Content

Building Materials Market Size and Share 2034

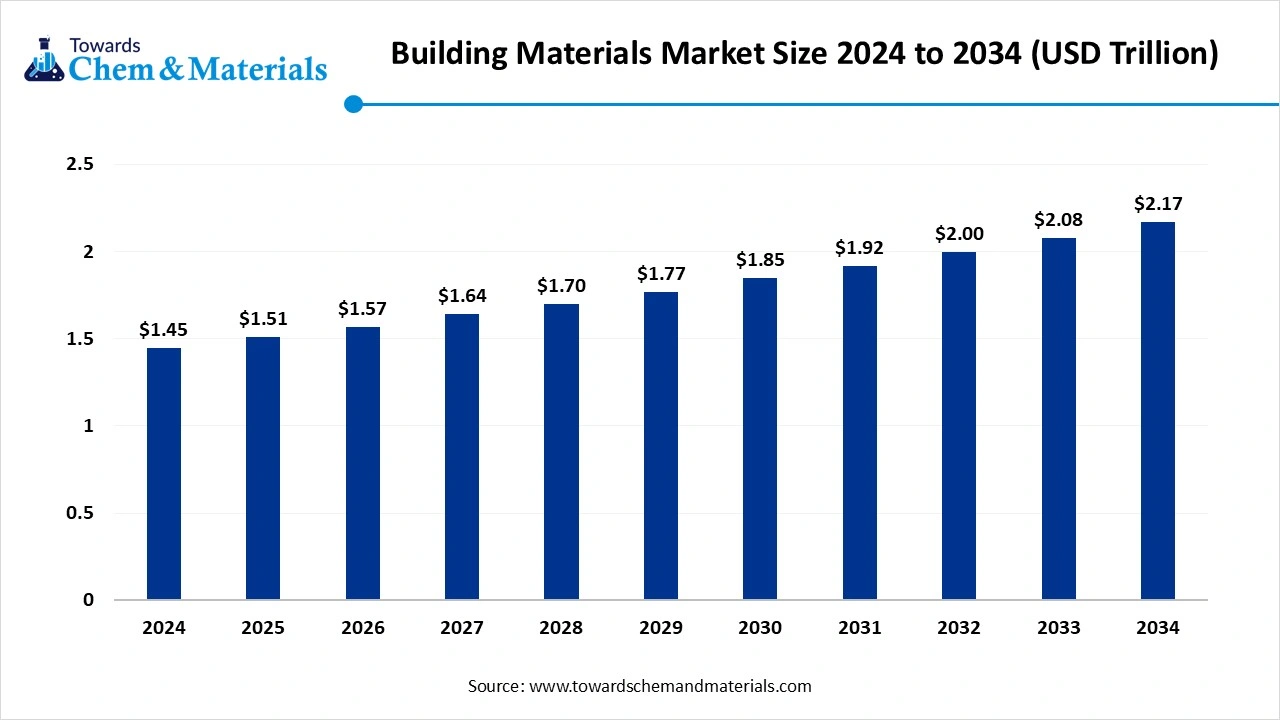

The global building materials market size was approximately USD 1.45 trillion in 2024 and is projected to reach around USD 2.17 trillion by 2034, with an estimated compound annual growth rate (CAGR) of about 4.11% between 2025 and 2034.

The growth of the market is driven by the rapid urbanization and increased infrastructure development projects by the government, and growing initiative and demand for green building construction fuel the growth of the market.

Key Takeaways

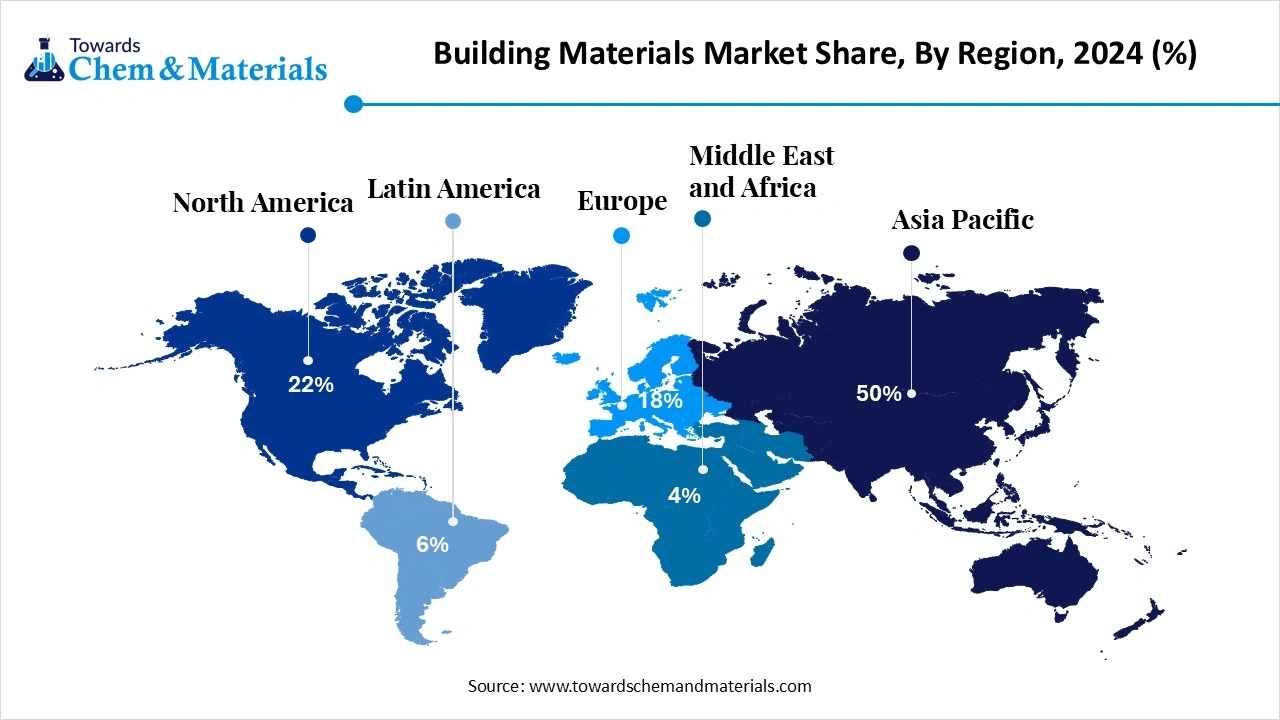

- By region, Asia Pacific dominated the market in 2024. The Asia Pacific region held approximately 50% share in the market in 2024.

- By region, the Middle East and Africa are expected to have significant growth in the market in the forecast period.

- By product type, the cement & concrete segment dominated the market in 2024. The cement & concrete segment held approximately 38% share in the market in 2024.

- By product type, the composites & polymers segment is expected to grow significantly in the market during the forecast period.

- By application, the residential construction segment dominated the market in 2024. The residential construction segment held approximately 35% share in the market in 2024.

- By application, the commercial & industrial projects segment is expected to grow in the forecast period.

- By material type, the natural materials segment dominated the market in 2024. The natural materials segment held approximately 41% share in the market in 2024.

- By material type, the engineered & sustainable materials segment is expected to grow in the forecast period.

- By enterprise type, the construction & infrastructure segment dominated the market in 2024. The construction & infrastructure segment held approximately 40% share in the market in 2024.

- By enterprise type, the DIY & home improvement segment is expected to grow in the forecast period.

- By enterprise type, the large enterprises segment dominated the market in 2024. The large enterprises segment held approximately 60% share in the market in 2024.

- By enterprise type, the SMEs (regional suppliers) segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Building Materials Market

The building materials market refers to the global industry producing materials used in construction, renovation, and infrastructure projects. This includes products such as cement, concrete, metals, ceramics, glass, wood, and composites. The market is driven by urbanization, rising infrastructure development, increasing residential and commercial construction, and sustainable construction practices.

What Are The Key Growth Drivers That Support The Growth Of The Building Materials Market?

The growth of the market is driven by rapid urbanization, which leads to increasing demand for the construction sector for the construction of houses, commercial spaces, and urban infrastructure. This is also due to increased population, fueling the growth of the market. The government initiatives and foreign direct investment are also key drivers. The sustainability initiatives and environmental drivers like green building materials, energy efficiency, and governmental regulations further drive the growth and expansion of the market.

Market Trends

- Sustainable & Green Materials: Growing environmental awareness and regulations are leading to increased adoption of green building materials, including lower-emission cement, recycled aggregates, and bio-based insulation.

- Innovative & Advanced Materials: There's a rising demand for high-performance materials like advanced composites, lightweight materials, nano-formulations, and smart materials for enhanced durability and functionality.

- Prefabrication & Modular Construction: The use of ready-mix concrete, precast components, and modular building methods is increasing to reduce construction time and costs.

- 3D Printing (Additive Manufacturing): 3D printing is emerging as a key technology for developing novel materials and enabling the construction of complex structures.

- Digitalization & Technology Integration: Technologies such as Building Information Modeling (BIM) and automated production systems are transforming construction processes by streamlining workflows and improving quality control.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 1.51 Trillion |

| Expected Size by 2034 | USD 2.17 Trillion |

| Growth Rate from 2025 to 2034 | CAGR 4.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Application, By Material Type, By End-User Industry, By Enterprise Size, By Region |

| Key Companies Profiled | LafargeHolcim, CEMEX , HeidelbergCement , Saint-Gobain , CRH plc , Boral Limited , China National Building Material Group (CNBM) , ACC Limited, Ultratech Cement , Taiwan Cement Corporation, Knauf Gips KG , James Hardie Industries , RPM International Inc. , Owens Corning , U.S. Concrete , Kingfisher plc , CRH Asia , Jushi Group Co., Ltd. , Sika AG , Georgia-Pacific LLC |

Market Opportunity

Technological Advancement In Construction Industry

The key growth opportunity that supports the growth of the market is the technological advancements, like the adoption of precast components and modular construction techniques, which also help in reducing the building time and costs.

The integration of 3D printing technology, which offers customized, novel, and efficient construction materials, contributes to and supports the market for customizable solutions due to increasing demand, creating an opportunity for growth. Building Information Modeling (BIM) and Automated Production and Construction Systems (APCS) streamline processes and reduce waste, driving growth.

Market Challenge

Economic And Financial Challenges

The economic and financial challenges include price volatility, such as fluctuating costs for raw materials like cement, steel, and aggregates. Inflation and tight budgets of projects increased interest rates. Cash flow issues like irregular cash flow and project financing challenges hinder the operations and investment in the market, which is a challenge limiting the growth and expansion of the market. Technological and operational issues, supply chain and logistics, and labor and workforce are also key challenges.

Regional Insights

Building Materials Market Size, Industry Report 2034

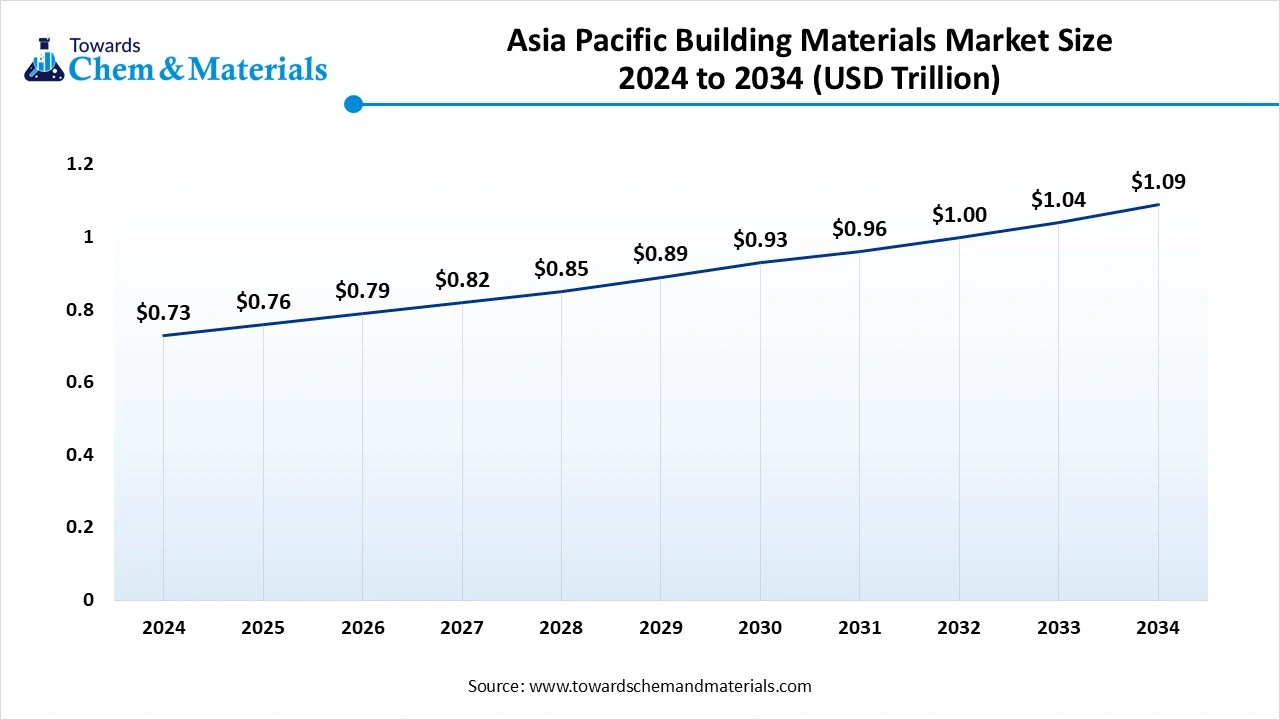

The Asia Pacific building materials market size was estimated at USD 0.73 trillion in 2024 and is projected to reach USD 1.09 trillion by 2034, growing at a CAGR of 4.09% from 2025 to 2034. Asia Pacific dominated the building materials market in 2024.

The growth of the market in the Asia Pacific is driven by the growing infrastructure development projects in the region, with heavy investment by the government for projects increasing the demand for building materials, fueling the growth of the market.

The rapid urbanization and focus on sustainability also increase the demand for green buildings and the adoption of advanced building materials in response to environmental regulations due to increased awareness of climate change, which increases the demand for eco-friendly solutions, contributing to the growth and expansion of the market in the region.

India Has Seen Significant Growth In The Market, Driven By Rapid Urbanization.

The growth of the market in India is driven by the rapid urbanization and housing demand for commercial and residential buildings, also resulting in increased population, which increases the growth of the market in the country. The increased disposable income also increases the spending in sustainable products, green building materials, especially in the metropolitan areas, due to the expanding IT sector, fuelling the growth and expansion of the market in the country.

- India shipped out 20 building materials shipments from September 2023 to August 2024 (TTM). These exports were handled by 13 Indian exporters to 16 buyers, showing a growth rate of 18% over the previous 12 months.(Source: www.volza.com)

- Globally, China, the United States, and the European Union are the top three exporters of Building Materials. China is the global leader in Building Materials exports with 16,608 shipments, followed closely by the United States with 16,399 shipments, and the European Union in third place with 5,847 shipments.(Source: www.volza.com)

The Middle East And Africa Have Seen Significant Growth Driven By The Adoption Of Advanced Materials

The Middle East and Africa are expected to experience significant growth in the building materials market in the forecast period. The growth of the market in the Middle East and Africa is driven by the integration of smart and advanced materials for high performance.

The growing population and adoption of pre-engineered buildings, which offer advantages such as faster construction and cost efficiency, also increase the growth and adoption of the market. There is a growing adoption of eco-friendly materials, such as solar panels, insulation, and recycled products, driven by environmental awareness and regulatory mandates influencing growth in the region.

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated The Building Materials Market In 2024?

The cement & concrete segment dominated the market in 2024. It is widely used in residential, commercial, and infrastructure projects. They provide structural strength, durability, and versatility. Advances in ready-mix concrete, lightweight aggregates, and sustainable formulations such as low-carbon cement are shaping this segment. With urbanization and infrastructure modernization driving demand, cement and concrete continue to be indispensable in creating sustainable and high-performance structures while meeting green building standards.

The composites & polymers segment expects significant growth in the market during the forecast period. Composites and polymers are gaining traction due to their lightweight, durable, and design-flexible properties. Used in roofing, cladding, insulation, and structural applications, these materials offer high performance and energy efficiency. Their resistance to corrosion, ease of installation, and recyclability make them attractive alternatives to traditional building materials. Growth in green construction practices and demand for energy-efficient buildings are pushing composites and polymers into mainstream applications, particularly in advanced residential and commercial projects.

Application Insights

How Did the Residential Construction Segment Dominated The Building Materials Market In 2024?

The residential construction segment dominated the market in 2024. Residential construction remains a major application area for building materials, driven by rising urban housing demand, renovation projects, and the growing popularity of sustainable homes. Materials like concrete, engineered wood, composites, and eco-friendly polymers are being used for structural and interior applications. The focus on energy-efficient housing, smart homes, and cost-effective construction solutions further fuels material innovation. This segment continues to evolve with a balance of traditional building supplies and modern engineered alternatives.

The commercial & industrial projects segment expects significant growth in the market during the forecast period. Commercial and industrial projects demand durable, high-performance, and large-scale building materials. Cement, steel-reinforced concrete, composites, and engineered materials play critical roles in constructing offices, warehouses, factories, and large public facilities. The emphasis on longevity, safety, and energy efficiency in industrial-grade construction drives the adoption of advanced materials like fire-resistant composites and insulating polymers. Growth in industrialization and commercial infrastructure development underpins this segment’s strong demand.

Material Type Insights

Which Material Type Segment Dominated The Building Materials Market In 2024

The natural materials segment dominated the market in 2024. Natural materials such as stone, clay, wood, and bamboo hold an important place in the market, valued for their availability, aesthetic appeal, and eco-friendliness. They are commonly used in both traditional and modern designs, especially for residential projects. Increasing demand for green construction and sustainable architecture has revived interest in natural materials. However, integration with engineered solutions is expanding their role in contemporary urban construction.

The engineered & sustainable materials segment expects significant growth in the building materials market during the forecast period. Engineered and sustainable materials are rapidly expanding due to the global push for eco-friendly and high-performance construction. These include recycled composites, low-carbon cement, insulated panels, and advanced polymers.

Their lightweight, strong, and energy-efficient characteristics make them suitable for both residential and large-scale projects. They also address modern challenges like reducing carbon footprints and supporting circular economy practices. This segment is expected to drive innovation in the market.

End-User Industry Insights

How Did the Construction & Infrastructure Segment Dominated The Building Materials Market In 2024?

The construction & infrastructure segment dominated the market in 2024. Construction and infrastructure projects are the largest end-use sector for building materials, consuming cement, steel, concrete, composites, and advanced polymers. Infrastructure growth, including roads, bridges, smart cities, and utilities, fuels material demand globally. This sector emphasizes longevity, cost-efficiency, and environmental compliance, driving the adoption of engineered materials alongside traditional supplies. Government investments in large infrastructure projects further sustain this segment’s growth.

The DIY & home improvement segment expects significant growth in the building materials market during the forecast period. DIY and home improvement activities are increasingly contributing to building material demand. Consumers are using paints, insulation, wood panels, composite boards, and eco-friendly materials for renovations, extensions, and interior design projects.

The availability of materials through retail stores and online platforms makes this segment accessible. Sustainability trends, modular construction kits, and user-friendly products are boosting DIY demand in both urban and suburban markets.

Enterprise Size Insights

Which Enterprise Size Segment Dominated The Building Materials Market In 2024?

The large enterprises segment dominated the market in 2024. Large enterprises dominate the market, leveraging economies of scale, advanced production technologies, and wide distribution networks. These companies are increasingly investing in sustainable product development, digital construction solutions, and green certifications to align with evolving global standards. Their significant R&D capacity and ability to form strategic collaborations further consolidate their leadership in driving innovation in building materials.

The SMEs (regional suppliers) segment expects significant growth in the building materials market during the forecast period. Small and medium-sized enterprises (SMEs) are vital contributors to the market, particularly in specialized products, local supply, and niche innovations. SMEs also benefit from government support in housing and infrastructure projects, especially in emerging markets. Their agility and adaptability allow them to respond quickly to changing consumer trends, making them an essential part of the global supply chain.

Building Materials Market Value Chain Analysis

- Chemical Synthesis And Processing: The building materials are synthesized and processed through extraction, injection molding, calendaring, casting, and chemical recycling.

- Key players: ArcelorMittal, CRH (Cement Roadstone Holding), Holcim, and Vulcan Materials Company

- Quality Testing and Certification: The building materials require GreenPro Certification from CII, ISO 14001 certification, ISI Mark, and BIS Quality Control Orders.

- Key players: Bureau of Indian Standards, National Accreditation Board for Testing and Calibration Laboratories, and Green Building Council

- Distribution to Industrial Users: The building materials are distributed to the packaging, automotive, electronics, and construction industries.

- Key players: Holcim, CRH, Saint-Gobain, UltraTech Cement, Ambuja Cements, and Grasim Industries.

Recent Developments

- In September 2025, Richards Building Supply launched contractor CRM, which is a comprehensive, easy-to-use software solution designed specifically for residential and commercial exterior remodeling. The platform aims to deliver to the consumer a wide range of features.(Source: www.roofingcontractor.com)

- In April 2025, the China Building Materials Federation, Conch Group, in collaboration with Huawei, announced the launch of an AI model for cement building materials for the cement industry. The application will help in terms of quality control, production optimization, safe production, and intelligent Q&A.(Source: www.huawei.com)

- In May 2025, ZS2 Technologies announced the launch of second-generation magnesium cement building materials, which align with climate-resilient construction. The material aims to provide the consumer with a durable, noncombustible alternative to conventional materials.(Source: www.worldconstructionnetwork.com)

Building Materials Market Top Companies

- LafargeHolcim

- CEMEX

- HeidelbergCement

- Saint-Gobain

- CRH plc

- Boral Limited

- China National Building Material Group (CNBM)

- ACC Limited

- Ultratech Cement

- Taiwan Cement Corporation

- Knauf Gips KG

- James Hardie Industries

- RPM International Inc.

- Owens Corning

- U.S. Concrete

- Kingfisher plc

- CRH Asia

- Jushi Group Co., Ltd.

- Sika AG

- Georgia-Pacific LLC

Segments Covered

By Product Type

- Cement & Concrete

- Metals & Alloys (Steel, Aluminum, Copper)

- Wood & Engineered Wood Products

- Glass & Ceramics

- Composites & Polymers

- Paints & Coatings

- Insulation Materials

- Others (Bricks, Stones, Roofing Materials)

By Application

- Residential Construction

- Commercial Construction

- Industrial & Infrastructure Projects

- Renovation & Remodeling

- Interior & Exterior Finishing

By Material Type

- Natural Materials (Wood, Stone, Clay)

- Synthetic & Engineered Materials (Concrete, Composites, Polymers)

- Metal-Based Materials (Steel, Aluminum)

- Glass & Ceramics

By End-User Industry

- Construction & Infrastructure

- Real Estate Development

- Industrial Manufacturing

- Interior Design & Fit-Out

- DIY & Home Improvement

By Enterprise Size

- Large Enterprises (Multinational Building Material Manufacturers)

- Small & Medium Enterprises (Regional/Local Manufacturers)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait