Content

What is the Current Agricultural Biologicals Market Size and Share?

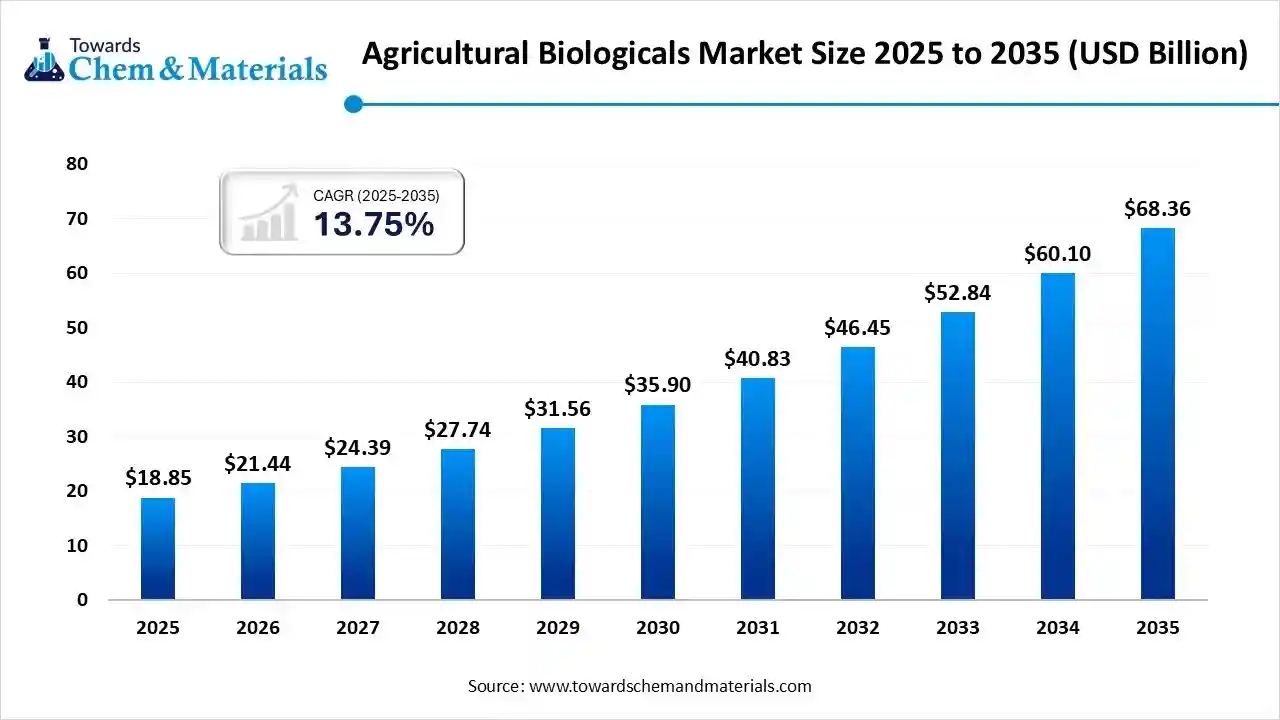

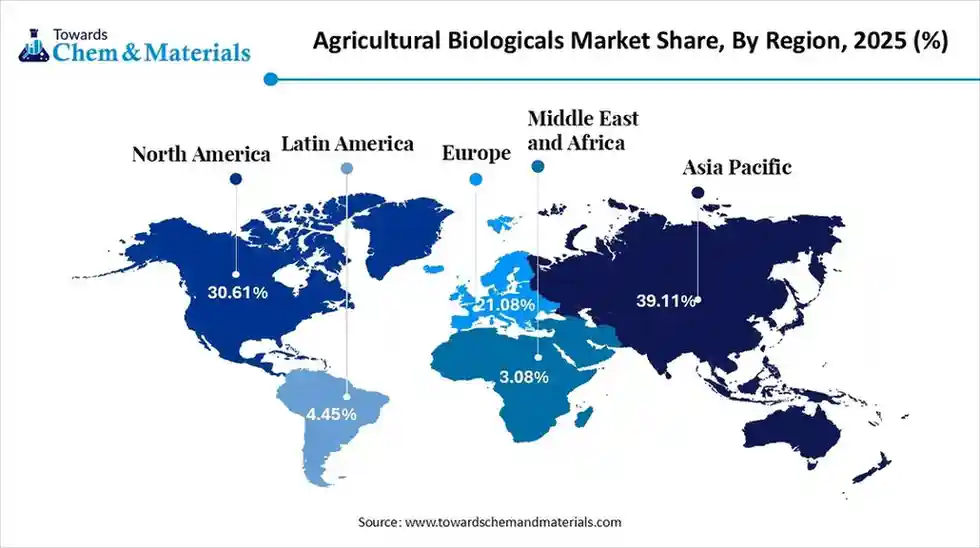

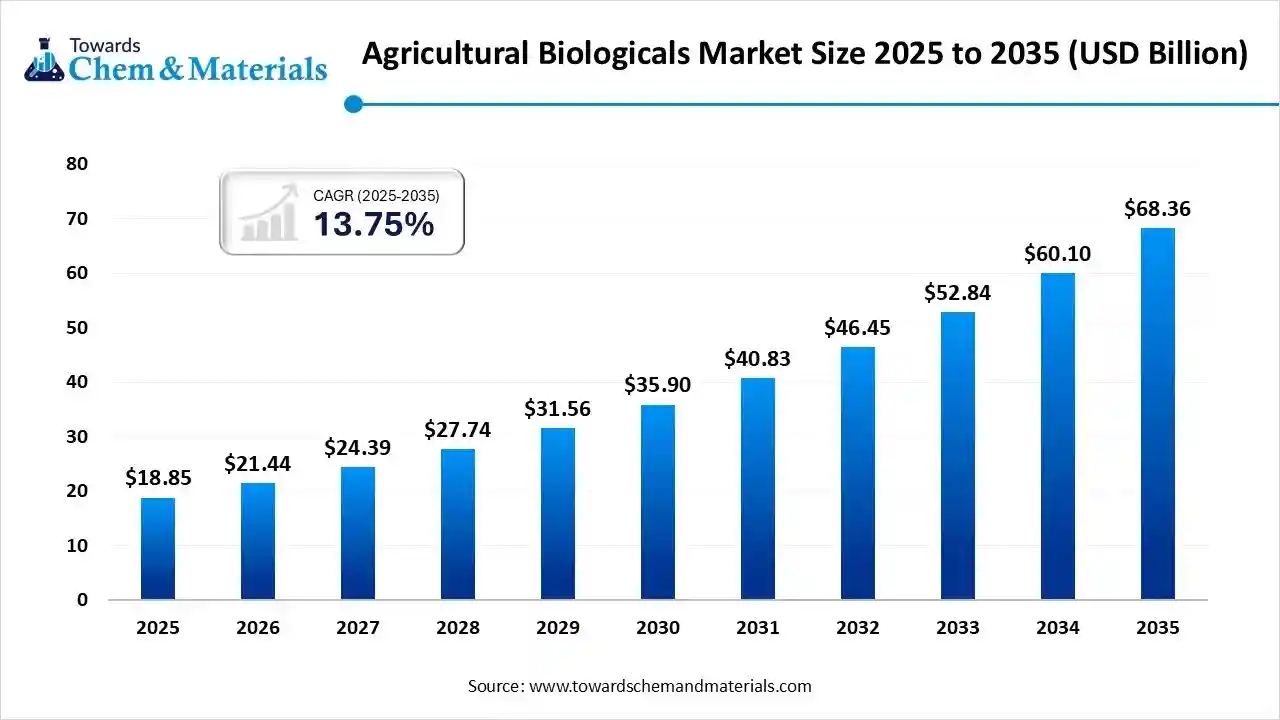

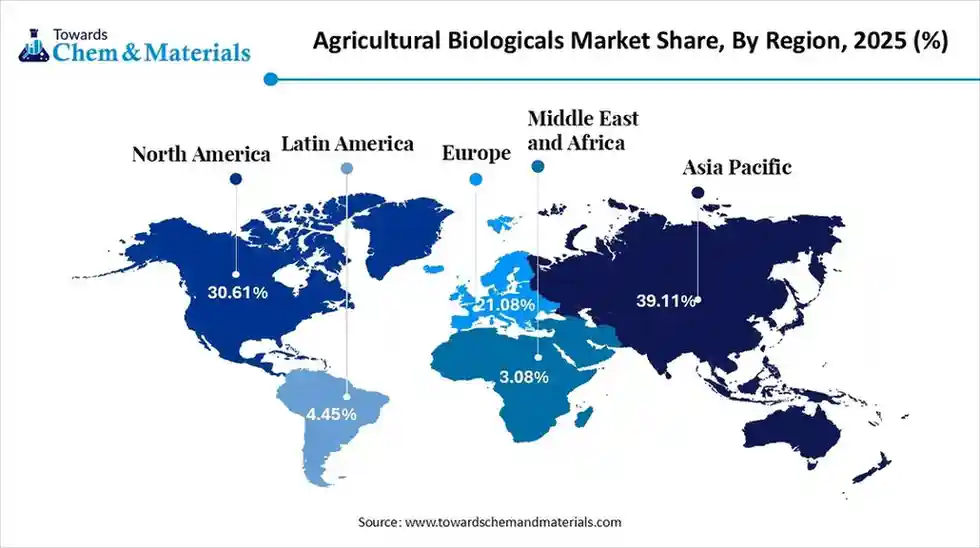

The global agricultural biologicals market size is calculated at USD 18.85 billion in 2025 and is predicted to increase from USD 21.44 billion in 2026 and is projected to reach around USD 68.36 billion by 2035, The market is expanding at a CAGR of 13.75% between 2026 and 2035. Asia Pacific dominated the agricultural biologicals market with a market share of 39.11% the global market in 2025. The growing demand for sustainable food and focus on improving soil fertility drive the market growth.

Key Takeaways

- Asia Pacific dominated the agricultural biologicals market with the largest revenue share of over 39.11% in 2025.

- By product type, the biopesticides segment held the largest revenue share of 46.11% in 2025 in terms of value.

- By crop type, the cereals & grains segment led the market with the largest revenue share of 41.07% in 2025.

- By mode of application, the foliar spray segment led the market with the largest revenue share of 43.77% in 2025.

- By formulation type, the liquid segment accounted for the largest revenue share of 49.14% in 2025.

- By origin, the microbial-based segment dominated with the largest revenue share of 56.32% in 2025.

- By farming type, the conventional farming segment dominated the market and accounted for the largest revenue share of 66.22% in 2025.

What’s Driving the Growth of Agricultural Biologicals?

- The agricultural biologicals market growth is driven by increasing demand for residue-free food, rising awareness about soil degradation, rise in plant diseases, growing chemical fertilizers costs, and stringent regulations on synthetic pesticides.

- The increasing outbreaks of diseases and pests on plants increase demand for agricultural biologicals to manage crops effectively. The specialized biological companies like Novonesis, Valent Biosciences LLC, Koppert Biological Systems, and agrochemical corporations like BASF SE, FMC Corporation, UPL Limited are investing in research & development of biological products that help the expansion of the market.

What are Agricultural Biologicals?

- Agricultural biologicals are organic products made from natural sources like minerals, microorganisms, and plant extracts to enhance crop health. They include products like biofertilizers, pheromones, biopesticides, and biostimulants. They offer benefits like maintaining a healthier ecosystem, strengthening the health of plants, compatibility of conventional & organic farming, minimal environmental impact, and enhancing the uptake of nutrients.

- Agricultural biologicals can be applied to foliage, seeds, and soil at different stages of farming. They minimize the reliance on conventional chemical fertilizers. They can be applied through diverse methods like root treatment, foliar spray, seed treatment, drip irrigation, and soil application.

Agricultural Biologicals Market Trends:

- Growing Consumption of Organic Food: The increasing awareness about the health risks associated with synthetic fertilizers and pesticides increases demand for organic food. The high consumption rate of organic food increases demand for agricultural biological products.

- Increasing Cost of Conventional Chemical products: The growing cost of conventional synthetic agrochemicals like pesticides, fertilizers, and others increases the adoption of agricultural biologicals. Farmers are looking for alternative synthetic chemicals and giving preference to sustainable products like biofertilizers, biopesticides & others.

- Shift Towards Sustainable Agriculture: The growing awareness about environmental concerns and stringent regulations on chemical pesticides increases adoption of sustainable farming practices that require agricultural biologicals for enhancing plant growth and lowering residues.

- Government Support: Many governments strongly support for adoption of agricultural biologicals in farming through educational programs, initiatives, financial incentives, and subsidies. These initiatives overcome challenges like a lack of awareness about biological products and high cost.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 21.44 Billion |

| Revenue Forecast in 2035 | USD 68.36 Billion |

| Growth Rate | CAGR 13.75% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | South America |

| Segments covered | By Product Type, By Crop Type, By Mode of Application, By Formulation Type, By Origin, By Farming Type, By Region |

| Key companies profiled | CBF China Bio-Fertilizer AG,Mapleton Agri Biotec, Biomax, Rizobacter Argentina SA, Symborg S.L., National Fertilizers Ltd., Lallemand Inc., Agricen, Sigma Agri-Science, LLC, Agrinos Inc., Kiwa Bio-Tech Products Group Corporation, Zebra Medical Vision, Inc. |

Key Technological Shifts in the Agricultural Biologicals Market:

The agricultural biologicals market is undergoing key technological shifts driven by the demand for the delivery of natural products, enhancing efficacy, and sustainability. Technological innovations in agricultural biologicals, such as gene editing, encapsulation technologies, phytovaccines, nanotechnology, and sensors for targeted applications, help to develop more effective solutions. One of the major shifts is the integration of artificial intelligence optimizes product formulation and accelerates the discovery of new products.

Artificial intelligence analyzes genomic data to identify new natural compounds. The new compound enhances pest resistance and improves the uptake of nutrients. AI predicts the performance of biological solutions under diverse environmental conditions. AI provides precise recommendations for applications of biological products. AI minimizes post-harvest losses and optimizes product stability. Overall, AI lowers environmental impact and offers a sustainable approach to farming.

Trade Analysis of Agricultural Biologicals Market: Import & Export Statistics

- China exported 138 shipments of biofertilizer.

- Vietnam imported 468 shipments of biofertilizer.

- China exported 21 shipments of biopesticides.

- China exported 355 shipments of seaweed extract.

- Vietnam imported 602 shipments of seaweed extract.

Agricultural Biologicals Market Value Chain Analysis

- Feedstock Procurement : Feedstock procurement is the process of sourcing raw materials like energy crops like switchgrass, organic waste streams like animal manure, agricultural residues like wheat straw, and aquatic biomass like seaweed & algae.

- Key Players:- Bayer AG, FMC Corporation, Koppert Biological Systems, BASF SE, Corteva Agriscience, Syngenta Group

- Chemical Synthesis and Processing: The chemical synthesis and processing involve steps like sourcing raw materials, pretreatment of biomass, manufacturing the active ingredient, formulation of products, and quality control & testing.

- Key Players:- Syngenta Group, Corteva Agriscience, BASF SE, UPL Limited, Novonesis

- Quality Testing and Certifications: Quality testing is the process of evaluating attributes like composition, efficacy, active ingredient, performance, microbial viability, toxicity, physical properties, shelf-life, & safety, and certifications like National Programme for Organic Production, AGMARK, GAP, and ISO Standards.

- Key Players:- Eurofins Scientific SE, Intertek Group, SGS SA, Bureau Veritas SA, Fare Labs Pvt. Ltd.

Power Players Transforming the Agricultural Biologicals Landscape

| Company Name | Headquarters | Biologicals Product | Examples |

| Syngenta | Switzerland |

|

|

| Bayer | Germany |

|

|

| Isagro S.p.A. | Italy |

|

|

| Valent Biosciences | Illinois |

|

|

| Corteva Agriscience | United States |

|

|

| BASF SE | Germany |

|

|

| UPL | India |

|

|

Segmental Insights

Product Type Insights

Why the Biopesticides Segment Dominates the Agricultural Biologicals Market?

The biopesticides segment dominated the agricultural biologicals market with approximately 46.11% share in 2025. The lower intrinsic toxicity and minimal impact on the environment of biopesticides help market growth. The growing demand for organic food and increasing awareness about the impact of traditional pesticides increase demand for biopesticides. The adoption of Integrated Pest Management Strategies and the overuse of chemical pesticides increases demand for biopesticides, supporting the overall market growth.

The biostimulants segment is the fastest-growing in the market during the forecast period. The growing adoption of sustainable farming practices and focus on enhancing crop health increases demand for biostimulants. The growing demand for the development of better crop quality and enhancing the absorption of nutrients requires biostimulants. Advancements like seaweed-based and microbial-based biostimulants support the overall market growth.

The biofertilizers segment is growing significantly in the market. The growing environmental concerns due to synthetic chemicals and increasing demand for residue-free food products increase the demand for biofertilizers. The decline in soil fertility and focus on increasing nutrient availability require biofertilizers. The cost-effectiveness and eco-friendly nature of biofertilizers help overall market growth.

Crop Type Insights

How did the Cereals & Grains Segment hold the Largest Share in the Agricultural Biologicals market?

The grains & cereals segment held the largest revenue share of approximately 41.07% in the market in 2025. The growing demand for corn, wheat, and rice increases demand for biological products. The presence of large cultivation areas for cereals and grains and increasing pests & diseases in cereals & grains increases demand for biofertilizers & biopesticides. The changing dietary references and high consumption of cereals & grains drive the overall market growth.

The fruits & vegetables segment is experiencing the fastest growth in the market during the forecast period. The strong focus on a healthy diet and increasing consumption of fruits & vegetables requires agricultural biologicals. The high susceptibility of diseases & pests on fruits & vegetables increases demand for biological products. The growing awareness about the consumption of fruits & vegetables and the vast production area support the overall market growth.

The oilseeds & pulses segment is growing at a significant rate in the market. The high consumption of protein-rich food and increasing demand for plant-protein increases demand for oilseeds & pulses. The strong focus on food security and increasing demand for food increases the production of oilseeds & pulses. The growing demand for organic food and focus on lowering pesticide residues on oilseeds & pulses increases demand for agricultural biologicals, supporting the overall market growth.

Mode of Application Insights

Why the Foliar Spray Segment is Dominating the Agricultural Biologicals Market?

The foliar spray segment dominated the agricultural biologicals market with approximately 43.77% share in 2025. The foliar spray's ease of application in both organic and conventional farming helps market expansion. The strong focus on rapid absorption of nutrients and the increasing need for targeted action during specific stages increases the adoption of foliar spray. The foliar spray suitability with biofertilizers & biopesticides drives the overall market growth.

The seed treatment segment is the fastest-growing in the market during the forecast period. The strong focus on enhancing crop quality and high pressure on food production increases demand for seed treatment. The growing preference for organic farming and a strong focus on IPM increase the adoption of seed treatment. The cost-effectiveness and ability to improve nutrient uptake of seed treatment support the overall market growth.

The soil treatment segment is growing significantly in the market. The growing degradation of soil health and increasing demand for food increase the adoption of soil treatment. The focus on enhancing soil structure and the decline of arable land increases demand for soil treatment. The growing soilborne pests like bacteria, nematodes, & fungi, and the rise in soil nutrient deficiencies require soil treatment, supporting the overall market growth.

Formulation Type Insights

How did the Liquid Segment hold the Largest Share in the Agricultural Biologicals Market?

The liquid segment held the largest revenue share of approximately 49.14% in the market in 2025. The ease of application through various methods, like irrigation systems and standard sprayers, increases demand for the liquid form. The strong focus on extending efficacy and uniform distribution of the product increases the adoption of the liquid form. The strong focus on rapid plant uptake and lowering handling issues increases adoption of the liquid form, driving the overall market growth.

The dry/granular segment is experiencing the fastest growth in the market during the forecast period. The longer shelf life, easy transportation, and ease of storage of the dry form help market growth. The strong focus on easy application in large areas and the need for improving microbial survivability increase the adoption of the granular form. The flexibility of application and controlled-release properties of the dry form support the overall market growth.

The powder segment is growing at a significant rate in the market. The lower storage & shipping costs and ease of handling of powder form help market growth. The strong focus on longer shelf life and growing adoption of sustainable agriculture practices increases demand for powder form. The versatility in application and easy blending with other materials increases the adoption of powder form, supporting the overall market growth.

Origin Insights

Why the Microbial-Based Segment Dominates the Agricultural Biologicals Market?

The microbial-based segment dominated the agricultural biologicals market with approximately 56.32% share in 2025. The shift towards sustainable agricultural practices and focus on enhancing crop protection increases demand for microbial-based products. The increasing need for enhancing soil fertility and high adoption of residue-free products increase demand for microbial-based products. The minimal environmental impact and cost-effectiveness of microbial-based products drive the overall market growth.

The plant-based segment is the fastest-growing in the market during the forecast period. The growing consumer demand for natural food products and high willingness to purchase organic products increases demand for plant-based agricultural biologicals. The increasing issues like loss of biodiversity, soil degradation, and water contamination increase demand for plant-based biologicals that support the overall market growth.

The animal-based segment is growing significantly in the market. The growing adoption of organic farming practices increases demand for animal-based products like blood meal, manure, & bone meal. The strong focus on enhancing microbial activity and improving soil structure increases the adoption of animal-based agricultural biologicals. The growing health-conscious consumer and increasing farmers' awareness about soil health require animal-based agricultural biologicals, supporting the overall market growth.

Farming Type Insights

Which Farming Type Held the Largest Share in the Agricultural Biologicals Market?

The conventional farming segment held the largest revenue share of approximately 66.22% in the market in 2025. The well-established conventional farming infrastructure and lower production cost increase demand for agricultural biologicals. The growing production of high-yield row crops like soybeans, cereals, and grains requires agricultural biologicals. The growing integration of IPM strategies with conventional farming supports the overall market growth.

The organic farming segment is experiencing the fastest growth in the market during the forecast period. The growing consumer demand for organic food products and increasing awareness about synthetic chemical environmental impact increase demand for organic farming, which requires agricultural biologicals. The strong focus on minimizing water environmental impact and conservation of water increases the adoption of organic farming. The strong government support for organic farming through various initiatives supports the overall market growth.

Regional Insights

The Asia Pacific agricultural biologicals market size was valued at USD 7.37 billion in 2025 and is expected to reach USD 26.77 billion by 2035, growing at a CAGR of 13.77% from 2026 to 2035. Asia Pacific dominated the market with approximately 39.11% share in 2025.

The presence of a vast agricultural base and growing production of high-yielding crops increases demand for agricultural biologicals. The growing population in countries like India & China and the rising demand for food increase the adoption of agricultural biologicals. The strong government support for organic farming and focus on enhancing crop yields requires agricultural biologicals. The increasing awareness about the benefits of biologicals among farmers drives the overall market growth.

From Soil to Solution: India’s Rise in Agricultural Biologicals

India is a key contributor to the market. The growing demand for organic food products and increasing awareness about the impact of synthetic chemicals on the environment increase demand for agricultural biologicals. The well-established large agricultural base and growing row crop cultivation increase demand for biological products. The strong government support for the development of biofertilizers and biopesticides through policies like MOVCD-NER National Farmer Policy, & PKVY supports the overall market growth.

- India exported 170 shipments of biofertilizer.

South America Agricultural Biologicals Market Trends

South America is experiencing the fastest growth in the market. The growing cost of chemical fertilizers and the presence of high biodiversity increase the production of agricultural biologicals. The high production of monoculture crops like sugarcane and soybeans increases demand for biofertilizers. The increasing adoption of sustainable pest management solutions drives the overall market growth.

Cultivating Change: Brazil at the Centre of Agricultural Biologicals Solutions

Brazil expects a significant growth in the market. The strong government support for sustainable agriculture through policies like PNAPO increases the development of biopesticides and biofertilizers. The well-established agricultural landscape, especially in sugarcane, soybeans, and corn, increases demand for biological products. The high availability of natural compounds and microorganisms increases production of agricultural biologicals, supporting the overall market growth.

North America Agricultural Biologicals Market Trends

North America is growing in the market. The growing consumer preference for organic food products and stringent regulations on synthetic pesticides increase the development of agricultural biological products. The growing commercialization of new biological products and well-established R&D infrastructure help market expansion. The high adoption of sustainable agricultural practices requires agricultural biologicals, driving the overall market growth.

Innovation Harvested: Ag-Biologicals Breakthroughs in the United States

The United States is growing substantially in the market. The growing demand for organic vegetables, fruits, and other food products increases demand for biological products. The strong government support for sustainable agriculture through initiatives like the USDA’s Organic Transition Initiative and increasing development of targeted biological solutions supports the overall market growth.

- The United States exported 66 shipments of biofertilizer.

Europe Agricultural Biologicals Market Trends

Europe is growing at a notable rate in the market. The strong government support for organic farming through policies like the Common Agricultural Policy & Organic Action Plan increases demand for agricultural biologicals. The strong consumer preference for sustainable food products and stringent regulations on chemical pesticide use increase the adoption of biological products, driving the overall market growth.

Sustainable Agriculture: Germany’s Contribution to Ag-Biological Landscape

Germany is growing at a significant rate in the market. The strong government support for sustainable agriculture practices and a well-established organic food landscape increases demand for agricultural biologicals. The growing adoption of biologicals in precision farming and the increasing development of biostimulant-based solutions support the overall market growth.

Middle East & Africa Agricultural Biologicals Market Trends

The Middle East & Africa are growing significantly in the market. The growing water scarcity concerns and strong focus on improving soil health increase demand for agricultural biologicals. The declining arable land and increasing food demand require agricultural biologicals. The strong government support for sustainable agriculture in countries like Egypt and the growing adoption of organic farming practices increase demand for biofertilizers and biopesticides, driving the overall market growth.

South Africa Agricultural Biologicals Market Trends

South Africa is a key contributor in the market in the MEA region. The increasing adoption of low-residue products and the shift towards sustainable agricultural practices increase demand for agricultural biologicals. The strong focus on improving soil health and addressing pest resistance increases demand for agricultural biologicals. The high export of crops like pome fruits, stone fruits, grapes, and citrus requires biologicals. The growing use of biopesticides and biofertilizers supports the overall market growth.

Recent Developments

- In May 2025, IPL Biologicals launched its NXG product range to boost farm productivity. The product range includes Viridex, BT-dex, 360, Subtilin, Sporidex, and B.E.E Boost. It is available in powder format and supports IPM & Integrated Nutrient Management. The products focus on microbial efficacy, soil health, and nutrient availability. (Source: agrospectrumindia.com)

- In January 2025, Super Crop launched bio-fertilizer, Super Gold WP+, for sustainable farming practices. The bio-fertilizer promotes environmental sustainability and enhances crop productivity. The bio-fertilizer enhances nutrient absorption, improves crop yield, enhances root growth, and improves soil health. (Source: chemindigest.com)

- In November 2025, Rallis India Ltd launched a science-led biologicals brand, NuCode, to offer products like biopesticides, biofertilizers, and biostimulants. The biological product focuses on enhancing plant & soil health across India. (Source: agritimes.co.in)

Top Agricultural Biologicals Market Companies List

Novozymes A/S

Corporate Information

- Novozymes A/S was a global biotechnology company headquartered in Bagsværd (near Copenhagen), Denmark.

- Its core business: production of industrial enzymes, microorganisms, and various biological/biopharmaceutical ingredients.

- In 2022, the company had ~ 6,781 employees.

History and Background

- Novozymes in its modern form was founded in 2000, when it was spun out of pharmaceutical/industrial-enzyme business of the parent group.

- Its lineage traces back further: The parent entity had roots in early 20th-century companies involved in insulin production and other biopharma/biotech work (though this predates Novozymes proper).

Key Developments and Strategic Initiatives

- Diversification from purely industrial enzymes into “BioBusiness” microbial solutions, biofertility, bio-agriculture, bioenergy, biopharma etc.

- Large investments in fermentation and manufacturing capacity for example, building enzyme fermentation facilities (in China among other places) to support global scale production.

Mergers & Acquisitions

- In 2016, Novozymes spun out its biopharmaceutical operations into a separate entity (Albumedix), indicating a strategic focus on core enzyme + bio-business rather than full biopharma.

- In 2020, it further expanded its bio-microbial/health-oriented portfolio by acquiring two companies: PrecisionBiotics (Ireland) and Microbiome Labs (USA), strengthening its microbial/ probiotic / microbiome-based offerings.

Partnerships & Collaborations

Over its history, Novozymes engaged in collaborations and partnerships to deploy its bio-solutions particularly in agriculture, bioenergy, industrial biotech. For example, when entering bio-agriculture (after crop-bio acquisitions), it collaborated with existing users of biofertility products to integrate enzyme/microbial solutions adapted to soils and crops.

As part of its broader aim, the company positioned itself as a sustainability-driven partner to industries seeking to reduce chemical and energy footprints, working across sectors (food & beverage, cleaning, textiles, energy, agriculture), which inherently requires collaborations with downstream industries.

Product Launches / Innovations

Its core offering has been industrial enzymes used in many industries: detergents/cleaning (for low-temperature washing, energy-efficient cleaning), textiles (processing/finishing), biofuels (enzymes for bioethanol and other bioenergy), food & beverage (baking, brewing, dairy, fermentation), waste-processing, pulp/paper, leather enabling more sustainable, efficient industrial processes.

Key Technology Focus Areas

- In bioenergy: Novozymes developed enzyme solutions to enable conversion of cellulosic biomass (e.g., agricultural waste) into biofuels making bio-fuels more viable.

- Their technology focus broadly: fermentation, enzyme engineering, microbial strain development, optimizing biological solutions for industrial scale, enabling “bio-based” alternatives to chemical processes.

R&D Organisation & Investment

- R&D has been central to Novozymes’ strategy. In 2022, the company reported having 892 active “patent families” evidence of a strong innovation pipeline.

- In 2022, Novozymes launched 26 new products globally.

- Historically, a significant portion of employees have worked in R&D / innovation: in earlier years roughly ~23% of employees were involved in R&D (as per older Novozymes annual reports) underlining research-intensive nature.

SWOT Analysis

Strengths

- Leading global position in industrial enzymes and microbial technologies, with decades of know-how.

- Diversified portfolio across many industries (industrial enzymes, agriculture bio-inputs, bioenergy, food & beverage, detergents, environmental biotech) reducing dependence on any single sector.

- Strong R&D and innovation capacity large patent portfolio, continuous new product launches.

Weaknesses

- Biological solutions (microbes, enzymes) often face regulatory, agricultural-adoption, and variability challenges performance may vary depending on region, climate, crop/soil, making consistency a potential concern.

- Scientific / technical complexity and cost: R&D and scaling biological solutions globally requires significant investment; scaling and adoption might be slower than chemical alternatives.

Opportunities

- Rising global demand for sustainable agriculture, biofertilizers, bio-stimulants, and reduced-chemical farming biological agriculture is gaining relevance.

- Growth in bioenergy, waste-to-energy, bioprocessing demand for enzyme/microbial solutions remains high as industries seek greener alternatives.

Threats

- Adoption risk: farmers/industries may prefer traditional chemical/industrial solutions, especially where price or reliability matters acceptance of biological alternatives can lag.

- Regulation: bio-inputs sometimes face regulatory hurdles (approval, safety, registration) which may vary widely by country.

Recent News & Strategic Updates

- The biggest recent development: On 29 January 2025, the statutory merger of Novozymes A/S with another major bioscience company Chr. Hansen Holding A/S was completed creating a new biosolutions-focused entity: Novonesis.

- The combined entity reportedly has ~ 10,000 employees worldwide, a global network of R&D & application centers and manufacturing sites, and a broad biological-solutions portfolio across many industries.

Other Companies List

- CBF China Bio-Fertilizer AG: The German-holding company distributes and manufactures powder and liquid bio-fertilizers in China through its subsidiary.

- Mapleton Agri Biotec: The Australia-based company manufactures microbial-based products like PastureN & TwinN that enhance crop sustainability, nutrition, and yield.

- Biomax: The India-based biotechnology company manufactures compost bio-stimulators, bio-fertilizers, and soil inoculants to support sustainable farming.

- Rizobacter Argentina SA: The agricultural biotechnology company develops diverse biological products like biocontrol agents, biological adjuvants, inoculants, and biostimulants.

- Symborg S.L.

- National Fertilizers Ltd.

- Lallemand Inc.

- Agricen

- Sigma Agri-Science, LLC

- Agrinos Inc.

- Kiwa Bio-Tech Products Group Corporation

- Zebra Medical Vision, Inc.

Segments Covered

By Product Type

- Biopesticides

- Bioinsecticides

- Biofungicides

- Bionematicides

- Biofertilizers

- Nitrogen-Fixing Microorganisms

- Phosphate-Solubilizing Microorganisms

- Biostimulants

- Humic & Fulvic Acids

- Seaweed Extracts

- Beneficial Insects

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Turf & Ornamentals

- Plantations & Cash Crops

By Mode of Application

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Post-Harvest Treatment

By Formulation Type

- Liquid

- Dry / Granular

- Powder

By Origin

- Microbial-Based

- Plant-Based

- Animal-Based

By Farming Type

- Conventional Farming

- Organic Farming

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa