Content

What is the Current Agriculture Fertilizers Market Size and Share?

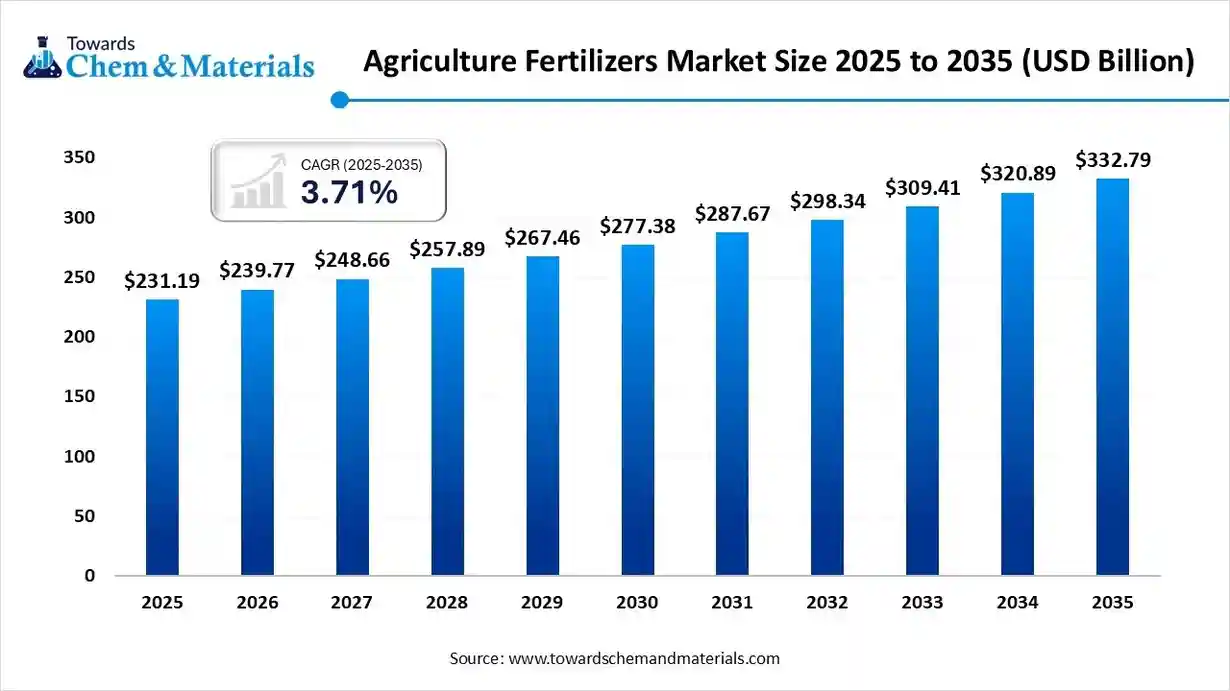

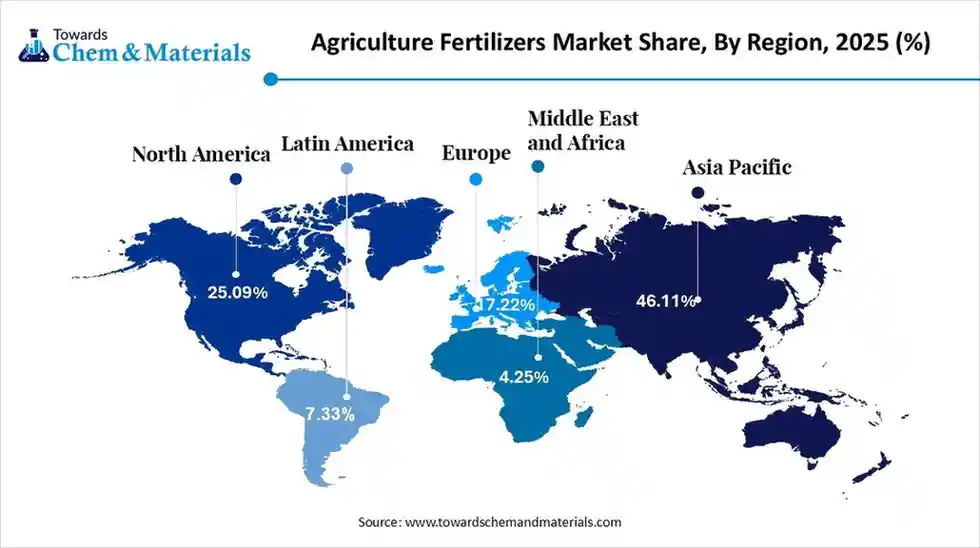

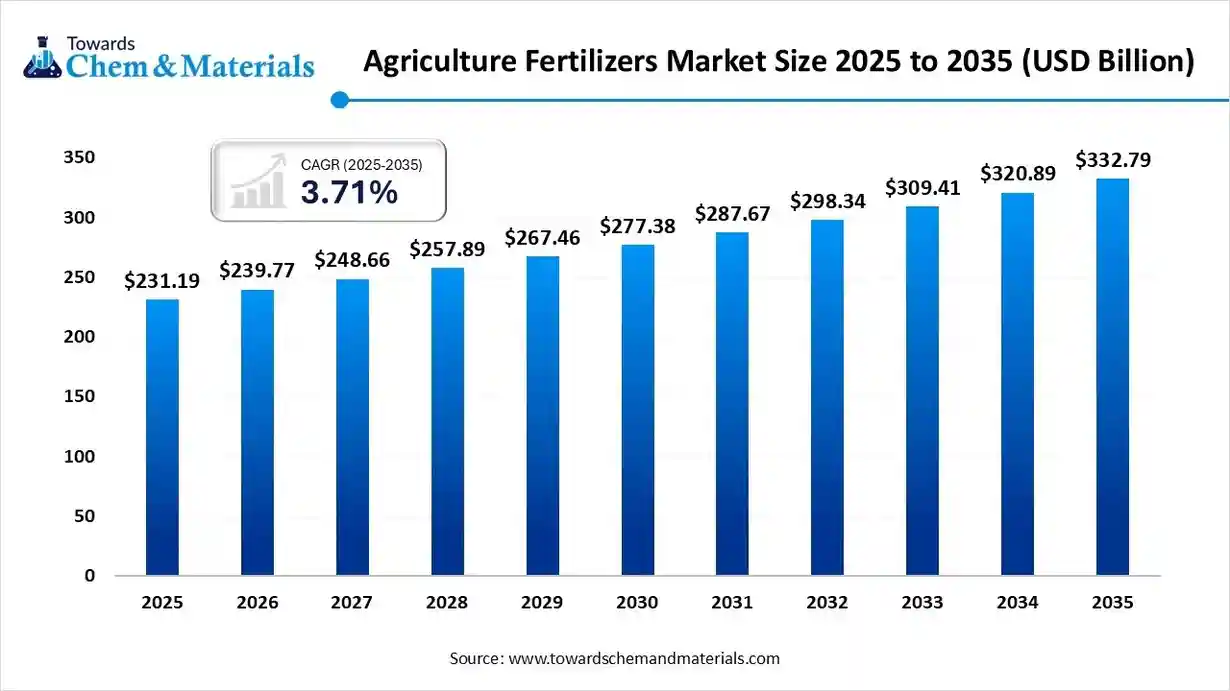

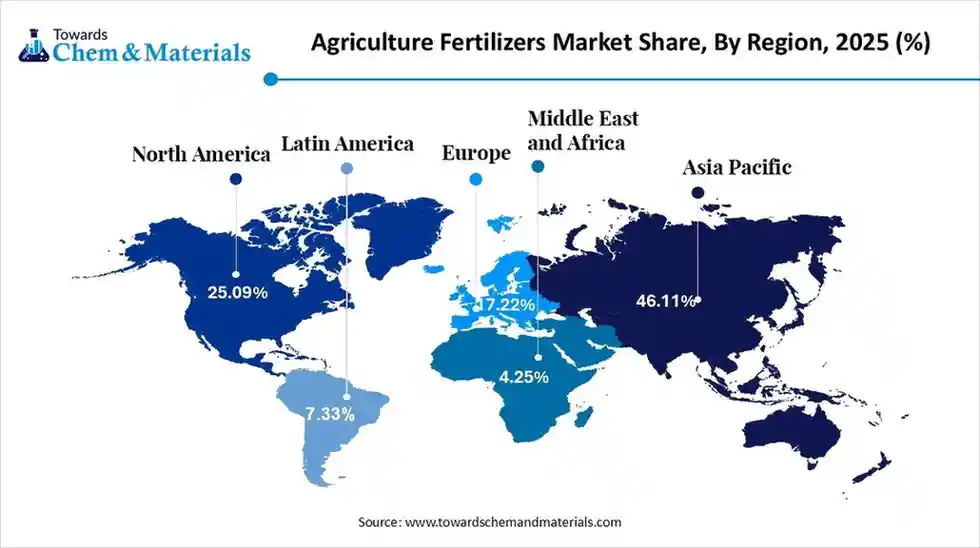

The global agriculture fertilizers market size was estimated at USD 231.19 billion in 2025 and is predicted to increase from USD 239.77 billion in 2026 and is projected to reach around USD 332.79 billion by 2035, The market is expanding at a CAGR of 3.71% between 2026 and 2035. Asia Pacific dominated the agriculture fertilizers market with a market share of 46.33% the global market in 2025. The soil nutrient depletion and growing food demand drive the market growth.

Key Takeaways

- By region, Asia Pacific led the agriculture fertilizers market with the largest revenue share of over 46.33% in 2025.

- By product type, the nitrogenous fertilizers segment led the market with the largest revenue share of 58.11% in 2025.

- By nature, the inorganic fertilizers segment led the market with the largest revenue share of 91.10% in 2025.

- By form, the dry/solid segment accounted for the largest revenue share of 81.28% in 2025.

- By application method, the soil application segment dominated with the largest revenue share of 88.21% in 2025.

- By crop type, the field crops segment dominated the market and accounted for the largest revenue share of 63.17% in 2025.

- By release mechanism, the conventional (fast-release) fertilizers segment accounted for the largest market revenue share of 85.15% in 2025.

What Drives the Agriculture Fertilizers Market Growth?

The agriculture fertilizers market growth is driven by a strong focus on higher agricultural productivity, a rise in precision agriculture, a shrinkage of arable land, a shift towards sustainable agriculture, the depletion of soil nutrients, and the growing cultivation of high-value crops.

The strong government focus on lowering import dependency and expanding domestic production of crops increases demand for agriculture fertilizers. The increasing need for nutrients like potassium, nitrogen, and phosphorus for plant growth increases demand for agriculture fertilizers.

What are Agriculture Fertilizers?

Agriculture fertilizers are natural or synthetic products applied to plants, leaves, soil, to offering essential nutrients. They enhance soil properties, improve soil fertility, and increase crop yields. Fertilizers are classified into types like inorganic fertilizers, biofertilizers, and organic fertilizers.

Organic fertilizers are made up of animal waste, compost, manure, & decomposed plant whereas synthetic fertilizers are made from the chemical compounds. They improve water retention in plants and support the healthy development of plants. Some examples of agricultural fertilizers are potassium fertilizers, nitrogenous fertilizers, blended fertilizers, and others.

Agriculture Fertilizers Market Trends:

- Growing Agriculture Sector: The growing agriculture sector in regions like Africa, Asia Pacific, and South America increases demand for fertilizers to enhance plant growth. The production of higher crop yields and the depletion of nutrients in the soil require agriculture fertilizers.

- Growing Population: The growing population in regions like Asia, Africa, and others increases demand for higher agricultural yields. The growing population increases demand for food, which increases the adoption of agriculture fertilizers to enhance crop productivity and maintain the fertility of the soil.

- Government Support: The government support helps to lower import dependency, boost domestic production capacity, and develop new plants.

- Focus on Improving Soil Fertility: The growing depletion of nutrients like potassium, nitrogen, and phosphorus in soil and the less arable land increases demand for agriculture fertilizers. Farmers are heavily investing in fertilizers to improve soil fertility.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 239.77 Billion |

| Revenue Forecast in 2035 | USD 332.79 Billion |

| Growth Rate | CAGR 3.71% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Segments covered | By Product Type, By Nature/Origin, By Form, By Application Method, By Crop Type, By Release Mechanism (Specialty Fertilizers), By Region |

| Key companies profiled | Yara International ASA, The Mosaic Company, CF Industries Holdings, Inc.,EuroChem Group AG, OCP Group S.A., Sinopec (China Petroleum & Chemical Corporation), ICL Group Ltd., K+S AG, Koch Industries (Koch Fertilizer, LLC), Sociedad Química y Minera de Chile S.A. (SQM), Indian Farmers Fertiliser Cooperative Limited (IFFCO), Coromandel International Limited, BASF SE, Paradeep Phosphates Limited (PPL), PhosAgro PJSC, Rashtriya Chemicals & Fertilizers Ltd. (RCF), Fertilizers and Chemicals Travancore Ltd. (FACT), Kingenta Ecological Engineering Co., Ltd., Sumitomo Chemical Co., Ltd. |

Key Technological Shifts in the Agriculture Fertilizers Market:

The agriculture fertilizers market is undergoing key technological shifts driven by the demand for nutrient management, lower environmental impact, and performance efficiency. The technological innovations like nano-fertilizers, GIS, data analysis, biodegradable coatings, and automation enhance crop yields, optimize the delivery of nutrients, and reduce waste. One of the major shifts is the integration of artificial intelligence (AI) minimizes cost, increases efficiency, and develops higher crop yields.

AI collects data like the temperature, nutrient content, soil moisture, and pH levels, and provides recommendations for the exact application of fertilizer. AI manages quality control and optimizes the production process. AI predicts equipment failures and weather events. AI helps farmers manage resources and plan planting schedules. Overall, AI is transforming traditional agricultural methods into a proactive way that helps the environment and farmers.

Trade Analysis of the Agriculture Fertilizers Market: Import & Export Statistics

- Russia exported $15.3B of fertilizers in 2023.

- In 2023, China exported $5.05B of nitrogenous fertilizers.

- Brazil imported $4.35B of nitrogenous fertilizers in 2023.

- Morocco exported $713M of phosphatic fertilizers in 2023.

- Canada exported $9.44B of potassic fertilizers in 2023.

- Brazil imported $5.65B of potassic fertilizers in 2023.

Agriculture Fertilizers Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement is the sourcing of raw materials like natural gas, naphtha, raw phosphate rock, potash, aquatic plants, agricultural waste, phosphoric acid, and organic municipal waste.

- Key Players:- Yara International ASA, The Mosaic Company, IFFCO, Nutrien Ltd, ICL Group Ltd.

- Chemical Synthesis and Processing: The chemical synthesis and processing involve the haber-bosch process, granulation, drying, cooling, coating, bagging, sealing, and packaging.

- Key Players:- OCP Group S.A., Nutrien Ltd, The Mosaic Company, ICL Group Ltd., CF Industries Holdings, Inc.

- Quality Testing and Certifications: The quality testing involves evaluation of properties like nutrient, moisture content, harmful contaminants, physical form, composition, & safety, and certifications like ISO, Ecocert, USDA organic, and AGMARK.

- Key Players:- CAAE, Alfa Chemistry Testing Lab, CFQCTI, NFL, SOHISCERT

From Mines to Markets: How Nations Map the Fertilizer Sector

| Country | Key Regulations | Major Fertilizer Produced | Key Companies |

| China |

|

|

|

| United States |

|

|

|

| Saudi Arabia |

|

|

|

| Germany |

|

|

|

Segmental Insights

Product Type Insights

Why Nitrogenous Fertilizers Segment Dominates the Agriculture Fertilizers Market?

The nitrogenous fertilizers segment dominated the agriculture fertilizers market with a 58.11% share in 2025. The emphasis on increasing crop yields and focus on the overall development of the plant increases the adoption of nitrogenous fertilizers. The rise in development of staple crops like grains & cereals and increasing production of cotton, fruits, & vegetables requires nitrogenous fertilizers.

The micronutrient fertilizers segment is the fastest-growing in the market during the forecast period. The growing global food demand and focus on correcting soil deficiencies increase the adoption of micronutrient fertilizers. The focus on improving crop qualities like color, nutritional value, size, and taste increases the adoption of micronutrient fertilizers. The increasing need to enhance crop resilience and the shift towards sustainable agriculture practices require micronutrient fertilizers, supporting the overall market growth.

The potassic fertilizers segment is significantly growing in the market. The growing cultivation of high-quality crops and the presence of limited arable land increase the adoption of potassic fertilizers. The strong focus on enhancing nitrogen efficiency and increasing demand for organic food requires potassic fertilizers. The growing expansion of high-value crops like fruits, cereals, vegetables, and others requires potassic fertilizers, supporting the overall market growth.

Nature Insights

How did the Inorganic Fertilizers Segment hold the Largest Share in the Agriculture Fertilizers Market?

The inorganic fertilizers segment held the largest revenue share of 91.10% in the agriculture fertilizers market in 2025. The growing demand for nutrients like potassium, nitrogen, and phosphorus for rapid plant growth increases demand for inorganic fertilizers. The focus on maximizing crop yields and the increasing need for food security increase the adoption of inorganic fertilizers. The inorganic fertilizers' cost-effectiveness, ease of handling, and availability in convenient forms like liquids & dry granules drive the overall market growth.

The bio-fertilizers segment is experiencing the fastest growth in the market during the forecast period. The strong focus on enhancing soil texture and increasing microbial activity of plants increases the adoption of bio-fertilizers. The increasing consumer preference for organic food and the rise in sustainable agriculture practices require bio-fertilizers. The diverse application ways, like foliar, broadcasting, and fertigation of bio-fertilizers, support the overall market growth.

The organic fertilizers segment is growing at a significant rate in the market. The growing shift towards organic food and the growing synthetic fertilizers environmental concerns increase demand for organic fertilizers. The strong focus on enhancing the fertility of the soil and growth in eco-friendly agriculture practices requires organic fertilizers that support the overall market growth.

Form Insights

Why the Dry or Solid Segment is Dominating the Agriculture Fertilizers Market?

The dry/solid segment accounted for the largest revenue share of 81.28% in 2025. The longer shelf life, cost-effectiveness, and ease of handling of the dry form help market growth. The growing production of crops like grains and cereals, vegetables, and others increases the adoption of dry or solid forms. The compatibility with large-scale & traditional farming and the slow-release properties of the dry form drive the overall market growth.

The liquid segment expects the fastest growth in the market during the forecast period. The strong focus on faster absorption of nutrients and lower loss of nutrients increases demand for the liquid form. The growth in precision farming and focus on lowering environmental impact increases the adoption of the liquid form. The ease of handling, high effectiveness, and compatibility with other crop protection solutions of liquid form support the overall market growth.

Application Method Insights

Why Soil Application Segment held the Largest Share in the Agriculture Fertilizers Market?

The the soil application segment dominated with the largest revenue share of 88.21% in 2025. The growing cultivation of crops like cereals & grains and the increasing need for direct nutrient absorption increase demand for soil application. The strong focus on absorption of nutrients like potassium, nitrogen, and phosphorus requires soil application. The increasing need for building long-term soil health and focus on correcting deficiencies in soil requires soil application, driving the overall market growth.

The fertigation segment is experiencing the fastest growth in the market during the forecast period. The strong focus on lowering nutrient loss and reducing contamination of groundwater increases the adoption of fertigation. The increasing need to enhance plant growth and improve the quality of crops requires fertigation methods. The rise in modern agriculture practices and growing sustainable farming practices increases demand for fertigation, supporting the overall market growth.

The foliar application segment is significantly growing in the market. The focus on delivering nutrients directly to leaves and the need for correcting deficiencies increase the adoption of foliar application. The growing production of high-quality crops and the rise in sustainable agriculture increase demand for foliar application. The increasing development of foliar products like water-based formulas & controlled-release technology supports the overall market growth.

Crop Type Insights

Which Crop Type Dominated the Agriculture Fertilizers Market?

The field crops segment dominated the market and accounted for the largest revenue share of 63.17% in 2025. The presence of a large cultivation area for field crops like wheat, soybeans, rice, cotton, and corn helps market growth. The increased consumption of staple foods and the rise in demand for high-nutrient-intensity food increase the adoption of field crops. The field crop nutrient consistency, ease of transport, and cost-effectiveness drive the overall market growth.

The horticulture crops segment is the fastest-growing in the market during the forecast period. The growing consumption of horticulture crops like vegetables, spices, fruits, and flowers helps market growth. The increasing awareness about the consumption of fresh vegetables and fruits requires agriculture fertilizer. The shifting dietary preferences and increased consumption of high-nutrient foods increase the adoption of horticulture, supporting the overall market growth.

The pulses and oilseeds segment is growing at a significant rate in the market. The growing demand for protein and a strong focus on food security increase demand for pulses & oilseeds. The growth in global population and changing dietary preferences increases the consumption of pulses & oilseeds. The increased consumption of canola & soybeans and the rise in cultivation of pulses & oilseeds support the overall market growth.

Release Mechanism Insights

How did the Conventional Fertilizers Segment hold the Largest Share in the Agriculture Fertilizers Market?

The conventional fertilizers segment held the largest revenue share of 85.15% in the market in 2025. The increasing need for nutrients like potassium, nitrogen, & phosphorus, and focus on boosting crop yields requires conventional fertilizers. The properties like ease of application, ease of storage, and cost-effectiveness of conventional fertilizers help market growth. The precise nutrient delivery and wide availability of conventional fertilizers drive the overall market growth.

The enhanced efficiency fertilizers (EEF) segment is experiencing the fastest growth in the market during the forecast period. The strong focus on lowering volatilization and nutrient runoff increases adoption of EEF. The growing demand for higher crop yields and the need to lower environmental pollution require EEF. The focus on minimizing application frequency and enhancing the growth of the plant requires EEF, supporting the overall market growth.

The water-soluble fertilizers segment is significantly growing in the market. The well-established high-yield farming and the rise in horticulture increase demand for water-soluble fertilizers. The rise in greenhouse farming and the adoption of modern farming practices require water-soluble fertilizers. The fast nutrient uptake and less waste generation of water-soluble fertilizers support the overall market growth.

Regional Insights

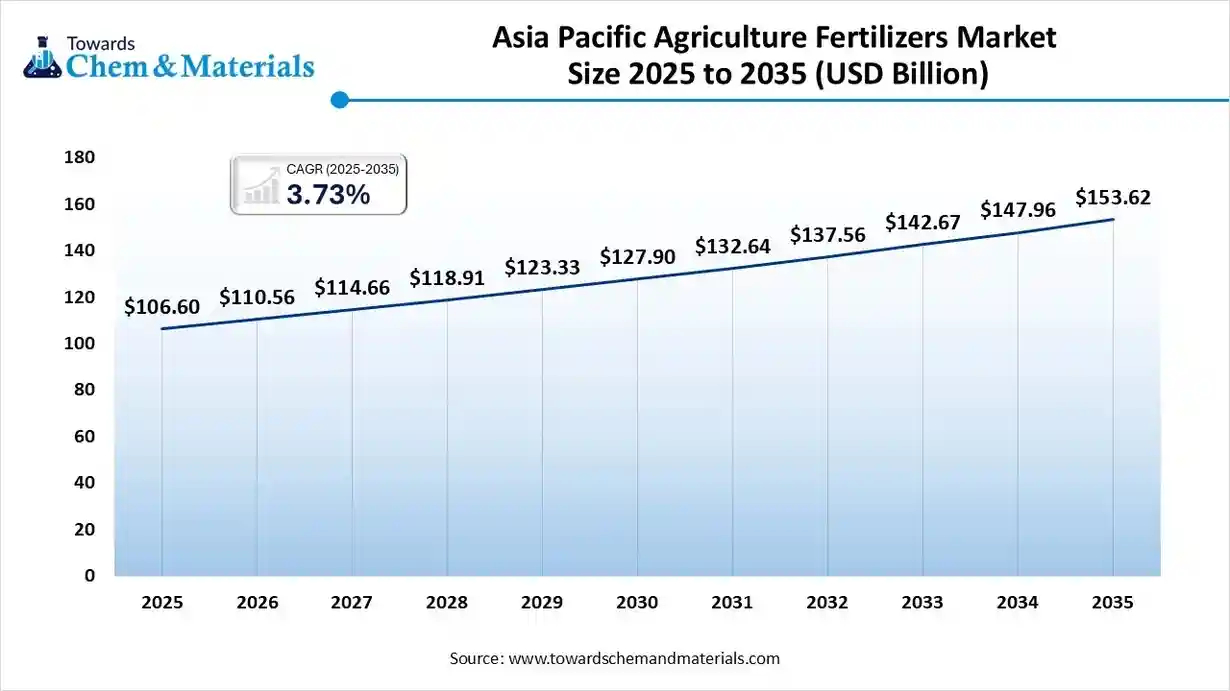

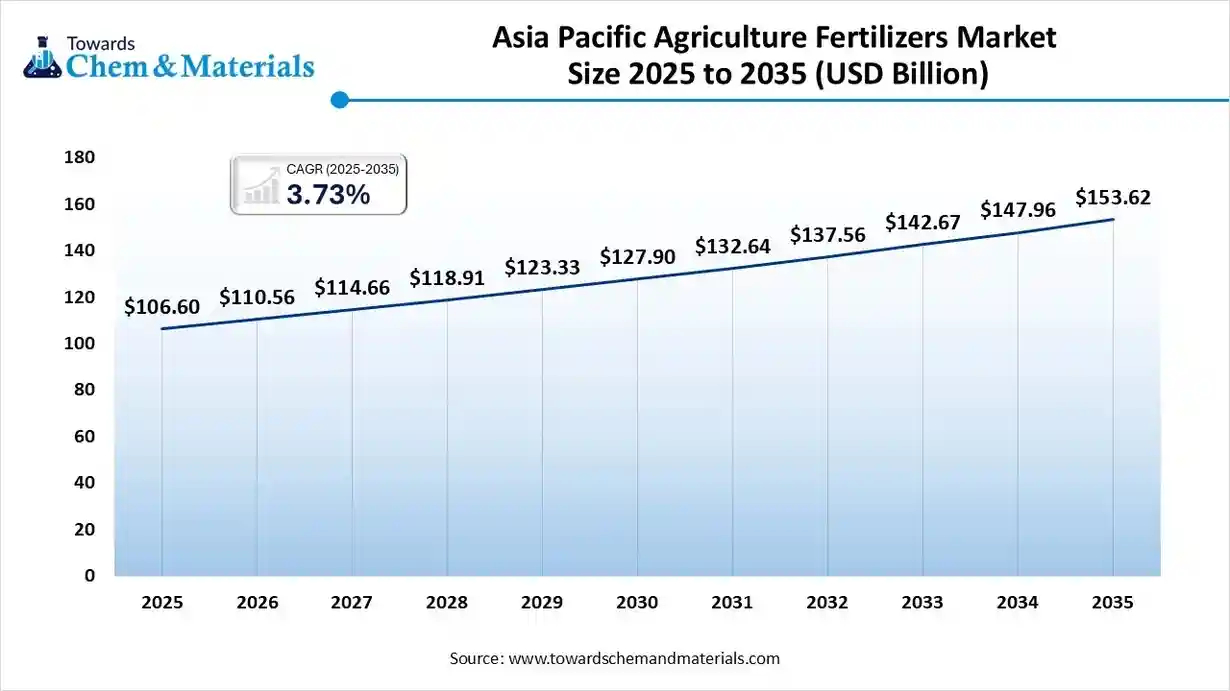

The Asia Pacific agriculture fertilizers market size was valued at USD 106.60 billion in 2025 and is expected to surpass around USD 153.62 billion by 2035, expanding at a compound annual growth rate (CAGR) of 3.73% over the forecast period from 2026 to 2035. Asia Pacific dominated the market with a 46.11% share in 2025. The rapid growth in population and increasing need for production increases the adoption of agriculture fertilizers. The decline in arable land and growing adoption of precision agriculture require agriculture fertilizers. The increasing cultivation of crops like fruits, rice, oilseeds, and wheat requires agriculture fertilizers. The well-established agricultural base and growing awareness about soil health require agriculture fertilizers, driving the overall market growth.

From Factory to Field: China’s Contribution to the Agriculture Fertilizers

China is a major contributor to the market. The strong focus on food security and increasing need for maximizing crop yields requires agriculture fertilizers. The presence of a large agricultural base and increasing use of fertigation & smart fertilizers help market growth. The vast reserves of phosphate rock and abundance of coal increase production of nitrogenous & phosphate-based fertilizers, supporting the overall market growth.

- China exported $10.9B of fertilizers in 2023.

Middle East & Africa Agriculture Fertilizers Market Trends

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The strong focus on improving crop yields and the presence of intensive agricultural methods increase the adoption of agriculture fertilizers. The increasing micronutrient like iron & zinc deficiencies in soil and rising food security concerns increase demand for agriculture fertilizers. The increased consumption of high-value crops like vegetables & fruits and the rise in production of staple crops increase demand for agriculture fertilizers, driving the overall market growth.

Nurturing Harvests: Saudi Arabia Shaping the Agriculture Fertilizers Landscape

Saudi Arabia is a key contributor to the market. The strong government focus on minimizing import reliance and enhancing food security increases demand for agriculture fertilizers. The increasing domestic food demand and emphasis on sustainable farming practices require fertilizers. The abundance of natural gas increases the production of fertilizers like ammonia, supporting the overall market growth.

- Saudi Arabia exported $4.8B of fertilizers in 2023.

North America Agriculture Fertilizers Market Trends

North America expects the significant growth in the market during the predicted period. The growing population and strong focus on enhancing crop yields require agriculture fertilizers. The increasing adoption of precision agriculture and emphasis on soil health management increases demand for agriculture fertilizers. The rapid growth in hydroponic systems and the expansion of urban agriculture require fertilizers. The increasing use of controlled-release, organic, and slow-release fertilizers drives the overall market growth.

From Industry to Agriculture: Rise of Agriculture Fertilizers in the United States

The United States is growing notably in the market. The presence of a robust agricultural landscape and a shift towards organic food increases demand for agriculture fertilizers. The strong government support for sustainable farming and the strong government support for the agriculture sector increase the adoption of agricultural fertilizers. The innovations, like bio-fertilizers and controlled-release fertilizers, support the overall market growth.

Europe Agriculture Fertilizers Market Trends

Europe is growing substantially in the market. The presence of limited arable land and focus on maximizing the production of crops increases demand for agriculture fertilizers. The growing consumption of organic food and the rise in sustainable farming practices require agriculture fertilizers. The increasing production of high-quality ornamental plants, fruits, and vegetables requires agriculture fertilizers, driving the overall market growth.

Feeding the Fields: Germany’s Role in Agriculture Fertilizers Expansion

Germany is growing significantly in the market. The growing production of food and a strong focus on ensuring food security increase demand for agriculture fertilizers. The rise in precision farming and government support for sustainable agricultural practices requires agriculture fertilizers. The presence of a vast agricultural land area and the growing cultivation of field crops like rapeseed, wheat, & barley increases demand for agriculture fertilizers, supporting the overall market growth.

South America Agriculture Fertilizers Market Trends

South America is growing in the market. The growing expansion of cultivation area and presence of critical agricultural hubs increases demand for agriculture fertilizers. The increasing production of crops in countries like Argentina and Brazil increases demand for agriculture fertilizer. The innovations like precision farming and growing adoption of bio-fertilizers & specialty fertilizers drive the overall market growth.

Modern Agriculture: Brazil’s Footprint in the Agriculture Fertilizers

Brazil is seen a notable growth in the market. The presence of a robust agricultural landscape and focus on enhancing crop yields increases demand for agriculture fertilizers. The increasing interest in controlled-environment agriculture and organic fertilizers helps market growth. The growing export of agricultural products like soybeans requires fertilizers, supporting the overall market growth.

Recent Developments

- In January 2025, Super Crop Safe launched bio-fertilizer Super Gold WP+. The bio-fertilizer absorbs water efficiently, enhances root development, and absorbs nutrients. The bio-fertilizer is available in states like Rajasthan, Haryana, Uttarakhand, Chhattisgarh, Karnataka, Gujarat, Punjab, Uttar Pradesh, Maharashtra, Kerala, and Madhya Pradesh. (Source: www.indianchemicalnews.com)

- In February 2025, Wilbur-Ellis launched a liquid organic nitrogen fertilizer, BenVireo TerraLux 10-0-0. The fertilizer lowers greenhouse gas emissions, and its pH is neutral. The fertilizer is available in 27-gallon totes and is easy to handle.(Source: www.growingproduce.com)

- In September 2024, KRIBHCO collaborated with Novonesis to launch KRIBHCO Rhizosuper, biofertilizer. The fertilizer improves soil quality and supports robust plant growth.(Source: www.indianchemicalnews.com)

Top Companies List

- Yara International ASA: The Norway-based company manufactures biological & mineral fertilizers like biostimulants, urea, and compound fertilizer for agricultural practices.

- The Mosaic Company: The company is the leading distributor and producer of concentrated potash, phosphate, and other crop nutrients like K-Mag, MicroEssentials, & Aspire for the agriculture industry.

- CF Industries Holdings, Inc.: The company manufactures diverse products like granular urea, nitric acid, ammonia, DEF, and UAN, especially for fertilizer to enhance crop yields.

- EuroChem Group AG: The company is the leading producer of diverse fertilizers like potash, nitrogen, complex, phosphate, and specialty fertilizers to support crop nutrition.

Top Key Players in the Agriculture Fertilizers Market

- OCP Group S.A.

- Sinopec (China Petroleum & Chemical Corporation)

- ICL Group Ltd.

- K+S AG

- Koch Industries (Koch Fertilizer, LLC)

- Sociedad Química y Minera de Chile S.A. (SQM)

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- Coromandel International Limited

- BASF SE

- Paradeep Phosphates Limited (PPL)

- PhosAgro PJSC

- Rashtriya Chemicals & Fertilizers Ltd. (RCF)

- Fertilizers and Chemicals Travancore Ltd. (FACT)

- Kingenta Ecological Engineering Co., Ltd.

- Sumitomo Chemical Co., Ltd.

Segments Covered

By Product Type

- Nitrogenous Fertilizers

- Urea

- Ammonium Nitrate (AN) / Calcium Ammonium Nitrate (CAN)

- Urea Ammonium Nitrate (UAN) Solution

- Ammonium Sulfate

- Anhydrous Ammonia

- Other Nitrogen Forms

- Phosphatic Fertilizers

- Di-Ammonium Phosphate (DAP)

- Mono-Ammonium Phosphate (MAP)

- Single Super Phosphate (SSP)

- Triple Super Phosphate (TSP)

- Other Phosphates

- Potassic Fertilizers

- Muriate of Potash (MOP) / Potassium Chloride (KCl)

- Sulfate of Potash (SOP) / Potassium Sulfate ($K_2SO_4$)

- Potassium Nitrate

- Other Potash Forms

- Secondary Macronutrient Fertilizers

- Sulfur

- Calcium

- Magnesium

- Micronutrient Fertilizers

- Zinc

- Boron

- Iron

- Manganese

- Copper

- Molybdenum

- Other Micronutrients

By Nature/Origin

- Inorganic (Mineral/Chemical) Fertilizers

- Straight Fertilizers (Single Nutrient)

- Complex/Compound Fertilizers (Multiple Nutrients, e.g., NPK, DAP)

- Organic Fertilizers

- Manure-Based

- Compost-Based

- Crop Residue-Based

- Bio-solids

- Bio-Fertilizers (Microbial)

- Nitrogen-Fixing (e.g., Rhizobium, Azotobacter)

- Phosphate-Solubilizing (PSB)

- Potassium-Mobilizing (KMB)

- Mycorrhizal

By Form

- Dry/Solid

- Granular/Prilled

- Powdered/Crystalline

- Liquid

- Solution

- Suspension

By Application Method

- Soil Application (Broadcasting, Banding, Placement)

- Conventional Soil Application

- Precision Soil Application

- Fertigation (Application via Irrigation Systems)

- Drip Fertigation

- Sprinkler Fertigation

- Foliar Application (Direct Spray on Leaves)

- Seed Treatment

By Crop Type

- Field Crops (Grains and Cereals)

- Rice

- Wheat

- Maize/Corn

- Others (Barley, Oats)

- Pulses and Oilseeds

- Soybeans

- Groundnut

- Canola/Rapeseed

- Lentils

- Horticultural Crops

- Fruits and Vegetables

- Plantation Crops (Tea, Coffee, Rubber)

- Flowers and Ornamentals

- Turf and Lawns

By Release Mechanism (Specialty Fertilizers)

- Conventional (Fast-Release) Fertilizers

- Enhanced Efficiency Fertilizers (EEF)

- Slow-Release Fertilizers (SRF)

- Controlled-Release Fertilizers (CRF)

- Stabilized Fertilizers (with Inhibitors)

- Water-Soluble Fertilizers (WSF)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa