Content

Calcium Propionate Market Size & Share Report, 2034

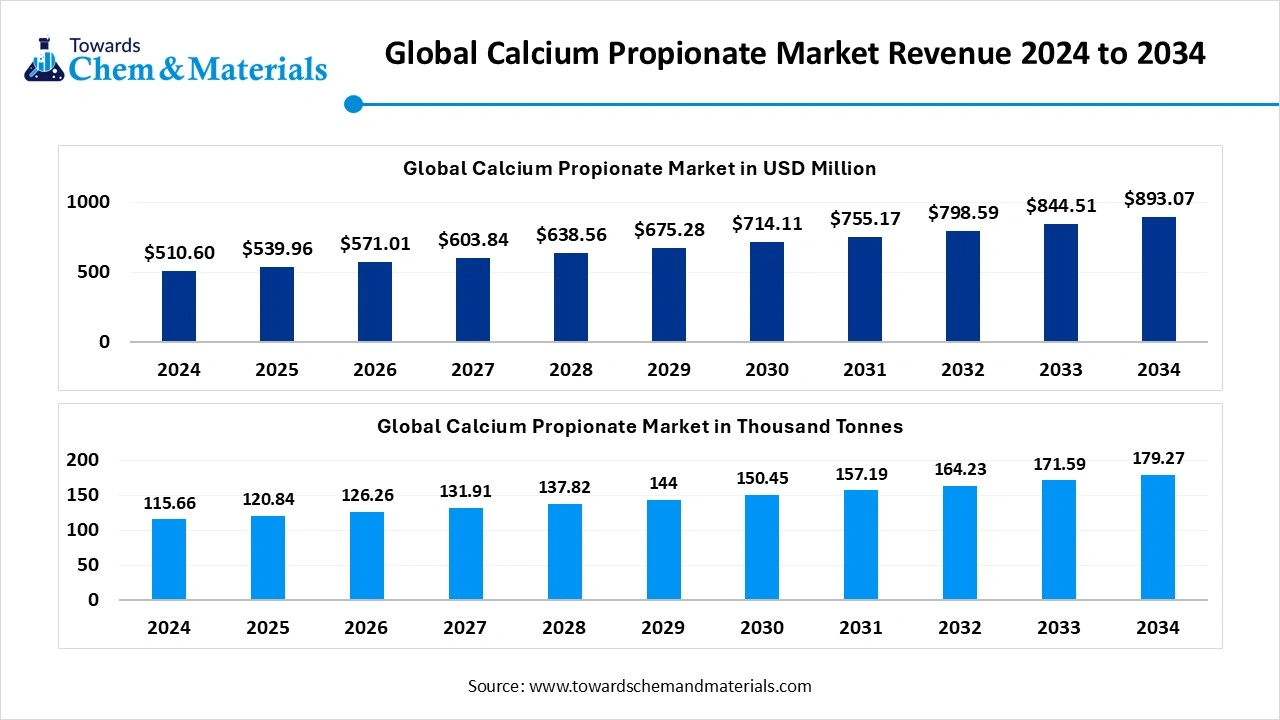

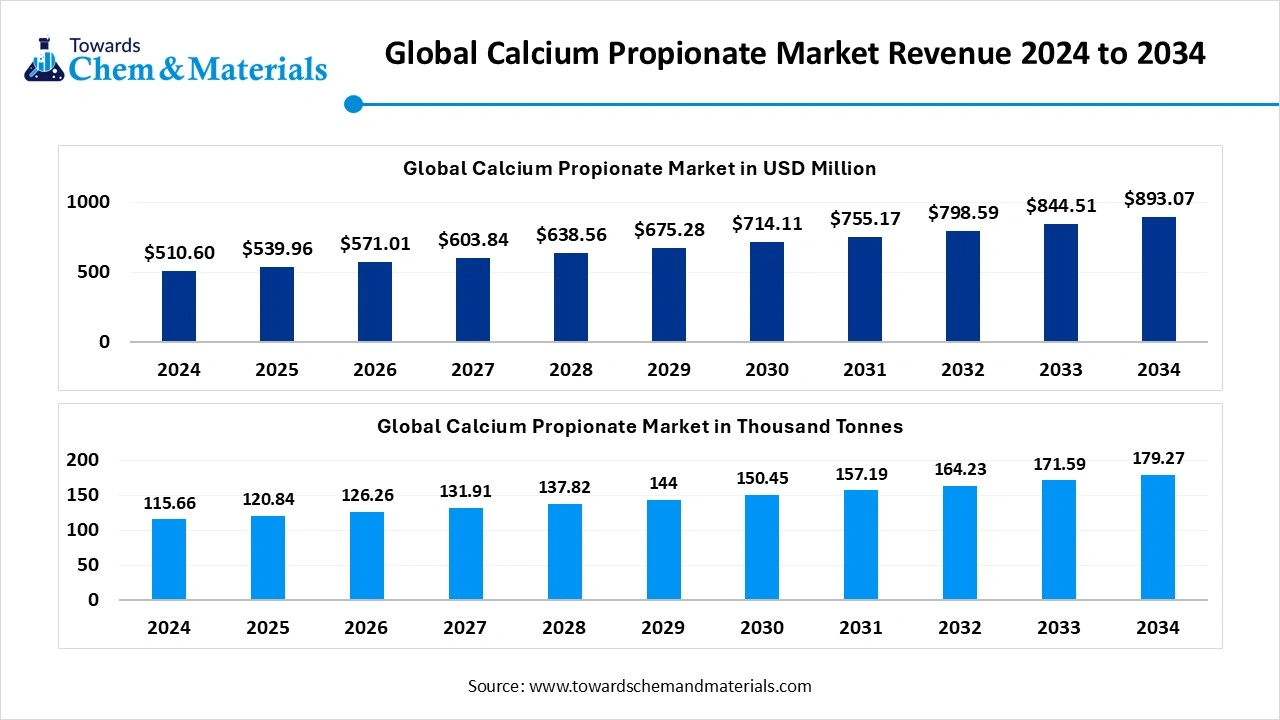

The global calcium propionate market volume was reached at 115.66 thousand tons in 2024 and is expected to be worth around 179.27 thousand tons by 2034, growing at a compound annual growth rate (CAGR) of 4.48% over the forecast period 2025 to 2034. The need for the freshness maintenance of the packaged and ready-to-eat food has accelerated industry potential in recent years.

Key Takeaways

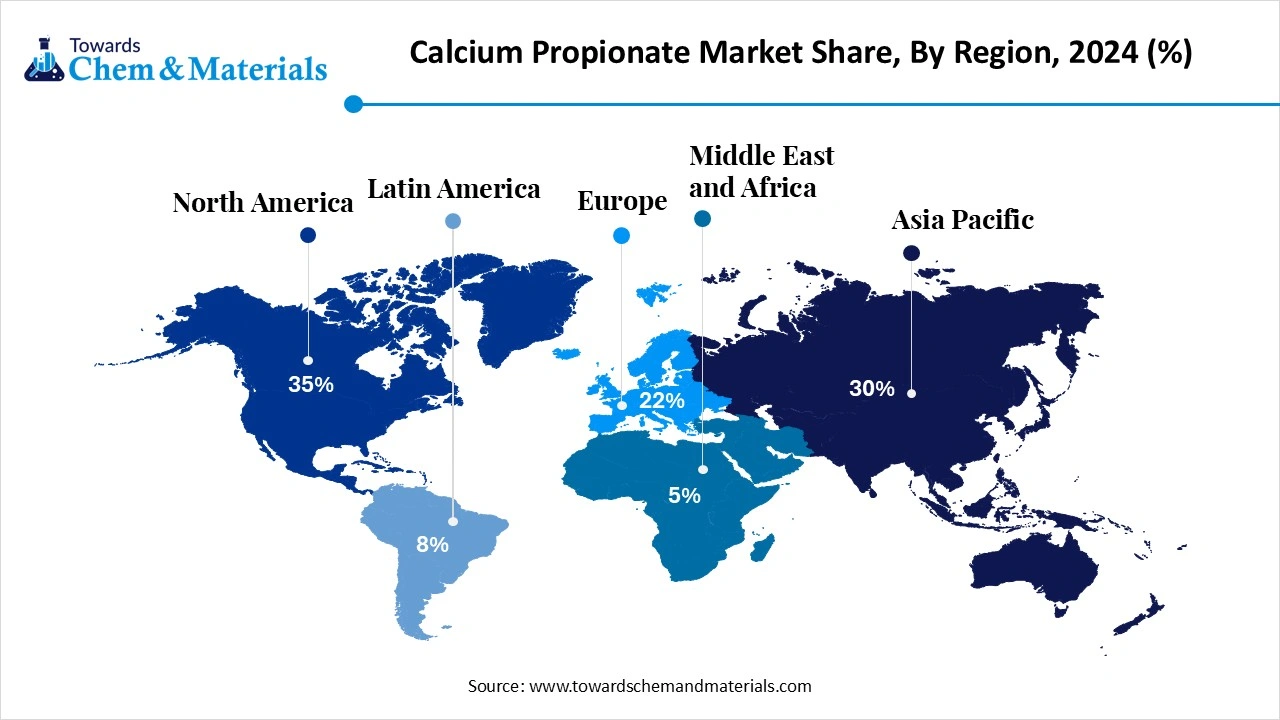

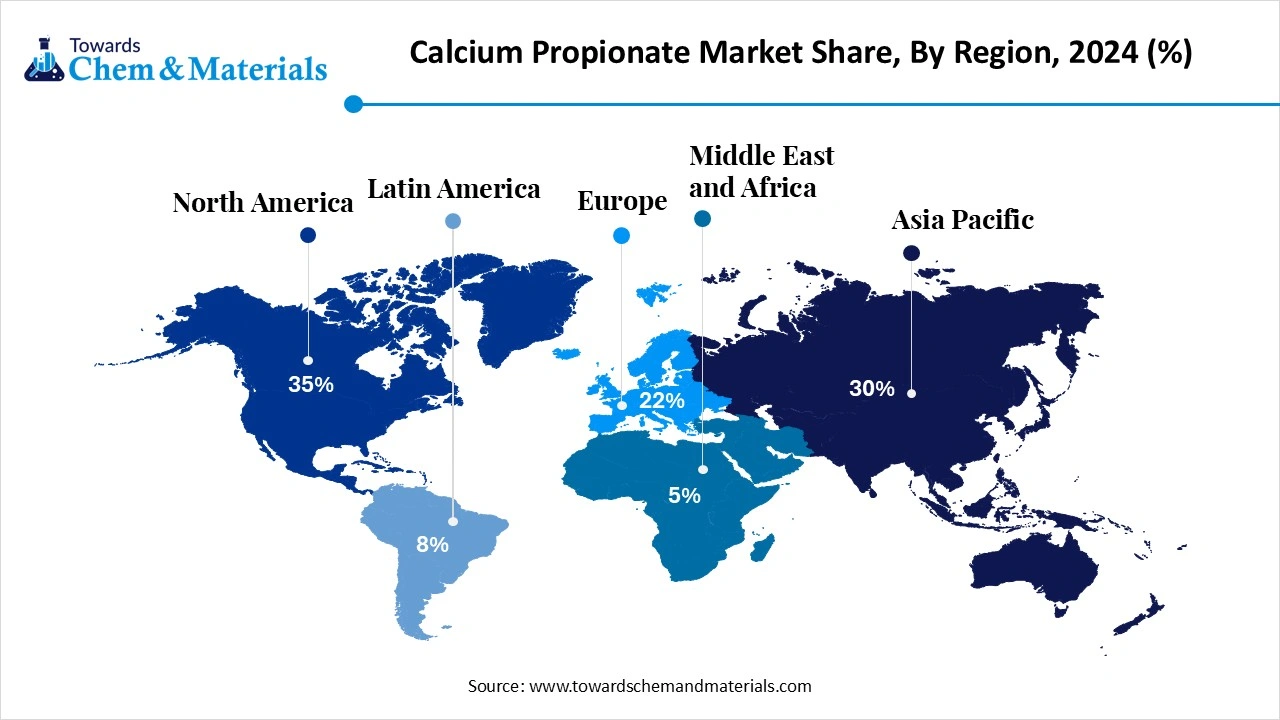

- By region, North America dominated the market in 2024 with 35% of the industry share, akin to the presence of the advanced food processing industry.

- By region, Asia Pacific is expected to grow at a notable rate in the future, due to factors such as sudden changes in food habits and increased need for packaged foods.

- By application type, the food and beverage segment led the market in 2024 with 30% market share, due to calcium propionate being considered the crucial element in the bakery items such the cakes, bread, and pastries.

- By application type, the animal feed segment is expected to grow at the fastest rate in the market during the forecast period, akin to the calcium propionate seen in preventing mold and spoilage in livestock.

- By end use, the food industry segment emerged as the top-performing segment in the calcium propionate market in 2024 with 35% industry share, due to increased adoption of bakery products where freshness is the priority.

- By end use, the confectionery is expected to lead the market in the coming years, due to the increased global consumption of sugary snacks, sweets, and chocolates in recent times.

- By form type, the powder segment led the market in 2024 with 40% market share, because it is easy to mix into flour and other food ingredients during processing.

- By form type, the granules segment is expected to capture the biggest portion of the market in the coming years, because it offers better flow properties and is easier to handle in automated systems.

- By distribution channel, the direct sales segment led the market in 2024 with 45% industry share, because large food and feed manufacturers prefer buying calcium propionate directly from producers.

- By distribution channel, the distributors & suppliers’ segment is expected to grow at the fastest rate in the market during the forecast period, because small and mid-sized businesses may not have access to bulk purchasing from manufacturers.

Market Overview

From Bakery to Barn: The Versatile Uses of Calium Propionate

Calcium Propionate (C6H10CaO4) is a chemical compound commonly used as a preservative in food, beverages, and animal feed to prevent the growth of mold and bacteria. It is a salt of propionic acid and calcium and is known for its antimicrobial properties. Calcium Propionate extends the shelf life of products like bread, cakes, processed foods, and animal feed by inhibiting mold formation and bacterial growth.

Which Factor is Driving the Calcium Propionate Market?

The sudden global shift towards preservative-based packaged food adoption is spearheading the industry growth in the current period. Factors such as the fast-paced lifestyle and urban living trend have actively contributed to the industry's growth in recent years. By maintaining the freshness of ready-to-eat meals, calcium propionate has gained immense industry attention in the past few years.

Market Trends

- The increased preference for clean-label foods is driving industry growth in the current era. Several manufacturers have been using the clean label initiatives to promote their products as safer products in recent years.

- The tightening of global food safety regulations is contributing to industry growth as several food safety regulations have officially accepted calcium propionate approved officially as a safer food preservative.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 120.84 Thousand Tons |

| Expected Volume by 2034 | 179.27 Thousand Tons |

| Growth Rate from 2025 to 2034 | CAGR 4.48% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Application, By End-Use Industry, By Form, By Distribution Channel, By Region |

| Key Companies Profiled | AkzoNobel N.V., Eastman Chemical Company , Penta Manufacturing Company , Galactic S.A., Kemin Industries, Inc. , Hawkins, Inc. , The Chemical Company , Simagchem Corporation , Zhejiang Xinhecheng Chemical Co., Ltd. , Azelis , Jiangsu Kangbo Biochemical Co., Ltd. , Hubei Xinjing Chemical Industry Co., Ltd. , Shanghai Xinyi Industrial Co., Ltd. , Solvay S.A. , Cargill, Inc. , Evonik Industries AG , BASF SE , Tianjin Zhongtai Chemical Co., Ltd. Univar Solutions Inc. , Nantong Acetic Acid Chemical Co., Ltd. |

Market Opportunity

Clean Label Demand Drives Growth for Natural Preservatives

The development of the naturally derived calcium propionate is expected to create lucrative opportunities for the manufacturers during the forecast period, as the growing consumer awareness towards organic food or clean label, and sustainability standards is likely to contribute to the market in the coming years. Furthermore, by developing these natural calcium propionates, the producers can attract the health-conscious consumer as well during the projected period, as per the future industry expectations.

Market Challenge

Consumer Habits Challenge Market Progress

The continuous adoption of traditional preservatives is expected to hinder industry growth during the forecast period. Several consumers are seen using traditional artificial preservatives, which creates growth barriers for the market. Also, the lack of awareness of calcium propionate as a safer option can create hurdles for new entrants in the coming years.

Regional Insights

North America Calcium Propionate Market Trends

North America dominated the calcium propionate market in 2024, akin to the presence of the enlarged and advanced food processing industry in the region. Having stricter food processing laws is leading the industry growth in the current period of time in North America. Also, by stopping the mold growth while extending the shelf life, the calcium propionate is seen under heavy usage in bakery products such as bread and cakes in recent years.

How Are Food Manufacturers in the United States Keeping Products Fresher for Longer?

The United States maintained its dominance in the market, owing to the increased need for the maintenance of the freshness of food in the current period by food manufacturers. Also, the massive consumption of packaged food and baked goods is actively contributing to the industry growth, as the increased demand for food preservatives in the country nowadays.

Asia Pacific Calcium Propionate Market Trends

Asia Pacific is expected to capture a major share of the market during forecast period, owing to factors such as sudden changes in food habits and increased need for packaged foods. Moreover, the individuals are actively demanding more fresh packaged food due to the fast-paced lifestyle in the region nowadays. Also, the regional countries such as India, China, and Japan have seen a heavy processed food and bakery boom in recent years, where calcium propionate is expected to emerge as a crucial element in the upcoming years.

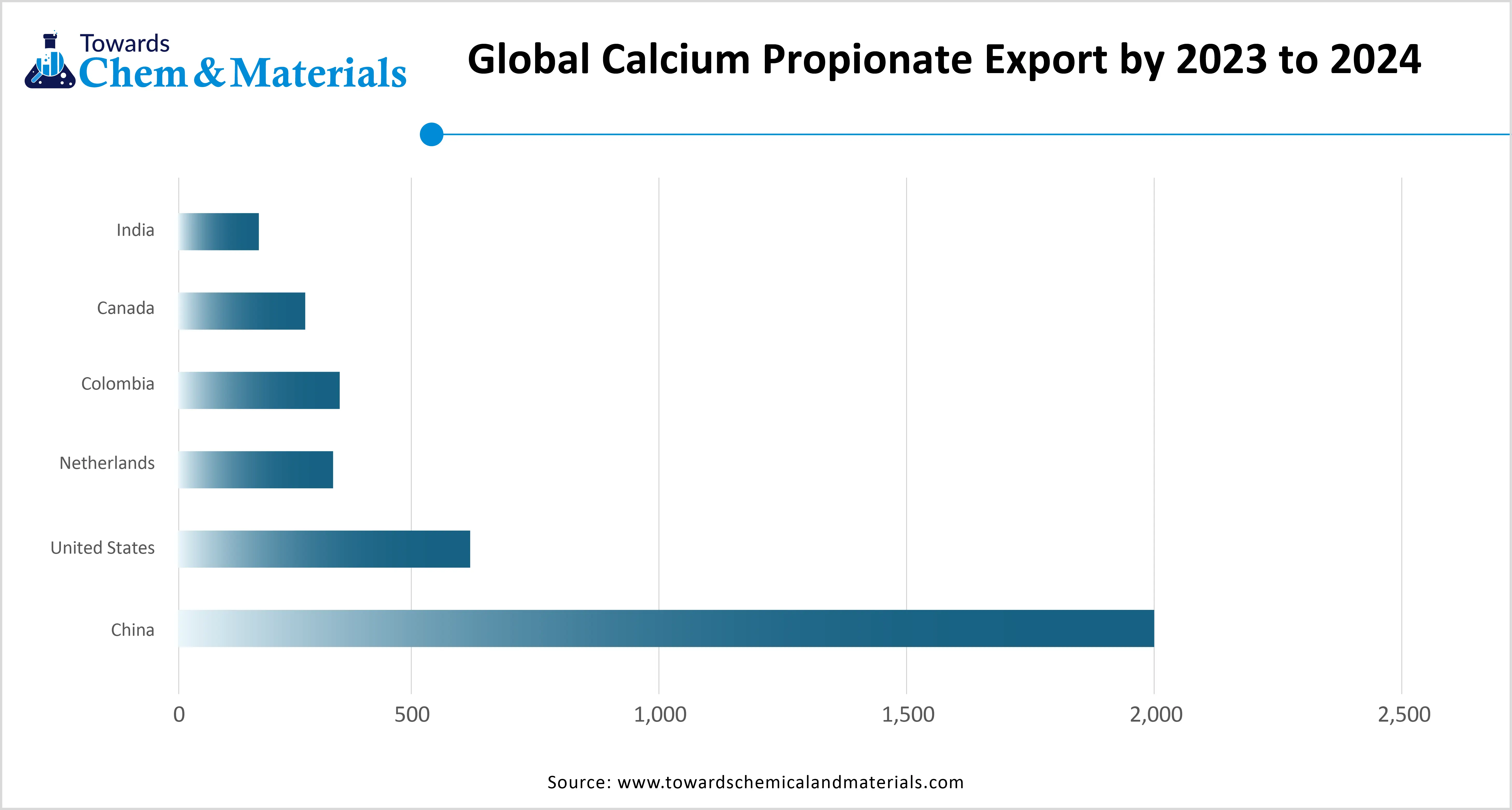

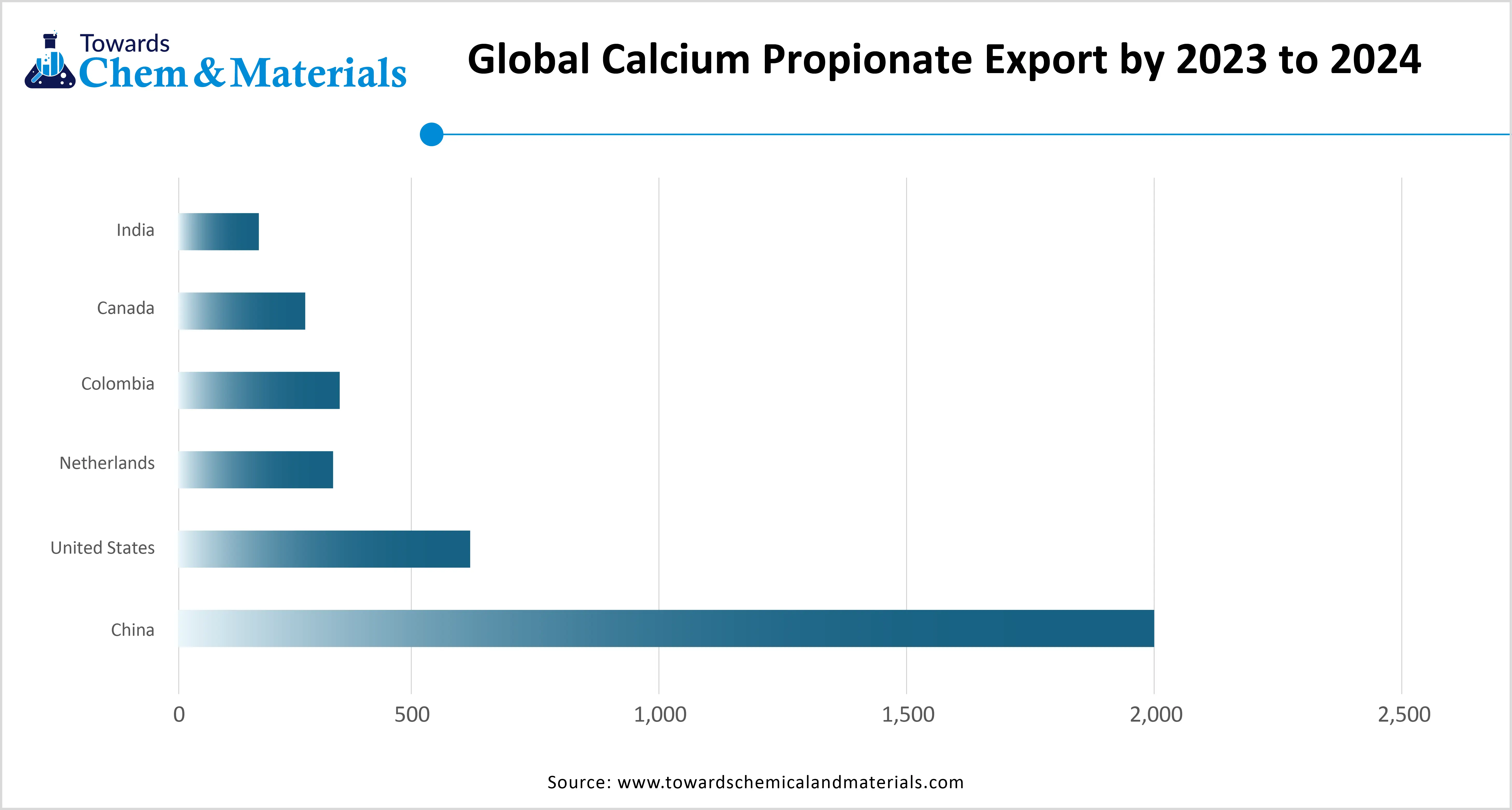

What Role Does Food Safety Play in China’s Calcium Propionate Industry Growth?

China is expected to rise as a dominant country in the region in the coming years, owing to having enlarged food packaging manufacturing infrastructure. Moreover, the government's push for better food safety and the freshness of the food has actively fueled industry growth in recent years. Moreover, the enlarged domestic production capacities and the need for convenience food are expected to gain major industry share during the projected period.

Segmental Insights

Application Type Insights

How did the Food and Beverage Segment Dominate the Calcium Propionate Market in 2024?

The food and beverage segment held the largest share of the market in 2024, due to calcium propionate being considered the crucial element in the bakery items such the cakes, bread, and pastries. Moreover, the changes in dieting habits and fast-paced lifestyles have led to the segment's growth in recent years. Furthermore, by having cost-effectiveness and safety approvals, they are actively contributing to the segment potential in the recent period.

The animal feed segment is expected to grow at a notable rate during the predicted timeframe, akin to the calcium propionate seen in preventing mold and spoilage in livestock. Moreover, the increased need for the freshness maintenance of the livestock while transporting and long-term storage is expected to contribute to the industry growth in the coming years, as per the current market observation.

End Use Insights

Why does the Food Industry Segment Dominate the Calcium Propionate Market in 2024?

The food industry segment held the largest share of the calcium propionate market in 2024, due to increased adoption of bakery products where freshness is the priority. Food processors are heavily seen under the massive use of food preservatives, followed by the regulations that are released by major food safety authorities. Also, a sudden increase in demand for ready-to-eat food has driven the segment's growth in recent years.

The confectionery segment is expected to grow at a notable rate due to the increased global consumption of sugary snacks, sweets, and chocolates in recent times. Also, the manufacturers are heavily using calcium propionate in the processing of these items for greater and longer freshness and the shelf life in the current era. The sudden rise in disposable incomes and innovative product launches is contributing immensely to the segment's growth.

Form Type Insights

Why does the Powder Segment Dominate the Calcium Propionate Market in 2024?

The powder segment dominated the market with the largest share in 2024, because it is easy to mix into flour and other food ingredients during processing. It blends evenly, works effectively, and has a longer shelf life, which makes it ideal for food manufacturers. Powdered calcium propionate is also more commonly available and affordable. It is simple to transport, store, and use in large-scale production. This convenience and efficiency in processing made the powdered form the most preferred and widely used type across the food and feed industries.

The granules segment is expected to grow at a significant rate because it offers better flow properties and is easier to handle in automated systems. As more food processing plants adopt modern machinery, granular forms become more compatible with their equipment. It reduces dust and improves cleanliness during handling. Granules also dissolve more slowly than powder, which can be beneficial in certain applications.

Distribution Channel Insights

Why does the Direct Sales Segment Dominate the Calcium Propionate Market in 2024?

The direct sales segment held the largest share of the calcium propionate market in 2024, because large food and feed manufacturers prefer buying calcium propionate directly from producers. It allows them to get bulk quantities at better prices and ensures a steady, reliable supply. Direct deals often include technical support and faster delivery. Many big companies have long-term agreements with chemical suppliers to meet their ongoing production needs.

The distributors & suppliers segment is expected to grow at a notable rate because small and mid-sized businesses may not have access to bulk purchasing from manufacturers. Distributors help bridge the gap by offering flexible order sizes and localized support. As calcium propionate demand spreads to smaller bakeries, regional feed mills, and new markets, these suppliers play a key role in expanding reach.

Recent Developments

- In August 2024, Manuchar acquired the key player of the chemical distributor Proquiel Quimicos. The main motive behind the acquisition is to expand the portfolio and company footprint in Chile for the coming years, as per the report published by the company.(Source: www.chemanalyst.com)

Calcium Propionate Market Top Companies

- AkzoNobel N.V.

- Eastman Chemical Company

- Penta Manufacturing Company

- Galactic S.A.

- Kemin Industries, Inc.

- Hawkins, Inc.

- The Chemical Company

- Simagchem Corporation

- Zhejiang Xinhecheng Chemical Co., Ltd.

- Azelis

- Jiangsu Kangbo Biochemical Co., Ltd.

- Hubei Xinjing Chemical Industry Co., Ltd.

- Shanghai Xinyi Industrial Co., Ltd.

- Solvay S.A.

- Cargill, Inc.

- Evonik Industries AG

- BASF SE

- Tianjin Zhongtai Chemical Co., Ltd.

- Univar Solutions Inc.

- Nantong Acetic Acid Chemical Co., Ltd.

Segment Covered

By Application

- Food & Beverages

- Baked Goods

- Dairy Products

- Beverages

- Meat & Poultry Products

- Processed Foods

- Animal Feed

- Poultry Feed

- Cattle Feed

- Aquaculture Feed

- Pet Food

- Others

- Cosmetics

- Pharmaceuticals

- Personal Care Products

By End-Use Industry

- Food Industry

- Industrial Bakeries

- Confectioneries

- Frozen Foods

- Canned & Packaged Foods

- Feed Industry

- Livestock

- Poultry

- Aquaculture

- Pharmaceuticals

- Tablets

- Capsules

- Cosmetics & Personal Care

- Creams & Lotions

- Hair Care Products

- Skin Care Products

- Agriculture

- Crop Protection

By Form

- Powder

- Granules

- Liquid

By Distribution Channel

- Direct Sales

- Online Sales

- Distributors & Suppliers

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE