Content

Biobased Insulation Material Market Size | Companies Revenue

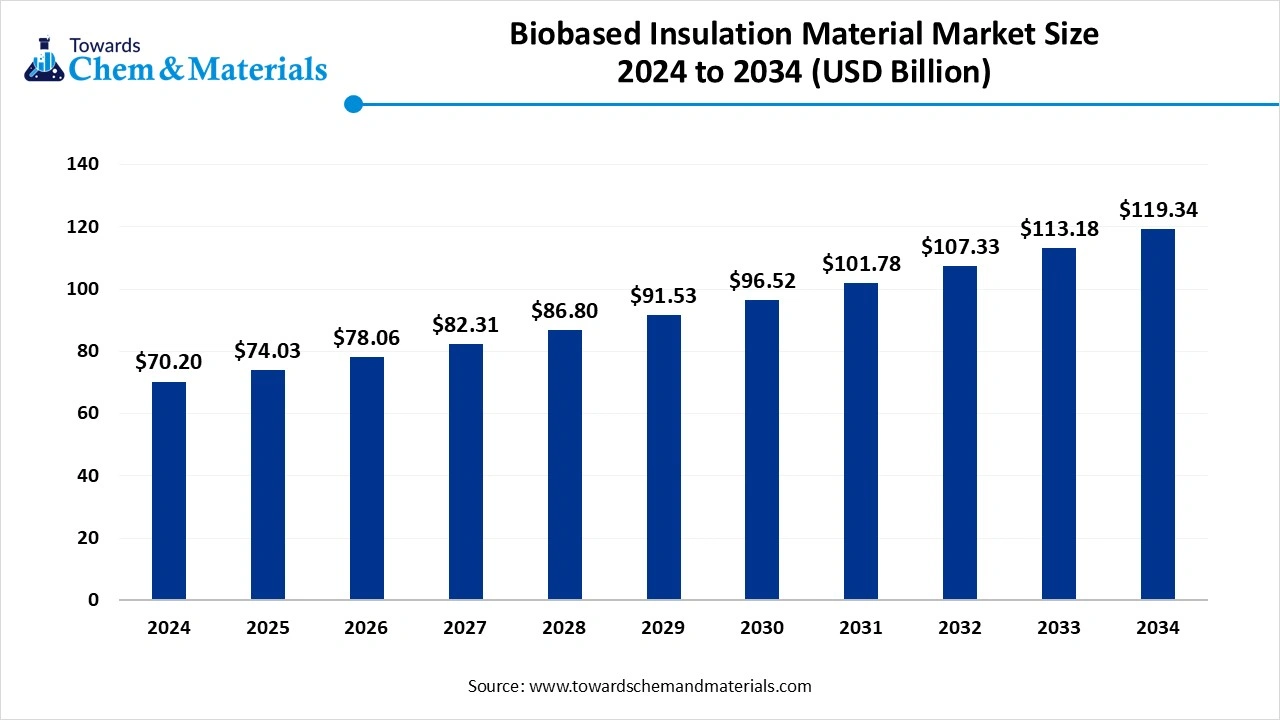

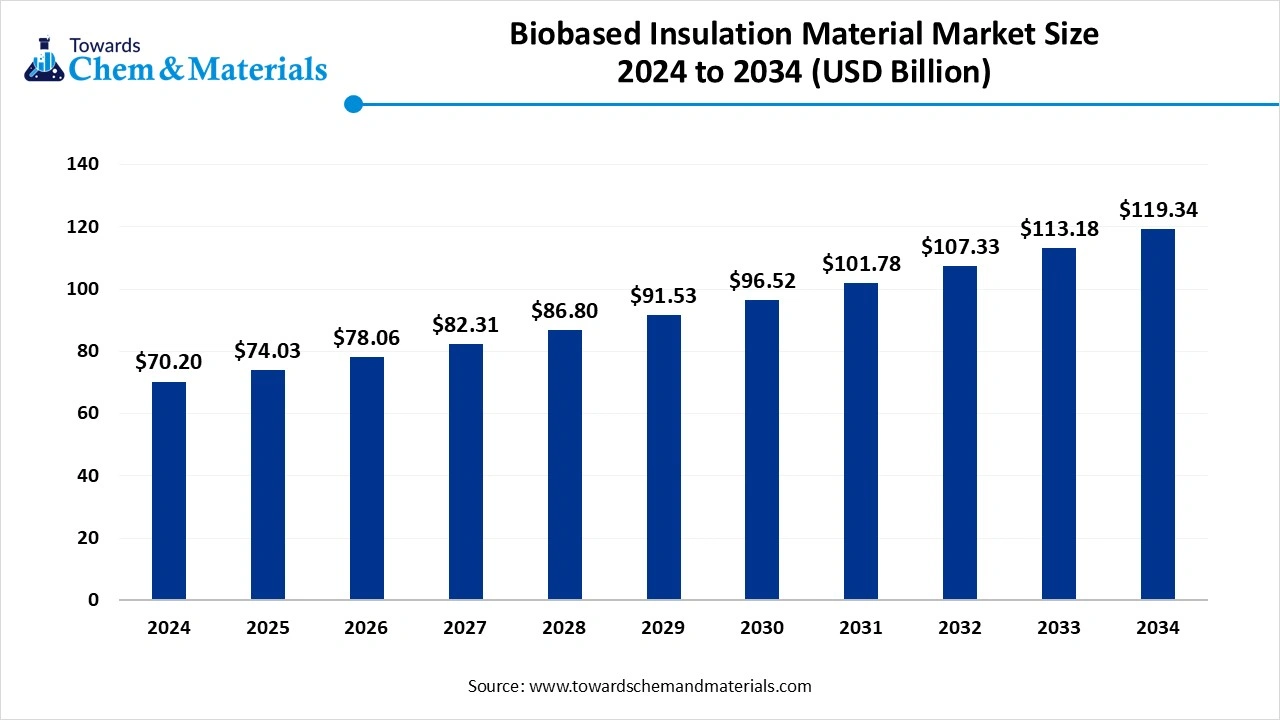

The global biobased insulation material market size was reached at USD 70.20 Billion in 2024 and is expected to be worth around USD 119.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.45% over the forecast period 2025 to 2034. The growing environmental awareness, rising demand for sustainable building solutions, and focus on energy efficiency drive the market growth.

Key Takeaways

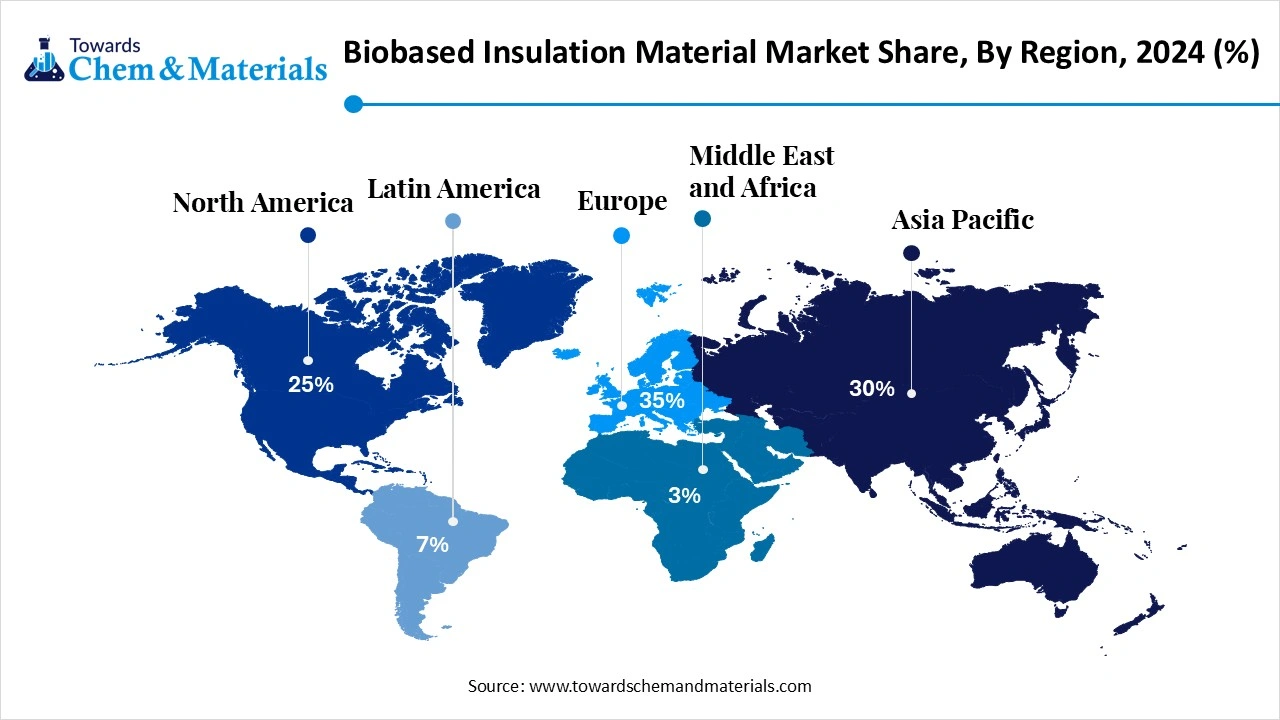

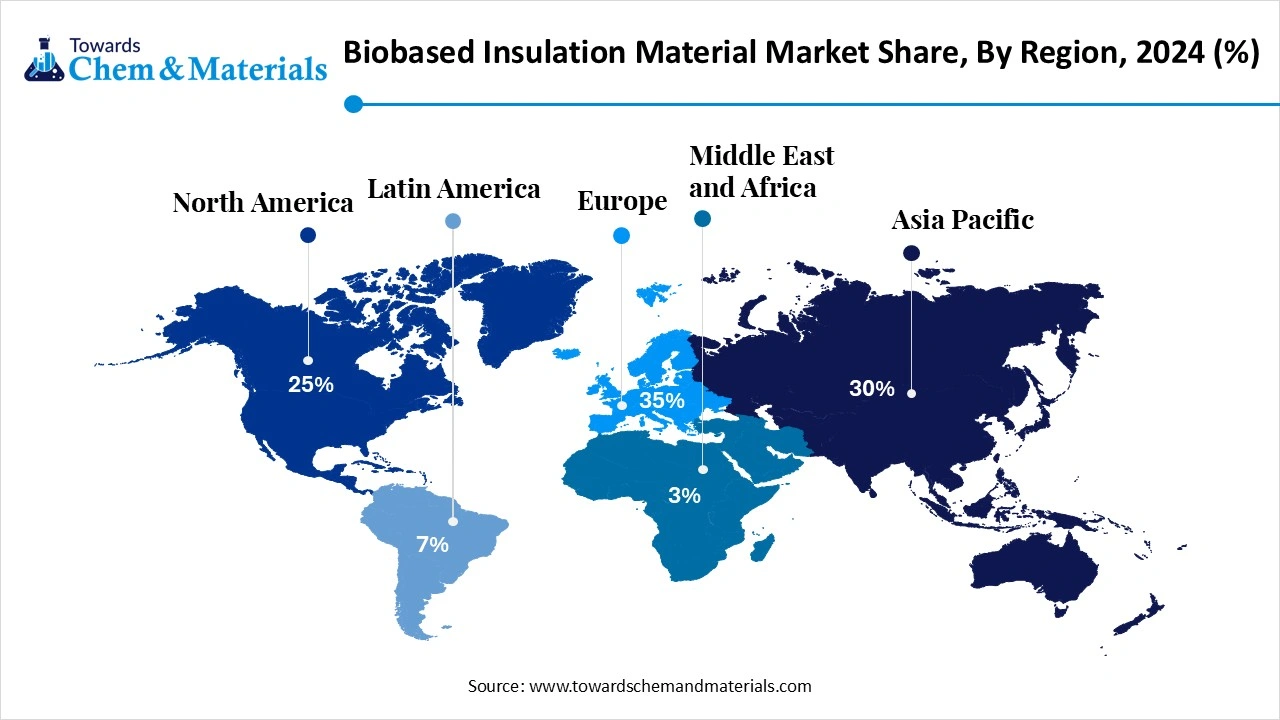

- By region, Europe dominated with a 35% share in the biobased insulation material market in 2024 due to the stringent environmental regulations.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to the increasing construction activities.

- By product type, the plant-based insulation materials segment held a 35% share in the market in 2024 due to the cost-effective production of insulation.

- By product type, the animal-based insulation materials segment is expected to grow at a significant CAGR in the market during the forecast period due to the good thermal performance.

- By end-use industry, the construction segment held a 50% share in the market in 2024 due to the growing construction activities.

- By end-use industry, the automotive segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rise in electric vehicles.

- By form factor, the rigid boards segment held a 25% share in the market in 2024 due to the increasing demand across commercial & residential construction.

- By form factor, the spray foam insulation segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing focus on energy-efficient building construction.

- By thermal conductivity, the low thermal conductivity segment held a 60% share in the biobased insulation material market in 2024 due to the increasing demand for enhancing indoor comfort.

- By thermal conductivity, the medium thermal conductivity segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing industrial facilities.

- By performance, the thermal insulation segment held a 55% share in the market in 2024 due to the growing development of EV batteries.

- By performance, the sound insulation segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for noise control.

- By durability, the long-term durability segment held a 60% share in the market in 2024 due to the strong focus on frequent replacements of insulation.

- By durability, the medium-term durability segment is expected to grow at the fastest CAGR in the market during the forecast period due to the focus on energy consumption.

Biobased Insulation Material: Power in Green Building & Modern Construction

Biobased insulation material is insulation material made up of plant-based, animal-based, and other renewable resources. Biobased insulation material is made up of renewable resources like hemp, wood fiber, straw, cellulose, cork, and sheep’s wool. It offers acoustic and thermal insulation for appliances, buildings, and industrial equipment. Biobased insulation material is used to minimize carbon footprints, improve energy efficiency, and reduce cooling & heating costs. They are environmentally friendly, biodegradable, and recyclable.

The growing environmental awareness increases the adoption of biobased insulation materials for lowering carbon emissions. Factors like the adoption of green buildings, focus on sustainability, technological advancements, supportive government policies, growing renovation, and increasing focus on the improvement of healthier indoor quality contribute to the growth of the biobased insulation material market.

- Russia exported 384 shipments of thermal insulation materials.(Source: www.volza.com)

- Vietnam exported 261,453 shipments of insulation material.(Source: www.volza.com)

- The World exported 20.1K shipments of hemp.(Source: www.volza.com)

- The United States exported $6.96B of cotton in 2023.(Source: oec.world)

- India exported $6.34B of cotton in 2023.(Source: oec.world)

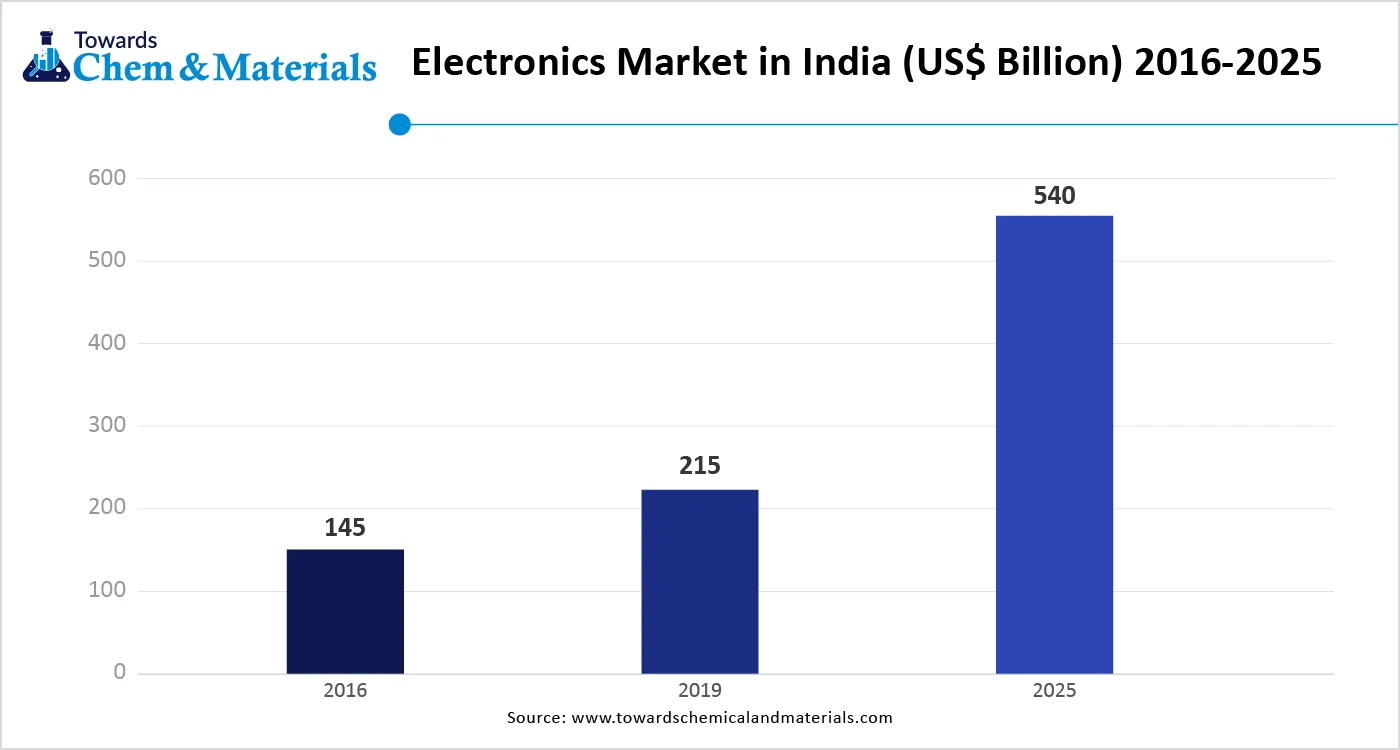

Growing Electronic Industry Propels Market Growth

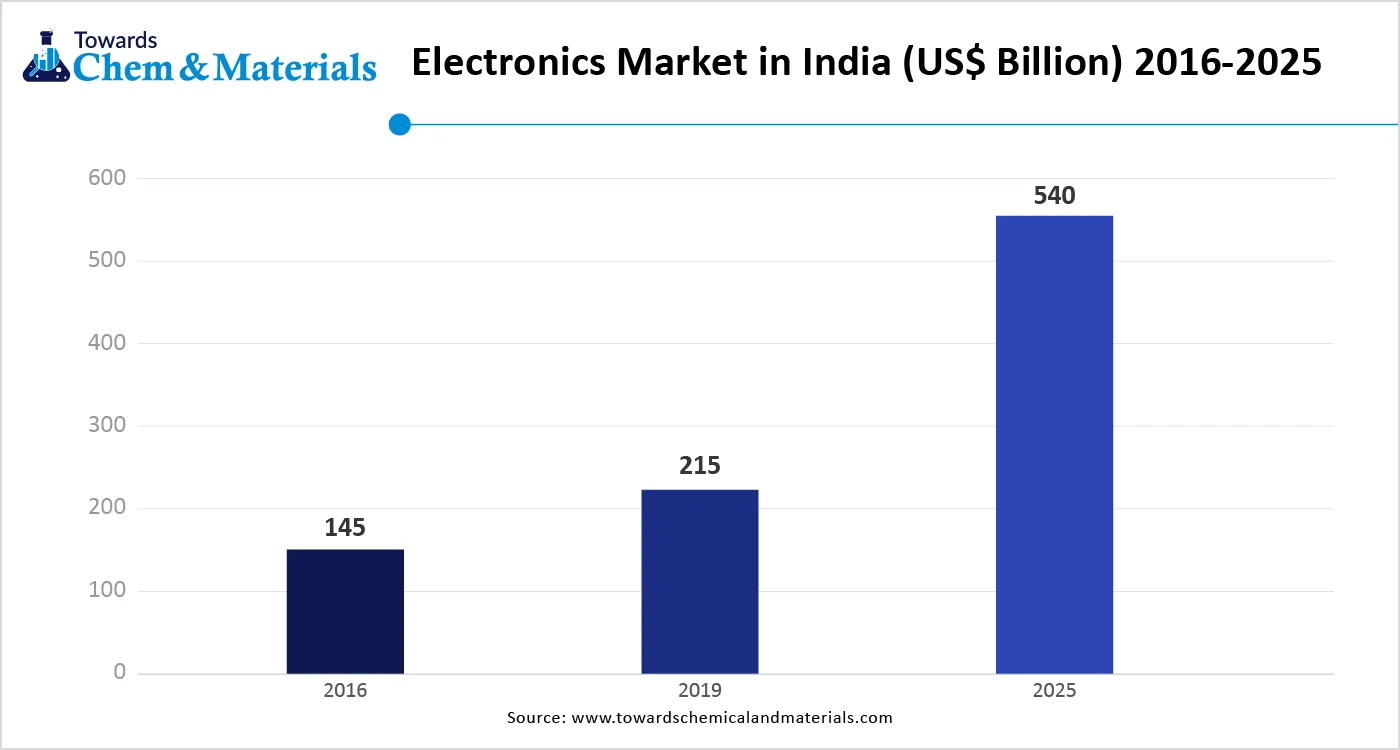

The growing electronic industry in various regions increases demand for biobased insulation materials for various applications. The increasing demand for energy-efficient electronics like appliances & devices increases the adoption of bio-based insulation materials. The increasing demand for electronic devices like smartphones, laptops, smartwatches, wearables, computers, and fitness trackers increases the demand for bio-based insulation materials to enhance performance.

The growing adoption of electronic devices increases demand for biobased insulation materials for applications like sealing electronic devices, protecting underwater cables, microelectronic components encapsulation, and printed circuit boards insulation. The increasing demand for circuit boards, wires, casing, cables, and connectors in electronic devices requires biobased insulation materials. The growing electronic industry is a key driver for the growth of the biobased insulation material market.

Market Trends

- Growing Environmental Concerns: The growing environmental concerns increase demand for biobased insulation materials made from wood fibers, straw, and hemp to lower carbon footprint and minimize waste.

- Improving Indoor Air Quality: The focus on improving indoor air quality increases demand for biobased insulation materials for better moisture management.

- Technological Advancements: The ongoing technological advancements in the manufacturing processes of biobased insulation materials help to enhance characteristics like moisture management, thermal conductivity, and fire resistance.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 74.03 Billion |

| Expected Size by 2034 | USD 119.34 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Product Type, By End-Use Industry, By Form Factor, By Thermal Conductivity, By Performance, By Durability, By Region |

| Key Companies Profiled | Corkcom, ThermoNatur, Kingspan Group, BASF SE, Rockwool International, Owens Corning, Mannok Insulation, Saxony Insulation, HempFlax, EcoCork, Green Building Materials, Steico, U.S. GreenFiber, Johns Manville, Green Insulation Solutions, Naturinsulation, Armacell, FlexiCell, Cotton Insulation, Sustainable Insulation Systems |

Market Opportunity

Growing Construction Activities Unlocks Opportunity for Market

The rapid urbanization and growing construction activities in various regions increase demand for biobased insulation materials. The increasing development of residential, commercial, industrial, and infrastructure construction fuels demand for biobased insulation materials. The growing environmental concerns and focus on sustainable building practices increase demand for biobased insulation materials to reduce carbon emissions and energy consumption. The growing demand for residential construction increases the adoption of biobased insulation materials for thermal insulation and sound insulation. The strong government support for green buildings and growing renovations of existing buildings increases demand for biobased insulation materials. The growing construction activities create an opportunity for the biobased insulation material market growth.

Market Challenge

High Production Costs Limit Expansion of Market Growth

Despite several benefits of the biobased insulation material in various industries, the high production costs restrict the market growth. Factors like undeveloped supply chains, high cost of raw materials, and specialized manufacturing processes are responsible for the high production cost. The high cost of raw materials like agricultural byproducts, hemp, and wood fibre directly affects the market. The need for specialized processes and equipment increases the production cost. The underdeveloped and less efficient supply chains lead to higher initial costs. The heavy investment in research & development of bio-based insulation materials directly affects the market. The complex manufacturing process requires a high cost. The high production costs hamper the growth of biobased insulation material.

Regional Insights

Europe Biobased Insulation Material Market Trends

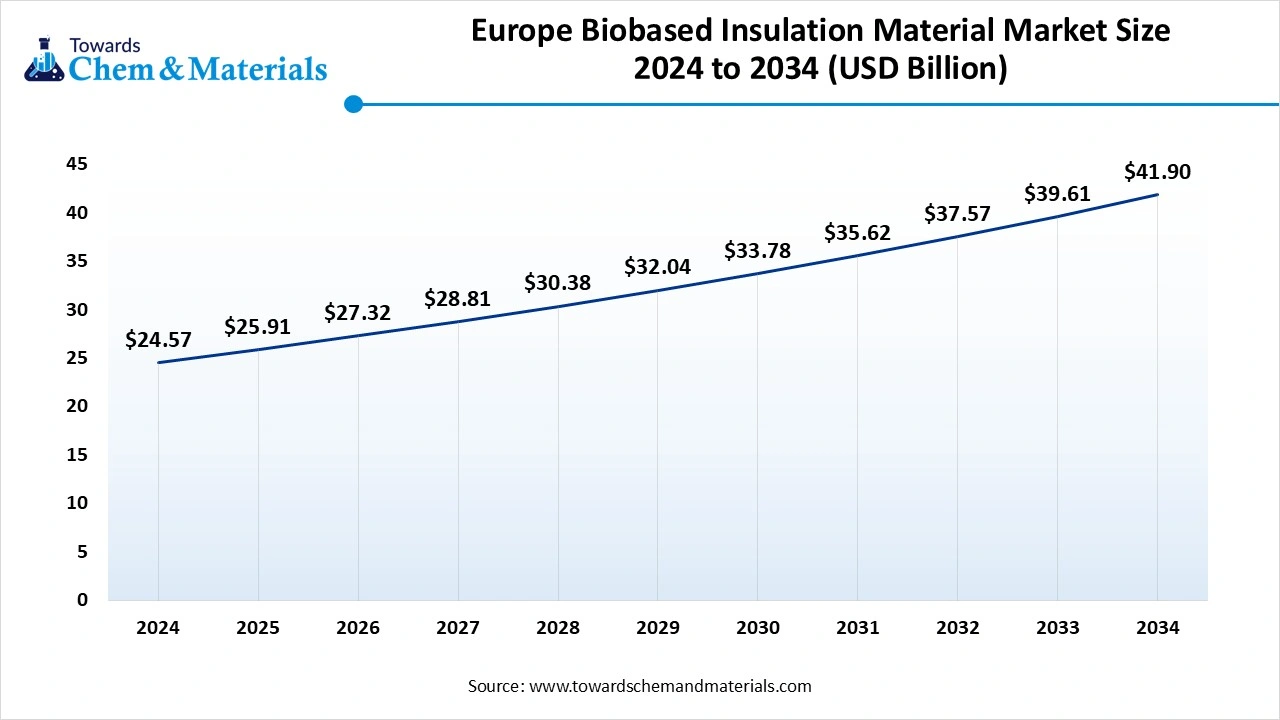

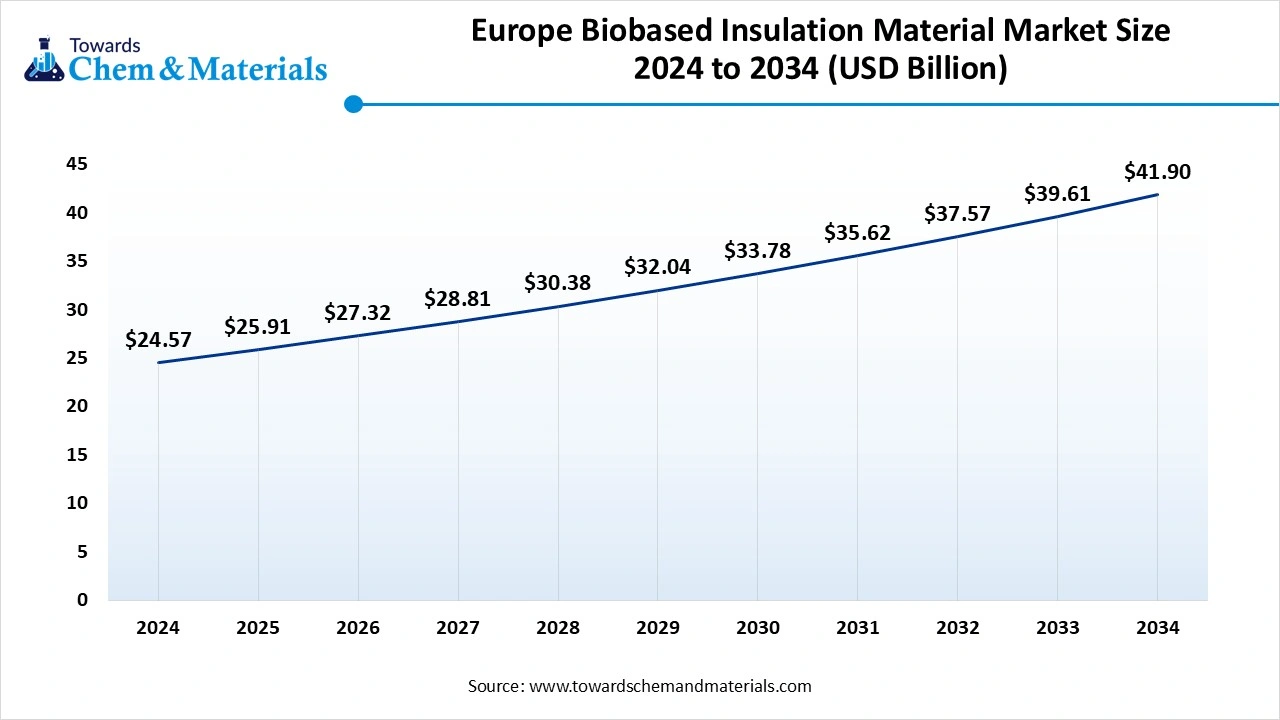

The Europe biobased insulation material market size was estimated at USD 24.57 billion in 2024 and is anticipated to reach USD 41.90 billion by 2034, growing at a CAGR of 35% from 2025 to 2034. Europe dominated the biobased insulation material market in 2024.

The stricter environmental regulations, like the EU’s Green Deal, increase the adoption of biobased insulation materials. The strong focus on minimizing carbon footprint in the construction & building sector increases demand for biobased insulation materials. The strong government support for green building projects and increasing consumer demand for sustainable materials increases demand for biobased insulation materials. The focus on sustainable construction in countries like the UK, Germany, and France drives the overall growth of the market.

Germany Biobased Insulation Material Market Trends

Germany is growing in the market. The stringent regulations, like the Energy Efficiency Strategy for Buildings and the Energy Saving Ordinance, increase demand for biobased insulation materials. The strong government support through various tax deductions and subsidies increases the adoption of biobased insulation materials, helping the market growth. The ongoing innovations in insulation materials and the increasing popularity of green building practices increase the adoption of biobased insulation material, supporting the overall market growth.

Asia Pacific Biobased Insulation Material Market Trends

Asia Pacific experiences the fastest growth in the market during the forecast period. The rapid urbanization and growing construction activities in the region increase demand for biobased insulation materials. The strong government support for energy-efficient buildings through various policies increases demand for bio-based insulation material. The increasing implementation of green building codes and the focus on energy conservation increases demand for biobased insulation materials. The growing awareness about environmental issues and focus on sustainability increases demand for biobased insulation materials, driving the overall growth of the market.

China Biobased Insulation Material Market Trends

China is a major contributor to the market. The growing urbanization and focus on infrastructure development increase demand for biobased insulation materials. The strong government support for green building materials and energy efficiency increases the adoption of biobased insulation materials. The well-established manufacturing base and growing demand for biobased insulation in industrial refrigeration & prefabricated housing support the market growth.

- China exported 962 shipments of thermal insulation materials.(Source: www.volza.com)

- China exported 13,760 shipments of insulation material.(Source: www.volza.com )

- China exported $9.19B of cotton in 2023.(Source: oec.world )

Segmental Insights

Product Type Insights

Why did Plant-Based Insulation Materials Dominate the Biobased Insulation Material Market?

The plant-based insulation materials segment dominated the market in 2024. The increasing focus on sustainable construction and green building practices increases demand for plant-based insulation, helping the market growth. Plant-based insulation is made up of straw, wood, and hemp and requires less energy for production. They offer excellent moisture regulation capabilities and thermal performance. The focus on reducing carbon footprint and affordable production of insulation increases demand for plant-based insulation materials, driving the market growth.

The animal-based insulation materials segment expects the significant growth in the market during the forecast period. The growing awareness about environmental concerns increases demand for animal-based insulation. It requires low energy for production and minimizes the carbon footprint of construction. Animal-based insulation is biodegradable and easily releases & absorbs moisture. They offer superior thermal performance and good acoustic insulation. The growing demand for sheep wool and feather-based insulation supports the market growth.

End-Use Industry Insights

Which End-Use Industry Held the Largest Share in the Biobased Insulation Material Market?

The construction segment held the largest revenue share in the market in 2024. The growing development of commercial and residential buildings increases demand for biobased insulation materials for acoustics & thermal insulation. The increasing retrofitting and development of new construction fuels demand for biobased insulation materials. The strong focus on energy-efficient buildings and shift towards green buildings increases the adoption of biobased insulation materials. The growing infrastructure development & industrial buildings increase demand for biobased insulation materials, driving the overall growth of the market.

The automotive segment is experiencing the fastest growth in the market during the forecast period. The growing demand for lightweight materials in the automotive industry increases demand for biobased insulation materials. The focus on minimizing noise and improving passenger comfort increases demand for biobased insulation materials for thermal insulation and soundproofing. The growing production of interior components like bumpers, seat cushioning, headliners, and others increases demand for biobased insulation materials. The increasing adoption of electric vehicles and production of battery components fuels demand for biobased insulation materials, supporting the overall growth of the market.

Form Factor Insights

Why did the Rigid Boards Segment Dominate the Biobased Insulation Material Market?

The rigid boards segment dominated the market in 2024. The growing expansion of the building and construction sector increases demand for rigid boards. The applications like aerospace, industrial furnaces, and power plants fuel demand for rigid boards. The strong focus on sustainable and energy-efficient building practices increases demand for rigid boards, helping the market growth. Rigid boards are easy to install and offer excellent thermal resistance. They offer high resistance against mechanical stress, moisture, and pests. The increasing construction of commercial & residential buildings increases demand for rigid boards for application in floors, walls, and roofs. The growing demand across industrial and commercial sectors drives the market growth.

The spray foam insulation segment is the fastest-growing in the market during the forecast period. The increasing shift towards sustainability and focus on energy efficiency increases demand for spray foam insulation. the increasing development of industrial, residential, and commercial buildings increases demand for spray foam insulation. They are widely used to seal cracks and gaps. Spray foam insulation is cost-effective and offers excellent moisture resistance. The increasing demand across attics, agricultural structures, walls, and roofs supports the market growth.

Thermal Conductivity Insights

How Low Thermal Conductivity Segment Held the Largest Share in the Biobased Insulation Material Market?

The low thermal conductivity segment held the largest revenue share in the market in 2024. The increasing demand for reducing heat flow through floors, walls, and roofs increases the adoption of low thermal conductivity insulation materials. The focus on improving the energy efficiency of buildings increases demand for low thermal conductivity insulation. It lowers energy consumption for cooling & heating and enhances thermal comfort. The focus on enhancing indoor comfort and minimizing temperature fluctuations drives the market growth.

The medium thermal conductivity segment is experiencing the fastest growth in the market during the forecast period. The focus on green buildings and sustainable construction increases demand for medium thermal conductivity. The government's stringent building codes and focus on lowering energy consumption increase the adoption of medium thermal conductivity. The increasing development of commercial buildings like retail spaces, offices, and others increases demand for medium thermal conductivity. The growing development of industrial facilities fuels demand for medium thermal conductivity for storage tanks, pipes, and other industrial equipment & processes supporting the overall growth of the market.

Performance Insights

Why did the Thermal Insulation Segment Dominate the Biobased Insulation Material Market?

The thermal insulation segment dominated the market in 2024. The focus on lowering energy consumption for cooling & heating increases demand for thermal insulation. The high-energy efficiency building codes and stricter building codes increase demand for thermal insulation. The rise in electric vehicles increases demand for thermal insulation for the development of HAVC systems and batteries. The growing demand across sectors like aerospace, construction, and automotive drives the market growth.

The sound insulation segment is the fastest-growing in the market during the forecast period. The growing construction activities, like the commercial and residential sectors, increase demand for sound insulation. The focus on noise control in buildings and growing renovation activity increases demand for sound insulation. The increasing health concerns like sleep disorders, stress, and others due to high noise levels increase the demand for sound insulation. The growing demand across sectors like aerospace, entertainment, automotive, and healthcare supports the market growth.

Durability Insights

How Long-Term Durability Segment Held the Largest Share in the Biobased Insulation Material Market?

The long-term durability segment held the largest revenue share in the market in 2024. The increasing focus on maintaining the effectiveness of insulation for the entire lifespan increases demand for long-term durability. The strong demand for frequent maintenance & replacements of insulation increases the adoption of long-term durability. The focus on avoiding issues like heat gain & heat loss and consistent thermal performance increases demand for long-term durability, driving the overall market growth.

The medium-term durability segment is experiencing the fastest growth in the market during the forecast period. The stricter carbon emission regulations and energy consumption increase demand for medium-term durability. The growing construction activity and increasing industrialization increase the adoption of medium-term durability. The increasing development of the commercial and residential sectors increases the adoption of medium-term durability, supporting the overall market growth.

Recent Developments

- In November 2023, Kingspan launched the biobased insulation Hemkor range. The product is made up of hemp and minimizes the carbon footprint of building. The Hemkor range includes: Padding, Jute Blends, and Pure.(Source: www.kingspangroup.com )

- In April 2024, SA-Dynamics launched bio-based aerogel insulation. The insulation material reduces carbon footprint and energy consumption. The insulation is made up of 100% biobased aerogel fibers and raw materials sourced sustainably.(Source: www.fibre2fashion.com)

- In August 2024, Carlisle launched biobased Polyiso Eco rigid foam insulation. The insulation material is made up of 5% bio-circular content and offers longevity & superior performance. The insulation material is available for developers, architects, and builders.(Source: www.roofingcontractor.com)

Biobased Insulation Material Market Top Companies

- Corkcom

- ThermoNatur

- Kingspan Group

- BASF SE

- Rockwool International

- Owens Corning

- Mannok Insulation

- Saxony Insulation

- HempFlax

- EcoCork

- Green Building Materials

- Steico

- U.S. GreenFiber

- Johns Manville

- Green Insulation Solutions

- Naturinsulation

- Armacell

- FlexiCell

- Cotton Insulation

- Sustainable Insulation Systems

Segments Covered

By Product Type

- Plant-Based Insulation Materials:

- Cork

- Cellulose

- Hemp

- Flax

- Cotton

- Kenaf

- Wood Fiber

- Animal-Based Insulation Materials:

- Sheep Wool

- Alpaca Wool

- Goat Hair

- Other Biobased Materials:

- Mushroom-based Insulation

- Straw

- Recycled Paper

By End-Use Industry

- Construction:

- New Constructions

- Renovation and Retrofitting

- Automotive:

- Insulation for Electric Vehicles (EVs)

- Traditional Vehicles

- Consumer Electronics:

- Appliances

- Electronics Enclosures

- Industrial:

- Machine Insulation

- Thermal Insulation

- Agriculture:

- Storage of Agricultural Products

By Form Factor

- Rolls & Batts

- Loose Fill

- Rigid Boards

- Spray Foam Insulation

- Panels

By Thermal Conductivity

- Low Thermal Conductivity (<0.040 W/mK)

- Medium Thermal Conductivity (0.040–0.060 W/mK)

- High Thermal Conductivity (>0.060 W/mK)

By Performance

- Thermal Insulation

- Sound Insulation

- Fire Resistance

- Moisture Resistance

By Durability

- Short-Term Durability (< 5 years)

- Medium-Term Durability (5-10 years)

- Long-Term Durability (>10 years)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait