Content

What is the Current Fire Fighting Chemicals Market Size and Volume?

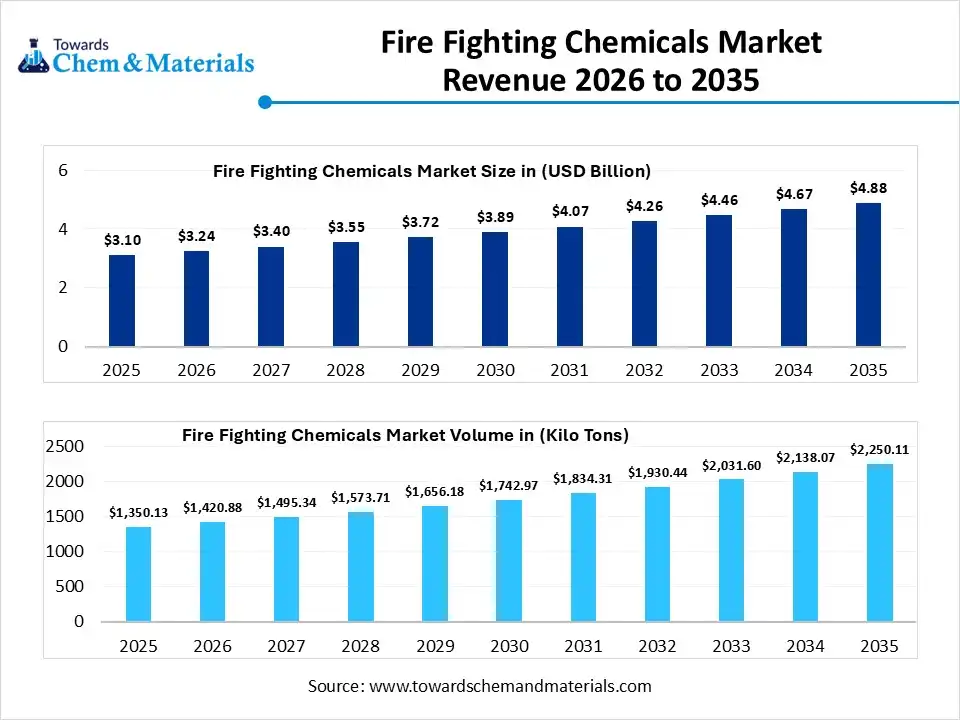

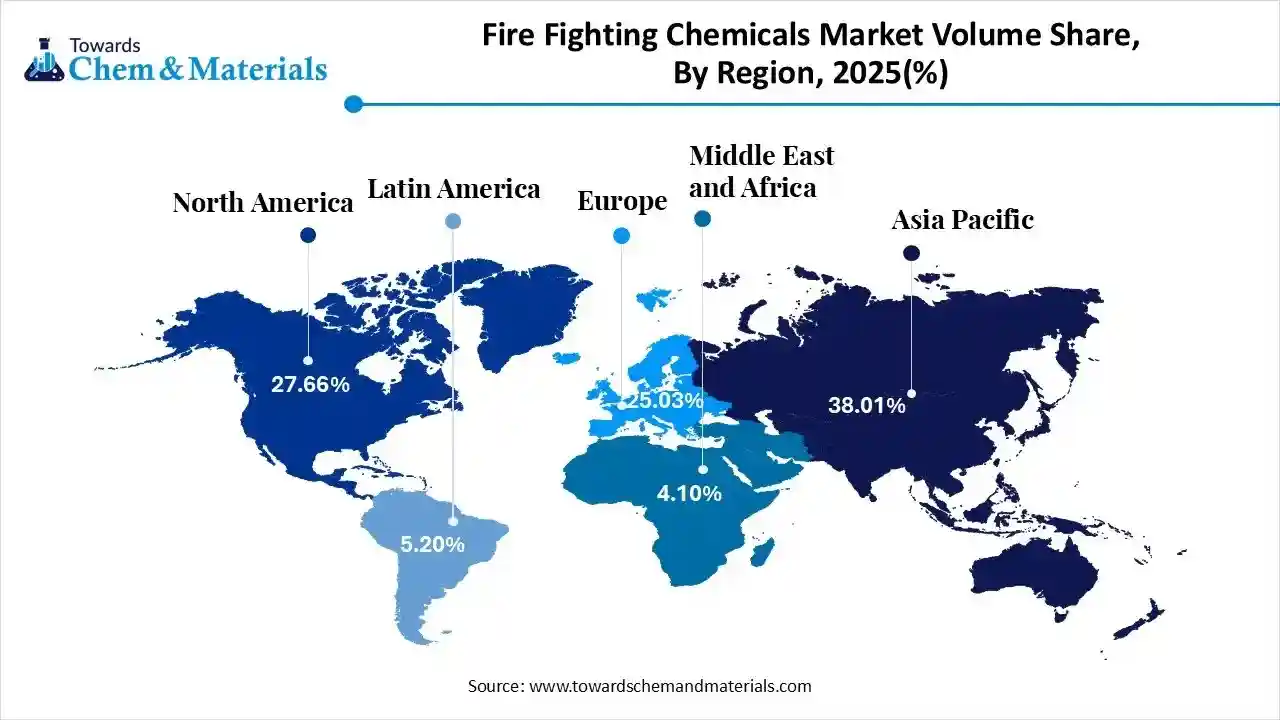

The global fire fighting chemicals market size was estimated at USD 3.10 billion in 2025 and is expected to increase from USD 3.24 billion in 2026 to USD 4.88 billion by 2035, growing at a CAGR of 4.65% from 2026 to 2035. In terms of volume, the market is projected to grow from 1350.13 kilo tons in 2025 to 2250.11 kilo tons by 2035. growing at a CAGR of 5.24% from 2026 to 2035. Asia Pacific dominated the fire fighting chemicals market with the largest volume share of 38.01% in 2025.The expansion of industries and the rapid growth in high-risk assets drive the market growth.

Market Highlights

- The Asia Pacific dominated the fire fighting chemicals market with the largest volume share of 38.01% in 2025.

- The fire fighting chemicals market in North America is expected to grow at a substantial CAGR of 3.57% from 2026 to 2035.

- The Europe fire fighting chemicals market segment accounted for the major volume share of 25.03% in 2025.

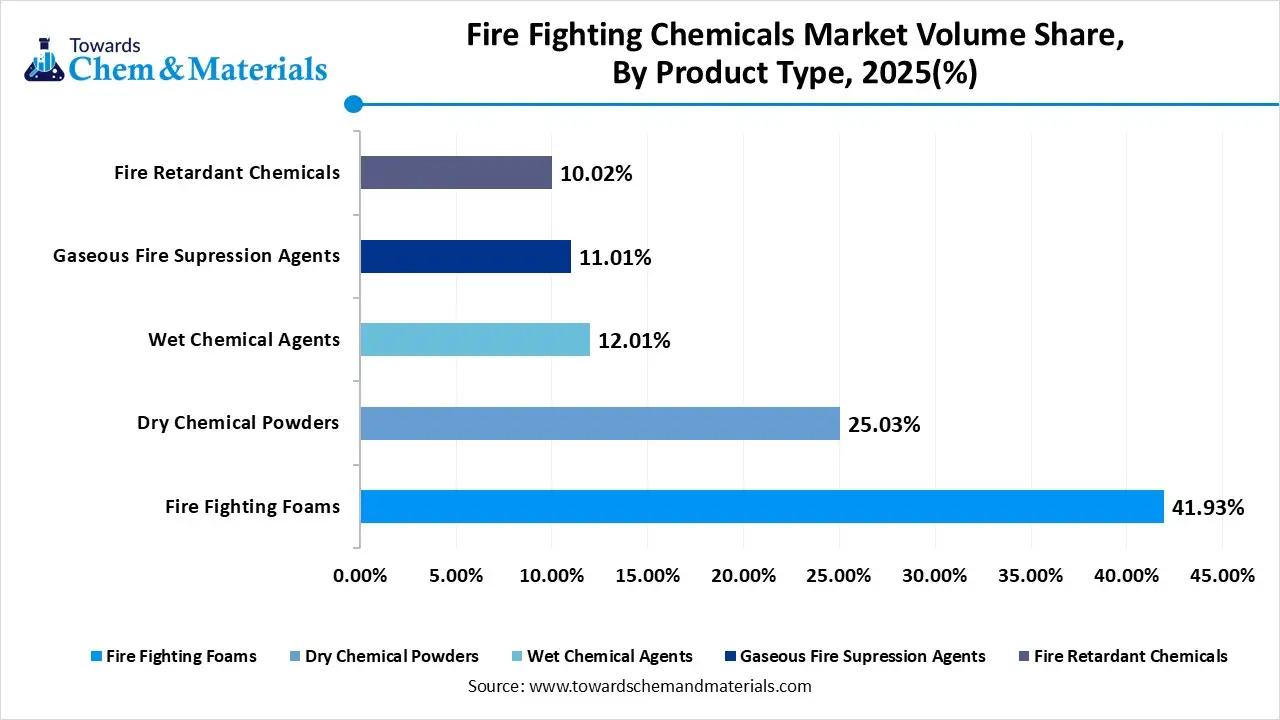

- By product type, the fire fighting foams segment dominated the market and accounted for the largest volume share of 42% in 2025.

- By product type, the gaseous suppression agents segment is expected to grow at the fastest CAGR of 41.93% from 2026 to 2035 in terms of volume.

- By fire type, the Class B fires segment led the market with the largest revenue volume share of 34% in 2025.

- By end-use industry, the industrial & manufacturing segment dominated the market and accounted for the largest volume share of 30% in 2025.

- By application, the fire extinguishers segment led the market with the largest revenue volume share of 35% in 2025.

Market Overview

Fire fighting chemicals are chemical substances that are used to extinguish fire through chemical inhibition, cooling, and smothering. The various types of chemicals are foams, fire retardants, dry chemical powders, carbon dioxide, and wet chemicals. The diverse chemical agents are made to combat various fire classes. They offer benefits like increasing water efficiency, enhancing fire suppression, minimizing collateral damage, and increasing safety.

The fire fighting chemicals market growth is driven by the increasing renewable energy adoption, increasing use of firefighting foams, stricter fire safety regulations, growing development of data centers, high production of smart fire suppression chemicals, increased awareness about fire prevention, and the growth of electric vehicles.

Fire Fighting Chemicals Market Trends:

- Growing Manufacturing:-The growing manufacturing activities and the increasing rate of inherent fire hazards in the manufacturing facilities increase demand for fire fighting chemicals to protect high-quality assets.

- Industrial Expansion:-The rapid growth in high-risk sectors and the strong focus on preventing industrial operational disruptions increase demand for fire fighting chemicals. The focus on protecting industrial assets and increasing potential fire hazards increases demand for fire fighting chemicals.

- Infrastructure Development Growth:-The growing expansion of urban areas and the rising development of large-scale public infrastructure projects increase demand for fire fighting chemicals for fire protection and employee safety.

- Growing Renewable Energy Projects:-The increasing awareness about green building standards and the growing expansion of the renewable energy industry increase demand for fire fighting chemicals.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 3.24 Billion / 1420.88 Kilo Tons |

| Revenue Forecast in 2035 | USD 4.88 Billion / 2250.11 Kilo Tons |

| Growth Rate | CAGR 4.65% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Fire Type, By End-User Industry, By Application, By Region |

| Key companies profiled | Johnson Controls, Tyco Fire Products, BASF, Solvay, Clariant, 3M, Ansul, Angus Fire, Dafo Fomtec, National Foam, Buckeye Fire Equipment, Sabo Foam, FirePro, Kidde, Minimax, Rosenbauer |

Key Technological Shifts in the Fire Fighting Chemicals Market:

The fire fighting chemicals market is undergoing key technological shifts driven by the demand for safety, regulatory compliance, and performance. Innovations like nanomaterials, predictive analytics, advanced sensors, digital twins, robotics, and IoT-enabled system enhances performance and minimize residues. The key innovations are the incorporation of artificial intelligence, which supports smarter production and lowers costs.

AI creates chemical formulations for various fire types and optimizes workflows. AI predicts the behavior of new compounds and easily identifies hazardous chemicals. AI identifies fire-safety materials and fine-tunes manufacturing workflows. AI easily identifies the optimal suppression agent and detects the fire faster. Overall, AI is a data-driven approach that increases production efficiency.

Trade Analysis of Fire Fighting Chemicals Market: Import & Export Statistics

- The United States exported 68 shipments of fire fighting chemical.

- China exported 52 shipments of fire fighting chemical.

- The United States exported 94 shipments of fire fighting foams.

- Peru imported 42 shipments of fire fighting chemical.

- Vietnam imported 15 shipments of fire fighting chemical.

Fire Fighting Chemicals Market Value Chain Analysis

- Feedstock Procurement:The stage focuses on acquiring feedstocks like fluorochemicals, glycols, alkali metal salts, carbon dioxide, additives, solvents, water, and stabilizers.

- Key Players:- Angus Fire, BASF SE, KV Fire Chemicals, Johnson Controls, Vizag Chemical

- Chemical Synthesis and Processing:The stage involves steps like sourcing of raw materials, blending of ingredients, grinding ingredients into powder form, formulation, and packaging of the final product.

- Key Players:- BASF SE, LANXESS, J.M. Huber Corporation, Albemarle Corporation, ICL Group

- Quality Testing and Certifications:Quality testing focuses on testing aspects like specific gravity, flash point, biodegradability, heavy metal content, shelf life, non-combustibility, performance, viscosity, and aquatic toxicity. Certifications include Underwriters Laboratories, NFPA, BIS, CE Marking, and ASTM International.

- Key Players:- FM Approvals, Intertek, TUV Rheinland, UL Solutions, Bureau Veritas, SGS Group

Study of Diverse Fire Fighting Chemicals and Their Applications

| Types | Used for Fire Class | Applications |

| Dry Chemical Powders | Class A, B, C |

|

| Wet Chemical Agents | Class /K, A, B |

|

| Fire Fighting Foams | Class A and B |

|

| Gaseous Fire Suppression Agents | Class C |

|

Segmental Insights

Product Type Insights

Why the Fire Fighting Foams Segment Dominates the Fire Fighting Chemicals Market?

The fire fighting foams segment volume was valued at 566.11 kilo tons in 2025 and is projected to reach 971.82 kilo tons by 2035, expanding at a CAGR of 6.19% during the forecast period from 2025 to 2035. The fire fighting foams segment dominated the fire fighting chemicals market with approximately 41.93% share in 2025. The expansion of industrial activities and the rapid growth in the chemical sector increase demand for fire fighting foams. The stringent fire safety regulations and the growing expansion of the aviation industry increase demand for fire fighting foams. The superior performance, effective oxygen barrier, and longer shelf life of fire fighting foams drive the market growth.

The gaseous suppression agents segment volume was valued at 148.65 kilo tons in 2025 and is projected to reach 320.19 kilo tons by 2035, expanding at a CAGR of 8.90% during the forecast period from 2025 to 2035. The growing development of new facilities and the increasing use of sensitive equipment in telecommunication facilities increase demand for gaseous suppression agents. The rapid growth in electronics manufacturing and the strong focus on combating industrial hazards increase demand for gaseous suppression agents. The residue-free extinguishing and superior asset protection in gaseous suppression agents support the overall market growth.

Fire Fighting Chemicals Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Fire Fighting Foams | 41.93% | 566.11 | 971.82 | 6.19% | 43.19% |

| Dry Chemical Powders | 25.03% | 337.94 | 475.22 | 3.86% | 21.12% |

| Wet Chemical Agents | 12.01% | 162.15 | 297.69 | 6.98% | 13.23% |

| Gaseous Fire Supression Agents | 11.01% | 148.65 | 320.19 | 8.90% | 14.23% |

| Fire Retardant Chemicals | 10.02% | 135.28 | 185.18 | 3.55% | 8.23% |

Fire Type Insights

How did the Class B Fires Segment hold the Largest Share in the Fire Fighting Chemicals Market?

The Class B fires segment held the largest revenue share of approximately 34% in the fire fighting chemicals market in 2025. The strong presence of pervasive fuel sources and the strong presence of storage facilities increase demand for fire fighting chemicals. The well-developed petrochemical base and the strong industrial settings create a higher demand for fire fighting chemicals. The growing development of chemical processing plants drives the overall market growth.

The Class K fires segment is experiencing the fastest growth in the market during the forecast period. The increasing use of vegetable oils in restaurants and the growth in commercial cooking appliances increase demand for fire fighting chemicals. The increasing kitchen fires in commercial settings and the expansion of the food service industry create a higher demand for fire fighting chemicals. The growing risk in residential kitchens and the intense cooking activities support the overall market growth.

End-User Industry Insights

Which End-User Industry Dominated the Fire Fighting Chemicals Market?

The industrial & manufacturing segment dominated the fire fighting chemicals market with approximately 30% share in 2025. The development of oil and gas facilities and the heavy manufacturing activities increases demand for fire fighting chemicals. The industrial facilities' safety standards and the increasing electrical fires in industrial settings increase demand for fire fighting chemicals. The strong presence of warehouse facilities and the growth in power generation increase demand for fire fighting chemicals, driving the market growth.

The commercial buildings segment is the fastest-growing in the market during the forecast period. The rapid urbanization and the stringent fire safety regulations in commercial properties increase demand for fire fighting chemicals. The growing development of commercial complexes and the construction of tall buildings increases demand for fire fighting chemicals. The increasing investment in data centers and the expansion of the tourism sector support the overall market growth.

Application Insights

Why did the Fire Extinguishers Segment hold the Largest Share in the Fire Fighting Chemicals Market?

The fire extinguishers segment held the largest revenue share of approximately 35% in the fire fighting chemicals market in 2025. The growing business clusters and the expansion of offices increase demand for fire extinguishers. The government fire safety regulatory mandates and the expanding high-risk sectors create higher demand for fire extinguishers. The simplicity, versatility, easy accessibility, and cost-effectiveness of fire extinguishers drive the overall market growth.

The fixed suppression systems segment is experiencing the fastest growth in the market during the forecast period. The stringent fire safety codes in industrial applications and the rapid growth in smart cities increase demand for fixed suppression systems. The expansion of energy facilities and the increased production of sensitive electronics creates higher demand for fixed suppression systems.

Regional Insights

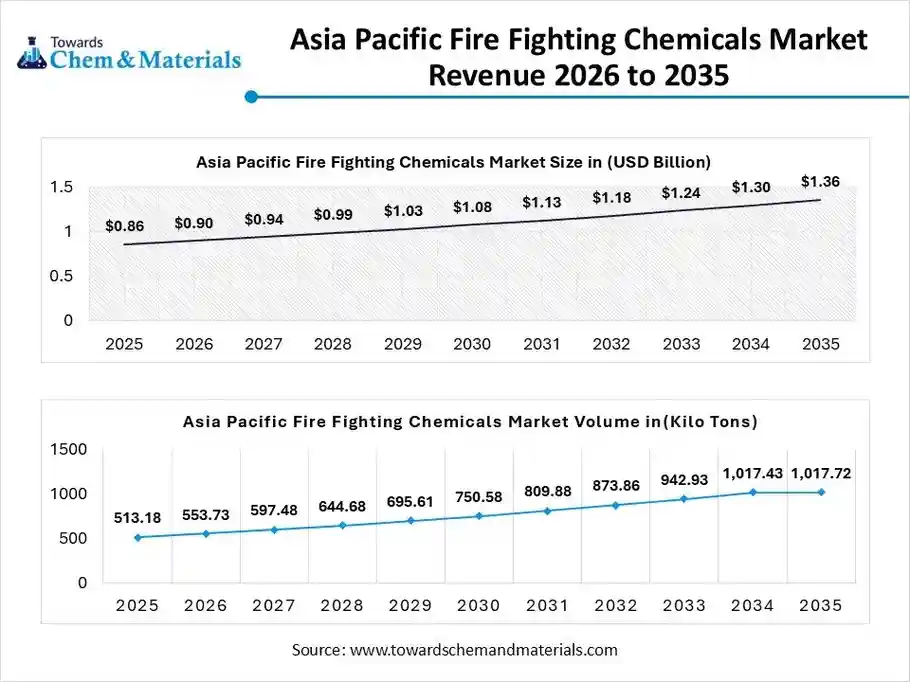

The Asia Pacific fire fighting chemicals market size was valued at USD 1.15 billion in 2025 and is expected to be worth around USD 1.82 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.67% over the forecast period from 2026 to 2035.

The Asia Pacific fire fighting chemicals volume was estimated at 513.18 kilo tons in 2025 and is projected to reach 1017.72 kilo tons by 2035, growing at a CAGR of 7.90% from 2026 to 2035.Asia Pacific dominated the fire fighting chemicals market with approximately 38.01% share in 2025. The growing expansion of chemical processing and the surging residential building projects increase demand for fire fighting chemicals. The heavy manufacturing activities and increasing fire safety awareness increase demand for fire fighting chemicals. The growing aviation industry and the growth in development of large infrastructure projects require fire fighting chemicals, driving the overall market growth.

From Factory to Fireline: China's Leading Fire Fighting Chemicals Solution

China is a key contributor to the market. The massive growth in construction activities and the strong focus on fire safety in public spaces increase demand for fire fighting chemicals. The well-established petrochemical base and the rapid expansion of cities create higher demand for fire fighting chemicals. The growing chemical manufacturing and the increasing use of fluorine-free foams support the overall market growth.

North America Fire Fighting Chemicals Market Trends

The North America fire fighting chemicals volume was estimated at 373.45 kilo tons in 2025 and is projected to reach 511.90 kilo tons by 2035, growing at a CAGR of 3.57% from 2026 to 2035. North America is experiencing the fastest growth in the market during the forecast period. The increased modernization of critical infrastructure and growing awareness about the negative impacts of fire hazards increase demand for fire fighting chemicals. The increasing investment in real estate and the development of PFAS-free foam support the overall market growth.

Smart Buildings Behind the Fire Fighting Chemicals Growth in the U.S.

The United States is a major contributor to the market. The growing frequency of intense wildfires and the increasing investment in smart buildings increase demand for fire fighting chemicals. The expansion of petrochemicals and the rapid growth in energy increase demand for fire fighting chemicals. The increasing awareness about proactive safety measures and the increasing fire hazards increase demand for fire fighting chemicals, supporting the overall market growth.

Fire Fighting Chemicals Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 27.66% | 373.45 | 511.90 | 3.57% | 22.75% |

| Europe | 25.03% | 337.94 | 497.95 | 4.40% | 22.13% |

| Asia Pacific | 38.01% | 513.18 | 1017.72 | 7.90% | 45.23% |

| South America | 5.20% | 70.21 | 120.16 | 6.15% | 5.34% |

| Middle East & Africa | 4.10% | 55.36 | 102.38 | 7.07% | 4.55% |

Recent Developments

- In September 2024, CheckFire launched a new PFAS-free fire extinguisher range, Green Crosshair, in line with EU regulations. The range includes fluorine-free alternatives. The range offers high performance and provides environmentally friendly options.(Source: internationalfireandsafetyjournal.com)

- In April 2025, SOLBERG SPARTAN 1% fluorine-free Class A/B firefighting foam introduced by Perimeter Solutions at FDIC 2025 in the United States. The fire fighting foams are used across various fires like wildland, gasoline, structural, dumpster, and vehicle fires. The product is compatible with nozzles, monitors, eductors, compressed air foam systems, and foam devices.(Source: fireandsafetyjournalamericas.com)

- In October 2024, Firefly Fire Pumps launched a compressed air foam system for enhanced firefighting at Fire India 2024. The system supports industrial and high-rise firefighting. The system minimizes water usage and creates a protective layer.(Source: internationalfireandsafetyjournal.com)

Top Companies List

- Johnson Controls:- The company manufactures diverse fire fighting chemicals like film-forming, dry chemical powders, foam concentrates, and gaseous suppression agents to serve diverse sectors like data centers, healthcare, and education.

- Tyco Fire Products:- The company produces extinguishing agents like FFFP ARC, aqueous film-forming foam, and AFFF ARC to support residential, commercial, and industrial applications.

- BASF:- The German-based company manufactures non-combustible materials, flame retardants, and fire protection systems to serve industrial applications.

- Solvay:- The Belgium-based company manufactures flame-retardant materials like Halar ECTFE, Solef PVDF, and Hylar PVDF to serve industries like industrial infrastructure, electronics, and transportation.

- Clariant

- 3M

- Ansul

- Angus Fire

- Dafo Fomtec

- National Foam

- Buckeye Fire Equipment

- Sabo Foam

- FirePro

- Kidde

- Minimax

- Rosenbauer

Segments Covered

By Product Type

- Fire Fighting Foams

- Dry Chemical Powders

- Wet Chemical Agents

- Gaseous Fire Suppression Agents

- Fire Retardant Chemicals

By Fire Type

- Class A (Solid Combustibles)

- Class B (Flammable Liquids)

- Class C (Electrical Fires)

- Class D (Metal Fires)

- Class K (Cooking Oils & Fats)

By End-User Industry

- Industrial & Manufacturing

- Oil & Gas

- Commercial Buildings

- Aviation & Marine

- Residential

- Defense & Others

By Application

- Fire Extinguishers

- Fixed Fire Suppression Systems

- Fire Sprinkler & Deluge Systems

- Fire Retardant Coatings & Treatments

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa