Content

What is the Current Bio-polyols Market Size and Volume?

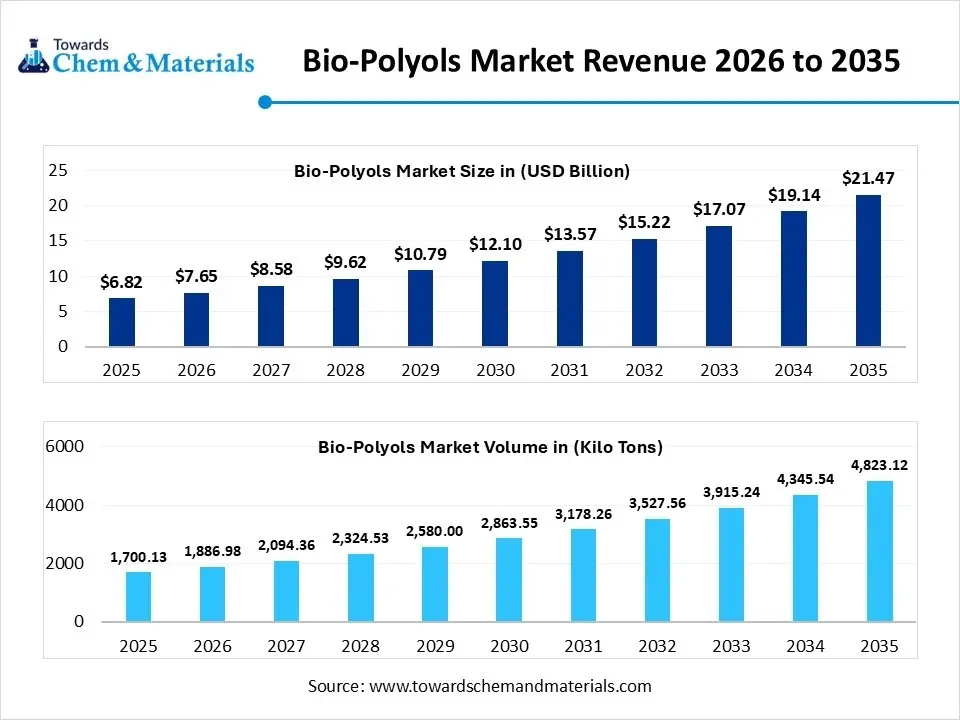

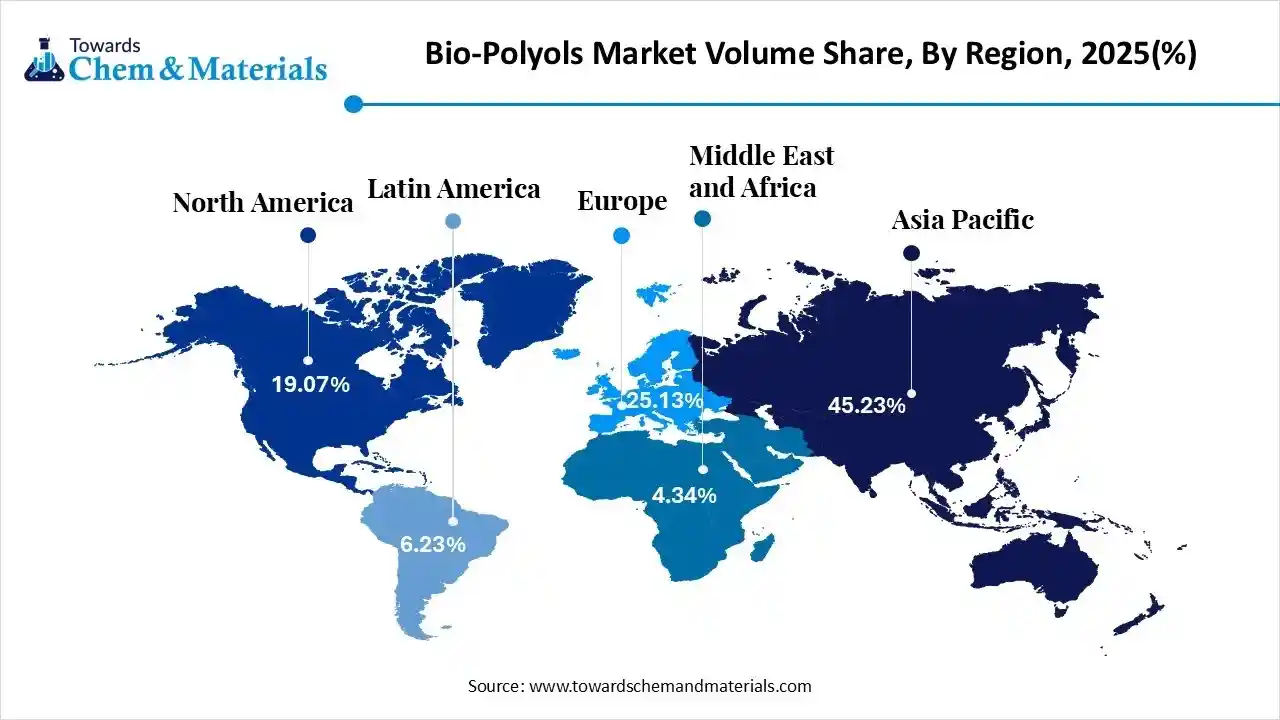

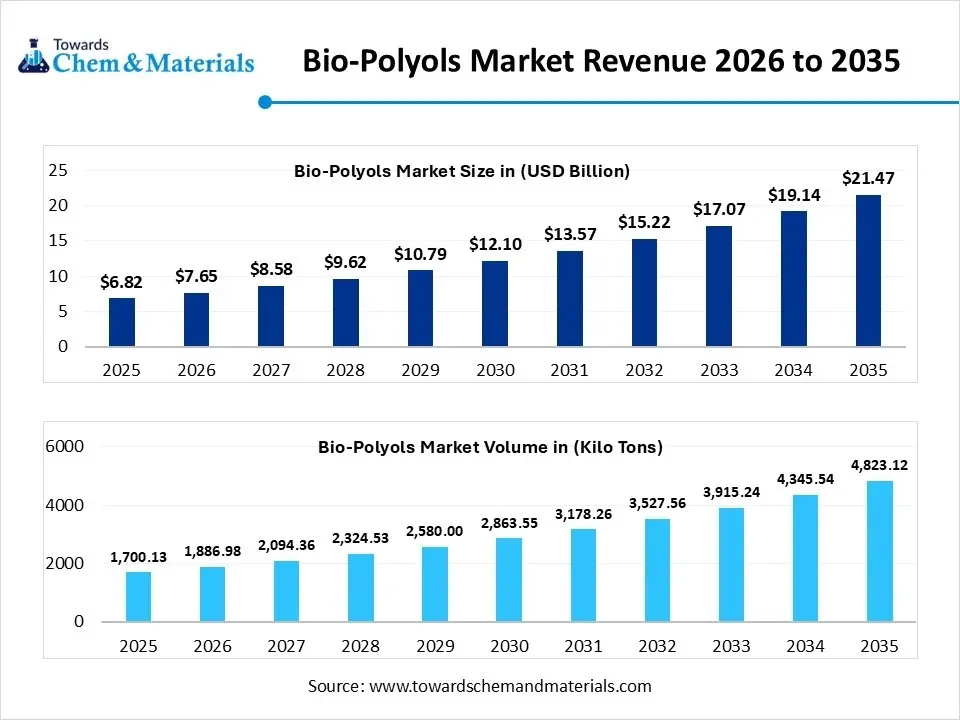

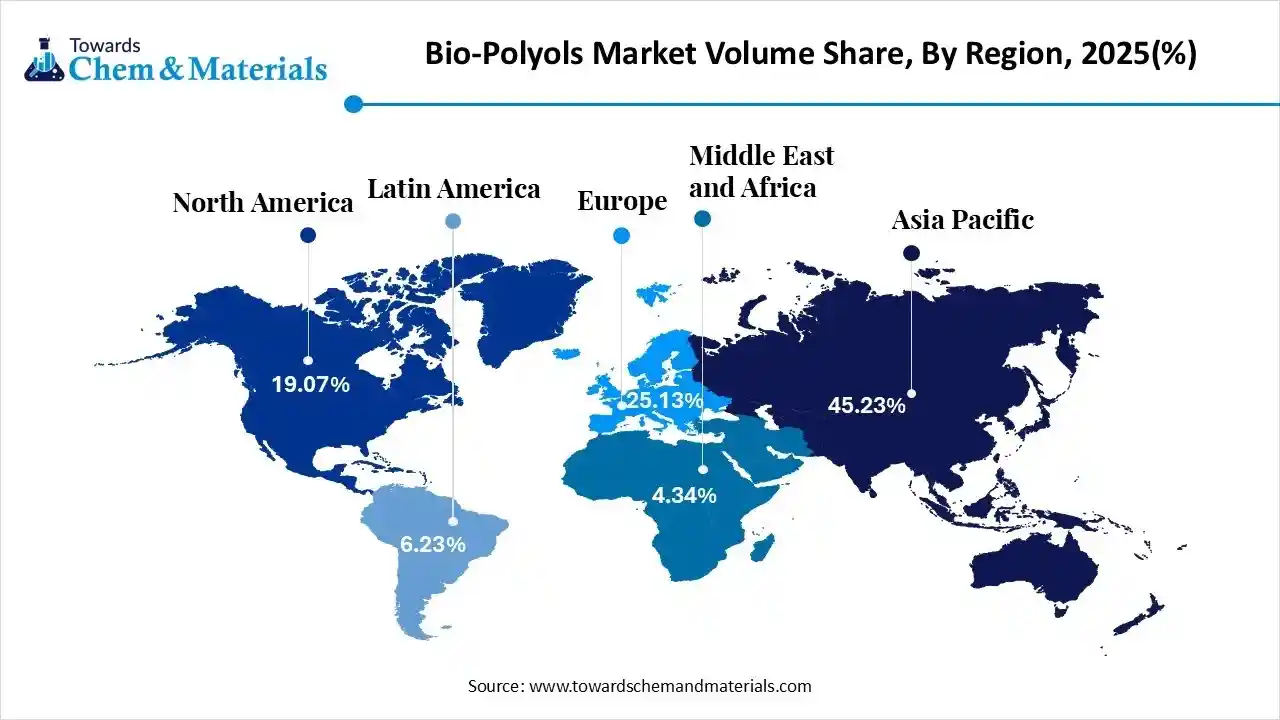

The global bio-polyols market size was estimated at USD 6.82 billion in 2025 and is expected to increase from USD 7.65 billion in 2026 to USD 21.47 billion by 2035, growing at a CAGR of 12.15% from 2026 to 2035. In terms of volume, the market is projected to grow from 1700.13 kilo tons in 2025 to 4823.12 kilo tons by 2035. growing at a CAGR of 10.99% from 2026 to 2035. Asia Pacific dominated the bio-polyols market with the largest volume share of 45.23% in 2025. The increased environmental consciousness and the rapid expansion of energy-efficient insulation drive market growth.

Market Highlights

- The Asia Pacific dominated the global bio-polyols market with the largest volume share of 45.23% in 2025.

- The bio-polyols market in Europe is expected to grow at a substantial CAGR of 11.19% from 2026 to 2035.

- The North America bio-polyols market segment accounted for the major volume share of 21.0% in 2025.

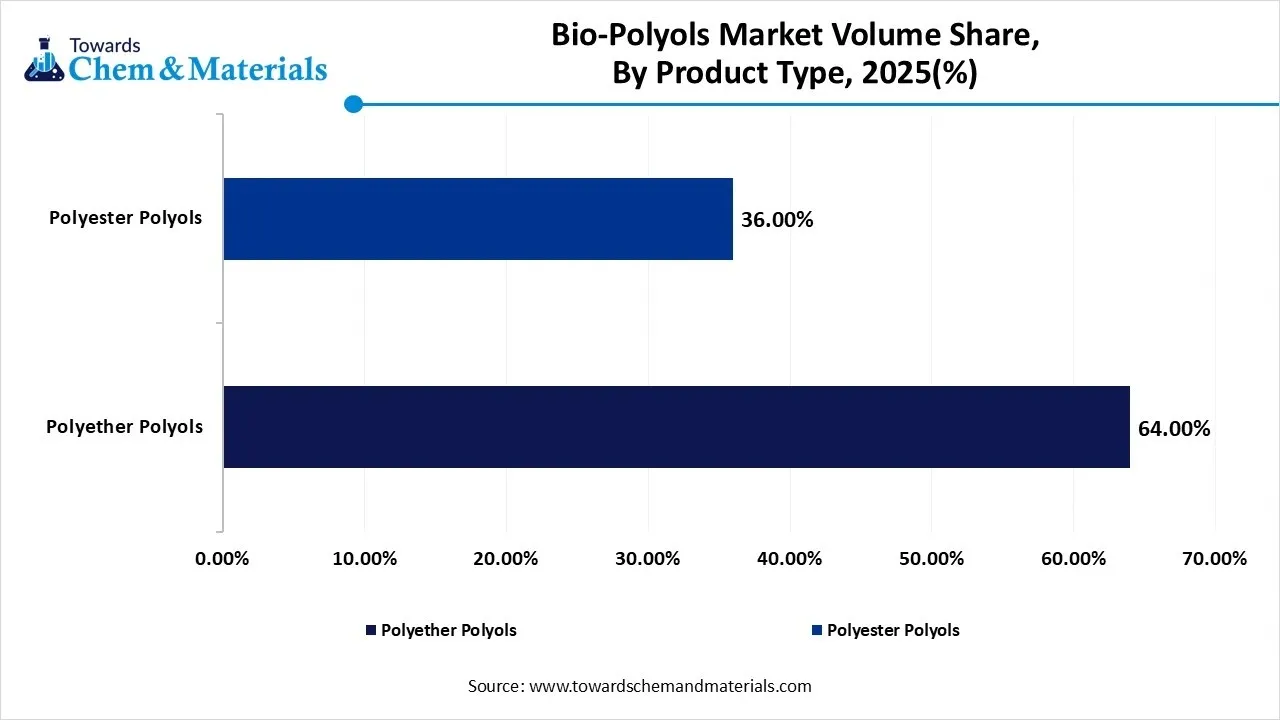

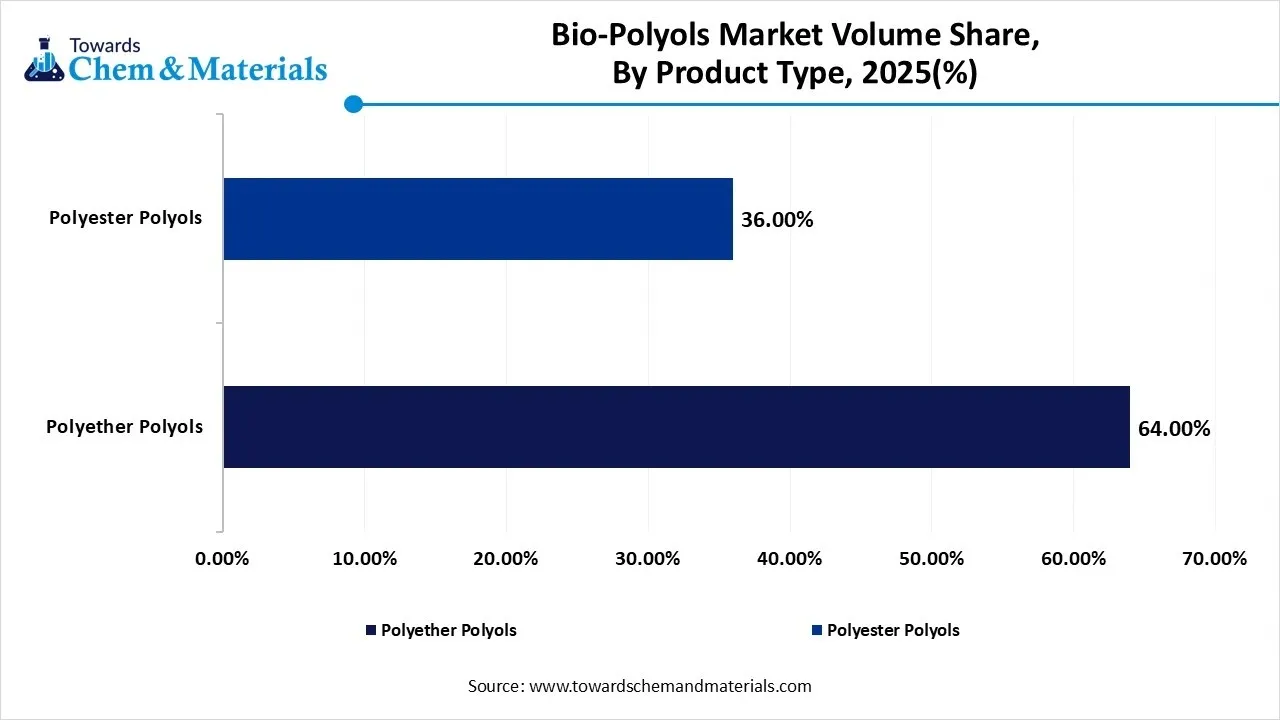

- By product type, the polyether polyols segment dominated the market and accounted for the largest volume share of 64% in 2025.

- By product type, the polyester polyols segment is expected to grow at the fastest CAGR of 13.36% from 2026 to 2035 in terms of volume.

- By raw material, the natural oils segment led the market with the largest revenue volume share of 55% in 2025.

- By application, the flexible polyurethane foam segment dominated the market and accounted for the largest volume share of 42% in 2025.

- By end-user industry, the furniture & bedding segment led the market with the largest revenue volume share of 32% in 2025.

What are Bio-polyols?

Bio-polyols are polyols made from agricultural byproducts and renewable resources. They offer benefits like a lower CO2 footprint, resource efficiency, less non-renewable energy use, and lower dependence on crude oil. Bio-polyols are widely used in applications like rigid foams, adhesives, elastomers, flexible foams, and others. Some examples of bio-polyols are BiOH, Merginol, Priplast, Sovermol, and Agrol.

The bio-polyols market growth is driven by the consumer shift towards eco-friendly products, the rise of automotive lightweighting, the increasing need for insulation, stringent government policies, focus on decreasing fossil fuel reliance, increased recycling of PET, development of polyurethane foams, and the modification of bio-polyols.

Bio-polyols Market Trends:

- Push for Environmental Sustainability:- The growing awareness about sustainable product use and the strong focus on minimizing the negative impact of carbon footprint increases demand for bio-polyols.

- Growth of Automotive Sector:- The focus on extending the electric vehicle range and the global sustainability automotive targets increases demand for bio-polyols.

- Green Building Focus:- The push for green building materials and the stringent energy codes in buildings increases demand for bio-polyols. The growing use of insulation across various construction parts increases demand for bio-polyols.

- Packaging Industry Expansion:- The development of protective packaging and the booming global online shopping increases demand for bio-polyols. The increased production of green shopping bags and the shift towards single-use items increase demand for bio-polyols.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 7.65 Billion / 1886.98 Kilo Tons |

| Revenue Forecast in 2035 | USD 21.47 Billion / 4823.12 Kilo Tons |

| Growth Rate | CAGR 12.15% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Raw Material, By Application, By End-User Industry, By Region |

| Key companies profiled | BASF SE, Cargill, Inc., Dow Inc., Covestro AG, Huntsman Corporation, Arkema S.A., Emery Oleochemicals, Mitsui Chemicals, Inc., Stepan Company, Evonik Industries AG, Jayant Agro-Organics Ltd., Alberdingk Boley GmbH, BioBased Technologies LLC, Vertellus Holdings LLC, Global Bio-Chem Technology Group |

Key Technological Shifts in the Bio-polyols Market:

The bio-polyols market is undergoing key technological shifts driven by the demand for sustainability, enhanced performance, and regulatory compliance. Innovations like nanotechnology, smart manufacturing, advanced conversion technologies, and machine learning enhance performance and develop high-quality products. The incorporation of artificial intelligence supports rapid innovation and enhances efficiency.

AI accelerates the innovation of new bio-based materials and optimizes the steps of the production process. AI focuses on enhancing operational efficiency and supports the management of inventory. AI develops high-performance polyols and develops the needed molecular structure of polyols. AI lowers the energy use and forecasts the failures of equipment. Overall, AI supports faster innovation and develops more agile polyols.

Trade Analysis of Bio-polyols Market: Import & Export Statistics

- China exported 28,088 shipments of polyether polyol.

- Vietnam imported 4,831 shipments of polyester polyols.

- China exported 5,653 shipments of polyester polyols.

- Vietnam imported 17,101 shipments of polyether polyols.

- Thailand exported 4,565 shipments of polyether polyol.

Bio-polyols Market Value Chain Analysis

- Feedstock Procurement: The stage focuses on sourcing raw materials like sugars, cooking oils, natural oils, glycerol, algae, and starches.

- Key Players:- Emery Oleochemicals, The Dow Chemical Company, Stepan Company, BASF SE, Covestro AG

- Chemical Synthesis and Processing: The stage involves methods like epoxidation, ring-opening, transesterification, liquefaction, and oxypropylation.

- Key Players:- The Dow Chemical Company, Covestro AG, Arkema S.A., Stepan Company, BASF SE, Emery Oleochemicals

- Quality Testing and Certifications: The stage focuses on evaluating properties like acid value, moisture content, thermal stability, hydroxyl value, molecular weight, purity, and viscosity. Certifications like USDA, DIN-Geprüft Biobased Certification, ISCC PLUS, ISO, and ASTM are required for bio-polyols.

- Key Players:- SGS, Anacon Laboratories, URS Lab, DIN CERTCO, Intertek, ERRL

Overview of Country-Wise Key Applications of Bio-Polyols

| Country | Key Raw Material Used | Key Applications |

| United States |

|

|

| China |

|

|

| Germany |

|

|

| Brazil |

|

|

Segmental Insights

Product Type Insights

How did the Polyether Polyols Segment hold the Largest Share in the Bio-Polyols Market?

The polyether polyols segment volume was valued at 1088.08 kilo tons in 2025 and is projected to reach 2931.49 kilo tons by 2035, expanding at a CAGR of 11.64% during the forecast period from 2025 to 2035. The polyether polyols segment held the largest revenue share of 64% in the market in 2025. The increasing use of rigid foams in construction projects and the development of PU flexible foams increase demand for polyether polyols. The growing demand for CASE across industries and the increasing use of high-performance materials in the interiors of automotive vehicles require polyether polyols. The superior hydrolytic stability, cost-effectiveness, and ease of production of polyether polyols drive the overall market growth.

The polyester polyols segment volume was valued at 612.05 kilo tons in 2025 and is projected to reach 1891.63 kilo tons by 2035, expanding at a CAGR of 13.36% during the forecast period from 2025 to 2035. The strict regulations for lowering dependence on fossil fuels and booming construction projects increase the demand for polyester polyols. The focus on enhancing fuel efficiency and the increasing use of biocompatible capsule coatings requires polyester polyols. The enhanced performance and sustainability of polyester polyols support market growth.

Global Bio-Polyols Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Polyether Polyols | 64.00% | 1088.08 | 2931.49 | 11.64% | 60.78% |

| Polyester Polyols | 36.00% | 612.05 | 1891.63 | 13.36% | 39.22% |

Raw Material Insights

Why the Natural Oils Segment Dominates the Bio-Polyols Market?

The natural oils segment dominated the market with a 55% share in 2025. The strong sustainability goals and the consumer focus on sustainable products increase demand for natural oils. The cost-effectiveness, abundance, high performance, and versatility of natural oils help market expansion. The high availability of rapeseed oil, soy oil, and castor oil drives the overall market growth.

The carbon dioxide segment is the fastest-growing in the market during the forecast period. The corporate firms' sustainability goals and the stringent environmental regulations increase demand for carbon dioxide-based polyols. The strong focus on combating climate change issues and the volatility in crude oil prices increases demand for carbon dioxide-based polyols. The enhanced performance and the environmental benefits of carbon dioxide support the overall market growth.

Application Insights

Why the Flexible Polyurethane Foam Segment Dominates the Bio-Polyols Market?

The flexible polyurethane foam segment dominated the market with a 42% share in 2025. The increasing use of mattresses and the growth in the development of carpet underlay increase demand for flexible polyurethane foam. The regulatory push for reducing carbon footprint and the creation of greener products increase demand for flexible polyurethane foam. The comfort, cost-effectiveness, excellent processability, and superior cushioning of flexible polyurethane foam drive the market growth.

The coatings, adhesives, sealants, & elastomers (CASE) segment is the fastest-growing in the market during the forecast period. The rapid expansion of wind turbines and the growth in construction applications increase demand for CASE. The focus on protecting delicate electronic components and the increased use of furniture increases demand for CASE. The expanding consumer goods sector supports the overall market growth.

End-User Industry Insights

Which End-User Industry Segment held the Largest Share in the Bio-Polyols Market?

The furniture & bedding segment held the largest revenue share of 32% in the bio-polyols market in 2025. The growing home furnishing activities and the increasing need for cushioning in furniture increase demand for bio-polyols. The rapid growth in furniture production and the high spending on luxury home furnishing require bio-polyols. The shift towards green living and increased upholstery production drives the market growth.

The automotive & transportation segment is experiencing the fastest growth in the market during the forecast period. The push for minimizing carbon footprint in automobiles and the increased production of automotive interiors increase demand for bio-polyols. The development of seat foam and the increasing use of electric vehicles increase demand for bio-polyols. The growing integration of eco-friendly materials in automobiles supports the overall market growth.

Regional Insights

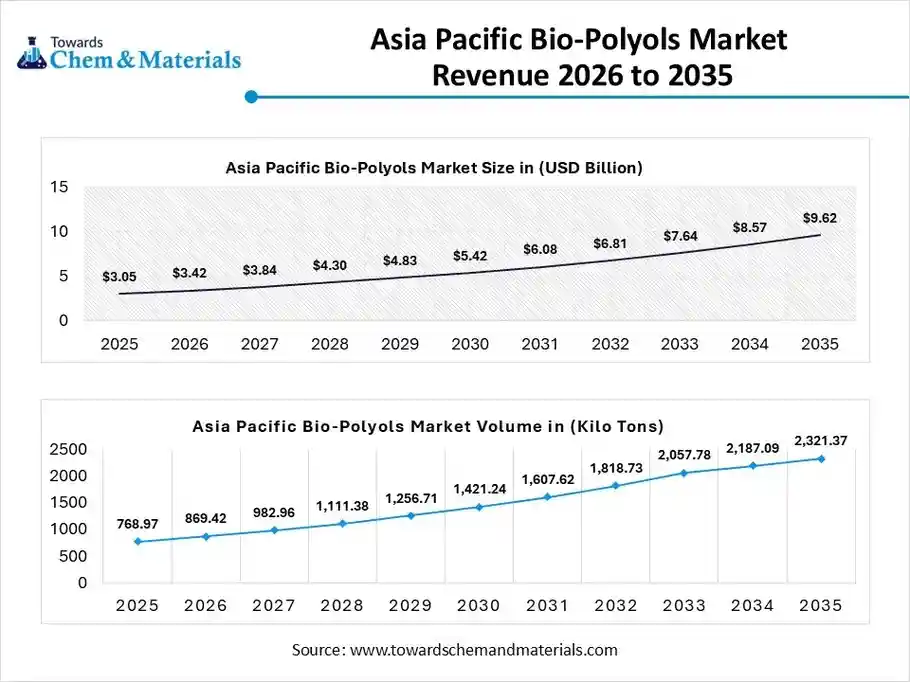

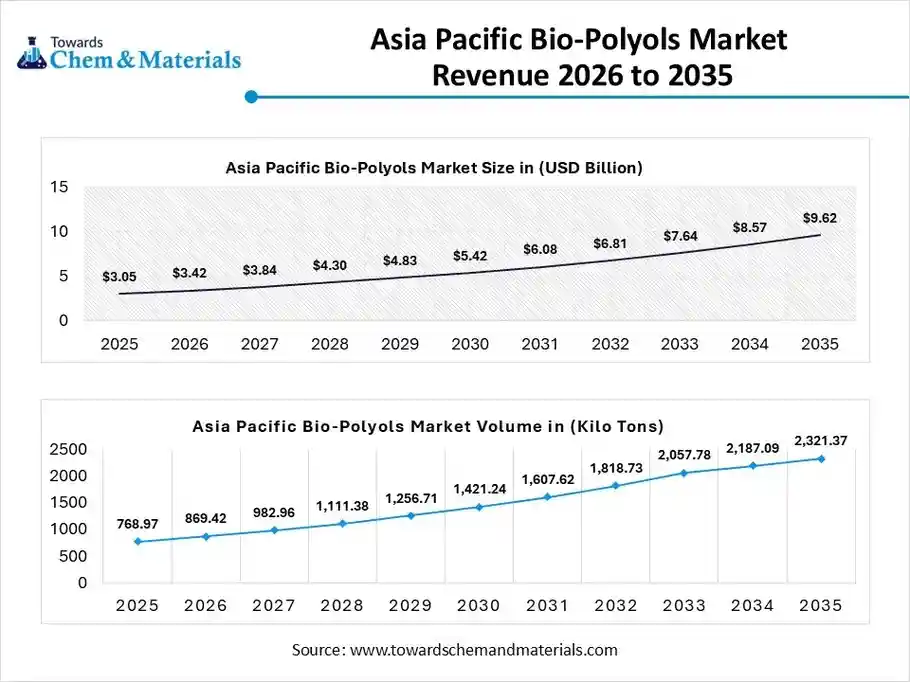

The Asia Pacific bio-polyols market size was valued at USD 3.05 billion in 2025 and is expected to be worth around USD 9.62 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 12.17% over the forecast period from 2026 to 2035.

The Asia Pacific bio-polyols market volume was estimated at 768.97 kilo tons in 2025 and is projected to reach 2321.37 kilo tons by 2035, growing at a CAGR of 13.06% from 2026 to 2035.Asia Pacific is experiencing the fastest growth in the market during the forecast period. The growing expansion of urban areas and the increased consumption of durable goods increase demand for bio-polyols. The shift towards sustainable practices and the strong presence of manufacturing infrastructure increase demand for bio polyols. The increased development of lightweight automotive components and the increasing use of eco-friendly foams require bio polyols, driving the overall growth of the market.

Rise Construction Drives Bio-Polyols Growth in the United States

The United States is a major contributor to the market. The strong focus on green buildings and the increasing use of sustainable materials increases demand for bio-polyols. The advanced manufacturing abilities and thriving construction activities increase demand for bio-polyols. The increased utilization of soy-based polyols and the growing demand for polyurethane support the overall growth of the market.

Evolution of Bio-polyols in North America

The North America bio-polyols market volume was estimated at 324.21 kilo tons in 2025 and is projected to reach 988.74 kilo tons by 2035, growing at a CAGR of 13.19% from 2026 to 2035. North America dominated the bio-polyols market in 2025. The increasing use of energy-efficient insulation and the well-established agricultural industry increase demand for bio-polyols. The growing expansion of construction projects and the increasing consumer awareness about green products create a higher demand for bio-polyols. The well-established industrial base and the increasing use of plant-based products increase demand for bio-polyols, driving the overall growth of the market.

Global Bio-Polyols Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 19.07% | 324.21 | 988.74 | 13.19% | 20.50% |

| Europe | 25.13% | 427.24 | 1109.80 | 11.19% | 23.01% |

| Asia Pacific | 45.23% | 768.97 | 2321.37 | 13.06% | 48.13% |

| South America | 6.23% | 105.92 | 247.43 | 9.89% | 5.13% |

| Middle East & Africa | 4.34% | 73.79 | 155.79 | 8.66% | 3.23% |

From Farm to Foams: Evolution of Bio-polyols in India

India is rapidly growing in the market. The emphasis on meeting climate goals and the development of lightweight components increases demand for bio-polyols. The increasing use of eco-friendly foams and the focus on energy-efficient insulation increase demand for bio-polyols. The strong consumer preference for bio-based products and the need to lower dependence on petroleum create demand for bio-polyols, supporting the overall market growth.

Recent Developments

- In November 2025, Monument Chemical launched high-performance polyols, polycarbonate ether (PCE) polyols from renewable carbon. The polyols are widely used in applications like mattresses, apparel, coatings, sealants, furniture, footwear, elastomers, and adhesives.(Source: www.econic-technologies.com)

- In August 2024, Cargill launched 100% bio-based polyols at FEICA 2024. The line includes 100% bio-based polyols, bye-bye to isocyanate, and rPET polyol.(Source: www.specialchem.com)

- In October 2024, Mitsubishi Chemical Group launched plant-based polyurethane polyols BioPTMG to develop bio-synthetic leather bags. The bio-polyols lower the GHG emissions and are made up of high biomass content.(Source: www.indianchemicalnews.com)

Top Companies List

- BASF SE:- The Germany-based company manufactures bio-polyols, including Pluracol and Sovermol, by using renewable feedstocks like soybean oils, rapeseed, and castor.

- Cargill, Inc.:- The company supplies and manufactures bio-polyols to serve diverse industrial applications like construction, furniture, automotive, and bedding.

- Dow Inc.:- The company manufactures bio-polyols with product lines SPECFLEX REN, Ecolibrium, and VORANOL REN to serve applications like sealants, coatings, and adhesives.

- Covestro AG:- The company manufactures bio-polyols using bio-based raw materials to serve applications like buildings, medical devices, cars, and electronics.

- Huntsman Corporation:- The company produces bio-based polyols ACOUSTIFLEX VEF BIO and JEFFADD for the development of various end-use products.

- Arkema S.A.

- Emery Oleochemicals

- Mitsui Chemicals, Inc.

- Stepan Company

- Evonik Industries AG

- Jayant Agro-Organics Ltd.

- Alberdingk Boley GmbH

- BioBased Technologies LLC

- Vertellus Holdings LLC

- Global Bio-Chem Technology Group

Segments Covered

By Product Type

- Polyether Polyols

- Polyester Polyols

By Raw Material

- Natural Oils

- Soybean

- Castor

- Palm

- Rapeseed

- Sucrose & Sugars

- Glycerin

- Carbon Dioxide (CO2-based)

- Others (Lignin/Recycled Polymers)

By Application

- Flexible Polyurethane Foam

- Rigid Polyurethane Foam

- Coatings, Adhesives, Sealants, & Elastomers (CASE)

- Others (Insulation/Specialty)

By End-User Industry

- Furniture & Bedding

- Automotive & Transportation

- Construction & Infrastructure

- Packaging

- Footwear & Consumer Goods

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa