Content

What is the Current Printed Electronic Materials Market Size and Volume?

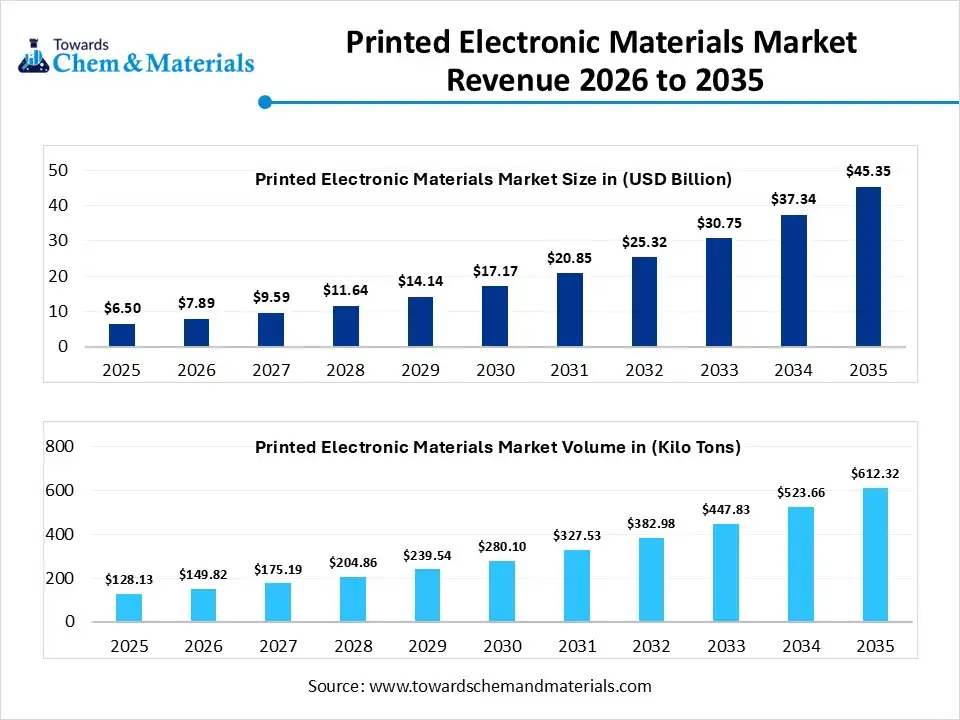

The global printed electronic materials market size was estimated at USD 6.50 billion in 2025 and is expected to increase from USD 7.89 billion in 2026 to USD 45.35 billion by 2035, growing at a CAGR of 21.44% from 2026 to 2035. In terms of volume, the market is projected to grow from 128.13 kilo tons in 2025 to 612.32 kilo tons by 2035. growing at a CAGR of 16.93% from 2026 to 2035. Asia Pacific dominated the printed electronic materials market with the largest volume share of 56.5% in 2025.The growth of the market is driven by the growing demand for lightweight materials, technological advancements, and the growing demand from various sectors.

Key Takeaway

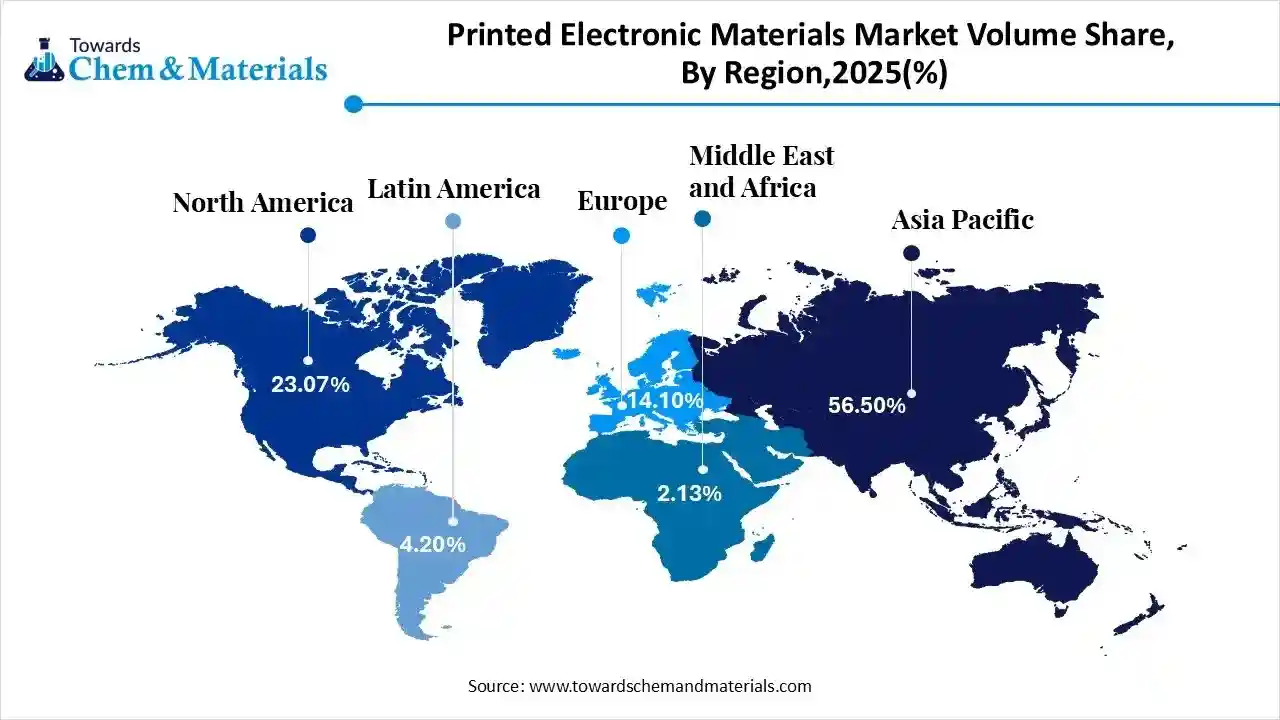

- The Asia Pacific dominated the printed electronic materials market with the largest volume share of 56.5% in 2025.

- The printed electronic materials market in North America is expected to grow at a substantial CAGR of 20.02% from 2026 to 2035.

- The Europe printed electronic materials market segment accounted for the major volume share of 14.10% in 2025.

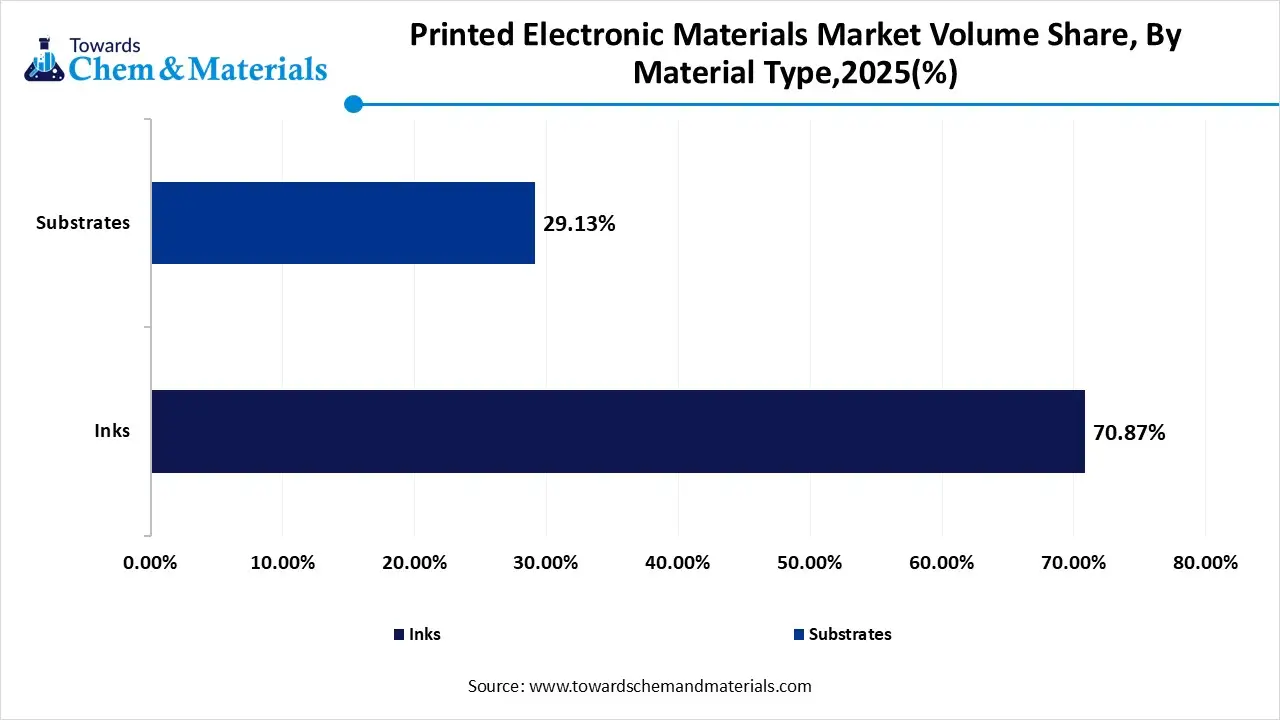

- By material type, the inks segment dominated the market and accounted for the largest volume share of 71% in 2025.

- By material type, the substrates segment is expected to grow at the fastest CAGR of 20.73% from 2026 to 2035 in terms of volume.

- By ink chemistry, the conductive silver inks segment led the market with the largest revenue volume share of 64% in 2025.

- By technology, the screen-printing segment dominated the market and accounted for the largest volume share of 44% in 2025.

- By application, the displays segment led the market with the largest revenue volume share of 42% in 2025.

Market Overview

What Is The Significance Of The Printed Electronic Materials Market?

The printed electronic materials market is significant because it enables the creation of low-cost, lightweight, flexible electronics for IoT, wearables, automotive, and healthcare, driving innovation in smart packaging, remote monitoring, and consumer devices by offering cost-effective mass production and reduced material waste compared to traditional methods, fueling rapid growth across industries. Its importance lies in making electronics adaptable, integrated into everyday objects, and sustainable, bridging the gap between digital and physical worlds.

Printed Electronic Materials Market Growth Trends:

- IoT & Wearables: Huge driver, enabling smart sensors, flexible displays, and connected devices with low power needs.

- Flexible & Smart Displays: Foldable organic LCDs and advanced flexible screens are a major consumer trend.

- Smart Packaging: Increasing use of printed electronics for functionality in packaging.

- Healthcare: Growth in printed medical sensors, diagnostics, and flexible batteries.

- Automotive: Growing adoption for in-car displays, sensors, and integrated electronics.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 7.89 Billion / 149.82 Kilo Tons |

| Revenue Forecast in 2035 | USD 45.35 Billion / 612.32 Kilo Tons |

| Growth Rate | CAGR 21.44% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | North America |

| Segment Covered | By Material Type, By Ink Chemistry, By Technology, By Application, By Regions |

| Key companies profiled | DuPont de Nemours, Inc., Henkel AG & Co. KGaA, BASF SE, Agfa-Gevaert Group, Nissha Co., Ltd., 3M Company, NovaCentrix, Sun Chemical (DIC Corporation), Heraeus Holding GmbH, Ink-T (Korea), Samsung Electronics, LG Display Co., Ltd., Nissha Co., Ltd., Toyo Ink SC Holdings, Intrinsiq Materials, E Ink Holdings Inc. |

Key Technological Shifts in the Printed Electronic Materials Market:

Key shifts in printed electronics involve a move towards sustainable, functional materials for IoT, smart packaging, automotive, and healthcare, driven by digital printing, 3D printing, and roll-to-roll techniques, enabling flexible, lightweight, and cost-effective wearable sensors, displays, and RFID for efficient tracking and enhanced user experience.

Trade Analysis of Printed Electronic Materials Market: Import & Export Statistics

- According to Global Export data, between July 2024 and June 2025 (TTM), the world shipped 191,598 shipments of Electronic Print Boards.

- The majority of these exports went to Vietnam, South Korea, and Japan.

- Globally, the leading exporters of Electronic Print Boards are Vietnam, China, and South Korea. Vietnam tops the list with 192,408 shipments, followed by China with 152,490 shipments, and South Korea with 43,940 shipments.

Printed Electronic Materials Market Value Chain Analysis

- Material Formulation and Processing:Printed electronic materials are developed through processes such as conductive ink formulation, dielectric and semiconductor material synthesis, rheology optimization, dispersion, and compatibility tuning for printing techniques including inkjet, screen, gravure, and flexographic printing.

- Key players: DuPont, Henkel AG & Co. KGaA, Sun Chemical, Toyo Ink Group

- Quality Testing and Certification: Printed electronic materials require certifications ensuring electrical performance, printability, material stability, and compliance with electronics and environmental regulations. Key certifications include ISO quality standards, IEC electronic material standards, RoHS compliance, and REACH registration.

- Key players: ISO (International Organization for Standardization), IEC (International Electrotechnical Commission), TÜV SÜD, UL Solutions.

- Distribution to Industrial Users: Printed electronic materials are supplied to manufacturers of flexible electronics, sensors, RFID tags, displays, smart packaging, photovoltaics, and wearable devices.

- Key players: Architectural Plastics Inc. and Arkay Plastics Inc.

Printed Electronic Materials Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | EPA (Environmental Protection Agency) OSHA (Occupational Safety & Health Administration) FCC (Federal Communications Commission) FDA (where applicable) |

|

|

| European Union | European Chemicals Agency (ECHA) European Commission |

|

|

| India | MoEFCC (Ministry of Environment, Forest & Climate Change) CPCB (Central Pollution Control Board) BIS (Bureau of Indian Standards) |

|

|

Segmental Insights

Material Type Insights

Which Material Type Segment Dominated the Printed Electronic Materials Market in 2025?

The inks segment volume was valued at 90.81 kilo tons in 2025 and is projected to reach 408.97 kilo tons by 2035, expanding at a CAGR of 18.20% during the forecast period from 2025 to 2035. The inks segment dominated the market accounting for approximately 71% share in 2025, as they define the conductivity, flexibility, and functional performance of printed devices. Growing adoption of flexible electronics, wearable devices, RFID tags, and smart packaging continues to drive demand for advanced printed electronic inks with improved conductivity, adhesion, and environmental stability.

The substrates segment volume was valued at 37.32 kilo tons in 2025 and is projected to reach 203.35 kilo tons by 2035, expanding at a CAGR of 20.73% during the forecast period from 2025 to 2035, as they play a key role in determining mechanical flexibility, durability, and thermal resistance. Increasing demand for lightweight, bendable, and cost-effective electronic components in displays, sensors, and IoT devices supports the growing use of flexible and eco-friendly substrate materials.

Prinited Electronic Materials Market Volume and Share, By Material Type, 2025-2035

| By Material Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Inks | 70.87% | 90.81 | 408.97 | 18.20% | 66.79% |

| Substrates | 29.13% | 37.32 | 203.35 | 20.73% | 33.21% |

Ink Chemistry Insights

How did Conductive Silver Inks Segment Dominated the Printed Electronic Materials Market in 2025?

The conductive silver inks segment dominated the market accounting for approximately 64% share in 2025, due to their superior electrical conductivity, compatibility, and reliability with multiple printing technologies. Despite higher material costs, silver inks remain preferred in applications requiring high precision and long-term stability, particularly in consumer electronics, automotive electronics, and medical devices.

The conductive polymers/carbon segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, as they are gaining traction as cost-effective and flexible alternatives to metal-based inks. Growing demand for printed sensors, smart labels, and flexible energy devices is accelerating adoption, especially in applications where moderate conductivity and environmental sustainability are prioritized over peak electrical performance.

Technology Insights

Which Screen Printing Segment Dominated the Printed Electronic Materials Market in 2025?

The screen-printing segment dominated the market, accounting for approximately 44% share in 2025, as it is a widely used technology in printed electronics due to its scalability, cost efficiency, and ability to deposit thick ink layers. Its robustness and compatibility with multiple ink types make it a preferred choice for large-area electronics and industrial-scale manufacturing.

The inkjet printing segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, due to its high precision, digital control, and material efficiency, making it important for customizing and prototyping electronic components. Increasing use of inkjet printing in flexible displays, printed sensors, and advanced electronics supports its growing role in next-generation printed electronic manufacturing.

Application Insights

How did Displays Segment Dominate the Printed Electronic Materials Market in 2025?

The displays segment dominated the market, accounting for approximately 42% share in 2025, driven by the rise of flexible, lightweight, and low-power display technologies. Printed materials are increasingly being used to reduce production costs and enable innovative form factors. Demand is further supported by growing adoption in consumer electronics, wearable devices, and smart signage solutions.

The printed sensors segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, benefiting from advancements in conductive inks and flexible substrates. The ability to produce low-cost, lightweight, and flexible sensors using printed electronic materials makes this segment highly attractive for large-scale IoT and smart device deployments.

Regional Insights

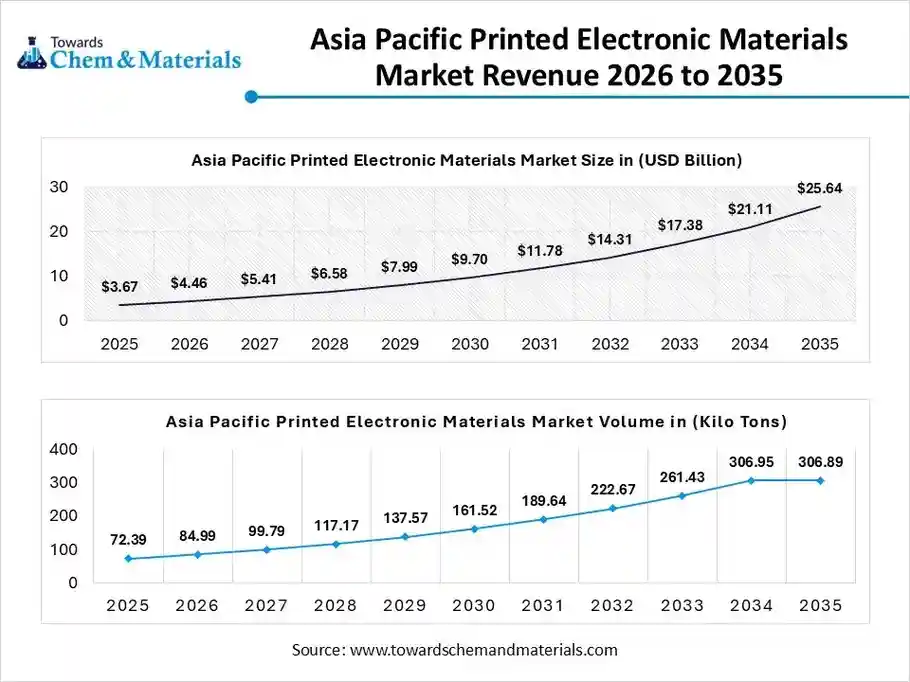

The Asia Pacific printed electronic materials market size was valued at USD 3.67 billion in 2025 and is expected to be worth around USD 25.64 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 21.46% over the forecast period from 2026 to 2035.

The Asia Pacific printed electronic materials volume was estimated at 72.39 kilo tons in 2025 and is projected to reach 306.89 kilo tons by 2035, growing at a CAGR of 17.41% from 2026 to 2035. Asia Pacific dominates the market with an approximate share of approximately 56.5% in 2025, fueled by large-scale electronics manufacturing, expanding consumer electronics demand, and rapid industrialization. Cost-effective manufacturing, availability of raw materials, and government support for electronics production strengthen the region’s dominance.

China: Printed Electronic Materials Market Growth Trends

China dominates the Asia Pacific market due to its massive electronics manufacturing infrastructure and strong domestic demand. Printed conductive inks, flexible substrates, and functional materials are widely used in displays, smart labels, wearable devices, and IoT products. Continuous investment in printed electronics production capacity and local material innovation further enhances China’s market leadership.

Europe Printed Electronic Materials Market Analysis

Europe expects the fastest growth in the market during the forecast period, supported by sustainability initiatives, lightweight electronics adoption, and strong automotive and industrial electronics sectors. The region emphasizes eco-friendly inks, recyclable substrates, and energy-efficient manufacturing processes. Expanding use of printed electronics in automotive interiors, smart textiles, and industrial automation contributes to increasing material consumption across multiple European countries.

Germany: Printed Electronic Materials Market Growth Trends

Germany plays a pivotal role in Europe’s printed electronic materials market, driven by its advanced automotive and industrial manufacturing ecosystem. Printed electronic materials are increasingly used in sensors, human–machine interfaces, and flexible circuits within automotive and industrial applications. Strong collaboration between research institutions and manufacturers further supports innovation in conductive inks and printed functional materials.

North America Printed Electronic Materials Market Analysis

North America represents a technologically advanced market for printed electronic materials, driven by strong demand from flexible electronics, smart packaging, wearable devices, and automotive electronics. The region benefits from a mature R&D ecosystem, early adoption of advanced manufacturing technologies, and high investment. Growth is further supported by increasing applications in healthcare diagnostics, aerospace electronics, and next-generation IoT-enabled devices.

United States: Printed Electronic Materials Market Growth Trends

The United States leads the North American market due to its strong electronics manufacturing base and robust innovation environment. High adoption of flexible circuits, printed sensors, and smart labels across healthcare, defense, and consumer electronics drives material demand. The presence of leading material suppliers, research institutions, and startups accelerates the commercialization of conductive inks, dielectric materials, and printable semiconductors.

Printed Electronic Materials Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 23.07% | 29.56 | 152.77 | 20.02% | 24.95% |

| Europe | 14.10% | 18.07 | 111.63 | 22.43% | 18.23% |

| Asia Pacific | 56.50% | 72.39 | 306.89 | 17.41% | 50.12% |

| South America | 4.20% | 5.38 | 27.55 | 19.90% | 4.50% |

| Middle East & Africa | 2.13% | 2.73 | 13.47 | 19.41% | 2.20% |

Recent Developments

- In August 2025, Wipro Infrastructure Engineering (WIN) launched Wipro Electronic Materials, a new division focused on producing high-performance base materials for Printed Circuit Boards (PCBs). (Source: propnewstime.com)

- In November 2025, Pegasus Materials debuted its first two high-performance, bio-based specialty materials targeting the electronics, data center, and aerospace sectors. This launch coincided with an expanded seed funding round led by the venture studio Ferment.(Source: www.businesswire.com)

- In December 2025, Specialty chemicals group ALTANA launched new resin-based Cubic Ink 3D printing materials for industrial additive manufacturing. The materials include options for medical and electronics applications.(Source: www.inkworldmagazine.com)

Top Players in the Printed Electronic Materials Market & Their Offerings:

- DuPont de Nemours, Inc.: DuPont is a global leader in advanced materials for printed electronics, offering high-performance conductive inks, dielectric coatings, and flexible substrates used in sensors, antennas, RFID, and flexible circuits. Its materials are widely adopted in consumer electronics, automotive, industrial, and IoT applications due to strong formulation expertise and reliability.

- Henkel AG & Co. KGaA: Henkel supplies a broad portfolio of printed electronic materials such as conductive inks, adhesives, and encapsulation coatings optimized for flexible and wearable electronics, smart packaging, and printed sensors. The company emphasizes sustainable chemistry, scalable manufacturing, and collaboration with OEMs on tailored solutions.

- BASF SE: BASF develops advanced polymer and conductive materials for printed electronic applications, including conductive polymers and organic semiconductor materials for next-generation flexible devices, displays, and interconnects. Its deep material science expertise supports performance and reliability in diverse end markets.

- Agfa-Gevaert Group: Agfa applies its imaging and coating know-how to printed electronics, producing specialty conductive and functional inks and substrates for sensors, photovoltaics, and hybrid printed circuits.

- Nissha Co., Ltd.: Nissha provides conductive and functional materials tailored for printed electronic components such as touch sensors, flexible displays, and smart labels. Its offerings emphasize high-precision deposition and integration with printed device production.

- 3M Company (USA)

- NovaCentrix (USA)

- Sun Chemical (DIC Corporation) (USA/Japan)

- Heraeus Holding GmbH (Germany)

- Ink-T (Korea) (South Korea)

- Samsung Electronics (South Korea)

- LG Display Co., Ltd. (South Korea)

- Nissha Co., Ltd. (Japan)

- Toyo Ink SC Holdings (Japan)

- Intrinsiq Materials (USA)

- E Ink Holdings Inc. (Taiwan)

Segments Covered

By Material Type

- Inks (Conductive, Dielectric)

- Substrates (PET, PI, Paper)

By Ink Chemistry

- Conductive Silver Inks

- Conductive Polymers/Carbon

- Others (Copper, Dielectric)

By Technology

- Screen Printing

- Inkjet Printing

- Flexographic/Gravure

- 3d Printed Electronics

By Application

- Displays (OLED, E-Paper)

- Printed Sensors

- Photovoltaics (OPV)

- RFID & Smart Labels

- Others (Lighting, Batteries)

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa