Content

What is the Asia Pacific Textile Market Size and Share?

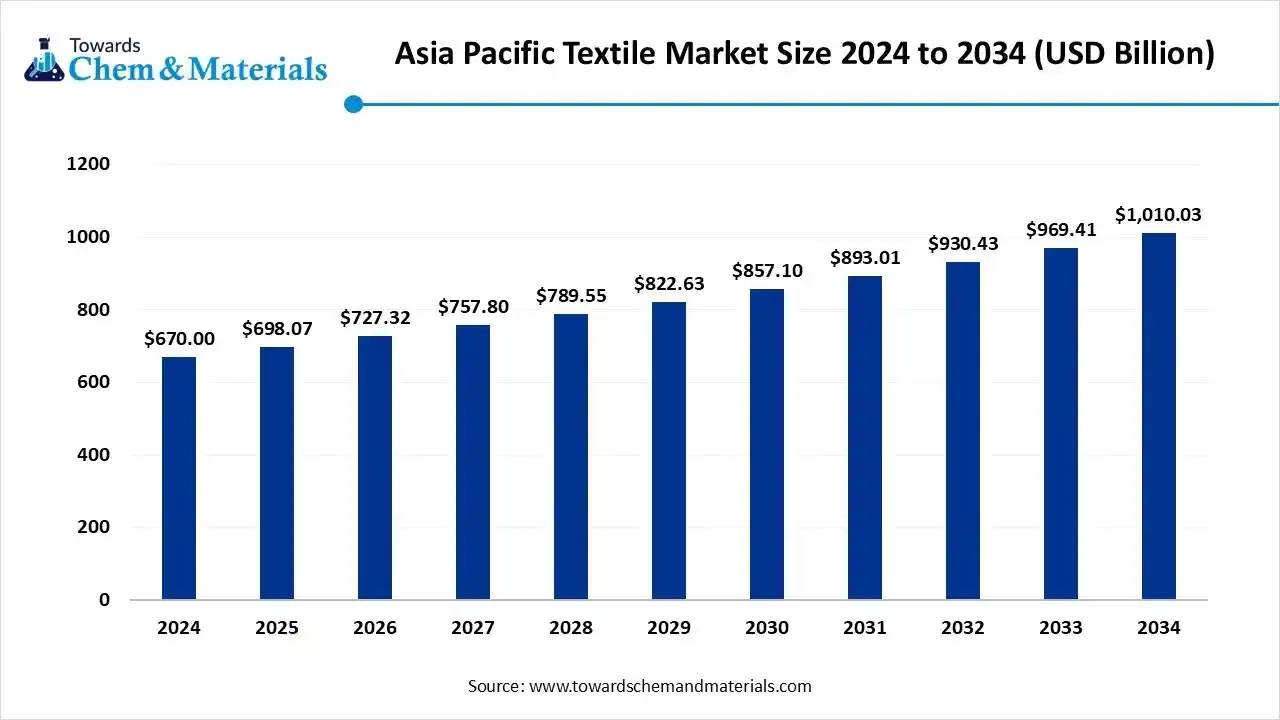

The Asia Pacific textile market size was estimated at USD 670 billion in 2024 and grew to USD 698.07 billion in 2025, and is projected to reach around USD 1,010.03 billion by 2034. The market is expanding at a CAGR of 4.19% between 2025 and 2034. China dominated the Asia Pacific textile market with a market share of 52.4% in 2024.The global shift towards organic cotton has emerged as a catalyst for unlocking the sector’s full potential.

Key Takeaways

- China dominated the Asia Pacific textile market with a market share of 52.4% in 2024.

- By material type, the synthetic fiber segment dominated the market with 47.4% industry share in 2024.

- By material type, the natural fiber segment is expected to grow at the fastest rate in the market during the forecast period.

- By fabric type, the woven fabrics segment dominated the market with 54.2% industry share in 2024.

- By fabric type, the non-woven fabrics segment is expected to grow at the fastest rate in the market during the forecast period.

- By product type, the fabric segment dominated the market with 47.4% industry share in 2024.

- By product type, the finished textiles segment is expected to grow at the fastest rate in the market during the forecast period.

- By application type, the apparel / fashion segment dominated the market with a 52.5% industry share in 2024.

- By application type, the technical/industrial textiles segment is expected to grow at the fastest rate in the market during the forecast period.

Asia Pacific: The Powerhouse of Global Textile Production

- The Asia Pacific textile market encompasses the production and trade of fibers, yarns, fabrics, and finished textiles across countries like China, India, Japan, Bangladesh, and Vietnam. It serves industries such as apparel, home furnishings, and technical textiles.

- Growth is driven by abundant raw materials, low manufacturing costs, rising domestic demand, and expanding export capacities. Sustainable and functional fabrics, along with automation and digitalization in textile manufacturing, are shaping the region’s transformation into the world’s largest textile production hub.

Asia Pacific Textile Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the surging demand for home fabrics, clothes, and technical textiles is actively driving the strategic transformation and industrial scalability in recent years. Also, the regional benefits like skilled workforce, low-cost manufacturing, and easier access to the cotton have allowed stakeholders to capitalize on growth opportunities in the current period.

- Sustainability Trends: The major manufacturers in the region are increasingly preferring organic cotton and recycled polyester nowadays, which is likely to strengthen the foundation of future sector growth. Moreover, with the shift towards the advanced waterless dying technology and establishment of the green textile parks, the industry is likely to gain a major market advantage in the upcoming years.

- Global Expansion: the Asian manufacturers are seen focusing on the European region by establishing warehouses and sales hubs in recent years. Also, several major exporters are actively offering speed to market models across the globe, which is likely to position the Asian industry for long-term expansion for the upcoming period.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 727.32 Billion |

| Expected Size by 2034 | USD 1,010.03 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.19% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Material / Fiber Type, By Fabric / Form, By Product Type, By Application / End-Use |

| Key Companies Profiled | Indorama Ventures Public Company Limited, Reliance Industries Limited – Textiles Division, Arvind Limited, Vardhman Textiles Ltd. , Lenzing AG , Shenzhou International Group Holdings Ltd. , Texhong Textile Group Ltd., Huafeng Textile Group, Raymond Ltd., Welspun India Ltd. , Trident Group, KPR Mill Limited , Esquel Group, Pacific Textiles Holdings Limited |

From Smart Looms to Robotics: The Digital Evolution Of Textiles

The key developers in the region are heavily adopting the automated production initiatives. Also, the AI-based quality checks, smart looms, and robotic cutting machines have gained major industry attention in recent years. Furthermore, the manufacturers are using high-tech technology to save fabric waste and reduce errors in the current period.

Trade Analysis of the Asia Pacific Textile Market:

Import, Export, Consumption, and Production Statistics

- India’s total merchandise export of textiles and apparel has reached USD 37.7 billion in 2024–25, as per the published report.(Source: www.pib.gov.in)

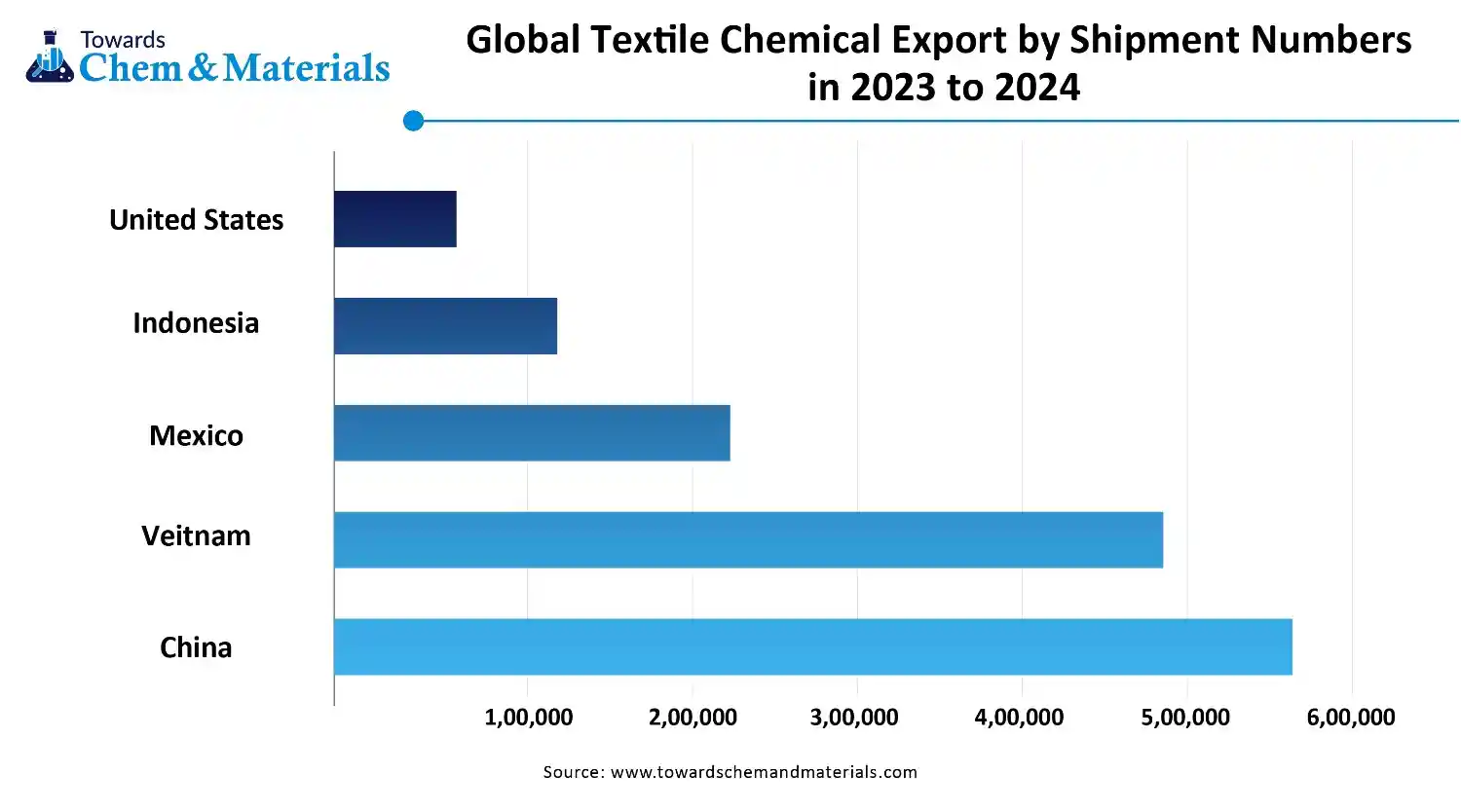

- China records a heavy amount of textile exports across the globe in 2024, which is worth around $301.101 billion as per the published report.(Source: www.fibre2fashion.com)

Value Chain Analysis of the Asia Pacific Textile Market:

- Distribution to Industrial Users : The distribution of industrial textiles to end-users in the Asia Pacific market is a complex ecosystem involving manufacturers, specialized distributors, and end-user industries.

- Chemical Synthesis and Processing : The chemical synthesis and processing segment of the Asia Pacific textile market is dominated by China, India, Bangladesh, and Vietnam, which produce a vast range of chemicals for every stage of textile manufacturing.

- Regulatory Compliance and Safety Monitoring : Regulatory compliance and safety monitoring in the market involve a complex, multi-layered system of national laws, global standards, and private-sector initiatives.

Asia Pacific Textile Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| China | China National Textile and Apparel Council (CNTAC) | Environmental Protection Law (EPL) | Sustainability and circular economy | This is the primary industry association, which works closely with the government to shape policy direction, including the current 14th Five-Year Plan. |

| India | Ministry of Textiles (MoT) | The Textiles Committee Act, 1963 | Sustainable manufacturing | This is the main governing body responsible for policy formulation, planning, and export promotion for the textile and apparel sector. |

Segmental Insights

Material Type Insights

How did the Synthetic Fiber Segment Dominate the Asia Pacific Textile Market in 2024?

- The synthetic fiber segment dominated the market with 47.4% of industry share in 2024 due to factors such as durability, affordability, and easier production on a large scale. Furthermore, by having unique qualities like faster drying, lasting longer, and the ability to mimic natural fiber, the synthetic fiber has gained market share in the current period.

- The natural fiber segment is expected to grow at a significant rate owing to the sudden shift towards eco-friendly manufacturing and sustainability. Also, the greater investment in the cleaner cotton production by regional countries is likely to play a major role in the future growth of the segment.

- The blended fiber segment is also notably growing, akin to having the greater combination of the comfort-like natural fiber and the strength of synthetic fiber. Also, by maintaining the stretch, softness, and durability, blends like viscose-nylon and cotton polyester have gained a sophisticated consumer base in recent years.

Fabric/Form Insights

Why does the Woven Fabrics Segment Dominate the Asia Pacific Textile Market?

- The woven fabrics segment dominated the market with 54.2% industry share in 2024, because it offers strength, stability, and wide use across apparel, home, and industrial products. Woven fabrics hold shape well and are used for jeans, shirts, upholstery, and uniforms. The Asia-Pacific region has massive weaving capacity and easy access to both cotton and synthetic yarns.

- The non-woven fabrics segment is expected to grow at a rapid rate because of its rising use in medical, hygiene, filtration, and packaging applications. Non-wovens are lightweight, low-cost, and made using recycled or biodegradable materials. The COVID-19 pandemic boosted their demand for masks and gowns, and that momentum continues in healthcare and home care.

- The knitted fabrics segment is also notably growing because of the rising demand for comfort, stretch, and casual wear. Knit fabrics are breathable, soft, and ideal for t- t-shirts, activewear, and athleisure, the fastest-growing apparel categories in Asia-Pacific. Modern knitting machines allow fast production of seamless garments with minimal waste.

Product Type Insights

How did the Fabric Segment Dominate the Asia Pacific Textile Market in 2024?

- The fabric segment dominated the market with 47.4% of industry share in 2024 because it forms the base for all textile finishing processes. Fabrics are unprocessed woven or knitted materials that are produced in large volumes and later dyed, printed, or coated based on demand. Asia-Pacific's high-speed weaving and knitting units produce massive amounts of grey fabric for both domestic finishing units and exports.

- The finished textiles segment is expected to grow at the fastest rate as fashion brands and consumers want ready-to-use, high-quality fabrics. Finished textiles are dyed, printed, or coated and ready for apparel, furnishings, or technical uses. Asia-Pacific companies are investing in digital printing, wrinkle-free coatings, and anti-bacterial finishes.

- The yarn segment is notably growing because of rising demand from local and export fabric producers. Asia-Pacific countries have built strong spinning infrastructure for cotton, polyester, and blended yarns. The growth of circular knitting and woven fabric exports boosts yarn production further. Many spinners are now producing specialty and recycled yarns for sustainable fabric.

Application Insights

Why does the Apparel Segment Dominate the Asia Pacific Textile Market by Application Type?

- The apparel / fashion segment dominated the market with 52.5% industry share in 2024 because Asia-Pacific is the world's largest clothing producer and exporter. Countries like China, Bangladesh, India, and Vietnam make billions of garments every year for global brands. The region's strong sewing, dyeing, and finishing capacity allows fast turnaround and competitive pricing.

- The technical/industrial textiles segment is expected to grow at a rapid rate because these materials are used in construction, automotive, medical, and protective clothing applications. Governments in India, China, and Japan are supporting technical textile innovation for defense, filtration, and smart clothing.

- The home textiles segment is notably growing, due to rising urban lifestyles and home décor spending. Products like curtains, bed sheets, rugs, and cushions are in higher demand as consumers upgrade their living spaces. Online retail and customized designs are helping home textile brands grow quickly.

Asia Pacific Textile Market Trends

From Fiber to Fabric: China’s Complete Value Chain Powers Market Dominance

China maintained its dominance in the Asia Pacific textile market with 52.4% industry share, owing to the country's known for its complete product value chain from fiber to the finished products. Moreover, the presence of technical textiles and advanced weaving the China has enabled the sector to explore untapped potential in recent years, as per the recent survey. Furthermore, the greater investment in the automated dyeing and digital printing system is likely to create lucrative opportunities for the manufacturers in China in the upcoming years.

Green Technologies and Policy Support Strengthen India’s Textiles Ambitions

India is expected to rise as a dominant country in the region in the coming years, owing to the availability of abundant cotton production and a large workforce. Moreover, the regional government has been actively supporting initiatives like the development of integrated textile parks and digital design systems in recent years. Also, the shift towards recycled polyester and zero liquid discharge dyeing units is expected to enhance market readiness and future industry capabilities during the projected period.

Growing Demand For The Sustainable Material Accelerate The Market Expansion In Japan

Asia Pacific textile market in Japan is experiencing steady growth, driven by advancements in sustainable materials, digital textile printing, and rising consumer demand for high-quality apparel. Japan’s textile industry benefits from its strong focus on innovation, automation, and eco-friendly production processes. Increasing collaborations with regional manufacturers and the adoption of smart textiles are further boosting market expansion. Additionally, government initiatives promoting sustainable manufacturing and circular economy practices are enhancing competitiveness.

Recent Developments

- In October 2025, Marzoli introduced their advanced textile ecosystem at the event called ITMA ASIA 2025. Also, the company showcases its digital intelligence and advanced machinery as per the published report.(Source: www.fibre2fashion.com )

Top Asia Pacific Textile Market Companies

Toray Industries, Inc.

Corporate Information

- Name: Toray Industries, Inc.

- Founded: January 1926.

- Headquarters: Nihonbashi Mitsui Tower, 1-1, Nihonbashi-Muromachi 2-chome, Chūō-ku, Tokyo 103-8666, Japan.

History and Background

- Toray was established in 1926 originally to produce rayon yarn. Over time it expanded into synthetic fibers, plastics, chemicals, films, advanced materials.

- The company continuously expanded its business via diversification from fibers & textiles into high-value materials (plastic resins, films, carbon fibre composites, electronics, water treatment, pharmaceuticals etc).

- Over the decades, Toray has become a global materials & advanced chemistry company, with more than 300 subsidiaries and affiliates worldwide.

Key Developments and Strategic Initiatives

- Medium-Term Management Programme: “Project AP-G 2025”: Toray aims to focus its growth on two core business fields: Sustainability Innovation (SI Business) and Digital Innovation (DI Business).

- Under this programme (FY 2023–25), Toray plans to invest 220 billion yen in R&D over the three years, allocating over 80% to growth business fields (SI & DI).

- Toray is targeting major growth in eco-friendly, advanced materials to align with global shifts (e.g., carbon neutrality by 2050).

Mergers & Acquisitions

- In 2024-25, Toray’s U.S. subsidiary (Toray Advanced Composites) further acquired assets / technology from Gordon Plastics (Colorado) enhancing continuous fiber-reinforced thermoplastic tape capability.

- In 2018, Toray agreed to acquire Dutch company TenCate Advanced Composites for €930 million to accelerate growth in high-performance thermoplastic and thermoset composites.

Partnerships & Collaborations

- Strategic partnership with apparel giant Uniqlo (started 2006) for material development: e.g., joint development of HEATTECH, AIRism fabrics from Toray’s fine polyester fibers; sustainable recycled PET derived fibers.

- Collaboration with Hyundai Motor Group (April 2024 / Oct 2025) on material innovation for future mobility: high-performance composites for vehicles, with Toray developing intermediate materials and Hyundai performing vehicle‐level design, performance evaluation and commercialization.

Product Launches / Innovations

- At the 2025 Paris Air Show, Toray announced new composite products: e.g., TORAYCA™ T1200 carbon fiber (tensile strength 8.0 GPa), thermoplastic composites Toray Cetex® TC1130 PESU, TC915 PA+™ for aircraft interior/urban air mobility applications.

- Introduction of PFAS-free mold release films, wide nano-multilayer films for head-up displays (March 2025) as part of its sustainable/next-gen materials push.

Key Technology Focus Areas

Major technology domains:

- Carbon fiber composite materials (TORAYCA™, prepregs, thermoset/thermoplastic composites) aerospace, mobility, wind energy.

- Advanced fibers & textiles (nylon, polyester, specialty fibers) for apparel and industrial use.

- Performance chemicals: resins (ABS, PBT, PPS), films, electronic materials (OLED, semiconductor packaging) reflected in growth in electronics & info materials segment.

R&D Organisation & Investment

- Toray groups its R&D functions in a single organisation called the Technology Center, integrating multiple specialised fields to accelerate innovation.

- Medium-term R&D investment: 220 billion yen over FY 2023–25 with more than 80 % focused on growth business fields (SI & DI).

- Basic policy: “Constant Pursuit of the Ultimate Limits” combining core techs and expanding into new business fields such as electronics, carbon fibre composites, medical devices, water treatment.

SWOT Analysis

Strengths:

- Broad, vertically integrated portfolio across fibers/textiles, chemicals, films, composites, environmental engineering giving resilience and cross-business synergy.

- Leadership in high‐end materials: world-leading carbon fibre supplier (TORAYCA™) with strong aerospace/mobility credentials.

- Strong R&D capability, with core technologies and strategic investment in innovation and sustainability.

- Global footprint with ~300+ subsidiaries/affiliates and a revenue base of ~¥2.56 trillion (FY 2025) giving scale.

Weaknesses:

- The business spans many segments, which may dilute focus; some segments (e.g., Life Science, Environment & Engineering) may be less profitable or have slower growth.

High capital intensity and long lead times for advanced materials and composites business; exposure to cyclical industries (aerospace, automotive) can pose risk. - Quality issues historically (e.g., data falsification scandal reported in earlier years) may impact reputation.

Opportunities:

- Growing demand for lightweight materials (carbon fiber composites) in EVs, aerospace, wind energy.

- Shift to sustainability and circular economy opens opportunities for recycled materials, low-carbon manufacturing, and green innovation aligned with Toray’s strategy.

- Digital innovation (AI, material informatics) to accelerate product development and cost reduction.

- Geographical growth: expansion in India (JV with MAS), broader Asia-Pacific growth.

Threats:

- Intense competition in advanced materials and textiles from global peers and emerging Chinese producers.

- Raw material cost volatility (commodities, oil, chemicals) impacting margins.

Macro-economic risks: downturns in automotive, aerospace, or textile end-markets can adversely affect demand. - Sustainability/regulatory risks: increasing environmental regulation may increase costs or render older technologies obsolete.

Recent News & Strategic Updates

- FY ended March 31, 2025: Reported revenue of ¥2,563.3 billion (+4% year-on-year) and core operating income of ¥142.8 billion (+39.1%). Profit attributable to owners rose by 255.8% to ¥77.9 billion.

- At 2025 Paris Air Show: Toray showcased latest composite materials for aerospace/defence, including TORAYCA™ T1200, and expanded fibre production in Europe.

- Indorama Ventures Public Company Limited: A global producer of intermediate petrochemicals and one of the world's largest manufacturers and recyclers of PET resins, which are used to produce fibers and packaging.

- Reliance Industries Limited – Textiles Division: An Indian manufacturer that operates one of the world's largest textile complexes in Naroda, Gujarat, producing synthetic and worsted fabrics under the iconic "Vimal" brand.

- Arvind Limited: An Indian textile and apparel giant headquartered in Ahmedabad, widely recognized as one of the largest denim manufacturers globally.

TOP Key Asia Pacific Textile Companies:

The following are the leading companies in the Asia Pacific textile market. These companies collectively hold the largest market share and dictate industry trends.

- Indorama Ventures Public Company Limited (Thailand)

- Lenzing AG (Austria)

- Reliance Industries Limited – Textiles & Fibres Division (India)

- Arvind Limited (India)

- Vardhman Textiles Ltd. (India)

- Texhong Textile Group (China)

- Shenzhou International Group Holdings Limited (China)

- Welspun India Ltd. (India)

- Trident Group (India)

- Nishat Mills Ltd. (Pakistan)

- Huafeng Textile Group (China)

- Raymond Ltd. (India)

- KPR Mill Limited (India)

- Bombay Dyeing & Manufacturing Co. Ltd. (India)

Segments Covered in the Report

By Material / Fiber Type

- Natural Fibers (Cotton, Wool, Silk, Linen, Jute)

Synthetic Fibers (Polyester, Nylon, Acrylic, Polypropylene) - Regenerated / Man-Made Cellulosic Fibers (Viscose, Rayon, Lyocell)

- Blended Fibers

By Fabric / Form

- Woven Fabrics

- Knitted Fabrics

- Non-Woven Fabrics

By Product Type

- Fibre

- Yarn

- Fabric

- Finished Textile (Garments, Home Textiles, Technical Textiles)

By Application / End-Use

- Apparel / Fashion

- Home Textiles (Bed Linen, Curtains, Upholstery, Towels)

- Technical / Industrial Textiles (Automotive, Medical, Protective, Construction)