Content

What is the Current Residential Building Thermal Insulation Market Size and Share?

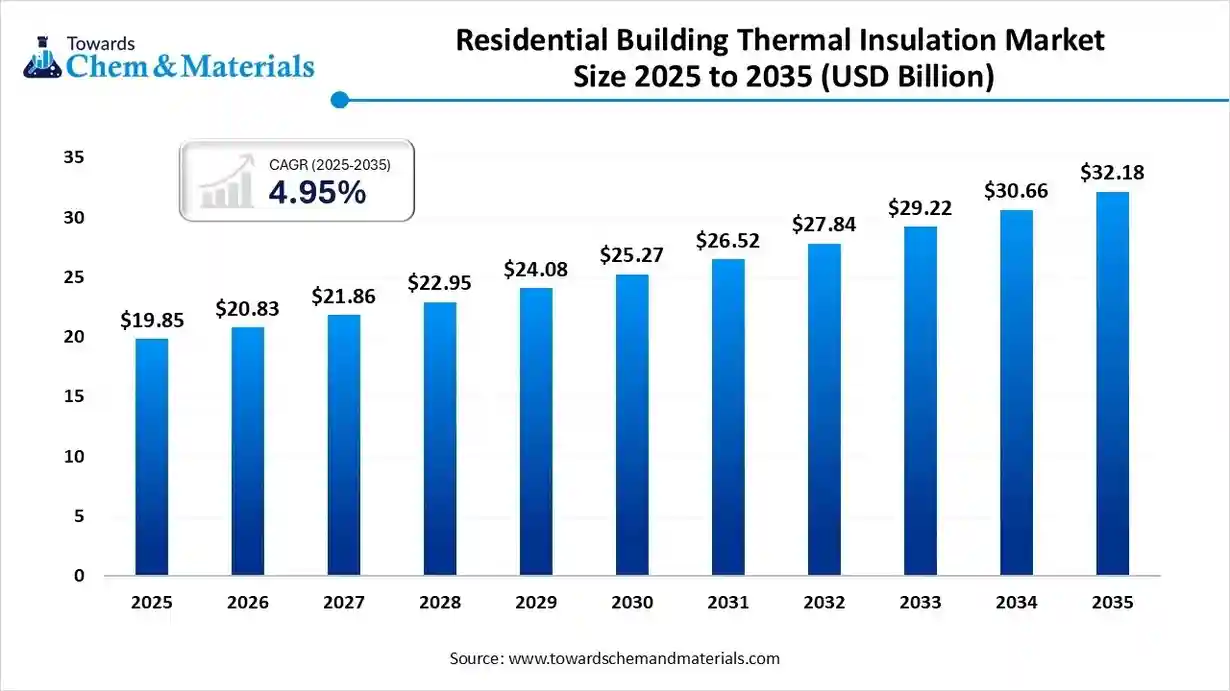

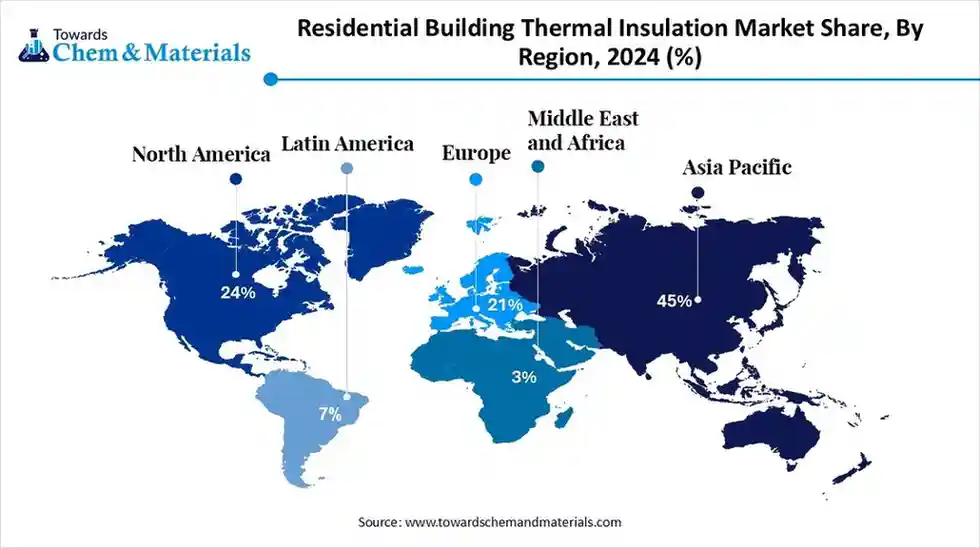

The global residential building thermal insulation market size was estimated at USD 19.85 billion in 2025 and is predicted to increase from USD 20.83 billion in 2026 and is projected to reach around USD 32.18 billion by 2035, The market is expanding at a CAGR of 4.95% between 2026 and 2035. Asia Pacific dominated the residential building thermal insulation market with a market share of 45% the global market in 2025. The growing consumer awareness of sustainability is the key factor driving market growth. Also, ongoing government incentives for green buildings, coupled with the innovations in sustainable materials, can fuel market growth further.

Key Takeaways

- By region, Asia Pacific led the residential building thermal insulation market with the largest revenue share of over 45% in 2025.

- By material type, the mineral wool segment led the market with the largest revenue share of 45% in 2025.

- By product form, the blanket insulation segment led the market with the largest revenue share of 60% in 2025.

- By application area, the roof/attic insulation segment accounted for the largest revenue share of 45% in 2025.

- By function, the multi-functional segment dominated the market and accounted for the largest revenue share of 70% in 2025.

What is Residential Building Thermal Insulation?

The residential building thermal insulation market covers the supply and application of materials and systems specifically designed to reduce heat transfer (heat loss in winter and heat gain in summer) through the building envelope (walls, roofs, floors) of residential structures (single-family homes, multi-family apartments, etc.).

Residential Building Thermal Insulation Market Trends

- The increase in construction spending and rapid urbanisation is the latest trend in the market. Also, there is an increasing demand to address energy consumption and minimize overall environmental impact. This factor is anticipated to boost the demand for thermal insulation solutions in different sectors.

- The ongoing innovations in technology, especially within the domain of thermal insulation materials, are expected to fuel market growth. These innovations aim to improve insulation properties, provide sustainable solutions, and drive energy efficiency, impacting positive market growth soon.

- Strict energy efficiency regulations are a leading force behind the use of thermal insulation in the construction industry. These regulations can improve energy efficiency in buildings by minimizing heating and cooling costs. As a result, thermal insulation plays a key role in the industry.

Major market players are emphasizing developing hybrid insulation systems that offer many benefits, such as acoustic advantages, superior thermal performance, and fire resistance within a single product, leading to further market expansion. - The surge in prefabrication and modular construction practices is another major trend shaping positive market growth. These practices need high-performance, standardized insulation solutions that can be installed effectively, propelling demand for certain product types.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 20.83 Billion |

| Revenue Forecast in 2035 | USD 32.18 Billion |

| Growth Rate | CAGR 4.95% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Material Type, By Product Form, By Application Area, By Function/Property, By Region |

| Key companies profiled | ROCKWOOL International A/S, Kingspan Group plc, Knauf Group (Knauf Insulation), Dow Inc., BASF SE, Johns Manville Corporation (A Berkshire Hathaway Company), Covestro AG, GAF Materials LLC, DuPont de Nemours, Inc., Atlas Roofing Corporation, Beijing New Building Materials Co., Ltd. (BNBM), Evonik Industries AG, ICL Group Ltd., Armacell International S.A., Wanhua Chemical Group Co., Ltd., Huntsman Corporation, Celotex (Part of Saint-Gobain), Holcim Ltd. |

How Cutting Edge Technologies are revolutionizing the Residential Building Thermal Insulation Market?

Advanced technologies are transforming the market by introducing sustainable, high-performance materials and combining smart data-driven systems. Furthermore, the ongoing development of new materials and their applications in nanotechnology is leading to substantially enhanced thermal performance and minimizing overall material thickness.

Trade Analysis of Residential Building Thermal Insulation Market: Import & Export Statistics:

Vietnam is the world's leading exporter of insulating materials, with 300,574 shipments. China follows in second place with 18,112 shipments, and South Korea is the third-largest exporter, accounting for 8,140 shipments.

Exports

- In 2024, Japan exported ¥11.6M of Electrical insulators of glass, being the 4,149th most exported product in Japan.

- In 2024, the main destinations of Japan's Electrical insulators of glass exports were: the United States (¥6.7M), Malaysia (¥3.19M), Singapore (¥702k), Philippines (¥562k), and China (¥253k).

Imports

- In 2024, Japan imported ¥9.06M of Electrical insulators of glass, being the 4,928th most imported product in Japan.

- In 2024, the main origins of Japan's Electrical insulators of glass imports were: Italy (¥3.6M), China (¥3.02M), the United States (¥1.69M), and Germany (¥758k).

Residential Building Thermal Insulation Market Value Chain Analysis

- Feedstock Procurement: It refers to the sourcing of raw materials required to manufacture insulation products like mineral wool, fiberglass, and plastic foams.

- Major Players: Owens Corning, Rockwool International A/S.

- Chemical Synthesis and Processing : It involves the creation and production of different synthetic polymer-based insulation materials through industrial processes and chemical reactions.

- Major Players: BASF SE, Evonik Industries AG

- Packaging and Labelling: The packaging mainly protects the products during logistics and installation, while labelling is a regulated component for disclosing crucial performance and safety information.

- Major Players: Owens Corning, Knauf Gips KG.

- Regulatory Compliance and Safety Monitoring: The market is heavily impacted by stringent building codes and energy efficiency regulations. It ensures product performance and safety, with market players often depending on established international standards.

- Major Players: Johns Manville, Saint-Gobain.

Residential Building Thermal Insulation Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| European Union (EU) | The EU framework is governed by the Energy Performance in Buildings Directive (EPBD), which requires member states to establish and enforce minimum energy efficiency requirements for buildings. |

| United States (USA) | The US system often mandates specific quantitative values for energy factors, unlike the EU's more general guidelines. |

| India | The National Building Code of India and the Energy Conservation Building Code (ECBC) 2017 provide the primary guidelines for energy-efficient design and construction. |

Segmental Insights

Material Type Insights

How Much Share Did the Mineral Wool Segment Held in 2025?

The mineral wool segment dominated the market with a 45.11% share in 2025. The dominance of the segment can be attributed to the strict energy codes and growing demand for fire safety across the globe. Its high-temperature resistance and non-combustible nature make it a favoured choice for fire-prone residential areas to fulfil safety standards.

The plastic foams segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing awareness regarding high energy costs and demand to minimize heat loss or gain in homes. Foamed plastics are cost-effective, lightweight, and easy to install, offering exceptional thermal resistance.

Product Form Insights

Which Product Form Type Segment Dominated the Residential Building Thermal Insulation Market in 2025?

The blanket insulation segment held a 60% market share in 2025. The dominance of the segment can be linked to the rapid advancements in material science, which enhance thermal performance and sustainability of blanket products. Blankets are easy to install in different spaces and provide a balance of performance and price.

The spray foam insulation segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the increasing prevalence of eco-conscious building trends and the ongoing development of advanced foam types such as flexible foam. The spray foam creates a seamless, air-tight barrier, providing a better thermal resistance than conventional options.

Application Area Insights

Which Application Area Type Segment Dominated the Residential Building Thermal Insulation Market in 2025?

The roof/attic insulation segment held a 45% market share in 2025. The dominance of the segment is owing to a surge in construction activities, particularly in the emerging regions, coupled with the growing need for thermal comfort. Also, financial incentives like subsidies and tax credits further encourage developers and homeowners to invest in efficient attic and roof insulation.

The wall insulation segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to rising consumer awareness regarding comfort & sustainability, fuelling demand for energy-efficient solutions such as mineral wool and fiberglass. Furthermore, homeowners seek better indoor air quality, reduced noise, and thermal comfort, which leads to more insulation.

Function Insights

Which Function Type Segment Dominated the Residential Building Thermal Insulation Market in 2025?

The multi-functional segment dominated the market with a 70% share in 2025 and is expected to grow at the fastest CAGR during the study period. The dominance and growth of the segment can be attributed to the growing need for products that give benefits other than thermal resistance, like fire safety, acoustic insulation, and environmental sustainability. The use of nanotechnology also results in efficient and less bulky multi-functional products.

The thermal performance segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surge in energy costs and growing emphasis on green building initiatives. Also, market players are constantly developing novel materials like phase-change materials (PCMs), aerogels, and vacuum insulation panels (VIPs), which offer excellent thermal resistance.

Regional Insights

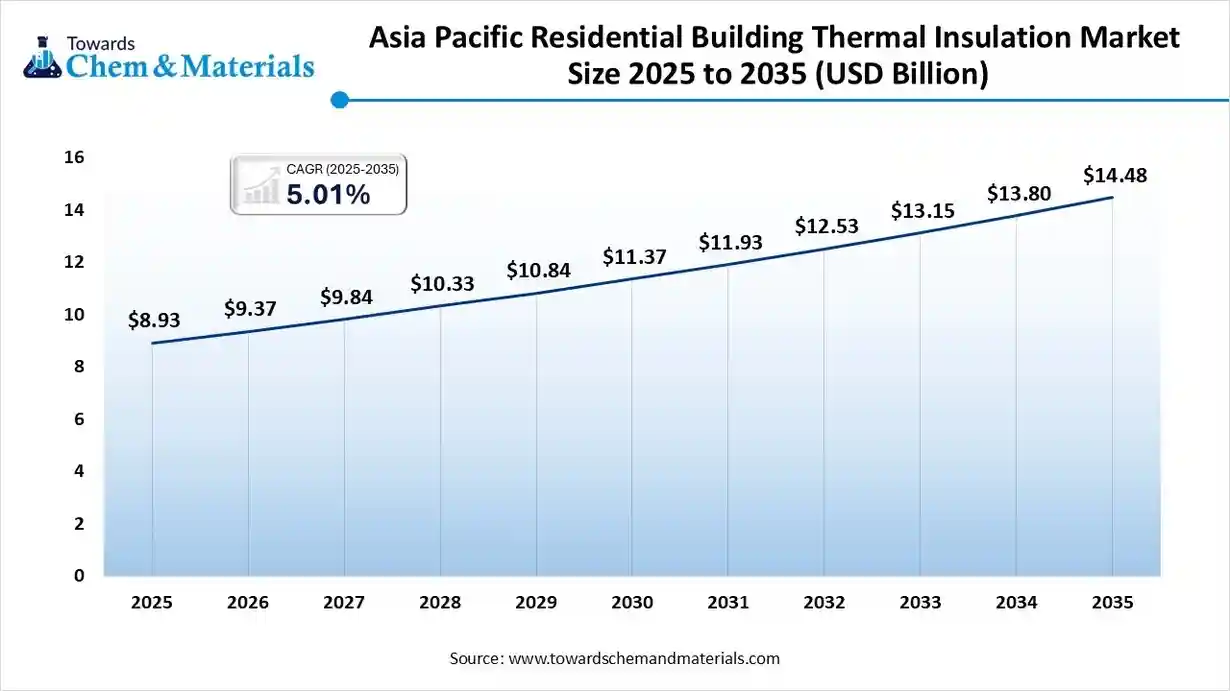

The Asia Pacific residential building thermal insulation market size was valued at USD 8.93 billion in 2025 and is expected to surpass around USD 14.48 billion by 2035, expanding at a compound annual growth rate (CAGR) of 5.01% over the forecast period from 2026 to 2035. Asia Pacific dominated the market with a 45% share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The dominance and growth of the region can be attributed to the massive infrastructure growth, ongoing urbanisation, and increasing energy costs. In addition, growing emphasis on smart buildings and sustainable construction fuels demand for high-performance insulation materials.

India Residential Building Thermal Insulation Market Trends

In the Asia Pacific, India dominated the market owing to the expanding construction sector and the government's push towards green building initiatives. India's extreme temperatures make thermal insulation important for minimizing indoor heat, a substantial driver for residential adoption.

North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the rising new construction& retrofitting activities and ongoing government incentives. Furthermore, the development of lightweight, high-performance, and sustainable materials is leading to regional expansion soon.

U.S. Residential Building Thermal Insulation Market Trends

In North America, the U.S. led the market due to advancements in insulation materials such as vacuum insulation panels (VIPs), high-performance spray foam, and aerogels, which give superior durability and thermal performance. The government incentives help offset the initial high cost associated with advanced insulation.

Europe held a substantial market share in 2025. The growth of the region can be linked to the surge in construction activities and urban populations, along with the government investments. Growing utility costs in the region are a major financial incentive for developers and homeowners to invest in efficient insulation, which leads to long-term energy cost savings.

Germany Residential Building Thermal Insulation Market Trends

The growth of the market in the country can be driven by its strong commitment to EU environmental regulations and sustainable targets to minimize energy use and greenhouse gas emissions. The country also has the strictest energy efficiency standards in Europe, driving market growth in the country soon.

South America held a major market share in 2025. The growth of the region can be driven by increasing emphasis on sustainability and minimizing carbon footprints to optimize the adoption of high-performance and sustainable insulation materials. Also, the varied climate zones across the region fuel diverse insulation needs.

Brazil Residential Building Thermal Insulation Market Trends

The growth of the country can be boosted by a surge in the commercial and residential construction sector, fuelled by rapid urbanisation and development. In addition, advancements in insulation technologies lead to high-performance materials with moisture control, superior thermal resistance, and fire safety.

The Middle East & Africa is one of the major shareholders in the market. The hot climate in the region leads to substantial energy use for cooling. Thermal insulation helps directly reduce energy consumption and utility costs for homeowners. Governments across the region are enforcing stringent regulations and building codes that require the use of thermal insulation.

Saudi Arabia Residential Building Thermal Insulation Market Trends

The growth of the market in the country can be driven by heavy investments in real estate and infrastructure under Vision 2030, which directly positively impacts the construction sector, fuelling demand for insulation. Rapid population growth in the new cities is creating a huge demand for new residential units, requiring insulation.

Recent Developments

- In December 2025, ALL IN OVERHALL LLC launches its new Residential Spray Foam Insulation services in Jupiter, FL, which aims to address the increasing interest from commercial and residential property owners preparing for occasional weather changes.(Source: www.shelbystar.com)

- In January 2025, Panasonic Corporation unveiled a business for the OASYS residential central air conditioning system in the United States market. OASYS can minimize energy consumption for air conditioning and heating by over 50% compared to traditional systems.(Source: news.panasonic.com)

Residential Building Thermal Insulation Market Companies

- Owens Corning: Owens Corning is a major global leader in the residential building insulation market, known for its signature PINK fiberglass products, driving innovation like faster-installing fiberglass and focusing heavily on energy efficiency and sustainability.

- Compagnie de Saint-Gobain S.A.: Compagnie de Saint-Gobain S.A. is a leading global player in the building thermal insulation market, recognized for its extensive range of solutions and strategic focus on sustainable, high-performance products for the residential sector.

Top Companies in the Residential Building Thermal Insulation Market

- Owens Corning

- Compagnie de Saint-Gobain S.A.

- ROCKWOOL International A/S

- Kingspan Group plc

- Knauf Group (Knauf Insulation)

- Dow Inc.

- BASF SE

- Johns Manville Corporation (A Berkshire Hathaway Company)

- Covestro AG

- GAF Materials LLC

- DuPont de Nemours, Inc.

- Atlas Roofing Corporation

- Beijing New Building Materials Co., Ltd. (BNBM)

- Evonik Industries AG

- ICL Group Ltd.

- Armacell International S.A.

- Wanhua Chemical Group Co., Ltd.

- Huntsman Corporation

- Celotex (Part of Saint-Gobain)

- Holcim Ltd.

Segments Covered

By Material Type

- Mineral Wool

- Glass Wool (Fiberglass)

- Stone Wool (Rock Wool)

- Plastic Foams

- Expanded Polystyrene (EPS)

- Extruded Polystyrene (XPS)

- Polyurethane (PU) Foam

- Polyisocyanurate (PIR) Foam

- Phenolic Foam

- Cellulosic and Natural Fibers

- Cellulose (Recycled Paper)

- Natural Fibers (e.g., Wood Fiber, Hemp, Cotton)

- Advanced Materials

- Aerogels (Granules, Blankets)

- Vacuum Insulated Panels (VIPs)

By Product Form

- Blanket Insulation

- Batts (Pre-cut sections)

- Rolls (Continuous lengths)

- Loose-Fill/Blown-In Insulation

- Loose-Fill Fiberglass

- Loose-Fill Cellulose

- Rigid Foam Boards/Panels

- EPS/XPS Boards

- PIR/PUR Boards

- Spray Foam Insulation

- Closed-Cell Spray Foam (e.g., Polyurethane)

- Open-Cell Spray Foam

- Reflective Insulation and Radiant Barriers

By Application Area

- Wall Insulation

- External Wall Insulation (EWI) / Exterior Cladding

- Cavity Wall Insulation

- Internal Wall Insulation

- Roof/Attic Insulation

- Flat Roof Insulation

- Pitched Roof Insulation

- Attic Floor/Loft Insulation

- Floor Insulation

- Below Grade (Basement/Crawl Space) Insulation

- Above Grade/Slab Insulation

By Function/Property

- Thermal Performance Only

- Multi-Functional (Thermal, Acoustic, and Fire Resistance)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa