Content

What is the Current North America Calcium Carbonate Market Size and Volume?

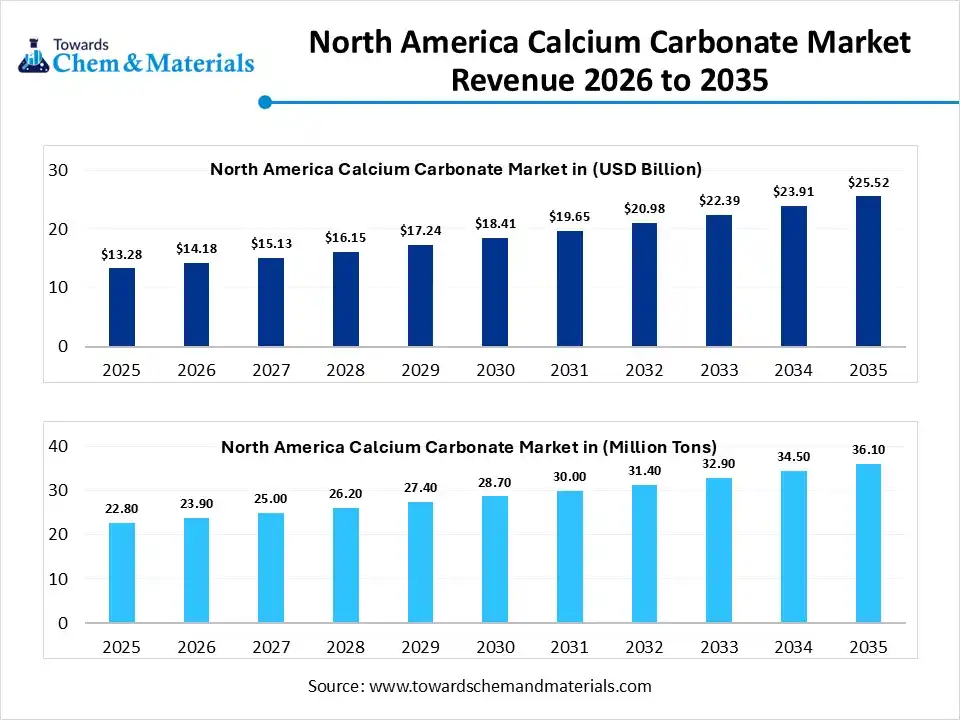

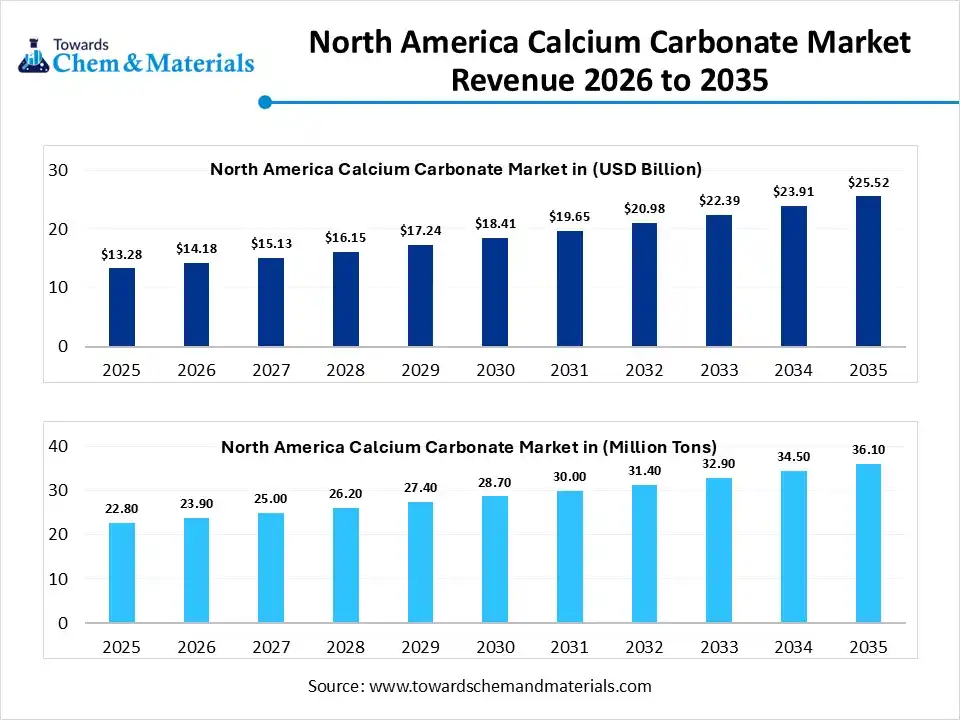

The North America calcium carbonate market size was estimated at USD 13.28 billion in 2025 and is expected to increase from USD 14.18 billion in 2026 to USD 25.52 billion by 2035, growing at a CAGR of 6.75% from 2026 to 2035. In terms of volume, the market is projected to grow from 22.80 million tons in 2025 to 36.10 million tons by 2035. growing at a CAGR of 4.70% from 2026 to 2035. The rising construction projects, demand for high-quality paper/packaging, advanced plastics, pharmaceutical applications, and supportive government initiatives for sustainable manufacturing drive the growth of the market.

Report Highlights

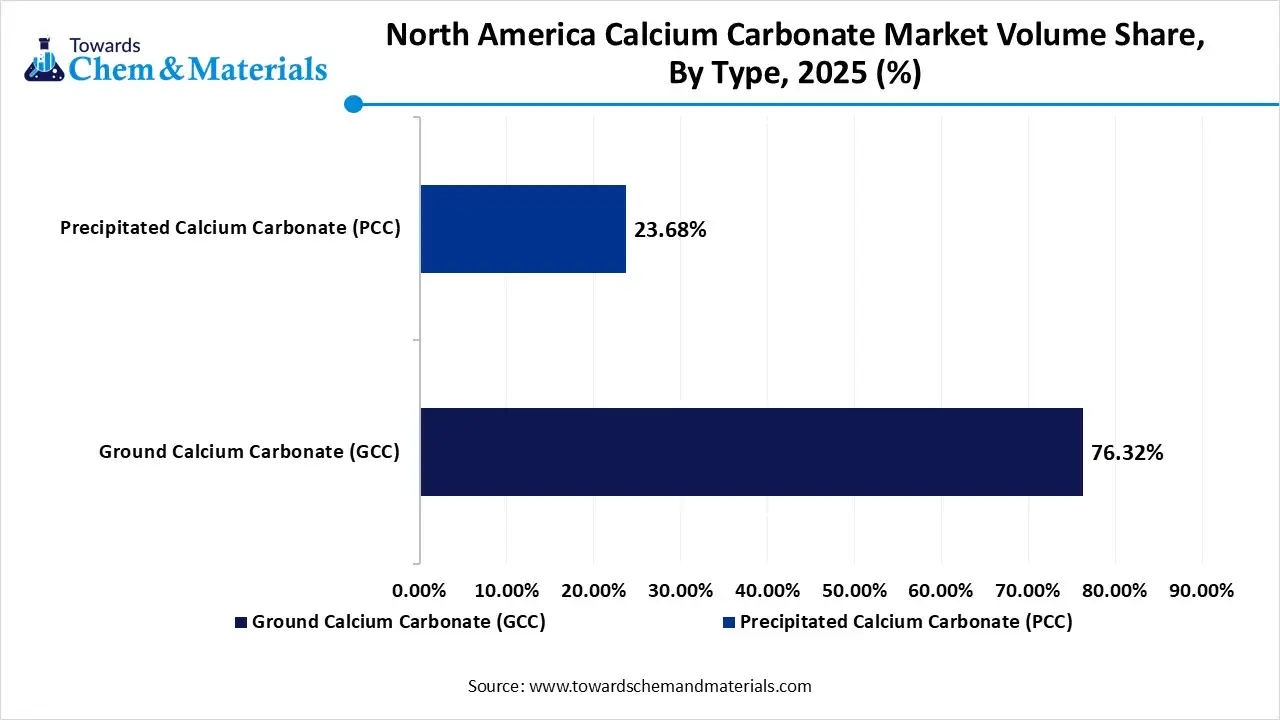

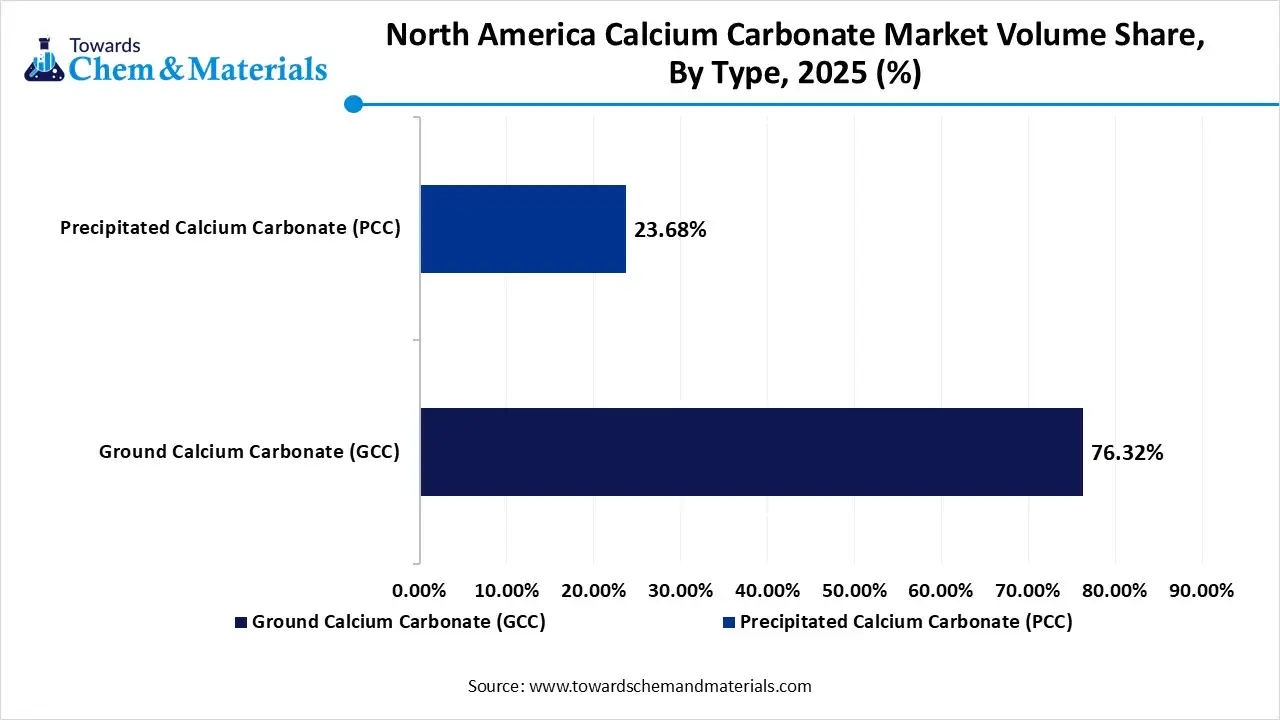

- By type, the ground calcium carbonate segment dominated the market and accounted for the largest volume share of 76.32% in 2025.

- By type, the precipitated calcium carbonate segment is expected to grow at the fastest CAGR of 6.19% from 2026 to 2035 in terms of volume.

- By particle size, the medium (1–10 μm) segment led the market with the largest revenue volume share of 48.00% in 2025.

- By product grade, the industrial grade segment dominated the market and accounted for the largest volume share of 68.00% in 2025.

- By coating treatment, the uncoated segment led the market with the largest revenue volume share of 72% in 2025.

- By application, the paper and pulp segment dominated the market and accounted for the largest volume share of 41% in 2025.

What Is The Significance Of The North America Calcium Carbonate Market?

The North America calcium carbonate market comprises the industrial ecosystem focused on the extraction, processing, and commercialization of calcium carbonate minerals across the continent. the market is significant due to its widespread use as a versatile filler, extender, and additive across crucial sectors like construction, paper, plastics, paints & coatings, and dietary supplements, driving robust growth supported by infrastructure development, demand for high-performance materials, and a shift towards sustainable products, though facing challenges from declining paper use in some areas.

North America Calcium Carbonate Market Growth Trends:

- Sustainability: Calcium carbonate is favored as a natural, cost-effective filler in green products, aligning with the goals of the circular economy.

- Government Support: Initiatives such as the CHIPS Act and green building codes encourage domestic production and the use of critical materials.

- Production Expansion: Companies like Imerys are investing in capacity to meet rising demand.

- Focus on High-Purity & Nano Grades: Shift towards advanced, value-added products (PCC) for specialty polymers, pharma, and electronics.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 14.18 Billion / 23.90 Million tons |

| Revenue Forecast in 2035 | USD 25.52 Billion / 36.10 Million tons |

| Growth Rate | CAGR 6.75% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (MillionTons) |

| Segment Covered | By Type, By Particle Size, By Product Grade, By Coating Treatment, By Application, By Region |

| Key companies profiled | J.M. Huber Corporation, Imerys S.A., Omya AG, Minerals Technologies Inc, Mississippi Lime Company, GLC Minerals , Carmeuse , Lhoist North America , Sibelco , United States Lime & Minerals, Inc. , Graymont Limited , Columbia River Carbonates , Blue Mountain Minerals , ILC Resources , Austin White Lime Company , Greer Limestone Company , National Lime & Stone Company , Pete Lien & Sons, Inc. , CalPortland , Chemstone Corporation |

Key Technological Shifts In The North America Calcium Carbonate Market:

The North America calcium carbonate market is undergoing a notable technological shift driven by innovation in production processes, product development, and sustainability initiatives. Key trends include the increasing adoption of advanced forms such as nano-precipitated calcium carbonate (NPCC), where finer particle sizes and surface modifications improve dispersion, compatibility, and performance in high-tech applications like plastics, coatings, and specialty materials.

Trade Analysis Of the North America Calcium Carbonate Market: Import & Export Statistics

- Based on United States Export data, the U.S. shipped 828 shipments of Calcium Carbonate from May 2024 to April 2025 (TTM). These shipments were sent by 221 U.S. exporters to 175 buyers, showing a 28% increase compared to the previous year.

- Most U.S. Calcium Carbonate exports head to Mexico, China, and Brazil.

- Globally, Vietnam, China, and Malaysia are the leading exporters, with Vietnam leading at 16,925 shipments, followed by China with 10,984, and Malaysia with 9,633 shipments.

- According to Global Export data, the world exported 1,045 shipments of Calcium Carbonate to the U.S. from June 2024 to May 2025 (TTM). These exports involved 211 exporters and 212 U.S. buyers.

Most Calcium Carbonate exports from the world are destined for India, Vietnam, and the U.S.

North America Calcium Carbonate Market -- Value Chain Analysis

- Extraction and Processing: Calcium carbonate in North America is produced through processes such as limestone and marble quarrying, crushing, grinding, precipitation (PCC production), surface treatment, and particle size classification for industrial and specialty applications.

- Key players: Omya AG, Imerys, Minerals Technologies Inc., Mississippi Lime Company

- Quality Testing and Certification: Calcium carbonate requires certifications related to chemical purity, particle size consistency, environmental compliance, and application-specific performance. Key certifications include ISO quality standards, ASTM material specifications, FDA approval for food and pharmaceutical grades, and REACH compliance for exports.

- Key players: ISO (International Organization for Standardization), ASTM International, FDA (U.S. Food and Drug Administration), UL Solutions

- Distribution to Industrial Users: Calcium carbonate is distributed to paper and pulp, plastics, paints and coatings, construction materials, pharmaceuticals, food and beverages, and rubber manufacturing industries across North America.

- Key players: Omya AG, Imerys, Huber Engineered Materials.

North America Calcium Carbonate Regulatory Landscape

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. Environmental Protection Agency (EPA) | Clean Air Act (CAA) Clean Water Act (CWA) Resource Conservation and Recovery Act (RCRA) |

Air emissions from processing/grinding Stormwater and wastewater discharge Waste classification & disposal |

Calcium carbonate (ground/powder) is generally non-hazardous, but dust management and particulate emissions from milling/handling must meet CAA standards; RCRA tracks waste from processing sites |

| Occupational Safety and Health Administration (OSHA) | OSHA standards (29 CFR 1910) Hazard Communication Standard (HCS) |

Worker exposure limits (silica/dust) Labeling and hazard communication for powders |

OSHA regulates respirable crystalline silica (often present in calcium carbonate mining) rather than the carbonate itself; facilities must monitor dust and protect worker health. | |

| Department of Transportation (DOT) | Hazardous Materials Regulations (49 CFR) | Classification of transport shipments Packaging and labeling of bulk powders |

Calcium carbonate is typically non-hazardous for transport, but mixed loads with additives or hazardous binders may require HM classification. | |

| U.S. Food and Drug Administration (FDA) | CFR Title 21 (Food Additives/GRAS) | Food-contact approval for calcium carbonate (food/pharma grade) | High-purity calcium carbonate used in food/medicine must meet FDA GRAS criteria and applicable CFR specs. | |

| Canada | Environment and Climate Change Canada (ECCC) | Canadian Environmental Protection Act (CEPA) National Pollutant Release Inventory (NPRI) |

Chemical substance assessment Emission and discharge reporting |

Calcium carbonate is typically considered low-risk, but facilities may need to report emissions to the NPRI if thresholds are exceeded. |

| Canadian Centre for Occupational Health and Safety (CCOHS) | Workplace Hazardous Materials Information System (WHMIS) | SDS, labeling, worker training | WHMIS requires Safety Data Sheets and hazard communication for chemical handling in manufacturing and processing. |

Segmental Insights

Type Insights

Which Type Segment Dominated The North America Calcium Carbonate Market In 2025?

The ground calcium carbonate segment dominated the market with a share of 76.32% in 2025. Ground calcium carbonate dominates volume consumption in North America due to its cost efficiency and wide availability. GCC is extensively used in paper, plastics, rubber, and construction applications where particle size control and brightness are important, but ultra-high purity is not critical. Strong demand from the packaging and infrastructure sectors continues to support steady growth.

The precipitated calcium carbonate segment is projected to grow at fastest CAGR between 2026 and 2035 in the market. Precipitated calcium carbonate holds a significant share in value terms owing to its controlled particle morphology and higher purity. PCC is preferred in specialty paper coatings, pharmaceuticals, food additives, and high-performance plastics. Growth is driven by rising demand for lightweight paper, enhanced surface properties, and pharmaceutical excipients across the U.S. and Canada.

North America Calcium Carbonate Market Volume and Share, By Type, 2025-2035

| By Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Ground Calcium Carbonate (GCC) | 76.32% | 17.4 | 26.8 | 4.93% | 74.32% |

| Precipitated Calcium Carbonate (PCC) | 23.68% | 5.4 | 9.3 | 6.19% | 25.68% |

Particle Size Insights

How Did the Medium Segment Dominated The North America Calcium Carbonate Market In 2025?

The medium (1–10 μm) segment dominated the market with a share of 48% in 2025. Medium particle size calcium carbonate is highly used in plastics compounding, paper filling, and paints and coatings. This segment benefits from balanced mechanical reinforcement, opacity, and dispersion properties. Stable demand from packaging, consumer goods, and building materials supports consistent market expansion in North America.

The nano-scale segment is projected to grow at fastest CAGR between 2026 and 2035 in the market. Nano-scale calcium carbonate is gaining traction in advanced polymers, specialty coatings, biomedical formulations, and high-performance composites. Its superior surface area, reinforcement capabilities, and functional performance drive adoption in premium applications. Increasing R&D investment and innovation in nanomaterials are key growth drivers in this emerging segment.

Product Grade Insights

Which Product Grade Segment Dominated The North America Calcium Carbonate Market In 2025?

The industrial grade segment dominated the market with a share of 68% in 2025. Industrial-grade calcium carbonate accounts for the largest market share due to its extensive use in paper, plastics, rubber, paints, adhesives, and construction materials. Its cost-effectiveness and adaptability make it ideal for high-volume applications. Growth is supported by manufacturing recovery and infrastructure development across North America.

The pharmaceutical grade segment is projected to grow at fastest CAGR between 2026 and 2035 in the market. Pharmaceutical-grade calcium carbonate is characterized by high purity and strict regulatory compliance. It is widely used as an excipient, dietary supplement, antacid, and calcium fortification agent. Rising healthcare expenditure, aging populations, and growing nutraceutical consumption are driving demand for this premium segment.

Coating Treatment Insights

How Did the Uncoated Segment Dominated The North America Calcium Carbonate Market In 2025?

The uncoated segment dominated the market with a share of 72% in 2025. Uncoated calcium carbonate is primarily used in paper, paints, and construction applications where surface compatibility requirements are minimal. Its lower cost and ease of processing make it suitable for bulk industrial uses. Stable consumption from traditional industries continues to sustain this segment.

The stearic acid-coated segment is projected to grow at fastest CAGR between 2026 and 2035 in the market. Stearic acid-coated calcium carbonate is extensively used in plastics and polymer applications due to improved dispersion, hydrophobicity, and mechanical performance. The coating enhances compatibility with polymer matrices, supporting growth in automotive, packaging, and consumer goods manufacturing across North America.

Application Insights

Which Application Segment Dominated The North America Calcium Carbonate Market In 2025?

The paper and pulp segment dominated the market with a share of 41% in 2025. The paper and pulp industry represents a key application segment, utilizing calcium carbonate as a filler and coating pigment to improve brightness, opacity, and printability. Although digitalization has moderated demand for printing paper, packaging paper, and specialty paper grades continue to drive steady consumption.

The plastics and polymers segment is projected to grow at fastest CAGR between 2026 and 2035 in the market. Plastics and polymers are a major growth application for calcium carbonate, particularly in packaging, automotive components, and consumer products. Calcium carbonate enhances stiffness, dimensional stability, and cost efficiency. Increasing demand for lightweight and recyclable plastic materials supports long-term growth in this segment.

Country Insights

United States Calcium Carbonate Market Trends

The United States calcium carbonate market is a mature and steadily growing industry driven by demand from construction, paper, plastics, paints and coatings, and pharmaceuticals. Calcium carbonate is widely used as a filler and extender because it improves strength, brightness, and durability while keeping costs low. Growth in residential and commercial construction supports demand through its use in cement, concrete, and asphalt, while the plastics and rubber industries rely on it to enhance product performance and processing efficiency.

North America Calcium Carbonate Market Volume and Share, By Country, 2025-2035

| By Country | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| U.S. | 78.00% | 17.8 | 27.5 | 4.94% | 76.07% |

| Canada | 10.12% | 2.3 | 4.0 | 6.34% | 11.12% |

| Mexico | 8.23% | 1.9 | 3.4 | 6.81% | 9.41% |

| Rest of NA | 3.65% | 0.8 | 1.2 | 4.41% | 3.40% |

Canada Calcium Carbonate Market Trends

The Canada calcium carbonate market is a growing industrial minerals industry serving a range of end-use sectors such as paper, plastics, construction, and specialty applications. Market expansion is also supported by technological improvements in processing and a shift toward eco-friendly and high-purity products, though the industry faces challenges from raw material price fluctuations and environmental regulations on mining and processing.

Recent Developments

- In October 2025, CarbonFree and Univar Solutions USA signed a Letter of Intent to distribute Endurocal, a carbon-neutral, mine-free calcium carbonate. Produced using "SkyCycle" technology that captures CO2 and calcium from industrial waste gases, this high-purity mineral offers a sustainable alternative to imported calcium carbonate. The partnership aims to supply North American markets with this domestically produced material.(Source : carbonherald.com)

- In September 2025, the Indian government imposed a five-year anti-dumping duty on calcium carbonate filler masterbatch imported from Vietnam. The measure follows a Directorate General of Trade Remedies (DGTR) investigation, which found Vietnamese exporters were dumping the material into the Indian market, causing injury to domestic manufacturers.(Source: scanx.trade)

- In May 2025, MIDROC Investment Group launched Ethiopia's first coated calcium carbonate plant in May 2025, located in the Afar Region. The facility has an 18,000-ton annual capacity and aims to replace significant imports for various industries, using 97% local raw materials.(Source: www.fanamc.com)

Top Players in the North America Calcium Carbonate Market & Their Offerings:

- J.M. Huber Corporation: J.M. Huber is a major supplier of calcium carbonate products used in plastics, coatings, adhesives, and paper applications. The company offers ground calcium carbonate (GCC) and precipitated calcium carbonate (PCC) grades tailored for industrial fillers and performance enhancement.

- Imerys S.A.: Imerys operates extensive calcium carbonate production and processing facilities in North America, providing high-quality GCC and specialty PCC for paper, paint, plastics, and construction materials. Its materials are valued for brightness, particle size control, and consistency.

- Omya AG: Omya is a key global producer of industrial minerals, including calcium carbonate. In North America, it supplies a broad range of GCC and PCC products for applications such as coatings, sealants, plastics, and paper, with a focus on sustainable sourcing.

- Minerals Technologies Inc: Minerals Technologies offers calcium carbonate products under its specialty additives and performance materials portfolio. The company’s PCC grades are widely used in paper coatings, polymers, and advanced industrial applications that require high brightness and controlled particle morphology.

- Mississippi Lime Company: Mississippi Lime is a prominent manufacturer of precipitated and ground calcium carbonate used in construction, agriculture, plastics, and industrial applications. Its products are known for purity and versatility across multiple end-use sectors.

- GLC Minerals

- Carmeuse

- Lhoist North America

- Sibelco

- United States Lime & Minerals, Inc.

- Graymont Limited

- Columbia River Carbonates

- Blue Mountain Minerals

- ILC Resources

- Austin White Lime Company

- Greer Limestone Company

- National Lime & Stone Company

- Pete Lien & Sons, Inc.

- CalPortland

- Chemstone Corporation

Segments Covered

By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

By Particle Size

- Coarse (>10 μm)

- Medium (1–10 μm)

- Fine (0.1–1 μm)

- Ultrafine (<0.1 μm)

- Nanoscale

By Product Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

- Technical/Laboratory Grade

By Coating Treatment

- Uncoated Calcium Carbonate

- Stearic Acid Coated

- Silane/Organic Coated

By Application

- Paper and Pulp

- Filling

- Coating

- Plastics and Polymers

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polypropylene (PP)

- Polystyrene (PS)

- Paints and Coatings

- Architectural Coatings

- Industrial Coatings

- Marine Coatings

- Building and Construction

- Cement and Concrete

- Drywall and Joint Compounds

- Roofing Materials

- Adhesives and Sealants

- Pharmaceuticals and Healthcare

- Antacids

- Calcium Supplements

- Drug Carrier Systems

- Food and Beverage

- Food Fortification

- Anti-caking Agents

- Agriculture and Forestry

- Soil Liming

- Fertilizer Additives

- Animal Feed

- Rubber and Elastomers

- Glass and Ceramics

- Environmental Applications (Water/Flue Gas Treatment)

By Region

- U.S.

- Canada

- Mexico

- Rest of NA