Content

What is the Current Release Liner Market Size and Volume?

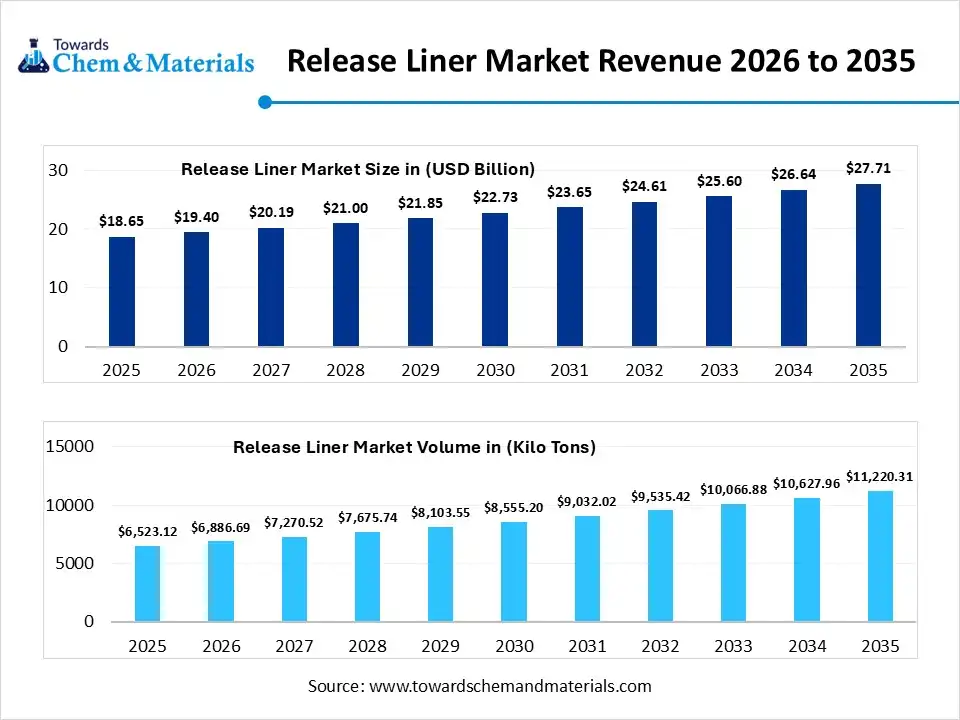

The global release liner market size was estimated at USD 18.65 billion in 2025 and is expected to increase from USD 19.40 billion in 2026 to USD 27.71 billion by 2035, growing at a CAGR of 4.04% from 2026 to 2035. In terms of volume, the market is projected to grow from 6523.12 kilo tons in 2025 to 11220.31 kilo tons by 2035. growing at a CAGR of 5.57% from 2026 to 2035. Asia Pacific dominated the release liner market with the largest volume share of 42% in 2025. The increased trend towards the updation of infrastructure has driven market growth in recent years.

Key Takeaways

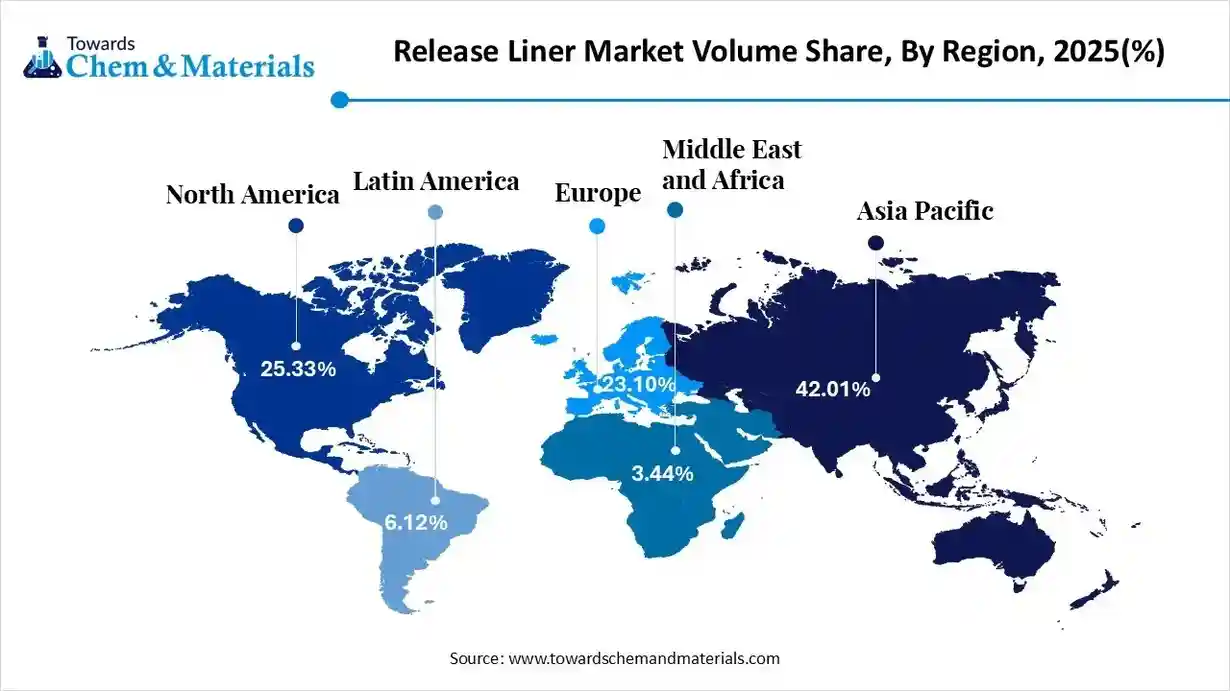

- The Asia Pacific dominated the release liner market with the largest volume share of 42% in 2025.

- The release liner market in North America is expected to grow at a substantial CAGR of 6.49% from 2026 to 2035.

- The Europe release liner market segment accounted for the major volume share of 23.10% in 2025.

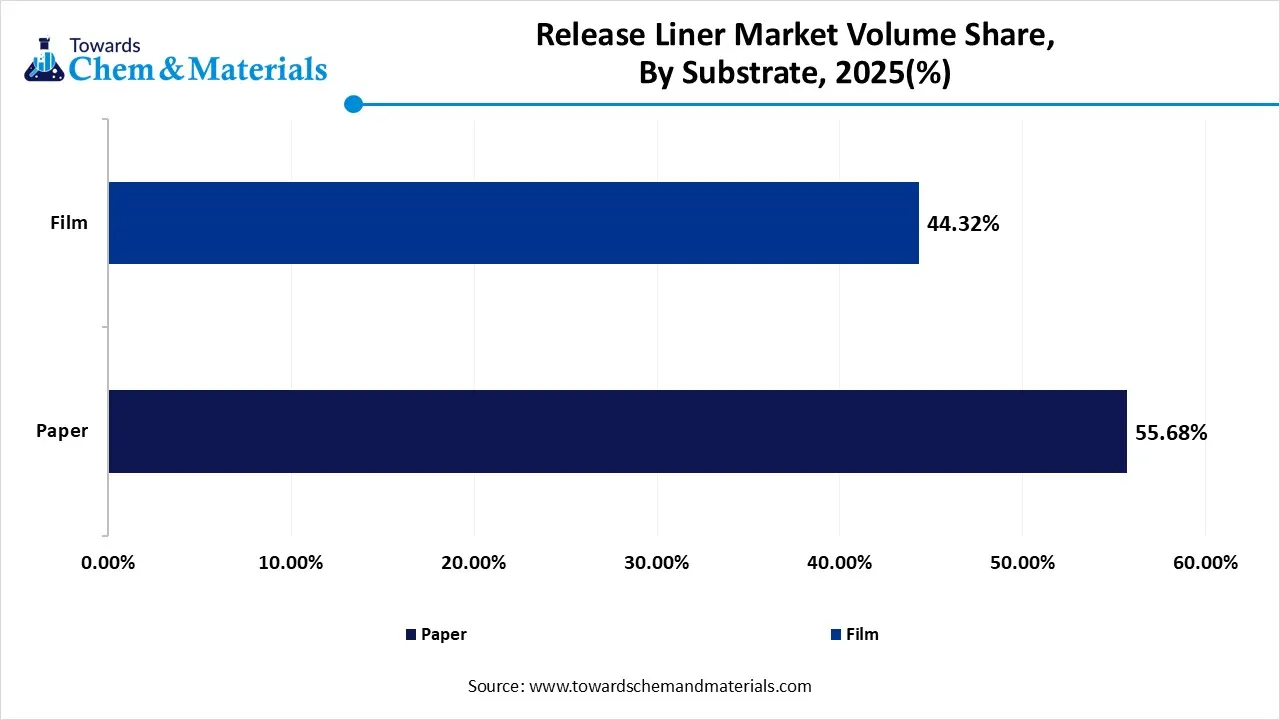

- By substrate, the paper segment dominated the market and accounted for the largest volume share of 56% in 2025.

- By substrate, the film segment is expected to grow at the fastest CAGR of 7.21% from 2026 to 2035 in terms of volume.

- By material type, the silicon coated segment led the market with the largest revenue volume share of 63% in 2025.

- By technology, the solventless segment dominated the market and accounted for the largest volume share of 51% in 2025.

- By application, the labels segment led the market with the largest revenue volume share of 43% in 2025.

Release Liners: Protective Adhesives with Precision

The protective layer, which is known as the backing layer used to cover the sticky side of the pressure-sensitive products, such as adhesive film, tapes, and labels, called the release liner. Moreover, by restricting the adhesive from sticking to unwanted surfaces before use, the release liner emerges as the ideal option in major industries nowadays.

Release Liner Market Trends:

- The emergence of sustainable manufacturing is driving the sectoral scalability and strategic transformation in recent years. Also, consumers are increasingly demanding eco-friendly liners, which are primarily made from biodegradable plastic and recycled paper instead of non-recyclable liners in the current period.

- The integration of the digital manufacturing machines, where automation, sensors, and data analytics have gained immense industry attention in release liner manufacturing. By monitoring the quality in real time while adjusting settings automatically without defects, the automation has emerged as an ideal transformation nowadays.

- The demand for the value-added and functional liners has allowed stakeholders to capitalize on growth opportunities in recent years. The consumers are increasingly turning towards the release liners, which are engineered with additional functions such as sensors, surface printing, and better recyclability.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 19.40 Billion / 6886.69 Kilo Tons |

| Revenue Forecast in 2035 | USD 27.71 Billion / 11220.31 Kilo Tons |

| Growth Rate | CAGR 4.04% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Substrate, By Material Type, By Technology, By Application, By Region |

| Key companies profiled | 3M Company, Ahlstrom (formerly Ahlstrom-Munksjö Oyj), Avery Dennison Corporation, Loparex LLC, UPM-Kymmene Oyj , LINTEC Corporation, Sappi Limited , Huhtamäki Oyj, Delfortgroup AG, Gascogne Group , Siliconature S.p.A. , Polyplex Corporation Ltd. , Rayven, Inc., Felix Schoeller Group , Mondi Group |

Intelligent Surface Chemistry Shapes The Market Efficiency

The integration of engineered surface chemistry paired with digital process control is expected to contribute to favorable market economies for the industry in the coming years. Moreover, modern release liners are formulated with precisely tuned release coatings that deliver uniform and predictable detachment forces, ensuring consistent adhesive performance across diverse substrates and application environments.

Trade Analysis of the Release Liner Market:

Import, Export, Consumption, and Production Statistics

- The United States has emerged as one of the leading exporters of release liner with 2,414 shipments, and the major buyers have Chile, Israel, and China, as per the published report.

- Germany has also seen a greater export of release liner after the United States where 426 shipments and 20 buyers as per the report.

Value Chain Analysis of the Release Liner Market:

- Distribution to Industrial Users: Distribution to industrial users is highly concentrated in segments requiring pressure-sensitive adhesives (PSA) for labeling and high-performance protection.

- Key Players: 3M Company and Avery Dennison.

- Chemical Synthesis and Processing: The chemical synthesis and processing of release liners involve the precise application and curing of low-surface-energy coatings onto substrates. As of 2026, the industry is dominated by silicone-based chemistries, with a major shift toward sustainable, solvent-free, and high-speed curing technologies.

- Key Players: Dow Inc and 3M Company

- Regulatory Compliance and Safety Monitoring: The release liner market is governed by a complex framework of chemical safety and industrial quality standards. Global regulatory updates, particularly in the EU and North America, are driving significant shifts toward PFAS-free and microplastic-compliant materials.

- Safety Standards- EU REACH (Microplastics & PFAS) and Medical Standards (ISO 13485)

Release Liner Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Regulatory Body Key Regulations |

Focus Areas |

| United States | Food & Drug Administration (FDA) | TSCA Section 8(a)(7); 21 CFR Parts 175–178 | Mandatory data submission for any PFAS manufactured or imported since 2011 begins April 13, 2026 |

| European Union | European Commission | Packaging and Packaging Waste Regulation (PPWR) (Regulation (EU) 2025/40) | Microplastics Reporting: First annual reports for synthetic polymer microparticles (SPMs) used at industrial sites are due May 31, 2026 |

| China | State Administration for Market Regulation (SAMR) | GB 9685-2016 (Standard for Uses of Additives in Food Contact Materials) | Sustainability & VOCs: Heavy focus on reducing Volatile Organic Compounds (VOCs) in coating processes |

Segmental Insights

Substrate Type Insights

How did the Paper Segment Dominate the Release Liner Market in 2025?

The paper segment volume was valued at 3632.07 kilo tons in 2025 and is projected to reach 5808.75 kilo tons by 2035, expanding at a CAGR of 5.36% during the forecast period from 2025 to 2035. The paper segment dominated the market with approximately 56% share in 2025, due to factors such as cost-effectiveness, vast availability, and easy processing. Moreover, by providing good stiffness and making handling and die cutting more efficient at high speed, the manufacturers are heavily preferring paper liners for the tapes and labels in recent years.

The film segment segment volume was valued at 2891.05 kilo tons in 2025 and is projected to reach 5411.56 kilo tons by 2035, expanding at a CAGR of 7.21% during the forecast period from 2025 to 2035. The film segment is expected to grow with a rapid CAGR, owing to the increasing demand for precision, thinner material, and consistency from the industries. Moreover, by offering greater dimensional stability, uniform thickness, and lower breakage at high production speeds, the film segment is expected to increase return on investment for manufacturers during the forecast period, as per future industry expectations.

Release Liner Market Volume and Share, By Substrate, 2025-2035

| By Substrate | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Paper | 55.68% | 3632.07 | 5808.75 | 5.36% | 51.77% |

| Film | 44.32% | 2891.05 | 5411.56 | 7.21% | 48.23% |

Material Type Insights

How did the Silicon Coated Segment Dominate the Release Liner Market in 2025?

The silicon coated segment dominated the market with approximately 63% share in 2025, due to its unmatched versatility and long-term performance reliability. Also, silicone coatings function effectively with acrylic, rubber, and silicone adhesives, allowing broad application coverage. Their durability under heat and humidity made them suitable for global distribution and storage. The coating process matured early, resulting in predictable quality and lower technical risk for manufacturers.

The non-silicon-coated segment is expected to grow, akin to evolving regulatory and brand requirements. These coatings eliminate silicone contamination, simplifying downstream recycling processes. Manufacturers benefit from reduced compliance complexity and improved environmental labeling opportunities.

Technology Type Insights

How did the Solventless Segment Dominate the Release Liner Market in 2025?

The solventless segment dominated the market with approximately 51% industry share in 2025, due to its simplicity and production reliability. By removing solvents, manufacturers reduce process variability and eliminate drying stages. This shortens production cycles and increases output efficiency. Solventless coatings also improve workplace safety by minimizing exposure to hazardous vapors.

The radiation-cured segment is expected to grow, owing to increased industry demand for accuracy and scalability. This process enables real-time curing and precise surface engineering, critical for electronics and medical applications. Radiation curing eliminates solvents, improving environmental compliance. It also supports compact production layouts and reduced downtime.

Application Type Insights

How did the Labels Segment Dominate the Release Liner Market in 2025?

The labels segment dominated the market with approximately 43% share in 2025, due to its universal presence across industries. Every packaged product requires labeling for branding, compliance, and traceability. Release liners enable efficient label processing at high speeds, making them essential to modern packaging lines. The growth of private labels and logistics tracking builds up liner demand in the current period.

The medical and healthcare segment is expected to grow, owing to innovation in patient-centric products. Wearable sensors, transdermal patches, and advanced wound care solutions require high- precision liners. These applications demand clean release, minimal residue, and compatibility with sensitive adhesives. Regulatory standards further favor high-quality liner materials.

Regional Insights

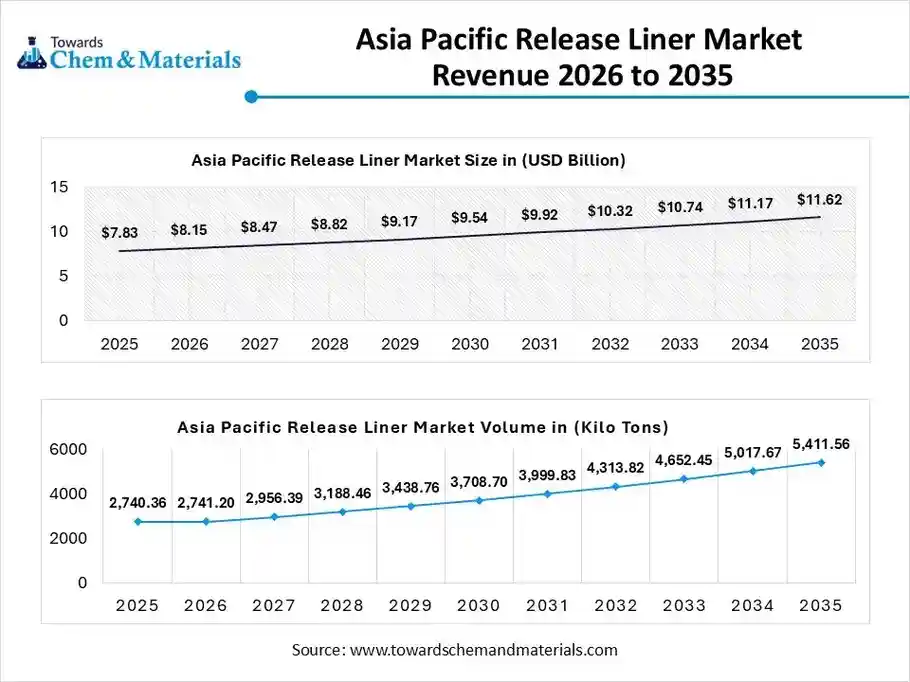

The Asia Pacific release liner market size was valued at USD 7.83 billion in 2025 and is expected to be worth around USD 11.62 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.03% over the forecast period from 2026 to 2035.

The Asia Pacific release liner volume was estimated at 2740.36 kilo tons in 2025 and is projected to reach 5411.56 kilo tons by 2035, growing at a CAGR of 7.85% from 2026 to 2035. Asia Pacific dominated the release liner market with approximately 42% share in 2025, due to the region being considered as one of the world's largest manufacturing bases for packaging, labels, and adhesives in the current period. Moreover, the sudden expansion of automotive and e-commerce businesses has resulted in high yield outcomes for the market players in recent years, as per the observation. Furthermore, the manufacturers have seen under the heavy adoption of both film and paper substrates to meet versatile market need.

China Lead High Volume Liner Production

China maintained its dominance in the market, owing to the country has greater producer of tapes, labels, and materials in the current period. Also, with the heavier adoption of the advanced technology while creating high volume industrial demand, the manufacturer of release liner in China has gained global attention in the past few years.

North America Release Liner Market Evaluation

North America is expected to capture a major share of the release liner market with a rapid CAGR, owing to advanced industrial infrastructure, early adoption of automation, and sustainability-focused production. Industries like medical, automotive, electronics, and packaging require high-performance liners with precise release properties. Moreover, manufacturers in the region invest in recyclable materials and film-based liners, reducing waste and improving environmental compliance.

Precision Liners Power United States Industries

The United States is expected to emerge as a prominent country for the release liner market in the coming years due to its technology-intensive industries, including medical devices, batteries, and electronics. Also, manufacturers in the United States demand precision liners for wearable patches, flexible electronics, and high-performance adhesives. Investment in recycling infrastructure encourages sustainable liner solutions. Regulatory standards on safety and quality further increase the adoption of advanced materials.

Europe Release Liner Market Examination

Europe is notably growing in industry, owing to sustainability-driven industrial practices and high-end packaging demands. Also, the cosmetic, food, and luxury goods sectors require advanced liners that support precision cutting, clean release, and recyclability. European manufacturers invest in film substrates, specialty coatings, and environmentally friendly processes.

Germany Drives Advanced Liner Demand

Germany is expected to gain a major industry share due to its advanced automotive, industrial, and packaging sectors. High-performance adhesives and precision applications in tapes, labels, and specialty products create strong demand for reliable liners. German manufacturers prioritize technical excellence, driving the adoption of film-based and radiation-cured liners.

Release Liner Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 25.33% | 1652.31 | 2910.55 | 6.49% | 25.94% |

| Europe | 23.10% | 1506.84 | 2045.46 | 3.45% | 18.23% |

| Asia Pacific | 42.01% | 2740.36 | 5411.56 | 7.85% | 48.23% |

| South America | 6.12% | 399.21 | 504.91 | 2.64% | 4.50% |

| Middle East & Africa | 3.44% | 224.40 | 347.83 | 4.99% | 3.10% |

Recent Developments

- In November 2025, Techlan introduced their latest release line called 80gsm Glassine Liner. Also, this newly launched release liner is specifically designed for the sustainable application and high performance as per the company's claim. (Source: techlanltd.co.uk)

- In April 2025, Elkem unveiled its latest range of recycled silicon release liners. Also, the newly launched release liner called SILCOLEASE®, which is able provide superior carbon profiles while delivering identical technical performance as per the published report. (Source: www.elkem.com)

Top Vendors in the Release Liner Market & Their Offerings:

- 3M Company: A diversified global technology conglomerate applying science to produce over 60,000 products across industrial, worker safety, healthcare, and consumer markets.

- Ahlstrom (formerly Ahlstrom-Munksjö Oyj): A leading global manufacturer of fiber-based specialty materials used for filtration, healthcare, life sciences, and sustainable food packaging.

- Avery Dennison Corporation: A global leader in materials science and digital identification, specializing in pressure-sensitive adhesive materials, RFID tags, and branding solutions for various industries.

- Loparex LLC

- UPM-Kymmene Oyj

- LINTEC Corporation

- Sappi Limited

- Huhtamäki Oyj

- Delfortgroup AG

- Gascogne Group

- Siliconature S.p.A.

- Polyplex Corporation Ltd.

- Rayven, Inc.

- Felix Schoeller Group

- Mondi Group

Segments Covered in the Report

By Substrate

- Paper (Glassine, SCK, CCK)

- Film (PET, PP, PE)

By Material Type

- Silicone-Coated

- Non-Silicone Coated

By Technology

- Solventless

- Radiation-Cured (UV/EB)

- Solvent-based

- Water-based (Emulsion)

By Application

- Labels

- Medical & Healthcare

- Tapes

- Hygiene & Industrial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa