Content

Asia Pacific Bioplastics Market Size and Growth 2025 to 2034

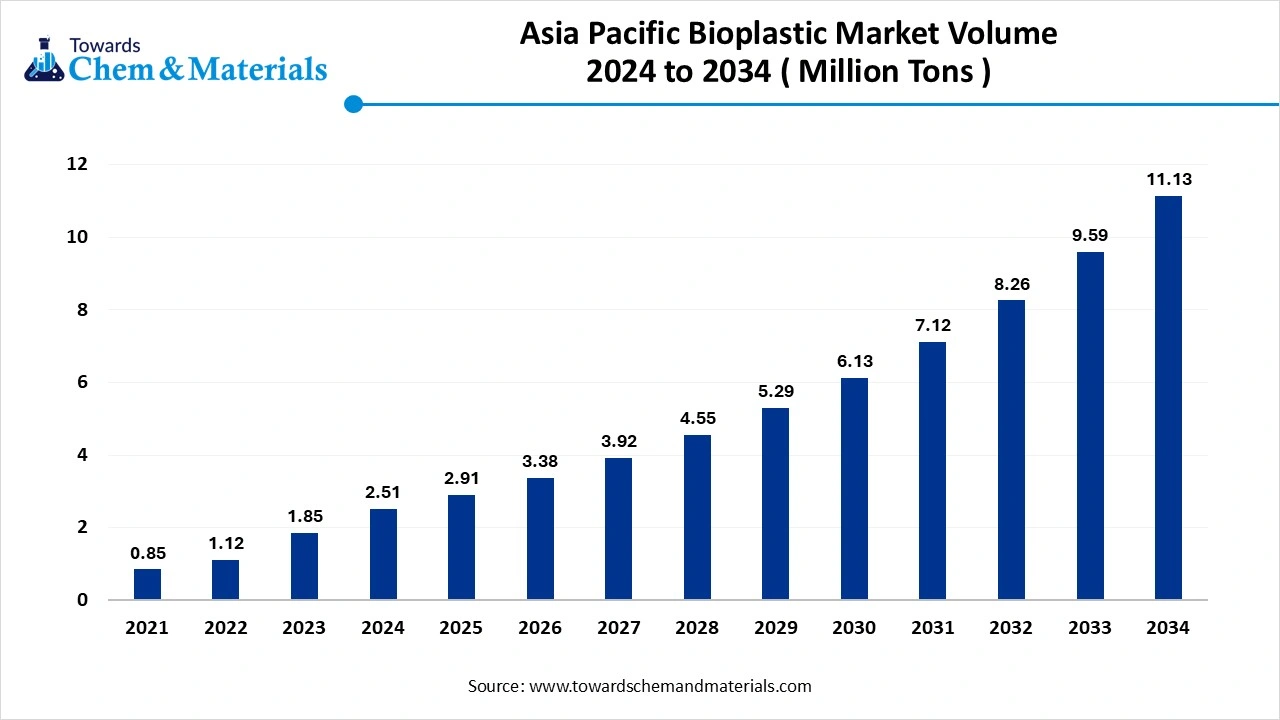

The Asia Pacific bioplastics market volume was reached at 2.51 million tons in 2024 and is expected to be worth around 11.13 million tons by 2034, growing at a compound annual growth rate (CAGR) of 16.07% over the forecast period 2025 to 2034. The growth of the market is driven by the growing applications and shift towards the use of eco-friendly and sustainable products, due to increasing awareness and government regulations fuel the growth of the market.

Key Takeaways

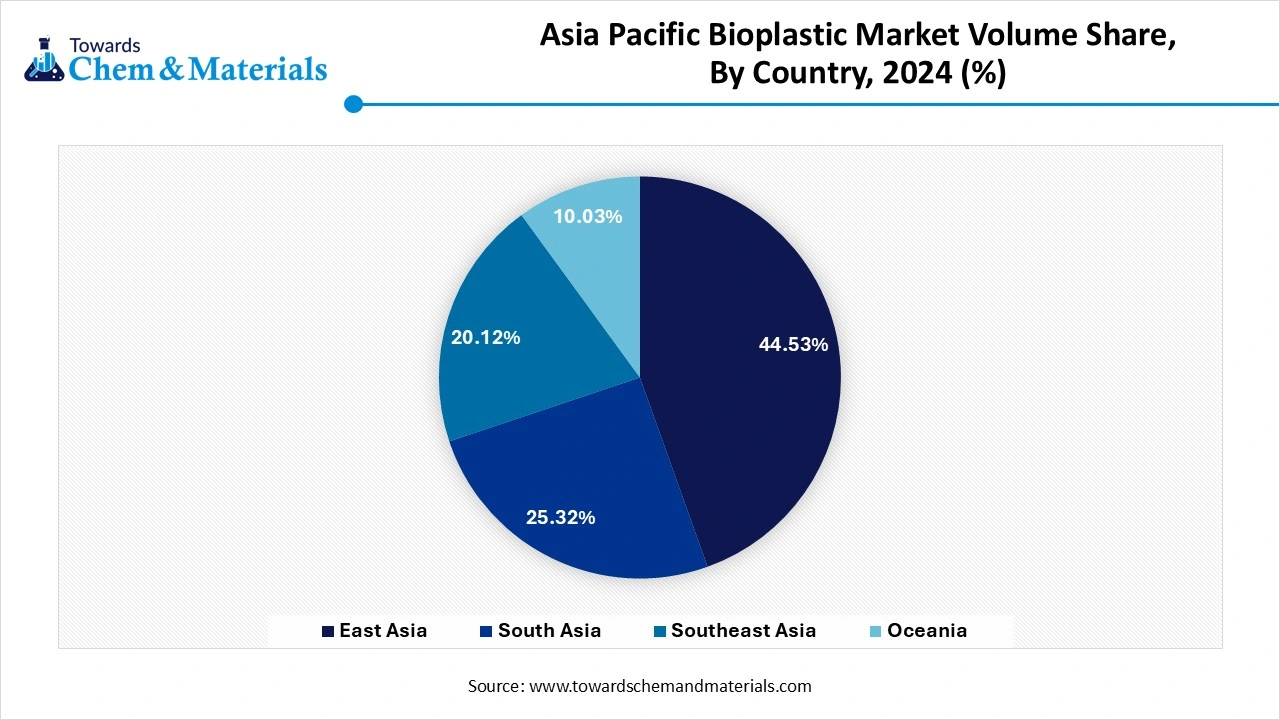

- By sub-region, East Asia dominated the market in 2024. The East Asia sub-region held a 48% share in the market in 2024. The growth is driven by technological advancements fuel the growth of the market.

- By sub-region, Southeast Asia is expected to have significant growth in the market in the forecast period. Sustainability efforts fuel the growth of the market.

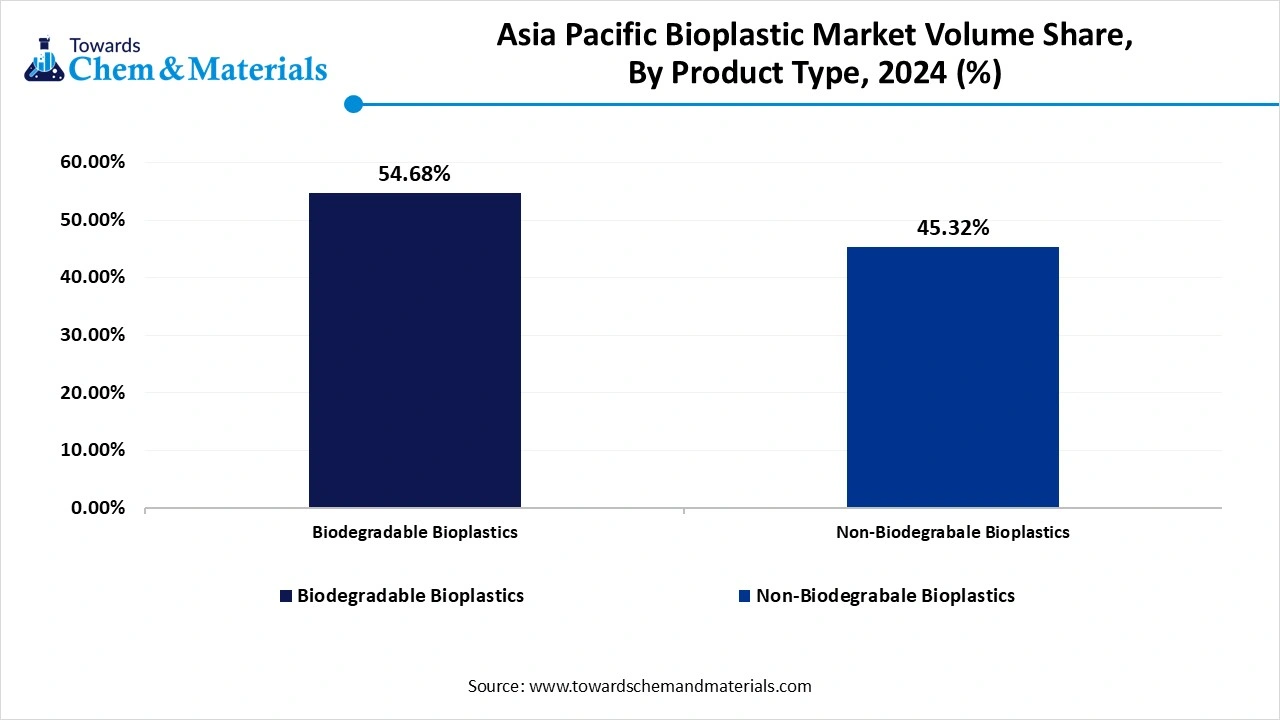

- By product type, the non-biodegradable bioplastics (bio-based plastics) segment dominated the market in 2024. The non-biodegradable bioplastics (bio-based plastics) segment held a 34% share in the market in 2024. The shift towards sustainability and eco-friendly material demand fuels the growth.

- By product type, the biodegradable bioplastics segment is expected to grow significantly in the market during the forecast period. The changing consumer preferences drive the growth of the market.

- By application, the packaging segment dominated the market in 2024. The packaging segment held a 38% share in the market in 2024. Growing industrialization and demand for sustainable products fuel the growth.

- By application, the medical and healthcare segment is expected to grow in the forecast period. Benefits offered and biocompatibility fuel the growth of the market.

- By feedstock source, the corn segment dominated the market in 2024. The corn segment held a 40% share in the market in 2024. The key properties are heat resistance and durability, which increase the demand.

- By feedstock source, the algae segment is expected to grow in the forecast period. The sustainable and eco-friendly properties increase the growth of the market.

- By processing tech, the extrusion segment dominated the market in 2024. The plastic segment held a 36% share in the market in 2024. The reduced environmental impact propels the growth of the market.

- By processing tech, the film casting segment is expected to grow in the forecast period. The versatility and adaptation increase the growth of the market.

- By end use, the food and beverage segment dominated the market in 2024. The plastic segment held a 42% share in the market in 2024. The use of bioplastic packaging in the food industry drives the growth of the market.

- By end use, the healthcare segment is expected to grow in the forecast period. The growing and expanding sector propels the growth.

Market Overview

Rising Demand For Durable Materials: Asia Pacific Bioplastics Market To Expand

The Asia Pacific Bioplastics Market refers to the regional market encompassing the production, distribution, and consumption of bioplastics—a class of plastics derived from renewable biomass sources (such as corn starch, sugarcane, or cellulose) or that are biodegradable. These materials serve as eco-friendly alternatives to conventional petroleum-based plastics and are used across diverse industries, including packaging, consumer goods, automotive, agriculture, textiles, and medical applications.

What Are the Key Growth Drivers of The Asia Pacific Bioplastics Market?

The growth of the market is driven by the government regulations and initiatives in the region to reduce reliance on conventional plastics and to promote the increasing adoption of bioplastics. Initiatives like China's nationwide plastic ban in 2025 and Japan's initiatives to achieve carbon neutrality by 2050 contribute to the growth of the market. The growing awareness and demand for eco-friendly products in packaging, consumer goods, and other applications. The advancement in manufacturing technologies and infrastructure development is making them accessible and cost-effective for manufacturers, fueling the growth due to a shift in consumers' preferences boosts the expansion of the market.

Market Trends

- The growing applications in automotive, packaging, agriculture, consumer goods, and other sectors are increasing the growth of the market.

- The government initiatives and regulations for the reduction in the use of plastics and mandates increase the adoption of the market.

- The technological advancements, like the development of new and innovative bio-based raw materials and manufacturing processes, drive the growth of the market.

- The shift in consumer preferences for the adoption of eco-friendly and sustainable bioplastics increases the growth of the market.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 2.91 Million Tons |

| Expected Volume by 2034 | 11.13 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 16.07% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Application, By Feedstock Source, By Processing Technology, By End-Use Industry, By Region |

| Key Companies Profiled | TotalEnergies Corbion (Thailand) , NatureWorks Asia Pacific (Thailand subsidiary) , Mitsubishi Chemical Group Corporation (Japan) , Teijin Limited (Japan) , Toray Industries (Japan) , Showa Denko Materials (Japan) , Kaneka Corporation (Japan) , Futuro Asia (Thailand) , Plantic Technologies (Australia) , PTT MCC Biochem (Thailand) , SKC Co., Ltd. (South Korea) , CJ CheilJedang (South Korea) , Tianan Biologic (China) , Kingfa Sci & Tech Co., Ltd. (China) , Hisun Biomaterials (China) ,, Green Science Alliance Co., Ltd. (Japan) , Shenzhen Ecomann Biotechnology Co., Ltd. (China) , Zhejiang Hisun Biomaterials Co., Ltd. (China) , Blest Co., Ltd. (Japan) , BiologiQ Asia (Malaysia arm) |

Market Opportunity

What are the key growth opportunities that support the growth of the Asia Pacific bioplastics market?

The key growth opportunities responsible for the growth of the market are the technological advancements, like innovation in biobased raw material and integration of AI and ML in the production process to improve efficiency and to improve accuracy boosts the growth of the market. The cost effectiveness and improved performance as compared to that of the traditional plastics increases the adoption, creating greater opportunity for growth and expansion of the market.

Market Challenge

What Are the Key Challenges That Limit the Growth of The Asia Pacific Bioplastics Market?

The high cost of production due to high raw material costs, which also requires specialized manufacturing processes, also contributes to the high cost of the product, which limits the growth of the market. The limited infrastructure and limited raw material availability are also major factors that disrupt the supply chain and hinder the consistency in bioplastic production, limiting the growth and expansion of the market.

Regional Insights

How Did East Asia Dominate the Asia Pacific Bioplastics Market In 2024?

East Asia dominated the market in 2024. The growth of the market is driven by the growing demand from various industries like automotive, packaging, and construction. The rapid industrialization and urbanization in East Asia have increased the growth of the market. Technological advancements like advancements in manufacturing technologies, recycling processes, and resin production, and ongoing research, increase the growth of the market. The sustainability focus and demand for sustainability solutions boost the growth and expansion of the market in East Asia.

The Sustainability Efforts and Initiatives Drive the Growth of The Market.

Southeast Asia is expected to have significant growth in the market in the forecast period. The growth of the market is driven by rapid urbanization, rising disposable incomes, and advances in polymer technology and recycling initiatives enhance and contribute to the growth of the market in Southeast Asia. The adoption of biodegradable and biobased plastics due to rising concerns over increasing environmental pollution is gaining attention from consumers and manufacturers to adopt sustainable processing, which helps in the growth and expansion of the market due to rising demand in Southeast Asia.

- India shipped out 42 Bioplastics shipments from September 2023 to August 2024 (TTM). These exports were handled by 6 Indian exporters to 9 buyers, with the growth rate of 425% over the last year.(Source: www.volza.com )

- Globally, China, Germany, and South Korea are the top three exporters of Bioplastics. China is the global leader in Bioplastics exports with 411 shipments, Germany with 319 shipments, and South Korea in 3rd with 71 shipments.(Source: www.volza.com)

Asia Pacific Bioplastics Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons - 2034 | CAGR (2025 - 2034) |

| East Asia | 44.53% | 1.12 | 47.33% | 5.27 | 18.80% |

| South Asia | 25.32% | 0.64 | 22.12% | 2.46 | 16.24% |

| Southeast Asia | 20.12% | 0.51 | 18.34% | 2.04 | 16.79% |

| Oceania | 10.03% | 0.25 | 12.21% | 1.36 | 20.60% |

| Total | 100% | 2.51 | 100% | 11.13 | 16.06% |

Segmental Insights

Product Type Insights

Which Product Segment Dominated the Asia Pacific Bioplastics Market In 2024?

The non-biodegradable bioplastics (bio-based plastics) segment dominated the market in 2024. The segment is witnessing rapid growth due to its compatibility with existing plastic processing and recycling systems, which increases the demand. Products like bio-PET and bio-PE are extensively used in packaging, automotive, and consumer goods. Their identical properties to conventional plastics enable easy substitution. Increasing demand for sustainable yet durable materials, especially in China and India, is propelling the growth and expansion of the market.

The biodegradable bioplastics segment expects significant growth in the market during the forecast period. Biodegradable bioplastics are gaining traction in the Asia-Pacific region due to rising environmental concerns and regulatory bans on single-use plastics. Materials like PLA, PHA, and starch blends are widely used in packaging, agricultural films, and disposable items. Their ability to decompose naturally makes them attractive in countries like Japan and South Korea. Government support and increasing consumer preference for eco-friendly alternatives are driving strong demand across multiple industries in the region. These factors fuel the growth and expansion of the market.

Asia Pacific Bioplastics Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume MillionTons - 2034 | CAGR (2025 - 2034) |

| Biodegradable Bioplastics | 54.68% | 1.37 | 57.88% | 6.44 | 18.74% |

| Non-Biodegrabale Bioplastics | 45.32% | 1.14 | 42.12% | 4.69 | 17.04% |

| Total | 100% | 2.51 | 100% | 11.13 | 16.06% |

Application Insights

How Did Packaging Segment Dominate the Asia Pacific Bioplastics Market In 2024?

The packaging segment dominated the market in 2024. Packaging is the dominant application segment in the Asia-Pacific bioplastic market, driven by increasing demand for sustainable alternatives in the food, beverage, and consumer goods industries. Both biodegradable and non-biodegradable bioplastics are used for bottles, films, trays, and bags. Rapid urbanization, rising e-commerce, and government restrictions on traditional plastics in countries like China and India are boosting adoption. Brand initiatives toward eco-friendly packaging are further propelling market growth, contributing to the expansion of the market.

The medical and healthcare segment expects significant growth in the market during the forecast period. The medical and healthcare segment is emerging as a promising area for bioplastics in Asia-Pacific, owing to their biocompatibility, sterility, and reduced environmental impact. Bioplastics are used in surgical tools, drug delivery systems, and packaging for medical devices. Increasing healthcare investments, aging populations, and growing awareness of sustainable materials are driving demand. Countries like Japan and South Korea are adopting bioplastics to align with green healthcare and circular economy goals, which increases the adoption of the market, supporting the growth.

Feedstock Source Insights

Which Feedstock Source Segment Dominated the Asia Pacific Bioplastics Market In 2024?

The corn segment dominated the market in 2024. Corn is a widely used feedstock for bioplastic production in Asia-Pacific due to its high starch content and availability. It is primarily used to produce PLA, which finds applications in packaging, textiles, and disposable items. Countries like China and Thailand have established corn-based bioplastic production facilities. These factors boost the growth and expansion of the market.

The algae segment expects significant growth in the Asia Pacific bioplastics market during the forecast period. Algae-based bioplastics are gaining attention in Asia-Pacific as a sustainable and non-food feedstock option. Rich in polysaccharides and oils, algae can be cultivated in wastewater or non-arable land, making it an eco-friendly alternative. Though still in early commercialization stages, countries like Japan and India are investing in algae R&D. Growing environmental concerns and interest in carbon-neutral materials are fueling future potential for algae-derived bioplastics across diverse applications.

Processing Tech Insights

How did Extrusion Segment Dominated the Asia Pacific Bioplastics Market in 2024?

The extrusion segment dominated the market in 2024. Extrusion is a widely adopted processing technology for bioplastics in the Asia-Pacific region, especially for producing films, sheets, and profiles used in packaging and agriculture. The method offers high efficiency and compatibility with bioplastics like PLA and starch blends. Growing demand for biodegradable packaging and sustainable agricultural materials in countries such as China and Indonesia is driving the use of extrusion. Technological advancements are further improving process stability and output quality.

The film casting segment expects significant growth in the Asia Pacific bioplastics market during the forecast period. Film casting is a key processing technology in the Asia-Pacific bioplastic market, primarily used for producing thin, flexible films for packaging and disposable items. This method is well-suited for biodegradable polymers like PLA and starch-based blends. The growing demand for compostable films in the food packaging and retail sectors is fueling their adoption. Countries like Japan and South Korea are leveraging film casting to produce high-clarity, eco-friendly bioplastic alternatives to traditional plastic films.

End-Use Industry Insights

Which End Use Industry Segment Dominated the Asia Pacific Bioplastics Market In 2024?

The food and beverage segment dominated the market in 2024. The food and beverage industry is the largest end-use sector for bioplastics in Asia-Pacific, driven by rising demand for sustainable packaging solutions. Bioplastics are used in bottles, trays, films, and containers to reduce environmental impact and comply with tightening regulations. Countries like China, India, and Japan are witnessing strong adoption as major brands shift toward biodegradable and compostable packaging. Consumer awareness and preference for eco-friendly food packaging further fuel segment growth.

The healthcare segment expects significant growth in the Asia Pacific bioplastics market during the forecast period. The healthcare industry in Asia-Pacific is increasingly adopting bioplastics due to their biocompatibility, safety, and environmental benefits. Applications include surgical instruments, drug delivery systems, and sterile packaging. Countries like Japan and South Korea are leading in integrating bioplastics into medical technologies as part of sustainable healthcare initiatives. Rising healthcare expenditure, regulatory support, and the push for reduced plastic waste in medical settings are key drivers for this segment’s growth.

Recent Developments

- In October 2024, Union Minister Dr. Jitendra Singh inaugurated the country’s first Demonstration Facility for Biopolymers in Jejuri, Pune. This is a step towards sustainability and for the development of sustainable solutions I the country amid growing environmental concerns in the country.(Source: themachinemaker.com)

Top Companies List

- TotalEnergies Corbion (Thailand)

- NatureWorks Asia Pacific (Thailand subsidiary)

- Mitsubishi Chemical Group Corporation (Japan)

- Teijin Limited (Japan)

- Toray Industries (Japan)

- Showa Denko Materials (Japan)

- Kaneka Corporation (Japan)

- Futuro Asia (Thailand)

- Plantic Technologies (Australia)

- PTT MCC Biochem (Thailand)

- SKC Co., Ltd. (South Korea)

- CJ CheilJedang (South Korea)

- Tianan Biologic (China)

- Kingfa Sci & Tech Co., Ltd. (China)

- Hisun Biomaterials (China)

- Green Science Alliance Co., Ltd. (Japan)

- Shenzhen Ecomann Biotechnology Co., Ltd. (China)

- Zhejiang Hisun Biomaterials Co., Ltd. (China)

- Blest Co., Ltd. (Japan)

- BiologiQ Asia (Malaysia arm)

Segments Covered

By Product Type

- Biodegradable Bioplastics

- Polylactic Acid (PLA)

- Polybutylene Succinate (PBS)

- Polybutylene Adipate Terephthalate (PBAT)

- Starch Blends

- Polyhydroxyalkanoates (PHA)

- Others (e.g., Cellulose Esters)

- Non-Biodegradable Bioplastics (Bio-Based Plastics)

- Bio-PET

- Bio-PE

- Bio-PA

- Bio-PTT

- Bio-PUR

- Others (e.g., Bio-PC)

By Application

- Packaging

- Rigid Packaging

- Bottles

- Trays

- Jars

- Rigid Packaging

- Flexible Packaging

- Films

- Wrappers

- Bags

- Agriculture

- Mulch Films

- Seed Coatings

- Plant Pots

- Automotive & Transport

- Interior Components

- Under-the-Hood Components

- Exterior Applications

- Textiles

- Fibers

- Nonwovens

- Consumer Goods

- Electronics Casings

- Household Items

- Toys

- Building & Construction

- Insulation

- Panels

- Fixtures

- Medical & Healthcare

- Drug Delivery Systems

- Surgical Tools

- Packaging

- Others

- 3D Printing

- Coatings

By Feedstock Source

- Corn

- Sugarcane / Sugar Beet

- Potato / Tapioca

- Vegetable Oils (e.g., soybean, castor)

- Cellulose

- Algae

- Others (e.g., waste oils, seaweed)

By Processing Technology

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Film Casting

- Others (e.g., Rotomolding, Foaming)

By End-Use Industry

- Food & Beverage

- Agriculture

- Automotive

- Textile

- Retail

- Healthcare

- Electronics

- Building & Construction

- Industrial

- Others

By Region

- East Asia

- China

- Japan

- South Korea

- South Asia

- India

- Bangladesh

- Sri Lanka

- Southeast Asia

- Indonesia

- Thailand

- Vietnam

- Malaysia

- Philippines

- Oceania

- Australia

- New Zealand