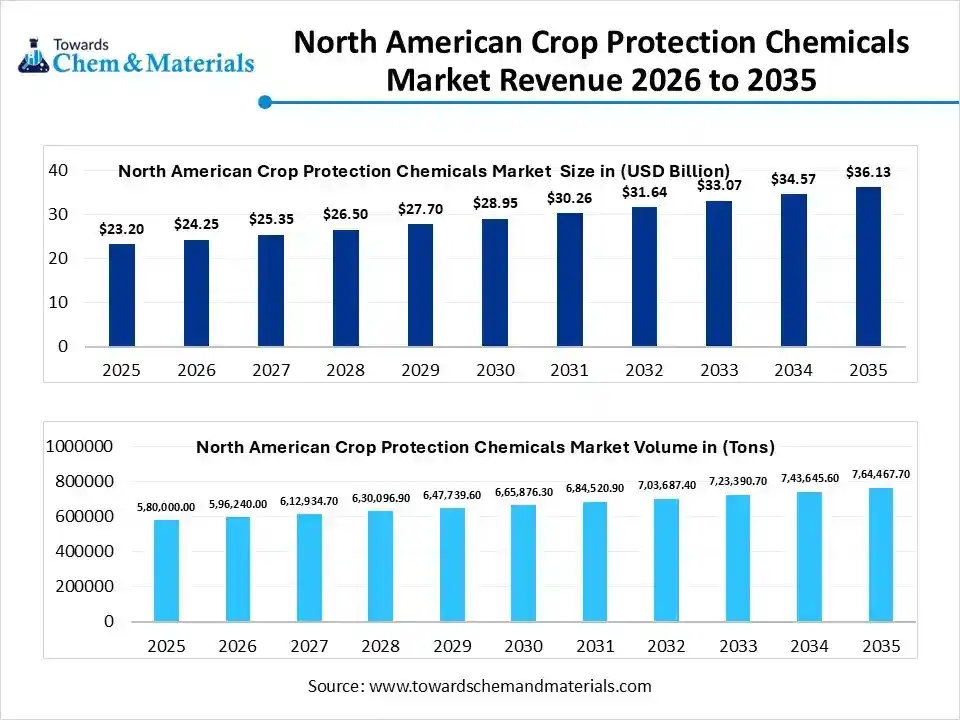

The North American crop protection chemicals market size was estimated at USD 23.20 billion in 2025 and is expected to increase from USD 24.25 billion in 2026 to USD 36.13 billion by 2035, growing at a CAGR of 4.53% from 2026 to 2035. In terms of volume, the market is projected to grow from 0.90 tons in 2025 to 1.30 tons by 2035. growing at a CAGR of 3.77% from 2026 to 2035. The growing demand for high-yielding crops and the strong emphasis on food security drive the market growth.

Market Highlights

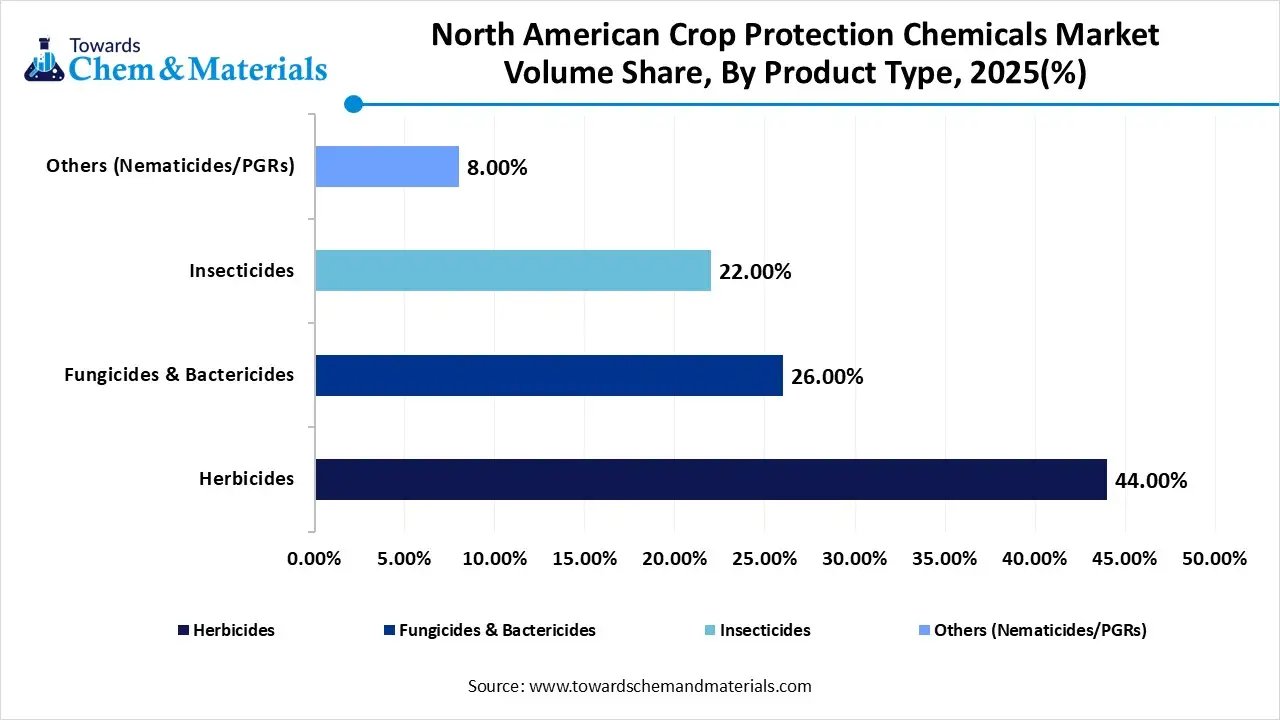

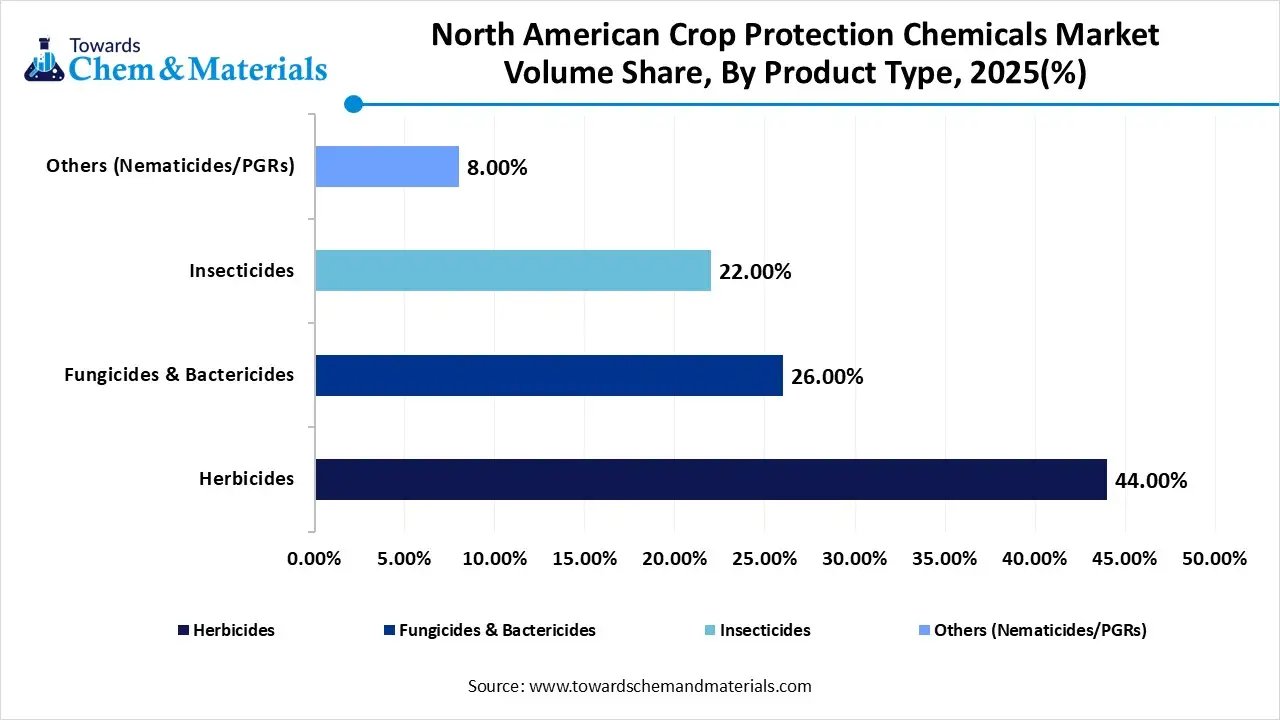

- By product type, the herbicides segment dominated the market and accounted for the largest volume share of 44% in 2025.

- By product type, the fungicides & bactericides segment is expected to grow at the fastest CAGR of 4.01% from 2026 to 2035 in terms of volume.

- By source, the synthetic chemicals segment led the market with the largest revenue volume share of 81% in 2025.

- By form, the liquid formulations segment dominated the market and accounted for the largest volume share of 68% in 2025.

- By crop type, the cereals & grains segment led the market with the largest revenue volume share of 44% in 2025.

- By mode of application, the foliar spray segment dominated the market and accounted for the largest volume share of 41% in 2025.

What Drives the Growth of the North American Crop Protection Chemicals Market?

The North American crop protection chemicals market growth is driven by the expanded food demand, the increased intensification of the agricultural landscape, the expansion of precision agriculture, changing climate patterns, increased sustainable agriculture initiatives, the shift towards organic farming, rapid growth in seed treatments, and a strong focus on biological products.

The strong focus on protecting the productivity of high-yielding crops and lowering agricultural waste increases demand for crop protection chemicals. The transition towards integrated pest management and the increased use of herbicides in agricultural practices help market growth.

Market Recent Trends:

- Vast Agricultural Presence:- The presence extensive scale of farmland and the strong government backing for advanced farming practices increases demand for crop protection chemicals for the cultivation of high-yield crops.

- Rapid Biologicals Expansion:- The push for organic agrochemical solutions and the strong consumer focus on residue-free agricultural practices increases demand for crop protection chemicals.

- Growth in Precision Agriculture:- The strong focus on conservation of agricultural resources and the shift towards precision agriculture increases demand for crop protection chemicals to boost yields and increase profitability.

- Climate Change Issues:- The changing rainfall patterns and extreme weather events like floods increase the range of diseases and pests on crops, which creates a higher demand for crop protection chemicals.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 24.25 Billion / 596,240.00 Tons |

| Revenue Forecast in 2035 | USD 36.13 Billion / 764,467.70 Tons |

| Growth Rate | CAGR 4.53% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Tons) |

| Segment Covered | By Product Type, By Source, By Form, By Crop Type, By Mode of Application |

| Key companies profiled | Bayer AG, Corteva Agriscience, Syngenta Group, BASF SE, FMC Corporation, UPL Limited, ADAMA Ltd., Nufarm Limited, Sumitomo Chemical Co., Ltd. (Valent USA), AMVAC Chemical Corporation, Albaugh, LLC, Gowan Company, American Vanguard Corporation, Drexel Chemical Company, Sipcam Agro USA |

Key Technological Shifts in the North American Crop Protection Chemicals Market:

The North American crop protection chemicals market is undergoing key technological shifts driven by the demand for effectiveness, safety, and efficacy. Technological innovations like predictive analytics, VRA software, computer vision, machine learning, and nanotechnology optimize chemical use and enhance efficacy. The key technological shift is the integration of Artifical Intelligence increases the profitability and minimizes environmental impact.

AI easily detects pest hotspots and optimizes the spray effectiveness. AI easily predicts outbreaks of disease and detects signs of infestations. AI accelerates the development of sustainable agrochemicals and detects weeds in real-time. AI predicts the efficacy of active ingredients and continuously monitors soil conditions. AI optimizes logistics processes and speeds up the discovery of active ingredients. Overall, AI is a proactive approach that reduces crop loss.

Trade Analysis of North American Crop Protection Chemicals Market: Import & Export Statistics

- From May 2024 to April 2025, the United States exported 984 shipments of fungicide products. (Source: www.volza.com )

- Mexico exported 630 shipments of bactericide.(Source: www.volza.com)

- The United States exported 8863 shipments of insecticides.(Source: www.volza.com)

- Mexico imported 48 shipments of nematicide.(Source: www.volza.com)

- The United States imported 6958 shipments of herbicides.(Source: www.volza.com)

North American Crop Protection Chemicals Market Value Chain Analysis

- Feedstock Procurement: The process acquires biological and petroleum-based raw materials like ethylene, crude oil, agricultural wastes, industrial waste, natural gas, minerals, and used cooking oil.

- Key Players:- Bayer AG, Corteva Agriscience, UPL Limited, BASF SE, Syngenta Group, FMC Corporation

- Chemical Synthesis and Processing: The stage focuses on steps like blending ingredients, mixing, formulation type, specialized techniques like microencapsulation, packaging of the finished product, and distribution.

- Key Players:- FMC Corporation, Bayer AG, AMVAC, Corteva Agriscience, Syngenta Group

- Quality Testing and Certifications: Quality testing is the evaluation of properties like viscosity, particle size, active ingredient concentration, potential harm, stability, chronic toxicity, residue level, and PH levels. Certifications include EPA, PMRA, USDA Organic Seal, CCA, and OMRI Listing.

- Key Players:- Eurofins Scientific, AmSpec, SGS, Intoxlab, Smithers, Cotecna

Overview of Country-Wise Key Regulatory Frameworks

| Country | Key Regulations | Major Product Used |

| United States |

|

|

| Canada |

|

|

| Mexico |

|

|

Segmental Insights

Product Type Insights

Why the Herbicides Segment Dominates the North American Crop Protection Chemicals Market?

The herbicides segment dominated the North American crop protection chemicals market with a 44% share in 2025. The presence of large-scale farming activities and consumer dietary shifts increases demand for herbicides for the development of high-quality crops. The increased production of genetically modified crops and the presence of extensive raw crop areas increase demand for herbicides. The cost-effectiveness, high efficacy, and crop safety of herbicides drive the overall market growth.

The fungicides & bactericides segment is the fastest-growing in the market during the forecast period. The increased spread of bacteria on plants and the large area of high-yielding crops increase demand for fungicides & bactericides. The increased adoption of precision agriculture and the increasing demand for food require fungicides & bactericides. The growing incidence of fungal attacks and the increased consumption of residue-free food products increase demand for fungicides & bactericides, supporting the overall market growth.

North American Crop Protection Chemicals Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume ( Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Herbicides | 44.00% | 255,200.0 | 329,638.5 | 2.88% | 43.12% |

| Fungicides & Bactericides | 26.00% | 150,800.0 | 214,815.4 | 4.01% | 28.10% |

| Insecticides | 22.00% | 127,600.0 | 156,027.9 | 2.26% | 20.41% |

| Others (Nematicides/PGRs) | 8.00% | 46,400.0 | 63,985.9 | 3.64% | 8.37% |

Source Insights

How did the Synthetic Chemicals Segment hold the Largest Share in the North America Crop Protection Chemicals Industry?

The synthetic chemicals segment held the largest revenue share of 81% in the North American crop protection chemicals industry in 2025. The extensive government focus on food security and a well-established agricultural base increases demand for synthetic chemicals. The focus on preventing crop losses and growth in integrated pest management increases demand for synthetic chemicals. The high reliability, cost efficiency, high stability, and proven reliability of synthetic chemicals drive market growth.

The biologicals/biopesticides segment is experiencing the fastest growth in the market during the forecast period. The growing consumer demand for organically grown food and the focus on lowering harmful residue concerns increase demand for biologicals/biopesticides. The strong preference for sustainable agriculture and the focus on enhancing crop quality increase demand for biologicals. The improved efficacy, environmental benefits, less toxicity, and safety of biologicals or biopesticides support the market growth.

Form Insights

Why the Liquid Formulations Segment is Dominating the North American Crop Protection Chemicals Market?

The liquid formulations segment dominated the North American crop protection chemicals market with a 68% share in 2025. The increasing focus on targeted treatments and the need to lower runoff increases demand for liquid formulations. The liquid formulations with modern sprayers and uniform spraying across large farms help market expansion. The superior efficacy, better storage stability, longer effectiveness, and uniform coverage of liquid formulations drive the market growth.

The solid formulations segment is the fastest-growing in the market during the forecast period. The increasing use of seed treatments and the focus on promoting sustainable practices increase demand for solid formulations. The increased popularity of green farming and the increased awareness about residues increase demand for solid formulations. The high precision, cost-effectiveness, controlled release, and enhanced stability of solid formulations support the market growth.

Crop Type Insights

How did the Cereals & Grains Segment hold the Largest Share in the North American Crop Protection Chemicals Industry?

The cereals & grains segment held the largest revenue share of 44% in the North American crop protection chemicals industry in 2025. The changing dietary habits of consumers and the large cultivation of land increase the production of cereals & grains. The growing food demand and the increased consumption of staple food create demand for cereals & grains. The growing consumption of barley, maize, and wheat drives the market growth.

The oilseeds & pulses segment is experiencing the fastest growth in the market during the forecast period. The strong consumer focus on healthy eating and increased consumption of protein-rich food increases demand for oilseeds & pulses. The shift towards plant-based diets and the growing population increases demand for oilseeds & pulses. The increased consumption & production of soybeans support the overall market growth.

Mode of Application Insights

Which Mode of Application Segment Dominated the North American Crop Protection Chemicals Market?

The foliar spray segment dominated the North American crop protection chemicals market with a 41% share in 2025. The strong focus on superior nutrient delivery and growing organic farming practices increases demand for foliar spray. The rapid action, high efficiency, and convenience of foliar spray help market expansion. The strong focus on delivering chemicals to stems and growing conventional farming practices increases demand for foliar spray, driving the market growth.

The seed treatment segment is the fastest-growing in the market during the forecast period. The strong focus on protecting seeds from insects and the popularity of organic farming increase demand for seed treatment. The growing costs of GM seeds and the focus on ensuring better germination increase demand for seed treatment. The shift towards biological seed treatment and the increasing investment in sustainable seed treatment support the overall market growth.

Country-Level Insights

Crop Cultivation Powering Crop Protection Chemicals Growth in the U.S.

The United States is a major contributor to the market. The presence of an advanced agricultural base and the increased production of food increase demand for crop protection chemicals. The growing cultivation of high-value crops and the increased adoption of genetically modified crops increase demand for crop protection chemicals. The strong focus on agricultural research and the need for maximizing crop yield output create demand for crop protection chemicals. The strong presence of agrochemical companies drives the market growth.

- The United States exported 289 shipments of bactericide.(Source: www.volza.com)

Safeguarding Crops:- Role of Crop Protection Chemicals in Canada

Canada is rapidly growing in the market. The extension of growing seasons and increasing pest pressure on crops increases demand for crop protection chemicals. The strong focus on stable harvesting and the government support for sustainable agricultural methods increase demand for crop protection chemicals. The intensive farming activities and the expansion of agricultural areas increase demand for crop protection chemicals, supporting the overall market growth.

Recent Developments

- In November 2025, Sipcam Agro USA launched a new herbicide, Lincphin. The herbicide is applicable in the northern United States area, and it controls more than 40 weeds. Herbicide is available as an extruded dry granule and offers long-lasting control.(Source: www.golfcourseindustry.com)

- In August 2025, Bayer Crop Science launched a foliar fungicide, Xivana Prime. The fungicide offers 10 to 21 days of efficacy is useful for pollinators. The foliar fungicide is used to control downy mildew in grapes and is available in a 5L pack size.(Source: www.global-agriculture.com)

- In November 2025, Syngenta launched an insecticide and fungicide seed treatment premix, CruiserMaxx Vibrance Elite for cereals. The premix manages soilborne fungi like Pythium, Rhizoctonia, and Fusarium. The premix insect protection and seed treatment.(Source: www.agribusinessglobal.com)

Top Companies List

- Bayer AG:- The multinational company produces fungicides, biologicals, herbicides, and insecticides to manage various crop diseases like diseases, pests, and weeds.

- Corteva Agriscience:- The company is a key producer of crop protection chemicals like insecticides, seed treatments, herbicides, and fungicides to support sustainable agriculture and enhance crop yields.

- Syngenta Group:- The company manufactures biological and chemical crop protection products to enhance nutrient uptake, control disease, and enhance plant resilience.

- BASF SE:- The company’s diverse product range includes insecticides, biologicals, fungicides, seed treatments, and herbicides to support farmers and sustainable agriculture.

- FMC Corporation:- The global agriculture science company offers diverse crop protection products like herbicides, crop nutrition solutions, insecticides, and fungicides to serve farmers.

- UPL Limited

- ADAMA Ltd.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd. (Valent USA)

- AMVAC Chemical Corporation

- Albaugh, LLC

- Gowan Company

- American Vanguard Corporation

- Drexel Chemical Company

- Sipcam Agro USA

Segments Covered

By Product Type

- Herbicides

- Fungicides & Bactericides

- Insecticides

- Others (Nematicides/PGRs)

By Source

- Synthetic Chemicals

- Biologicals/Biopesticides

By Form

- Liquid Formulations

- Solid Formulations

By Crop Type

- Cereals & Grains

- Corn

- Wheat

- Oilseeds & Pulses

- Soybean

- Canola

- Fruits & Vegetables

- Others (Turf/Ornamentals)

By Mode of Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others (Chemigation/Fumigation)